1. Here are comparisons of CDDs for the 1`2Z runs of today vs the 12Z runs of Fri (HDDs are now too low to have significant impact and likely will stay that way til at least some point well into Sep):

Euro ens: +3

GFS ens: +6

2. CDD comparisons of 12Z today vs 0Z on Fri

Euro ens: +6

GFS ens: +10

I suspect that some of Friday's very late session price increases were tied to the slightly warmer Fri 12Z runs vs 0Z runs. Note that the "pit" close was pretty wildly bullish with a sudden rise of a couple of cents after having just fallen back some. Those gains were largely maintained through the session close. For that reason, the wx aspect of this evening's open would probably be more related to the comparison to 12Z Fri runs rather than vs the Fri 0Z runs. Of course, with the wx changes being fairly small, other factors may have more of an impact on the opening.

Thanks much Larry,

I will guess higher open because the overall pattern looks more impressive with a heat ridge and heating up with time in week 2.

Ideally, we would have the heat ridge in the Southeast or East to maximize CDD's vs the Plains and farther West but it looks fairly widespread.

Metmike

Your comment about nat gas possibly rising near term. Keep in mind I see the gas market now as 1st time a world market like oil. Covid 10 has throttled LNG exports but I vie that as temporary.

Have been through a number of these downturns.... 1985 1998 2009 2014. Now this. I thought this in 2008, it felt "different". This really feels "different". The serious problems as I see them:

1. With the exception of the the largest of the shale independents..they are shutout of the capital markets and it may be for a long time. The shale model of finance capital expenditures with cheap coupon bonds then use a revolver to refinance then bonds again to refiance the revolver plus new capital expenditures has not worked. This was happening before Covid 19. WLL filed Chapt 11 before Corona really affected the economy and the pre-bankrupty common gets 3+% of newco.

2. The workforce including service is decimated. This actually began in 2014. Precipitated by pressure from private equity..... management of the shale cos adopted unrealistic numbers includes the EURs and to a lesser extend on the cost side. The most lauded CEOs were among most "optimistic" about EURs. Technical issues / problems abound when prediction affect of down spacing and UORs in drill units.

If any of you follow twitter @WillRayValentin (suedo name) and his associates in the Midland Mafia have been shorting the Shale Cos for some time. Excellent understanding of the technical issues of drilling completion stimulation. Caution ...they are taking a victory lap right now...IMO never as bad as a short seller says it is.

3. Have no idea when the economy recovers to precovid levels ... and an anti hydrocarbon campaign complicates things. I live in CO which has a shale play of its own. 500K Bbls per day in N Co Weld County. Most of the area up to Greeley are suburbs of Denver. City of Broomfield has done all it can to stop oil develoment in the City / County. XOG (80K Bbls/D) paid 600M$ for leases under Broomfield most of which will not be drilled. Will not be able to refi the bonds.

4. I do see extreme volatility. Problems not anticipated...the Black Swan period of the oil industry. Operations impaired by unanticipated volumes..both high and low....unqualified labor force ....don't get the best and brightest because of the extreme cycles ...lack of capital ... and of course the Sauds who can at least short term manipulate the price short term.

Not the most optimistic review. Believe it will be back but when? Politicians can't shut it down as there is no alternative ...exception perhaps the Covid restrictions remain in place.

Maybe the volatility is the answer to make some money. Where is SAG...the guy that wrote the put /calls book?

Anyway back to shift.

Thanks much for your views from the field Joe!

Sounds/Reads like a tremendous amount of uncertainty. Please keep us posted on what you see/think.

+++++++++++++++++++++++++++

Joe's post above, was a continuation of his thoughts from earlier today expressed here:

By joelund - May 24, 2020, 8:28 a.m.

14 Rigs active and i am down to 1.

Local Electric coop deals with the electric demand charge:

https://oilpatchhotline.com/mountrail-williams-cuts-electric-bills-to-aid-bakken-oil-producers/

Price +$13 per Bbl at the wellhead.

Obviously wrong about my prediction of 0 Rigs by the end of May, although only

1 Co (Burlington) has more than 1 (2) Rig active. The value of hedges and firm transport

out of the Basin.

+++++++++++++++++++++++++

By metmike - May 24, 2020, 12:37 p.m.

Thanks Joe!

One would think that when demand starts coming back, things could get pretty bullish for prices, considering where they are right now.

Residential cooling demand, if unusually high this Summer from widespread heat waves in the high population centers could more than offset the loss from industrial demand.

Previous ng thread for May is here:

June Natural gas did open higher at 1.746, touched 1.750, then has been dropping............ok, I looked at volume and realized its past time to switch to following July NG, which has traded 2,930 contracts compared to just 356 for June NG.

So July NG opened higher at 1.882 and managed to hit 1.895 a few seconds after that then weakened to a low of 1.848 2 hours later, just after 7pm.

Now at 1.857 -.24 vs the 1:30p close on Friday.

A bit surprised that we are this weak but the heat ridge in week 2 on the last GFS ensembles leaves out the South/Southeast to MidAtlantic which at this time of year are the areas with the biggest potential to generate the most CDD's because seasonal averages are so much higher than the north this early in the Summer and this area has a pretty high population.

CDD's are still fairly impressive from the Southwest to the Northern Plains but not a heck of a lot of people live there. This pattern is actually more bullish for the grains compared to natural gas but it is definately NOT bearish for ng and if all other things were exactly balanced except for weather, one would expect us to be a bit higher here.

NGM expires on Wednesday and there is always a higher than usual risk of a surprising spike up or down during the last few days of trading, as well as trading which defies expectations.

NGM set a new life of contract low on May 13th at 1.595.

However, NGN did not.

It's May low was on the 15th at 1.822, which I would call mega support. The price has dropped down to that area over half a dozen times over the last month and it held.

The life of contract low for July NG was set on March 13th at 1.802.

So NGN is just over $500 above its contract low but NGM is over $1,100 above its contract low.

for week ending May 15, 2020 | Released: May 21, 2020 at 10:30 a.m. | Next Release: May 28, 2020

+81 BCF Neutral to a tad bullish

| Working gas in underground storage, Lower 48 states Summary textCSVJSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (05/15/19) | 5-year average (2015-19) | |||||||||||||||||||||||

| Region | 05/15/20 | 05/08/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 469 | 452 | 17 | 17 | 346 | 35.5 | 376 | 24.7 | |||||||||||||||||

| Midwest | 576 | 554 | 22 | 22 | 356 | 61.8 | 432 | 33.3 | |||||||||||||||||

| Mountain | 124 | 117 | 7 | 7 | 87 | 42.5 | 129 | -3.9 | |||||||||||||||||

| Pacific | 253 | 240 | 13 | 13 | 183 | 38.3 | 246 | 2.8 | |||||||||||||||||

| South Central | 1,081 | 1,059 | 22 | 22 | 753 | 43.6 | 913 | 18.4 | |||||||||||||||||

| Salt | 345 | 340 | 5 | 5 | 246 | 40.2 | 286 | 20.6 | |||||||||||||||||

| Nonsalt | 737 | 719 | 18 | 18 | 507 | 45.4 | 627 | 17.5 | |||||||||||||||||

| Total | 2,503 | 2,422 | 81 | 81 | 1,724 | 45.2 | 2,096 | 19.4 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,503 Bcf as of Friday, May 15, 2020, according to EIA estimates. This represents a net increase of 81 Bcf from the previous week. Stocks were 779 Bcf higher than last year at this time and 407 Bcf above the five-year average of 2,096 Bcf. At 2,503 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2015 through 2019. The dashed vertical lines indicate current and year-ago weekly periods.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release May 21, 2020 Actual 81B Forecast 83B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| May 28, 2020 | 10:30 | 83B | 81B | ||

| May 21, 2020 | 10:30 | 81B | 83B | 103B | |

| May 14, 2020 | 10:30 | 103B | 107B | 109B | |

| May 07, 2020 | 10:30 | 109B | 106B | 70B | |

| Apr 30, 2020 | 10:30 | 70B | 69B | 43B | |

| Apr 23, 2020 | 10:30 | 43B | 39B | 73B |

Temperatures during the 7 day period thru last Friday for last weeks EIA report.

Pretty chilly in the N. Plains to Midwest to Northeast with an unusually high amount of HDD's which caused caused the injection to be lower than the previous 2 weeks.

7 day temps ending last Friday for this next EIA report. Not nearly as bullish so the injection will be triple digits again.

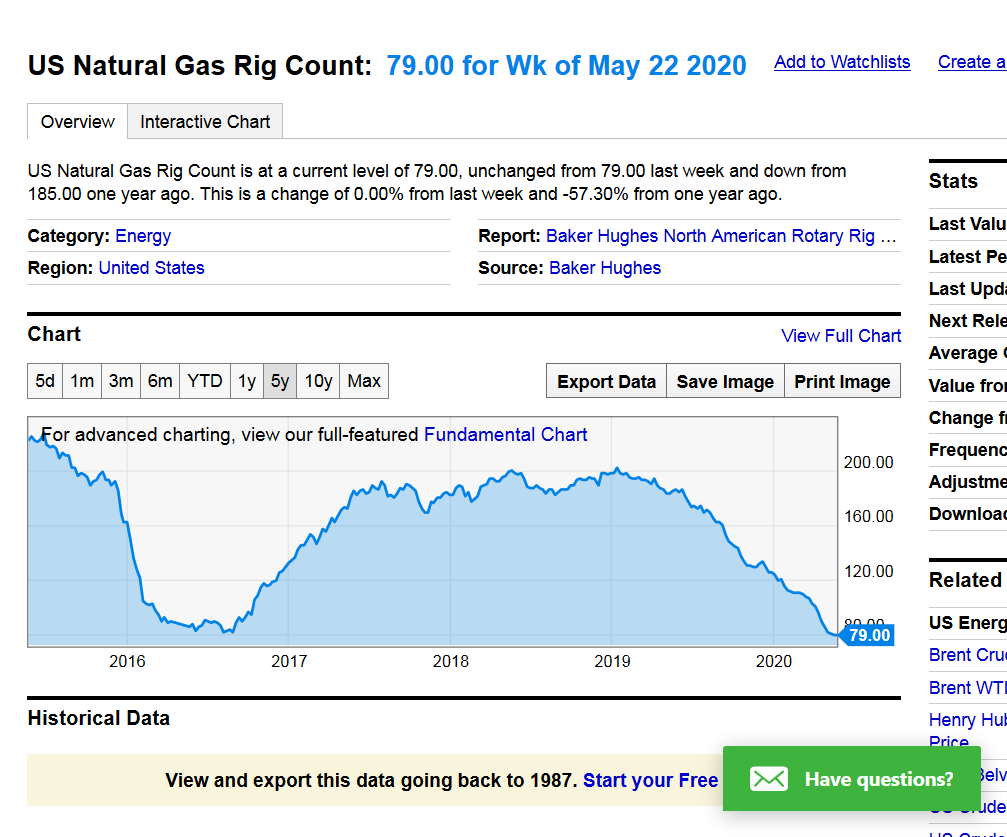

https://ycharts.com/indicators/us_gas_rotary_rigs

US Natural Gas Rig Count:

79.00 for Wk of May 22 2020

metmike: This is tied with the previous week and the lowest rig count number in history which was set back in August of 2016 when there were 81 rigs.

https://www.enerdynamics.com/Energy-Insider_Blog/Are-Natural-Gas-Prices-Below-3-Sustainable.aspx

om Bloomberg New Energy Finance, breakeven economics vary widely by production basin:

Source: Bloomberg New Energy 2019 Sustainable Energy in America Factbook

++++++++++++++++++++++++++++++++

It seems paradoxical that producers might break even with negative prices, but in some markets they can because they produce oil and/or natural gas liquids along with the natural gas. With certain types of wells, producers don’t have the option of producing just the most valuable commodities but must produce all fuels at once. In some basins such as the Permian and Eagle Ford in Texas, natural gas is produced as a by-product of oil.

The wells are also wet, meaning that significant quantities of natural gas liquids (NGLs) such as butane, ethane, and propane are also present in the gas stream. Thus, as long as prices hold for oil and NGLs, producers can afford to pay someone to take the natural gas away and still make money.

Even in basins such as the Marcellus Basin, which is primarily focused on natural gas, the economics vary significantly based on the presence of NGLs. This is demonstrated by the Marcellus Wet (wells with NGLs) breakeven price of $1.77/MMBtu compared to a price of $2.43 for a dry well (limited or no NGLs). This means that a producer of a wet gas can do quite nicely with a market price of $2.25 while a producer with a dry well will lose money.

Why don’t producers simply keep the valuable stuff and release the natural gas into the air or burn it at the wellhead in a process called flaring? Some producers do, but doing so results in significant greenhouse gas emissions, so many producers restrict the practice either as a matter of corporate policy or due to regulations. Many continue to find a market for the gas even if it isn’t contributing to profit in the short run as demonstrated by a recent run of negative prices in the Permian Basin.

The value associated with producing a well varies depending on the ratio of oil, gas, and NGLs, as well as the market price of each commodity. Prices vary significantly over time, requiring producers to continually evaluate whether to keep drilling more wells. Also banks must continually evaluate whether to keep lending producers the money to drill wells.

0z GFS ensemble had a whopping 10 less CDD's.

Pretty big cooling for one run of an ensemble to the next.

Impressive heat ridge in the Plains but strong cooling in the Northeast late week 1 and no heat ridge in the South/Southeast that we need in early June to really be bullish.

Dryness in the N.Plains/Upper Midwest, spreading south is the big deal here.

Heat shifts West! Turning much drier! Here's your Monday weather: https://www.marketforum.com/forum/topic/52777/

Heat continues to be farther west than ideal locations for ng bullishness which is where more people live.....in the south and east.

Instead, it will be centered closer to where crops are grown, in the Plains and west of that.

Natural Gas Intelligence Monday Morning:

Forecasts Warm Over Weekend as Natural Gas Futures Called Higher; LNG Hits New Monthly Low

8:56 AM

metmike: Widespread above temps but the hottest weather will be west of the high population centers in the South and East.

June Natural Gas Expires 7 Cents Lower on Bleak LNG Outlook, Ballooning Storage

5:08 PM

Natural gas futures took a step back Wednesday, quickly erasing the gains mounted following the holiday weekend. With export demand remaining a threat and eyes on a plump storage injection, the June Nymex gas futures contract expired 7.1 cents lower at $1.722. July, which takes over the prompt-month position on Thursday, fell 5.9 cents to $1.886

metmike: The heat, initially is missing the East and South where more people live and hitting where less people live and crops are grown, so not so bullish NG today but that could change.

Wed/Thu weather: Heat on the way, especially West to the Plains to points eastward for awhile(not in highest population centers of the East and South):

My look forward.

We have reached the point in the year where the weather will definitely start changing to summer weather for all. In the middle of Alabama, the humidity is normally already getting high by the first of May, and we are just now starting to feel it. The heat is usually just a couple of weeks behind it. Of course, we are generous with it, and share it with the rest of the nation to the north and east shortly thereafter. And if this year is a La Nina, then we should get pretty hot all the way up the eastern half of the country. So the A/Cs are going to be running soon.

Given the very low rig count, and the near historic lows in NG, even though we have a generous supply in storage, we gonna start using it. Prices are going to start rising again. Add to that, that if our economy breaks open in the next month, industrial needs will also be on the rise rather quickly.

Been playing NG off the cuff all spring. In my honest opinion, I think that after today's report, which I expect to be neutral/bearish, we are going to see a turn upwards for the rest of the summer.

Thanks Mark,

If we can get the heat to shift farther east, the weather will turn bullish.

for week ending May 22, 2020 | Released: May 28, 2020 at 10:30 a.m. | Next Release: June 4, 2020

+109 BCF is huge but just a bit higher than expected

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (05/22/19) | 5-year average (2015-19) | |||||||||||||||||||||||

| Region | 05/22/20 | 05/15/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 504 | 469 | 35 | 35 | 374 | 34.8 | 403 | 25.1 | |||||||||||||||||

| Midwest | 606 | 576 | 30 | 30 | 389 | 55.8 | 459 | 32.0 | |||||||||||||||||

| Mountain | 132 | 124 | 8 | 8 | 92 | 43.5 | 134 | -1.5 | |||||||||||||||||

| Pacific | 264 | 253 | 11 | 11 | 195 | 35.4 | 254 | 3.9 | |||||||||||||||||

| South Central | 1,105 | 1,081 | 24 | 24 | 784 | 40.9 | 939 | 17.7 | |||||||||||||||||

| Salt | 348 | 345 | 3 | 3 | 252 | 38.1 | 291 | 19.6 | |||||||||||||||||

| Nonsalt | 757 | 737 | 20 | 20 | 532 | 42.3 | 648 | 16.8 | |||||||||||||||||

| Total | 2,612 | 2,503 | 109 | 109 | 1,834 | 42.4 | 2,189 | 19.3 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,612 Bcf as of Friday, May 22, 2020, according to EIA estimates. This represents a net increase of 109 Bcf from the previous week. Stocks were 778 Bcf higher than last year at this time and 423 Bcf above the five-year average of 2,189 Bcf. At 2,612 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2015 through 2019. The dashed vertical lines indicate current and year-ago weekly periods.

Latest MarketForum weather on Thursday: https://www.marketforum.com/forum/topic/52900/

Life of contract low for July NG is 1.802 set on March 18th. The low tonight has been 1.805, which is the current price.

0Z European ensemble added 10 CDD from the heat ridge being farther east, in high population centers for much of the period..............very early morning and we spiked off of the near contract low of 1.804 to the highs of 1.865 but the late week 2 pattern suggested the heat ridge shifting farther west on all the models at that time.

The next run, 06z GFS ensemble really showed the shift much farther west of the heat ridge late week 2, with more cooling in the East and also, did not have the additional CDD's of the previous EURO which set ng up for selling on other bearish fundamental and technical factors.

Not that seasonals matter here but ng seasonals are coming off of their strongest period of the year and headed into a weaker period.

https://charts.equityclock.com/natural-gas-futures-ng-seasonal-chart

Heating up this week in many places! Here's your Sunday weather: https://www.marketforum.com/forum/topic/53065/

Temps not a great deal different overall......a tad cooler look on some models for late in the period but a bit warmer in some places before then on some models.

Sun 12Z vs Fri 12Z CDDs: mixed

GEFS: +3

EPS: -6

Thanks for that Larry!

I am pretty neutral here.

Friday, we actually put in a reversal higher, after dropping well below the previous contract low, we managed to close a bit higher for the day.

Surely this was from the threat of the upcoming heat, even if the South, East, Northeast or Upper Midwest will not be at the center of the heat ridge, there will be some modest heat in some of those locations for some of the time.

I would definately not call the weather bearish, even though fundamentals are bearish and seasonals turn lower this month(very strong up seasonals in the Spring failed to help NG this year).

News about shut ins and demand, crude and the stock market will probably take center stage if we don't get hotter or don't cool down...........there is some threat of much cooler weather in mid June for the middle of the country but thats speculative.

Not quite as hot, especially the farther you go out.

NG trading below the previous contract lows earlier this year.

Natural Gas Futures Tumble on Lower LNG Feed Gas Flows

5:19 PM

Natural gas futures gave up ground Monday as worries mounted about declining international demand and lower feed gas flows to U.S. liquefied natural gas (LNG) export facilities. The July Nymex contract settled at $1.774/MMBtu, down 7.5 cents day/day. August fell 6.9 cents to $1.871.

MarketForum weather early Tuesday: https://www.marketforum.com/forum/topic/53160/

Natural Gas Futures Cling to Slight Gains Despite Festering LNG Headwinds

5:08 PM

Natural gas futures crept up early Tuesday and hung on to a narrow advance on the day as heat took hold in the West and weekend weather forecasts trended modestly warmer, creating potential for increased air conditioner use that could begin to offset weakening demand for U.S. exports. The July Nymex contract settled at $1.777/MMBtu, up three-tenths of a cent day/day. August rose a half-cent to $1.876.

I'm thinking that long positions are being established these last couple of days. If you can weather the drawdown, probably a good idea.

11 Rigs active and I have 1

Wellhead price for ND Sweet recovered to almost $30 / Bbl

Oil Gas volumes Jan and March 2020. Shut ins not visable yet.

ND oil production 01 2020 1.430M Bbls/D

ND oil production 03 2020 1.428M Bbls/D

ND Gas prod 01 2020 93,685,245 MCF

ND Gas prod 03 2020 96,902,755 MCF

Hess announced 6 rig program through end of year. Target maintain 200,000 Bbls per D

NGI after the close:

Improving Supply/Demand Balances Boost Natural Gas Futures, For Now, and Power Burns Drive Cash

5:31 PM

Natural gas futures climbed Wednesday as much of the fundamental supply/demand backdrop became increasingly supportive of prices. Prices rallied strongly early in the session, but then gave up some ground, leaving the July Nymex gas futures contract up 4.4 cents to $1.821. August picked up 3.9 cents to settle at $1.915.

for week ending May 29, 2020 | Released: June 4, 2020 at 10:30 a.m. | Next Release: June 11, 2020

Initially a bit bullish with a spike higher that sold off to lower on the day. The forecast has some heat but not yet in the high population areas or sustained long enough to offset some short term negative fundamentals.

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (05/29/19) | 5-year average (2015-19) | |||||||||||||||||||||||

| Region | 05/29/20 | 05/22/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 536 | 504 | 32 | 32 | 405 | 32.3 | 433 | 23.8 | |||||||||||||||||

| Midwest | 634 | 606 | 28 | 28 | 425 | 49.2 | 489 | 29.7 | |||||||||||||||||

| Mountain | 140 | 132 | 8 | 8 | 99 | 41.4 | 140 | 0.0 | |||||||||||||||||

| Pacific | 273 | 264 | 9 | 9 | 209 | 30.6 | 264 | 3.4 | |||||||||||||||||

| South Central | 1,131 | 1,105 | 26 | 26 | 813 | 39.1 | 966 | 17.1 | |||||||||||||||||

| Salt | 353 | 348 | 5 | 5 | 255 | 38.4 | 297 | 18.9 | |||||||||||||||||

| Nonsalt | 778 | 757 | 21 | 21 | 558 | 39.4 | 668 | 16.5 | |||||||||||||||||

| Total | 2,714 | 2,612 | 102 | 102 | 1,952 | 39.0 | 2,292 | 18.4 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,714 Bcf as of Friday, May 29, 2020, according to EIA estimates. This represents a net increase of 102 Bcf from the previous week. Stocks were 762 Bcf higher than last year at this time and 422 Bcf above the five-year average of 2,292 Bcf. At 2,714 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2015 through 2019. The dashed vertical lines indicate current and year-ago weekly periods.

Friday after the close from Natural Gas Intelligence:

Natural Gas Futures Slide as Market Awaits Fresh Data; Cash Also Weakens

++++++++++++++++++++++++++++++++++++++++

Natural gas futures were slightly lower but still range bound to finish the week as the July Nymex contract swung in a less than 10-cent band before settling Friday at $1.782, off 4.0 cents day/day. August was down 3.1 cents to $1.886.

Sizzling Saturday! Update to Summer forecast. Here's your weather: https://www.marketforum.com/forum/topic/53434/

Natural Gas Intelligence Monday Morning:

"A decline in demand from liquefied natural gas (LNG) export facilities over the weekend had natural gas futures trading lower early Monday. The July Nymex contract was off 1.5 cents to $1.767/MMBtu at around 8:45 a.m. ET.

Flows to U.S. LNG facilities dropped below 4 Bcf/d to average 3.9 Bcf/d over the weekend, according to Tudor, Pickering, Holt & Co. (TPH) analysts.

“The biggest drop came from Sabine Pass, which dipped to a new low of 1.1 Bcf/d (about 35% utilization), making Cameron the largest demand source over the weekend at 1.4 Bcf/d,” the TPH analysts said. “Flows to Cameron have been quite resilient, with a trailing 30-day utilization of 96% and current rates at 72%, which is supported by offtake to Japanese ut

On the Mid-Atlantic coast, the Dominion Cove Point LNG export facility “has also seen resilient demand, sitting at 83% utilization,” the analysts added. Cove Point “benefits from its location in Maryland with access to discounted Northeast feed gas.”

On the supply side, Bespoke Weather Services said the latest production data showed a small decline in output, likely a result of shut-ins from Tropical Storm Cristobal over the weekend.

However, the drop in LNG demand “is the data point that has the market concerned, as traders want to see evidence that we can maintain the tightening of supply/demand balances with LNG at much lower levels,” Bespoke said.

As of 8 a.m. ET, the National Hurricane Center (NHC) had downgraded Cristobal to a tropical depression. The storm was about 50 miles south-southeast of Monroe, LA, and carrying maximum sustained winds of 35 mph.

“On the forecast track, the center of Cristobal should move through northeastern Louisiana today, through Arkansas and eastern Missouri tonight and Tuesday, and reach Wisconsin and the western Great Lakes by Wednesday,” the NHC said.

Looking at the bigger weather picture for the Lower 48, Bespoke said the latest guidance heading into Monday’s trading came in slightly hotter compared to Friday’s forecast. Bespoke noted a “small gain in forecast demand this week, thanks to more coverage of above normal temperatures in the eastern U.S. overriding less heat down in Texas, and a hotter look in the 11-15 day period from the Midwest to the East.

“In between, we do see a cooler interlude centered on this weekend in the wake of a trough passing through the East, which is enough to hold projected” gas-weighted degree days “down to just slightly above normal levels.”

Magnificent Monday to you!

Here's your weather: https://www.marketforum.com/forum/topic/53480/

Slightly Cool to close to average temps later this week into early next week for the high population centers of the Midwest/East/South

How much heating up after that?

Weatherwise, I think we have hit the bottom for NG. Today's low failed to break the previous low of 1.740 on June 1. The lower numbers for export just weren't enough to hold it down. And I don't think weather will either after this week.

JMHO

Thanks Mark!

You might be right. Today could have been a double bottom with the June 1 low of 1.742.

Ideally, we will see the heat in the Plains, where not many people live, spread farther east, to the high population regions that use a ton of electricity from burning natural gas to cool their houses.

I'm leaning strongly in the direction of this Summer being a hot one because of the La Nina conditions that I think have already started.

NG prices are incredibly low. How much longer can they stay down here?

If it stays cooler, however I can't guess where the price might go any better than anybody else.

NGI after the close on Monday:

Natural Gas Futures Bound to Narrow Range as Cristobal Strikes, LNG Demand Drops

4:57 PM

Natural gas futures scratched out a modest gain Monday after Tropical Storm Cristobal made landfall a day earlier, forcing shut-ins but also bringing cooler air to the South. Entrenched worries about weakness in demand from liquefied natural gas (LNG) export facilities curbed price momentum.

NG forecast still keeps the heat out of the high population centers in the Midwest/East/South so less ng burning to generate electricity for AC use...........bearish for demand and prices.

Natural Gas Futures Fall on Mixed Weather, Continued Weak LNG Outlook

5:12 PM

Natural gas futures dipped into the red early Tuesday and remained there on demand concerns tied to mixed weather forecasts and diminished natural gas exports. The July Nymex contract settled at $1.767/MMBtu, down 2.2 cents day/day. August was down 2.9 cents to $1.863.

metmike: Forecast is still too cool. If we can get a long lasting heat ridge to push into the Midwest, East or South, I feel confident that ng prices will surge higher.

WOW! Did you see that in ng?

The previous life of contract low had been 1.742 from June 1 and been holding this week. Lots of traders willing to buy just above this huge support earlier this week but not that many willing to sell when we got near this support level.

I figured there would be a ton of stops below that and at 6:09pm, when the 18z GFS ensemble was coming out a bit cooler yet, we got enough selling to offset all the buy orders above 1.742, then hit a massive load of sell stops that spiked us to 1.674 within seconds, a drop over almost $900/contract in just seconds.

I was actually not prepared to trade this spike lower or even anticipating it but was typing and caught the spike on the right part of my screen and immediately put an order in to buy 2 contracts at the market when we were below 1.700 and got filled at 1.678. ...........knowing there was no way that prices would keep going lower.

After we bounced higher, I put in a sell stop at 1.713, which quickly got hit and was out........but wait, I was so unprepared that my stop was for only 1 contract. I got out of the other one at 1.711 for +$680 in 1 minute.

I never post trades but had to post this one because it was so unusual and mostly based on luck(though I knew the spike would come back at least half way when it started) and have only had a couple of trades similar to this in my life.

Made me wish I had done alot more than 2 contracts.

You've heard of day traders?

How about minute traders?

Actually, there are probably many thousands of traders that use fluctuations measured in minutes to get in and out of the markets.

Quite frankly, they mess it up for everybody else by causing wild gyrations that can go in the opposite of the expected direction for a brief period..........stop other traders out, then proceed with the main move in the expected direction.

So 1.742 might now serve as resistance if you were looking from a technical point but we could easily violate that and/or get above it and stay above it, especially if the models turn warmer overnight.

Wed am from NGI: Weak U.S. LNG Export Utilization Expected as Natural Gas Futures Steady Early

Global Natural Gas Consumption Facing ‘Historic Shock’ in 2020, with Demand Set to Fall by 4%

9:20 AM

The pandemic and a mild winter in the northern hemisphere have delivered a “historic shock” to the global natural gas market, with consumption set to decline in 2020 by twice the amount lost after the 2008 financial crisis, the International Energy Agency (IEA) said Wednesday.

Here's your Wonderful Wednesday Weather....heating up next week: https://www.marketforum.com/forum/topic/53579/

12z GFS ensemble was COOLER!

NGI Wednesday:

Despite LNG Worries, Natural Gas Futures Gain Ground on Increased Cooling Demand Outlook

Natural gas futures rallied early Wednesday and held in positive territory throughout the trading day on forecasts for a relatively hot June and expectations that rising temperatures will drive seasonally robust energy demand to power air conditioners.

About to go long september NG. Will use august NG as a spread protection in order to profit on puilbacks/drawdowns.

Good luck!

Let us know how it goes.

You can always try to use a spike lower on a bearish EIA report to enter but I'm not advising going long unless we have sustained heat in the forecast.

Seasonally/historically this is actually a time to get short but the price has been doing the opposite of seasonal trends the past 3 months.

I can't imagine being short at this price, unless we had record cool weather for weeks.

Traders Awaiting EIA Number as Natural Gas Futures Steady

9:00 AM

Natural gas futures traders appeared to be keeping their powder dry early Thursday as they awaited the latest weekly government storage data. The July Nymex contract was up 0.5 cents to $1.785/MMBtu at around 8:45 a.m. ET. Read More

for week ending June 5, 2020 | Released: June 11, 2020 at 10:30 a.m. | Next Release: June 18, 2020

+93 BCF neutral to a bit bearish

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (06/05/19) | 5-year average (2015-19) | |||||||||||||||||||||||

| Region | 06/05/20 | 05/29/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 563 | 536 | 27 | 27 | 433 | 30.0 | 461 | 22.1 | |||||||||||||||||

| Midwest | 662 | 634 | 28 | 28 | 460 | 43.9 | 518 | 27.8 | |||||||||||||||||

| Mountain | 148 | 140 | 8 | 8 | 108 | 37.0 | 146 | 1.4 | |||||||||||||||||

| Pacific | 281 | 273 | 8 | 8 | 223 | 26.0 | 272 | 3.3 | |||||||||||||||||

| South Central | 1,153 | 1,131 | 22 | 22 | 836 | 37.9 | 988 | 16.7 | |||||||||||||||||

| Salt | 357 | 353 | 4 | 4 | 256 | 39.5 | 302 | 18.2 | |||||||||||||||||

| Nonsalt | 797 | 778 | 19 | 19 | 580 | 37.4 | 686 | 16.2 | |||||||||||||||||

| Total | 2,807 | 2,714 | 93 | 93 | 2,059 | 36.3 | 2,386 | 17.6 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,807 Bcf as of Friday, June 5, 2020, according to EIA estimates. This represents a net increase of 93 Bcf from the previous week. Stocks were 748 Bcf higher than last year at this time and 421 Bcf above the five-year average of 2,386 Bcf. At 2,807 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2015 through 2019. The dashed vertical lines indicate current and year-ago weekly periods.

Latest Release Jun 11, 2020 Actual93B Forecast93B Previous102B

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jun 11, 2020 | 10:30 | 93B | 93B | 102B | |

| Jun 04, 2020 | 10:30 | 102B | 110B | 109B | |

| May 28, 2020 | 10:30 | 109B | 107B | 81B | |

| May 21, 2020 | 10:30 | 81B | 83B | 103B | |

| May 14, 2020 | 10:30 | 103B | 107B | 109B | |

| May 07, 2020 | 10:30 | 109B | 106B | 70B |

Temps ending last Friday for the 7 day period for this last EIA.

HOT Plains and Rockies but not many people live there.

Natural Gas Futures Climb After Storage Build Meets Expectations; Forecasts Call for Late June Heat

5:12 PM

Natural gas futures advanced Thursday after the latest storage report met expectations and forecasts continued to call for more June heat. However, demand concerns lingered as markets absorbed an economic outlook that pointed to protracted fallout from the coronavirus pandemic. The July Nymex contract settled at $1.813/MMBtu, up 3.3 cents day/day. August rose 3.0 cents to $1.900.

Figgity Diggity Friday to you! Here's your refreshing weather............................cooler week 2 for NG!!!

Heating up this week!

Here's your weather: https://www.marketforum.com/forum/topic/53797/