Somethin' is brewing in the Atlantic.

Thanks Jim!

Here's the link to that site:

They're giving that one a 80% chance of developing in the next 48 hours.

https://www.marketforum.com/forum/topic/72658/

Natural gas futures prices rebounded Tuesday on increasing heat in the forecast for this week, as well as modest changes to the supply/demand balance. The September Nymex gas futures contract settled at $4.089, up 2.9 cents from Monday’s close. October picked up 2.8 cents to reach $4.103. At A Glance: Latest forecasts quick to cool…

Previous natural gas EIA weekly report........extremely bullish!

https://ir.eia.gov/ngs/ngs.html

for week ending July 30, 2021 | Released: August 5, 2021 at 10:30 a.m. | Next Release: August 12, 2021

+13 BCF VERY BULLISH!

| Working gas in underground storage, Lower 48 states Summary textCSVJSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (07/30/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 07/30/21 | 07/23/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 604 | 583 | 21 | 21 | 716 | -15.6 | 655 | -7.8 | |||||||||||||||||

| Midwest | 719 | 702 | 17 | 17 | 828 | -13.2 | 734 | -2.0 | |||||||||||||||||

| Mountain | 184 | 184 | 0 | 0 | 201 | -8.5 | 184 | 0.0 | |||||||||||||||||

| Pacific | 244 | 246 | -2 | -2 | 311 | -21.5 | 287 | -15.0 | |||||||||||||||||

| South Central | 976 | 999 | -23 | -23 | 1,214 | -19.6 | 1,053 | -7.3 | |||||||||||||||||

| Salt | 250 | 269 | -19 | -19 | 336 | -25.6 | 276 | -9.4 | |||||||||||||||||

| Nonsalt | 726 | 729 | -3 | -3 | 877 | -17.2 | 777 | -6.6 | |||||||||||||||||

| Total | 2,727 | 2,714 | 13 | 13 | 3,269 | -16.6 | 2,912 | -6.4 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,727 Bcf as of Friday, July 30, 2021, according to EIA estimates. This represents a net increase of 13 Bcf from the previous week. Stocks were 542 Bcf less than last year at this time and 185 Bcf below the five-year average of 2,912 Bcf. At 2,727 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly perio

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Aug 05, 2021 Actual13B Forecast21B Previous36B| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Aug 05, 2021 | 10:30 | 13B | 21B | 36B | |

| Jul 29, 2021 | 10:30 | 36B | 43B | 49B | |

| Jul 22, 2021 | 10:30 | 49B | 44B | 55B | |

| Jul 15, 2021 | 10:30 | 55B | 47B | 16B | |

| Jul 08, 2021 | 10:30 | 16B | 34B | 76B | |

| Jul 01, 2021 | 10:30 | 76B | 68B | 55B |

By WxFollower - Aug. 8, 2021, 5:16 a.m.

Mike asked:

Larry,

What's your valued opinion on this storage number and how does it stack up with different comparison metrics?

-------------------------------------------------------

Mike and others,

I finally got a chance to do some comparisons with not just earlier this season but also in past summers. My assessment:

- The +13 on 85 CDDs is barely behind the +16 bcf on 82 CDDs of 4 weeks ago for easily the two most bullish weeks of the summer.

- The bullishness of these two weeks this season appears to be about as strong as all other summer weeks going back to 1994 on a CDD adjusted basis!

Most bullish summer weeks (on CDD adjusted basis) of each summer (EIA/CDD)

2021: +16/82

2020: +35/84

2019: +36/91

2018: +24/89

2017: +30/73

2016: +17/87 (also had +11 on 94 CDDs and -6 on 105 CDDs, but these weren't as bullish)

2015: +32/88

2014: +75/64

2013: +41/87

2012: +20/92

2011: +25/100

2010: +27/88

2009: +57/75

2008: +57/74

2007: +21/92

2006: -12/103 (also had a -7 on 102 but that's not quite as bullish)

2005: +37/89

2004: +70/75

2003: +53/83

So, of these summers, the only ones comparable are 2017's +30/73 and 2006's -12/103 with 2016's +17/87 pretty close behind by ~8-9 bcf. All of the other summers were 15-20++ bcf more bearish than the most bullish 2021 week. The most bearish were 2004's +70/75, 2003's +53/83, 2011's +25/100, and 2019's +36/91, which were 44/38/36/34 bcf more bearish than 2021's most bullish week.

Temperatures for last Thursdays EIA report. Except for the Northeast(lots of people) and parts of the Southwest(not many people) much of the country was pretty hot. So the number should be smaller than average for that week, the last week in July.........which usually is one of the smallest numbers of the year because its barely after the climatological peak in temperatures and in fact, captures some of that period.

https://www.cpc.ncep.noaa.gov/products/tanal/temp_analyses.php

Here's the 7 days for the next EIA report. Same temp configuration as the 90 and 30 day temps below this but even cooler where the most people live in the Midwest, East and South.......so the EIA report this Thursday will show a bigger injection.

Here's the temps over the last 30 days. Very close to the pattern all Summer.

Re: Re: Re: Re: Re: Re: Re: Re: NG 7/24/21+

By MarkB - Aug. 8, 2021, 10:37 p.m.

In my honest observation, we in the SE have had a more moderate season temperature wise. It's August, and we should have already posted several 100+degree days. But the closest we have got, is a handfull of upper 90's at best. Even the lows are cooler than average for this time of year. Weather, both experienced and projected, doesn't really seem to have been the driving factor for NG. At least not over this summer. Seems that most of the driving force has been storage and export demand.

JMHO

+++++++++++++++++++++

Good observation Mark!

This is the last 90 days below, which is the main cooling season so far.

Temps in the South/Southeast have been around 1 deg. F below average. That's not huge but for 90 days that adds up to less CDD's. It's been -2 deg. F in TX.

Amazing heat out West, with anomolies of +5 deg. F in parts of the Northwest. That's amazing. The heat has been spilling out into the N.Plains and U.Midwest........exactly where the drought is and by no coincidence.......same pattern causing both, related to the cool temps in the tropical Pacific and La Nina type signature as well as the -PDO.

Maybe the big weekend cool down is putting pressure on prices?

for week ending August 6, 2021 | Released: August 12, 2021 at 10:30 a.m. | Next Release: August 19, 2021

+49 BCF Neutral?

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (08/06/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 08/06/21 | 07/30/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 629 | 604 | 25 | 25 | 735 | -14.4 | 674 | -6.7 | |||||||||||||||||

| Midwest | 741 | 719 | 22 | 22 | 852 | -13.0 | 757 | -2.1 | |||||||||||||||||

| Mountain | 185 | 184 | 1 | 1 | 205 | -9.8 | 187 | -1.1 | |||||||||||||||||

| Pacific | 241 | 244 | -3 | -3 | 314 | -23.2 | 286 | -15.7 | |||||||||||||||||

| South Central | 979 | 976 | 3 | 3 | 1,218 | -19.6 | 1,050 | -6.8 | |||||||||||||||||

| Salt | 247 | 250 | -3 | -3 | 337 | -26.7 | 271 | -8.9 | |||||||||||||||||

| Nonsalt | 732 | 726 | 6 | 6 | 882 | -17.0 | 779 | -6.0 | |||||||||||||||||

| Total | 2,776 | 2,727 | 49 | 49 | 3,324 | -16.5 | 2,954 | -6.0 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,776 Bcf as of Friday, August 6, 2021, according to EIA estimates. This represents a net increase of 49 Bcf from the previous week. Stocks were 548 Bcf less than last year at this time and 178 Bcf below the five-year average of 2,954 Bcf. At 2,776 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

U.S. Natural Gas Storage

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Aug 12, 2021 Actual49B Forecast49B Previous13B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Aug 12, 2021 | 10:30 | 49B | 49B | 13B | |

| Aug 05, 2021 | 10:30 | 13B | 21B | 36B | |

| Jul 29, 2021 | 10:30 | 36B | 43B | 49B | |

| Jul 22, 2021 | 10:30 | 49B | 44B | 55B | |

| Jul 15, 2021 | 10:30 | 55B | 47B | 16B | |

| Jul 08, 2021 | 10:30 | 16B | 34B | 76B |

Buying opportunity or breakdown….hmmmm. With a potential hurricane heading for the Gulf, best to just sit on the sidelines for now

Thanks Jim,

Fred is not going to be a threat. No way.

Too weak, too far east.

Natural gas futures continued to slide in early trading Friday as the market mulled evidence of a looser supply/demand balance in the latest government inventory data. Coming off a 12.6-cent sell-off in the previous session, the September Nymex contract was down another 3.9 cents to $3.894/MMBtu at around 8:50 a.m. ET. The Energy Information

metmike: Some big differences on models and especially run to run on the GFS ENS recently.

I'm not sure what all goes into a chart like this, certainly some things that don't add up in the real world to the price going from the highest of the year in mid June to the lowest price of the year a month later.............that almost never happens in the real market in any year.

However, a chart like this is useful because it shows the strong seasonal/historical tendencies.

July ng prices were the complete opposite of the seasonal below.

Instead of the weakest month of the year, like it often is historically, the very tight demand/supply balance and bullish EIA numbers(with storage below the 5 year average and NOT building fast enough) caused prices to spike much higher.

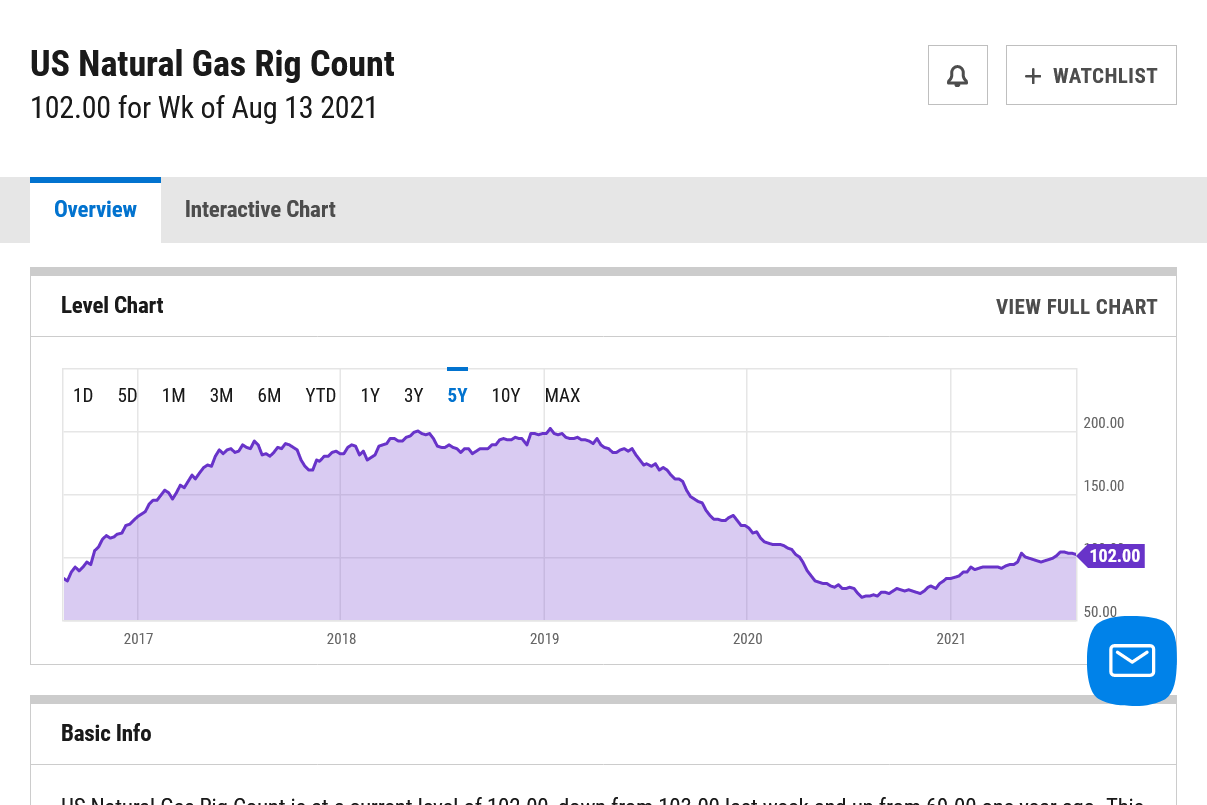

Rig count has been pretty steady the last 3 months, 102, down 1 on the week.......... after rising from an all time low of 68 last July(2020)

https://ycharts.com/indicators/us_gas_rotary_rigs

metmike: 6z GFS added a whopping 6 CDD's. Also Grace is making the shorts nervous, now predicted to hit 70 mph in the Southern GOM towards the end of the week.

metmike: We added some CDD's to the forecast since late Sunday....more bullish.

metmike: Models DID cool off overnight.

Amid a steady outlook for hot temperatures this weekend into next week, natural gas futures managed to recover some of their recent losses early Wednesday. After tumbling 10.9 cents in the previous session, the September Nymex contract had clawed back 3.0 cents to reach $3.867/MMBtu as of around 8:45 a.m. ET. The reasons behind Tuesday’s…

metmike: The European model was much cooler. -4 CDD's over night.

Possible daily and half primary low this week. 42 days today from last daily low; 12 weeks from last weekly low.

Cyclewise time frame is near. Could be big wash out first?

My 2 cents!

Great contribution tjc!

The lows this morning held.........lots of buyers earlier this morning....just below $3.80.

COVID is a huge wildcard though. It's still increasing. It won't be anything like the Spring of 2020(with the shut downs and demand crashing) but the market could get increasingly more nervous if it keeps going higher.

Models continue the cooler trend.

12z GFS was a whopping -7CDD's from the 6z run and European model held on to its cooler week 2 forecast from the previous run.

EIA up at 9:30am tomorrow could be the most important.......it has the potential to be pretty bullish!

Week 2 forecasts have REALLY, REALLY cooled off this week for the Midwest!

Grace now a hurricane. This could have been why we had the pop higher from 3.8 earlier? Maybe not. Several other factors mentioned below.

metmike: Cooling week 2 forecasts and COVID are bearish but the very weak EIA builds and low storage are bullish.

metmike: The forecast warmed up A LOT overnight but NG went DOWN anyways.

European model +4 CDD's.

6z GFS +7 CDD's vs previous run and +15 CDD's vs the 12z Wed run(which was the coolest in a long time and marked the coolest point)

I'm thinking that we are getting into that lull where weather isn't as big a driver while we transition the seasons. Could NG be following oil? Could be.

Projected is 31. Wouldn't surprise me to see higher, which would be bearish.

for week ending August 13, 2021 | Released: August 19, 2021 at 10:30 a.m. | Next Release: August 26, 2021

+46 BCF............implied +42 BCF

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (08/13/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 08/13/21 | 08/06/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 645 | 629 | 16 | 16 | 748 | -13.8 | 694 | -7.1 | |||||||||||||||||

| Midwest | 765 | 741 | 24 | 24 | 877 | -12.8 | 781 | -2.0 | |||||||||||||||||

| Mountain | 188 | 185 | 3 | 3 | 209 | -10.0 | 190 | -1.1 | |||||||||||||||||

| Pacific | 240 | 241 | -1 | -1 | 313 | -23.3 | 286 | -16.1 | |||||||||||||||||

| South Central | 984 | C | 979 | 5 | 1 | C | 1,222 | -19.5 | 1,045 | -5.8 | |||||||||||||||

| Salt | 244 | 247 | -3 | -3 | 335 | -27.2 | 264 | -7.6 | |||||||||||||||||

| Nonsalt | 741 | C | 732 | 9 | 5 | C | 887 | -16.5 | 781 | -5.1 | |||||||||||||||

| Total | 2,822 | C | 2,776 | 46 | 42 | C | 3,369 | -16.2 | 2,996 | -5.8 | |||||||||||||||

C=Reclassification. Reclassifications from base gas to working gas resulted in increased working gas stocks of 4 Bcf in the South Central nonsalt region for the week ending August 13, 2021. The implied flow for the week is an increase of 42 Bcf to working gas stocks. (See Notes and Definitions for more information on "implied flow.") Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,822 Bcf as of Friday, August 13, 2021, according to EIA estimates. This represents a net increase of 46 Bcf from the previous week. Stocks were 547 Bcf less than last year at this time and 174 Bcf below the five-year average of 2,996 Bcf. At 2,822 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

Mark,

Good call on the number being higher and bearish.

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Aug 19, 2021 | 10:30 | 46B | 31B | 49B | |

| Aug 12, 2021 | 10:30 | 49B | 49B | 13B | |

| Aug 05, 2021 | 10:30 | 13B | 21B | 36B | |

| Jul 29, 2021 | 10:30 | 36B | 43B | 49B | |

| Jul 22, 2021 | 10:30 | 49B | 44B | 55B | |

| Jul 15, 2021 | 10:30 | 55B | 47B | 16B |

The U.S. Energy Information Administration (EIA) reported a net 46 Bcf injection into storage inventories for the week ending Aug. 13, eclipsing estimates ahead of the weekly report. The latest government storage data included a reclassification from base gas that resulted in a 4 Bcf increase to working gas in the South Central’s nonsalt facilities.…

metmike: Probably the forecast warming up helped give us the strength to recover from $1,000/contract lower to higher for the day here.

And jobless claims dropped again. Positive news.

metmike: I didn't think about this one.

Thursday after the close:

Choppy trading continued along the Nymex natural gas futures curve on Thursday, with steep losses accrued early in the session amid a broader decline in equities and commodity markets. The September contract managed to bounce later in the day, though, as traders mostly turned a blind eye to hugely bearish storage data. The prompt month…

metmike: Wow! European model was +8 CDD's overnight!

Russia is supposed to be starting another NG line that might cut into our exports.

Thanks Jim!

Russia and China have no intention of cutting fossil fuel production, in fact they are INCREASING IT.

If we had been using the fake green energy(wind/solar) for most of our energy in recent decades and fossil fuels were just discovered and we know everything that we know now about climate and CO2 but fossil fuels couldn't be used politically like they are..... every entity everywhere and in every country would be 100% on board with using fossil fuels to replace wind and many solar applications that don't have high angled large amounts of year round sunshine.

Temperatures for this weeks EIA report released on Thursday at 9:30 am CDT.

Looks like the GFS is getting warmer in late 2nd week.

Thanks Mark!

Actually the GFS has been cooler the last 3 runs.

-1 CDD, then -2 CDD and the last run -2 CDD.

However, the last European model was a whopping +8 CCD!!

Natural gas futures advanced in early trading Monday as forecasts over the weekend increased heat expectations for the eastern Lower 48 to close out the month of August. The September Nymex contract was up 6.4 cents to $3.915/MMBtu at around 8:50 a.m. ET. Based on hotter forecast trends over the weekend, the latest Bespoke Weather…

GFS has been cooler by a CDD or 2 for 4 straight model runs but the European model which the market likes the most was +8 CDD's overnight.

| Directors Cut | 8/13/2021 | ||||||

| NDIC | |||||||

| Oil | M over M | M over M | Gas | M over M | |||

| Mth | Mthly cum | Bbls/ D | Mthly cum | ||||

| 2021 | June | 33,845,554 | -3% | 1,128,185 | 0% | 89,477,475 | -3% |

| May | 34,953,034 | 4% | 1,127,517 | 1% | 92,411,537 | 4% | |

| April | 33,646,529 | -2% | 1,121,551 | 1% | 88,898,778 | 0% | |

| March | 34,361,668 | 13% | 1,108,441 | 2% | 89,236,535 | 18% | |

| Feb | 30,324,555 | -15% | 1,083,020 | -6% | 75,710,555 | -14% | |

| Jan | 35,568,679 | -4% | 1,147,377 | -4% | 88,327,784 | -2% | |

| 2020 | Dec | 36,956,504 | 1% | 1,192,145 | -3% | 89,680,150 | 4% |

| Nov | 36,736,201 | -3% | 1,224,240 | 0% | 86,323,059 | -3% | |

| Oct | 37,909,008 | 3% | 1,223,107 | 0% | 89,083,281 | 5% | |

| Sept | 36,649,997 | 1% | 1,221,667 | 5% | 84,453,374 | 3% | |

| Aug | 36,126,492 | 12% | 1,165,371 | 12% | 81,692,742 | 14% | |

| July | 32,304,503 | 21% | 1,042,081 | 17% | 71,375,125 | 21% | |

| June | 26,703,268 | 0% | 890,109 | 4% | 59,198,681 | -1% | |

| May | 26,640,218 | -27% | 859,362 | -30% | 59,771,779 | -27% | |

| April | 36,572,571 | -17% | 1,219,086 | -15% | 81,365,042 | -16% | |

| March | 44,276,463 | 1,428,273 | 96,902,755 | ||||

| All time highs | |||||||

| Oil | 1,519,037 | Bbls/D | 11/30/19 | ||||

| Gas | 3,145,172 | Mcf/D | 11/30/19 | ||||

| Rig count | 218 | 5/29/2012 | |||||

From Tuesday evening:

Natural gas futures slipped several notches Tuesday as export demand weakened a bit and the latest data showed more seasonal weather ahead. The September Nymex contract settled 4.9 cents lower day/day at $3.896. October slipped 4.4 cents to $3.916. Spot gas prices, however, continued to strengthen amid widespread heat and humidity across the country.

Wednesday early:

metmike: Looks like the September contract expires tomorrow, the 26th and crazy things can happen before expiration in ng. The European model was slightly warmer overnight but temps are still expected to cool down, so I don't think that why we are higher. It's also at a time of year where weather is often not the main driver.

I think the market read your post. :)

Anyway, NG just fell out of bed. For how long though is a better question. There is another storm brewing in the Caribbean and this one "could" head straight to Louisiana.

Yeah, that was one heck of a drop..,$1,000 lower from the early price and even a bit lower for the day!

I could be wrong, but I think the market is looking at this potential Gulf hurricane, which is becoming more likely, as having more bearish potential than bullish potential due to there being much less Gulf production vs, say, 15 years ago, and exports vis the Gulf, which hardly existed 10+ years ago. Overall though, the market overreacts imo in both directions as it has a habit of doing.

If you're trading mainly on weather, this may be a good time to stay flat, my favorite position but to each their own. <G>

Thanks Larry,

I hadn't been paying much attention to the tropics today. Please keep us posted if you can.