Announcement of a historic bean meal import deal with Argentina together with supposedly so many fewer Chinese hogs to feed. the price should have cratered. Instead, support appeared, with price closing firmly on the week. I found a year old weekly analysis of soymeal on Trading View and by zooming out the chart, the bedrock support upon which meal sits on is glaring. Furthermore, it is a double bottom type situation, that if resolved as in past such twin derrieres, pair of cheeks, nay coupla oopa doopas, well then we might expect quite vigorous twerking in the very next weeks. Basically, a bean meal erotic orgasm of sorts. Mind you, this is merely technical conjecture based on some squiggly lines on a chart lumped together with likely fake news and deciphered with twisted imagination, but... A Markwright I ain't and neither am I a Century Farm hand. Though, I'm a commodity gunslinger nonetheless, so be careful. This town may not be big enough for the both of us! Signed Wyatt Earp, I mean Burp, LoL!

Announcement of a historic bean meal import deal with Argentina together with supposedly so many fewer Chinese hogs to feed. the price should have cratered. Instead, support appeared, with price closing firmly on the week. I found a year old weekly analysis of soymeal on Trading View and by zooming out the chart, the bedrock support upon which meal sits on is glaring. Furthermore, it is a double bottom type situation, that if resolved as in past such twin derrieres, pair of cheeks, nay coupla oopa doopas, well then we might expect quite vigorous twerking in the very next weeks. Basically, a bean meal erotic orgasm of sorts. Mind you, this is merely technical conjecture based on some squiggly lines on a chart lumped together with likely fake news and deciphered with twisted imagination, but... A Markwright I ain't and neither am I a Century Farm hand. Though, I'm a commodity gunslinger nonetheless, so be careful. This town may not be big enough for the both of us! Signed Wyatt Earp, I mean Burp, LoL!

Soybean Meal Weekly Range Analysis

https://www.tradingview.com/chart/XaAhQ31t/

"some of the best market clues come from noticing "the dog that didn't bark," an old Sherlock Holmes reference that seems to apply to soybean meal in 2019"

Also, Elaine Kub does a nice explanation of the Brazilian Real and how currency is a factor in price of exports, both soybeans and coffee out of Brazil. The Argentinean currency and impact on their soymeal export is of concern.

https://www.dtnpf.com/agriculture/web/ag/news/article/2019/04/24/explanation-soybeans-day-day-swings

Friday the 13th, Harvest Micro MOON

That flare candle, a shooting star with tall upper wick and tiny real body. This appeared on many different commodities across the board, spanning various groups. Most of the entire market reverberated in this way, on that day. Besides meal, soybeans, wheat, oats and corn reacted very similarly. In sharp contrast soybean oil was strongly up green candle, definitely the strongest member of the soy family. Cocoa and cotton exhibited identical behavior as well. Even the Euro, Swiss and Yen showed the same styledaily candle!

at least markwright has a sense of humor....century is wound so tight he never smiles

But, tell you what, Mr McFarm... If I had followed that cynical Century when he first put forth his bearish hypothesis a while ago, then I would be smiling ear to ear more than enough for the both of us. My Gosh, he hit the grains bulleye and even correctly nailed some cattle for good measure! Him lifting hedges was a sign to go long, hopefully for a good ways, too.

yes he went short and every indication said he did it foolishly....but correctly, somehow. That tends to tell me he was just another flash in the pan and will disappear like so many others the past few years. Cannot remember all the names that have come and gone when first they were genius.

Beans and its meal is drifting lower, where? Maybe this fork's lower tine supports meal right here, just above the round number of $300. Always say to "fade the night" markets. Down in the overnight may mean a positive day that follows. Anyway, price is respecting support right now at this time. But, will it hold?

A 2 hour candle chart that fits nicely within a fork contraption. Price has declined to a couple of coinciding Fib retrace levels, cradled in the arms of the lower fork tine. Fast oscillators even show oversold divergences, painting a pretty mirage of a potential intranight bottom. A place to add positions quietly before sunrise when all are asleep?

Thanks hayman!

Great to have you back posting.

Like you said, very strong open but we are lower now. Weather is not a huge factor in mid September......usually.

However, its been hot/dry in the southern half-2/3rds of the US for the last 2 weeks and this is hurting pod filling in those locations that were planted very late, despite the higher CO2 making beans more drought tolerant/water efficient.

Been to wet in the northern 1/3rd.

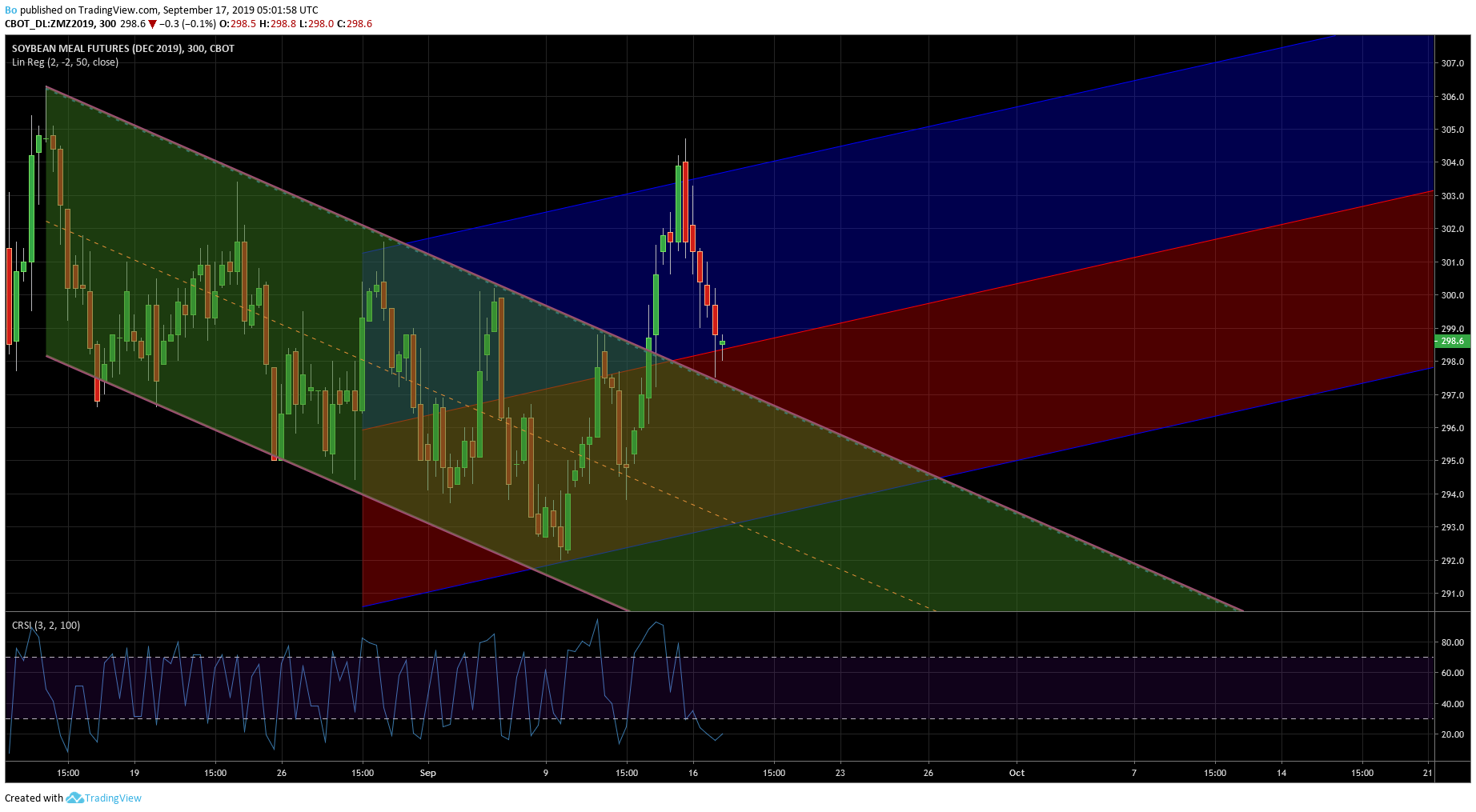

Fascinating juxtaposition of previous parallel downchannel trend of soymeal together with a 50 period linear regression channel that points higher. The meal price breakout rises to define the top of the regression channel. Then, its subsequent decline falls right between 50% and 61.8% Fib retrace that perfectly coincides with the meeting of both channel boundaries. Avery elegant retrace today of its breakout that supports on the midline of regression channel. Easier simply seen than described, so do look. Thinking that this may be embryo of a turnaround here. This is a 5 hour candle chart, by the way. And check out that Connor's RSI oscillator at the bottom, below the price chart. Appears to be scooping up from quite oversold territory, primed for reversal.

A 3 hour candle chart, intraday. Showing again, the prior downchannel morphing into an upchannel as defined by linear regression 50 period. Seem to be in the "crotch" between the two channels, a cycle low node, of sorts.

Thanks for the great charts hayman!

Here's a seasonal chart that more often than not, puts some heavy pressure on from now into early October. Harvest will be later than usual in many spots and there are still some bullish fundamentals.