I wasn't able to find export inspections this morning from my usual sources but found this:

Weekly grain movement: Soybeans continue to lead the charge

https://www.farmprogress.com/market-reports/weekly-grain-movement-soybeans-continue-lead-charge

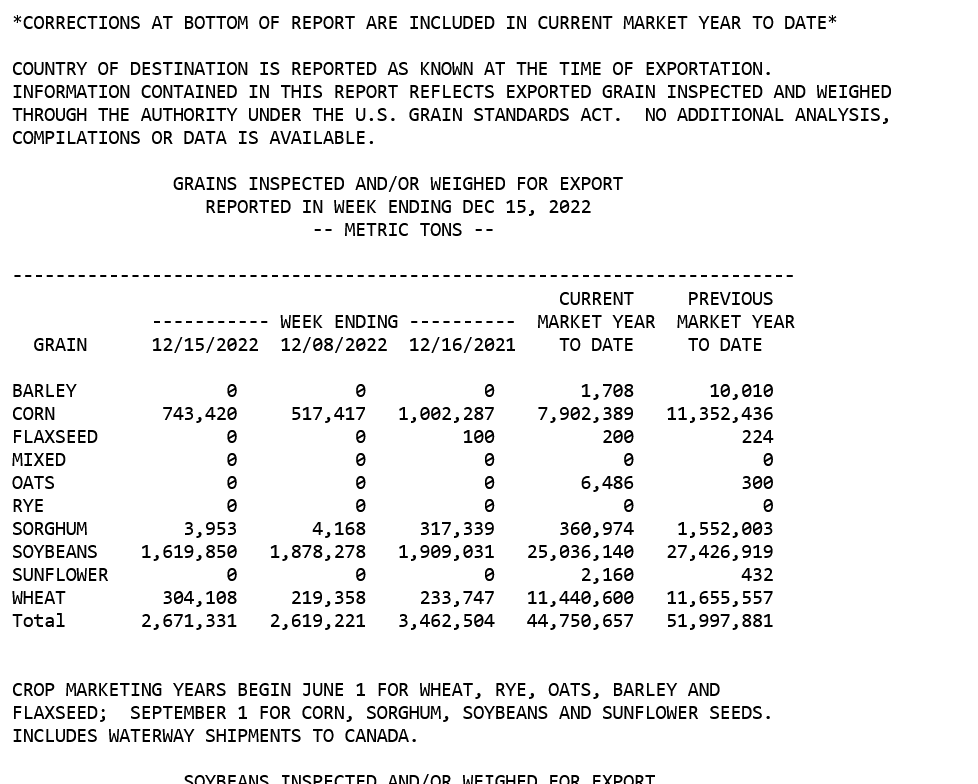

The latest set of grain export inspection data from USDA, out Monday morning and covering the week through December 15, once again held mixed but mostly positive data for traders to digest. Soybean volume led the way once again and remains seasonally strong despite a moderate week-over-week decline. Corn volume was also solid, trending 44% higher than the prior week’s tally. Wheat was relatively disappointing, in contrast, staying near the low end of analyst estimates.

Corn export inspections moved moderately above week-ago totals to 29.3 million bushels. That was also toward the higher end of trade guesses, which ranged between 17.7 million and 35.4 million bushels. Cumulative totals for the 2022/23 marketing year remain moderately below last year’s pace so far, with 311.1 million bushels.

China was the No. 1 destination for U.S. corn export inspections last week, with 16.4 million bushels. Mexico, Japan, Colombia and Taiwan rounded out the top five.

Sorghum export inspections were barely a blip on the radar, extending a troubling trend so far in 2022/23 after reaching only 155,000 bushels last week. The entirety of that ground is bound for Mexico. Cumulative totals for the 2022/23 marketing year are at about a fifth of last year’s pace last year, with 14.2 million bushels.

Soybean export inspections shifted moderately lower week-over-week but were still robust, with 59.5 million bushels. Still, analysts were generally expecting a bigger haul, with trade guesses ranging between 55.1 million and 77.9 million bushels. Cumulative totals for the 2022/23 marketing year are moderately below last year’s pace so far, with 919.9 million bushels.

China was by far the No. 1 destination for U.S. soybean export inspections last week, with 40.8 million bushels. Mexico, Italy, Thailand and Japan filled out the top five.

Wheat export inspections were fairly pedestrian but did improve moderately week-over-week to reach 11.2 million bushels. That was still toward the lower end of trade estimates, which ranged between 7.3 million and 22.0 million bushels. Cumulative totals for the 2022/23 marketing year are slightly below last year’s pace, with 420.4 million bushels.

South Korea was the No. 1 destination for U.S. wheat export inspections last week, with 3.1 million bushels. Japan, Mexico, Ethiopia and Yemen rounded out the top five.

Click here for more highlights from the latest USDA grain export inspection report, covering the week through December 15.

https://www.ams.usda.gov/mnreports/wa_gr101.txt

+++++++++++++

++++++++++++++++++

++++++++++++++++++

·

U.S. export inspection roundup from Monday:#Corn at higher end of trade range, #wheat & #soybeans at lower endsCorn is finally trending upward, much needed after a poor start, but momentum *must* continueNo material adjustment to prior week's inspections

#Mexico says the U.S. is satisfied with delaying the GMO #corn ban by 1 year to 2025. The issue is set for resolve next month. Pushing to 2025 means the current President will never be faced with enforcement as the next one takes office in Oct 2024.

·

#Ukraine says its 2022 #corn harvest may only be 22-23 million tonnes vs 41.9 mmt last year. In Sept they had hoped for 25-27 mmt. USDA this month reduced to 27 mmt from 31.5 mmt in Nov.

Dec. 21: New-crop CBOT #corn futures close above $6/bushel for the first time in 3 weeks, and the 1% climb is corn's best since mid-Nov. Most-active March futures rose 1.6% to $6.62-1/4, the month's best so far. In focus: U.S. wheat concerns, South American weather.