The local river corn basis has gone from -.34 on 9-26 to -.63 on 9-27. Beans -.19 on 9-26 to -54. This is extra ordinary.

https://www.extension.iastate.edu/agdm/crops/html/a2-40.html

What is Basis

Basis is the difference between the futures price and your local cash price. For example, if the May futures contract is trading at $4.96 and the cash price is $4.63, the cash price is 33 cents under May ($4.63 - 4.96 = -33 cents). So the basis is -33 cents.

Basis Levels for Soybeans, Corn, Wheat, and Grain Sorghum

https://www.agmanager.info/grain-marketing/grain-basis-maps

Looks like some extremes on those maps!

Now that we got that information under our belts/in our heads, why do you think that basis crashed by so much in just one day cutworm?

YOU are an authority on this, so your answer counts more than my thoughts below:

Basis levels often drop, especially early in harvest because of the new crop supplies pressuring the cash price, correct?

This year, we had extremely low old crop stocks and the market had to price ration demand in some places with VERY HIGH prices.......more than usual. Now we're reversing that.

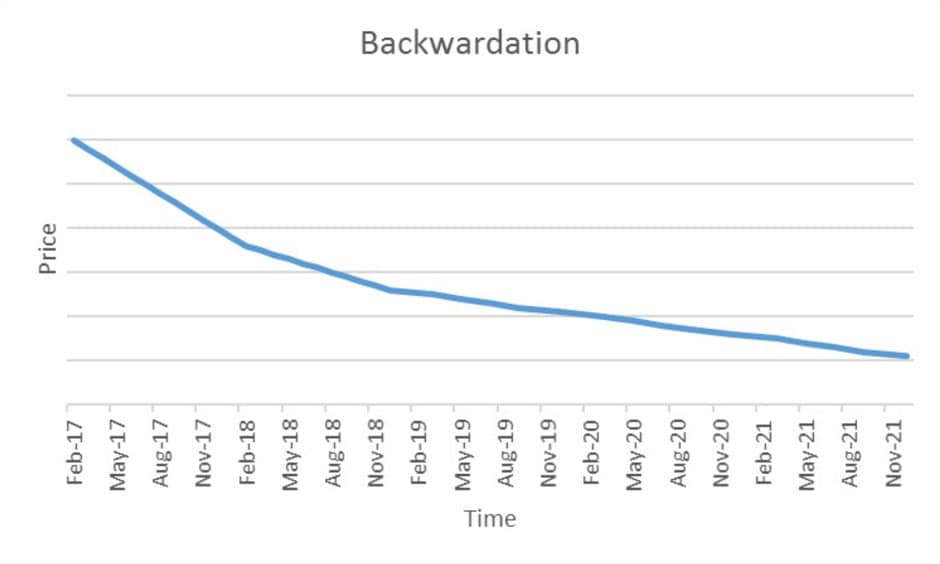

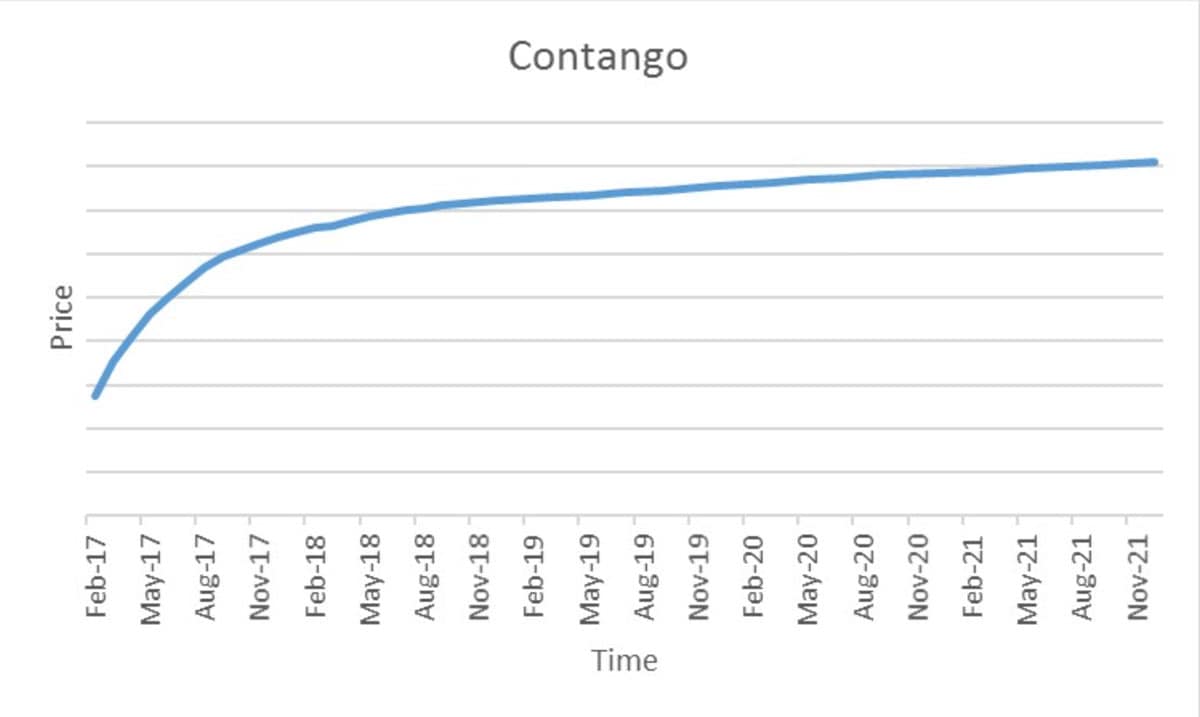

In fact with positive basis and the front months sometimes higher in price than back months in some crops at times, which is the opposite of normal/Contango below as the 2nd chart.

The 1st chart below is like we had in places this Summer. The cash price and front month were unusually high vs the back months because the market had to work higher to pry old crop grains/beans out of the hands of farmers that still had some.

With harvest in full swing, the supply chain is being refilled and there's no need to ration

with high prices so the cash price can go much lower, while back months tend to hold more premium, for things like storage cost.

There's obviously other things going on but I just described the background which is providing the environment that favors a bigger than usual slide in basis levels.

I rarely follow it, so am not sure what is normal in the WCB but the extremes in disparity seem incredible compared to the 3 year average and from state to state.

I'm pretty sure the drought in the Plains/WCB is responsible for a big part of this, which also reduced the size of our 2022 crops/new crop supplies.

Out there, basis levels look extraordinarily high.

While Mike has provided a certain evidence for area cash prices, futures prices are bigger. Based on, now global, expectations. Of which the Ukranian crisis has had an affect on the futures market. Not to mention the LaNina imposed drought in the US.

Mike , I'm not sure why. it is normal for the basis to climb this time of year but to do so much in one day is unusual. Maybe transportation cost, Rail strike??? suddenly less demand? But this is river price. Do not really know.

This is from CGB

The biggest news in the grain market yesterday had nothing to do with the futures market. Barge freight has, “Gone to the Moon!” The combination of harvest starting and low water on the Mississippi pushed barge freight up to 1500% of tariff on the Mid-Miss / Illinois Rivers

. This was probably a record high in barge freight