For weather that effects the natural gas market(Cooling Degree Days in the Summer help gauge residential natural gas use because natural gas is used to generate electricity for air conditioning:

From Natural Gas Intelligence:

August Natural Gas Called Near Even as Forecasts Seen Mostly Unchanged Overnight

September natural gas futures were set to open Tuesday about 0.5 cents lower at around $2.792/MMBtu, with overnight forecasts maintaining hotter trends for August as strong production continues to apply downward pressure on the market.

Turns out that Natural Gas was just waiting awhile to react to the upcoming, widespread heat! metmike

Storage is LOW for this time of year!!

Storage is at the bottom of the 5 year average:

Big drawdown in SouthCentral from the intense heat in TX last week.

| Working gas in underground storage, Lower 48 states Summary textCSVJSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (07/20/17) | 5-year average (2013-17) | |||||||||||||||||||||||

| Region | 07/20/18 | 07/13/18 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 527 | 507 | 20 | 20 | 624 | -15.5 | 630 | -16.3 | |||||||||||||||||

| Midwest | 524 | 501 | 23 | 23 | 742 | -29.4 | 686 | -23.6 | |||||||||||||||||

| Mountain | 145 | 144 | 1 | 1 | 197 | -26.4 | 174 | -16.7 | |||||||||||||||||

| Pacific | 257 | 259 | -2 | -2 | 294 | -12.6 | 311 | -17.4 | |||||||||||||||||

| South Central | 820 | 838 | -18 | -18 | 1,122 | -26.9 | 1,028 | -20.2 | |||||||||||||||||

| Salt | 214 | 230 | -16 | -16 | 310 | -31.0 | 286 | -25.2 | |||||||||||||||||

| Nonsalt | 606 | 608 | -2 | -2 | 813 | -25.5 | 741 | -18.2 | |||||||||||||||||

| Total | 2,273 | 2,249 | 24 | 24 | 2,978 | -23.7 | 2,830 | -19.7 | |||||||||||||||||

These were the temperatures for the 7 day period which passed for that EIA ng storage report:

These were the temperatures for the last 7 day period for this next EIA report.......much cooler, especially Midwest(N/C Plains were coolest but not many people live there-so not as much residential cooling demand in Summer)... so a much bigger injection coming up this Thursday:

By hayman - July 29, 2018, 5:59 p.m.

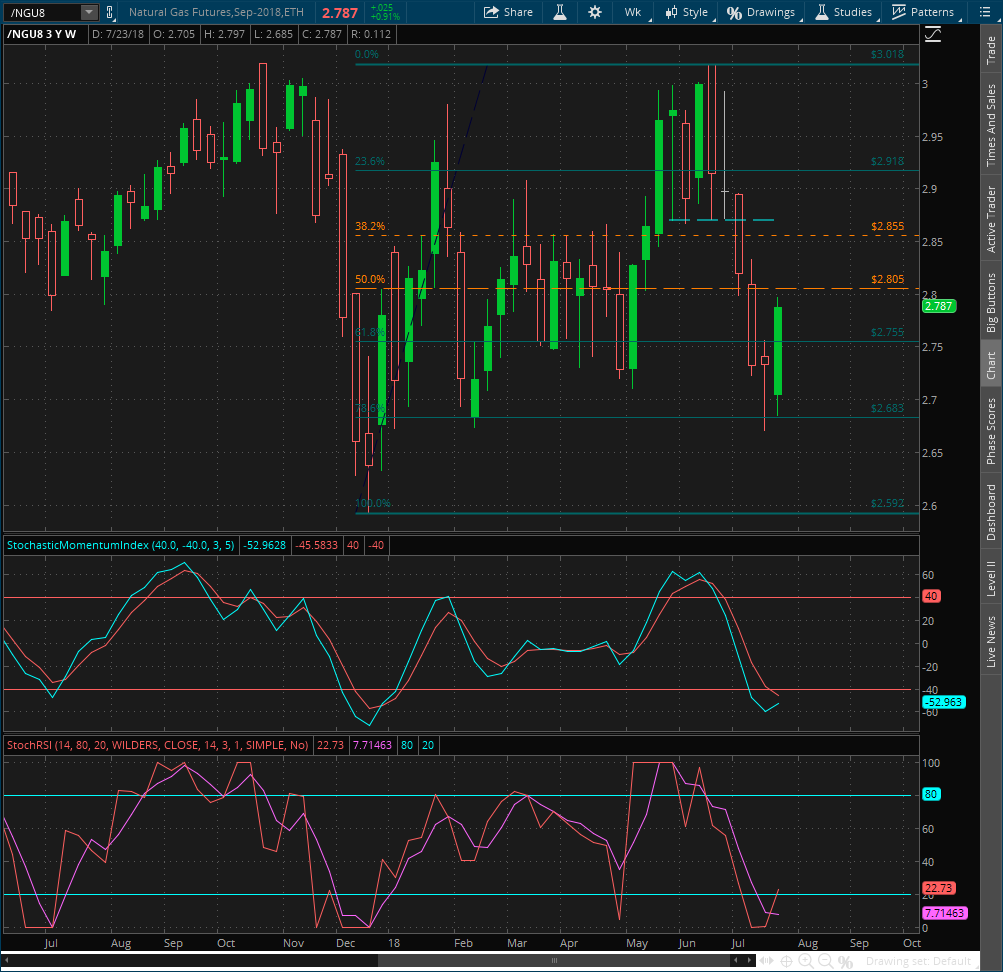

September Natty WEEKLY

Green Hulk up candle last week, oscillators curling up, teasing... A trip up to the top of the range for starters. Guessing a gap up in a couple minutes.

By silverspiker - July 29, 2018, 9:39 p.m.

... looks like clear sailing to the upside in U-September Nattie

... 3-84 & then 3-87.7

Mike et al,

My take on NG today is that it was up earlier on slightly warmer 2 week model consensus/forecasts, but that it fell back significantly (back to morning lows) on cooler 12Z GFS, 12Z GFS ensemble, and 12Z Euro because it had been up for several days in a row thus inducing rather robust selling/profit-taking at the first sign of cooler model consensus.

Yes, that's what I thought was a big part of it too Larry.

However, we made our lows of the day, after 6am when all the overnight guidance was out. This tested yesterdays lows. Then, 2 hours later, we spiked to the highs of the day, clearly taking out yesterdays highs and the highest price (in over 3 weeks) since July 9th............and also approached an area of significant resistance.

If the market was purely trading weather, it would not go from making new lows for the day to taking out highs from the last 3 weeks 2 hours later with ZERO new weather guidance out.

We could not stay up near the highs 2.830 for long and well before the cooler 12z GFS came out, we were already just below yesterdays highs but still up on the day. A much hotter GFS could have allowed us to test the 2.830 area again but the market was acting like it ran out of steam when it came back below yesterdays highs(based on increasing heat in forecasts for the past 10 days or so) .

So I agree that you could call it "profit taking" or something like that and the 12z GFS being cooler just added more fuel to the buying exhaustion pattern from earlier in a market that was primed/looking for an excuse to sell off after the recent rally from increasing heat in the forecast.

Also to consider maybe is that this weeks EIA # is going to have a much bigger injection than any of the last........long time. Also, I know that you don't think this is important but the week 3-4 CFS and other forecasts are looking VERY cool and have shown that on most days since late last week(there was a flip back to hot on Saturday I think). In a market focusing on big supplies about to hit, up near resistance and overbought, that could be enough(for such low storage vs the 5 year avg, I've been amazed at how little we have rallied)

I think that natural gas is dominated by some big players that have technical targets which in the short run(sometimes just hours or even minutes) will run over somebody trading on just the latest weather models.

If the weather is extremely powerful and you are right and you can hold on during the misleading spikes in the wrong direction, it usually works out.

Today was the perfect example.

You had 2 choices to maximize profits. If you were bullish...............wait for the market to sell off overnight to new lows(which means it was acting the opposite way against the weather to get down there) , then buy down there and get out when the market failed on new highs.............but if you are bullish on weather, then you are using weak price reactions to put on positions, which is not a great idea.

If you were bearish(hard to be with heat on the way) You could have waited for a failure at the highs..........but newer cooler guidance did not come out until after the failure and it was just one model that looked like an outlier, and you could have sold there but the overall upcoming pattern is still quite bullish overall with hot weather...........so you would have to trade against the weather, and guess that maybe all the heat was becoming old news and that the market would believe an outlier GFS cooler solution and jump on that being short.

I know that you get what I'm saying 100% but to most other people, it sounds confusing and to try to trade successfully using the same criteria every time..............impossible.

From Natural Gas Intelligence........closing comments for Tuesday. This sort of confirms my speculation earlier.

Production Puts Natural Gas Futures Bulls on Defensive

5:39 PM

Natural gas futures retreated Tuesday, giving back the prior day’s gains as record-level production and potential cooling toward the back half of August limit upside for prices. In the spot market, pipeline constraints contributed to lower prices at a couple Midcontinent locations as points in hot Southern California gained; the NGI National Spot Gas Average added a nickel to $2.78/MMBtu.

I know that you think the forecast below(temps for weeks 3 and 4) is more for entertainment but I think the market often takes long range forecasts serious enough for them to have a big effect on prices. Today could have just been a coincidence but we sure were weak for so much heat coming up during the next 2 weeks: