Some of you have said you don't want Canadian health care style services and cost. You may be correct but each to his own. I like our health care, as I have a diabetic ulcer on my foot. What this is, in layman terms, is an open wound which will take possibly a yr to heal [or maybe longer] due to my diabetic condition. [The ulcer started beneath a callus on my foot. So much for the gory details This started with 2 trips to a clinic for wound dressing changes and now my wife changes the dressing [bless her soul as I can't reach it to do a proper job]

This now means a trip to the clinic once every 6 days and a surgeon visit every 4 weeks plus my personal doctor. The danger is infection in the bone and then amputate the foot, part of the leg or who knows how far up they amputate. Fortunately I have no infection in the bone so far, but walking can be painful. We live some distance from the clinic and I am putting miles on my truck. Fortunately we can claim mileage as a deduction on income tax. I would rather my truck stay low mile as it only had 30,000 miles when my foot ulcer started

So guess what, I love my Canadian style health care with all these medical visits and so on, plus a monthly visit to a pain doctor [actually a private clinic as the hospital referred me to this pain doctor] plus monthly blood tests etc.

But what does this cost me???

Canadians pay on average 42.5% tax of all income on Federal provincial and local taxes [Health care is our biggest Federal cost in the budget] or was before Covid and probably still is as those numbers may be dated a bit

By comparison we pay 31 % of income on basic necessities including housing. [ I have no idea if TP is a necessity]

Old age security starts to ratchet back from a maximum of 613.53 per person with income of approx 65-70,000 ]not exactly sure as I don't always make 65,000] to zero at 121,279.00. Some variance for low income receive more, also widow [er] etc. That is a per person payment

One yr we goofed on our income tax schedule and I lost my old age security cheque for a whole dam yr. That was a costly re-alinement of assets for future tax code benefits

Just thought you would be interested in what our health care system costs

Wow Wayne! That is an awesome post!

Looks like you pay a bit more taxes than we do.

Do you have income tax brackets?

On old age security payments, that sure looks like a small amount for somebody to live on. $613. Is that per month? It must be per week then its plenty of money.

Is that based on income you made during your life? or is that just you?

Glad that you like your socialized medicine. I am for socialized medicine here. We hear all the time about how bad socialized medicine is in Canada but you are having a good experience.

I know some other Canadians(just 3 of them from Toronto) that complain about their wait and quality of service. They also complain about the high taxes and how slow the COVID vaccinations have been.

Thanks for sharing that!

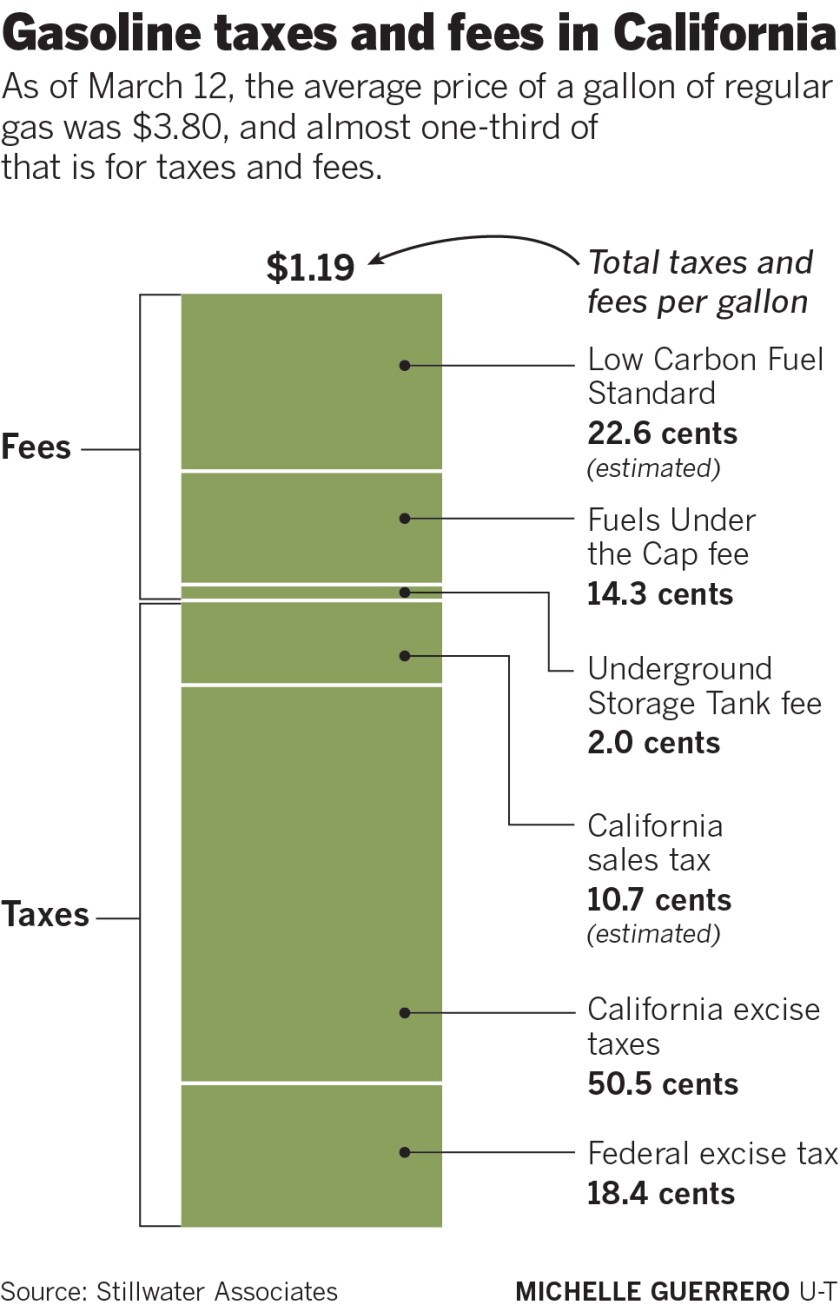

We should note that Canadians have been paying carbon taxes on gas for some time and those will be going up.

But there is a near 100% that during the Biden administration, the US will be paying carbon fuel taxes. Not just on gasoline at the pump but also, coal and ng companies will be paying CO2 penalties, power plants will be paying CO2 penalties for emissions and other industries that have emissions will be paying CO2 penalties that go to the government and is passed on to us consumers when we buy their products(utility bills will be a big one).

The old age security is a monthly cheque

I forgot our Canada pension which is geared toward automatic pay roll deductions from your pay cheque during your entire working career or your income tax return, if self employed. You pay, tax free, based on income up to a limit [I forget the monthly payment allowed] and then can start receiving monthly cheques at either 60 or 65 yrs old, All income is taxable once you go past the basic exemption which I forget. i Starting at 65 pays more CP but the system is setup for an average life span, then the Canada pension stops with death. There is no escaping payments for CP during working yrs when you file income tax

My wife paid more into the plan [paid more income tax] My wife receives a monthly CP cheque for 900.00/month and I receive 400.00/month. These are approx numbers but very close

So my wife and myself receive a monthly old age security cheque and a monthly Canada Pension cheque

When we were younger we decided I would invest in land and my wife had no choice but to pay pay roll deductions. She also made monthly contributions to a pension plan which went broke about 10 yrs before she retired, which kind of sucked. We thought either land or retirement funds would see us through retirement. My wife's pension fund did go broke, so there was that, but she immediately started a new plan., with larger payments, given a short time before retirement, but we paid for the land She started a new pension plan which consists of a stk portfolio, much like your 401k, which we thought stks would not go to zero. [I bet some thing will happen to our stk portfolio but what can we do??? She was able to make very large payments, which her employer matched dollar for dollar, and we were starting to make money on the farm and did not need her entire salary to live on. Plus our two sons were out of the house

In Canada if you live on social security and perhaps a small Canada pension cheque then that is a very frugal life style. In fact I don't know how some do it, Hopefully they have a house paid for, but some don't.

In our situation we have

two old age security cheques,

two CP cheques,

int from the stk portfolio [401k] in the form of dividends,

some stks we bought during the yrs which are dividend stks

rent from land rented to my grandson

Crops grown on the remaining acreage we own

We are incorporated, with a flat rate of 15 % on the 1st 500,000.00. We have 3 corp [father, son and grandson]so never go over the 500,000.00. No idea what the corp rate is after 500,000.00 Our personal income tax is higher at each level of income. Our personal income tax is approx 23 % and corp rate is 15 %

Yes we pay the stupid carbon tax on all fuel type energy