USDA cuts #Brazil's total #corn output to 98.5 mmt from 102 mmt last month, though they raised #soybeans to 137 mmt. No changes on the #Argentina crops.

No matter how you slice it, those are some skinny stock numbers and emphasize the need for a good crop this year.

Off the wire... "

The U.S. Department of Agriculture is forecasting stronger demand for U.S. crops than previously thought. In its latest monthly supply and demand report released Thursday, the USDA said that ending stocks for U.S. corn would fall to 1.11 billion bushels in 2020/21, and 1.36 billion bushels in 2021/22. These estimates are below those of analysts surveyed by The Wall Street Journal, at 1.21 billion bushels and 1.41 billion bushels, respectively. Meanwhile, soybean stocks are expected to rise in 2021/22, to 155 million bushels, up from a previous forecast of 140 million bushels. "[Corn] exports are raised 75 million bushels, based on export inspection data for the month of May that implies continued robust global demand for U.S. corn, despite high prices," the USDA said in Thursday's report.

USDA reduces old/new crop world #corn stocks, but new crop #wheat increases with bigger crops expected in USA, Europe, Russia and Ukraine. #China imports of corn and #soybeans unchanged in both crop years.

U.S. winter #wheat comes in fairly close to expectations. Hard red winter output improved from May while soft red improved slightly, but white wheat was clipped.

Thanks jim!

Yes, those are tight stocks.

On a day like today, there is no telling where the price will be 5 minutes from now for any grain.

I'm betting corn is higher. December $6.50 by the end of next week. My prediction.

Corn futures were headed for their highest finish in nearly a month on Thursday after the U.S. Department of Agriculture lowered its forecast for U.S. corn ending stocks for the 2021/2022 marketing year by 150 million bushels from the May estimate, or roughly 3.81 million metric tons. The USDA's forecast shows 2021/2022 corn ending stocks at 34.47 million metric tons, down from the previous forecast of 38.28 million metric tons. Corn ending stocks came in below trade expectations so corn bulls did have "some encouragement" from the report, lifting prices, said Sal Gilbertie, president and chief investment officer at Teucrium Trading. Still, "markets may have to wait for some weather news to get much above $7 for any prolonged period of time," he said. "It is weather from this point forward that will move corn prices." The most-active July corn contract was up 20 cents, or 12.9%, at $7.10 3/4 a bushel. Prices haven't settled above $7 since May 12, FactSet data show.

"I'm betting corn is higher. December $6.50 by the end of next week. My prediction. "

I have a prediction to Jim.............with extremely high confidence.

December corn will be..............at whatever price that the interpretation of the weather forecast and crop conditions commands it to be at..........tomorrow and every day next week (-:

Could be $1 higher or could be 50 cents lower in a week.

Or it might be close to the current price.

I will say that the market has been getting bombarded with some pretty bullish news lately and been unable to challenge the contract highs from just over a month ago.

$637.25 is the contract high for CZ.

USDA report today is pretty bullish corn.

Every 6-10/8-14 day forecast has been extremely bullish every day this week.

This could very well be a pause and then, we gap higher again next Sunday Night.

However seasonals are pretty negative here, funds are very long and the crop is actually in good shape at the moment............which is the bearish side.

There are also signs that it could turn much wetter during the last week of June but that is extremely speculative.

Yes, I agree, seasonals can be negative here, but in a normal season there is twice the amount of corn in stock, so this year is anything but normal. And you have Iowa and that whole area hanging on by a thread in terms of rain. We have already had a number of limit moves in both directions so the market is jumpy and in the broadest terms prices are still bullish.

I wouldn't sell here with your money. :)

Agree about the tight stocks............otherwise, old crop corn would not be $7 and old crop beans $15.40 and new crop holding a ton or risk premium.

I think that inflation concerns also motivate speculators to be long EVERYTHING.

In 2 weeks Iowa hasn't received an inch of rain. And it doesn't look good for them for the next 10 days. This is a lot of corn other states have to pick up the slack for. But you know all this already.

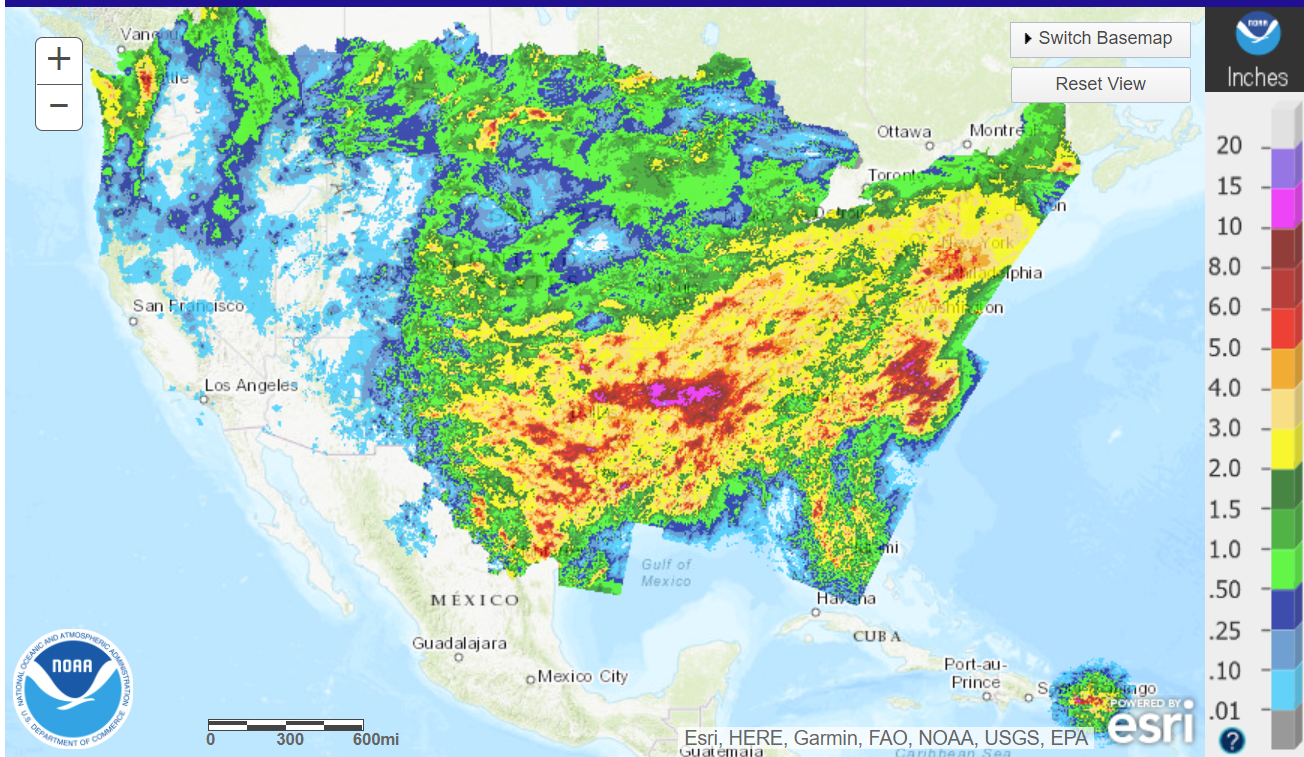

Thanks Jim............EXCELLENT map!

IA is the most important state for sure.

But that map tells us everything we needed to know about whats holding back the bulls/price this week.

There's just too much rain in too many other places outside of IA for the market to get all bulled up.

It's rained at our house for 6 days in a row now.

We NEED dry weather and heat in the southern cornbelt. Yes, thats just our backyard but we are a backyard of around 10 southern and eastern states that grow corn......and the N.Plains got some great rains........best in a year.

The market will trade whether the crop rating will go down or not next Monday.

If it stays the same............its bearish because we just went another week closer to making the crop.

So to be neutral, we need conditions to at least drop 1%.

This is a big reason for seasonals to be turning decidedly bearish here.

If you don't hurt the crop or see weather that clearly hurts the crop its almost always bearish.

Sometimes, even with slight adversity and seasonal slight deterioration the market can go down...........because the crop is marching towards being made and each week, is one less week left to hurt the crop.

And suddenly, it's late July and if you havent hurt the crop by then, the price is nowhere close to where it is now because time marches on and takes out risk premium, potentially quickly on any non adverse weather forecasts.

Not saying we can't have a dome of death and 100 degrees with no rain and record high grain prices.

Just stating what the odds/facts are, based on the last 50 years of growing crops.

Isn't it ironic though that on the day the USDA comes out with a somewhat bullish report, forecasters predicted a slightly cooler wetter end of the month? A little bit of my conspiracy side coming out.

Regardless, I enjoy the back and forth.

"Isn't it ironic though that on the day the USDA comes out with a somewhat bullish report, forecasters predicted a slightly cooler wetter end of the month?"

Did you see that somewhere else Jim?

I only mentioned it because the CFS week 3-4 model has been showing that for the past couple of days, not just today (as well as the pattern possibly becoming more favorable). This is the CFS from yesterday.

Rain below

Temps below

metmike: What a difference a year can make(from Chinese demand)!!!!

·

Projected U.S. #corn stocks/use is seen hitting a 25-year low of 7.4% in 2020/21 after an increase in demand expectations. Exactly a year ago, 2020/21 stocks/use was predicted at 22.5%, the highest since the early 1990s.

·

U.S. 2012/13 #corn stocks/use: 7.41% 2020/21 (estimated): 7.37%

Explanation for why stocks/use got this tight..............even with pretty good US crops.

Scroll down at this link: