It's time to continue the conversation here.

Gonna be an interestng month. Conversion from winter influence to spring influence. Supply/storage, still strong. Political influence is also in question. Gonna be interesting. Daily.

-128 bcf and the surplus grew from 7% to 9% over last year.

Thanks for starting the over due new thread Mark! I like it the most when you guys start the new threads and make posts...........contributions as a group/forum.

If I had known that I would have restarted some of those NG threads way earlier! Some of those threads were longer than the drop downs I have to go through to get to my birth year!

Thanks much!

It's nice to see if they can last at least a week, so we have all the ng or grain stuff on one thread for convenience and practicality purposes. 2 weeks is fine too for ng but there is no rule on that.

Actually, the only rule that always applies is that we are always grateful to you for any contributions/posts here!

Natural Gas EIA storage

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Jan 28, 2021 Actual-128B Forecast-136B Previous-187B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jan 28, 2021 | 10:30 | -128B | -136B | -187B | |

| Jan 22, 2021 | 10:30 | -187B | -174B | -134B | |

| Jan 14, 2021 | 10:30 | -134B | -130B | ||

| Jan 07, 2021 | 10:30 | -130B | -114B | ||

| Dec 31, 2020 | 10:30 | -114B | -125B | -152B | |

| Dec 23, 2020 | 12:00 | -152B | -160B | -122B |

for week ending January 22, 2021 | Released: January 28, 2021 at 10:30 a.m. | Next Release: February 4, 2021

-128 BCF BEARISH!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (01/22/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 01/22/21 | 01/15/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 641 | 679 | -38 | -38 | 655 | -2.1 | 605 | 6.0 | |||||||||||||||||

| Midwest | 780 | 828 | -48 | -48 | 776 | 0.5 | 718 | 8.6 | |||||||||||||||||

| Mountain | 170 | 176 | -6 | -6 | 145 | 17.2 | 148 | 14.9 | |||||||||||||||||

| Pacific | 275 | 275 | 0 | 0 | 213 | 29.1 | 225 | 22.2 | |||||||||||||||||

| South Central | 1,014 | 1,051 | -37 | -37 | 1,015 | -0.1 | 942 | 7.6 | |||||||||||||||||

| Salt | 288 | 296 | -8 | -8 | 306 | -5.9 | 280 | 2.9 | |||||||||||||||||

| Nonsalt | 726 | 755 | -29 | -29 | 709 | 2.4 | 662 | 9.7 | |||||||||||||||||

| Total | 2,881 | 3,009 | -128 | -128 | 2,803 | 2.8 | 2,637 | 9.3 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,881 Bcf as of Friday, January 22, 2021, according to EIA estimates. This represents a net decrease of 128 Bcf from the previous week. Stocks were 78 Bcf higher than last year at this time and 244 Bcf above the five-year average of 2,637 Bcf. At 2,881 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

These were the temperatures for the 7 day period ending last Friday for this last EIA report......mild for much of the country.

The GFS model is showing what looks to be a cold trough dropping down from Canada two weeks out. Should make things bullish tonight.

Thanks Mark!

What matters the most is what the GFS Ensemble shows and even much more important to the market will be the European Ensemble model.

The week 2 pattern has some extreme cold out West to the Plains. How far east it goes into high population land will determine how bullish the market wants to get.

From earlier:

Natural gas futures faltered Thursday following a bearish storage report and a key weather model pointing to lighter heating demand than previously expected, ending a rally. On its first day as the prompt month, the March Nymex gas futures contract shed 3.8 cents day/day and settled at $2.664. It ended a three-day run of solid…

Last night, shortly after this time frame, when the guidance came out milder(especially the EE) we spiked much lower.

No telling if it will be milder or colder or around the same but you will know by watching the price of NG the next 90+ minutes.

Yeah. The NOAA model shows cold moving from the western plains to the east. But not in the same way as what the GFS model is showing. They are very different. Makes me wonder about the accuracy of either one.

Of course, they (NOAA) can't even predict the accurate landfall of a hurricane from 2 days out.

Apparently, the european models came out with a warmer forecast.

Yes, good observation the EE was -2 HDDs.

Not a big deal really.

There is a ton of cold coming to the western 2/3rds and ng is barely holding up. Not a good sign for the bulls, especially since the cold looks a bit less threatening for the south and east this morning.

Most 12z guidance war less cold (GFS/European models)

Just a little gap up tonight.

The European model turned incredibly colder over the weekend.

From Fri 12z to Sun 12z I have +40 HDD!!!!

The GFS ENS was MUCH, MUCH colder than the Euro on Friday. It's actually -4HDD's so a tad less cold but obviously did a much better job.

We may have a hard time holding up here without the models getting even colder overnight because the cold wave only looks to last around a week in the areas that count and really modifies headed southeast.

I'm with ya on the cold not holding. Probably gonna be looking for an opportunity to short it.

6z GFS was an unbelievable +26HDD's colder. For an ensemble and just 1 run thats a WOW!

Testing mega resistence at 2.835 from the highs of early January.

12z GFS ensemble is coming out even colder!

12z GFS Ens mean was even COLDER +17 HDD's so +43 HDD's in just the last 2 runs...........12 hours!

EE was again incredibly colder!

I think they got an early tip from the woodchuck. LOL

It coordinated well with the timing on the 60minute chart, as the report came out about the time that price met MA.

great chart mark!

NG prices soared again overnight with the European Ensemble adding 26 HDDs

metmike: The extreme nature of the cold and how quickly it showed up on models, caused the massive spike higher and exhausted the short term buying early Tuesday when we spiked to $3.

Even with additional additions of HDD's on some models since then, its not been enough to generate the same amount of buying ammo, especially with prices so much higher than they were before the cold showed up over the weekend..................and with it being February and the market knowing we are on the backside of Winter.

However, if the models advertise the cold lasting thru February, its hard to imagine Natural Gas continuing downward.

I have long noticed how the market reacts differently, at different times of day, and from different weather vs supply. Of course, the supply report is every thursday. But the weather forecasts change daily. As do immediate demand and exports. This is why I can't take a long term position in NG. Some things are predictable. But right now, it's not dependable.

Agree Mark!

Very, very volatile and spikes up and down every time a different model comes out.

7 day temps for Thursdays EIA report:

Mild South, chilly NorthCentral and West.

Well, that hit the nail on the head. Reactions are small. Gonna take some weather to move it up now.

GFS shows warming in the latter part of week 2. Might start seeing it get dialed in tonight.

As the latest round of weather data further increased heating demand expectations, showing intense cold on track to reach the Lower 48 over the next two weeks, natural gas futures surged higher in early trading Friday. The March Nymex contract was up 9.7 cents to $3.032/MMBtu at around 8:45 a.m. ET. As of early Friday…

February 5, 2021

that was mainly the 0z euro ens from very early morning. since then models are much less cold.

A bit off topic but can you imagine how many solar panels would be required to met electric demand for heating plus all other electric needs in a Green society???

February 9, 2021

Imho and I've been following this market for a long time, NG is not trading primarily on wx because if it was it wouldn't be way down here vs the recent highs of ~3.05. It is obviously trading on something(s) bearish in the background, whatever they may be. If one had been following it closely, you can see that there have been selling algorithms in place to sell back any rise quickly and also bring prices further down. There are many times like this when NG doesn't trade primarily on wx.

Here's some evidence:

1. The EPS has gained 5 HDD (and it gained slightly in the 11-15, too) since the 0Z run yesterday. Just before the 12Z run of yesterday started, NG was ~2.87. Now it is ~2.82. So, during a period when the EPS gained 5 HDD, NG dropped 5 cents. Also, today's 12Z EPS 11-15 was 8 HDD colder than today's 0Z. I'm talking about the 11-15 because Mike usually places more emphasis on the late week 2 part of the model.

2. Today's 12Z GEFS: gained 10 HDD vs 0Z (and 6 vs 6Z). Also, it was like the 12Z EPS significantly colder late in week 2. And yet NG is 6.5 cents down for the day.

thanks much larry,

just my thoughts,

did you note the plunge lower in prices when the 0z GEFS, early last night was coming in 32 HDDs lower/warmer than the previous run? the eps then came in 16 hdds warmer adding to the downside pressure.

as always, spikes higher, like we had recently will always be overdone too. we had been fed models that were colder and colder for each run.

these are almost all speculators.

they dont equate xxx HDDs = y.yyy price.

so xxx HDDs today and also 5 days ago will not mean the same price as 5 days ago today.

we were triggering alot of short covering on the way up that provided extra fuel.....and there looked to be no end in sight to the cold, which kept getting colder on each run.....so longs could buy aggressively with little risk because the news was 100% bullish.

"I'm talking about the 11-15 because Mike usually places more emphasis on the late week 2 part of the model."

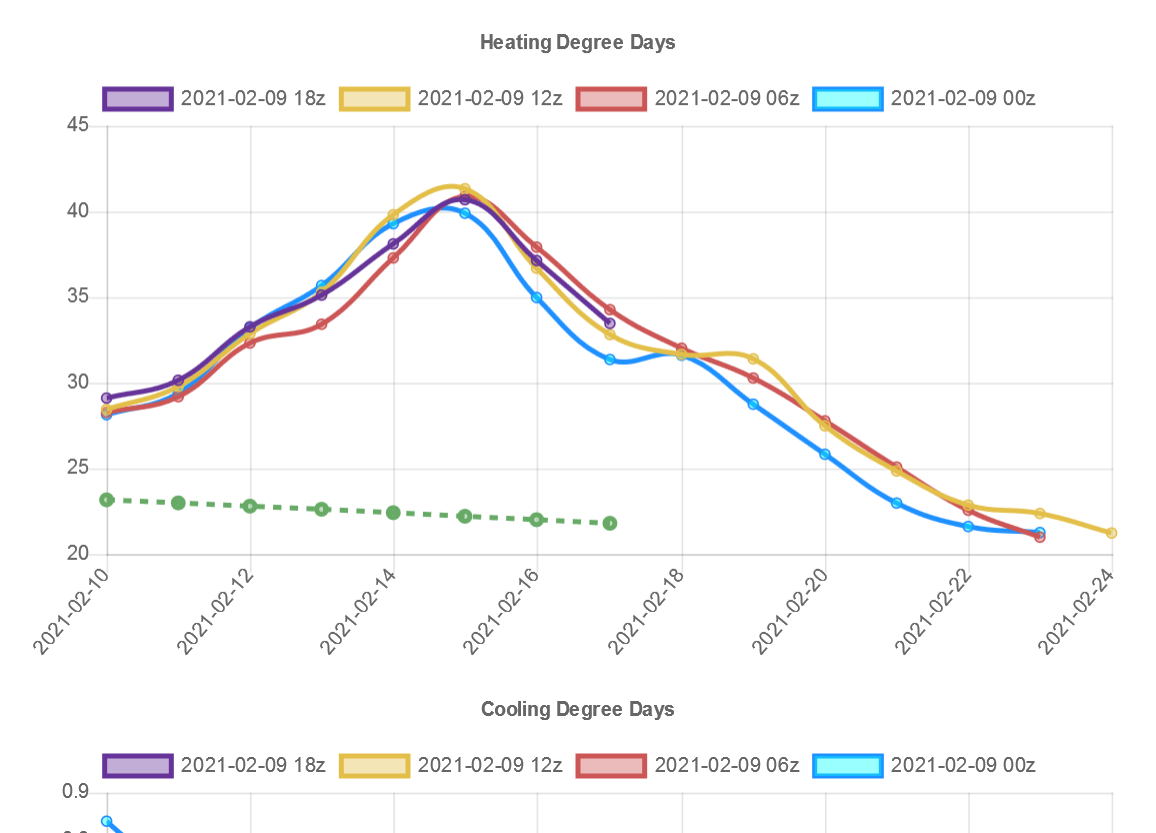

here are the latest plots of hdds for the 2 main models.

sure looks like a huge moderating trend/milder temps in week 2...almost back to average after the coldest air in at least 2 years, during week 1 that got dialed in last week.

note that strong downtrend on every single model run.

why would the market go up on this?

its more than just hdds on some individual models, which sometimes, like last week, dominated entirely when they add to the pattern. its THE PATTERN CHANGE and hdds.

the pattern change is clearly bearish right now, until it gets dialed in...which might be real soon.. so HDDs that are bullish like individual runs that you sited will be fighting upstream to keep prices from falling from the dominant bearish, milder wx pattern change.

so if 1 run below had more hdds but still exhibited the same downtrend as the other models, it doesnt break the bearish psychology.

.png)

Mike,

1. I hope your arm is doing ok.

2. I get the impression that you seemingly always want to explain price movements with wx. Whenever I post that it sometimes doesn't trade primarily on wx, you often will take the other side.

3. I need to amend what I said before. Yes, NG has largely been going down on warming models/forecasts, but is has been struggling to go up on bullish wx like what the 12Z GEFS had today. It just seems to want to go down from other reasons. The few times that it has spiked, it has quickly sold back down.

Maybe price is still too high to keep demand from falling too much?

4. It has been closer to normal though still colder than normal all the way out to near 2/21. It hasn't been warming vs prior runs. It has always been less cold than the near historic cold in mid Feb. It almost has to warm up from record cold. That warmup itself shouldn't be bearish day after day. Just like the record cold should already be dialed in and shouldn't cause prices to rise day after day, the warmup following has also been known and should already be dialed in and thus shouldn't cause prices to keep falling. Furthermore, as I said, 12Z models had that warmup colder than earlier runs!

5. Keep in mind that that days 11-15 are significantly less likely to verify well vs days 1-10 due to inherent uncertainties further out, especially considering recent extreme model volatility even well before in just trying to handle the polar vortex correctly!

6. I say we should agree to disagree. Different ways of looking at this. I don't think we'll be able to convince each other.

"I hope your arm is doing ok."

thanks very much larry,

im a 1 finger typer for at least several weeks.

"I get the impression that you seemingly always want to explain price movements with wx."

actually larry, i was just responding to your post earlier:

"NG is not trading primarily on wx because if it was it wouldn't be way down here"

i was just telling you what my perception of the affect of weather is at this time.

there are always lots of other items for ng to trade but since you only discussed weather for your entire post, i figured that YOU wanted me/others to talk about weather.

I had already expressed this BEFORE today(over 24 hours ago), so it was not after the fact bs that some gurus use, then pretend they knew it before hand.

https://www.marketforum.com/forum/topic/65392/

february 8, 2021 weather

16 responses |

Started by metmike - Feb. 8, 2021, 1:50 p.m.

Fantastic February to you!

Coldest blast in a couple of years on the way! numerous snow/ice events along the ohio river the next 10 days!

moderation expected the 2nd half of february is helping drive ng prices(lower)....containing the bulls.

metmike: regardless, i dont know everything and highly respect all of your valuable opinions even when we disagree.

3. I need to amend what I said before. Yes, NG has largely been going down on warming models/forecasts, but is has been struggling to go up on bullish wx like what the 12Z GEFS had today. It just seems to want to go down from other reasons. The few times that it has spiked, it has quickly sold back down.

Maybe price is still too high to keep demand from falling too much?"

Larry,

I agree 100% on that and it's why i mentioned the spike higher last week had extra short covering and spec buying fuel that came with the extreme bullish weather which over shot fair value.

Now, were probably closer to fair value.

the market does not think $3 is fair value right now. only the most bullish weather forecast possible could get us there briefly and with tons of sellers seeing that as too high.

so $2.8 might still seem too high with weather becoming LESS of a factor.

Thanks, Mike.

Although the record cold should already be dialed in, I predict that there will be one or two days later this month on which it goes up very strongly even without colder wx forecasts. The news stories will then mention the record cold as the reason as it if somehow it hadn't already been dialed in. Just in advance of the two storage reports with anticipated very large draws would be a likely time for one or two of these days. Heck, the expected largest draw for the extreme cold of Feb. 12-18 won't be reported til Feb 25th. I bet the market will rise Feb 23-4 just because of this even though it should have been dialed in even now. That's the weird nature of this market. It will do things that don't seem to make much sense.

I agree totally larry.

we have some extremely bullish eia reports coming up.

1. just that by itself will help to keep the market propped up......until the reports are out.

2. seasonals are starting to turn up and are very strong in march/april.

you dont want to be short ng in mar/april without a real good reason

3. almost everybody would agree that the lows are solidly in

if temps were to be MUCH above normal, that would be a reason to be short into march.