Here's a new NG thread. We're entering a tricky time of year as normal CDDs are rapidly catching up to and pretty soon will exceed normal HDDs.

The 12Z Euro ens was an interesting illustration. It had a large increase in HDDs (~14), but this large colder change also resulted in a ~7 CDD drop. So, the net was still ~+7 total DDs and that appeared to bring NG back up 2 cents from daytime lows hit near the start of the 12Z Euro ens (from 2.936 to 2.956). So, even as late as we are now, HDDs can still at least support NG or even allow it to bounce like it just did.

Part of a broad move higher across commodities, natural gas futures recorded a third straight day of gains despite an uptick in production and moderate weather outlooks. The May Nymex gas futures contract rolled off the board at $2.925, up 5.2 cents from Tuesday’s close. June, which takes over the prompt-month position on Thursday, climbed…

++++++++++++++++++++++

THURSDAY MORNING

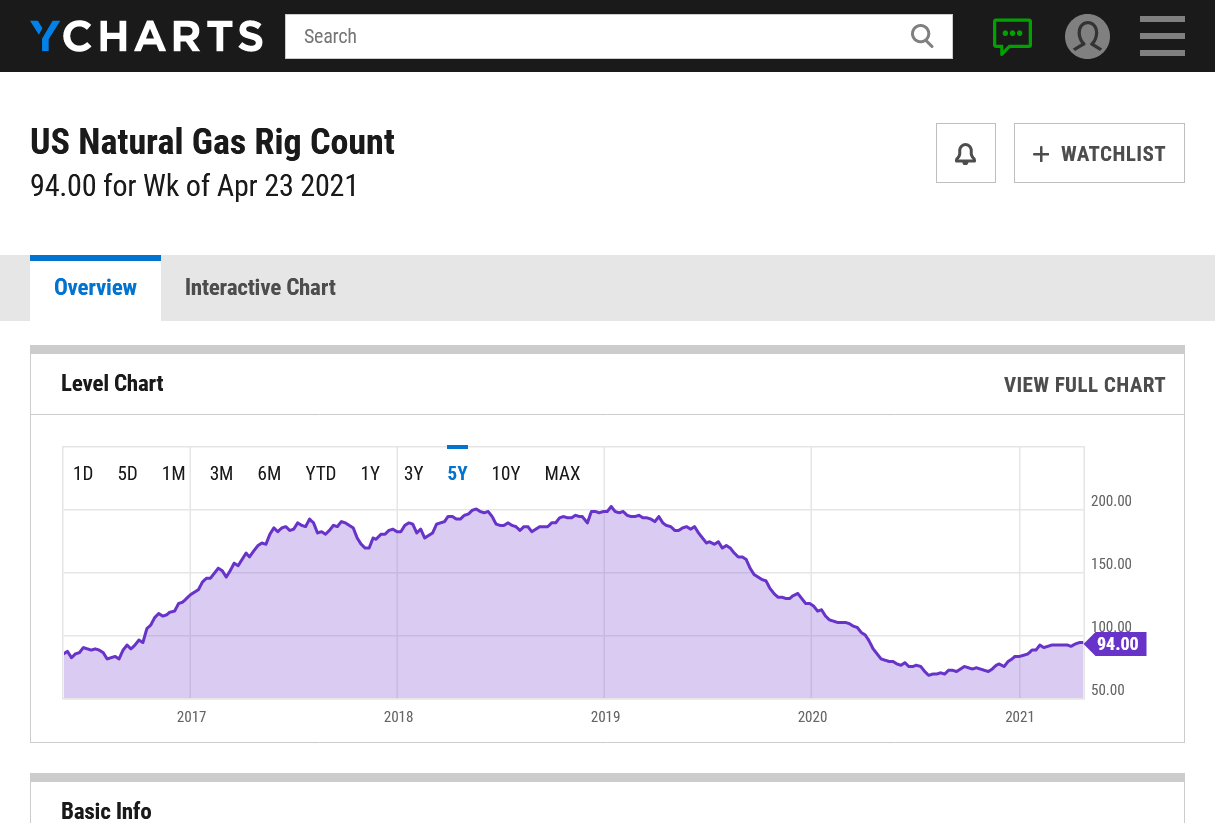

https://ycharts.com/indicators/us_gas_rotary_rigs

The rig count. Up from the lowest of the last 10 years of 68 in July 2020 because of COVID last year but still well below the previous loftier levels. Was flat at 94 rigs reported last week. Wonder how Joe L is doing.

Strong upward seasons going for a bit longer but waning up here.

Here's the very chilly temperatures from last week that caused an unusual amount of HDD's for this late in the year. This is the 7 day period for Thursdays EIA report.

This was the previous week of temps and the EIA report that resulted:

for week ending April 23, 2021 | Released: April 29, 2021 at 10:30 a.m. | Next Release: May 6, 2021

https://ir.eia.gov/ngs/ngs.html +15 BCF bearish vs market expectations.

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (04/23/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 04/23/21 | 04/16/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 319 | 325 | -6 | -6 | 404 | -21.0 | 326 | -2.1 | |||||||||||||||||

| Midwest | 427 | 421 | 6 | 6 | 504 | -15.3 | 412 | 3.6 | |||||||||||||||||

| Mountain | 119 | 118 | 1 | 1 | 102 | 16.7 | 113 | 5.3 | |||||||||||||||||

| Pacific | 217 | 210 | 7 | 7 | 217 | 0.0 | 210 | 3.3 | |||||||||||||||||

| South Central | 816 | 810 | 6 | 6 | 974 | -16.2 | 877 | -7.0 | |||||||||||||||||

| Salt | 258 | 256 | 2 | 2 | 312 | -17.3 | 278 | -7.2 | |||||||||||||||||

| Nonsalt | 558 | 554 | 4 | 4 | 661 | -15.6 | 599 | -6.8 | |||||||||||||||||

| Total | 1,898 | 1,883 | 15 | 15 | 2,200 | -13.7 | 1,938 | -2.1 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 1,898 Bcf as of Friday, April 23, 2021, according to EIA estimates. This represents a net increase of 15 Bcf from the previous week. Stocks were 302 Bcf less than last year at this time and 40 Bcf below the five-year average of 1,938 Bcf. At 1,898 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Apr 29, 2021 Actual 15B Forecast 11B Previous 38B

| Release Date | Time | Actual | Forecast | Previous |

|---|

| Apr 29, 2021 | 10:30 | 15B | 11B | 38B | |

| Apr 22, 2021 | 10:30 | 38B | 49B | 61B | |

| Apr 15, 2021 | 10:30 | 61B | 67B | 20B | |

| Apr 08, 2021 | 10:30 | 20B | 21B | 14B | |

| Apr 01, 2021 | 10:30 | 14B | 21B | -32B | |

| Mar 25, 2021 | 10:30 | -36B | -25B | -11B |

Will this heating season ever end? Both the Euro suite and GFS ens had HDD gains again vs 0Z that were significantly larger than the corresponding very small CDD losses. It is hard to know for sure, but it sure looked like NG was getting very solid support in the 2.880s to 2.890s for several hours starting from late morning followed by what appeared to be good short covering/buying just before and during pit close during the colder Euro op run.

Mike, any opinion about this?

15 Rigs running and I have 1.

| Directors Cut | 4/15/2021 | ||||||||

| NDIC | |||||||||

| Oil | M over M | M over M | Gas | M over M | M over M | ||||

| Mth | Mthly cum | Bbls/ D | Mthly cum | Mcf/ D | |||||

| 2021 | Feb | 30,324,555 | -15% | 1,083,020 | -6% | 75,710,555 | -14% | 2,703,943 | -5% |

| Jan | 35,568,679 | -4% | 1,147,377 | -4% | 88,327,784 | -2% | 2,849,283 | -2% | |

| 2020 | Dec | 36,956,504 | 1% | 1,192,145 | -3% | 89,680,150 | 4% | 2,892,908 | 0% |

| Nov | 36,736,201 | -3% | 1,224,240 | 0% | 86,323,059 | -3% | 2,887,402 | 0% | |

| Oct | 37,909,008 | 3% | 1,223,107 | 0% | 89,083,281 | 5% | 2,873,654 | 2% | |

| Sept | 36,649,997 | 1% | 1,221,667 | 5% | 84,453,374 | 3% | 2,815,112 | 7% | |

| Aug | 36,126,492 | 12% | 1,165,371 | 12% | 81,692,742 | 14% | 2,635,250 | 14% | |

| July | 32,304,503 | 21% | 1,042,081 | 17% | 71,375,125 | 21% | 2,302,356 | 17% | |

| June | 26,703,268 | 0% | 890,109 | 4% | 59,198,681 | -1% | 1,973,289 | 2% | |

| May | 26,640,218 | -27% | 859,362 | -30% | 59,771,779 | -27% | 1,928,122 | -29% | |

| April | 36,572,571 | -17% | 1,219,086 | -15% | 81,365,042 | -16% | 2,712,168 | -13% | |

| March | 44,276,463 | 1,428,273 | 96,902,755 | 3,125,895 | |||||

| All time highs | |||||||||

| Oil | 1,519,037 | Bbls/D | 11/30/19 | ||||||

| Gas | 3,145,172 | Mcf/D | 11/30/19 | ||||||

| Rig count | 218 | 5/29/2012 | |||||||

Large drop in Jan/Feb more due to extreme cold...freeze ups, impassable roads etc.

Little accident during a rig move eliminated my posting for a bit. Everything all right now.

Thanks Larry,

To be honest, I was not following ng last night because the weather in late April is rarely a factor, outside of extremes.

I'll comment more later but do see the increase in HDD's that you mentioned in recent runs.

I doubt that was a factor overnight, since the lows for this session were around 6:20 am Central just above 2.890, which as you noted earlier in the morning is very strong support.

From that low, we spiked up to the high of 2.962, just over 2 hours later and are right around mid range here before noon.

I don't have a strong feeling for where prices might go today.

The HDD and CDD are just too close. I know that you mentioned the HDD going up and CDD not going down which is an interesting, bullish dynamic right now.

The below average temps are all in the north and above average temps in the south, which will maximize the anomalies, especially at this time of year, when you still have lingering HDD's in the north..................with increasing, sometimes significant CDD's in the south.

Thanks Joe,

Here are Joe's recent reports, going back a year for a comparison. Wow, look at where we were 1 year ago today compared to his most recent report! 31 rigs running then and Joe had 4!

Joelund ng reports "From the Bakken" 2020/21

Started by metmike - May 2, 2021, 5:25 p.m.

Just to clarify since I made that post late last night, I was comparing yesterday’s 12Z to yesterday’s 0Z. I should have said that then.

Thanks for the clarification Larry!

With seasonal CDD's getting ready to pass up HDD's and both being seasonally low, only some sort of extreme weather anomaly at this time of year would make it even possible for weather to be clearly the main factor driving the market.

It can be the main factor with above average DD's added up, if the market decides to trade on that........... but never clearly at this time of year in the absence of it being an extreme anomaly.

As a weather trader, I sure would not use it for the main reason to be in natural gas.

Unless, again it was something extreme.

There can be other NON weather reasons along with that of course to have a position in ng at this time of year.

for week ending April 30, 2021 | Released: May 6, 2021 at 10:30 a.m. | Next Release: May 13, 2021

+60 BCF slightly bullish vs expections

| Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (04/30/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 04/30/21 | 04/23/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 332 | 319 | 13 | 13 | 421 | -21.1 | 346 | -4.0 | |||||||||||||||||

| Midwest | 442 | 427 | 15 | 15 | 527 | -16.1 | 429 | 3.0 | |||||||||||||||||

| Mountain | 124 | 119 | 5 | 5 | 110 | 12.7 | 117 | 6.0 | |||||||||||||||||

| Pacific | 224 | 217 | 7 | 7 | 227 | -1.3 | 219 | 2.3 | |||||||||||||||||

| South Central | 836 | 816 | 20 | 20 | 1,020 | -18.0 | 908 | -7.9 | |||||||||||||||||

| Salt | 264 | 258 | 6 | 6 | 329 | -19.8 | 289 | -8.7 | |||||||||||||||||

| Nonsalt | 572 | 558 | 14 | 14 | 691 | -17.2 | 619 | -7.6 | |||||||||||||||||

| Total | 1,958 | 1,898 | 60 | 60 | 2,303 | -15.0 | 2,019 | -3.0 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 1,958 Bcf as of Friday, April 30, 2021, according to EIA estimates. This represents a net increase of 60 Bcf from the previous week. Stocks were 345 Bcf less than last year at this time and 61 Bcf below the five-year average of 2,019 Bcf. At 1,958 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

Temperatures from the 7 period ending last Friday for this weeks EIA report:

metmike: CDD's, seasonally, will be passing up HDD's in several days. This is not the time of year when temperatures usually have a strong impact in determining prices

Thursday close:

7 day temps ending last Fri for this weeks EIA report. Pretty close to average compared to some recent anomalies.

Rig count is jumping much higher now! Up 7 more in the last week. Highest number since before COVID. Higher prices having an affect.

https://ycharts.com/indicators/us_gas_rotary_rigs

While the rig count is bearish, the GFS models show increased warming, especially in the south. Conundrum. Also, the daily chart is pretty much moving sideways now. Perhaps we have experienced all the spring seasonal uplift we are going to see. As production increases, and supply increases, despite the exports and usage, we may see the major trend start to fall.

With more rigs being brought back online, I expect to see the supply rise week to week.

Thanks Mark!

The weather will be warming up later this month but there's lots of uncertainty on the amount.

Natural gas futures gave up ground on Monday as traders mulled waning weather-driven demand and the potential implications of a cybersecurity attack on the largest fuel pipeline in the United States. The June Nymex contract dropped 2.6 cents day/day and settled at $2.932/MMBtu. July fell 2.6 to $2.978. NGI’s Spot Gas National Avg. advanced 5.5…

Over the weekend, both the domestic and European weather models shed modest degree days, keeping the five- to 15-day forecast “bearish weighted since comfortable temperatures will rule large stretches of the U.S., resulting in what’s expected to be light national demand,” the forecaster said.

The “first opportunity for more intimidating heat to show up in the weather maps won’t be until the last week of May,” NatGasWeather said. “To our view, the longer it takes for heat to show up in the maps, the more likely the natural gas markets will get impatient waiting. We continue to expect a hotter-than-normal summer over much of the U.S.; it’s just not expected to arrive for another two to three weeks.”

As a result, the firm said it anticipates the “largest weekly builds so far this year” with U.S. Energy Information Administration (EIA) storage reports in May.

Looking ahead to this week’s report, to be released Thursday, NGI’s model is forecasting an 82 Bcf injection for the week ended May 7. That would match the five-year average build. Last year, EIA recorded a 104 Bcf injection for the similar week.

Natural gas futures on Tuesday bounced back from the prior session’s losses, as export demand and other key fundamentals held strong, while a critical oil pipeline signaled it could restore operations this week following a ransomware attack. The June Nymex contract advanced 2.3 cents day/day and settled at $2.955/MMBtu. July gained 2.1 cents to $2.999.…

metmike: Weather is just not making a difference here. Its the wrong time of year for that outside of what widespread record breaking type heat could do.

What do you guys think?

12z GFS products had quite a few more CDD's/heat.

Natural gas futures advanced for a second straight day on Wednesday as production dipped and all indications pointed to continued strong demand for U.S. liquefied natural gas (LNG). The June Nymex contract settled at $2.969/MMBtu, up 1.4 cents day/day. July rose 1.9 cents to $3.018. NGI’s Spot Gas National Avg., however, declined 2.0 cents to…

metmike: All the models increased the heat and CDD's. See the 7 day temps for tomorrows EIA report here: https://www.marketforum.com/forum/topic/68653/#69154

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release May 13, 2021 Actual71B Forecast76B Previous60B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| May 13, 2021 | 10:30 | 71B | 76B | 60B | |

| May 06, 2021 | 10:30 | 60B | 64B | 15B | |

| Apr 29, 2021 | 10:30 | 15B | 11B | 38B | |

| Apr 22, 2021 | 10:30 | 38B | 49B | 61B |

for week ending May 7, 2021 | Released: May 13, 2021 at 10:30 a.m. | Next Release: May 20, 2021

https://ir.eia.gov/ngs/ngs.html

+71 BCF Bullish

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (05/07/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 05/07/21 | 04/30/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 347 | 332 | 15 | 15 | 448 | -22.5 | 369 | -6.0 | |||||||||||||||||

| Midwest | 458 | 442 | 16 | 16 | 551 | -16.9 | 448 | 2.2 | |||||||||||||||||

| Mountain | 131 | 124 | 7 | 7 | 116 | 12.9 | 122 | 7.4 | |||||||||||||||||

| Pacific | 235 | 224 | 11 | 11 | 238 | -1.3 | 227 | 3.5 | |||||||||||||||||

| South Central | 857 | C | 836 | 21 | 25 | C | 1,054 | -18.7 | 934 | -8.2 | |||||||||||||||

| Salt | 269 | 264 | 5 | 5 | 339 | -20.6 | 297 | -9.4 | |||||||||||||||||

| Nonsalt | 588 | C | 572 | 16 | 20 | C | 716 | -17.9 | 637 | -7.7 | |||||||||||||||

| Total | 2,029 | C | 1,958 | 71 | 75 | C | 2,407 | -15.7 | 2,101 | -3.4 | |||||||||||||||

C=Reclassification. Reclassifications from working gas to base gas resulted in decreased working gas stocks of 4 Bcf in the South Central nonsalt region for the week ending May 7, 2021. The implied flow for the week is an increase of 75 Bcf to working gas stocks. (See Notes and Definitions for more information on "implied flow.") Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,029 Bcf as of Friday, May 7, 2021, according to EIA estimates. This represents a net increase of 71 Bcf from the previous week. Stocks were 378 Bcf less than last year at this time and 72 Bcf below the five-year average of 2,101 Bcf. At 2,029 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

Hey Mike,

To determine if an EIA is bullish, bearish, or neutral, I normally consider just the “implied” flow, which in this case was +75. So, if the average guess was +76, I’d call it neutral.

Thanks Larry! I'm good with that.

I was just noting a pretty big spike higher, to the highs, just under $3 immediately upon the release and it coming in at -5 BCF vs the source above.

Two things to consider:

1. What happens immediately after the release (buys vs sells) can largely be predetermined regardless of the number. In other words, for example, a trader may decide he’s going to buy (at the market or at a limit) at exactly 10:30 AM EDT. Note how fast it moves right on the release. It is immediate! How can anyone trade it that quickly? I’ve always wondered about this.

2. Note that whereas the knee jerk was higher, it soon after came back down Perhaps it coming back down was when traders had enough time to see that the implied injection was 4 higher. .

Thanks Larry,

I note that ng, been higher than the price was before the release for 3 hours now.

GFS Ensemble was a whopping -11 CDD's! Very bearish....if that matters!

Natural gas futures on Thursday could not break out of a narrow range of gains and losses following a benign government inventory report and ongoing fallout from the ransomware attack on a major pipeline that is vital to the East Coast. The June Nymex contract crept in and out of the green throughout trading Thursday…

+++++++++++++++++++++++++++++++++++++++++++++++++++++++

metmike: Overnight, we added some cooling demand for the models(CDD's) and spiked above $3 but that was met with hefty selling, especially when the 6z GFS ensemble, backed up the building heat ridge much farther west late in week 2, allowing cooler air to push into the Midwest/East/Southeast in late May....and break the early, mini heat wave.

$3 has proven to be some mega resistance for the front month with the early tests of it. However, enough widespread heat and we could crack it.

+++++++++++++++++++++++++++++++++++++++++++

Friday Morning NGI:

With the latest government inventory data showing Lower 48 stockpiles falling further behind historical norms, natural gas futures climbed a couple cents higher in early trading Friday. The June Nymex contract was up 2.3 cents to $2.996/MMBtu at around 8:45 a.m. ET. The Energy Information Administration (EIA) on Thursday reported an injection of 71 Bcf…

NG is up quite a bit very likely due to a significant increase in the CDDs forecasted for the latter half of May.

Yes, I agree with that Larry!

metmike: We had a bullish gap higher above extremely powerful resistance at $3 on the open last night. The lows were tested several times around $3.03 overnight but held very solidly and we have continued higher this morning.

A key weather feature to this heat ridge building in the very strongly negative PNA.

This is pumping up the ridge downstream in the Eastern US.

GFS Ensemble 12z solution has less heat, especially well into week 2 which is hitting ng prices.....taking us well off the highs.

European model also starting off a bit cooler.

metmike: Yesterdays 12z GFS ensemble was cooler, which caused the early week highs to be in for this move. The 18z run was warmer again but the market buying had already been exhausted from that same solution Sunday Night/Monday Morning. Overnight guidance continued slightly cooler and end the heat wave in week 2.

After rocketing higher in the previous session, natural gas futures pared some of their recent gains early Tuesday as weather models showed upcoming heat over the eastern Lower 48 easing toward the end of the month. The June Nymex contract was down 3.5 cents to $3.074/MMBtu at around 8:45 a.m. ET. Weather models as of…

We have filled the small gap higher from Sunday Night, which was very bullish at the time but now, this becomes bearish and puts in a gap and crap buying exhaustion formation.

We MUST hold here or this becomes a strong signal of a top.

This is either very strong support, just above $3(last weeks resistance) or a serious violation here, means the gap higher was not a bullish break out but was instead a bullish FAKE OUT.

The strongly negative PNA, shown above and updated daily, shows a huge increase towards 0 in week 2. This signals the end of the heat wave as it will no longer serve to pump up the heat ridge downstream.

Forecasts for heat held, but Monday’s rally was overcooked With summer near, futures are on the cusp of sustained higher prices Cash prices lost momentum, led lower by declines in Texas Natural gas futures on Tuesday gave back a big chunk of the gains made in a weather-driven surge a day earlier. Analysts said forecasts…

metmike: Looking bad technically as we had a daily and WEEKLY price gap higher to start this week on Sunday Night. We closed that gap on Tuesday, but held above $3 during the day and closed above $3 on Tuesday, right around the bottom of the gap.....near last weeks highs. On Tuesday evening, we've dropped BELOW $3 and are near the lows at $2.990. There is enough short term heat and the extended, while cooling down a bit is not cool enough to cause major selling.........one would think.

It's conceivable to likely if the maps turned hotter again overnight, that we could get back above $3. However, we are entering a time frame where, seasonally, ng prices often lose their greatest support(after being very strong for the previous 2 months).

Mid June to late July is a time frame that often features profound seasonal/historical weakness for natural gas. Not sure why...........and guesses?

Late Oct. thru Feb. is also noted for weakness. This seems counter intuitive because its the coldest time of year but the cold is often dialed in with higher prices/a price premium and cold must be more than expected to be bullish, with average cold often being bearish. Maybe the same thing is happening in June/July when temperatures are approaching and hitting their peak.

https://www.marketforum.com/forum/topic/68653/#68664

The amount of residential demand in Summer for cooling using electricity generated by ng is MUCH less than for heating in the Winter by way of natural gas burning and electricity from natural gas burning.

Maybe double the demand/use in Winter?

Larry?

https://www.eia.gov/todayinenergy/detail.php?id=22892

metmike: I don't know if less heat is really the cause of this much drop. Maybe just the bullish OVER enthusiasm buying from Monday on the increased heat from the approaching heat ridge dried up as the the forecast for the heat ridge since then, showed it to be transient and not persist into week 2....which still features temps CDD's above average.

Production flat, but weather demand softens Maintenance work keeps LNG levels in check Cash prices decline amid rains and cooler temperatures Natural gas futures fell for a second straight session on Wednesday as traders contemplated weather-driven demand uncertainty, a lull in U.S. exports and estimates for the next government inventory report. The June Nymex contract…

metmike: They get paid to have reasons for price moves like this. When was the last time they said..........."I can't explain it?"

Their boss would say, "let me explain why you've been replaced"(-:

Today would be a good day for that as you can speculate with plenty of possible reasons.

One is that that we had a daily and weekly gap and crap buying exhaustion failure to start the week at the top of a move higher in a time frame for a seasonal top. This is a very bearish technical formation and all the big traders know it.

https://www.marketforum.com/forum/topic/68653/#69578

We could add a ton of heat to offset that but that or an extremely bullish EIA report tomorrow are the best hope for the bulls here.

I just started a new NG thread.