"The American Petroleum Institute reports inventories of crude oil in the US unexpectedly surged by a sizable 10.5M barrels in the latest week, a source citing the report says, while gasoline supplies rose by 6.1M. The bearish, coronavirus-driven results were released ahead of official inventories data from the Department of Energy set to be published tomorrow morning. Average forecasts in a WSJ survey indicate the DOE report will show crude supplies rose by 4.5M from the previous week and that gasoline supplies increased by 1.9M from the previous week."

Unexpected by who? I'm surprised it wasn't more.

Agree Jim!

We've actually been surprised the past couple of weeks that the numbers then had not started to reflect the supply glut.

Maybe the excess crude was floating on ships.

I personally think this is just the beginning of what is to come for the next 2-3 months. I wouldn't be surprised to see a 20-30 mbbl increase somewhere along the line.

What's interesting is that HO inventory dropped 4.5 million barrels. Demand destruction that is killing the unleaded gas is not going to affect heating oil demand as much. Since the Winter is over and the high demand for heating oil in the Northeast is mostly over but it will be interesting to see how refiners handle this.

Heating oil is at 99c and UNL at 56c, so HO is 43c higher. In December, the May contracts featured HO being 10c higher. The spread has moved 33c. Of course that's a record but maybe it's not wide enough?

Or, maybe refiners will start churning out much more HO over the next few months.

https://finance.yahoo.com/news/u-crude-stocks-jump-10-203604318.html

Crude inventories rose by 10.5 million barrels in the week to March 27 to 461.9 million barrels, compared with analysts' expectations for a build of 4 million barrels.

Crude stocks at the Cushing, Oklahoma, delivery hub rose by 2.9 million barrels, API said.

Refinery crude runs fell by 928,000 barrels per day, API data showed.

Gasoline stocks rose by 6.1 million barrels, compared with analysts' expectations in a Reuters poll for a 1.9 million-barrel increase.

Distillate fuel inventories, which include diesel and heating oil, fell by 4.5 million barrels, compared with expectations for an increase of 1 million barrels.

https://www.oilandgas360.com/oil-retreats-from-session-highs-one-day-after-sinking-to-18-year-lows/

Oil prices rose on Tuesday after U.S. President Donald Trump and Russian President Vladimir Putin agreed to talks aimed at stabilizing energy markets, with benchmarks climbing off 18-year lows hit as the coronavirus outbreak cut fuel demand worldwide.

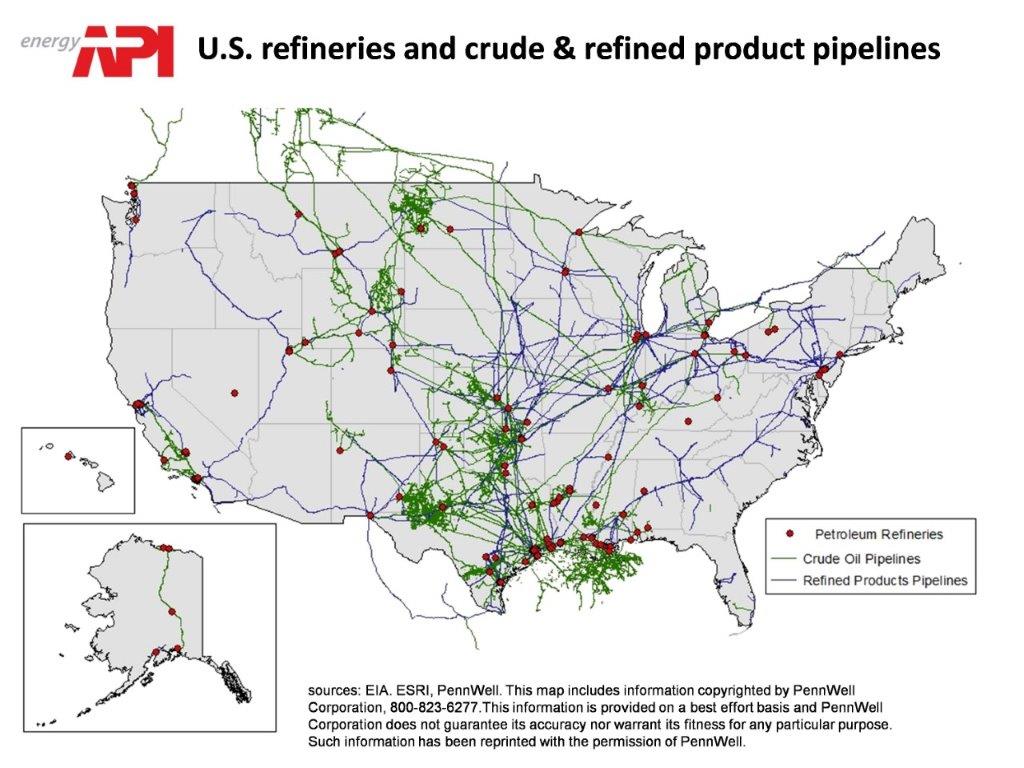

Rick Perry, from Texas is suggesting that we stop importing all foreign oil and use only US crude oil to keep the US oil industry from collapsing because of the lowest prices in decades.

What do you think of that idea?

https://www.api.org/news-policy-and-issues/blog/2018/06/14/why-the-us-must-import-and-export-oil

Quality

Crude oil is not a homogenous product. The U.S. continues to import and export crude oil because the viscosity of oil (measured by its API gravity) being light or heavy and its sulfur content being low (sweet) or high (sour) largely determine the processes needed to refine it into fuel and other products. In general, refineries match their processing capabilities with types of crude oils from around the world that enable them to:

While transportation runs primarily on motor fuels, our society also depends on thousands of products that begin as crude oil.

Heavier crude oils contain more complex molecules, so they are better for producing many of these niche products. However, turning heavy oil into high-quality products also requires more advanced molecular processing than is possible with simple refining or distillation.

Since the U.S. energy renaissance has accelerated, however, most of the 4.8 mb/d of new U.S. oil production the past six years has been light oil. With U.S. refining capacity geared toward a diverse crude oil slate, a key implication for U.S. petroleum trade is that it would be uneconomic to run refineries solely on domestic light crude oil. Consequently, the United States:

The US preaches capitalism ad nauseoum .....let markets do what they do. We know the oil is in the ground now. What Perry is suggesting is dangerously close to price fixing. The US oil drillers knew they were over producing. That just got hit with a perfect storm.

Besides, there are probably trades and contracts that could take months to fulfill.

I doubt Trump will do anything. He loves low gas prices too.

EIA

Risk/reward of selling at $20 crude, even in this environment is alot different than when it was trading at $40. We know that crude is not going to 0$ but nobody can rule out $40 by the end of the year if things get closer to normal and supplies shut down.

This is all unprecedented of course, so any statement/opinion on April 1st can be invalidated by new unexpected/unprecedented information.

Data from the Energy Information Administration on Wednesday revealed that U.S. crude supplies rose by 13.8 million barrels for the week ended March 27, marking a 10th straight weekly increase. Analysts polled by S&P Global Platts expected the data to show a rise of 4.6 million barrels. The American Petroleum Institute on Tuesday reported a climb of 10.5 million barrels, according to sources. The EIA data showed a supply increase of 7.5 million barrels for gasoline and a decline of 2.2 million barrels for distillates. The S&P Global Platts survey had shown expectations for a supply rise of 3.6 million barrels for gasoline, but distillate stockpiles were expected to fall by 600,000 barrels

WASHINGTON – Top U.S. officials have for now put aside a proposal for an alliance with Saudi Arabia to manage the global oil market, according to three sources with knowledge of the matter, an idea one of them said came from White House national security advisers.

Source:Reuters

That the concept was even considered at high levels reflects both the depth of the crisis facing the global oil industry as well as its growing importance to the U.S. economy. A few weeks ago, proposals for Washington to work together with oil producers to curb supply to the global market would have been dismissed for violating U.S. antitrust laws.

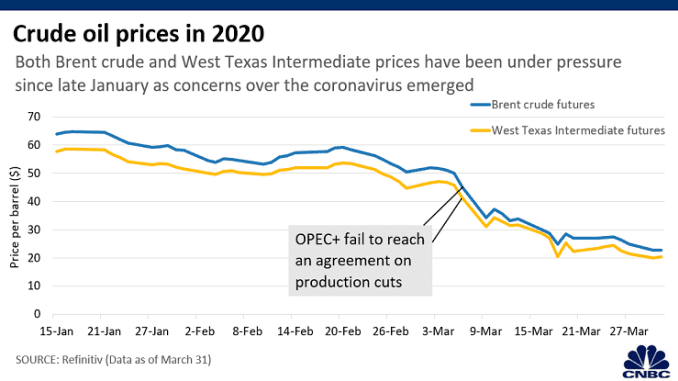

But prices for oil have slumped to an 18-year low because of the twin hits of the coronavirus pandemic slashing energy demand and a price war between top producers Saudi Arabia and Russia, threatening higher-cost U.S. and global drillers with bankruptcy.

The EIA total build was 21MMB - 3 million barrels a day, and on net the US was an exporter.

Gasoline per day was 6659, vs 8837 last year. The gasoline numbers look like 1985, and are lower than the late 1970s before the Iranian revolution

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MGFUPUS2&f=M

Goes along with the empty streets in the city, and the people travelling on the interstates talking about seeing nothing but trucks.

Thanks Patrick!

I said earlier that oil isn't going to 0 but apparently some think that it will get below that. Holy Cow!

He pointed out that when refineries shut down, many oil producers have nowhere to send their crude if the refinery is also part of the logistical chain to the market.

“For land-based or land-locked oil producers, this means only one thing,” Schieldrop continued. “The local oil price or well-head price they receive very quickly goes to zero or even negative, because if they have too much oil, they must pay someone to transport it away until they have managed to shut down their production.”

Holy Cow!

After having crashed nearly 70 percent in the first three months of 2020, benchmark WTI prices are trying to form a bottom around $20 per barrel.

But this psychological threshold is looking increasingly shaky as global crude storage facilities are filling up at an unprecedented pace. OPEC and its partners officially ended their output cut deal today, following the words of Russian Energy Minister Novak that every producer is ‘’free to pump at will’’.

With a flood of physical crude set to hit the market, it will take weeks, not months, for global oil storage space to run out. The storage problem could grow even worse as refining capacity is coming offline due to coronavirus health risks and in some cases a (very) negative crack spread caused by a double whammy of low fuel demand and crude oversupply.

The United States has grown in recent years into the world’s largest oil and gas producer, thanks to a technology-driven shale drilling boom. But the current price of oil is below the production cost of many American drillers, threatening the highly leveraged U.S. shale industry.

Trump on Monday said Saudi Arabia and Russia “both went crazy” with their production after the supply deal failed. “I never thought I’d be saying that maybe we have to have an oil (price) increase, because we do,” he said.

The Trump administration is trying to persuade Saudi Arabia, the world’s top oil exporter, to cut crude output. It will soon send a special energy envoy, Victoria Coates, to the kingdom.

The Kremlin said on Wednesday that Russia and Saudi Arabia were not holding talks regarding the oil market at the moment and Russian President Vladimir Putin had no immediate plans to have a phone call with Saudi leadership.

https://www.oilandgas360.com/5-charts-that-explain-the-saudi-arabia-russia-oil-price-war-so-far/

But that top position has been threatened as American producers struggle to break-even as a result of the price war.

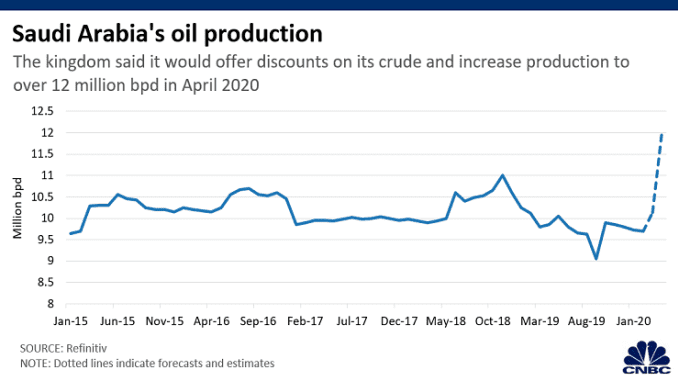

Saudi Arabia could potentially claim the top spot. State-owned Saudi Aramco said in a statement last month that it will provide 12.3 million bpd of crude oil in April. That’s nearly 2 million bpd more than an estimate for March, according to Refinitiv Eikon data.

Russia and the United Arab Emirates have also indicated that they could increase production, and other countries that have the capacity to pump more barrels are likely to do so, said Ravi Krishnaswamy, senior vice president of Frost & Sullivan’s Asia Pacific industrial practice.

Prices plummeted after Russia declined to approve OPEC’s proposal to cut production by an additional 1.5 million bpd, on top of the 1.7 million bpd agreed upon in December, excluding voluntary reductions.

Saudi Arabia responded by offering discounts on its oil and announcing that it would increase production, leading both WTI and Brent to their worst days since 1991 on March 9, which in turn caused a sell-off in global markets.

Yes Jim for the 2nd straight day the President mentioned the oil, Russia and the Saudis, He stated what you did and he is right....."its amazing what free markets will do"

I haven't been following the UNL/HO spread the last week but previous to that, it was getting killed(obviously the UNL leading the way down) having lost something like 20c recently.

However, its reversed sharply today.

The UNL came back from lower last evening to unchanged right now ...make that +1c at 70c.......and yesterday evening, the HO was up sharply (maybe from cold with the UNL lower) and the heating oil is down modestly. -3c.

Maybe the lows are in for that spread.