It is time for a new natural gas thread. NG was down sharply today due to (per MetMike in the prior thread) warming for much of the US later in week 2 as mild Pacific air comes back. In the meantime, the coldest air of the season to date will be paying what appears to be a fairly short visit as of the latest models/forecasts.

It is potent cold but the key is that it is projected to not last that long although models can change. Currently, for example, the first week in November is when will be the bulk of the cold per current progs. It is centered around the 6-10 day period or 11/2-6. Currently, 11/2-6 looks quite cold in much of the E 2/3 of the US. But if you go back to just five days ago the 10/23/21 model consensus for 11/2-6, which was then in the 11-15 day period, actually was pretty close to normal for the E 2/3 of the US. So, the models didn’t do a good job of foreseeing this chill that far in advance. That’s a primary reason why NG has had a lot of volatility this week, including some strong spikes to over $6.

Today’s EIA was anywhere from slightly bearish to neutral depending on what survey it is compared to.

Thanks much Larry for starting the new thread. You're right that it was long overdue.

I like it when you guys start the new threads and make comments. It's more of a forum that way which would be the optimal situation in my opinion.

I'll add more stuff later on Friday but agree with your analysis.

NG has popped higher here tonight with the GFS and Euro both showing the week 2 solutions a few HDD's colder.

Here's the previous NG thread:

https://www.marketforum.com/forum/topic/76401/

Rather than take up a ton of space and require excessive scrolling, let me just copy the links to the previous stuff and see if that helps to minimize that affect a bit.

Temps from the last 2 EIA reporting periods:

https://www.marketforum.com/forum/topic/76401/#76714

EIA report yesterday:

https://www.marketforum.com/forum/topic/76401/#76768

https://www.marketforum.com/forum/topic/76401/#76772

Comments after the report:

https://www.marketforum.com/forum/topic/76401/#76774

Friday am: Though there had more HDD's in the forecast overnight that caused the dead cat bounce, as mentioned yesterday, we have a huge pattern change which is swamping the market with a bearishness weather psychology.

From yesterday:

"metmike: The November expired yesterday and we were down much more than that for the front month December today. The market is looking ahead of this big cold snap which IS NOT a permanent pattern change to meridional, north to south flow.

The surges of cold air from Canada (but not frigid) will last for less than 2 weeks, after which, mild, zonal flow will kick in and spread dried out Pacific origin air masses from west to east. Most of the models agree on that today vs only just over half of them yesterday. This is clearly milder than Monday, when we finished dialing in ALL the cold that this pattern has to offer in the forecast.......which started getting dialed in late last week.

The milder pattern by mid November is still not certain.

We still have not filled the bullish breakaway gap higher from Sunday Nights open. If the models keep this trend, that will get filled, if not tomorrow, then for sure next week but only if the models stay mild.

You DON'T want to be long in the month of November if the forecasts are turning much milder."

Been short since 6am., due to fundamental reasons, other than weather. Current stop at 5.520. Not planning to hold over the weekend, even though I believe there will be a gap down sunday night.

Out at 5.470. It's been a good week. Have a good weekend!!

Directors Cut | 10/13/2021 | |||||||

| NDIC | ||||||||

| Oil | M over M | M over M | Gas | M over M | ||||

| Mth | Mthly cum | Bbls/ D | Mthly cum | Mcf/ D | ||||

| 2021 | Aug | 34,323,696 | 3% | 1,107,216 | 3% | 91,774,175 | 3% | 2,960,457 |

| July | 33,411,470 | -1% | 1,077,789 | -4% | 89,122,575 | 0% | 2,874,922 | |

| June | 33,845,554 | -3% | 1,128,185 | 0% | 89,477,475 | -3% | 2,982,583 | |

| May | 34,953,034 | 4% | 1,127,517 | 1% | 92,411,537 | 4% | 2,981,017 | |

| April | 33,646,529 | -2% | 1,121,551 | 1% | 88,898,778 | 0% | 2,963,293 | |

| March | 34,361,668 | 13% | 1,108,441 | 2% | 89,236,535 | 18% | 2,878,598 | |

| Feb | 30,324,555 | -15% | 1,083,020 | -6% | 75,710,555 | -14% | 2,703,943 | |

| Jan | 35,568,679 | -4% | 1,147,377 | -4% | 88,327,784 | -2% | 2,849,283 | |

| 2020 | Dec | 36,956,504 | 1% | 1,192,145 | -3% | 89,680,150 | 4% | 2,892,908 |

| Nov | 36,736,201 | -3% | 1,224,240 | 0% | 86,323,059 | -3% | 2,887,402 | |

| Oct | 37,909,008 | 3% | 1,223,107 | 0% | 89,083,281 | 5% | 2,873,654 | |

| Sept | 36,649,997 | 1% | 1,221,667 | 5% | 84,453,374 | 3% | 2,815,112 | |

| Aug | 36,126,492 | 12% | 1,165,371 | 12% | 81,692,742 | 14% | 2,635,250 | |

| July | 32,304,503 | 21% | 1,042,081 | 17% | 71,375,125 | 21% | 2,302,356 | |

| June | 26,703,268 | 0% | 890,109 | 4% | 59,198,681 | -1% | 1,973,289 | |

| May | 26,640,218 | -27% | 859,362 | -30% | 59,771,779 | -27% | 1,928,122 | |

| April | 36,572,571 | -17% | 1,219,086 | -15% | 81,365,042 | -16% | 2,712,168 | |

| March | 44,276,463 | 1,428,273 | 96,902,755 | 3,125,895 | ||||

| All time highs | ||||||||

| Oil | 1,519,037 | Bbls/D | 11/30/19 | |||||

| Gas | 3,145,172 | Mcf/D | 11/30/19 | |||||

| Rig count | 218 | 5/29/2012 | ||||||

Observations from the ground. Plenty of rigs stacked but no labor to man. Specialty trades such as electricians, experienced wireline operators, drillers very scarce. And of course no qualified truckdrivers. Fracs are harder to crew.

Parts for maintenance all on back order. If you have an equiped/stocked machine shop near an active oilfield you are doing well.

Word from management In Houston is discipline. Drill only pads with majority of infrastructure in place (road, pad,gas& water lines), EUR > 500K Bbls.

Thanks Joe!

I notice the rig count is up to 29 and almost back to April 2020 when it was 31. What was it prior to that?

Joelund ng reports "From the Bakken" 2020/21

Started by metmike - May 2, 2021, 5:25 p.m.

NG opened with around a $2,500 gap lower price compared to the close on Friday and $1,000 lower than the lows on Friday. Friday afternoon showed some good buying the last couple of hours.

The low of 5.270 was put in during that first minute of trading this evening.

We closed the gap just over an hour later and have traded just above the Friday lows for the last several hours.

Regarding the weather.

Pretty dang chilly this week but gradually moderating to just above average by the end of 2 weeks, with the warmth maximized in the northcentral part of the country in week 2(some much above average days), while the southeast stays chilly in week 2(still some below average days but even there, moderating).

7 day temperatures last week for the next EIA report coming up this Thursday.

Above average most places, so the injection should be another robust one for the end of October.

"Oddly, an even bigger price increase in natural gas – futures were up 115% so far this year – has not yet encouraged drillers to seek more gas. The oil rig count was up about 66% since the start of the year, while the number of active gas rigs was only up about 20%.

Even though producers were not drilling many new gas wells, the U.S. Energy Information Administration (EIA) projected gas output from the biggest shale basins would rise to a record high for a sixth month in a row in November.

That is in part because companies were completing oil and gas wells drilled long ago, prompting some analysts to project that drilling will have to increase soon or production will decline as the number of drilled but uncompleted (DUCs) falls.

“With DUC inventories reaching critical levels, continual rig additions are needed to further sustain dry gas production from 2023-onward,” analysts at Raymond James said this week in a report.

The EIA said producers completed 876 oil and gas wells in the biggest shale basins in September, the most since March 2020, leaving just 5,385 DUCs, the lowest since February 2017.

That was the 15th month in a row that the number of DUCs declined, the longest streak on record, according to EIA data going back to 2014."

metmike: Natural gas is having a hard time attracting new investment capital because of the war on fossil fuels and massive money flowing into the fake green energy.........solar and wind power NOT natural gas.

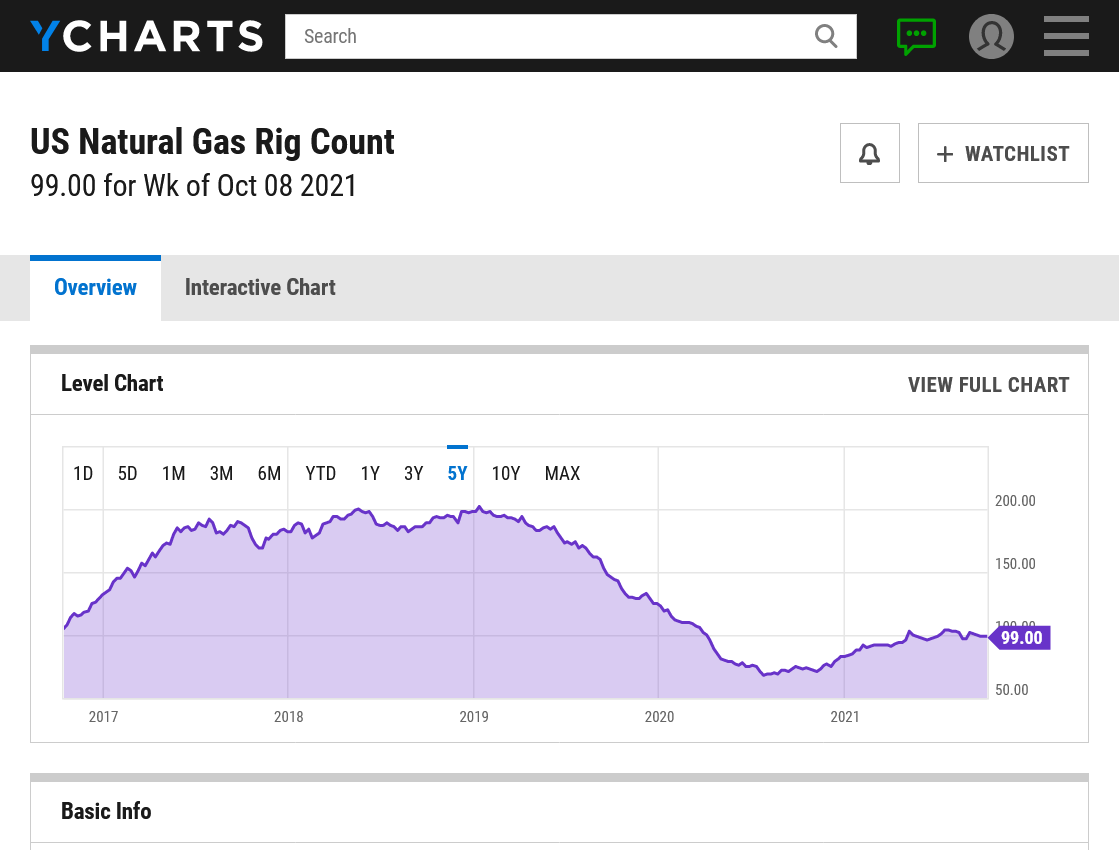

The rig count recovered from the historic lows last Summer but is still only half of the number from less than 3 years ago.

++++++++++++++++++++++++++++++++++++++++++++++++++

https://ycharts.com/indicators/us_gas_rotary_rigs

This link is now pay walled but here's the last free graph below.

Rig count still on the low side....not going up much.

The record low was 68 last July(2020). However, the rig count is only half of what it was in 2018/19. It was already plunging BEFORE COVID hit.

It's not that there are more gas rigs being sunk. It's the fact that more established gas rigs are staying offline. And the ones operating, are producing enough to meet the demand. NG is overpriced.

And even so, we are seeing expectations met with the current flow of NG into the storage capacities, of both Europe, and the US. This is highly bearish, given the current price. Despite the weather factor. Although, I wouldn't discount weather influences at this time of year.

https://www.cred.org/seven-steps-of-oil-and-natural-gas-extraction/

Learn More!

Want to learn more about fracking? What is in fracking fluid? How much water does fracking use? Click here to get the facts on fracking in Colorado – from our state’s stringent regulations to how it powers our economy and supports our communities.

This is for crude oil but is probably similar for natural gas:

https://www.eia.gov/todayinenergy/detail.php?id=41253

Natural gas production is doing well right now because of previously drilled wells(from years ago when the rig count was twice the current size) that are being completed.

However, a stat that they call DUC's........Drilled but Uncompleted wells (the ones noted above) has been shrinking to smaller and smaller numbers because NEW wells are not keeping up as a result of the rig count NOT increasing to where it was prior to 2019.

So eventually, unless they pick up the rig count in order to drill new wells, the DUC number will run so low that there won't be enough drilled wells ready to complete to keep up with production. At that point, the production starts dropping off.

Not sure what the rate of increase in new wells should be that they need to complete to keep up with production.........which I assume has to be at least equal to the rate at which old well production starts fizzling.

Regardless, the ng rig count will need to increase at some point with certainty. The DUC's are the lowest in years and when it gets too low.........production WILL drop.

At every other point in history, when prices more than doubled.............the rig count drilling new rigs went up MUCH more than this. Investment capital sees too much risk in something that many major energy policy gatekeepers are trying to obliterate, with subsidies and financing probably drying up too in favor of fake green and crappy alternatives(mainly solar and wind).

metmike: Tricky market overnight. The 0z GFS came out about the same but the EE was much milder..........and the market actually went up to new highs, near 5.5 before 5am. Maybe because the last couple of days were actually colder? Then we commenced the sell off just before 5am and the 6z GFS came out MUCH milder which gave it more fuel.

Mike,

I think that one of the main reasons NG was rising at that point early this morning also was that crude was strong/rising. So, until wx came back into the picture later in a more clearcut fashion and considering how much NG fell Fri as well as earlier in today's session, it appears to have been like a shortlived dead-cat bounce to me.

That sounds plausible to me Larry.

I’m seein increasin signs that the moderation in this weeks very chilly temps in week 2, that takes us well into above temp and below HDD-land coul morph colder later in week 2.

Some individual ensemble and operational model solutions feature much below temperatures but those are still a minority.

The AO and NAO are NOT very favorable for strong sustained cold but they sometimes are just a reflection of the models.

However, the present cold wave was forecast well in advance from, especially the -NAO which is not there yet for a potential turn back to cold....so it’s still low confidence.

However, the main positive Anamoly at 500 mb in the northern hemisphere is solidly in Northeast Canada to Greenland at the end of 2 weeks and now that I think about it, that was the feature that I keyed on in early October to predict this current cold wave.....though we had the solidly -NAO and slightly -AO.

So I’m starting to lean towards moderate confidence because of the favorable teleconnections with that Anamoly. ....often seen with a Greenland bock set up that features backdoor type cold fronts which are especially chilly in the East.

The La Niña set up that we have also causes a building ridge out West which is a good tel connection to help amplify troughing downstream in the Midwest and east.

If we have the upper high/positive Anamoly in northeast Canada and troughing to the south in the eastern us, odds are pretty high for below normal temps in the east.

We need the AO to drop more to get a source region from the Arctic to make it MUCH below.

chart as of Nov 1

Thanks for this analysis. Yeah, there does seem to battle or sorts that has developed in recent days as you're saying between:

1. The weakening of the cold anomalies for late this week into early next week vs how they earlier appeared

2. A tease of a potential pattern change back to western North American ridging starting near day 11.

I assume you agree that Factor #1 easily won the battle today because there was a very large loss of HDDs vs Fri on the more reliable EE. Any HDD gains from the late week potential 2 pattern change have so far been fairly small and much smaller than the aforementioned big HDD losses. There are still no major cold pushes yet showing up on the ensemble means (though some GFS operational (very unreliable) have had strong cold. Plus, late week 2 is obviously much more speculative and thus less likely to be real vs the much earlier losses.

metmike: Agree 100%. The market doesn't count HDD's as much when there is a powerful weather pattern change coming up that will over power everything else, including model to model fluctuations in HDD's. In this case, back to colder as mentioned on Monday PM. I'll show some maps in a minute.

Several factors have increased my moderate confidence pattern change to colder in mid-November from yesterday to high confidence.

The main feature mentioned yesterday continues and is still evolving/changing. Positive anomalies now along the West Coast are linking nicely with those in N. Canada to Greenland with a weakness from the Upper Midwest east/southeast. This strongly teleconnects and favors air from Canada moving southward into the Midwest/East.

These indices are changing rapidly too and becoming MORE favorable than yesterday. It's what held me back from higher confidence on Monday and which now favors higher confidence today.

We need a -AO and -NAO to strongly favor sustained, strong cold.

The AO below NOW shows numerous members that nose dive into negative territory vs none yesterday.

The NAO yesterday was closer to 0 but today, has shifted to a definite negative bias in tandem with the pattern change.

A +PNA helps out too with a ridge in western North America. Several members REALLY like that solution. A -PNA, which is the opposite,should that happen instead....tends to provide more zonal flow from the Pacific that tries to undercut cold from a -AO/NAO. Larry alluded to this battle yesterday. Todays late week 2 maps give the win to the colder solutions.....but those can change. The trend is your friend in trading and also weather predicting but models can flip back and forth.

Thanks for the analysis Mike!

YW Jim!

And thanks for the chart Gunter.

The NWS extended outlooks didn't seen to justify the huge move up today............but the NWS is ALWAYS behind the market reaction.

When we had the huge spike higher last month to dial in this current cold wave, the market started reacting several days before the NWS outlooks looked cold.

They are always conservative and often stick to protocol, using the same tools. I think they often will not dial in enough extra weight using pattern recognition, which I gave you a sample of above.

It's with pattern recognition that a meteorologist can kick the models ars in predicting weather.

Models are just solutions of the future atmosphere using mathematical equations. We wouldn't be able to predict weather without them and even pattern recognition, is just using model output.

However, mathematical equations lack the ability to look at specific, large scale patterns and apply human discerment by applying relationships(physical and historical) based on that pattern which the models don't do well with.

metmike: Yep

Major indices not much different.

AO and NAO shifting lower but not extremely low.

PNA more neutral.

Actual maps didn't look quite as cold to me overnight, with less amplification of the trough in the Midwest/East.

Euro was +2 HDD's but the actual extended weather maps matter the most, because they define the overall pattern.......not expected fluctuations in HDD's from run to run(which when big-DO MATTER at the time)

metmike: Typically the futures FALL as peak demand season nears.........unless temps are getting COLDER on the weather models. Typical of NG trading. The models were not THAT much colder today than yesterday but nobody wanted to be short and this market that often over reacts in Winter is over reacting on max steroids, blood doping and amphetamines (-:

There's a chance that we just peaked with this natural gas spike higher. Just depends on the models overnight. This is NOT my prediction. But I will explain.

When mentioning models, I am only discussing the ensembles here and forever unless otherwise noted.

The 12z European and 12z CMC models from earlier, that won't update until after midnight, keep the cold into early week 3, especially in the East. At day 14 day, the last day, HDD's are still moving a bit higher and above average on those solutions.

The 12z GFS, however peaks several days earlier, around day 11, followed by very slow moderation with a zonal, west to east flow spreading mild Pacific air across the country and slowly eroding the cold that is still hanging on in the northeast 1/4 to possibly 1/3 of the country but with a pattern hinting at more moderation in week 3.

This is why ng had some weakness, starting at noon when the week 2 part of that forecast was coming out.

The European model disagreed and for the hour following 2:27 pm, we popped $1,500/contract.

The 12z European model had the cold continuing to increase for days 11-14 with a pretty deep upper level trough all the way back to the Great Lakes and down to the Southeast.

The biggest change came with the 18z GFS which really kicks up the mild, west to east flow and flushes out almost all the cold, except in the Northeast by the end of week 2.

If you want to believe this solution, then most of the country, except the far northeast early in the period will be seeing above to much above temperatures in week 3.

IF the 18z GFS is correct.........huge IF, then the highs are in or close to in. The rest of the guidance MUST confirm this overnight.

If the 18z GFS is not correct and the European model is correct, then we might have more to go to the upside..........but maybe only if the models are COLDER overnight.

If they are just the same overnight, we may have dialed in all the cold in the last 2 days.....and need MORE cold to go higher. The EIA comes out tomorrow also but at this time of year, the reports affect is usually short lived, then we quickly go back to the latest weather models.

The 12zvCanadian model is not a great model but it looks more like the GFS.

Looking at the MANY individual solutions of the 12z ensembles for the GFS and Canadian models shows a massive disparity.

Some are pretty dang cold, others are very mild. When you have this much disagreement, the confidence level of the forecast is always low.

Here was the solution of the 12z GFS on the last map at 384 hours, day 16. Many more cold members(but some mild)......but the 18z warmed up. The 18z, however could either be off or it could be seeing something bases on data 6 hours fresher. 384 hours doesn't show great skill but the market has REALLY been paying attention to the late week 2 maps this week.

http://www.meteo.psu.edu/fxg1/ewall.html

Here was the 12z Canadian model. Clearly the mildest of the 12z models.

https://weather.gc.ca/ensemble/charts_e.html?Hour=384&Day=1&RunTime=00&Type=gz

384h GZ 500 forecast valid on Nov 19, 2021 00 UTC

Forecasts for the control (GEM 0) and the 20 ensemble members

Thanks mark!

We got milder maps overnight and sold off more than 2,000 from the highs and had a powerful reversal lower......followed by a spike back just above mid range and modestly higher on the day.

Wild!

If you scroll up to the NAO and AO you will see and extreme spread in the solutions. Some are solidly positive, favoring warmth, just as many solidly negative and cold....actually a couple more this way on the AO.

We could still go either way.

IMHO, all of a sudden NG looks wildly over priced. Like $2 over priced. It will be interesting to see how long prices can hang up here on the wave of Europe's problems.

https://ir.eia.gov/ngs/ngs.html

for week ending October 29, 2021 | Released: November 4, 2021 at 10:30 a.m. | Next Release: November 10, 2021

+63 BCF Neutral

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (10/29/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 10/29/21 | 10/22/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 899 | 885 | 14 | 14 | 946 | -5.0 | 913 | -1.5 | |||||||||||||||||

| Midwest | 1,071 | 1,052 | 19 | 19 | 1,119 | -4.3 | 1,086 | -1.4 | |||||||||||||||||

| Mountain | 213 | 212 | 1 | 1 | 241 | -11.6 | 221 | -3.6 | |||||||||||||||||

| Pacific | 256 | 255 | 1 | 1 | 320 | -20.0 | 304 | -15.8 | |||||||||||||||||

| South Central | 1,172 | 1,144 | 28 | 28 | 1,298 | -9.7 | 1,188 | -1.3 | |||||||||||||||||

| Salt | 320 | 304 | 16 | 16 | 350 | -8.6 | 319 | 0.3 | |||||||||||||||||

| Nonsalt | 852 | 840 | 12 | 12 | 948 | -10.1 | 869 | -2.0 | |||||||||||||||||

| Total | 3,611 | 3,548 | 63 | 63 | 3,924 | -8.0 | 3,712 | -2.7 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,611 Bcf as of Friday, October 29, 2021, according to EIA estimates. This represents a net increase of 63 Bcf from the previous week. Stocks were 313 Bcf less than last year at this time and 101 Bcf below the five-year average of 3,712 Bcf. At 3,611 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

metmike: Weather forecasts matter the most. Incredible range because half the solutions are cold and half are mild. The average of them was a bit milder overnight compared to Wednesday........so we dropped hard........but then came back earlier this morning because half of them are still cold!

I get that weather reports are important, but we are usually talking about prices ranges in the $3-$4 dollar range. Gas is pouring into storage at a pretty strong rate and it looks like we might get two more weeks of injections. We get a warm forecast somewhere here and NG could drop hard.

You might be right Mark.

Jim, I totally get your point too. November is the worst month of the year to be long when the weather is very mild and if we fill up storage.

There are other factors too.

Though production is keeping up from rigs drilled a few years ago, that were not developed(DUC's) and have now become developed, the rig count remains at only 50% of what it was 3 years ago DESPITE the highest prices in over a decade.

https://www.marketforum.com/forum/topic/76792/#76918

Eventually, the DUC's will run out and production will drop orrrrrr, the rig count will need to go up to drill new rigs.

So far, the rig count has been resisting the increase that it had previously experienced every other time in history when prices more than doubled and the financial reward incentive made doing this greatly irresistible/lucrative. ....which happens in all businesses because of the laws of demand/supply.

Something is different at this point in time.

I believe its the war on fossil fuels.

All the big money is investing mostly in solar and wind............alternative energies of the future. This is where ALL the government funding and tax breaks are. This is where they will get much more bang for their buck and more free money.

The energy markets are in the early stages of learning a tough lesson that the green fairy energy can never replace fossil fuels with some impossible schemes and numbers based on the physics of dense, reliable energy, that is its own battery, being replaced by diffuse, unreliable energy that lacks storage ......but the incentives right now and bottom line are telling the big money to throw all their new investments at it. ...even if its not going to work as planned.

Huge investors tie their investments to what makes the most money. The markets are screaming at the big money to get wealthy by investing in solar and wind. It's a call that can't be resisted.

Drilling rigs are step 1 in the natural gas business. The rig count stabilizing instead of going up here is most likely explained by the fundamentals above.

$555 billion to fight the fake climate crisis

Started by metmike - Nov. 2, 2021, 12:19 p.m.

https://www.marketforum.com/forum/topic/76969/

"The centerpiece of the climate spending is $300 billion in tax incentives for producers and purchasers of wind, solar and nuclear power, inducements intended to speed up a transition away from oil, gas and coal."

metmike: Wow. Several ensemble solutions have it pretty cold at the end of week 2 and maybe a few more that have it moderating. Monumental risk to holding a position this weekend.

metmike: No news is bearish news? It is for the moment when the models suggest the potential for the cold to be easing at the end of the period and we are at the highest price by far in over a decade. But there is still a great deal of disparity in week 2. Some models deepen the cold pattern much more than others and try to hang on to it......those favoring the northern stream. Others model favor the Pacific branch of the jet and allow only allow a more shallow and transient penetration of cold that gets blown out from a west to east, mild flow.

I do like the fact that it is going to be in the 60s here in NE Ohio next week! I was giving up hope that I would get in one more nice motorcycle ride. It's peak leaf season.

Fall Foliage map

12z models were MUCH colder.

Especially the Euro- +9 HDD's, CMC and Canadian models!!

metmike: Some much colder 12z models resulted in a $1,200/contract pop after the day session ended.........actually entirely from the European model because the other ones were out already and we still made new lows afterward. but the Euro mostly comes out AFTER the 1:30pm close.

Mike,

Market action today was weird if one considers wx, alone. I realize there are always other factors to consider. But regarding models, as you said all of them were significantly colder with solid Arctic shots and yet it still made new lows at 2:30 EDT on a sharp drop, which makes no sense from a pure wx standpoint. Only after 2:45 did it finally have a big rally. Why then and not earlier? Based on earlier action, a sharp rise on the much colder EE wasn’t at all predictable. And typically the GFS suite has as much and sometimes more influence vs others like earlier this week. One thing I saw today was immediate programmed selling (algos) when a buy occurred. That kept it from being able to rally well on cold. What I don’t understand is how that can happen all day session long. It is as if there’s some very large entity controlling it but that makes no sense. Weird. Maybe those algos stopped at 2:30??

Actually, Larry I agree 100% with you and just came back to my desk to elaborate.

So let me back up. The 18z GFS came out COLDER and we made new highs up around $800 to around 5.76 from the open on the peak, then we drifted lower, continuing during the milder 0z GFS, then did a huge spike down almost $1,000 in 5 minutes when the E was coming out milder to a new low below 5.56.

Then we started drifting higher again and the 6z GFS was MUCH colder and we got up above 5.7 just after 6am.

Then the pressure was on with new lows below 5.52 around 9am.

Bounced around with a really wide range and managed 5.64 just before noon.

The 12z GFS came out colder than the 0z run from 12 hours ago but not AS cold as the MUCH COLDER 6z run, 6 hours ago. The Canadian model that doesn't have a 6z run came out MUCH colder than its previous run 12 hours earlier.

So both those models were a decent amount colder than the runs 12 hours earlier but there were numerous waves of selling for an hour then the last 17 minutes + a few minutes it wasnt in waves but just mainly selling that was often hitting the bids all the way down until we made new lows, just above 5.5. This type of selling with no spikes in the opposite direction(big waves) is a bit unusual for ng trading until 6 minutes after the day session closed.

Then we had sustained buying that was often hitting the offers on the way up(with no opposite move spikes) that lasted an hour straight and got us above 5.6 again. This seems tied to the much colder E model.

I was not tracking it extremely close because I was spending hours on political posting, responding with rebuttals to junk COVID vaccine science but feeling obligated as moderator to correct it so we don't have to censor it.

This is something that I need to change to improve my trading and tracking weather models/markets.

At least with the market and weather stuff its pure data and analysis and always a joy to share with you guys, who are seeing data and analysis based on whats REAL and giving your valuable insights(thank you for that).

I refuse to be moderator of a forum that turns into a big echo chamber for people that promote conspiracy theories.

Some of you remember how awful it was for some people who wanted only to talk trading and they had to wade thru the political battles. This is why we separated the forums. The world is totally different now but the separation of the forums was a very good idea by Alex.

But not nearly as good as adding the ability to post images, graphs, charts and data.

Speaking of politics and trading, it looks like we might have lost tallpine because he doesn't like my view on Trump and COVID vaccines.......just my guess. I'm here to provide honest stuff not generate extra traffic by lowering standards 1 iota or enabling something that's destroying our country right now........seriously it is. You may have noticed his absence too. I hope he returns because he was incredibly reliable and had some wonderful stuff and like me, was just providing it because he loves generously sharing. If so, I completely understand, don't judge and will always be grateful to the years of being on the same team with him.

Tallpine is a crop farmer in Iowa in case you didn't know.

Thanks, Mike. My main observation is that if one were to trade strictly on wx during the day session yesterday that it could have gone in any direction due to other factors being in opposition/choppiness/unrelenting programmed selling. If one were to do that strictly on the timing of the 12Z Euro, that would have been the only way to have a likely gain since the session low was just before it started. How would one know to do that, especially with the earlier choppiness and then drop to session lows just before?

When I talk about programmed selling, I mean that there were many cases where someone buying the offer would result in a simultaneous sell at the bid actually bringing it down in many cases.

I hear you exactly Larry.i was kicking myself for not being long early during the euro solution but was discombobulated from how the market was reacting to weather earlier...and when it was coming out....was skeptical tha it would finally obey the commands of the newest almighty European ensemble solution.....like you said..

NG comments the last couple of days have been at this thread:

Lucky NG trade

16 responses |

Started by Jim_M - Nov. 6, 2021, 1:15 p.m.

Still a battle between the potential of the northern stream vs the Pacific stream which features mild, west to east flow.

Big spreads in the AO/NAO that both lean negative and cold.

The last GFS was -10 HDD's vs the previous run and an incredible -20 HDD's vs the cold 0z run from 18 hours earlier.

I think that without them being much less cold, we might be sharply higher here.

We opened on the highs. 5.605.......with the milder 18z GFS taking us down to the lows pretty quickly at 5.515 less than 30 minutes later and now are close to mid range after getting back to 5.573. Latest was 5.560 on the NGZ-21

metmike: Battle between mild Pacific flow and some northern stream from Canada may just result in some ups and downs with temperatures as individual systems move thru thru the flow and cause temperatures to bounce higher for several days as they approach, then plunge lower for a few days after they pass by.

Overall its a ridge west/trough east tendency which usually means milder west and colder east. The ensemble means are not very amplified but much of that is because the individual solutions represent some extreme versions that cancel each other out when you average them together. This fairly wide spread suggests some uncertainty and is why individual solutions can drastically change if most of the solutions suddenly change their tune. The GFS ensemble mean got colder over the weekend, then greater warmed up at 12z Sun by -10 HDD's, then another -10 HDD's at the next model run, 18z solution.

Overnight, this same model was +8 HDD's on both solutions and went back to a bit colder again but still not nearly as cold as the solution from very early Sunday morning.

Larry,

This was a great assessment by you yesterday!

The afternoon weakness is contrasting the solution of the almighty European Ensemble model.

The 12z solution came out +6 HDD's colder than the previous 0Z solution but we sold off anyways..........after a brief spike higher after it came out.

I've often said, don't be long in November if the temperatures are not extremely cold but even modest cold, at these prices is not holding us up.

There are several other factors going on, including that the market, as usual dialed in MORE cold than was justified on the last run up and may need something more extreme looking to inspire strong fresh buying that overwhelms sellers........at these prices.

The pattern is not amplified enough to bring anything but modest cold.

The bull spreads are actually working though........which is telling.

On most moves, the front month LEADS with the biggest gains or biggest losses in which ever direction the move is ........... but the front month Dec is down LESS than Jan today by more than $300/contract....instead of being down the most.

This suggests, on the surface more support for the front month, sometimes from strong cash values but it could be tied to other dynamics related to speculators.

Thanks, Mike.

What is the NG market suddenly looking for in just the middle of November to not continue to fall, a Siberian Express or something? Something doesn’t add up. It rose a bunch on the Fri 12Z EE and that wasn’t even as cold as today’s 12Z EE. At times, it apparently is trading nonwx items as the dominant things. I don’t think anyone knows.

Thanks Larry. I'm glad that you're watching too in order to share it.

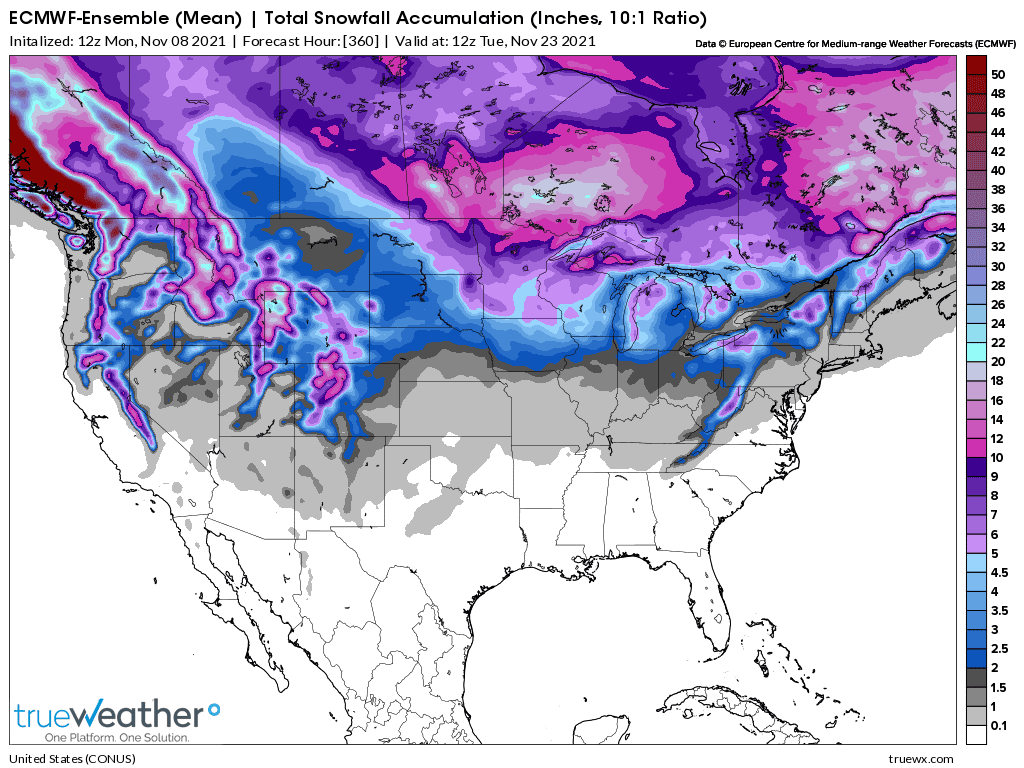

Something just struck me as being a bit of a potential factor later this month that's at least interesting to us. The market won't trade this but it should increase HDD's a bit ......down the road as they happen..... to be higher with temps COLDER than model forecasts for these air masses in S.Canada headed into the US............fairly deep snow pack in Canada down to the US border.

That's if the European models bullish snow amounts fall in the forecast below(more than other models).

With the low angled sun, air masses tracking over the snow pack will NOT moderate as much as they often do headed south over bare ground.

Ideally, to maximize this affect HDD's we need the snow to be on the ground in a huge area of the high population regions of the US.

Just for fun, I think I will look at the historical snowpack in the US for the last 2 decades on the date below but start a new thread with it.

metmike: Appears as if we need a more potent brand of cold to move higher than this. at these prices(highest in over a decade), storage levels and being November.

Natural gas futures extended their recent losses in early trading Tuesday as the latest forecasts did little to change a mixed overall temperature outlook for the next two weeks. Coming off an 8.9-cent decline in the previous session, the December Nymex contract was down another 18.8 cents to $5.239/MMBtu at around 8:50 a.m. ET. Overnight…

metmike: Wow! Modest cold still coming up but as discussed yesterday, only extreme cold is going to help ng here in November at these prices and point in time. Lack of reaction to the colder European model yesterday was an indicator of this too.

Glad the models didn't turn sharply colder overnight and tempt me to go long........which would have been a recipe for a loss in this environment.

These were the temps last week for the upcoming EIA report this Thursday at 9:30am. Not quite as robust as recent reports.

The map below show a modest ridge west/trough east pattern which would be favorable for very mild temps in the West to Plains and chilly in the East. However, the streamlines connected to the flow have Pacific origins and not enough north to south component to drag down Arctic air......which means that even in the chlliest places, the brand of cold will be modest.

Maybe we purged some excessive longs and can use $5..or some other lower price as support if the models turn much colder?

Not predicting anything, just speculating because the -AO and tilted -NAO mean an amplification in the pattern IF IT WOULD HAPPEN would increase the intensity of the cold.

Mike,

I think you agree that domestic wx (and wx, period) change is not as dominant a factor as it used to be. Sometimes it will still be a significant factor and sometimes it won’t. It isn’t consistent. This is a different market as there are more outside factors, including nondomestic due to much increased exports..

Example: the colder Fri 12Z GFS suite lead to only choppiness and was followed by session lows. Then the colder EE unpredictably (you agreed) lead to sharp gains. Colder versions of it since have lead to little and no more than very short term rises at much lower prices than when it rose sharply on Friday. So, we’re now much lower than then even with a colder forecast.

And to go with that continuing, the 18Z GFS ensemble came out -3 HDDs which would be bearish....but ng went up.

If I hadn't been on the road driving for 7 hours today, I would be totally baffled.

NGI gave no explanation but NPR was discussing the ng market at length today because of the huge news in Europe. NPR was bent out of shape that Russia is supplying Europe with natural gas, which is sabotaging the fake green energy's attempt to obliterate fossil fuels.

Anna Shiryaevskaya and Elena Mazneva

https://news.yahoo.com/european-gas-prices-slide-signs-092622440.html

(Bloomberg) -- European natural gas prices slipped on signs Russia may be starting to gradually deliver the boost in supplies President Vladimir Putin promised.

Benchmark Dutch futures fell as much as 12% after allocations of capacity on a key Ukrainian-Slovakian border point increased for Wednesday after a smaller gain for Tuesday.

Benchmark European gas futures fell 8.2% to close at 72.59 euros a megawatt-hour. The equivalent U.K. contract dropped 7.8% to close at 187.18 pence a therm.

European gas prices have more than tripled this year as Russia kept supplies capped just as liquefied natural gas cargoes were being diverted to Asia. That meant Europe started the heating season with the lowest inventories in more than a decade.

But there are now signs that the tightness may be easing. Just over 19 million cubic meters a day of pipeline capacity at the Ukraine-Slovakia border at a day-ahead auction on Tuesday, or about double the amount that cleared at the previous day’s sale.

metmike: US storage has never justified prices at these lofty levels but instead, has been pulled much higher from tracking GLOBAL prices because the US, is no longer isolated from the rest of the world like it had been.

Global ng exports from the US have been ramping up and are now significant enough to be a huge factor in determining US prices.

Record high prices in Europe got us up here and now, prices crashing lower are taking a toll on US prices...........on days like today.

metmike: NGI doesn't even mention the price crash in Europe on Tuesday.

With forecasts hinting at a turn toward milder conditions for the Lower 48 in late November, natural gas futures continued to erode in early trading Wednesday. The December Nymex contract was down 19.4 cents to $4.785/MMBtu at around 8:50 a.m. ET. Recent model runs as of early Wednesday advertised warmer trends and lower overall weather-driven…

metmike: Models were a bit milder overnight. Also, AO and NAO are not tilted negative anymore......closer to 0/neutral now, which reduces cold risks additionally. We may need to check the prices of ng in Europe to see if spikes there are affecting prices here.

Looks like NG is recovering some. Getting in position for the storage report tomorrow.

Tomorrow is Veterans Day. Report is out today.

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (11/05/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 11/05/21 | 10/29/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 897 | 899 | -2 | -2 | 943 | -4.9 | 915 | -2.0 | |||||||||||||||||

| Midwest | 1,075 | 1,071 | 4 | 4 | 1,126 | -4.5 | 1,096 | -1.9 | |||||||||||||||||

| Mountain | 213 | 213 | 0 | 0 | 243 | -12.3 | 222 | -4.1 | |||||||||||||||||

| Pacific | 258 | 256 | 2 | 2 | 322 | -19.9 | 304 | -15.1 | |||||||||||||||||

| South Central | 1,175 | 1,172 | 3 | 3 | 1,293 | -9.1 | 1,201 | -2.2 | |||||||||||||||||

| Salt | 324 | 320 | 4 | 4 | 345 | -6.1 | 328 | -1.2 | |||||||||||||||||

| Nonsalt | 850 | 852 | -2 | -2 | 948 | -10.3 | 873 | -2.6 | |||||||||||||||||

| Total | 3,618 | 3,611 | 7 | 7 | 3,926 | -7.8 | 3,737 | -3.2 | |||||||||||||||||

Thanks Mark,

The early release caught me off guard. When the slightly bullish number came out, we immediately sold off hard, so the market had at least anticipated it or even considered something more bullish.

https://ir.eia.gov/ngs/ngs.html

https://www.investing.com/economic-calendar/natural-gas-storage-386

a bit BULLISH!

Latest Release Nov 10, 2021 Actual 7B Forecast 10B Previous 63B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Nov 10, 2021 | 12:00 | 7B | 10B | 63B | |

| Nov 04, 2021 | 09:30 | 63B | 63B | 87B | |

| Oct 28, 2021 | 09:30 | 87B | 86B | 92B | |

| Oct 21, 2021 | 09:30 | 92B | 90B | 81B | |

| Oct 14, 2021 | 09:30 | 81B | 94B | 118B | |

| Oct 07, 2021 | 09:30 | 118B | 105B | 88B |