This one is for you Bear:

https://fred.stlouisfed.org/series/FYONGDA188S

With the exception of WWII and the pandemic it has fluctuated above and below 20% of GDP for the past 65 years.

I agree that the government is often wasteful. So are all bureaucracies, even those in large corporations. I'd be happy if that number was around 15% (start the cutting with DOD). But I think the perception that government spending is careening ever higher is not correct as the chart clearly shows.

Thats a great chart JOJ.

mm will prolly like it.

Sort of dispels the myth you mentioned by showing the facts.

If we want that trend line to remain gentle ,tho , government needs to be diligent this up-coming decade!

Thanks 7475.

Probably that number is going to go up a bit in the coming years as baby boomers retire in numbers...

Thanks joj. Great chart!

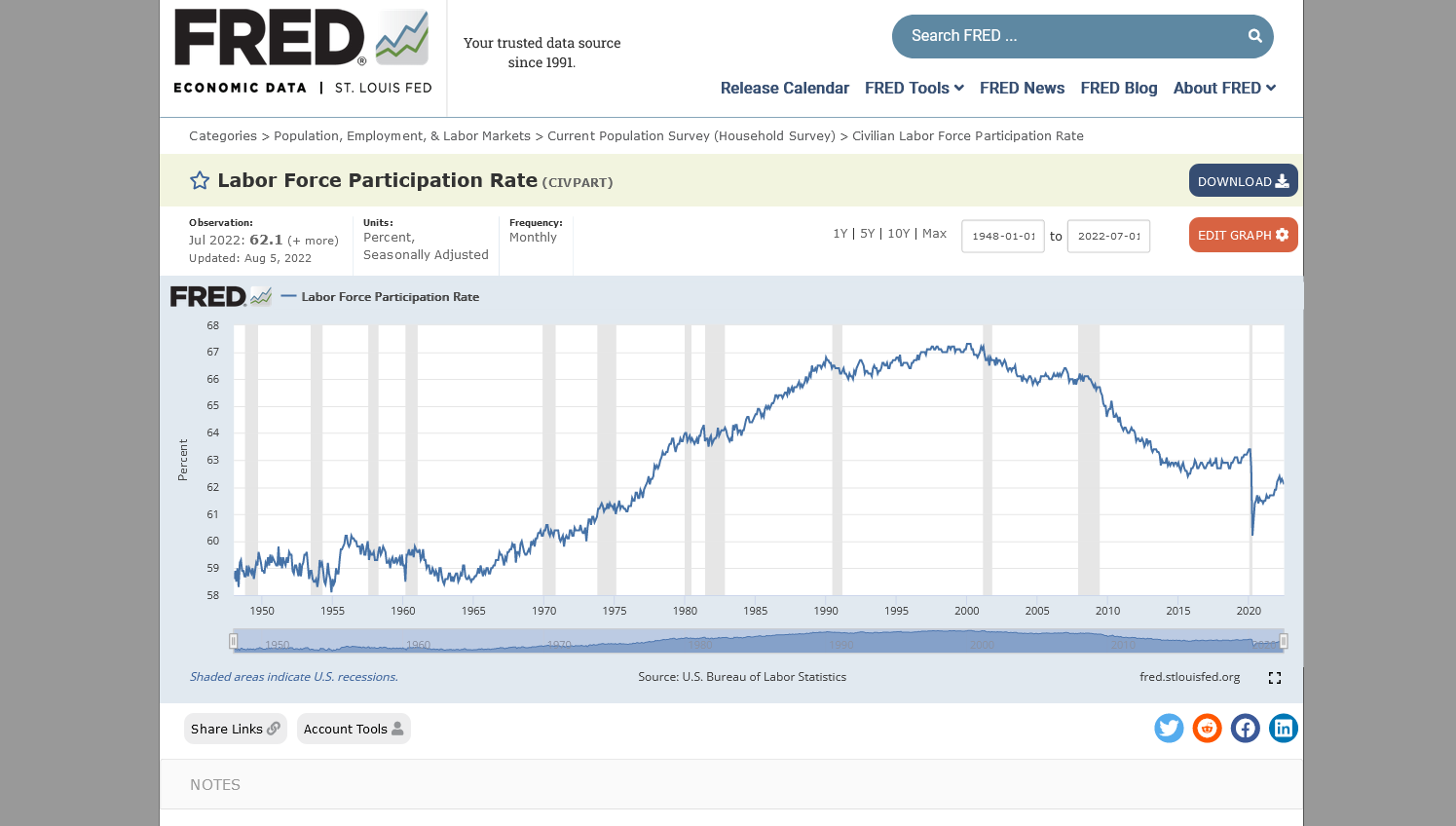

This is more concerning than anything to me.

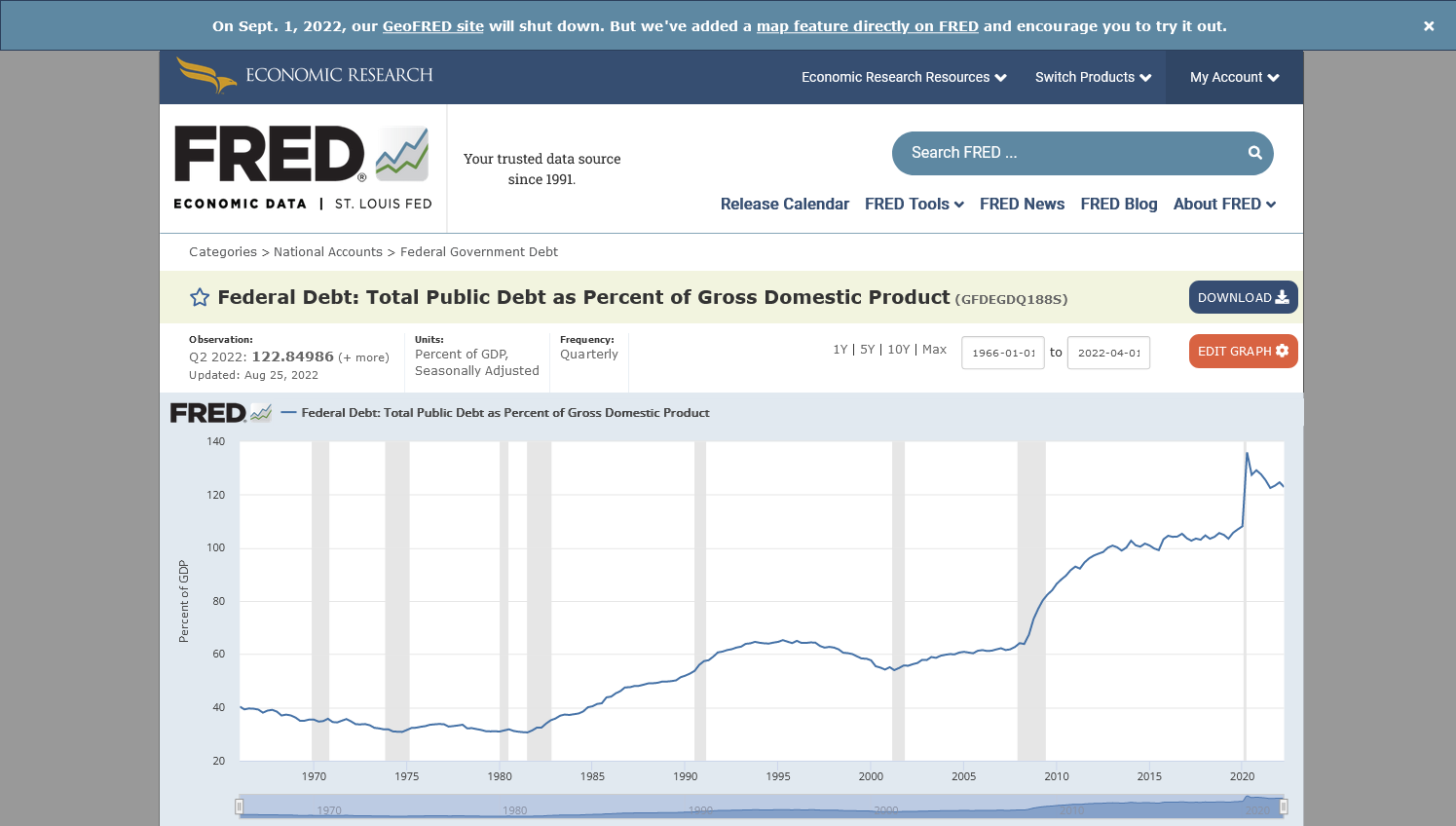

Like these related charts. Growing debt obligations. Increasing people NOT working that receive benefits, less people working to fund them.

It can't keep going in that unhealthy direction forever.

History tells us that bubbles from unsustainable moves don't end with adjustments to correct the imbalances.

They almost always end with collapses because the time to make healthy adjustments is usually completely ignored by the people enjoying the things which a bubble creates too much of.

Ride the overextended markets move up and maximize the enjoyment and benefits of the ride.

When it peaks..........and it will, the amount needed for a healthy correction is several times greater than a healthy correction.

So there is an unpredictable, uncontrolled collapse that includes panic and the correction is anything but controlled and anything but healthy because of the damage that it does.

The consequences of the fast moving, impossible to control crash(because of emotions) will likely outweigh the benefits of countless years of being in the bubble.

Then, we all assume that history will repeat and the government will save us with rescue packages until things revert back to happy times are here again.

But history will NOT repeat.

The future is MUCH different than the past.

The retired and elderly people that need to be supported by the system is growing every year and adding up to massive numbers.

Automation and robots will replace a double digit number of human jobs in the next decade.

Those are just 2 things that will be heavy anchors on our economy.

Sorry to bring this one up again but the cost to fully electrify the economy using solar and anti environmental wind is 433 trillion dollars, currently 20 times the GDP. Flushing good money down the toilet for unreliable energy schemes related to this scam is the recipe for the trigger of the collapse and is amplifying all the bad things mentioned above.

Sorry if this sounds pessimistic but it's the reality.

Despite this, living in this age will still be far better than life 150 years ago.

The only thing is that we will compare it to life 5 years ago, not life 150 years ago and it will not seem as good.

https://fred.stlouisfed.org/series/GFDEGDQ188S

I agree with much of your assessment MM. However, one thing you said is not necessarily an anchor but a tail wind.

"Automation and robots will replace a double digit number of human jobs in the next decade."

In my view automation increases productivity, which puts a damper on inflation..

Aside from expanding immigration to counter the lopsided age demographics problem we have (which will never happen), automation and/or technological advancements are the only hope we have to avoid the pessimistic scenario which you and I share.

The advent of the internet caused an explosion in productivity that kept inflation and debt problems at bay for the last 30 years. I don't think any economist saw that coming. What future breakthrough are we unable to see from our vantage point that might yet put off a day of reckoning?

Agreed that automation will increase productivity for the rich but it eliminate tens of millions of jobs for the poor and creates more dependents/unemployed and less taxpayers.

The only way that works is to greatly raise taxes on the rich or on robots/automation which is replacing tax paying humans.

More than what's been replaced because the ones replaced are drains on the system instead of contributing positively.

There might be new jobs from new industries that I'm overlooking but we are also hitting the law of diminishing returns when it comes to all the old industries that are saturated with demand.

New products from improvements or new features in old industries lead to less and less return/productivity than the previous ones do, generally speaking.

There are people 10 times smarter and inventive than me that will create/invent things I can't imagine but if you look at how our needs are being met today from all the inventions, it becomes obvious that there are MUCH, MUCH less needs that are not being met that can be from a new product, compared to the ones that are not met.

The exception to that would be the undeveloped world NOT having those needs met right now and that's a heck of a lot of potential demand.

But then, you run into the tremendous amount of increased massive natural resource consumption on a planet with finite resources, which is the REAL environmental threat to the planet.

In others words, there is incredible conflict and resistance that will take place with any plan for increasing productivity and in the case above, it really does help destroy the planet.

https://www.zippia.com/advice/law-of-diminishing-marginal-returns/?survey_step=step3

This is why I love conversations like this with another intelligent person. They inspire the type of thinking which results in profound discernment for both of us.

Thanks for that!

WW2 was an extreme emergency. if we ignore that big blip, look at the long term trend. UP. this IS a long term problem.

back in the 1910's 20's, 40's, 50's, 60's, when we were Not in recession, the economy often grew at 5-10% y-o-y.

the last couple decades, when we are not in recession, the economy grows at 2 or 3% at y-o-y.

armstrong has a good graph on this. i will explain it differently. think of a see-saw. if govt spending as a % of gdp goes up, then economic growth in the future (next 10-15 years) will be lower. if govt spending as a % of gdp is lower, then economic growth in the future will be higher. long term, more govt means weaker growth.

as we have too much debt, too much taxation, too much bureaucracy, too much socialism, then economic growth gets weaker, and weaker. as things get weaker, leaders and central banks throw more and more money at the system to try to "stimulate' things. this eventually leads to higher inflation.

https://commons.wikimedia.org/wiki/File:Historical_GDP_growth_-_France.png

here is a prime example of the long term trend, when you have too much debt, too much taxation, too much bureaucracy, too much socialism.

weak growth and high inflation is BAD .

here is the larger picture of what it means for us and our kids...

in the 1800's, and early 1900's, when we tried to stick to a gold standard, and we had low taxes, less bureaucracy, less socialism,... the poverty rate went down decade after decade, and wages went UP faster than inflation. in fact there was NO long term inflation. good growth and no inflation is good. (but yes, sometimes recessions felt brutal because no central power stepped in to mitigate anything). standards of living improved substantially.

since the late 60's, early 70's, when we scrapped the last of the gold standard, and we have higher taxes, more bureaucracy, and more socialism, and we have been fighting the war on poverty. ... the poverty rate has been stagnant, and wages have gone up LESS than inflation.

as this gets worse and worse, this is why countries evolve into 3rd world countries. Yes, this will happen to many western economies by the 2070's.

yes, i agree that we need to cut defense spending. but we also need to cut other spending also.

the only way to avoid this long term decline, is to keep taxes LOW, ... slash govt spending, reduce bureaucracy, and balance the budget year after year for 20-30 years.

here is a grand irony... when uncle sam did far less to help people, the poverty rate came down decade after decade for well over a century.

when we have higher taxes, and more socialism, and try to fight a war on poverty, the poverty rate has mostly remained stagnant for 50 years.

sometimes we need to learn a lesson from zen buddhism. don't just do something, stand there.

often times, passing a law does NOT accomplish what you think it will accomplish.

sometimes it is better if you do NOT try to help people.

bear,

You raise many great points.

Our massive, growing number of paid bureaucrats that are not contributing anything to productivity and in many cases, even making laws/rules that take away from productivity.

The amount of pork spending for special interest groups is excessive too.

Green Energy Scores a 76X ROI for Their Lobbying Efforts

https://www.transparencyusa.org/article/green-energy-lobby-roi

This article is Part 2 of a four-part series demonstrating how the money in a lobby sector can impact state politics and legislation. We’ve selected the Green Energy sector due to a resurgence of interest in a behind-the-scenes look at renewables following the 2021 snowstorms, but you can follow the money in any industry of interestthat is spending lobbying dollars in Austin.

To see the first article in this series, read “How Big is the Green Energy Lobby?” here.

by Tracy Marshall

04/22/2021

The Real Political Powerhouse

Between 2006 and 2029, green energy companies doing business in Texas will rake in an estimated $36 billion in federal and state subsidies.

Conversations about money in politics tend to focus on wealthy donors, big corporations, and powerful political action committees. Scant attention is paid to the role of lobbying. But the numbers show that lobbying is actually the financial powerhouse in American politics.

Our site includes a list of lobbyists in Texas, whose interests they’re representing, and how much they’re being paid, but to get a complete picture of the way money influences lawmakers, other means of influence should be considered.

Businesses, industry groups, and government organizations hire lobbyists to influence legislators in Austin, often by wining and dining them or providing tickets to exclusive events.

Those same organizations sometimes donate to those same lawmakers through their PACs. Executives in those corporations may make individual donations to a politician’s campaign account.

In return, those organizations may get favorable laws, beneficial regulatory positions, government payouts, tax breaks, etc. Known as crony capitalism, it is a distortion of the free market. Practiced by Republicans and Democrats alike, it ultimately creates an uneven playing field benefiting those who are willing to to pay for access and favor from those in power.

While many individuals and organizations play this game, we are currently doing a case study of the lobbying efforts and other monies spent by the green energy industry in Texas. Since the record breaking winter storm which left millions of Texans without power and more than 200 dead, questions and accusations have been swirling about how so much of Texas’ energy grid — at least 25 percent — came to rely on green energy. Last week we provided a list of green energy-related entities in Texas and the money they have spent to lobby Austin lawmakers.

Since 2015, as much as $71.7 million has been spent on lobbying by companies whose primary source of income is renewable energy, including solar, wind and nuclear. That number likely climbs much higher if other companies with a strong interest in green energy are included — companies like Shell Oil and AT&T, who have invested billions in green energy and have a strong lobbying presence in Austin. So what are lobbyist clients getting for all that money spent? Quite a bit, actually.

According to records compiled by the Texas Comptroller’s office and a 2019 study by the Texas Public Policy Foundation, the total cost to taxpayers and consumers for the myriad of subsidies going to green energy operators in Texas from 2006 to 2029 will be $36 billion.

Transparency USA has catalogued up to $71.7 million invested in lobbying by Texas green energy companies since 2015. (That number only includes lobbying of state-level lawmakers, not any lobbying efforts in D.C.) In return, green energy companies have received and will continue to receive subsidies from the Texas government of almost $18 billion — that’s recouping the money they will have spent between 2006 and 2029 about 76 times over.

The available lobbying numbers only cover about seven out of those 23 years. To get a more accurate comparison, we extrapolated those same lobbying numbers over the entire 2006-2029 period where the $18 billion in state and local subsidies would be received. The green energy lobby continues to grow in each available cycle, but there are not enough data points to assume an accurate growth rate. Instead, we’re applying the same rate of investment in lobbying from the known seven-year stretch. Using those numbers as a guide, we estimate a $235 million investment by renewables companies operating in Texas.

At around 76 times the sector’s reportable investment in lobbying Austin lawmakers, it’s an incredible return on investment. And even if our estimate of the lobbying money that will be spent in Texas over the entire period turns out to be on the low end, it’s certainly not going to be off by billions. It’s absolutely going to be money well spent for companies in the green energy sector.

Bottom line: it can pay off — big time — to be in the lobbying game. What private market can compete with that return on investment?

metmike: Now you know!

bear,

Did you manage to look at any of these debates?

I came away with a new found understanding of several things by listening to these people.......even if I don't agree with everything.

However, what was crystal clear is that libertarians are the most informed and very intelligent party of all that is also very consistent and honest about their views with solid justifications and very little hypocrisy and the ones in the debates were all wonderful communicators.

In most cases, they agree with each other on almost everything and even support each other.

In the 2016 debate, they applauded each others responses. This is definately the party with the best frame of mind to support each other and NOT attack them, opponents from their own party.

https://www.marketforum.com/forum/topic/88376/

" However, one thing you said is not necessarily an anchor but a tail wind.

"Automation and robots will replace a double-digit number of human jobs in the next decade."

In my view automation increases productivity, which puts a damper on inflation. "

I agree JOJ. After all farming has seen tremendous growth in automation, productivity, allowing a large part of the population to advance to other things. It helped to increase the standard of living,

bear,

I take your points about the drag of government spending and it's effect on GDP growth. My response is not meant to negate those points but rather to soften them. All, or nearly all, economic entities (countries or corporations) have a sharper growth rate in their early years and a slowing growth rate as they become behemoths.