2 days does not a trend make. But when the markets launched on Fed day, gold went with it. Then yesterday, Stocks gave a lot (S&Ps) to all (Nasdaq) of it back. But gold held it's gains and even added a bit.

Bear always talks about seasonal tendencies. Gold may have bottomed in line with its seasonal low in mid December. More likely it is a rally within the sideways slosh we've been looking at for quite some time.

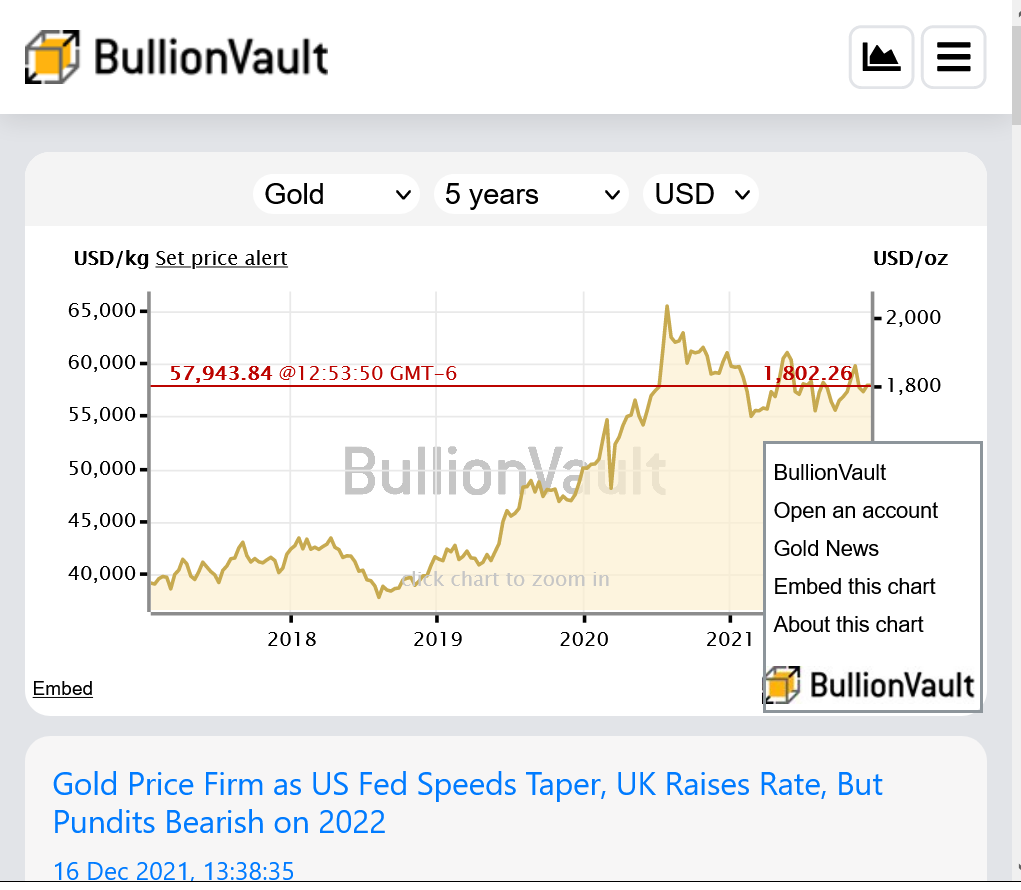

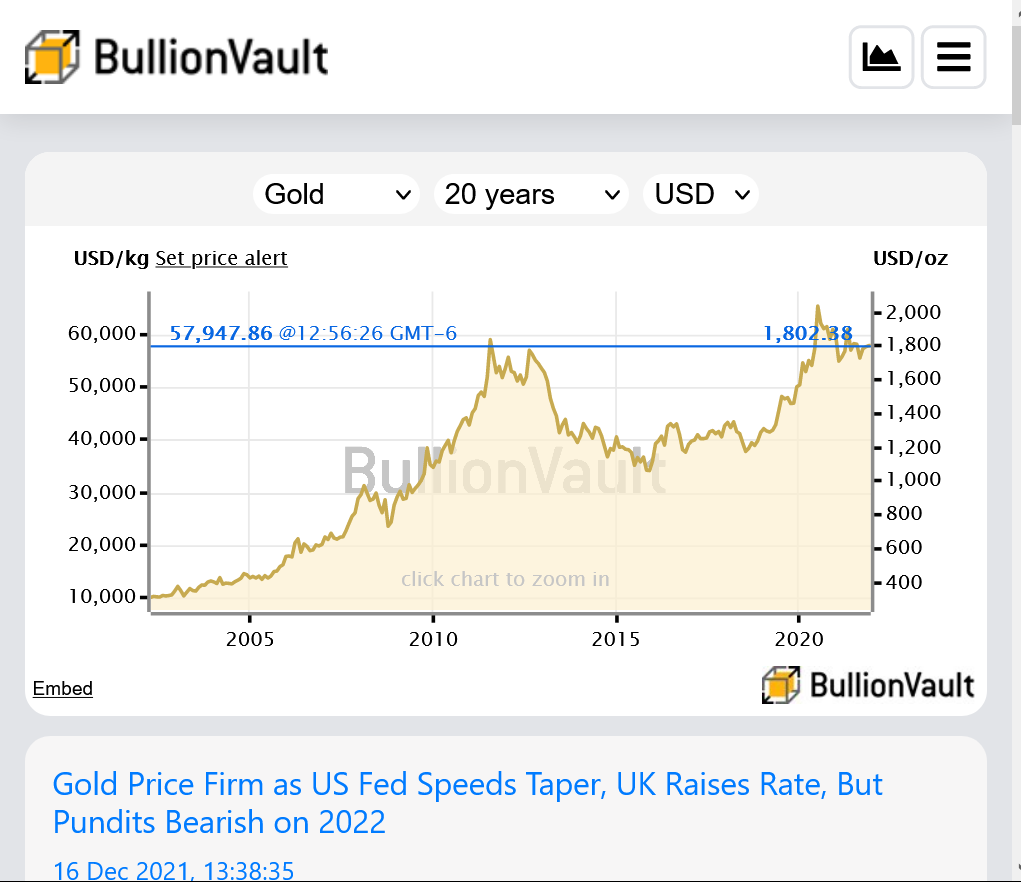

I never traded or bought gold in my life.........so don't mind me but it looks pretty bullish long term.

https://www.bullionvault.com/gold-price-chart.do

https://www.marketforum.com/forum/topic/79198/

Some things people just don't love so much

Started by wglassfo - Dec. 17, 2021, 4:59 p.m.

A historical spread between gold and silver would be 40 or 50 - 1

Currently silver is 80.46 - 1 last time I looked

To get back to historical ratio, of 40 50 - 1

does

gold go up

Silver down

This is approx the new ratio of 80 - 1

I have read reports new world silver supplies are less than demand

I have also read of large amounts of silver standing for delivery in 2020 and 2021

This has all, not been confirmed, so take it with a grain of salt

I think silver will go up in value by at least 100.00/oz

2022 or 2023 at the latest

I think some large investors are hoarding silver and gold, when it is cheap

Crypto is the poster child for an inflation hedge

Some day the world will discover gold and silver

Although I do admit crypto has some definite advantages, in the consumer world

The last time the Gold-Silver ratio was in the 40s was 2011 and that was for a brief spike (as I recall). I'm not sure, but when a ratio stays "away from the norm" for a long enough spell, I'm inclined to believe that a new ratio is now "normal". Time will tell.

For a long time an ounce of gold bought a fellow a nice suit. $20-30 a hundred years ago. Then $300 - $400 an ounce bought a nice suit 30-40 year ago. Now for several years gold is $1800/oz but you can easily get a nice suit for $300-400 (although I haven't been shopping for it)

Similarly with gold oil. Fracking changed the price of energy and hence the relationship between gold and oil.

As for Crypto, I will never own it. Young folks are more computer savvy than older folks, so I expect all things being equal, crypto currencies are here to stay.

joj. I can appreciate your views about crypto. I feel the same way. There is no physical backing to cryptos. They are purely digital currency, developed in the digital world, which can be eliminated by a keystroke. Much like our bank accounts these days.