KEY EVENTS TO WATCH FOR:

Tuesday, August 9, 2022

6:00 AM ET. July NFIB Index of Small Business Optimism

Small Business Idx (previous 89.5)

8:30 AM ET. 2nd Quarter Preliminary Productivity & Costs

Non-Farm Productivity, Q/Q% (previous -7.5%)

Unit Labor Costs (previous +11.6%)

8:55 AM ET. Johnson Redbook Retail Sales Index

Ret Sales Mo-to-Date, M/M%

Ret Sales Mo-to-Date, Y/Y% (previous +14.1%)

Latest Wk, Y/Y% (previous +15.5%)

10:00 AM ET. August IBD/TIPP Economic Optimism Index

Economic Optimism Idx (previous 38.5)

6-Mo Economic Outlook (previous 32.2)

4:30 PM ET. API Weekly Statistical Bulletin

Crude Stocks, Net Chg (Bbls) (previous +2.2M)

Gasoline Stocks, Net Chg (Bbls) (previous -0.2M)

Distillate Stocks, Net Chg (Bbls) (previous -0.4M)

Wednesday, August 10, 2022

7:00 AM ET. MBA Weekly Mortgage Applications Survey

Composite Idx (previous 279.2)

Composite Idx, W/W% (previous +1.2%)

Purchase Idx-SA (previous 208.4)

Purchase Idx-SA, W/W% (previous +1.0%)

Refinance Idx (previous 640.6)

Refinance Idx, W/W% (previous +1.5%)

8:30 AM ET. July CPI

CPI, M/M% (previous +1.3%)

Core CPI, M/M% (previous +0.7%)

Energy Idx, M/M% (previous +7.5%)

Food Idx, M/M% (previous +1%)

Real Avg Wkly Pay-Infla Adj, M/M% (previous -1%)

CPI, Y/Y% (previous +9.1%)

Core Annual, Y/Y% (previous +5.9%)

8:30 AM ET. July Real Earnings

10:00 AM ET. June Monthly Wholesale Trade

Inventories, M/M% (previous +1.8%)

10:00 AM ET. July Online Help Wanted Index

10:30 AM ET. EIA Weekly Petroleum Status Report

Crude Oil Stocks (Bbl) (previous 426.553M)

Crude Oil Stocks, Net Chg (Bbl) (previous +4.467M)

Gasoline Stocks (Bbl) (previous 225.294M)

Gasoline Stocks, Net Chg (Bbl) (previous +0.163M)

Distillate Stocks (Bbl) (previous 109.324M)

Distillate Stocks, Net Chg (Bbl) (previous -2.4M)

Refinery Usage (previous 91.0%)

Total Prod Supplied (Bbl/day) (previous 19.948M)

Total Prod Supplied, Net Chg (Bbl/day) (previous -0.028M)

2:00 PM ET. July Monthly Treasury Statement of Receipts & Outlays of the U.S. Govt

Thursday, August 11, 2022

8:30 AM ET. Unemployment Insurance Weekly Claims Report - Initial Claims

Jobless Claims (previous 260K)

Jobless Claims, Net Chg (previous +6K)

Continuing Claims (previous 1416000)

Continuing Claims, Net Chg (previous +48K)

8:30 AM ET. July PPI

PPI, M/M% (previous +1.1%)

Ex-Food & Energy PPI, M/M% (previous +0.4%)

Personal Consumption (previous +1.3%)

8:30 AM ET. U.S. Weekly Export Sales

Corn (Metric Tons) (previous 314.6K)

Soybeans (Metric Tons) (previous 399.6K)

Wheat (Metric Tons) (previous 249.9K)

10:30 AM ET. EIA Weekly Natural Gas Storage Report

Working Gas In Storage (Cbf) (previous 2457B)

Working Gas In Storage, Net Chg (Cbf) (previous +41B)

4:30 PM ET. Foreign Central Bank Holdings

4:30 PM ET. Federal Discount Window Borrowings

Friday, August 12, 2022

8:30 AM ET. July Import & Export Price Indexes

Import Prices (previous +0.2%)

Non-Petroleum Prices (previous -0.4%)

Petroleum Prices (previous +5%)

10:00 AM ET. August University of Michigan Survey of Consumers - preliminary

Mid-Mo Sentiment (previous 51.1)

Mid-Mo Expectations (previous 47.3)

Mid-Mo Current Idx (previous 57.1)'

12:00 PM ET. World Agricultural Supply & Demand Estimates (WASDE)

Corn, End Stocks (Bushels)

Soybeans, End Stocks (Bushels)

Wheat, End Stocks (Bushels)

Cotton, End Stocks (Bales)

The STOCK INDEXES? http://quotes.ino.com/ex?changes/?c=indexes

The Dow closed higher on Monday as it extends the rally off June's low. The low-range close sets the stage for a steady to lower opening when Tuesday's night session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If the Dow extends the rally off June's low, June's high crossing at 33,272.34 is the next upside target. Closes below the 20-day moving average crossing at 32,002.17 would signal that a short-term top has been posted. First resistance is June's high crossing at 33.272.34. Second resistance is May's high crossing at 34,117.74. First support is the 20-day moving average crossing at 32,002.17. Second support is the 50-day moving average crossing at 31,725.72.

The September NASDAQ 100 closed lower on Monday as it consolidated some of the rally off June's low. Today's low-range close sets the stage for a steady to lower opening when Tuesday's night session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off June's low, the 50% retracement level of the 2021-2022 decline crossing at 13,812.10 is the next upside target. Closes below the 20-day moving average crossing at 12,535.67 would signal that a short-term top has been posted while opening the door for additional weakness near-term. First resistance is today's high crossing at 13,419.25. Second resistance is the 50% retracement level of the 2021-2022 decline crossing at 13,812.10. First support is is the 20-day moving average crossing at 12,535.67. Second support is the 50-day moving average crossing at 12,217.25.

The September S&P 500 closed slightly lower on Monday as it consolidated some of the rally off June's low. The low-range close sets the stage for a steady to lower opening when Tuesday's night session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off June's low, the 50% retracement level of the January-June decline crossing at 4215.81 is the next upside target. Closes below the 20-day moving average crossing at 3995.62 would confirm that a short-term top has been posted. First resistance is the 50% retracement level of the January-June decline crossing at 4215.81. Second resistance is the April 28th high crossing at 4308.50. First support is the 20-day moving average crossing at 3995.57. Second support is the July 14th low crossing at 3723.75.

INTEREST RATES? http://quotes.ino.com/ex?changes/?c=interest ""

September T-bonds closed up 1-18-pts. at 142-25.

September T-bonds posted an inside day with a higher close on Monday. The high-range close sets the stage for a steady to higher opening when Tuesday's night session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 141-15 would confirm that a short-term top has been posted while opening the door for additional weakness near-term. If September renews the rally off June's low, the 50% retracement level of the 2021-2022 decline crossing at 147-27 is the next upside target. First resistance is last-Tuesday's high crossing at 145-31. Second resistance is the 50% retracement level of the 2021-2022 decline crossing at 147-27. First support is the 20-day moving average crossing at 141-15. Second support is the 50-day moving average crossing at 138-23.

September T-notes closed up 180-pts. at 119.300.

September T-notes posted an inside day with a higher close on Monday as it consolidated some of the decline off last-Tuesday's high. The low-range close sets the stage for a steady to lower opening when Monday's night session begins trading. Stochastics and the RSI have turned neutral to bearish signaling sideways to lower prices are possible near-term. If September extends the decline off last-Tuesday's high, the 50-day moving average crossing at 118.147 is the next downside target. If September renews the rally off June's low, the 50% retracement level of the December-June decline crossing at 122.204 is the next upside target. First resistance is last-Tuesday's high crossing at 122.020. Second resistance is the 50% retracement level of the December-June decline crossing at 122.204. First support is the 50-day moving average crossing at 118.147. Second support is the July 21st low crossing at 117.145.

ENERGY MARKETS? http://quotes.ino.com/ex?changes/?c=energy ""

September crude oil closed higher on Monday as it consolidated some of the decline off the July 29th high. The high-range close sets the stage for a steady to higher opening when Tuesday's night session begins. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off June's high, the 38% retracement level of the 2021-2022 rally crossing at $86.43 is the next downside target. Closes above the 20-day moving average crossing at $94.84 would temper the near-term bearish outlook. First resistance is the July 29th high crossing at $101.88. Second resistance is the 50-day moving average crossing at $102.69. First support is the 38% retracement level of the 2021-2022 rallycrossing at $86.43. Second support is the 50% retracement level of the 2021-2022 rallycrossing at $76.56.

September heating oil closed lower on Monday as it extended last-Friday's downside breakout of the July-August trading range. The mid-range close sets the stage for a steady to lower opening when Tuesday's night trading session begins. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off June's high, the 50% retracement level of the 2021-2022 rally crossing at 2.8185 is the next downside target. Closes above the 20-day moving average crossing at 3.4858 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at 3.4858. Second resistance is the July 28th high crossing at $3.7308. First support is the 38% retracement level of the 2021-2022 rally crossing at 3.1874. Second support is the 50% retracement level of the 2021-2022 rally crossing at 2.8185.

September unleaded gas closed higher on Monday as it consolidated some of the decline off June's high. The high-range close sets the stage for a steady to higher opening when Tuesday's night session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off June's high, the 50% retracement level of the 2021-2022 rally crossing at 2.4586 is the next downside target. Closes above last-Wednesday's high crossing at $3.1427 would signal that a short-term low has been posted. First resistance is the July 29th high crossing at $3.2492. Second resistance is the 50-day moving average crossing at $3.3654. First support is the 38% retracement level of the 2021-2022 rally crossing at 2.8073. Second support is the 50% retracement level of the 2021-2022 rally crossing at 2.4586.

September Henry natural gas closed lower on Monday as it extended last week's trading range. The low-range close sets the stage for a steady to lower opening when Tuesday's night session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 50-day moving average crossing at 7.494 would signal that a short-term top has been posted. If September renews the rally off July's low, June's high crossing at 9.598 is the next upside target.First resistance is July's high crossing at 9.419. Second resistance is June's high crossing at 9.598. First support is the 50-day moving average crossing at 7.494. Second support is the July 15th low crossing at 6.351.

CURRENCIES? http://quotes.ino.com/ex?changes/?c=currencies ""

The September Dollar closed lower on Monday. The mid-range close sets the stage for a steady to lower opening when Tuesday's nights session begins trading. Stochastics and the RSI are neutral to bullish signaling sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at 106.703 would signal that a short-term low has been posted. Closes below the 50-day moving average crossing at $105.227 would open the door for additional weakness near-term. First resistance is the July 27th high crossing at $107.300. Second resistance is July's high crossing at $109.140. First support is the 50-day moving average crossing at $105.227. Second support is the June 16th low crossing at 103.200.

The September Euro closed slightly higher on Friday as it extends the trading range of the past five-weeks. The mid-range close sets the stage for a steady opening when Tuesday's night session begins trading. Stochastics and the RSI have turned neutral to bearish signaling that sideways to lower prices are possible near-term. If September renews the decline, the December-2002 low on the monthly continuation chart crossing at $0.98540 is the next downside target. Closes above the July 21st high crossing at $1.03200 would signal that a low has been posted while opening the door for additional gains near-term. First resistance is the July 21st high crossing at $1.03200. Second resistance is the 50-day moving average crossing at $1.04260. First support is the July 14th low crossing at $1.00000. Second support is the December-2002 low on the monthly continuation chart crossing at $0.98540.

The September British Pound posted an inside day with a higher close on Monday. The low-range close sets the stage for a steady to slightly higher opening when Tuesday's night session begins trading. Stochastics and the RSI are neutral to bearish signaling sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 1.2054 would temper the near-term friendly outlook. If September renews the rally off July's low, the 25% retracement level of the 2021-2022 decline crossing at 1.2385 is the next upside target. First resistance is the 25% retracement level of the 2021-2022 decline crossing at 1.2385. Second resistance is the May high crossing at 1.2677. First support is the 20-day moving average crossing at 1.2054. Second support is July's low crossing at 1.1778.

The September Swiss Franc closed higher on Monday. The high-range close sets the stage for a steady to higher opening when Tuesday's night session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 50-day moving average crossing at 1.03886 would signal that a short-term top has been posted. If September renews the rally off July's low, the 38% retracement level of the 2021-2022 decline crossing at 1.06242 is the next upside target. First resistance is the 38% retracement level of the 2021-2022 decline crossing at 1.06242. Second resistance is the 50% retracement level of the 2021-2022 decline crossing at 1.08120. First support is the 50-day moving average crossing at 1.03886. Second support is the July 14thcrossing at 1.01650. Third support is June's low crossing at 1.00235.

The September Canadian Dollar closed higher on Monday as it extended the trading range of the past three-weeks. The high-range close sets the stage for a steady to higher opening when Tuesday's night session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off last-Monday's high, the July 5th low crossing at 76.43 is the next downside target. If September renews the rally off July's low, the 62% retracement level of the April-July decline crossing at 78.67 is the next upside target. First resistance is the 50% retracement level of the April-July decline crossing at 78.09. Second resistance is the 62% retracement level of the April-July decline crossing at 78.67. First support is the July 5th low crossing at 76.43. Second support is July's low crossing at 75.61.

The September Japanese Yen closed slightly higher on Monday as it consolidates some of the decline off last-Tuesday's high. The mid-range close sets the stage for a steady to higher opening when Tuesday’s night session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 0.073858 is the next downside target. If September renews the rally off July's low, the 38% retracement level of this year's decline crossing at 0.078281 is the next upside target. First resistance is last-Tuesday's high crossing at 0.076960. Second resistance is the 38% retracement level of the crossing at 0.078281. First support is the 20-day moving average crossing at 0.073858. Second support is July's low crossing at 0.072085.

PRECIOUS METALS? http://quotes.ino.com/ex?changes/?c=metals ""

December gold posted an inside day with a higher close on Monday. The high-range close sets the stage for a steady to higher opening when Tuesday's night session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 50-day moving average crossing at $1807.40 would open the door for additional gains near-term. Closes below the 20-day moving average crossing at $1755.80 would signal that a short-term top has been posted. First resistance is the 50-day moving average crossing at $1807.40. Second resistance is the 38% retracement level of the March-July decline crossing at $1846.60. First support is the 20-day moving average crossing at $1755.80. Second support is July's low crossing at $1696.10.

September silver closed higher on Monday as it extended the rally off July's low. The high-range close sets the stage for a steady to higher opening when Tuesday's night session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. Today's close above the 50-day moving average crossing at 20.397 would open the door for a possible test of the 38% retracement level of the March-July decline crossing at 21.575. Closes below the 20-day moving average crossing at 19.253 would signal that a short-term top has been posted. First resistance is the 50-day moving average crossing at 20.397 Second resistance is the 38% retracement level of the March-July decline crossing at 21.575. First support is the 20-day moving average crossing at 19.253. Second support is the July 14th low crossing at 18.010.

September copper closed higher on Monday. The mid-range close sets the stage for a steady to higher opening when Tuesday's night session begins trading. Stochastics and the RSI remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September renews the rally off July's low, the 50-day moving average crossing at 3.7716 opens the door for additional gains near-term. Closes below the 20-day moving average crossing at 3.3938 would signal that a short-term top has been posted. First resistance is today's high crossing at 3.6225. Second resistance is the 50-day moving average crossing at 3.7716. First support is the 20-day moving average crossing at 3.3938. Second support is the July 15th low crossing at 3.1315.

GRAINS? http://quotes.ino.com/ex?changes/?c=grains "

December Corn closed down $0.02 3/4-cents at $6.07 1/4.

December corn closed lower on Monday. The high-range close sets the stage for a steady to higher opening when Tuesday's night session begins trading. Stochastics and the RSI have turned neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends the rally off July's low, the 50-day moving average crossing at $6.46 3/4 is the next upside target. Closes below the July 26 Th gap crossing at $5.84 1/4 would temper the near-term neutral to friendly outlook. First resistance is the July 29th high crossing at $6.36 1/2. Second resistance is the 50-day moving average crossing at $6.46 3/4. First support is the gap crossing at $5.84 1/4. Second support is the 50% retracement level of the 2020-2022 rally crossing at $5.74 3/4.

September wheat closed up $0.04-cents at $7.79 3/4.

September wheat closed higher on Monday as it extends the trading range of the past four-weeks. The high-range close sets the stage for a steady to higher opening when Tuesday's night session begins trading. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the July 29th high crossing at $8.45 3/4 would signal that a short-term low has been posted while marking a potential upside breakout of the aforementioned trading range. If September renews the decline off May's high, the 75% retracement level of the January-May rally crossing at $7.23 is the next downside target. First resistance is the July 29th high crossing at $8.45 3/4. Second resistance is the July 11th high crossing at $9.40 1/4. First support is last-Wednesday's low crossing at $7.52. Second support is the 75% retracement level of the January-May's rally crossing at $7.23.

September Kansas City Wheat closed down $0.00 1/2-cent at $8.47 3/4.

September Kansas City wheat closes fractionally lower on Monday as it extends the trading range of the past four-weeks. The mid-range close sets the stage for a steady to lower opening when Tuesday's night session begins trading. Stochastics and the RSI are neutral signaling that sideways trading is possible near-term. If September renews the decline off May's high, February's low crossing at $7.64 1/2 is the next downside target. Closes above the July 29th high crossing at $9.15 1/4 would signal that a short-term low has been posted. First resistance is the July 29th high crossing at $9.15 1/4. Second resistance is the July 11th high crossing at $9.98 1/4. First support is July's low crossing at $8.14 1/2. Second support is February's low crossing at $7.64 1/2.

September Minneapolis wheat closed down $0.05 3/4-cents at $8.80 3/4.

September Minneapolis wheat closed lower on Monday as it extends the trading range of the past four-weeks. The low-range close sets the stage for a steady to lower opening when Tuesday's night session begins trading. Stochastics and the RSI have turned neutral signaling that sideways trading is possible near-term. Closes above the July 20th high crossing at $9.56 would signal that a short-term low has been posted. If September resumes the decline off May's high, the 75% retracement level of the January-May rally crossing at $8.12 3/4 is the next downside target. First resistance is the July 20th high crossing at $9.56. Second resistance is the July 11th high crossing at $9.56. First support is last-Wednesday's low crossing at $8.64 3/4. Second support is the 75% retracement level of the January-May rally crossing at $8.12 3/4.

SOYBEAN COMPLEX? http://quotes.ino.com/ex?changes/?c=grains "

November soybeans closed down $0.08 3/4-cents at $14.00.

November soybeans closed lower on Monday. The low-range close sets the stage for a steady to lower opening when Tuesday's night session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If November renews the rally off July's low, the June 30th high crossing at $15.07 3/4 is the next upside target. Closes below the 20-day moving average crossing at $13.75 would confirm that a short-term top has been posted. First resistance is the July 29th high crossing at $14.89. Second resistance is the June 30th high crossing at $15.07 3/4. First support is the bottom of the July 26th gap crossing at $13.49 1/4. Second support is the 38% retracement level of the 2020-2022 rally crossing at $12.99 1/4.

December soybean meal closed down $6.00 at $399.10.

December soybean meal closed lower on Monday. The mid-range close sets the stage for a steady to lower opening when Tuesday's night session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If December resumes the rally off July's low, March's high crossing at $436.80 is the next upside target. Multiple closes below last-Wednesday's low crossing at $395.50 would signal that a short-term top has been posted. First resistance is March's high crossing at $436.80. Second resistance is February's high crossing at $439.00. First support is last-Wednesday's low crossing at $395.50. Second support is the July 22nd low crossing at $380.80.

December soybean oil closed up 35-pts. at 64.32.

December soybean oil closed higher on Monday. The low-range close sets the stage for a steady to higher opening when Tuesday's night session begins trading. Stochastics and the RSI have turned neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends today's rally, the June 29th crossing at 67.76 is the next upside target. Closes below the 20-day moving average crossing at 59.97 would signal that a short-term top has been posted. First resistance is the 50-day moving average crossing at 65.98. Second resistance is the June 29th high crossing at 67.76. First support is the 20-day moving average crossing at 59.97. Second support is July's low crossing at 54.42.

LIVESTOCKhttp://quotes.ino.com/exchanges/?c=livestock

October hogs closed up $1.95 at $100.35.

October hogs closed higher on Monday as it extends the rally off July's low. The high-range close sets the stage for a steady to higher opening when Tuesday's session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If October extends the rally off July's low, weekly resistance crossing at $103.72 is the next upside target. Closes below the 50-day moving average crossing at $93.72 would signal that a short-term top has been posted. First resistance is today's high crossing at $100.75. Second resistance is weekly resistance crossing at $103.72. First support is the 50-day moving average crossing at $93.72. Second support is the July 26th low crossing at $92.43.

October cattle closed up $0.38 at $144.25

October cattle closed higher on Monday as it extends the rally off May's low. The high-range close sets the stage for a steady to higher opening on Tuesday. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If October extends the rally off June's low, May's high crossing at $145.10 is the next upside target. Closes below the 20-day moving average crossing at $142.08 would confirm that a short-term top has been posted. First resistance is May's high crossing at $145.10. Second resistance is the top of the April 25th gap crossing at $145.98. First support is the 20-day moving average crossing at $142.08. Second support is the 50-day moving average crossing at $140.85.

September Feeder cattle closed up $2.23 at $185.65.

September Feeder cattle closed higher on Monday. The high-range close sets the stage for a steady to higher opening when Tuesday's session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off May's low, February's high crossing at $188.25 is the next upside target. Close below the July 29th low crossing at $178.28 would confirm that a short-term top has been posted while opening the door for additional weakness near-term. First resistance is today's high crossing at $186.25. Second resistance is February's high crossing at $188.25. First support is the July 29th low crossing at $178.28. Second support is the 50-day moving average crossing at $177.73.

FOOD & FIBERhttp://quotes.ino.com/ex changes/?c=food

September coffee closed higher on Monday. The mid-range close sets the stage for a steady to higher opening on Tuesday. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the reaction low crossing at $20.42 would signal that a short-term top has been posted. Closes above the 50-day moving average crossing at $22.15 would open the door for additional gains near-term. First resistance is the 50-day moving average crossing at $22.15. Second resistance is July's high crossing at $22.90. First support is the reaction low crossing at $20.42. Second support is July's low crossing at $19.60.

September cocoa closed higher on Monday. The high-range close sets the stage for a steady to higher opening on Tuesday. Stochastics and the RSI are neutral signaling sideways trading is possible near-term. Closes below last-Thursday's low crossing at 22.59 would signal that a short-term top has been posted. Closes above the 50-day moving average crossing at 23.86 would open the door for additional gains near-term.

October sugar closed slightly higher on Monday. The mid-range close sets the stage for a steady to higher opening on Tuesday. Stochastics and the RSI have turned neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at 18.17 would signal that a short-term low has been posted. If October extends the decline off July's high, the 38% retracement level of the 2020-2022 rally crossing at 16.88 is the next downside target.

December cotton closed lower on Monday. The low-range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends the rally off July's low, the June 30th high crossing at 99.49 is the next upside target. If December renews the decline off May's high, the 75% retracement level of the 2020-2022 rally crossing at 74.58 is the next downside target.

Thanks tallpine!

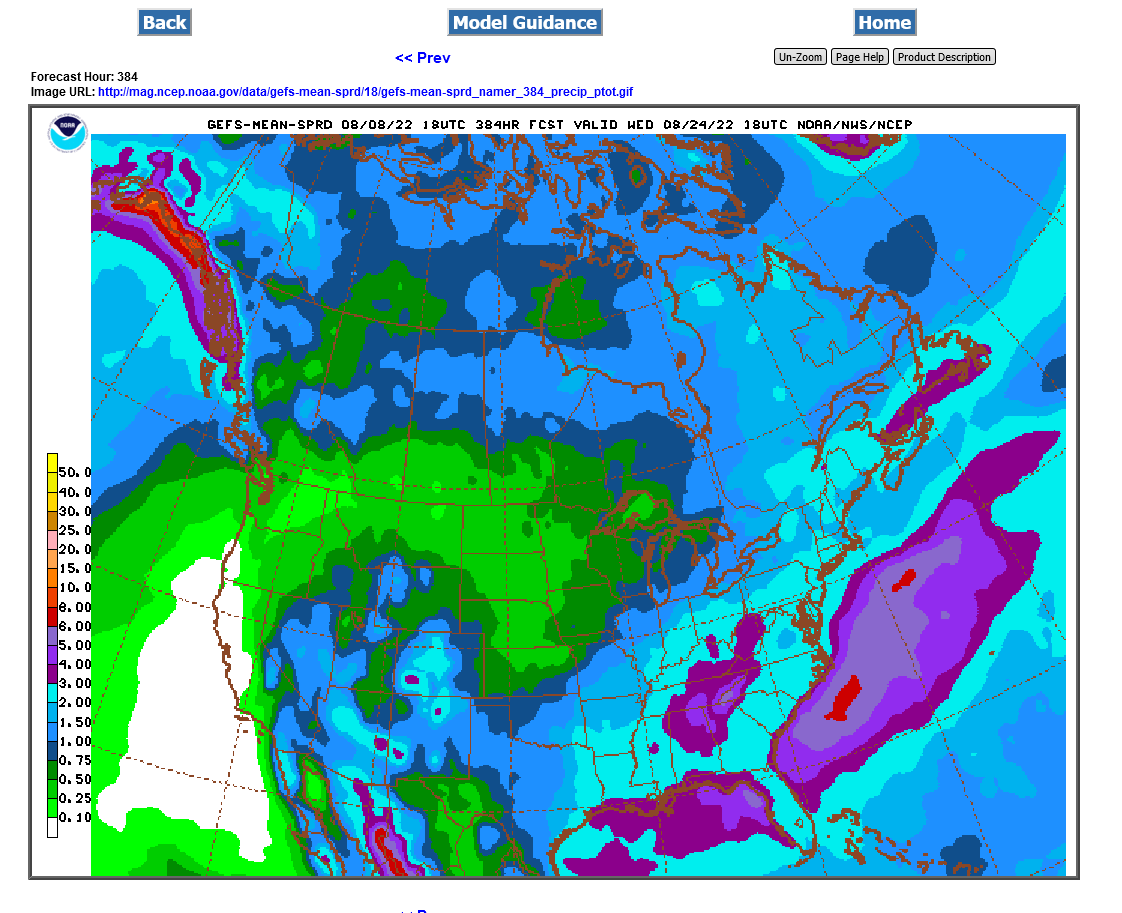

Not much rain for the Western and Central Cornbelt the next 2 weeks! Temps will be less hot than recent weeks but may start warming up again late in the period.

Corn deteriorated -3% on the crop report which was a bullish surprise.

Beans -1% as expected.