KEY EVENTS TO WATCH FOR:

Monday, August 15, 2022

8:30 AM ET. August Empire State Manufacturing Survey

Mfg Idx (previous 11.1)

Employment Idx (previous 18.0)

New Orders Idx (previous 6.2)

Prices Received (previous 31.3)

10:00 AM ET. August NAHB Housing Market Index

Housing Mkt Idx (previous 55)

4:00 PM ET. June Treasury International Capital Data

Tuesday, August 16, 2022

8:30 AM ET. July New Residential Construction - Housing Starts and Building Permits

Total Starts (previous 1.559M)

Housing Starts, M/M% (previous -2.0%)

Building Permits (previous 1.685M)

Building Permits, M/M% (previous -0.6%)

8:55 AM ET. Johnson Redbook Retail Sales Index

Ret Sales Mo-to-Date, M/M%

Ret Sales Mo-to-Date, Y/Y% (previous +10.4%)

Latest Wk, Y/Y% (previous +10.4%)

9:15 AM ET. July Industrial Production & Capacity Utilization

Industrial Production, M/M% (previous -0.2%)

Capacity Utilization % (previous 80.0%)

Capacity Utilization, Net Chg (Pts) (previous -0.3)

4:30 PM ET. API Weekly Statistical Bulletin

Crude Stocks, Net Chg (Bbls) (previous +2.2M)

Gasoline Stocks, Net Chg (Bbls) (previous -0.6M)

Distillate Stocks, Net Chg (Bbls) (previous +1.4M)

Wednesday, August 17, 2022

7:00 AM ET. MBA Weekly Mortgage Applications Survey

Composite Idx (previous 279.8)

Composite Idx, W/W% (previous +0.2%)

Purchase Idx-SA (previous 205.4)

Purchase Idx-SA, W/W% (previous -1.4%)

Refinance Idx (previous 662.9)

Refinance Idx, W/W% (previous +3.5%)

8:30 AM ET. July Advance Monthly Sales for Retail & Food Services

Overall Sales-SA, M/M% (previous +1.0%)

Sales, Ex-Auto, M/M% (previous +1.0%)

Sales, Ex-Auto & Gas, M/M% (previous +0.7%)

10:00 AM ET. June Manufacturing & Trade: Inventories & Sales

Total Inventories (previous +1.4%)

10:30 AM ET. EIA Weekly Petroleum Status Report

Crude Oil Stocks (Bbl) (previous 432.01M)

Crude Oil Stocks, Net Chg (Bbl) (previous +5.457M)

Gasoline Stocks (Bbl) (previous 220.316M)

Gasoline Stocks, Net Chg (Bbl) (previous -4.978M)

Distillate Stocks (Bbl) (previous 111.49M)

Distillate Stocks, Net Chg (Bbl) (previous +2.166M)

Refinery Usage (previous 94.3%)

Total Prod Supplied (Bbl/day) (previous 19.474M)

Total Prod Supplied, Net Chg (Bbl/day) (previous -0.474M)

2:00 PM ET. Federal Open Market Committee meeting minutes published

Thursday, August 18, 2022

8:30 AM ET. August Philadelphia Fed Business Outlook Survey

Business Activity (previous -12.3)

Prices Paid (previous 52.2)

Employment (previous 19.4)

New Orders (previous -24.8)

Prices Received (previous 30.3)

Delivery Times (previous -10.2)

Inventories (previous -9.3)

Shipments (previous 14.8)

8:30 AM ET. Unemployment Insurance Weekly Claims Report - Initial Claims

Jobless Claims (previous 262K)

Jobless Claims, Net Chg (previous +14K)

Continuing Claims (previous 1428000)

Continuing Claims, Net Chg (previous +8K)

8:30 AM ET. U.S. Weekly Export Sales

Corn (Metric Tons) (previous 383.1K)

Soybeans (Metric Tons) (previous 410.5K)

Wheat (Metric Tons) (previous 359.2K)

10:00 AM ET. July Existing Home Sales

Existing Sales (previous 5.12M)

Existing Sales, M/M% (previous -5.4%)

Unsold Homes Month's Supply (previous 3.0)

Median Price (USD) (previous 416000)

Median Home Price, Y/Y% (previous +13.4%)

10:00 AM ET. July Leading Indicators

Leading Index, M/M% (previous -0.8%)

Leading Index

Coincident Index, M/M% (previous +0.2%)

Lagging Index, M/M% (previous +0.8%)

10:30 AM ET. EIA Weekly Natural Gas Storage Report

Working Gas In Storage (Cbf) (previous 2501B)

Working Gas In Storage, Net Chg (Cbf) (previous +44B)

4:30 PM ET. Federal Discount Window Borrowings

4:30 PM ET. Foreign Central Bank Holdings

Friday, August 19, 2022

10:00 AM ET. 2nd Quarter Quarterly Retail E-Commerce Sales

10:00 AM ET. 2nd Quarter Advance Quarterly Services

10:00 AM ET. July State Employment and Unemployment

N/A U.S: Hawaii Statehood Day

Thanks tallpine!

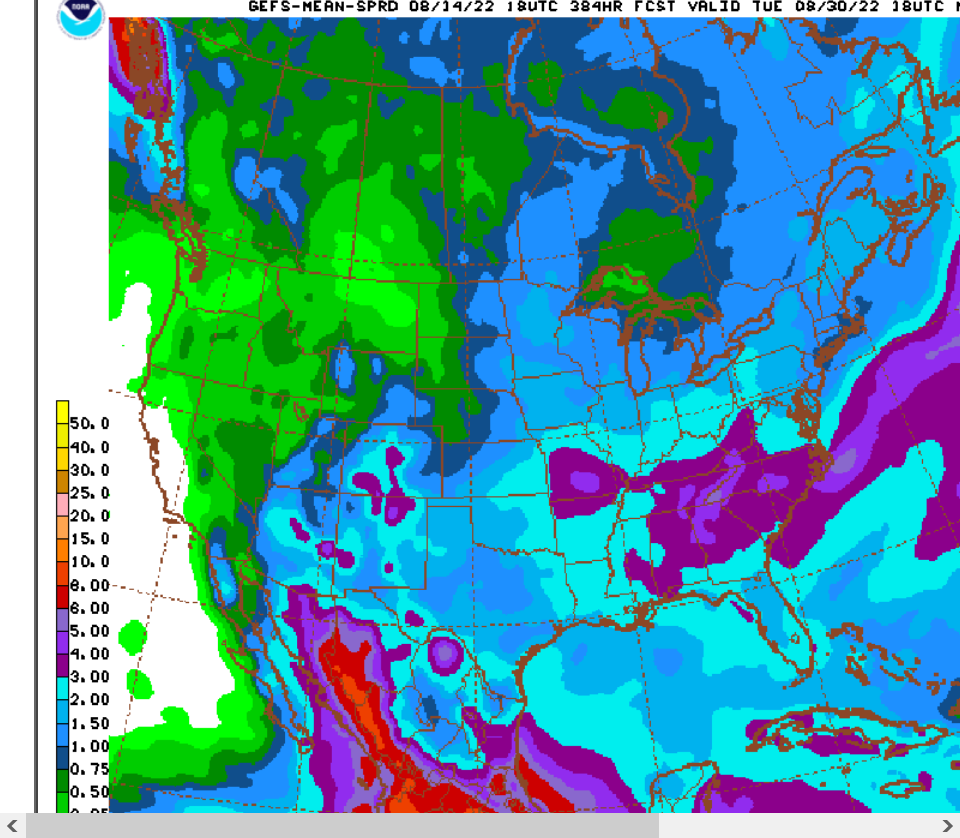

the weather forecast has added rain compared to Friday And is not that bullish but it’s so late int he hear that wx is not a huge deal any more.

I’ll have an update in a short while.

Last 18z GFS ensemble, rains for 2 weeks.

More rain compared to Friday.

Almost all locations get an inch of rain.

Southern cornbelt gets 2 inches of rain which is slightly above average.