From the article:

The president remarked Thursday that the U.S. release of emergency oil reserves would lead to gas prices declining by up to 35 cents a gallon. However, White House economic adviser Jared Bernstein noted that SPR releases were a “time-limited function” during a press briefing on Friday.

“It’s not a ‘strategic price reserve.’ It was never intended for this and it won’t do anything, just like the last one,” Institute for Energy Research President Tom Pyle told the Daily Caller News Foundation after Biden’s announcement. “This is about nine days worth of demand, but even less because a barrel of crude from the Reserve does not equal a barrel of gasoline.”

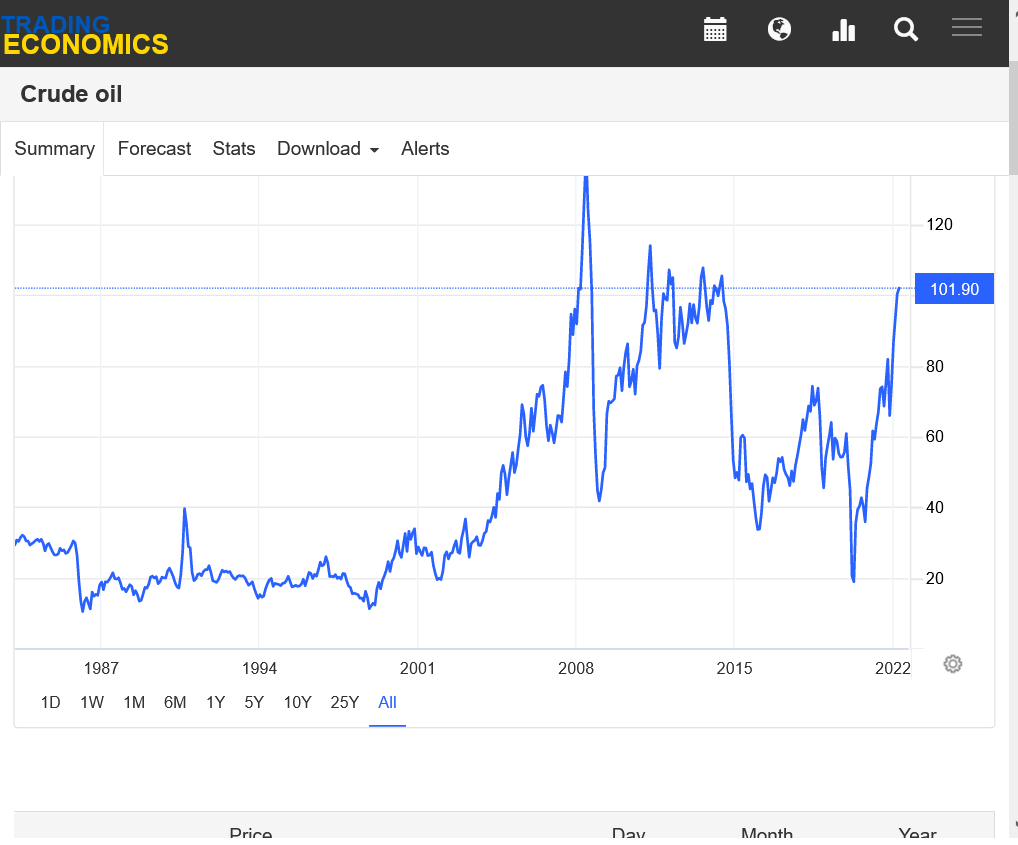

Biden released 50 million barrels of oil in November and another 30 million barrels on March 1. Both previous stockpile releases were followed by temporary decreases in gasoline prices before prices then shot up again.

The average cost of gasoline hit its highest level ever mere weeks after Biden’s March 1 release of oil.

On Monday, oil prices again seemed unfazed by the historic global oil stockpile releases, rising on continued concerns about the impact of declining Russian energy output and lack of progress on a renewed Iran nuclear deal, Reuters reported.

metmike: This would be like, in the middle of the great Mississippi River flood in the Summer of 1993.......when it didn't rain for a day with the forecast for the rains to increase again in 2 days and be heavy for the rest of the month saying.......look everybody, it's not raining today, that means the Mississippi River will be going down!Or in the drought of 1988, that started early in the year from a La Nina(like this current one) that lasted well into the Summer... after a small rain in May, saying, "look everyone, it rained! This will really help our crops come harvest time in September!The reality is that this is an ABUSE of the SPR.

The PERMANENT solution to fix the long term issue of high prices is to send a signal to the market to DRILL FOR and GET MORE from the ground. Closing pipelines(Keystone) and making it illegal to drill (for ng) on federal land is the complete opposite of this.

Telling big oil and big money to go get more fossil fuels (with actions favorable for it) to lower prices in the US is needed...instead of discouraging them and trying to entice all their money to be invested in fake green energy.