Nothing of consequence being reported today and I have a busy weekend coming up, so off we go.

Note: I;ve excluded the PMI Composite Flash, key word being "Flash". I'll include the more comprehensive full report which will be released next week. I gave it an honorable mention earlier.

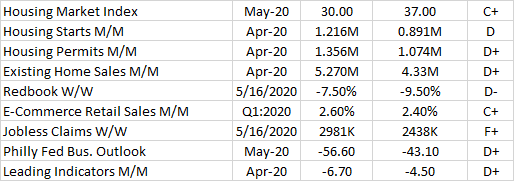

Again with no real surprise this week:

Retail showed an increased decrease this week. I do find this a little dissapointing as I expect we'll be seeing better (not good) numbers in the near term. I also expected E-Commerce to take a larger slice than it did as Amazon, et.al. have been going full blast+. Perhaps next QTR? Q1 was on the cusp Needless to say, people will continue to rely more and more on internet shopping. I also expect Retail will be one of the earliest signs of recovery.

Jobless claims continue to measure in the millions but continue to drop at significant rates. That well has to go dry, hopefully sooner than later. The impact remains largely in the lower income brackets.

Housing is in the ditch with a slight ray of hope in the Housing Market Index which showed an uptick of 7 points. This is a good leading indicator as it's a survey of Builders. Of course, it still remains at about half of the low normal.

Philly Fed and Leading indicators trimmed their descent but remain in historically low territory.

Overall, the trend is "Not as bad as it was".. Still abnormally bad, just not quite as abnormally bad. I continue to hold optimism for the not too distant. I'll give the week a well earned D+.

Looks like progress and slightly better than last week.

Thanks very much Tim!

I may start using that old tried and true statistical metric known as the "Suck Scale" where 1="hardly sucks at all" to 10="sucks more than anything".

We've been at a solid 10 for about a month but are working towards a 9.5..