ken morrison@morrisonmkts·

ken morrison@morrisonmkts·

The bigger corn short at this time last year is a big reason that the record planting delays triggered such a strong price reaction to the upside. Fund short covering really provided most of the fuel in the first half of the spike higher.

Considering the massive black ethanol/demand destruction cloud overhanging the corn market right now, it's going to be really tough to get a big rally to go very far.

It is definitely more skewed to the funds, though their short is far less extreme than it was a year ago this time.

The planting weather outlook is excellent right now:

National Weather Service 6-10 day, 8-14 day outlooks.

Updated daily just after 2pm Central.

Temperature Probability

| the 8-14 day outlooks ArchivesAnalogsLines-Only FormatGIS Data | |

Temperature Probability | |

| |

Crop condition report

Started by metmike - April 20, 2020, 7:48 p.m.

It's looking more and more like we are going to see corn with a 2 handle on it. It's been a long while since that has happened.

We almost got below $3 today Jim but this might be a significant short term low>

https://www.marketforum.com/forum/topic/50940/

Re: INO Morning Market Commentary

By metmike - April 21, 2020, 2:54 p.m.

Thanks tallpine!

Corn may have put in a significant low today.

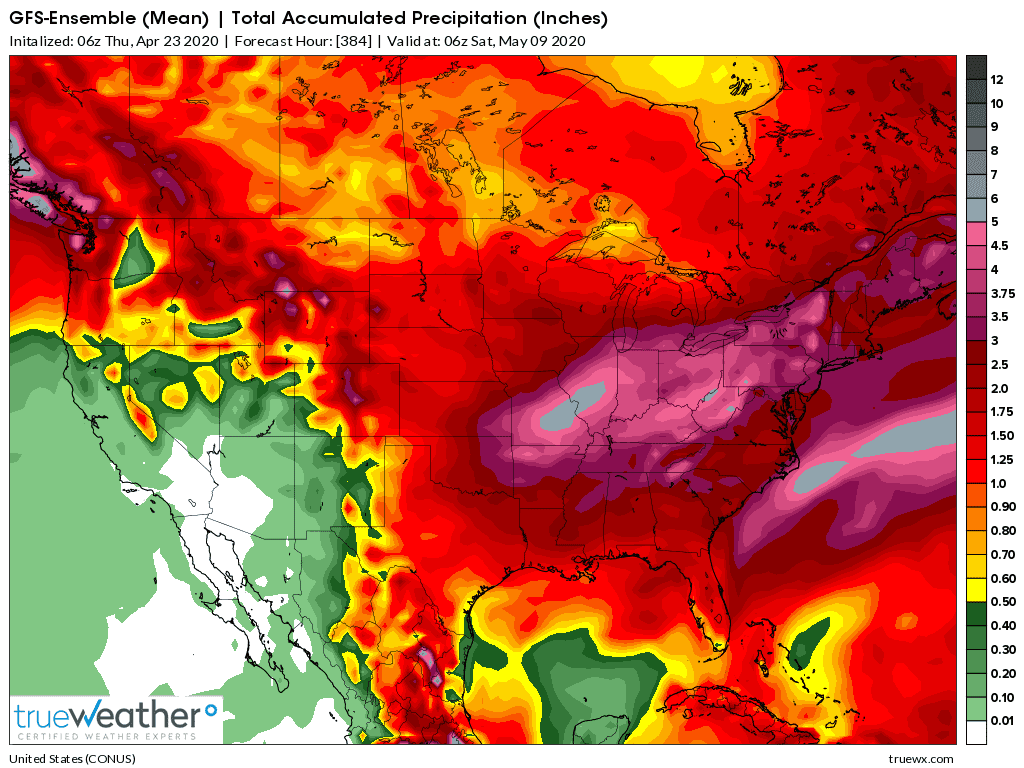

Potential for heavy rains for the southern and eastern belt is growing in week 2. I think it took us off the lows today.......but there is very high uncertainty.

2 week totals below from the last GFS ensemble.

#Corn futures

The did-you-know format of #AGTRIVIA felt more appropriate today given its unpleasant nature. Most-active (July) #corn hit $3.09 early Tuesday. The last time the most-active contract traded below $3 was October 13, 2006. $3.09 is lowest for most-active since Sept. 11, 2009.

ken morrison@morrisonmkts·

ken morrison@morrisonmkts·Replying to

bullish sentiment in corn for the 2008 & 2009 dates: 9/8/2009 10% 12/8/2008 11% 12/5/2008 5% sentiment on 10/13/2006 was 92%, corn rallied @ 60-cents during the month bullish sentiment at Monday's close 9%

Conditions in the U.S. #Corn Belt have improved over the last three weeks for #plant20. Some areas could even use a rain. Actual soil moisture is still largely above average for most of the Belt, but it is trending the correct way for planting - opposite of 2019.

This is the actual soil moisture anomaly: latest date compared with April 2019. Some places are still wet but overall, much better this year. #agwx

Latest 2 week rains from 6z GFS ensemble(early this morning)