KEY EVENTS TO WATCH FOR:

Monday, April 27, 2020

10:30 AM ET. April Texas Manufacturing Outlook Survey

Business Activity (previous -70.0)

Mfg Production Idx (previous -35.3)

Tuesday, April 28, 2020

7:45 AM ET. The Retail Economist/Goldman Sachs Weekly Chain Store Sales Index

Chain Store Sales, W/W% (previous +1.3%)

Chain Store Sales, M/M% (previous -20.1%)

8:30 AM ET. March Advance Economic Indicators Report

8:55 AM ET. Johnson Redbook Retail Sales Index

Ret Sales Mo-to-Date, M/M% (previous -10.6%)

Ret Sales Mo-to-Date, Y/Y% (previous -4.4%)

Latest Wk, Y/Y% (previous -6.9%)

9:00 AM ET. February S&P CoreLogic Case-Shiller Indices

10-City Idx, M/M% (previous +0.1%)

10-City Idx, Y/Y% (previous +2.6%)

20-City Idx, M/M% (previous +0.0%)

20-City Idx, Y/Y% (previous +3.1%)

National Idx, M/M% (previous +0.0%)

National Idx, Y/Y% (previous +3.9%)

10:00 AM ET. April Richmond Fed Business Activity Survey

Mfg Idx (previous 2)

Shipments Idx (previous 13)

10:00 AM ET. April Consumer Confidence Index

Cons Conf Idx (previous 120)

Expectation Idx (previous 88.2)

Present Situation Idx (previous 167.7)

10:00 AM ET. 1st Quarter U.S. Housing Vacancies

4:30 PM ET. API Weekly Statistical Bulletin

Crude Stocks, Net Chg (Bbls) (previous +13.2M)

Gasoline Stocks, Net Chg (Bbls) (previous +3.4M)

Distillate Stocks, Net Chg (Bbls) (previous +7.6M)

N/A U.S. Federal Open Market Committee meeting

Wednesday, April 29, 2020

7:00 AM ET. MBA Weekly Mortgage Applications Survey

Composite Idx (previous 768.5)

Composite Idx, W/W% (previous -0.3%)

Purchase Idx-SA (previous 186.4)

Purchase Idx-SA, W/W% (previous +2.1%)

Refinance Idx (previous 4206.7)

Refinance Idx, W/W% (previous -0.8%)

8:30 AM ET. 1st Quarter Advance estimate GDP

Annual Rate, Q/Q% (previous +2.1%)

Chain-Weighted Price Idx, Q/Q% (previous +1.3%)

PCE Price Idx, Q/Q% (previous +1.4%)

Purchase Price Idx, Q/Q% (previous +1.4%)

Real Final Sales 1st Est, Q/Q% (previous +3.1%)

Core PCE Price Idx, Q/Q% (previous +1.3%)

Personal Consumption, Q/Q% (previous +1.8%)

10:00 AM ET. March Metropolitan Area Employment & Unemployment

10:00 AM ET. March Pending Home Sales Index

Pending Home Sales (previous 111.5)

Pending Home Sales Idx, M/M% (previous +2.4%)

Pending Home Sales Idx , Y/Y% (previous +9.4%)

10:30 AM ET. EIA Weekly Petroleum Status Report

Crude Oil Stocks (Bbl) (previous 518.64M)

Crude Oil Stocks, Net Chg (Bbl) (previous +15.022M)

Gasoline Stocks (Bbl) (previous 263.234M)

Gasoline Stocks, Net Chg (Bbl) (previous +1.017M)

Distillate Stocks (Bbl) (previous 136.88M)

Distillate Stocks, Net Chg (Bbl) (previous +7.876M)

Refinery Usage (previous 67.6%)

Total Prod Supplied (Bbl/day) (previous 14.103M)

Total Prod Supplied, Net Chg (Bbl/day) (previous +0.306M)

(Bbl/day)

2:00 PM ET. U.S. interest rate decision

Federal Funds Rate

Federal Funds Rate Change (Pts)

Fed Funds Rate-Range High (previous 0.25)

Fed Funds Rate-Range Low (previous 0.00)

FOMC Vote For Action

FOMC Vote Against Action

Discount Rate (previous 0.25)

Discount Rate Change (Pts)

Discount Rate-Range High

Discount Rate-Range Low

Thursday, April 30, 2020

8:30 AM ET. March Personal Income & Outlays

Personal Income, M/M% (previous +0.6%)

Consumer Spending, M/M% (previous +0.2%)

PCE Price Idx, M/M% (previous +0.1%)

PCE Price Idx, Y/Y% (previous +1.8%)

PCE Core Price Idx, M/M% (previous +0.2%)

PCE Core Price Idx, Y/Y% (previous +1.8%)

8:30 AM ET. Unemployment Insurance Weekly Claims Report - Initial Claims

Jobless Claims (previous 4427K)

Jobless Claims, Net Chg (previous -810K)

Continuing Claims (previous 15976000)

Continuing Claims, Net Chg (previous +4064K)

8:30 AM ET. 1st Quarter Employment Cost Index

ECI, Q/Q% (previous +0.7%)

ECI, Y/Y% (previous +2.7%)

8:30 AM ET. U.S. Weekly Export Sales

Corn (Metric Tons) (previous 670.8K)

Soybeans (Metric Tons) (previous 345.4K)

Wheat (Metric Tons) (previous 399.9K)

9:45 AM ET. Bloomberg Consumer Comfort Index

9:45 AM ET. April ISM-Chicago Business Survey - Chicago PMI

PMI-Adj (previous 47.8)

10:30 AM ET. EIA Weekly Natural Gas Storage Report

Working Gas In Storage (Cbf) (previous 2140B)

Working Gas In Storage, Net Chg (Cbf) (previous +43B)

3:00 AM ET. March Agricultural Prices

Farm Prices, M/M% (previous -2.2%)

4:30 PM ET. Foreign Central Bank Holdings

4:30 PM ET. Money Stock Measures

4:30 PM ET. Federal Discount Window Borrowings

N/A Foreign portfolio holdings of U.S. securities final results

Friday, May 1, 2020

9:45 AM ET. April US Manufacturing PMI

PMI, Mfg (previous 48.5)

10:00 AM ET. March Construction Spending - Construction Put in Place

New Construction (previous -1.3%)

Residential Construction

10:00 AM ET. April ISM Manufacturing Report on Business

Manufacturing PMI (previous 49.1)

Prices Idx (previous 37.4)

Employment Idx (previous 43.8)

Inventories (previous 46.9)

New Orders Idx (previous 42.2)

Production Idx (previous 47.7)

4:00 PM ET. April Domestic Auto Industry Sales

The STOCK INDEXES http://quotes.ino.com/exchanges/?c=indexes"

The STOCK INDEXES:The June NASDAQ 100 was higher in overnight trading on expectations of reopening the economy and central bank action. The high-range trade sets the stage for a steady to higher opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If June resumes the rally off March's low, the 75% retracement level of the February-March-decline crossing at 9003.03. Closes below the 20-day moving average crossing at 8299.80 would confirm that a short-term top has been posted. First resistance is the 75% retracement level of the February-March-decline crossing at 9003.03. Second resistance is the 87% retracement level of the February-March-decline crossing at 9384.61. First support is the 20-day moving average crossing at 8299.80. Second support is the reaction low crossing at 7948.00.

The June S&P 500 was higher in late-overnight trading. The high-range overnight trade sets the stage for a steady to higher opening when the day session begins trading later this morning.Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. If June extends the rally off March's low, the 62% retracement level of the February-March-decline crossing at 2921.04 is the next upside target. Closes below the 20-day moving average crossing at 2715.20 would confirm that a short-term top has been posted. First resistance is the 62% retracement level of the February-March-decline crossing at 2921.04. Second resistance is the 75% retracement level of the February-March-decline crossing at 3081.80. First support is the 20-day moving average crossing at 2715.20. Second support is the April 1st low crossing at 2448.00.

INTEREST RATES http://quotes.ino.com/ex changes/?c=interest"

INTEREST RATES: June T-bonds were slightly lower in late-overnight trading while extending this month's trading range. Stochastics and the RSI are diverging and are turning neutral to bearish hinting that a double top with the early April high might be forming. Multiple closes below the reaction low crossing at 177-14 would confirm that a double top has been posted. If June renews the rally off March's low, the March 12th high crossing at 184-07 is the next upside target. First resistance is the March 12th high crossing at 184-07. Second resistance is March's high crossing at 191-22. First support is the reaction low crossing at 177-14. Second support is the 50-day moving average crossing at 175-24.

June T-notes were slightly lower overnight. The low-range overnight trade sets the stage for a steady to lower opening with the day session begins trading. Stochastics and the RSI have turned neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the April 7th low crossing at 138.160 would confirm that a short-term top has been posted while opening the door for additional weakness near-term. If June extends the rally off March's low, March's high crossing at 140.240 is the next upside target. First resistance is last-Tuesday's high crossing at 139.220. Second resistance is March's high crossing at 140.240. First support is the April 7th low crossing at 138.160. Second support is the 50-day moving average crossing at 136.216.

ENERGY MARKETS? http://quotes.ino.com/ex?changes/?c=energy ""

June crude oil was lower in overnight trading as it consolidates some of the rebound off last-Tuesday's low.The low-range overnight trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at 24.13 would signal that a short-term low has been posted. If June renews this year's decline, downside targets are unknown. First resistance is the 20-day moving average crossing at 24.13. Second resistance is the April 9th high crossing at 33.15. Third resistance is the 50-day moving average crossing at 33.86. First support is last-Tuesday's low crossing at 6.50. Second support is unknown.

June heating oil was steady to slightly lower overnight as it extends this year's decline. The low-range overnight trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are oversold but remain turning neutral to bearish signaling that sideways to lower prices are possible near-term. If June extends this year's decline, the October-2001 low on the monthly continuation chart crossing at 49.30 is the next downside target. Closes above the 20-day moving average crossing at 95.79 are needed to confirm that a short-term low has been posted. First resistance is the 20-day moving average crossing at 95.79. Second resistance is the April 2nd high crossing at 116.02. First support is last-Wednesday's low crossing at 70.84. Second support is the October-2001 low on the monthly continuation chart crossing at 49.30.

June unleaded gas was slightly lower overnight. The low-range late-overnight trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are turning neutral signaling that sideways trading is possible near-term. Closes above the reaction high crossing at 82.72 would signal that a short-term low has been posted. If June renews last-Tuesday's decline, March's low crossing at 51.89. First resistance is the reaction high crossing at 82.72. Second resistance is the 25% retracement level of the January-March-decline crossing at 88.30. First support is March's low crossing at 51.89. Second support is monthly support crossing at 32.40.

June Henry natural gas was lower overnight. The low-range overnight trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 1.864 would confirm that a short-term top has been posted. If June renews the rally off April's low, the 50% retracement level of the 2019-2020-low crossing at 2.154 is the next upside target. First resistance is March's high crossing at 2.108. Second resistance is the 50% retracement level of the 2019-2020-low crossing at 2.154. First support is the 20-day moving average crossing at 1.864. Second support is the April 16th low crossing at 1.705. Third support is April's low crossing at 1.649.

CURRENCIEShttp://quotes.ino.com/ex changes/?c=currencies"

CURRENCIES:The June Dollar was lower in late-overnight trading as it consolidates some of the rally off April's low. The low-range overnight trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. If June resumes the decline off March's high, the 62% retracement level of March's rally crossing at 98.14 is the next downside target. If June extends the rally off April's low, the April 6th high crossing at 101.03 is the next upside target.First resistance is the April 6th high crossing at 101.03. Second resistance is March's high crossing at 103.96. First support is the 50% retracement level of March's rally crossing at 99.24. Second support is the 62% retracement level of March's rally crossing at 98.13.

The June Euro was steady to slightly higher in late-overnight trading. The high-range overnight trade sets the stage for a steady to higher opening when the day session begins trading. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 50-day moving average crossing at 109.94 would temper the near-term bearish outlook. If June extends this month's decline, March's low crossing at 106.71 is the next downside target. First resistance is April's high crossing at 110.07. Second resistance is the March 27th high crossing at 111.88. Third resistance is the March 16th high crossing at 112.78. First support is last-Friday's low crossing at 107.39. Second support is March's low crossing at 106.71.

The June British Pound was slightly higher overnight as it consolidates some of last-Tuesday's decline.The high-range overnight trade sets the stage for a steady to higher opening when the day session beings trading. Stochastics and the RSI are turning neutral to bullish hinting that sideways to higher prices are possible near-term. If June resumes the rally off March's low the 62% retracement level of the December-March-decline crossing at 1.2758 is the next upside target. If June extends last-Tuesday's decline, the April 7th low crossing at 1.2174 is the next downside target. First resistance is the 62% retracement level of the December-March-decline crossing at 1.2758. Second resistance is the 75% retracement level of the December-March-decline crossing at 1.3042. First support is the April 7th low crossing at 1.2174. Second support is March's low crossing at 1.1438.

The June Swiss Franc was slightly lower in late-overnight trading. The low-range overnight trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI remain neutral to bearish signaling that sideways to lower prices are possible near-term. If June extends last-week's decline, March's low crossing at 1.0138 is the next downside target. Closes above the 50-day moving average crossing at 1.0397 would confirm that a short-term low has been posted. First resistance is April's high crossing at 1.0443. Second resistance is the March 30th high crossing at 1.0566. Third resistance is the March 16th high crossing at 1.0698. First support is last-Friday's low crossing at 1.0216. Second is March's low crossing at 1.0138.

The June Canadian Dollar was higher overnight as it consolidates some of the decline off the April-13th high crossing at 72.24. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If June resumes the rally off March's low, the 50-day moving average crossing at 72.22 is the next upside target.If June renews the aforementioned decline, the March 31st low crossing at 69.73 is the next downside target. First resistance is the 50-day moving average crossing at 72.22. Second resistance is the 50% retracement level of the January-March-decline crossing at 72.73. First support is the March 31st low crossing at 69.74. Second support is March's low crossing at March's low crossing at 68.20.

The June Japanese Yen was higher in quiet overnight trading as it extends the trading range of the past two-weeks. The high-range overnight trade sets the stage for a steady to higher opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If June resumes the rally off March's low, the 25% retracement level of the 2016-2020 decline crossing at 0.0943 is the next upside target. Closes below the 50-day moving average crossing at 0.0927 would temper the near-term friendly outlook. First resistance is the April 1st high crossing at 0.0938. Second resistance is the 25% retracement level of the 2016-2020-decline crossing at 0.0943. First support is April's low crossing at 0.0916. Second support is March's low crossing at 0.0900.

PRECIOUS METALS http://quotes.ino.com/ex changes/?c=metals"

PRECIOUS METALS: June gold was lower in late-overnight trading as it consolidates some of the rally off last-Tuesday's low. The low-range overnight trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below last-Tuesday's low crossing at $1666.20 would confirm that a short-term top has been posted while renewing the decline off April's high. If June renews the rally off March's low, the October-2012 high on the monthly continuation chart crossing at $1798.10 is the next upside target. First resistance is the April 14th high crossing at $1788.80. Second resistance is the October-2012 high on the monthly continuation chart crossing at $1798.10. First support is last-Tuesday's low crossing at $1666.20. Second support is the 50-day moving average crossing at $1646.60.

July silver was steady to slightly lower overnight. The mid-range overnight trade sets the stage for a steady opening when the day session begins trading later this morning. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below last-Tuesday's low crossing at $14.715 would confirm that a short-term top has been posted. If July renews the rally off March's low, the 75% retracement level of the February-March-decline crossing at $17.237 is the next upside target. First resistance is the 62% retracement level of the February-March-decline crossing at $16.252. Second resistance is the 75% retracement level of the February-March-decline crossing at $17.237. First support is last-Tuesday's low crossing at $14.715. Second support is April's low crossing at $13.935.

July copper was steady to slightly lower in late-overnight trading. The low-range overnight trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are becoming overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If July extends the rally off March's low, the 50% retracement level of the January-March-decline crossing at 2.4380 is the next upside target. Closes below last-Tuesday's low crossing at 2.2170 would signal that a short-term top has been posted. First resistance is the 50-day moving average crossing at 2.3787. Second resistance is the 50% retracement level of the January-March-decline crossing at 2.4380. First support is last-Tuesday's low crossing at 2.2170. Second support is March's low crossing at 1.9795.

GRAINS http://quotes.ino.com/ex changes/?c=grains

July corn was lower overnight due to spillover weakness from crude oil. The low-range trade sets the stage for a steady to lower opening when the day sessions begins trading. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. If July resumes the decline off December's high, psychological support crossing at $3.00 is the next downside target. Closes above the 20-day moving average crossing at $3.31 3/4 are needed to confirm that a low has been posted. First resistance is the 20-day moving average crossing at $3.31 3/4. Second resistance is the 50-day moving average crossing at $3.54 3/4. First support is last-Tuesday's low crossing at $3.09. Second support is psychological support crossing at $3.00.

July wheat was lower in late-overnight trading. The low-range trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If July resumes the decline off March's high, the 75% retracement level of March's rally crossing at $5.13 1/2 is the next downside target. Closes above the 20-day moving average crossing at $5.45 1/2 would temper the near-term bearish outlook. First resistance is April's high crossing at $5.64 1/2. Second resistance is March's high crossing at $5.71 1/2. First support is the 62% retracement level of March's rally crossing at $5.23 3/4. Second support is 75% retracement level of March's rally crossing at $5.13 1/2.

July Kansas City Wheat closed down $0.10-cents at $4.83 1/4.

July Kansas City wheat closed lower on Friday. The low-range close sets the stage for a steady to lower opening when Monday night session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 50-day moving average crossing at $4.75 3/4 are needed to confirm that a short-term top has been posted. If July resumes the rally off March's low, January's high crossing at $5.19 is the next upside target. First resistance is March's high crossing at $5.09 1/4. Second resistance is January's high crossing at $5.19. First support is the 50-day moving average crossing at $4.75 3/4. Second support is April's low crossing at $4.67 3/4.

July Minneapolis wheat was lower overnight as it is poised to extend this year's decline. The low-range overnight trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If July extends this year's decline psychological support crossing at $5.00 is the next downside target. Closes above the 50-day moving average crossing at $5.33 1/4 are needed to confirm that a short-term low has been posted. First resistance is the 50-day moving average crossing at $5.33 1/4. Second resistance is April's high crossing at $5.48 1/4. Third resistance is March's high crossing at $5.51 1/2. First support is last-Friday's low crossing at $5.11 1/4. Second support is psychological support crossing at $5.00.

SOYBEAN COMPLEX? http://quotes.ino.com/ex?changes/?c=grains "

July soybeans were steady to fractionally higher overnight. The low-range trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at $8.56 are needed to signal that a short-term low has been posted. If July renews the decline off the March 25th high, psychological support crossing at $8.00 is the next downside target. First resistance is the 20-day moving average crossing at $8.56. Second resistance is the 50-day moving average crossing at $8.74 1/2. First support is last-Tuesday's low crossing at $8.18 1/2. Second support is psychological support crossing at $8.00.

July soybean meal was slightly higher overnight. The mid-range trade sets the stage for a steady to higher opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that a low might be in or is near. Closes above the 20-day moving average crossing at $299.20 are needed to confirm that a short-term low has been posted. If July resumes this year's decline, monthly support crossing at $283.10 is the next downside target. First resistance is the 20-day moving average crossing at $299.20. Second resistance is the 50-day moving average crossing at 304.20. First support is last-Tuesday's low crossing at $286.50. Second support is monthly support crossing at $283.10.

July soybean oil was lower overnight. The low-range trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes above the 20-day moving average crossing at 26.85 would temper the near-term bearish outlook. If July extends the decline off April's high, March's low crossing at 25.02 is the next downside target. First resistance is the 25% retracement level of the January-March-decline crossing at 27.82. Second resistance is the 38% retracement level of the January-March-decline crossing at 29.31. First support is last-Tuesday's low crossing at 25.18. Second support is March's low crossing at 25.02.

LIVESTOCKhttp://quotes.ino.com/exchanges/?c=livestock

June hogs closed down $0.10 at $51.53.

June hogs closed slightly lower on Friday. The mid-range close sets the stage for a steady to lower opening when Monday's night session begins trading. Stochastics and the RSI remain neutral to bullish signaling that sideways to higher prices are possible near-term. Today's close above the 20-day moving average crossing at $50.55 confirms that a short-term low has been posted. If June renews this year's decline, weekly support crossing at $40.70 is the next downside target. First resistance is today's high crossing at $53.48. Second resistance is the April 8th high crossing at $57.15. First support is last-Tuesday's low crossing at $41.50. Second support is weekly support crossing at $40.70.

June cattle closed down $0.30 at $82.62.

June cattle closed lower on Friday. The high-range close sets the stage for a steady to higher opening on Monday. Stochastics and the RSI are neutral signaling that sideways prices are possible near-term. Closes above last-Friday's high crossing at $88.13 are needed to confirm that a short-term low has been posted. If June resumes this year's decline, monthly support crossing at $69.29 is the next downside target. First resistance is last-Friday's high crossing at $88.13. Second resistance is the 50-day moving average crossing at $94.05. First support is April's low crossing at $76.60. Second support is monthly support crossing at $69.29.

May Feeder cattle closed up $0.18-cents at $117.45.

May Feeder cattle closed higher on Friday. The high-range close sets the stage for a steady to higher opening when Monday's session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above last-Friday's high crossing at $120.85 would signal that a short-term low has been posted. If May resumes this year's decline, monthly support crossing at $95.50 is the next downside target. First resistance is last-Friday's high crossing at $120.85. Second resistance is the 50-day moving average crossing at $124.57. First support is April's low crossing at $103.62. Second support is monthly support crossing at $95.50.

FOOD & FIBERhttp://quotes.ino.com/ex changes/?c=food

May coffee gapped down and closed sharply lower on Friday as it extends the decline off March's high. The low-range close sets the stage for a steady to lower opening on Monday. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If May extends this week's decline, March's low crossing at 10.14 is the next downside target. Closes above the 20-day moving average crossing at 11.59 would signal that a low has been posted.

July cocoa closed sharply lower on Friday as it extends the decline off March's high. The low-range close sets the stage for a steady to lower opening on Monday. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If July extends the decline off March's high, March's low crossing at 10.13 is the next downside target. Closes above the 20-day moving average crossing at 11.72 would signal that a short-term low has been posted.

July sugar closed lower on Friday as it extends this week's decline. The low-range close set the stage for a steady to lower opening on Monday. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible. If July extends the decline off February's high, monthly support crossing at 8.36 is the next downside target. Closes above the 20-day moving average crossing at 10.33 are needed to temper the near-term bearish outlook.

July cotton closed lower on Friday. The low-range close sets the stage for a steady to lower opening on Monday. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If July extends the rally off March's low, the 50-day moving average crossing at 58.46 is the next upside target. Closes below the 20-day moving average crossing at 52.83 would temper the near-term friendly outlook.

Thanks tallpine!

Planting resumes in places in the cornbelt...........waits to dry out in other places.

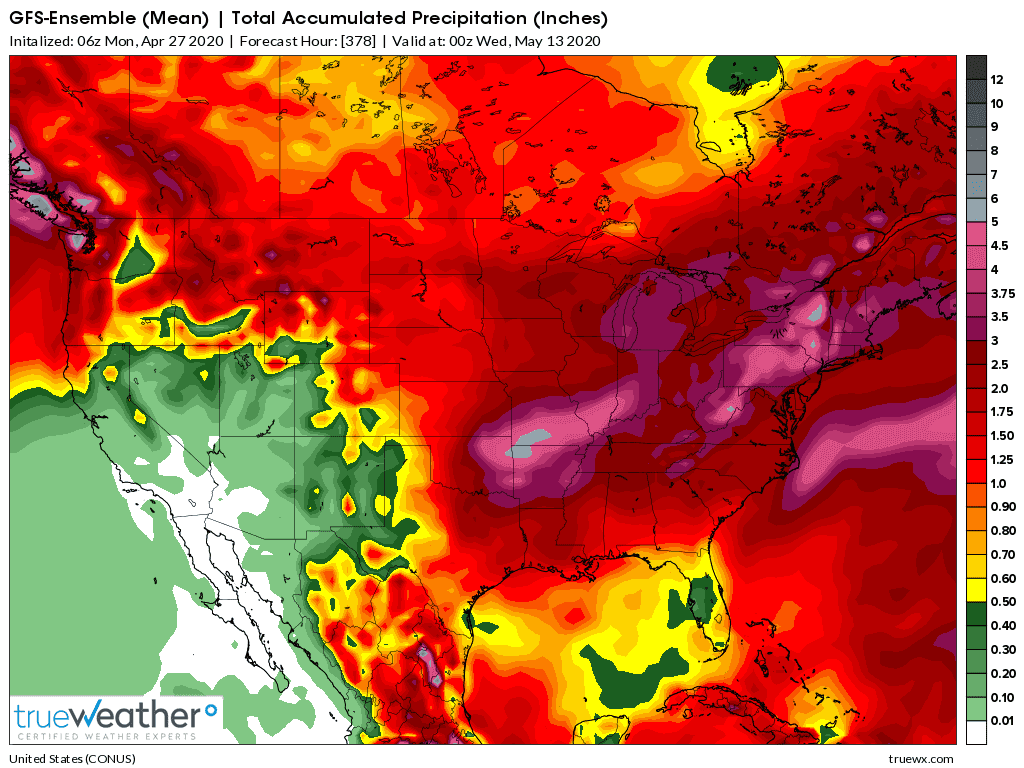

2 week rains from the latest 6z GFS.

Good for planting northwest 2/3rds of the Cornbelt. Turning/staying too wet southeast 1/3rd.