I BELIEVE THIS IS TRADE RELATED... IF NOT, IT'S MOVABLE

FROM THE BEGINNING... THE CHIP REALITY ~ THEN, (YOU CAN SKIP THE SHORT PUPPY BREATH PART, IF YA DON'T LIKE PUPPIES) WHEN THEY GET HOME, HE EXPLAINS WHAT HE LEARNED ABOUT THE CHIPS.

THANKS JEAN!

INTERESTING THAT LESS THAN 6 MONTHS AGO, WE HAD THIS:

by Dan Mayfield

If you needed any more proof that trucksare hot right now, one visit to the Ford Super Duty trucks page will tell you all you need to know.

The company has suspended deliveries of the 2022 Ford Super Duty trucks because of “high demand.”

There is so much demand for the company’s big trucks that you can’t even order one, according to the official website. That also means that whatever inventory your local dealer has on the lot is all they’re going to get.

ord’s line of Super Duty trucks includes heavy-duty F-250, F-350, and larger trucks. They are based on an F-150 truck but are bigger, longer, and can be ordered as dually trucks, with extra wheels in the back. They can tow some impressively-sized trailers. The trucks can tow so much weight, you may need a commercial driver’s license in some states.

But the trucks are getting harder to find.

“Due to high demand, the current model year is no longer available for retail order. Limited inventory may be available at selected dealers. Contact your dealer for more information,” reads the official Super Duty page.

The base Super Duty is the F-250 XL starts at $37,895 and is one of the gold standards of work trucks. You can order it with a snow plow, after all. It can be ordered with a Heavy Service Suspension package that allows it to haul 4,000 pounds in the bed, and it can be prepped for a 5th wheel, or gooseneck trailer. A fully-loaded F-250 can cost nearly 90,000.

While Ford may not be delivering any new Super Duty trucks, they are available. From the Super Duty website, you can click some boxes to find your dream truck and create an order and Ford will help you find one at a dealer. Or, you can click the “search inventory” box and see what’s available at your local dealership. There aren’t many.

Interestingly, the company posted a similar message on the 2022 Lincoln Navigator site recently.

These trucks are popular and demand has remained about the same, it’s the supply that’s dwindled. You can blame the coronavirus slowdowns, the computer chip shortage, supply chain problems and probably even sun spots for the low supply of used trucks. Nearly every manufacturer is having trouble meeting the need for new vehicles for a variety of issues. Last year, Ford cut production of the F-150 because of a shortage of computer chips that the trucks need to run everything from the radios to the power seats.

Thanks Jean.

I was wondering why Ford stock has been languishing. 2 billion $ of inventory.

I believe this is related to the China policy of lockdown. China produces about 25% of the world's chips. They have an ineffective vaccine and refuse to buy the Pfizer or Moderna vaccines. My nephew married a girl who is originally from China. She told me they have to persist with this errant policy (both the vaccine and the lockdown) because to admit error and adjust would cause them to "lose face".

On another trade related note I found this on a google search:

"On September 9, 2022, Intel held the official groundbreaking ceremony for its $20 billion investment in a new semiconductor manufacturing site to produce leading-edge chips. The project is expected to generate 7,000 construction jobs and 3,000 long-term positions in manufacturing and engineering."

I think Ford might be a good long term investment at these depressed levels. Perhaps Intel as well.

Interesting and very sad.

LOTSA QUESTIONS GO THRU MY MIND.

1. HOW FAR FROM THE PLANT ARE THEY?

2. HOW'D THEY GET THERE? BY TRUCK? HOW MANY MILES ON 'EM? ODOMETER UNHOOKED?

3. THE PARKING LOT WAS EMPTY AUGUST 16TH. DOES THAT MEAN THEY MADE 40,000+ A MONTH?

4. ETC. ETC. ETC.

5. WHERE'S GM STASH THEIRS?

6. ETC. ETC. ETC.

THOSE SKILLED WORKER'S ARE GONNA HAVE AN AVERAGE WAGE OF $135,000.00.

I'M A BUCKEYE, SOOOOOOO... I'VE PAID PRETTY CLOSE ATTENTION TO INTEL & WILL CONTINUE TO.

I DON'T LIKE OUR GOVERNOR, BUT...AT LEAST HE MADE SURE OHIO GOT THAT PLANT. LOL

https://en.wikipedia.org/wiki/Ford_Super_Duty

| Chronology | |

|---|---|

| Body and chassis | |

| Manufacturer | Ford |

| Production | January 5, 1998–present[1] |

| Model years | 1999–present |

| Assembly | Louisville, Kentucky (Kentucky Truck Plant) |

| Class | Heavy duty pickup truck Medium-duty truck |

| Layout | Front engine, rear-wheel drive / four wheel drive |

| Predecessor | Ford F-250/F-350/F-Super Duty (1953–1997) |

THANKS, MIKE!!

DEPENDING ON EXACT LOCATION, IT'S 60+ MILES TO THE STASH YARD.

I LIVED IN OKC FOR A SHORT TIME IN THE MID 8O'S. WHEN GM HAD 8,000 IN THEIR PLANT PARKING LOT... THEY CUT PRODUCTION. WHEN THEIR CONTRACTED DEAL WITH OKLAHOMA CAME DUE FOR RENEWAL, THEY CLOSED SHOP! THEY DIDN'T GET THE SWEET DEAL RENEWED.

Sept 27 (Reuters) - Ford Motor Co (F.N) said Tuesday it will invest $700 million and add 500 jobs at its Kentucky plant to support production of its new 2023 model year F-Series Super Duty truck.

The No. 2 U.S. automaker and its South Korean battery partner SK Innovation (096770.KS) said in September 2021 they would invest $11.4 billion to build an electric F-150 assembly plant and three battery plants in the United States. The companies said they would invest $5.8 billion in Kentucky, and $5.6 billion in Tennessee. The Kentucky JV will create about 5,000 jobs.

The Kentucky Economic Development Finance Authority (KEDFA) on Tuesday approved a supplemental project to an existing agreement with Ford that can provide up to $430 million in cumulative tax incentives based on the company’s total cumulative investment of $3.65 billion with an annual job target requirement of up to 12,500 over the term of the agreement.

Ford said its F-Series truck franchise generated nearly $40 billion in revenue in 2021 -- nearly one-third of the company's global automotive revenue last year.

Through August, Ford F-Series U.S. truck sales are down 11% to 420,969, a third of total sales. Of the total F-Series sales, 6,842 were electric F-150 Lightning trucks.

metmike: Maybe truck sales are down in part because they can't fill orders as a result of the chip issue or possibly high gas prices or the weakening economy? Just speculating.

No speculation on why the autocompanies are throwing money at electric vehicle manufacturing. Not because its a good idea(its a disaster in the making) but because the governments are giving them deals they can't refuse.

Tax breaks at the state and federal level. Grant money. Carbon credits. Consumers will also get huge rebates and other incentives.

Here's an example in Texas:

Green Energy Scores a 76X ROI for Their Lobbying Efforts

https://www.transparencyusa.org/article/green-energy-lobby-roi

It's capital cronyism throwing money at a boondoggle.

https://www.marketforum.com/forum/topic/88534/#88539

All these goodies being offered to the electric/green industries are coming from the pockets of tax payers to subsidize something that can never work.

2+2 will never make 10.

Diffuse energy from solar and wind(that will wreck the planet) and grid scale storage capacity that hasn't been invented will never supply the additional 40% of electricity needed for electric cars on top of providing electricity for homes/businesses.

It's actually laughable that this absurd scheme has even made it to 1st base but this is no joke. Many trillions of dollars are being flushed down the toilet to build a house of cards that will collapse at some point when the boondoggle becomes obvious in the real world (vs the manufactured world of fairy tale promises).

At some point, it will no longer be sustained but only after tremendous damage to the economy and drain on government/tax payers.

Actual sales, last reported by Ford in August.

https://media.ford.com/content/dam/fordmedia/North%20America/US/2022/09/02/sales-ford-22-aug.pdf

If 83,000 is the total sales for trucks in August, does 40,000 equate to 2 weeks worth of sales?

https://www.fox19.com/2022/09/28/unsellable-ford-trucks-fill-kentucky-motor-speedway-parking-lot/

Think it's bad now?

Just imagine what WILL happen if we tried to manufacture this many electric cars?

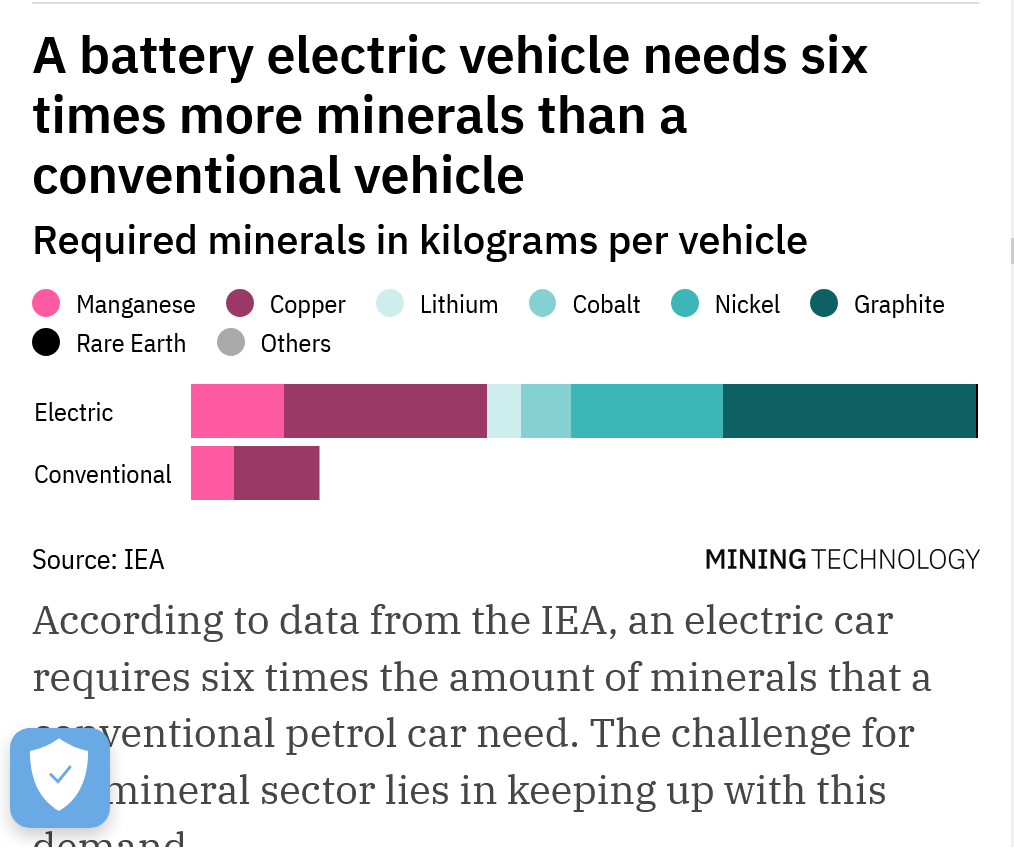

Minerals such as lithium, cobalt and nickel are integral to the construction of batteries, while rare earth elements such as neodymium are crucial to wind turbines and electric vehicles. As electricity replaces fossil fuels, copper and aluminium will take centre stage as well.

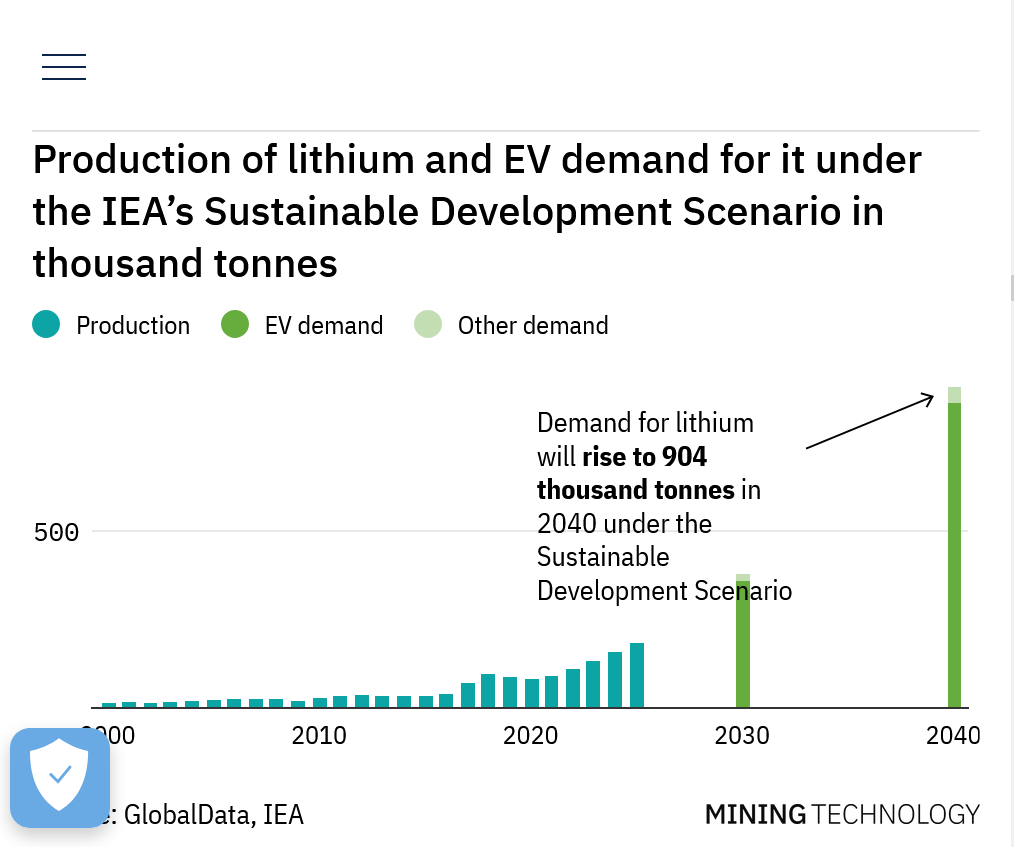

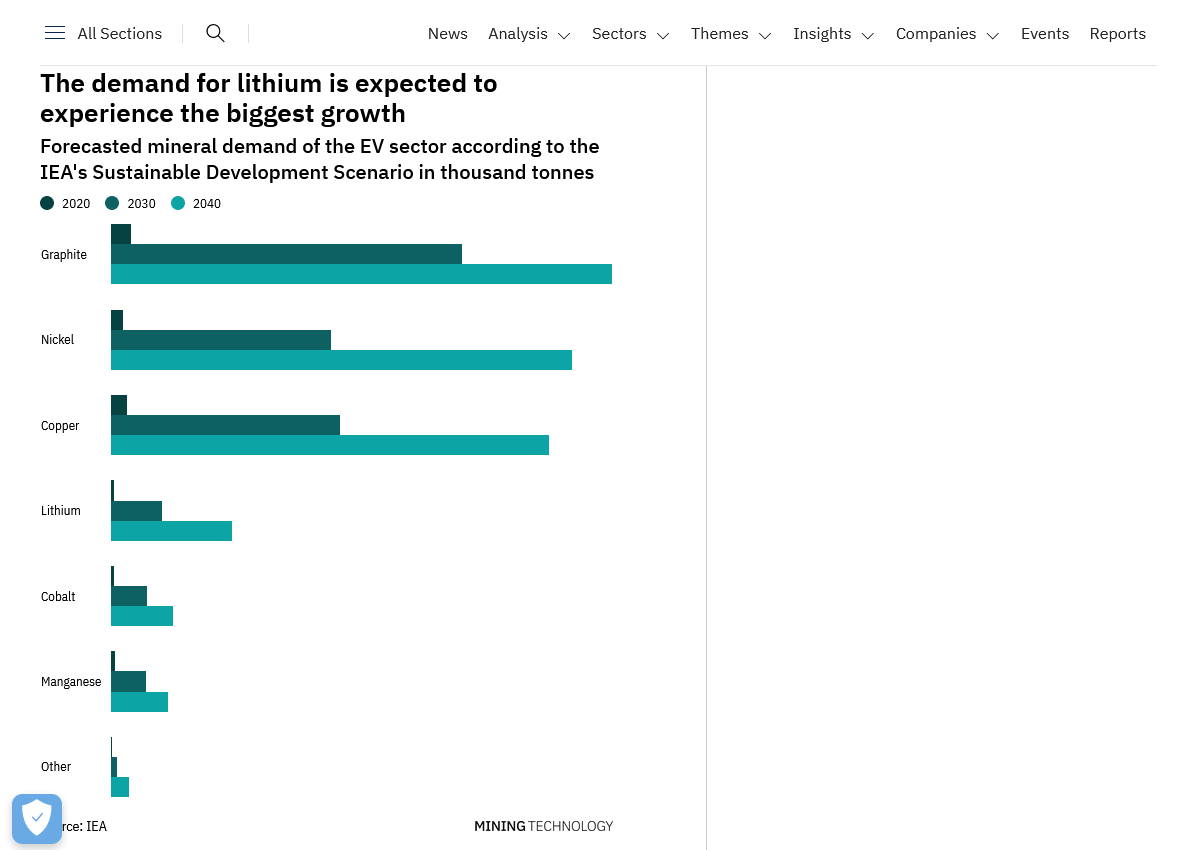

As a result, if the world is to meet its goal of keeping the rise in global temperatures to “well below 2 degrees Celsius”, as pledged in the Paris Agreement, the International Energy Agency estimates that demand for these minerals will increase hugely: for lithium, by as much as 40 times, while the market for graphite, cobalt and nickel will shoot up by around 20-25 times

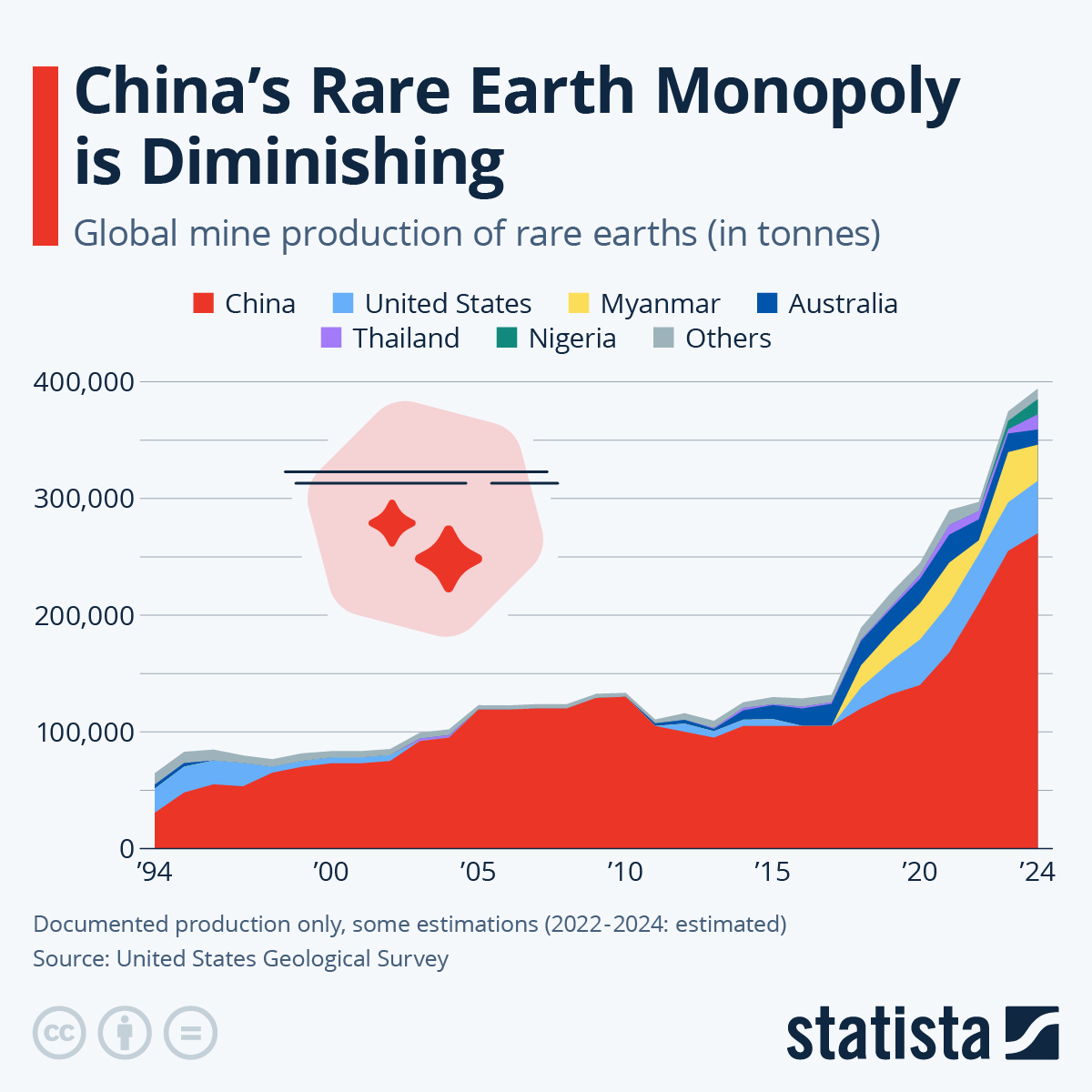

Such manoeuvres have now given China outsize influence in the refining and processing of the next generation of fuels. According to the International Energy Agency, China processes 50-70 per cent of the world’s lithium and cobalt, and as much as 90 per cent of its rare earth metals. China is also the largest processor of copper and nickel, with shares of 40 per cent and 35 per cent respectively.

But, as far as green energy minerals are concerned, existing mines are far more concentrated in a few countries than is the case for oil and gas reserves – leaving the world with little option but to depend on China for at least the medium term.

metmike: We're selling people on a technology that's a recipe for complete disaster in the US in every respect!!! If we don't change our tune quickly, we'll be toast in a few years.

The sad thing is that the writing is crystal clear on the wall and we continue to walk into a certain economic ambush/failure anyways!

Why is that?

Greed of people who are benefiting right now from doing this.......with money, power and politics dictating the path forward. Not policies based on sanity.

The sales of electric cars are booming, but the rising demand for transition minerals will pose a challenge for the mining industry.

https://www.mining-technology.com/analysis/concerns-for-mineral-supply-chain-amid-booming-ev-sales/

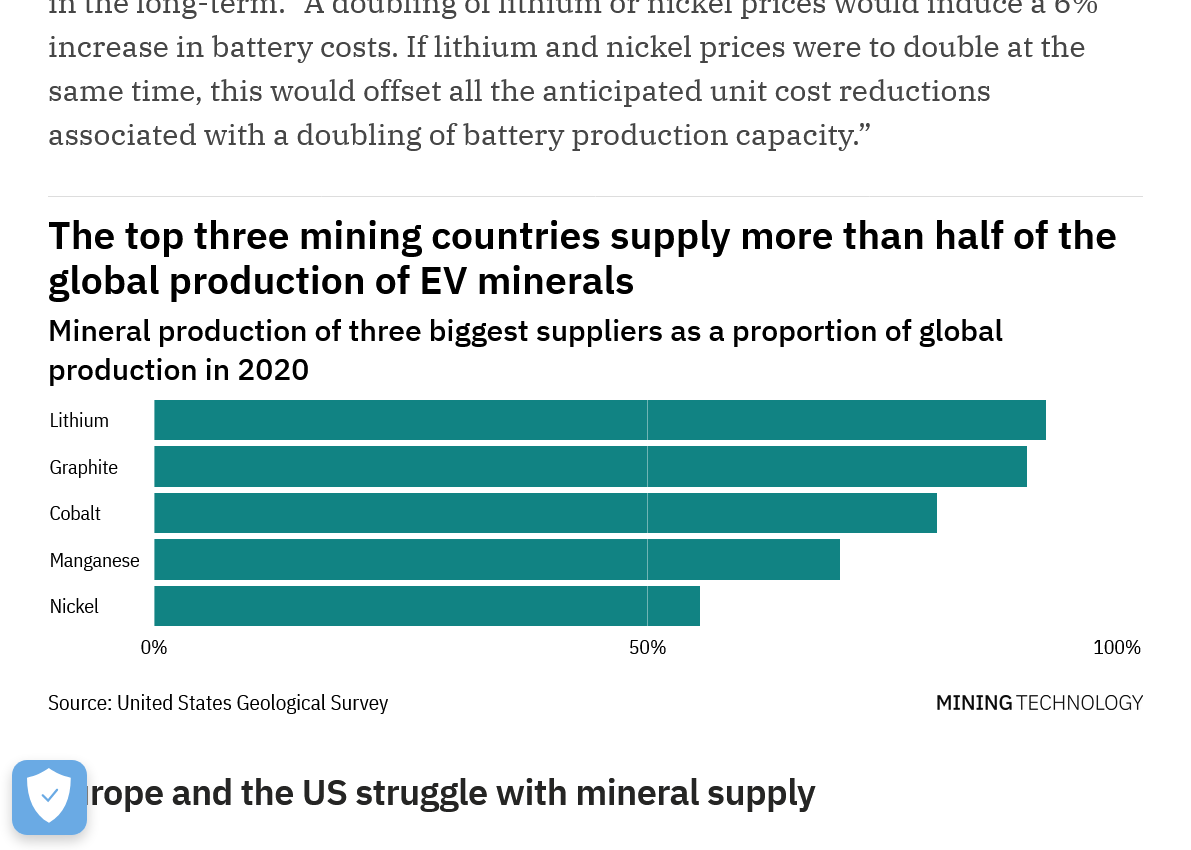

Another challenge for the future supply chain is that unlike some fossil fuels, many of the minerals essential for EVs are produced in just a handful of countries. Over half of the supply of minerals needed for EV batteries comes from the top three producing countries.

In 2020, Australia was responsible for 48% of global lithium production. For graphite, China is the world’s main supplier, with nearly 79% of global production originating from the country. In the same year, the Democratic Republic of the Congo (DRC) supplied 69% of global cobalt.

With regards to rare earth metals, China has most of them!

https://www.statista.com/chart/18278/global-rare-earth-production/

https://geology.com/articles/rare-earth-elements/

Note the amount of reserves below:

World Mine Production and Reserves | ||

| Country | Production (Metric Tons) | Reserves (Metric Tons) |

| United States | 38,000 | 1,500,000 |

| Australia | 17,000 | 4,100,000 |

| Brazil | 1,000 | 21,000,000 |

| Burma | 30,000 | not available |

| Burundi | 500 | not available |

| Canada | -- | 830,000 |

| China | 140,000 | 44,000,000 |

| Greenland | -- | 1,500,000 |

| India | 3,000 | 6,900,000 |

| Madagascar | 8,000 | not available |

| Russia | 2,700 | 12,000,000 |

| South Africa | -- | 790,000 |

| Tanzania | -- | 890,000 |

| Thailand | 2,000 | not available |

| Vietnam | 1,000 | 22,000,000 |

| Other Countries | 100 | 310,000 |

| World total (rounded) | 240,000 | |

+++++++++++++

China Dominates the Rare Earths Supply Chain

However, with China dominating the supply chain for minerals needed for electric cars and green energy schemes, it's like our leaders are retarded or have a self destruction complex.

In reality, many are just ignorant and want to believe in things that enrich and empower them TODAY and screw the future. The save the planet scheme is actually wrecking the planet in several ways.

BTW, completely eliminating fossil fuels, if it were possible would do almost NOTHING to change the weather/climate.....but that's not what its about.

The fake climate crisis is really a climate optimum and wind turbines are the energy source from environmental hell, replacing fossil fuels that are greening up the planet and increasing food for all creatures. (Eliminating fossil fuels tomorrow, would result in 1 billion humans starving within 3 years and only the rich being able to afford to eat).

What will replace the 6,000+ products made with petroleum products?

Life without petroleum based products:6,000 products made with petroleum. Killing Coal. Fossil fuels and fertilizer. Biden praises high gasoline prices.

https://www.marketforum.com/forum/topic/84689/ 2022

Twenty-Five Industrial Wind Energy Deceptions

https://www.masterresource.org/droz-john-awed/25-industrial-wind-energy-deceptions/

The cost to completely electrify and get rid of fossil fuels is at least $433 trillion.