Once again, analysts are looking for a sizable cut to #Brazil's #soybeans from USDA on Friday. Does the bet finally pay off? No upside assumptions, either. #Corn seen lower, too.#Argentina corn seen down notably after pest damage. Minor changes for soy but downside baked in.

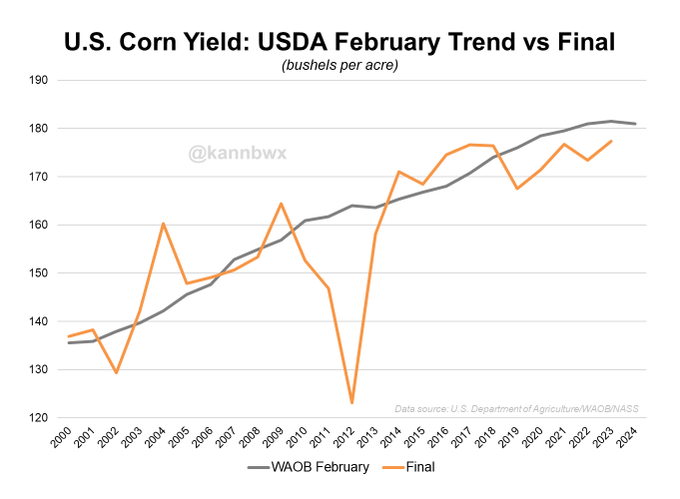

I like to use the Feb (outlook) yields here because it shows what the model spits out BEFORE any weather happens. But you could plot the initial May yields too (shown below). USDA employed its current yield model in 2013, and late planting in 13 & 22 bumped the yield down by May.

USDA's preliminary 2024 U.S. #corn trend yield of 181 bu/acre (issued in February) marked the first time in 11 years that the trend declined year-on-year. Since 2013, the May yield was different (lower) than in February twice: 2013 & 2022. So a 181 print is likely on Friday.

Replying to

Anyone analyzing U.S. corn & soy yields (esp in context of USDA estimates) must read this paper if they haven't. It explains exactly how USDA's World Board handles the trend yield modeling. USDA's NASS estimates (from August-on) are different. https://ers.usda.gov/webdocs/outloo

++++++++++++++++

Weather Effects on Expected

Corn and Soybean Yields

https://www.ers.usda.gov/webdocs/outlooks/36651/39297_fds-13g-01.pdf?v=884.4

Sorry for being slow to update on the USDA report. Been focused more on the rare, extreme solar geomagnetic storm.

USDA trims 2023/24 outlooks for #Brazil & #Argentina #corn and Brazil #soybeans. Record Brazilian soy crop seen in 2024/25, though Argy expectations are more modest.

U.S. 2023/24 ending stocks come in at or below trade expectations, though 2024/25 #corn is below and #soybeans above. The projected year-on-year build in U.S. corn stocks is MUCH smaller than previously feared.

2024/25 world #corn & #wheat ending stock estimates land well below the average trade guess, but #soybeans landed very far above. RU+UA wheat crop seen down 5% YOY, exports down 7%. China corn imports seen unch from 23/24 at 23 mmt. China soy imports at 109 mmt vs 105 in 23/24.

U.S. farmers in 2024 are set to harvest a smaller #corn crop than in 2023, but output of #soybeans may rise significantly. This is mostly due to a year-on-year acreage shift from corn to soybeans.

The 2024 U.S. #wheat harvest is seen slightly smaller than analysts thought but above last year's crop. Winter wheat output is up 2% year-on-year, HRW up 17%, SRW down 23%, white winter up 16%. The SRW number in particular was well below the average trade guess.

Compared with demand, world #wheat supplies among major exporting countries are seen hitting 17-year lows in 2024/25. Stocks-to-use is pegged at 13.5%, near all-time lows. Stocks-to-use in 2023/24 (14.7%) sits at a 16-year low but nearly identical to 2020/21.