Export inspections of U.S. #soybeans last week fell sharply from the prior week but were still within normal range for the week, and 48% of the volume was to #China. 1 cargo each of #wheat, #corn & #sorghum were also inspected for China last week.

+++++++++++++

People will think the bean # looks "bad", but I might argue the corn one, in context with normal weekly volumes and relative to yearly expectations, were worse. Corn wasn't BAD, though, but more is better. Wheat inspections were fine, esp. given the expected 52-year export low.

As of March 5, money managers held a RECORD net short in CBOT #soybeans at 172k fut&opt contracts, surpassing the prior high of 169k set in May 2019. That also caps off a staggering 16th consecutive week of fund net selling in beans (prior record was 10 weeks).

·

Last time the funds sold #soybeans like this (i.e. this many contracts consecutively or semi-consecutively) was in May-June 2018 when the US-China trade war kicked off. Though that was a steeper, shorter selloff.

Funds sold CBOT #soymeal in the week ended March 5, marking their most bearish ever start to March (~50k f&o net short). Funds have been net sellers in meal 14 of last 15 weeks, and their net short in #soyoil (62k f&o) is the biggest since May 2019, record for time of year.

USDA LAST FRIDAY:

USDA cuts #Brazil's 23/24 harvest of #soybeans by 1 mmt (less than expected) and leaves #Argentina's soy unch. Brazil's #corn crop was also unch but Argentina's old and new corn crop were both raised 1 mmt.

++++++++++++++

USDA raised U.S. #wheat ending stocks due to an export reduction but #corn & #soybeans were unchanged from last month's balance sheet.

++++++++

Global ending stock estimates for #corn, #wheat & #soybeans all came down from last month (by more than expected for corn/wheat). Trade dead-on nailed soy stocks. #China soy imports were hiked 3 mmt to 105 mmt. #Ukraine's wheat/corn exports were up again. Aus/Argy wheat crops up.

WEDNESDAY AFTER THE CLOSE:

March 13: CBOT May #soybeans settle at $11.96-3/4 per bu, their highest finish in a month. Beans failed to break $12 again on Wed (last $12 was Feb. 13), though they are 6% off the Feb. 29 contract lows. May beans have popped above the 20 dma but have been below the 50 since Dec.

May #corn is also above the 20 dma but below the 50, and it has come up 8% from the Feb. 26 low. Slightly lower close of $4.41-1/4 per bu on Wed, very similar to Mon-Tue. These are the highest settles in a month.

+++++++++++++

Prices were strong early this morning but have reversed here after 10 am.

Wheat has been the one really getting hammered today!

Maybe from beneficial precip next week???

Have already reposted with this comment, but just in case you missed it, the story was referring to U.S. cargoes, not French ones. Here's the update:

Farmers in #Canada will plant more durum wheat, oats, corn and lentils in 2024 versus 2023, and they will plant fewer canola and barley acres. Total wheat area is bigger than analysts expected, canola a little smaller. StatsCan conducted this area survey Dec. 14 - Jan. 22.

Conab cut #Brazil's 2023/24 output of #soybeans by 2.5 mmt to 146.9 mmt on lower yields. Total #corn output was reduced ~1 mmt. New-crop corn exports were unch but old crop fell by ~1 mmt. New-crop soy exports are seen lighter than previously estimated.

USDA on Monday morning reported last week's U.S. export inspections for #corn at the top end of trade ideas (1.24 mmt, range was 0.9-1.25 mmt). #Soybeans at 686kt were mid-range (0.3-1.15 mmt). Both are somewhat average for the week, but wanna see corn a bit stronger maybe.

And now, with the titles copied over! None of the corn cargoes were headed to China but 80% of the beans were. Wheat inspections were 302kt, at the low end of a 300-500kt range.

#China's Jan-Feb imports of #soybeans were a 5-year low for the period, down 9% from last year. Arrivals of #corn, #barley & #sorghum were higher than last year, but #wheat and #pork imports were lighter.

https://talk.newagtalk.com/forums/thread-view.asp?tid=1152992&mid=10671689#M10671689

big gov could likely be big wrong on crush numbers

Great point, mcfarm!

Last month was the warmest February in 130 years of records for the Midwestern U.S., and it was the 125th driest of 130 with just 41% of normal precipitation. No close comparisons, but closest are 2017 and 1987. All labeled years below correspond with El Nino, except 2017.

+++++++++

metmike:

Very impressive!!

The February temperature anomaly bar color code only goes to +8 degrees F. In the Upper Midwest, temperatures were as much as +13 Deg F above average for the entire month!!!

https://www.cpc.ncep.noaa.gov/products/tanal/temp_analyses.php

This is Dec-Jan-Feb. There was a warm spot along the Canadian border that was +10 Deg F..........for an entire 3 month period.

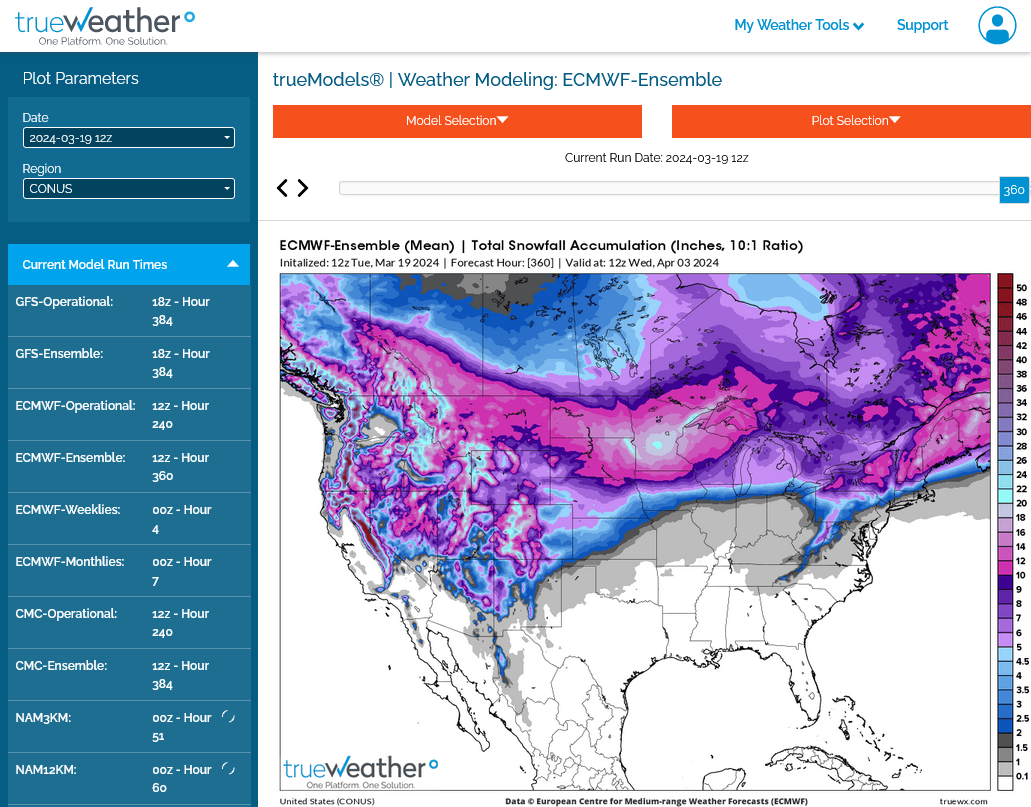

Incredibly, here in the 2nd half of March, look at the total snowfall forecast for the next 2 weeks from the European model ensemble:

That's 20 inches of snow in the light blue at the same spots with the warmest temperature anomalies this Winter!

MetMike

Would you be so kind as to comment on the implications of potential weather delays? OATS, for sure?

Great to read you, tjc and with a wonderful request for, what may be the most important weather factor impacting the markets the next month.

For sure its going to be cold with way too much precip for planting (but great for soil moisture in the long run, where soils are dry)

Let me do some homework on this and report back in more comprehensive fashion at a new thread.

Early planting issues 3-20-24

14 responses |

Started by metmike - March 20, 2024, 12:22 p.m.

https://www.marketforum.com/forum/topic/102729/

And thanks!

U.S. export inspections fell into the ranges of expectations last week. #Corn was on the higher end w/ similar volumes leaving the Gulf and PNW (tho no cargoes to #China). Two-thirds of the inspected #soybeans were destined for China (almost all departing the Gulf).

As far as inspections are concerned, soybeans haven't had a "bad" week in two months. Corn is finally sustaining larger volumes, haven't yet calculated whether it's a proper pace. Wheat has had some better weeks recently. See screenshot for last week's revisions (big in corn/wht)