I purposely cut out the April 2020 crude debacle because it messes with the scale, making it harder to see the typical relationship.

But in the spirit of not erasing history, here it is in all its glory, -$40 spot crude on April 20, first ever negative oil price.

Here's a longer history for more comparison. Timing/magnitude of moves do not always match up, but directionally they have a pretty good relationship.

There are times of divergence, like in 2017-2018, which make for an interesting discussion.

Comparing Chicago soybean oil futures and U.S. crude oil futures. Crude at just below $90/barrel is the highest since Oct. 2014 and up about 42% from the early Dec. bottom. Soyoil is below the June record but up 29% from the mid-Dec. low.

https://www.youtube.com/watch?v=U79GURF8rfg latest Snodgrass on SA

Thanks VERY much mcfarm!

Thanks mcfarm!

Whoa...something must have happened. I haven't seen any pop ups yet! :)

Are we going to bust through $16 today?

china bought more NC, weather the same, USDA has backed itself into a corner on numbers

Mar beans easily cleared 16 dollars in the overnite and Dec corn is just below 6 bucks. Crazy to say but with an average crop we may squeeze a profit out yet even with some costs tripling. Problem is history has shown high prices cure high prices and in a stunning quick fall and once demand is killed with high prices it takes a while to rekindle.....so its be careful for what you wish for

new news from Kory out of SA....."conab has cut 15 m at one crack" "mind blowing" now at 125 v usda 134

The question is what is falling faster? Demand or supply? Supply seems to be dropping at a precipitous rate.

Not saying that this is THE top but THE top will always happen BEFORE the most bullish news hits.

When everybody that is willing to buy......has bought.

You can always force more long lived longs out or top pickers out with spikes higher but not much fresh buying from large specs putting on new positions is going to happen up here because the 5th or 6th production cut took off X amount of production.

You get to the point of it being the principle of "buy the rumor, sell the fact" .

The release of extremely bullish production cut news is just confirming the reason that many traders bought.........and they main reason that they have been long.

Once its released/confirmed.......their reason to be long AHEAD of the news vanishes.

Yesterday's seemingly bearish numbers(compared to what the market guessed) may have actually caused the market to go higher later in the day and today.

That seems counterintuitive.

However, those too bearish numbers told alot of traders that there will be much more bullish numbers ahead in future USDA reports, when the USDA corrects their mistakes.

I think a confirmation of what the market guessed, would have caused a huge number of traders to cover their long bets/shorts to feel more comfortable selling because most of the news feeding the bull will have been out.

Up here, anything can happen. Including a key reversal lower on a day like today.

Could be a reversal. Could be a bad reaction to the inflation news today.

https://www.youtube.com/watch?v=xEXFKJqVrQY SA bean crop

CBOT #soybeans have come well off their Thursday highs by mid-session, but the most-active contract reached $16.33/bu earlier, not too far off the May 12-13, 2021 highs. The most-active contract has hit that price on only 43 other trading days: 2021 (2), 2012 (39), 2008 (2).

Thanks mcfarm!

At the end of that period and just after it, rains really pick up but no rain and heat for the most of the rest of the month is going to reduce crop size even more and rains in March will be too late to help.

Thru Feb 26 below.

Then, with the last 2 days of the month added.

just received a blog, and audio and new maps form Kory. The dry in Argy is expanding. The areas that are planting corn are too dry to germinate but they must plant now. Bean yields have continued to fall as harvest progresses. All this bullish news is not to be confused with the better areas of Brazil where there have been areas of very good beans

Thanks mcfarm!

If I were a producer, I wouldn't be hanging on to any old crop at these prices and would be locking in some new crop production.

Sure we can go to $20+ if the US planting season has serious issues but odds are pretty high that bean acres will be huge and with anything close to average yields, prices will be plunging already early in the planting season if the weather is anything but adverse because the market will be anticipating that very early on in the growing season.

We had a pretty impressive reversal lower last week when we went up to test the all time highs.

I'm not shorting here or predicting the top but just giving advice based on eliminating any emotion that includes hoping.

US farmers got a massive present from the very bullish weather in South America the last 2 months.

The weather can't get much more bullish right now, nor the damage that's been done.

We hit $16 and turned back this evening. Maybe this is just a pause but the top will come before the bullish weather peaks and before the lowest crop estimate comes out.

statements out of Russia getting a little more squishing as to the big msm predicted all out assault that was coming any second...damn where is bill Clinton when you need a distraction?

Thanks mcfarm,

You seem to need to tie everything to politics and the msm, even grains, the stock market, oil....everything.

Fox and other similar places train their viewers/readers brains to do that without them thinking. Did you know that?

When something bad happens............automatically assume from the conditioning at these far right sources that the libs or MSM or far left or Biden played some sort of role.

These evil sources are destroying the US and the world, after all.

When something good happens...........those same sources NEVER play a role and it was likely conservative policies that caused it.

You do realize that's how you post here, right?

How do I know this about those sources? I go there too to see what they state and how they report. Not usually to get my authentic news but to get the viewpoint of the far right...........which sometimes get's it right but mainly to try to understand why they have that opinion.

My wife Deb will chide me with "Why are you always watching Fox news if you disagree with them so much?"

Think about that. Who does that? Everybody goes to the sources that tell them what they want to hear or twist the interpretations to make it support one side..........THEIR side.

Like watching a football game............where YOUR team wins every single time.

I go to analyze the plays and especially analyze why one team always wins at those sources............even without the best players and plays.

And it greatly appeals to my analytic/scientific nature.

So how do they always win at those places?

They cheat, man!

It can actually be fascinating to see cheating, especially blatant cheating which millions of people accept as legitimate..........which takes the analysis to another level...........why would so many people believe it?

Sorry for the NTR type dissertation.

https://www.marketforum.com/forum/topic/81678/#81681

It's ok for you to post your sincere thoughts in the Trading Forum like that because you can't help that its been incorporated into your thinking.

Just thought it would be a good piece of information to know in case it mattered to you.

https://www.facebook.com/photo?fbid=10159947556183537&set=pcb.10159947558668537 photo of beans with heat damage taken over the weekend by kory. doubtful these are able to be sold at market

thanks, good info on your last post about Fox news. Problem is I read about 10 marketing reports this morning that all mention the Russian position as compared to what the msm are reporting and that is what I relayed here and the darndest thing is not one word or thought came from fox news

Brazils Rio grand do sul has cut beans estimate 11mmt from 19 last year

news from RGDS beans have grade of 2 or lower and have no commercial value

Thanks mcfarm!

seems for years SA would plant the crop and then harvest a record, very few problems. Well this year they have had many. Now Mato Grasso has had so much rain those beans are showing moisture damage v the southern beans showing drought damage. China has walked from 3 cargoes. But the market is so difficult this year it is not going to let China walk and then come back in at a cheaper price. They will be trapped for another change for them.

Good points mcfarm!

looks like beans to catch again here. Close above that 1626 and clear air. Dry and hot where its been dry and hot with scattered showers. There is another chance of rain late next week.....again another chance....China is being pressured to release some reserves. Our long term forecaster has colder coming into the mid America areas late next week and get this....he sees a large area in early April with a heavy turn to cold and a heavy snow storm........then a rapid warm up....corn been a follower and acre battle is under way

get this....he sees a large area in early April with a heavy turn to cold and a heavy snow storm...

Thanks mcfarm,

Who is forecasting this?

Forecasts at that range have very low skill but I'd like to see their reasoning.

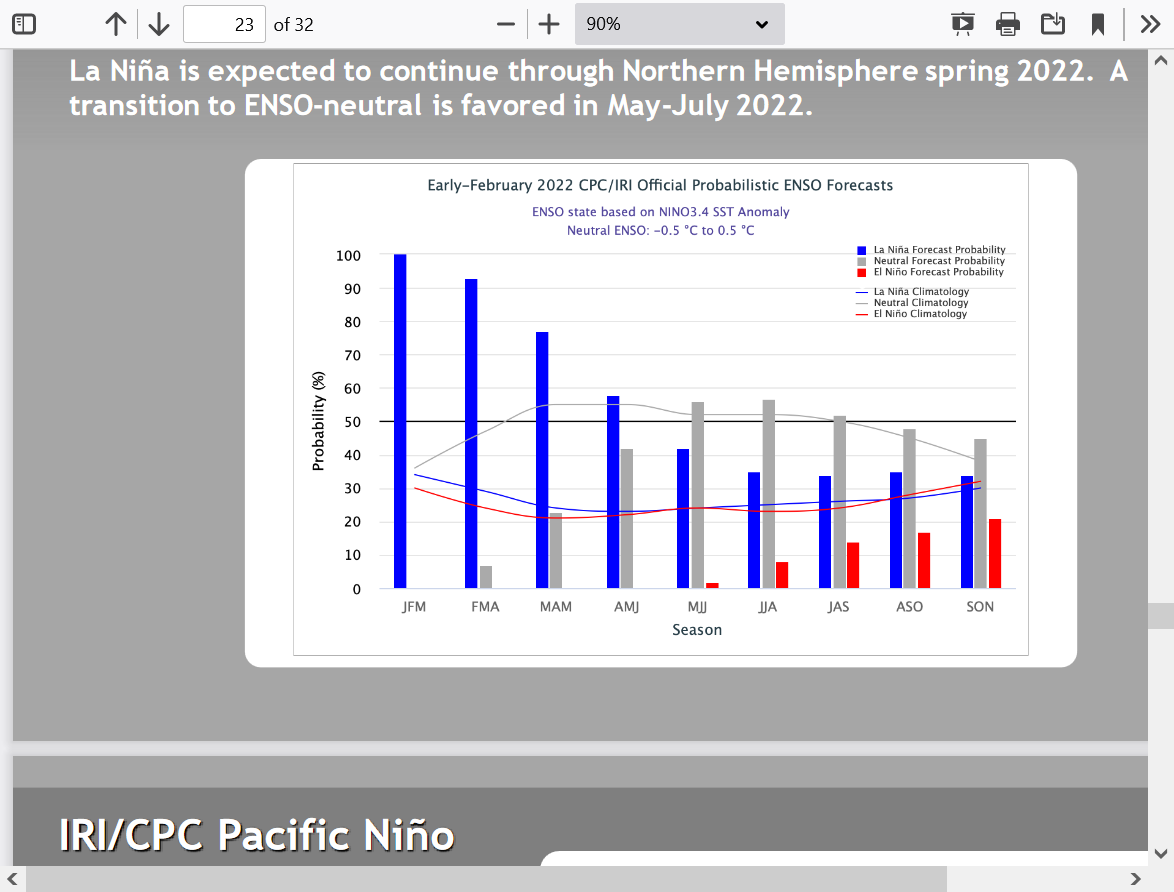

I saw something on the weather channel, that because of the lingering La Nina event, that spring was expected to be dry and warm.

Time will tell. If I had to pick, I would go with the dry and warm only because I hate the cold. :)

With regards to SA weather. Nothing new this week. The wetter weather pattern gets 1 day closer each day. Now dry for just 5 more days........then it turns wetter. The damage is all done and everybody knows it. Weather doesn't matter much anymore.

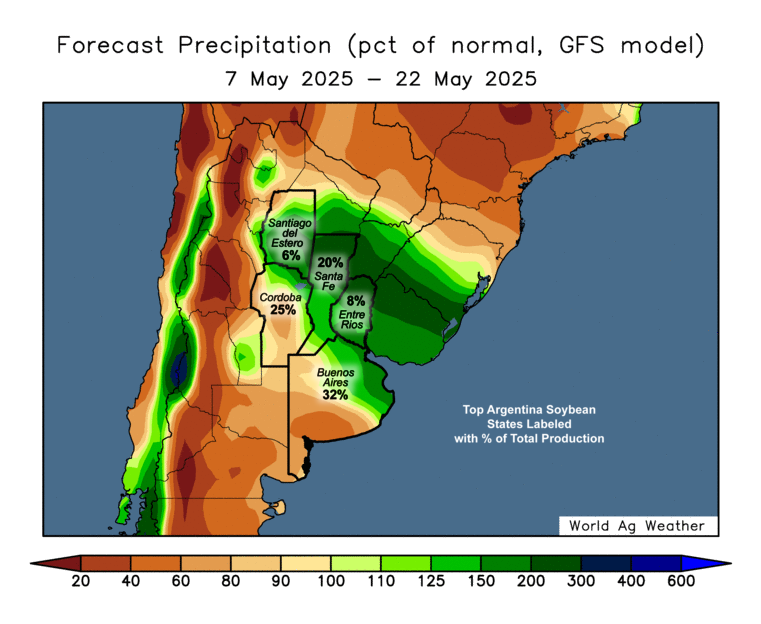

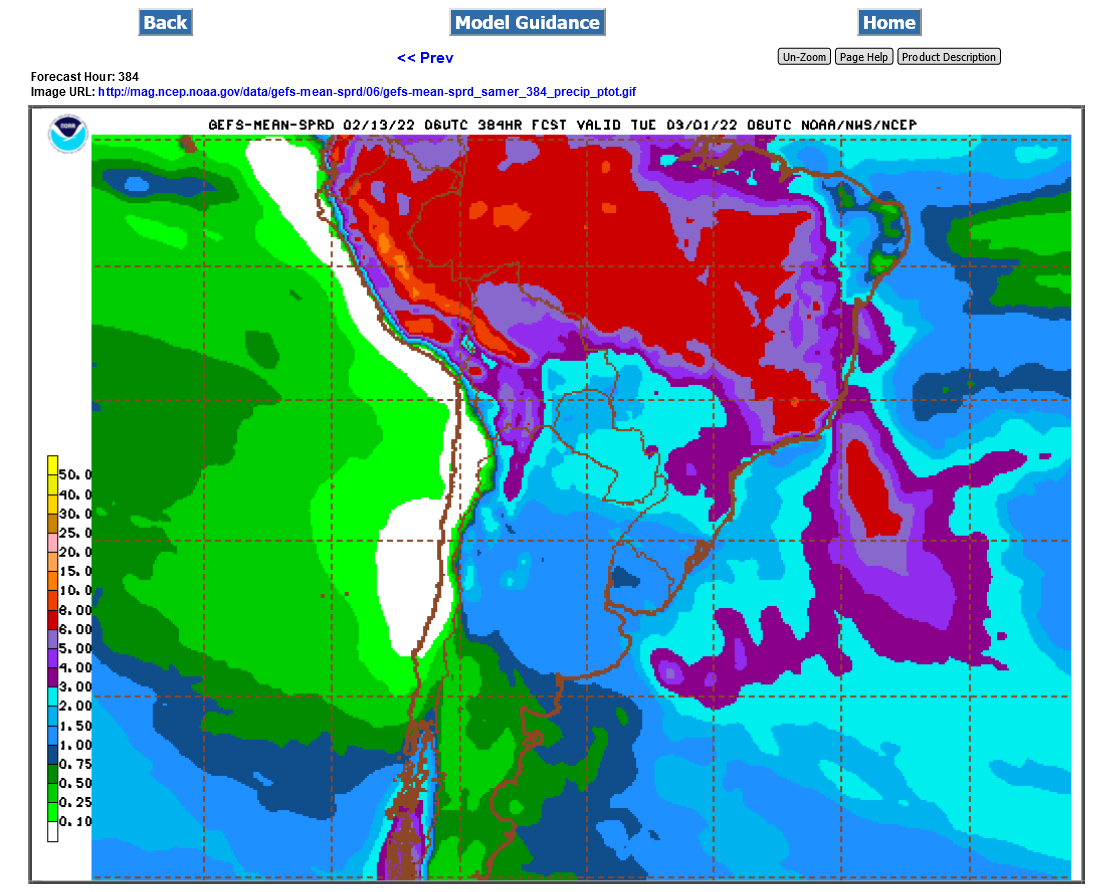

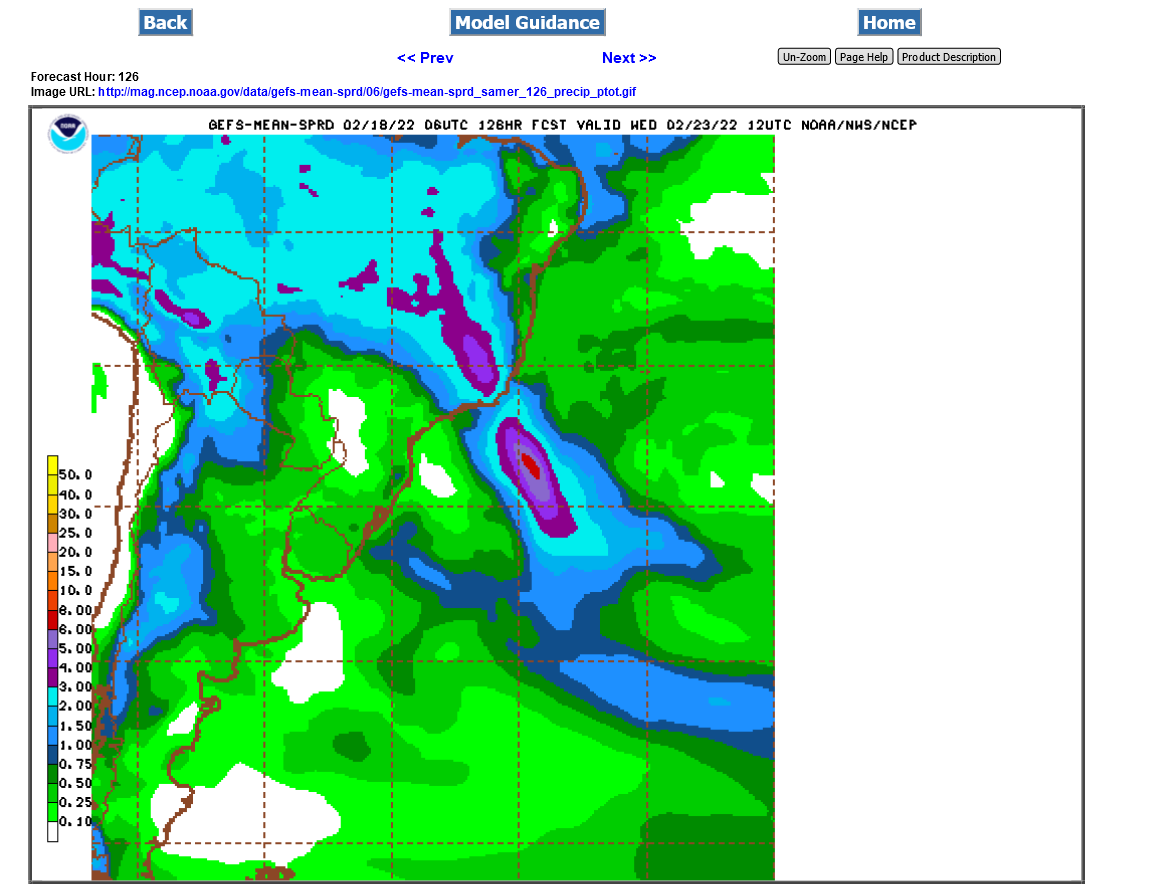

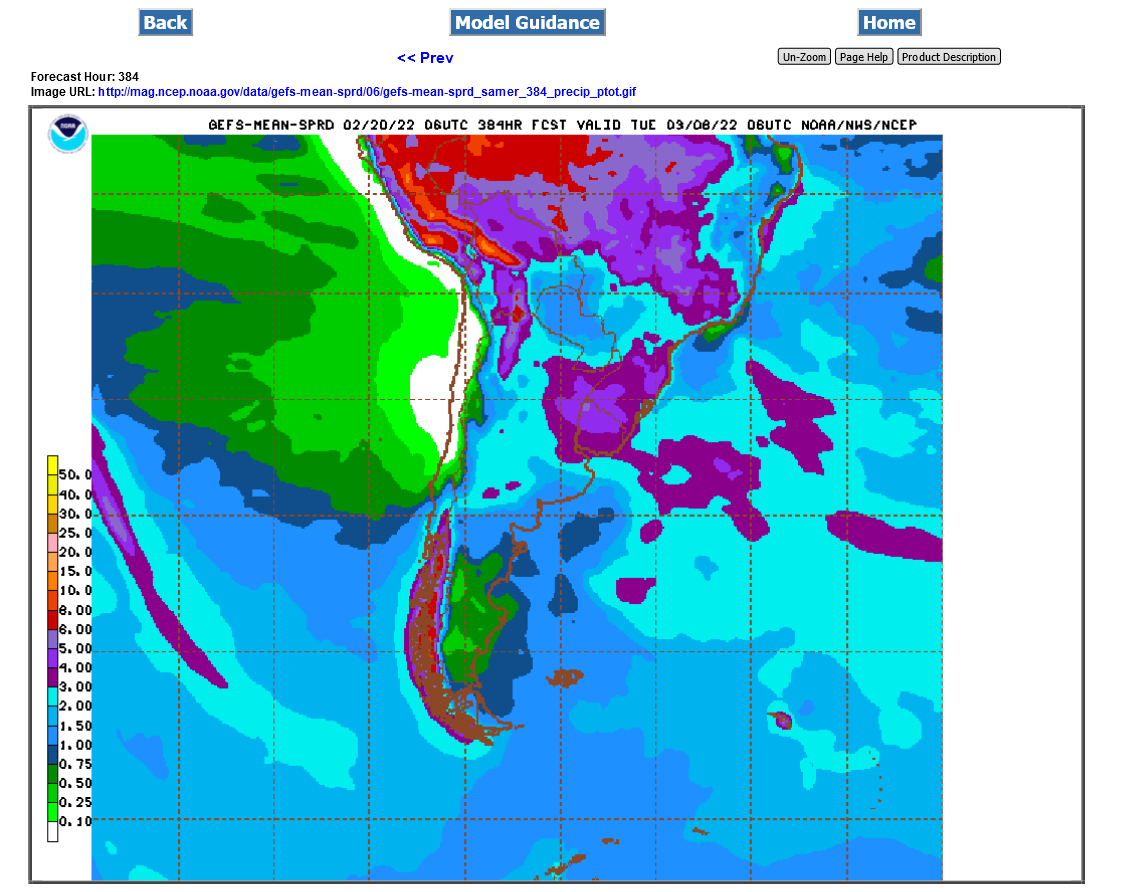

1. Rains the next 5 days on the last GFS ensemble below........not much!

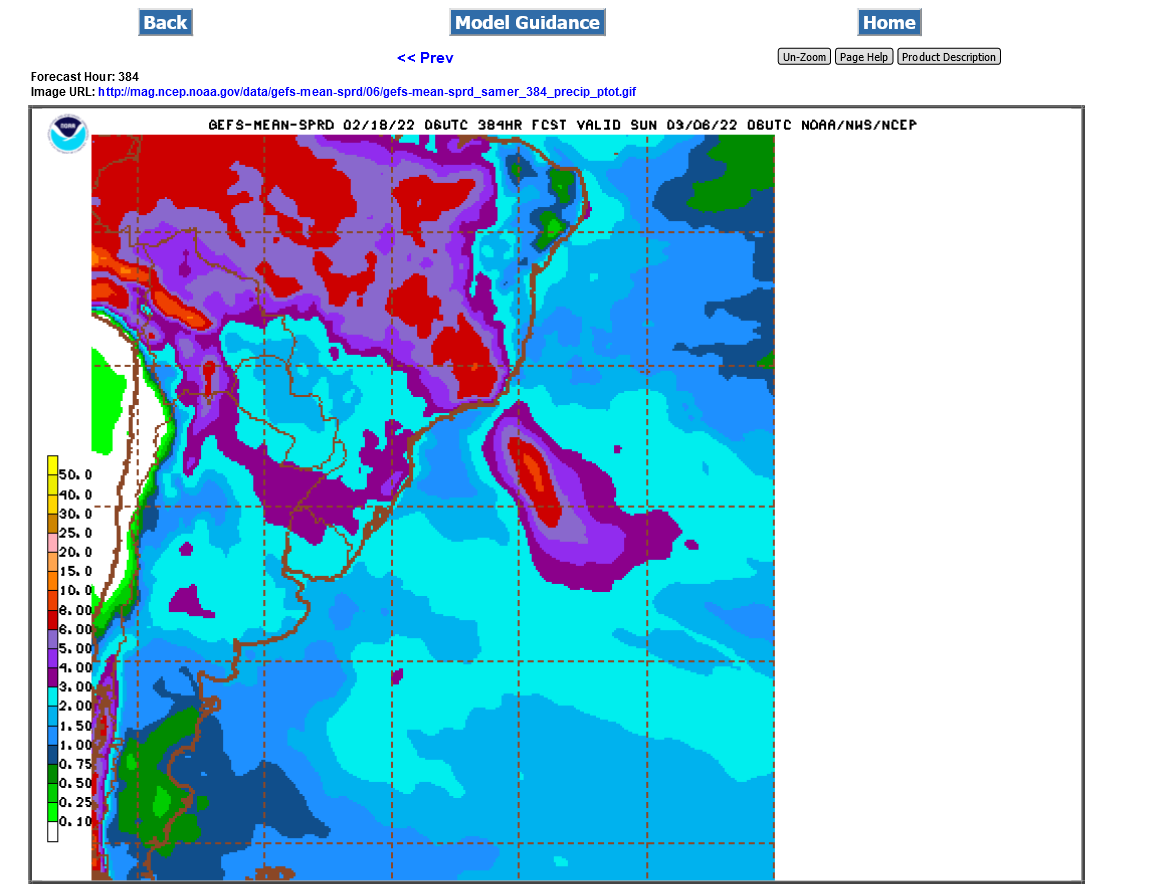

2. Rains the next 2 weeks.......lots.

there is a word for that MM, proprietary maybe? anyway private but I always think LT forecast are not worth much after a few days. This guy did one time a few years ago actually predict that big May snow event on a cold winter afternoon. But as you know Iowa has its most famous forecaster {taylor} who predicted drought for years until he got it right.

mcfarm,

I didn't ask for the proprietary information, just the name out of curiosity. That is usually something the proprietary source considers an advertisement and a plus and I hadn't planned to do anything with it except take a mental note and if my over the hill brain remembered it in April(unlikely) mention it.

Darren Frye - $8.50 Corn / $21.50 Soybeans@Frye_WSS

#Soybean double feature movie day on Saturday afternoon! Parabolic baby, enjoy! #oatt #Elliottwave

Risk Management@FarmsMarketing

Risk Management@FarmsMarketing

·

#Brazil 21/22 #Soybean production private est cut to new low 122MMT, down ~23 since start. Add #Argentina down ~9 for total SA loss of ~32 (1.175 bil bu) with downward bias. Futures not yet factoring magnitude of drop with more price upside to follow? Next 30 days critical

Palm-oil Prices&Analysis@Imran_Eshak

·

A Startling Rally in #soybean Prices This Year Could Reach Record Highs if Dry Weather Doesn’t Improve for South American Farmers, According To #Cargill https://bloomberg.com/news/articles/2022-02-10/cargill-trading-head-says-breakneck-soybean-rally-can-run-higher

From last week:

Jeff Peterson@jeffpeterson01·Feb 14#Soybean Commodity Fund Position

Just a few more hot/dry days and the damage will be done..........then a huge pattern change to much wetter..extremely high confidence.

2 week rains from the last 6z GFS ensemble.

Thanks Mike!

MetMike

Seems EVERY last bit of negative news now know in S.A. Much like USA previous year(s), high is in??

Yields may not be as bad as projected?

Buy rumor, now sell fact??

Yields are likely to be pretty bad tjc.

I doubt the upcoming rains will help that much this late in the season but would have to know that stage of the bean crop right now. Area's that still have a couple weeks of filling can still benefit.

I don't remember so many people being this bullish in February on all the grains

The hot/dry in SA has run its course.

Nobody is going to buy this market on weather now, unless it gets too wet for harvest.

At some point, they could get bulled up over the drought in the Plains ahead of our growing season. But the reality is, if we have anything close to average weather in the US, there will be a huge crop and beans will be several $ lower.

We still have a global cooling La Nina that means elevated chance of the drought getting worse.

Global warming and El Nino's always increase the odds for favorable weather the most.

Some models morph the ENSO to neutral, some keep us in La Nina (CFS) thru the growing season. El Nino chances are unlikely thru the rest of the year.

++++++++++++++++++++++++++++++

Soilmoisture anomaly:

These maps sometimes take a day to catch up to incorporate the latest data(the bottom map is only updated once a week).

https://www.cpc.ncep.noaa.gov/products/Soilmst_Monitoring/US/Soilmst/Soilmst.shtml#

ENSO: Recent Evolution,

Current Status and Predictions

http://www.roachag.com/Resources/World-Crop-Weather/Argentina this is roach forecast. Yes it has some rain in near term but look at 7 day and up to the end of Feb for Argy. Don't see much and how would it help beans now anyway?

https://www.youtube.com/watch?v=f4M0V-KcceY new Snodgrass for SA

Eric is the best I've ever seen at showing and explaining comprehensive weather.

Thanks mcfarm!