By

The American Petroleum Institute reported late Tuesday that U.S. crude supplies rose by 1.97 million barrels for the week ended Dec. 11, according to sources. The data also reportedly showed gasoline stockpiles up by 828,000 barrels, while distillate inventories rose by 4.8 million barrels. Crude stocks at the Cushing, Okla., storage hub, meanwhile, edged down by 165,000 barrels for the week, sources said. Inventory data from the Energy Information Administration will be released Wednesday. On average, the EIA data are expected to show crude inventories down by 1.9 million barrels last week, according to a survey of analysts conducted by S&P Global Platts, which also forecast supply increases of 2.6 million barrels for gasoline and 1.1 million barrels in distillates. January West Texas Intermediate crude CLF21, -0.13% was at $47.55 a barrel in electronic trading, compared with Tuesday’s settlement at $47.62 on the New York Mercantile Exchange.

Previous thread on Crude.

EIA report out 9:30 am Wednesday.

EIA massive oil build!

11 responses |

Started by metmike - Dec. 9, 2020, 11:02 a.m.

Crude oil prices rose today after the Energy Information Administration reported a crude oil inventory decline of 3.1 million barrels for the week to December 11.

The report came out a day after the American Petroleum Institute estimated inventory builds across crude and fuels, pressuring prices just as they had started to improve again.

Analysts had expected the EIA to report a 3.5-million-barrel decline in crude oil inventories for the week to December 11, after it estimated a huge build of over 15 million barrels for the previous week.

In gasoline, the authority reported an inventory build of 1 million barrels for last week, which compared with a hefty increase of 4.2 million barrels for the previous week, following another increase, of 3.5 million bpd for the week before that. Gasoline production last week averaged 8.5 million bpd, which compared with 8.3 million bpd a week earlier.

In middle distillates, the EIA estimated an inventory increase of 200,000 barrels for the week to December 11, compared with a build of 5.2 million barrels for the previous week and another, of 3.2 million barrels, for the week before that. Distillate fuel production averaged 4.6 million bpd last week, compared with 4.7 million bpd for the prior week.

API’s inventory report surprised market participants, causing a decline in prices, which was also fueled by renewed worry about demand as several European countries reinstated or tightened their movement restrictions—despite the upcoming holidays—to stem the spread of the coronavirus.

It appears the initial enthusiasm about oil demand recovery driven by mass vaccinations has started to wear off as the challenges come to the surface in terms of availability and distribution. These challenges mean it will take more than a few weeks to vaccinate enough people to be able to talk about a return to normal, just like medical experts warned at the height of the vaccine hype a month ago.

Tsvetana Paraskova

Pressured by plunging oil prices and the need to adjust to the lower oil demand, U.S. oil producers have slashed costs and managed to bring down their average breakeven costs by nearly 20 percent to $45 a barrel on average, Bloomberg’s research service, BloombergNEF (BNEF), said on Thursday.

According to BloombergNEF’s estimates, U.S. oil producers have cut their average breakeven costs from an average of $56.50 per barrel last year to $45 a barrel now. Some of the most prolific areas in the U.S. shale patch, such as the core of the Permian and Eagle Ford basins, have even seen breakeven costs dropping to an average of $36.50 per barrel now, from $44 a barrel last year.

All companies, from the smallest driller to the largest corporations, have reduced capital spending this year in response to the collapse in oil prices, and they will continue to show spending discipline next year amid the uncertain recovery of oil demand and oil prices.

Due to the plunge in oil prices and oil demand, U.S. drillers quickly implemented drastic cost cuts. As a result, they improved efficiencies, optimized well and field operations, and renegotiated contracts, BNEF said.

Earlier this month, BNEF said that even though the U.S. shale patch had further reduced its breakevens over the past year, the decline in drilling costs alone may not be sufficient to help producers to lift production after this year’s downturn.

The Third-Quarter Dallas Fed Energy Survey from the end of September showed that most executives from 154 oil and gas firms—66 percent—believe U.S. oil production has already peaked.

Total U.S. crude oil production is set to remain close to its current levels of around 11 million barrels per day (bpd) through the end of 2021, as new drilling activity will not be enough to offset declines from existing wells, the Energy Information Administration (EIA) said last month

https://www.investing.com/economic-calendar/eia-crude-oil-inventories-75

Latest Release Dec 16, 2020 Actual-3.135M Forecast-1.937M Previous15.189M

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Dec 23, 2020 | 10:30 | -1.937M | -3.135M | ||

| Dec 16, 2020 | 10:30 | -3.135M | -1.937M | 15.189M | |

| Dec 09, 2020 | 10:30 | 15.189M | -1.424M | -0.679M | |

| Dec 02, 2020 | 10:30 | -0.679M | -2.358M | -0.754M | |

| Nov 25, 2020 | 10:30 | -0.754M | 0.127M | 0.768M | |

| Nov 18, 2020 | 10:30 | 0.768M | 1.650M | 4.278M |

| Weekly US ending stocks of crude oil. https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRSTUS1&f=W Weekly ending stocks for unleaded gasoline. https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGTSTUS1&f=W Weekly US ending stocks for distillate fuel oil(heating oil-especially used in the Northeast). https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDISTUS1&f=W |

Crude 3 month chart

| |

Crude 1 year chart below

| |

Crude 5 year chart below

| |

Crude 10 year chart below

| |

Unleaded Gasoline Price Charts:

| |

| |

5 year........are we headed back to the highs?

| |

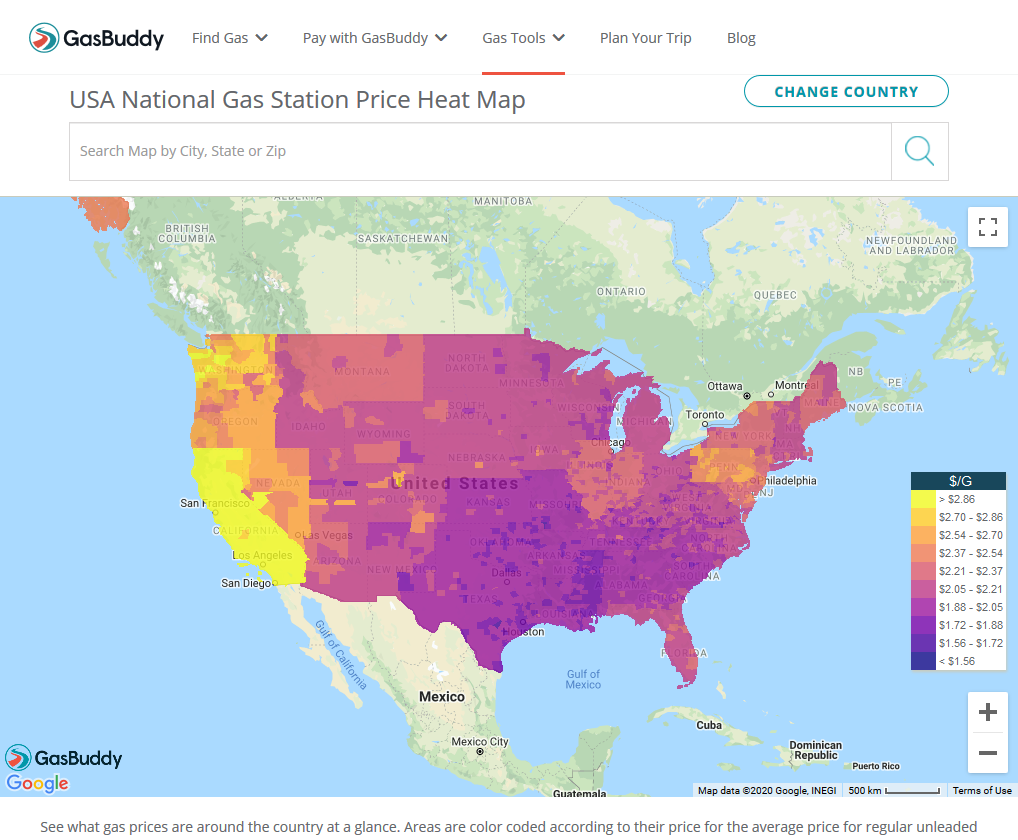

Current gas prices.

https://www.gasbuddy.com/GasPriceMap?z=4&lng=-96.591588&lat=38.822395

Why are west coast gasoline prices higher?

https://www.quora.com/Why-are-west-coast-gasoline-prices-higher