NGI Tuesday Morning: Natural Gas Futures Called Lower as Weather Mixed; Analysts See ‘Plummeting Demand’

+++++++++++++++++++++++++++++++++++++

Terrific Tuesday to you! Here's your weather:

https://www.marketforum.com/forum/topic/50532/

++++++++++++++++++++++++++++++

NGI after the close Tuesday:

5:01 PM

An increasingly milder April outlook sapped any early momentum in natural gas futures trading on Tuesday. The May Nymex gas futures contract settled at $1.650, off 7.4 cents day/day and at the low end of its 9-cent trading range. June fell 5.3 cents to $1.826.

for week ending April 3, 2020 | Released: April 9, 2020 at 10:30 a.m. | Next Release: April 16, 2020

+38 BCF Bearish but the market seemed to expect it.

| Working gas in underground storage, Lower 48 states Summary textCSVJSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (04/03/19) | 5-year average (2015-19) | |||||||||||||||||||||||

| Region | 04/03/20 | 03/27/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 382 | 382 | 0 | 0 | 209 | 82.8 | 274 | 39.4 | |||||||||||||||||

| Midwest | 475 | 476 | -1 | -1 | 240 | 97.9 | 355 | 33.8 | |||||||||||||||||

| Mountain | 92 | 92 | 0 | 0 | 64 | 43.8 | 111 | -17.1 | |||||||||||||||||

| Pacific | 203 | 197 | 6 | 6 | 117 | 73.5 | 209 | -2.9 | |||||||||||||||||

| South Central | 872 | 840 | 32 | 32 | 517 | 68.7 | 751 | 16.1 | |||||||||||||||||

| Salt | 265 | 256 | 9 | 9 | 163 | 62.6 | 225 | 17.8 | |||||||||||||||||

| Nonsalt | 607 | 585 | 22 | 22 | 354 | 71.5 | 527 | 15.2 | |||||||||||||||||

| Total | 2,024 | 1,986 | 38 | 38 | 1,148 | 76.3 | 1,700 | 19.1 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,024 Bcf as of Friday, April 3, 2020, according to EIA estimates. This represents a net increase of 38 Bcf from the previous week. Stocks were 876 Bcf higher than last year at this time and 324 Bcf above the five-year average of 1,700 Bcf. At 2,024 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and m

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Apr 09, 2020 Actual38B Forecast24B Previous-19B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Apr 09, 2020 | 10:30 | 38B | 24B | -19B | |

| Apr 02, 2020 | 10:30 | -19B | -24B | -29B | |

| Mar 26, 2020 | 10:30 | -29B | -25B | -9B | |

| Mar 19, 2020 | 10:30 | -9B | -6B | -48B | |

| Mar 12, 2020 | 10:30 | -48B | -59B | -109B | |

| Mar 05, 2020 | 11:30 | -109B | -108B | -143B |

Temperatures for last Thursdays EIA report. Very mild eastern half of the country where a lot of people live and use ng for heating.

No heating needed in the South!

7 day temps for this Thursdays report. Even warmer in the Southeast with some light CDD's. Very mild eastern half again.

Wednesday after the close:

Fifth Day of Losses for Natural Gas Futures Ahead of Hefty Storage Build; Cash Slides

5:14 PM

With eyes on another plump storage injection, natural gas traders trimmed futures for a fifth consecutive session on Wednesday as weather forecasts continued to trend milder. The May Nymex contract settled at $1.598, down 5.2 cents day/day. June slipped a more substantial 7.8 cents to $1.748.

Wonderful Wednesday to you!

Here's your weather(no affect on natural gas prices): https://www.marketforum.com/forum/topic/50631/

for week ending April 10, 2020 | Released: April 16, 2020 at 10:30 a.m. | Next Release: April 23, 2020

+73 BCF Bearish but we spiked down and went higher-huge reversal up today!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (04/10/19) | 5-year average (2015-19) | |||||||||||||||||||||||

| Region | 04/10/20 | 04/03/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 400 | 382 | 18 | 18 | 223 | 79.4 | 274 | 46.0 | |||||||||||||||||

| Midwest | 487 | 475 | 12 | 12 | 250 | 94.8 | 353 | 38.0 | |||||||||||||||||

| Mountain | 95 | 92 | 3 | 3 | 65 | 46.2 | 112 | -15.2 | |||||||||||||||||

| Pacific | 203 | 203 | 0 | 0 | 125 | 62.4 | 213 | -4.7 | |||||||||||||||||

| South Central | 912 | 872 | 40 | 40 | 557 | 63.7 | 776 | 17.5 | |||||||||||||||||

| Salt | 286 | 265 | 21 | 21 | 181 | 58.0 | 237 | 20.7 | |||||||||||||||||

| Nonsalt | 626 | 607 | 19 | 19 | 376 | 66.5 | 539 | 16.1 | |||||||||||||||||

| Total | 2,097 | 2,024 | 73 | 73 | 1,221 | 71.7 | 1,727 | 21.4 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,097 Bcf as of Friday, April 10, 2020, according to EIA estimates. This represents a net increase of 73 Bcf from the previous week. Stocks were 876 Bcf higher than last year at this time and 370 Bcf above the five-year average of 1,727 Bcf. At 2,097 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2015 through 2019. The dashed vertical lines indicate current and year-ago weekly periods.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Apr 16, 2020 Actual 73B Forecast64B Previous 38B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Apr 16, 2020 | 10:30 | 73B | 64B | 38B | |

| Apr 09, 2020 | 10:30 | 38B | 24B | -19B | |

| Apr 02, 2020 | 10:30 | -19B | -24B | -29B | |

| Mar 26, 2020 | 10:30 | -29B | -25B | -9B | |

| Mar 19, 2020 | 10:30 | -9B | -6B | -48B | |

| Mar 12, 2020 | 10:30 | -48B | -59B | -109B |

NGI after the close Thursday:

Thanks for another Thursday!

Here's your weather: https://www.marketforum.com/forum/topic/50681/

Friday's weather(still chilly Great Lakes/Northeast): https://www.marketforum.com/forum/topic/50735/

Natural Gas Intelligence after the close on Friday:

Buoyed by Rig Data and Supply Cuts, Natural Gas Futures Post More Gains to Close Week

5:48 PM

Natural gas futures extended their rally to cap off a week in which the coronavirus pandemic continued to decimate demand and producers snatched more rigs off the field. The May Nymex gas futures contract settled Friday at $1.753, up 6.7 cents from Thursday’s close. June rose 5.8 cents to $1.903.

"The latest data reinforces the notion that while the ongoing collapse of the oil and gas industry is hurting everyone, size still matters," Bob Williams, Enverus' director of content, said.

Natural gas prices rallied sharply and recaptured resistance near the 10-day moving average at 1.71, which is now seen as support. Resistance is seen near the April highs at 1.92. Short-term momentum has turned positive as the fast stochastic generated a crossover buy signal. Medium-term momentum is turning positive as the MACD histogram is beginning to accelerate higher with an upward sloping trajectory.

Advertisement

LNG exports rose week over week, according to the EIA. Seventeen LNG vessels with a combined LNG-carrying capacity of 61 Bcf departed the United States between April 9 and April 15, 2020, according to the EIA. This was offset by a larger than expected storage injection this week. Net injections into storage totaled 73 Bcf for the week ending April 10, compared with the five-year average net injections of 27 Bcf and last year’s net injections of 73 Bcf during the same week.

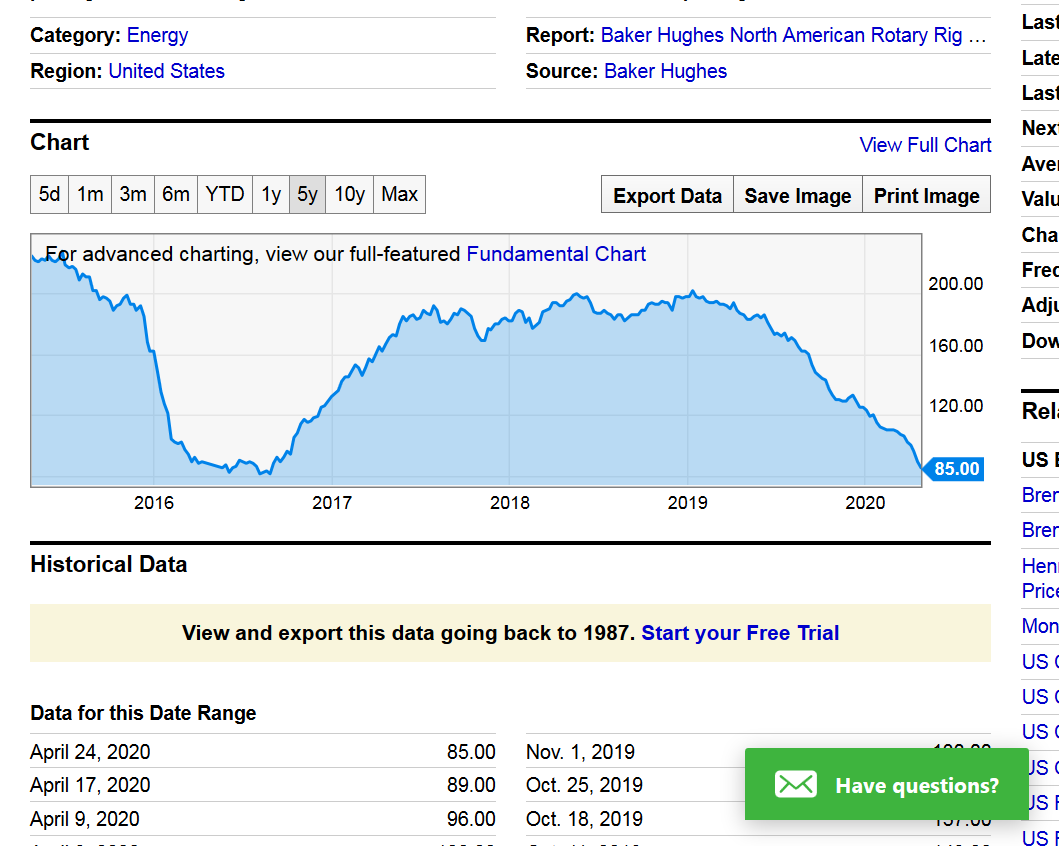

This graph is only updated thru January but the current rig count for natural gas, at 89 is close to the lowest in history. We got a bit lower than this in the Spring/Summer of 2016.

Splendid Sunday to You! Here's your weather: https://www.marketforum.com/forum/topic/50793/

Magnificent Monday to you!

Here's your weather: https://www.marketforum.com/forum/topic/50907/

Natural Gas Futures Surge as WTI Crude Goes Negative, but Waha Cash Trades at Record Low

Natural Gas Futures Pare Gains as ‘Startling’ Crude Collapse Points to Production Cuts

9:00 AM

metmike: ng can't decide one day to the next whether it wants to trade huge demand destruction or huge production cuts.

Tuesday Weather: Chilly Northeast/Great Lakes.......Warm West.

https://www.marketforum.com/forum/topic/50986/

NGI: Volatility Continues for Natural Gas; Futures Plunge 10 Cents, Waha Cash Rebounds

5:06 PM Tuesday

It was much colder last week vs the previous week:

LAST WEEK BELOW

PREVIOUS WEEK BELOW:

The last 3 EIA reports have featured numbers more bearish than the market was expecting......the last 2 reports were especially bearish. An injection of 73BCF last week has got to easily be a record for so early in the year.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release EIA Apr 16, 2020 Actual73B Forecast64B Previous38B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Apr 23, 2020 | 10:30 | 64B | 73B | ||

| Apr 16, 2020 | 10:30 | 73B | 64B | 38B | |

| Apr 09, 2020 | 10:30 | 38B | 24B | -19B | |

| Apr 02, 2020 | 10:30 | -19B | -24B | -29B | |

| Mar 26, 2020 | 10:30 | -29B | -25B | -9B | |

| Mar 19, 2020 | 10:30 | -9B | -6B | -48B |

May Natural Gas Called Lower as Analysts Expect ‘Erratic Price Action’

8:58 AM

metmike:; That's an understatement!

NG jumped over $1,000/contract right after that.

The EIA report tomorrow may not be as bearish as the last 3 with more weather demand last week using up natural gas.

Roller Coaster’ Continues at Full Speed for Natural Gas Futures; Permian Cash Gains Again

5:23 PM

Early selling in natural gas futures failed to hold, with erratic, non-fundamentally driven price fluctuations continuing midweek. After sinking to a $1.774 intraday low, the May Nymex gas futures contract settled Wednesday at $1.939, up 11.8 cents on the day. Increases continued throughout the curve, with June picking up 6.9 cents to hit $2.053.

for week ending April 17, 2020 | Released: April 23, 2020 at 10:30 a.m. | Next Release: April 30, 2020

+43 BCF Initially we went a big higher..............then sold off.

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (04/17/19) | 5-year average (2015-19) | |||||||||||||||||||||||

| Region | 04/17/20 | 04/10/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 400 | 400 | 0 | 0 | 244 | 63.9 | 285 | 40.4 | |||||||||||||||||

| Midwest | 493 | 487 | 6 | 6 | 261 | 88.9 | 360 | 36.9 | |||||||||||||||||

| Mountain | 96 | 95 | 1 | 1 | 69 | 39.1 | 114 | -15.8 | |||||||||||||||||

| Pacific | 210 | 203 | 7 | 7 | 135 | 55.6 | 217 | -3.2 | |||||||||||||||||

| South Central | 941 | 912 | 29 | 29 | 603 | 56.1 | 801 | 17.5 | |||||||||||||||||

| Salt | 301 | 286 | 15 | 15 | 199 | 51.3 | 247 | 21.9 | |||||||||||||||||

| Nonsalt | 640 | 626 | 14 | 14 | 405 | 58.0 | 554 | 15.5 | |||||||||||||||||

| Total | 2,140 | 2,097 | 43 | 43 | 1,313 | 63.0 | 1,776 | 20.5 | |||||||||||||||||

NGI: Natural Gas Futures Trim Losses After EIA Reports 43 Bcf Storage Injection

metmike: That is a bad assessment of what really happened.

We had a bit of a spike higher right after the release, suggesting the market expected a bigger injection and have been very weak after that..........making success new lows as we get closer to noon.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Apr 23, 2020 Actual43B Forecast39B Previous73B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Apr 23, 2020 | 10:30 | 43B | 39B | 73B | |

| Apr 16, 2020 | 10:30 | 73B | 64B | 38B | |

| Apr 09, 2020 | 10:30 | 38B | 24B | -19B | |

| Apr 02, 2020 | 10:30 | -19B | -24B | -29B | |

| Mar 26, 2020 | 10:30 | -29B | -25B | -9B | |

| Mar 19, 2020 | 10:30 | -9B | -6B | -48B |

Soggy Saturday to You! Here's your weather: https://www.marketforum.com/forum/topic/51178/

Sensational Sunday to you! Here's your weather:

https://www.marketforum.com/forum/topic/51234/

May NG expires on Tuesday.

Weather is HOT sw to Plains, chilly Northeast.

Tough to generate alot of HDD or CDD this time of year but adding them up, they are above average.

Hi Mike

I had a question asked of me that I could not answer. So here is the question

With so many oil wells shutting down, does this affect NG production. Is NG a by-product of crude oil wells and sold on the market

Or:

Is NG production a seperate industry from crude oil wells

The question was:

If so many crude oil wells are shutting down, would this have any effect on NG production???

Thinking mostly NA production but not sure if this is a world thing or not

I know temps affect useage but this question was on the supply side of the equation

Marvelous Monday! Here's your weather:

Hot Southwest to S.Plains later this week. Chilly Northeast.

https://www.marketforum.com/forum/topic/51283/

NGI after the close Monday:

Natural Gas Futures Claw Back From Earlier Lows Amid Thin, ‘Tricky’ Trading

5:24 PM

Natural gas futures got hammered early, but came roaring back Monday in another “chaotic” session. The May Nymex contract, which expires Tuesday, plunged to an intraday $1.593 low and then bounced back, settling the day at $1.819, up 7.3 cents from Friday’s close. June picked up 2.1 cents to close at $1.916.

Great question Wayne,

I'm not sure and every day the interpretation seems to flip back and forth.

My understanding is that when they shut down oil rigs and production, it also curtails ng production because most shale producers extract both oil and NG.

Of course ng industrial demand has plunged but a case is being made for production to plunge even more than demand with so many rigs shutting down.

https://www.kallanishenergy.com/2020/04/27/us-rig-count-drops-for-sixth-straight-week/

Lowest rig count number in almost 4 years.........which I think was the lowest ever!

https://ycharts.com/indicators/us_gas_rotary_rigs

https://www.fool.com/investing/2020/04/26/4-ways-the-2020-oil-crash-will-change-the-energy-l.aspx

Hydrogen itself is a very clean, energy-efficient fuel. But that hydrogen has to come from somewhere, and in the U.S., it mostly comes from natural gas. Fuel cell companies like to tout that it can come from cleaner sources like biomass, but those sources make fuel cells more expensive than relying on hydrogen from cheap, abundant natural gas, drilled right out of a shale basin near you. At least...for now.

The oil price crash has destroyed the economics of U.S. shale drilling, with many producers simply opting to shut down their shale operations. Since most shale producers extract both oil and gas, the big domestic natural gas oversupply that's kept prices so cheap may be coming to an end.

I wonder what the shale industry will be like when oil increases in price to make shale profitable, once again.

The question is:

How much oil will be produced. I read that many wells once capped off, will not be worth opening up again as many wells were pumping minimum amounts of oil. The cost of fracking was already into the well, but the flow was down to barely covering variable costs but so long as the well could produce some profit, it kept on pumping, mind you at a very low volume. Once capped, many wells won't be worth the cost to re-open, as opening a capped well is not a cheap operation. [so I am told]

There is also a risk to re-opening a capped well as the under ground geology or oil flow may not be as much as before. There is no guarantee the flow will resume, at the same volume as when the well was capped

Maybe there is enough oil, not yet fracked to equal previous volume [I don't know]. Then the question might be, access to capital, as the majority of the industry never did turn a profit. If it wasn't for a flow of constant new capital, the majority of fracking would be un-economical. I wish I could raise new capital on an un-profitable venture. lol

Many things will change post corona and fracking oil wells may see some changes. Or maybe not, if oil goes to 300.00 [Richard]

Great questions Wayne!

I found this to be a good discussion on it:

https://www.oilandgas360.com/exclusive-360-energy-expert-network-video-interview-sproule/

Key Takeaways

Thanks for another Thursday! Here's the weather:https://www.marketforum.com/forum/topic/51407/

Natural Gas Futures Fall as Market Gears Up for ‘Dramatic’ Storage Injections in May

An initial bump in natural gas futures prices failed to gain momentum Wednesday, with demand destruction weighing more heavily on the front of the curve than any declines in production. The June Nymex gas futures contract, on the first day in the prompt-month position, fell 7.9 cents to $1.869. July also dropped 7.9 cents to hit $2.091.

7 day period for the EIA report out on Thurday. Pretty chilly across much of the country!

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Apr 23, 2020 Actual 43BForecast39B Previous73B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Apr 30, 2020 | 10:30 | 69B | 43B | ||

| Apr 23, 2020 | 10:30 | 43B | 39B | 73B | |

| Apr 16, 2020 | 10:30 | 73B | 64B | 38B | |

| Apr 09, 2020 | 10:30 | 38B | 24B | -19B | |

| Apr 02, 2020 | 10:30 | -19B | -24B | -29B | |

| Mar 26, 2020 | 10:30 | -29B | -25B | -9B |

Since I just caught a break...thought I would give you the Bakken perspective to help answer some of your question. Down to 31 Rigs in the Bakken and I have 4 of them. My TX relief never showed. Local rig count dropping by about 5 a week.

Re your questions:

Oil and gas bs is the same business. Think of it as a well producing a single hydro carbon stream with oil, nat gas , nat gas liquids, and water all combined. Once you get to surface with the "stream" there are various processes of separation of the components. There are exceptions to this however this is the norm in the Shale. Depending on the producing reservoir it varies in ratio of the components. The Marcellus is dry for example. The extreme western section where the Utica is developed is "wetter", more oil and nat gas liquids in the stream vs WV and W PA. Permian is quite "wet", higher porpotion of Nat gas and nat gas liquids i the "stream".

As far as shutting in a productive oil well in the shale. Not a problem. Just takes money. Reservoir conditions will determine requirements. Here in the Bakken the crude has paraffins, which require fresh water injection down the well bore to "clean it up. If this is process is curtailed may require additional treatment to resume efficient production. State of ND Industrial commission estimates 40K to restart a shut in shale well.

Re the question of a low volume producer and if it will restart or is it is economic to do so. This is not a new problem. A shale well produces 80% of it UOR in its 1st three yrs. A well that IPs at ~1500 Bbls/D well be down to ~60 Bls/D at the end of year three. Again exceptions, but the profile is accurate. Producers have been wrestling with this problem for time memorial. Will just depend on the the price of oil. However, if the Fed steps in with a lending program, as the rumor goes, it may change all this.

Joe,

Thanks a million for sharing your valuable knowledge of the industry with us. I've been trading natural gas for almost 3 decades and read thousands of articles but just learned something...........and it's never been more relevant to the industry in history than right now.

When I start new ng threads, I will include this ng post of yours for sometime. Please keep us posted when you find the time.

Wayne, thanks for bringing this up!

for week ending April 24, 2020 | Released: April 30, 2020 at 10:30 a.m. | Next Release: May 7, 2020

+70 BCF

That's a huge injection for April with so many HDD's but it was expected.

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (04/24/19) | 5-year average (2015-19) | |||||||||||||||||||||||

| Region | 04/24/20 | 04/17/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 405 | 400 | 5 | 5 | 271 | 49.4 | 306 | 32.4 | |||||||||||||||||

| Midwest | 506 | 493 | 13 | 13 | 283 | 78.8 | 373 | 35.7 | |||||||||||||||||

| Mountain | 103 | 96 | 7 | 7 | 74 | 39.2 | 117 | -12.0 | |||||||||||||||||

| Pacific | 218 | 210 | 8 | 8 | 148 | 47.3 | 224 | -2.7 | |||||||||||||||||

| South Central | 979 | 941 | 38 | 38 | 652 | 50.2 | 830 | 18.0 | |||||||||||||||||

| Salt | 314 | 301 | 13 | 13 | 218 | 44.0 | 259 | 21.2 | |||||||||||||||||

| Nonsalt | 664 | 640 | 24 | 24 | 434 | 53.0 | 571 | 16.3 | |||||||||||||||||

| Total | 2,210 | 2,140 | 70 | 70 | 1,427 | 54.9 | 1,850 | 19.5 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Apr 30, 2020 Actual 70B Forecast 69B Previous 43B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Apr 30, 2020 | 10:30 | 70B | 69B | 43B | |

| Apr 23, 2020 | 10:30 | 43B | 39B | 73B | |

| Apr 16, 2020 | 10:30 | 73B | 64B | 38B | |

| Apr 09, 2020 | 10:30 | 38B | 24B | -19B | |

| Apr 02, 2020 | 10:30 | -19B | -24B | -29B | |

| Mar 26, 2020 | 10:30 | -29B | -25B | -9B |

NGI after the EIA report:

Natural Gas Futures Bounce After On-Target EIA Storage Build

Thanks again for this Thursday. Afternoon weather update: https://www.marketforum.com/forum/topic/51407/

Thanks Mike. Glad to contribute.

One other item I thought about after I posted. I stepped away from the actual production side and focused on drilling opeartions in 2003. However, when I was involved in production you could shut in a well and reduce most of the cost of operations. In other words, there were few if any carrying costs. Not the case in teh Shale. Most of the wells are artificial lift requiring power (electricity). With no production there is no ability to generate electricity on site (nat gas generation). The rural coops in W ND have a demand charge which continues with or w/o power usage. I have seen demand charges of 50% of the bill.

Most Operators in the Bakken have completed the well using gas lift equipment. This production technique involves gas compression equipment which more often than not is Leased from one of the large gas equipment companies. Those lease payments are not dependent on the well producing.

Most of you probably know that the wells in a drill unit are all drilled from a graded pad (maybe 10+ acres, graded graveled built up). Most of the drill units are two section N/S so you have two pads per drill unit of 1280 acres. These pads are leased from the surface owner. Payments will go on w or w/o production.

Hope my point is obvious by now. Operators are in a bind. There are significant carrying costs owning a shut in Shale well.

Also, just my opinion and I am not offering investment advice. It has not escaped me that nat gas pricing has actual improved since late 2019. My opinion, it may positioned to weather the storm and recover quicker than oil in spite its in demand destruction as well. I would like to hear the opinion of the guys/gals on here that actually crunch the #s

Joe,

Thanks again and some good points. Whether a shale well is producing or not or shut in or not, there are some costs(leasing for instance) that are the same...............and get factored into decisions.

So a shale well operator losing money producing at these prices, could lose even more money by shutting down because of the costs that remain. I would guess that this encourages more production at a price loss than would be the case if the producer could just shut in and suffer less loss, then wait for better prices.

What a dilemma. Hard to believe where we are compared to pre shale/fracking days, more than a decade ago, when prices were 4 times the current price.

These are the lowest prices in over 2 decades and earlier this year, were the lowest since the early 90's.

The front month June contract is trading below $2. The last time that happened was briefly in early 1999.

Even before the coronavirus hit, the price was down here after the very mild Winter combined with robust supplies gushing in to gradually add to the surplus...........that was gradually building after a pretty stout deficit that peaked, I think that it was around 2 years ago.

Based on the industrial demand dropping off of a cliff, estimates for end of season amounts in storage are off the charts...........there won't be enough room for it all. But those are probably not worth much because of changes that will take place between now and then.

Exports have gradually been picking up and if we have enough shut ins and a very hot Summer, prices could do better than expected, especially if the economy picks up.

But I can't predict those any better than anyone else.

The weather for the next 2-3 weeks is another story, as an operational meteorologist. We are at a seasonal weak point for weather demand when there usually are not many HDD's or CDD's in between the heating and cooling season. The CDD's, seasonally pass up the HDD's on around May 9th.

HDD's as you know use up way more ng and have a much, much bigger price influence. What's interesting right now, is that we will have unusually high HDD's for this time of year because of unseasonably cold weather in the high population centers of the Northeast and Great Lakes area......and at the same time a stout amount of CDD's because of the near record heat in the West to the Plains.

Add them together and over the next 10 days, we have some pretty good residential demand. I'm not sure if shut ins are having an affect on residential heating and cooling. If more people are at home during the day you could make a case that they will be using more vs not being at home but in this mega bearish environment, I doubt this will be huge.

NGI after the close on Thursday:

Natural Gas Futures Make Perplexing Move Higher; Cash Lower Amid Seasonal Temps

5:47 PM

Given so many moving targets in the natural gas market these days, it doesn’t take much to move the price needle. After the latest storage stat came in below some estimates, the June Nymex gas futures contract jumped 8.0 cents to settle Thursday at $1.949

Super Saturday to you: Here's your weather: https://www.marketforum.com/forum/topic/51514/