Builds in both crude and unleaded according to the API tonight. If that verifies tomorrow, we will start hearing worries about demand again.

Thanks Jim!

http://www.news.cn/english/northamerica/2021-09/29/c_1310215992.htm

HOUSTON, Sept. 28 (Xinhua) -- The American Petroleum Institute (API) on Tuesday reported an increase of 4.127 million barrels of crude oil in the U.S. crude oil inventories for the week ending Sept. 24.

API reported a draw of 6.108 million barrels for the previous week.

Economists were expecting a draw of about 2.333 million barrels.

Oil prices slipped on Tuesday, taking a breather after rising for five consecutive sessions.

The West Texas Intermediate (WTI) for November delivery lost 16 cents to settle at 75.29 U.S. dollars a barrel on the New York Mercantile Exchange. Brent crude for November delivery decreased 44 cents to close at 79.09 dollars a barrel on the London ICE Futures Exchange.

The slide came amid a stronger U.S. dollar. Historically, the price of oil is inversely related to the price of the U.S. dollar.

Traders await data on U.S. crude stockpiles as the U.S. Energy Information Administration is set to release its weekly petroleum status report on Wednesday. Analysts surveyed by S&P Global Platts forecast the U.S. crude inventories to show a fall of 4.5 million barrels for the week ending Sept. 24.

The API reports inventory levels of U.S. crude oil, gasoline and distillates stocks. The figure shows how much oil and product is available in storage and thus gives an overview of U.S. petroleum demand. Enditem

Sept 29 (Reuters) - U.S. crude oil, gasoline and distillate inventories rose last week as the production rebounded from recent storms, the Energy Information Administration said on Wednesday.

EIA-Crude

Latest Release Sep 29, 2021 Actual 4.578M Forecast-1.652M Previous-3.481M

https://www.investing.com/economic-calendar/eia-crude-oil-inventories-75

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Sep 29, 2021 | 10:30 | 4.578M | -1.652M | -3.481M | |

| Sep 22, 2021 | 10:30 | -3.481M | -2.440M | -6.422M | |

| Sep 15, 2021 | 10:30 | -6.422M | -3.544M | -1.529M | |

| Sep 09, 2021 | 11:00 | -1.529M | -4.612M | -7.169M | |

| Sep 01, 2021 | 10:30 | -7.169M | -3.088M | -2.979M | |

| Aug 25, 2021 | 10:30 | -2.979M | -2.683M | -3.234M |

Weekly US ending stocks of crude oil.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRSTUS1&f=W

Weekly ending stocks for unleaded gasoline.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGTSTUS1&f=W

Weekly US ending stocks for distillate fuel oil(heating oil-especially used in the Northeast).

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDISTUS1&f=W

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

https://finance.yahoo.com/news/oil-ignores-u-weekly-build-113701404.html

Investing.com - Goldman Sachs (NYSE:GS) has called for $90 a barrel, and the oil market seems bent on getting there, even if weekly U.S. inventory isn’t going to be as supportive.

The U.S. Energy Information Administration said crude stockpiles rose by 4.58 million barrels in the week to Sept. 24 versus forecasts for a drop of 2.2 million.

Instead of correcting substantially on the data, crude prices which have risen more than 10% since the start of September, fell only slightly on the data. There was, however, an overnight drop of 2% triggered by similar preliminary data from the American Petroleum Institute.

New York-traded West Texas Intermediate, the benchmark for U.S. oil, settled down 46 cents, or 0.6%, at $74.83 per barrel. It hit a session high of $75.79 after the EIA data, versus the overnight low of $73.73.

London-traded Brent crude, the global benchmark for oil, settled at $78.25 a barrel, down 45 cents, 0.6%. It reached a peak of $78.72 earlier, after an overnight bottom of $76.77.

Earlier in the week, Goldman raised its year-end forecast for Brent to $90 per barrel from $80, as damage from Hurricane Ida continued to shut-in at least 15% of production in the U.S. Gulf of Mexico.

Fewer headlines on hospitalizations from the Delta variant of Covid has also emboldened oil bulls, although the onset of fall and colder weather could bring in higher caseloads from here.

“Well, you know what Goldman Sachs called; so buy the dip!” John Kilduff, founding partner of New York energy hedge fund Again Capital, said with a chuckle. “We have a significant upward revision as well in weekly production estimates from the EIA. But none of that matters because it’s $90 oil that’s in everyone’s eyes.”

The EIA revised upwards by half a million barrels U.S. crude production for the week ended Sept. 24, estimating output at 11.1 million barrels per day versus a previous 10.6 million.

In other inventory data, the EIA said gasoline inventories rose by 193,000 barrels, versus the forecast draw of 1.5 million. It was the second straight weekly build for gasoline stockpiles, which rose by a beefy 3.48 million in the previous week.

Crude charts. .......Breaking out to the upside?

| |

| |

| |

Unleaded Gasoline Price Charts. Breaking out to the upside?

| |

| |

| |

Here are the latest gas prices across the country:

https://www.gasbuddy.com/GasPriceMap?z=4&lng=-96.591588&lat=38.10118167223963

https://www.quora.com/Why-are-west-coast-gasoline-prices-higher

The two main reasons are transportation and taxes. Part of the cost of gasoline is what it costs to take refined product and transport it to the end user. Below is a map of the main refineries and pipeline in North America.

You can see that the west coast has a much smaller amount of infrastructure than other parts of the map. As a result, more of your gasoline is refined in places that require it to be shipped by transportation.

The second reason is that the states on the West Coast have used fuel taxes more than the average.

If you add to that state requirements about how the gasoline is blended based on the various state environmental air quality and emissions standards, you can tweak the price again. The addition of MTBE or ethanol seasonally, further adds cost to a gallon.

Both coast tax their gasoline beyond the norm. Add to that in California they require 2 to 3 times as many fuel mixes as any other state which increases the cost again.

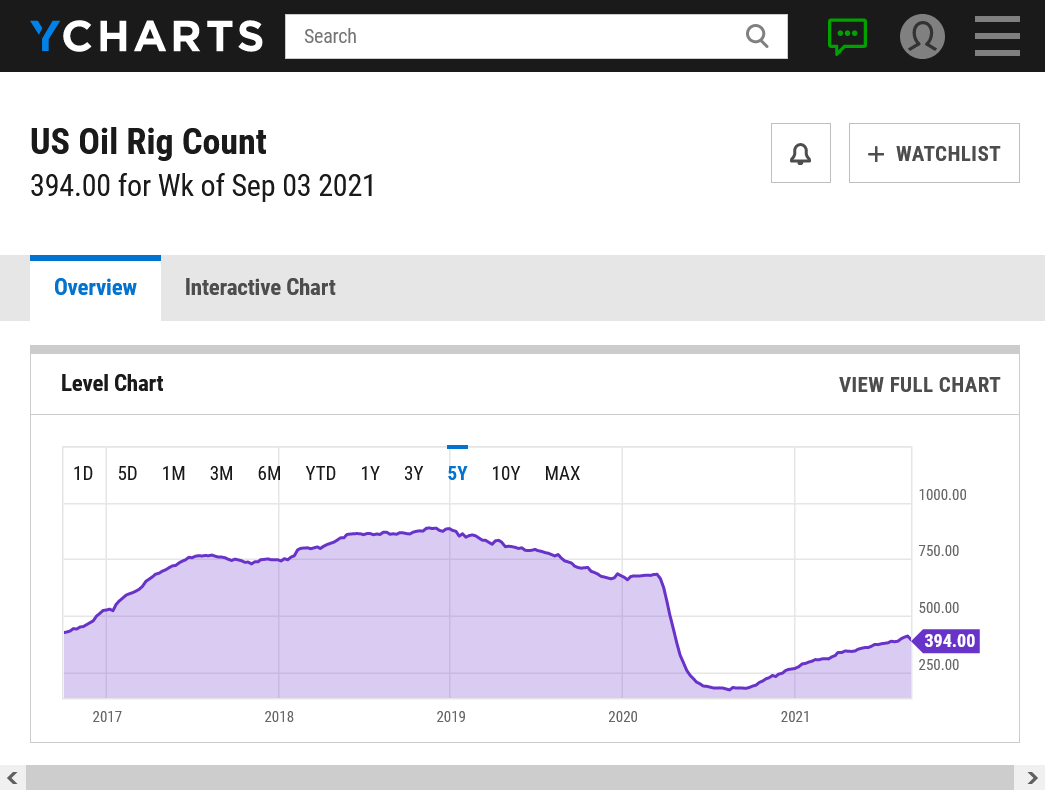

The rig count continues to climb higher but still way below 18+ months ago. For some odd reason, the last week saw a drop which was against the trend of the last year.

https://ycharts.com/indicators/us_oil_rotary_rigs

https://www.investing.com/economic-calendar/cftc-crude-oil-speculative-positions-1653

Latest Release Sep 24, 2021 Actual 356.0K Previous 355.1K

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Oct 01, 2021 | 15:30 | 356.0K | |||

| Sep 24, 2021 | 15:30 | 356.0K | 355.1K | ||

| Sep 17, 2021 | 15:30 | 355.1K | 349.2K | ||

| Sep 10, 2021 | 15:30 | 349.2K | 356.5K | ||

| Sep 03, 2021 | 15:30 | 356.5K | 374.3K | ||

| Aug 27, 2021 | 15:30 | 374.3K | 404.3K |