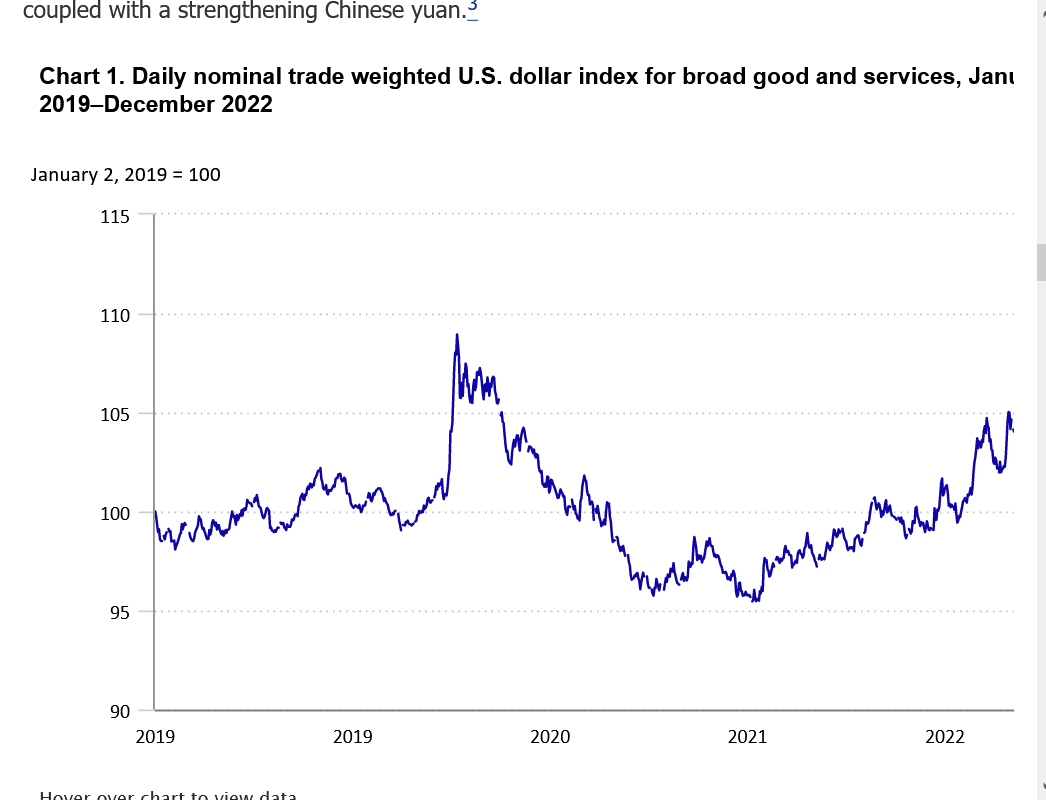

Let's keep in mind the value of the US Dollar. The higher it is, the more expensive our exports are to foreign customers.

The increase in interest rates caused the dollar to go higher and crushed our exports! See the explanations below.

https://www.marketwatch.com/investing/index/dxy

%20Overview%20MarketWatch.png)

%20Overview%20MarketWatch.png)

%20Overview%20MarketWatch.png) ++++++++++++

++++++++++++

| FOMC meeting date | Rate change (in basis points) | Federal funds rate (in percent) |

|---|---|---|

| December 15, 2022 | 50 | 4.25 to 4.50 |

| November 3, 2022 | 75 | 3.75 to 4.00 |

| September 22, 2022 | 75 | 3.00 to 3.25 |

| July 28, 2022 | 75 | 2.25 to 2.5 |

| June 16, 2022 | 75 | 1.50 to 1.75 |

| May 5, 2022 | 50 | 0.75 to 1.00 |

| March 17, 2022 | 25 | 0.25 to 0.50 |

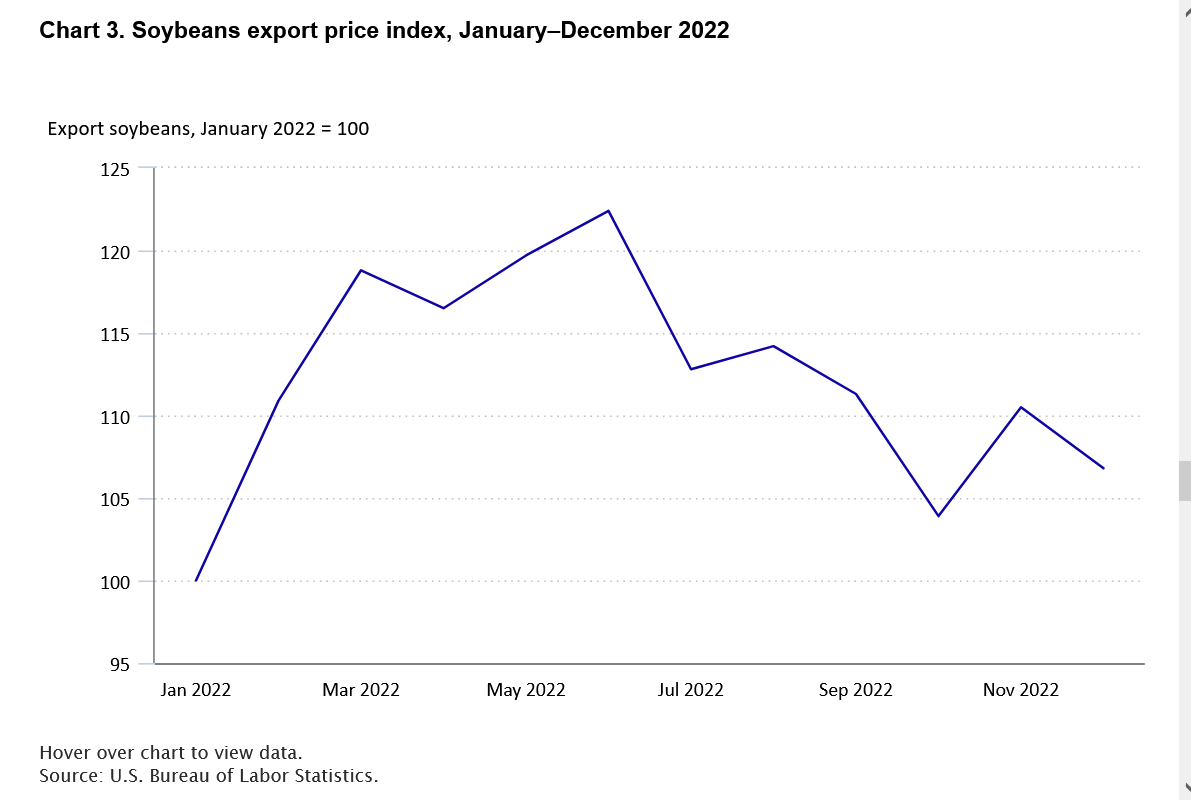

May 30: Most-active CBOT #soybeans settle below $13 per bushel for the first time since Dec. 20, 2021. Tuesday's 3% loss was the worst for any single session since Sept. 30, 2022. Macroeconomic concerns and chances for U.S. rains next week weighed on markets.

Another potential factor is that the funds could have been much bigger sellers of #soybeans in the latest COT week (week ended May 23), though they still held a tiny net long as of that date. Futures fell 2% in the week ended May 30 (data will be out Friday).

·

1. Our latest FDD on the renewable diesel boom is titled "Is the U.S. Renewable Fuel Standard in Danger of Going Over a RIN Cliff?" That should get your attention this morning. It is going to take me several twitter threads to go through the highlights.

Happy U.S. quarterly stocks day! We won't see June 1 data until the end of the month, but here's #corn vs trade estimates in recent years, all quarters. Trade nailed June 1, 2022 stocks. The last three truly bearish numbers were on 9/1/21, 6/1/20 & 3/1/19.

#Corn futures tend to react more to acres on June 30, however, the last three years have been interesting. Price surged on 6/30/20 despite mega-bearish stocks (huge miss in acres). Corn was limit up 6/30/21 (already had momentum). Trade nailed the 2022 numbers but (momentum).

Net export sales of U.S. #corn & #soybeans (old-crop) were OK last week against expectations, which were negative on the low end. Mexico bought both old and new corn, #China bought 265kt new beans. Philippines bought #soymeal. New #wheat sales beat expectations.

Why stop there? By July 25, there have been some years where #China has bought big volumes of U.S. #soybeans in advance of the marketing year. But that wasn't the case in 2015-2017, and then 2018 was the trade war, and 2019 was still the trade war plus African swine fever.

**label got left off, but chart is in million tonnes. Here's what things have looked like on June 25. Probably want to see at least 2 mmt by then, ideally more, though USDA currently pegs 2023/24 US soy exports at a four-year low.

As of May 25, USA had sold 1.32 million tonnes (48.4 mbu) of #soybeans to #China for delivery in 2023/24, down sharply from a year ago but in line with late 2010s averages. A 265kt sale was made in the latest week.