Stopped out of shorts last week.

There was actually an aggessive buy signal friday at the close, but will wait untill

monday see the price action.

After fridays buy signal, Monday was a buy.

soybeans broke out to the upside today

Funds are sitting ducks when they load up in 1 direction, following a trend (that they amplify by adding to the position) and we have a major bottom/top like the one that just happened with beans.

After the reversal and trend change, they will often need to cover a position that took many weeks to accumulate..........REAL FAST and we have days like Monday which likely featured a great deal of aggressive buying to cover shorts.

https://www.investing.com/economic-calendar/cftc-soybeans-speculative-positions-1811

I

Fund activity the past year is interesting. Lets go back farther to last December, when funds were still covering the long that they held for all of 2023. They got pretty short into early March 2024, covered most of that by late May, with flooding in the Upper Midwest (and ahead of a potentially adverse La Nina growing season). Then the weather straightened out and they piled on the shorts again in Jun-Jul-Aug. Then the growing season ended with a flash drought during late pod fill in many places and they've had to cover again, despite the strong negative seasonal at this time in September because of harvest which almost always pressures prices.

Fund activity the past year is interesting. Lets go back farther to last December, when funds were still covering the long that they held for all of 2023. They got pretty short into early March 2024, covered most of that by late May, with flooding in the Upper Midwest (and ahead of a potentially adverse La Nina growing season). Then the weather straightened out and they piled on the shorts again in Jun-Jul-Aug. Then the growing season ended with a flash drought during late pod fill in many places and they've had to cover again, despite the strong negative seasonal at this time in September because of harvest which almost always pressures prices.

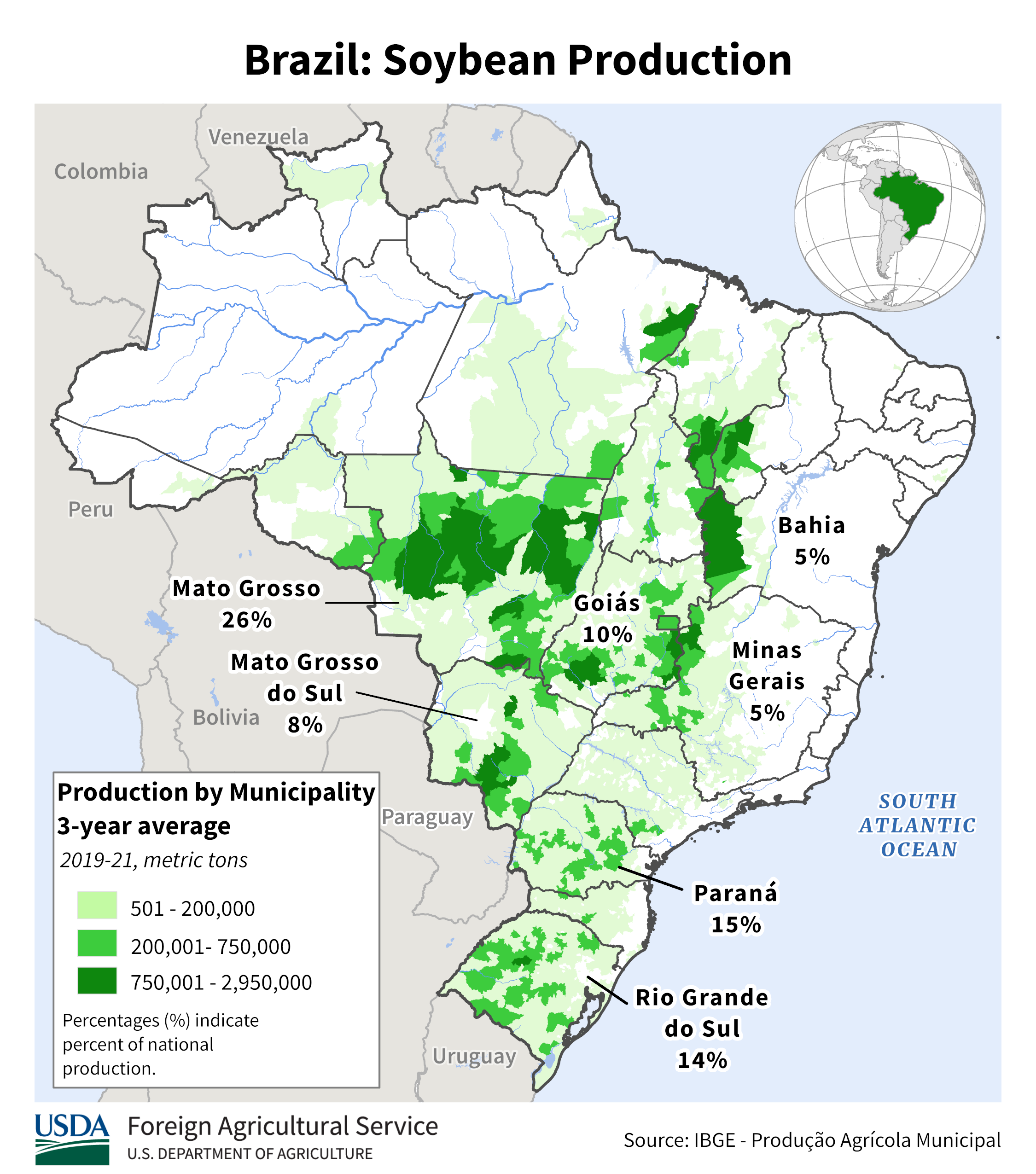

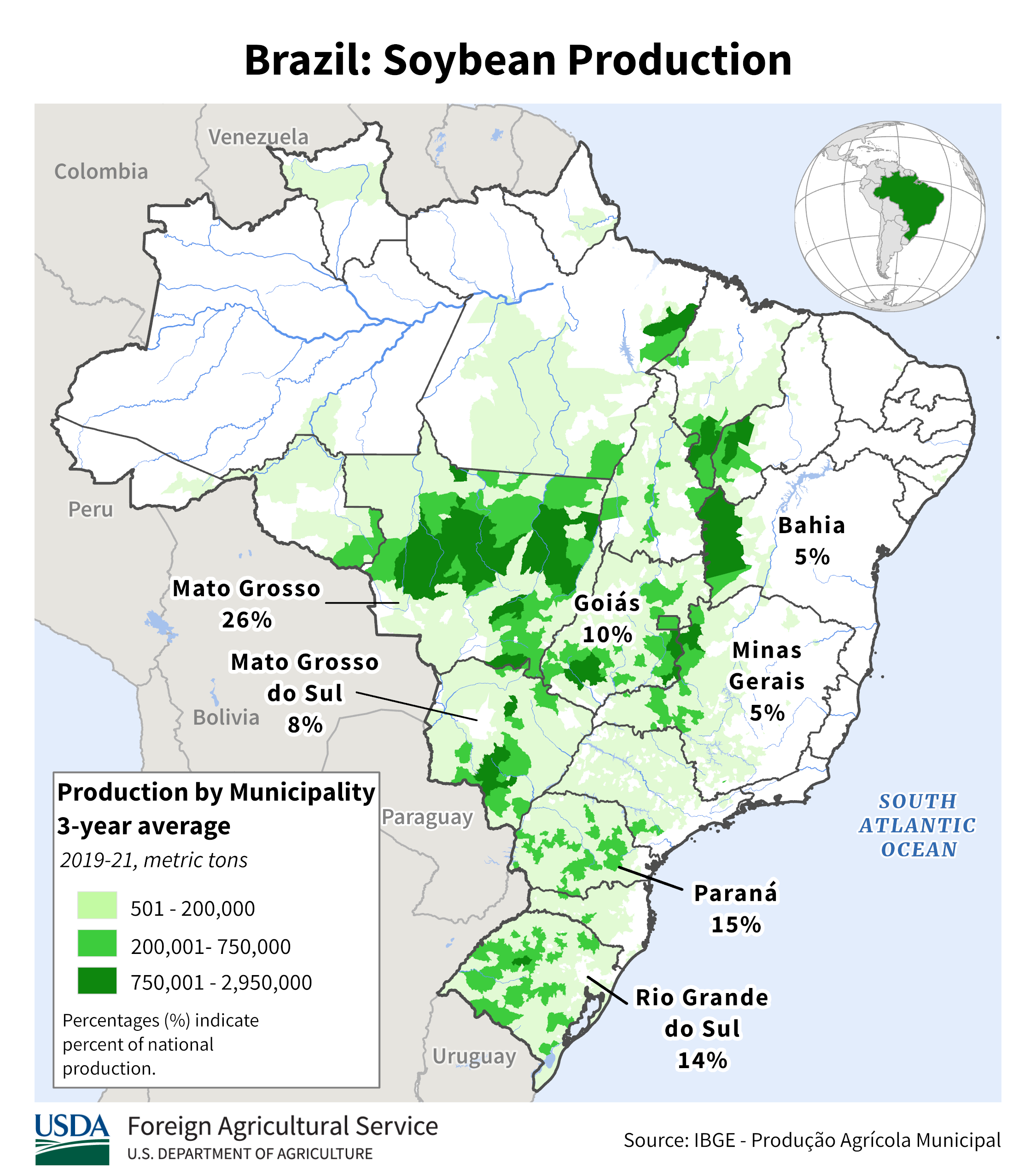

In addition, the wet monsoon is a bit slow to turn on in Central Brazil. Still lots of time but nothing substantial the next 2 weeks in #1 producer Mato Grosso.

Beans almost NEVER go up in the 2nd half of September with very heavy harvest pressure. However, the crop GOT SMALLER during the last month because of the flash drought during late pod fill. The market has been trading a SMALLER CROP this month. This isn't showing up with crop conditions/ratings on Mondays because the plants still look good. It's the smaller seeds inside the pods that cant be seen which have absolutely caused a smaller crop compared to a month ago.

Each year is different.

https://www.seasonalcharts.com/future_farmprodukte_soybean.html

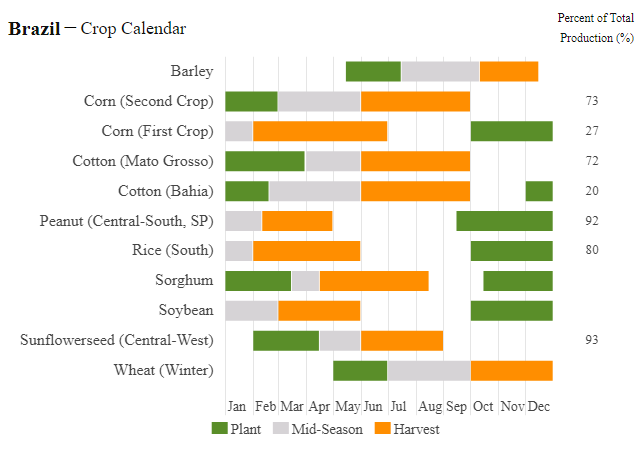

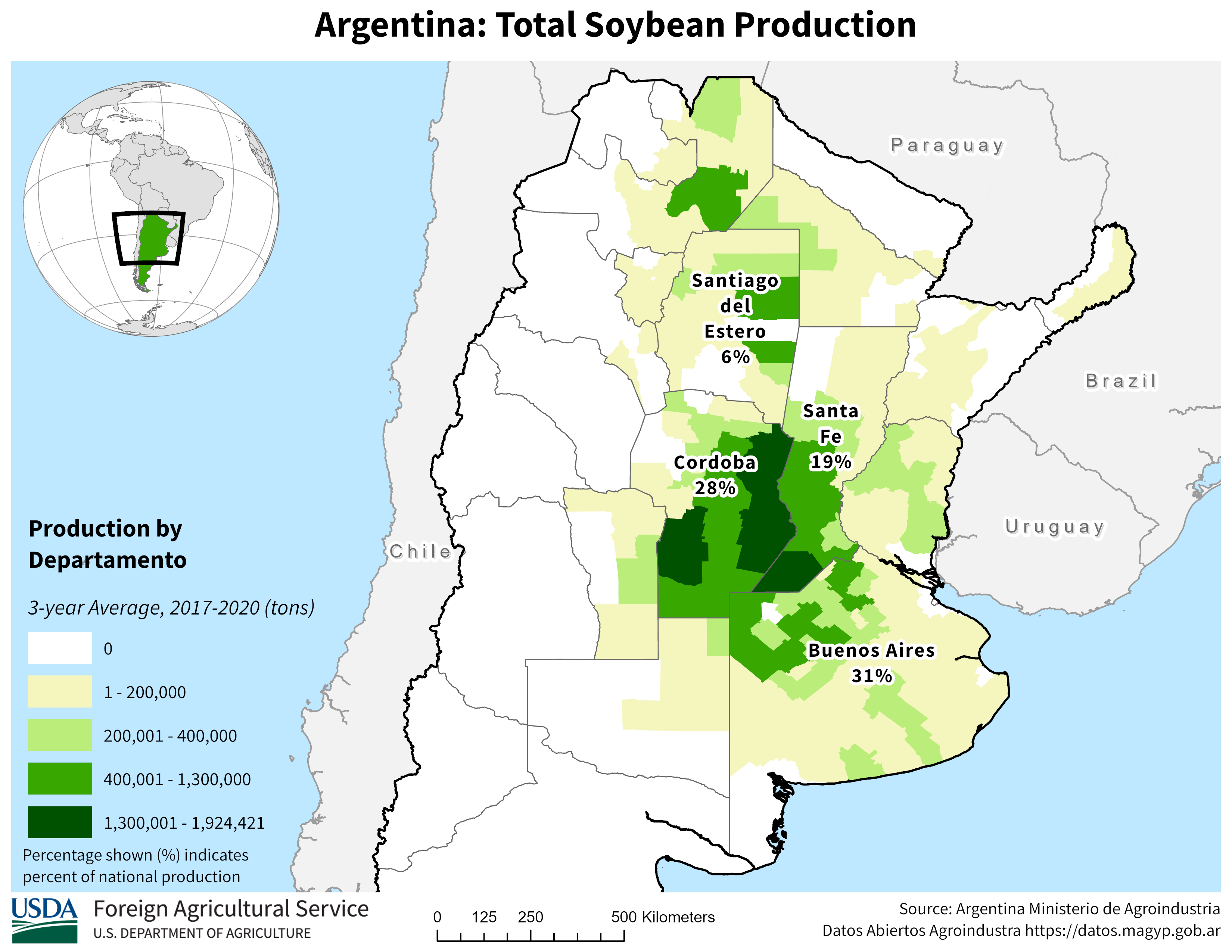

The market will now mainly trade the weather in South America:

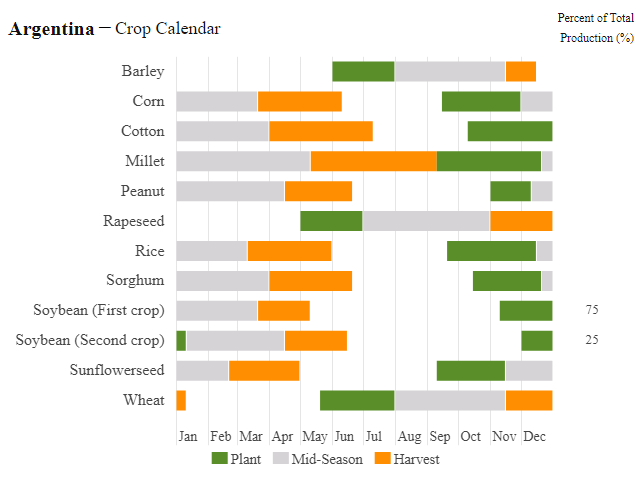

Beans won't start getting planted for over another month+ in Argentina but it's starting in Brazil(warms up sooner).

We need rain in Central Brazil(after 5+ monthd of the dry season) to have enough soil moisture to germinate planted beans. The rainy season is starting a bit late and making the market nervous but we still have plenty of time for the pattern to change.

https://en.wikipedia.org/wiki/Mato_Grosso

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.30day.figb.gif

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.90day.figb.gif

https://ipad.fas.usda.gov/countrysummary/default.aspx?id=BR

https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/Brazil/Municipality/Brazil_Soybean.png

https://ipad.fas.usda.gov/countrysummary/default.aspx?id=AR

The market will key off the forecast for Central Brazil/Mato Grosso.

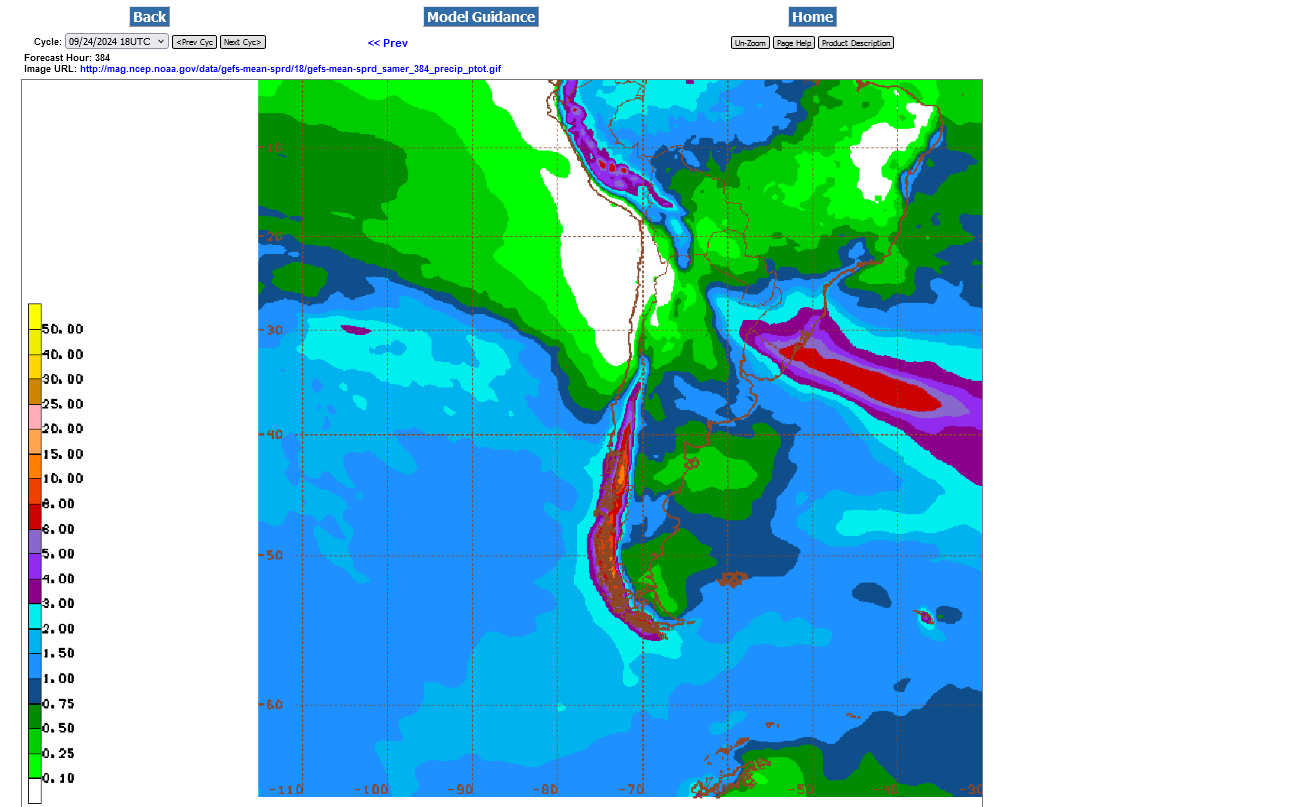

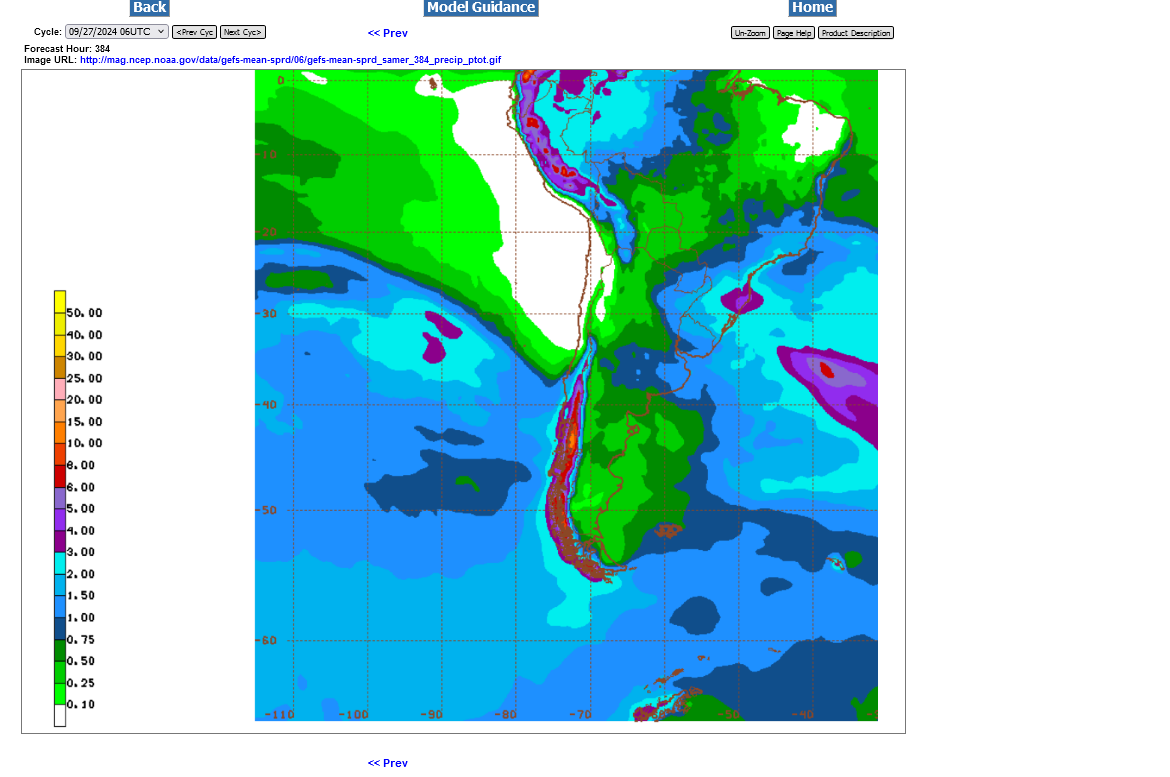

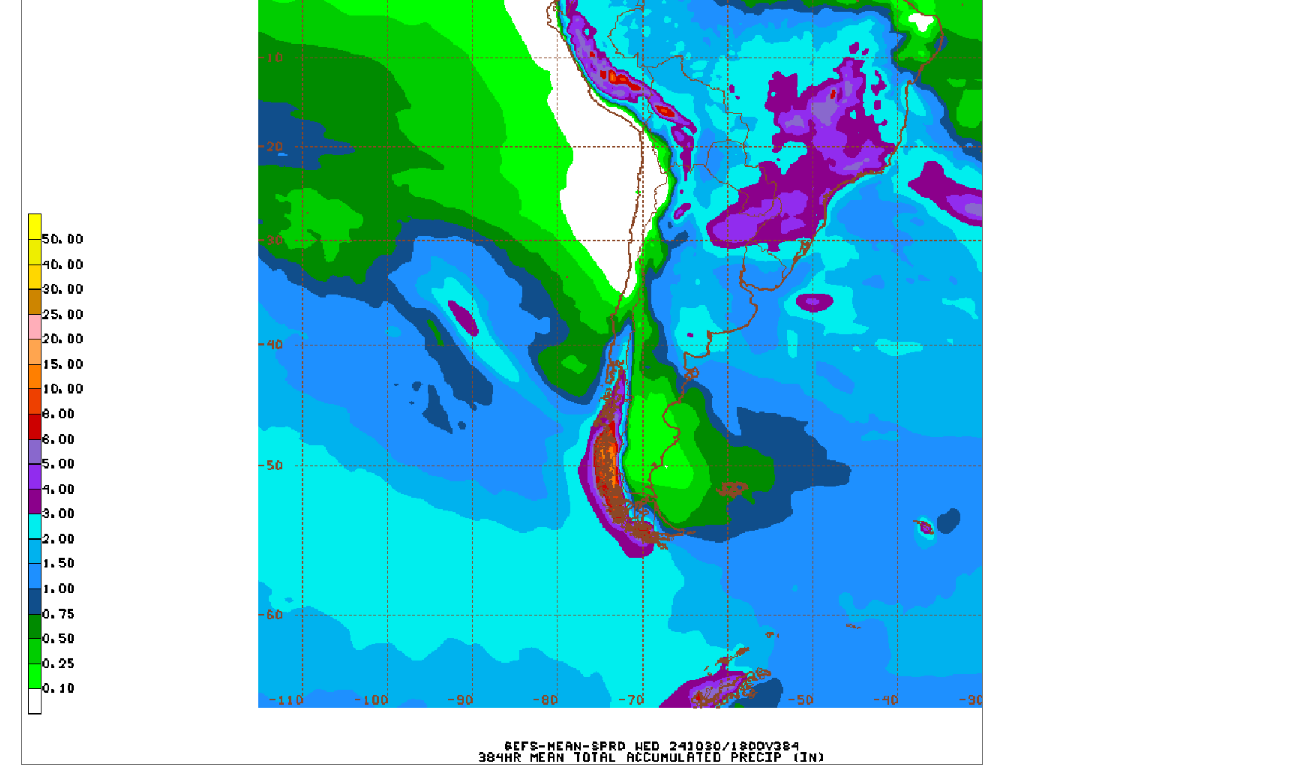

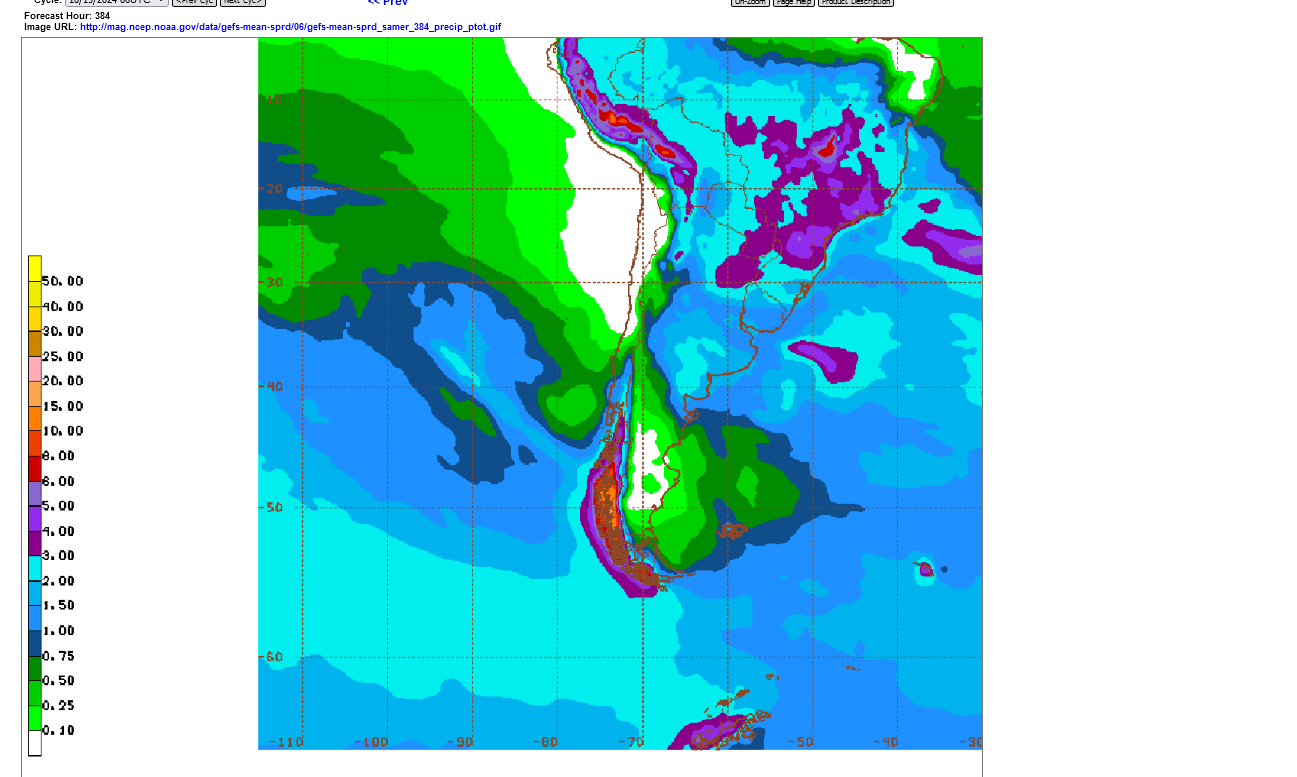

Not much rain yet thru 2 weeks. This is supporting the beans right now. When a big weather pattern change to much wetter shows up in Central Brazil, the beans are likely to sell off by double digits.

It's extremely doubtful we get close to the recent lows. We lost TOO MUCH production in the US with this flash drought.

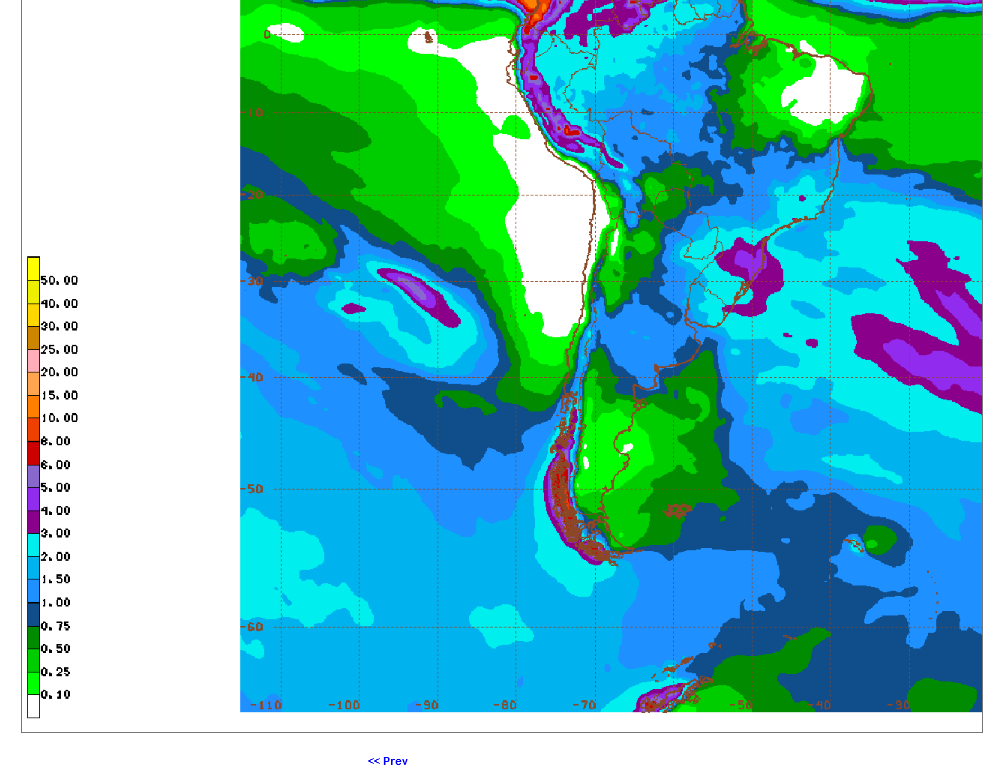

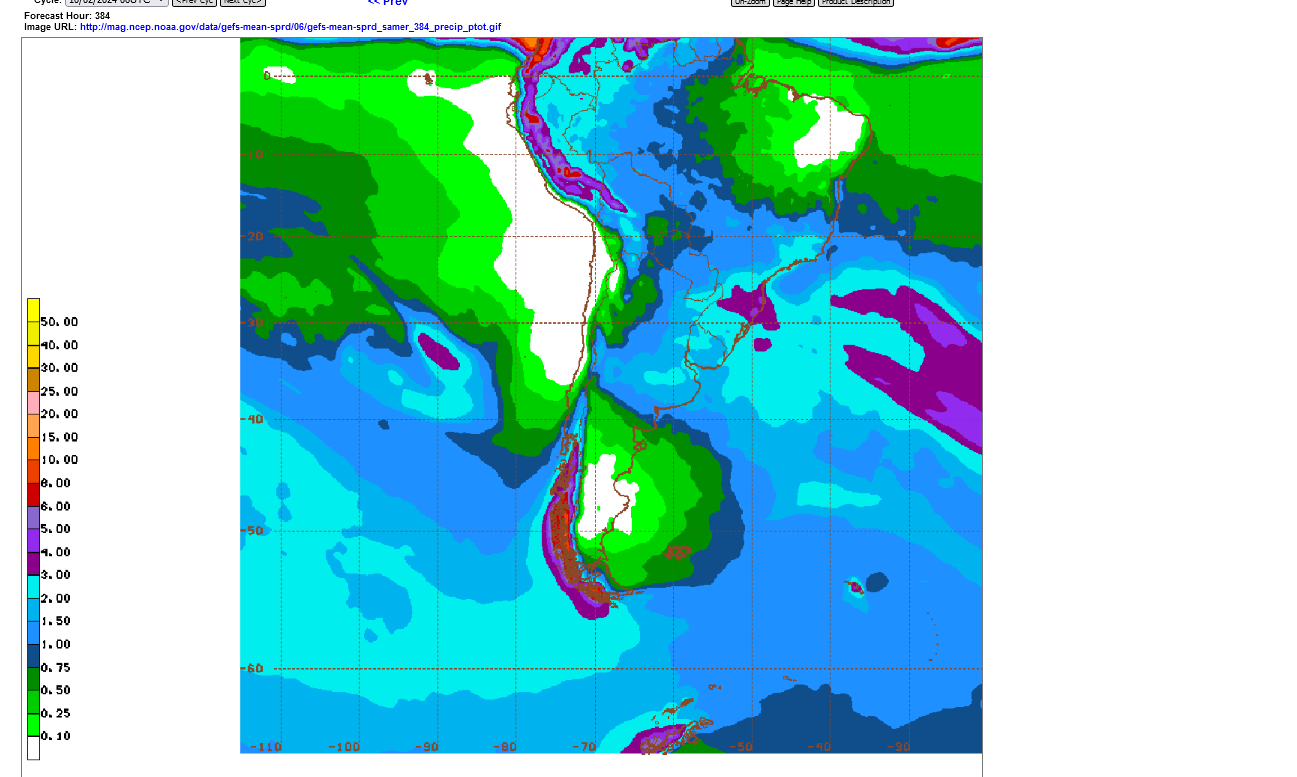

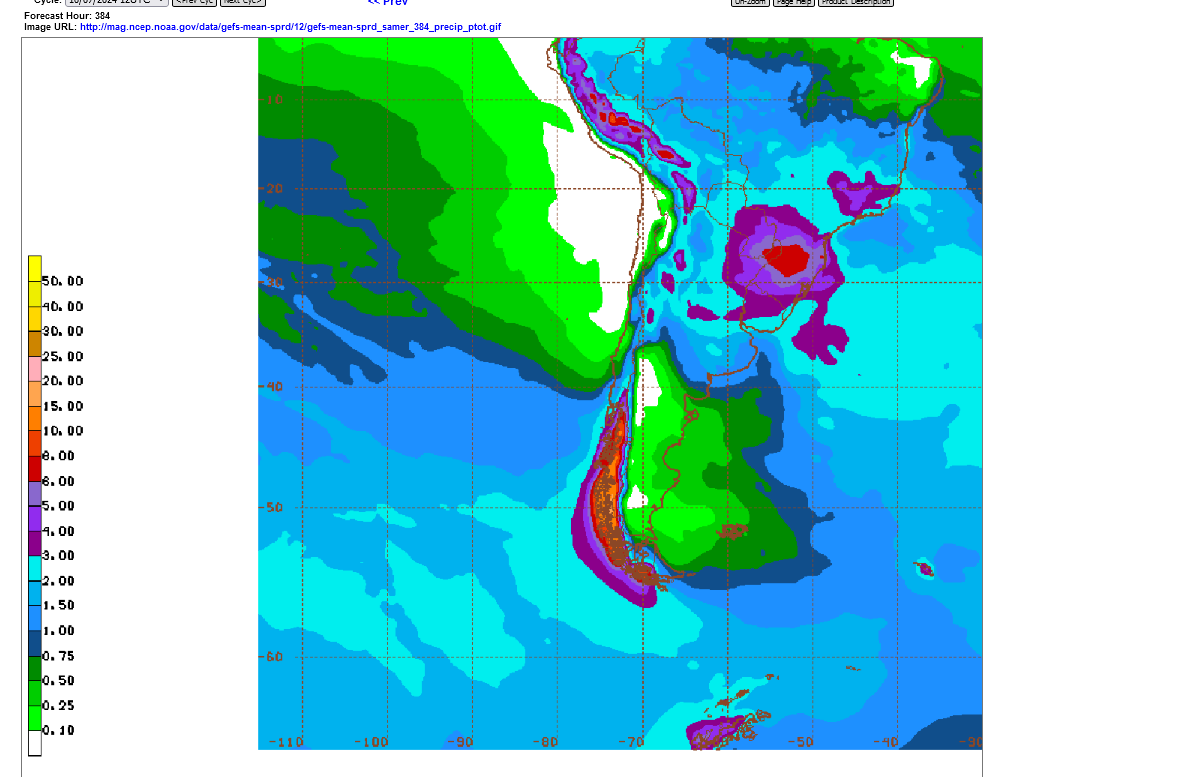

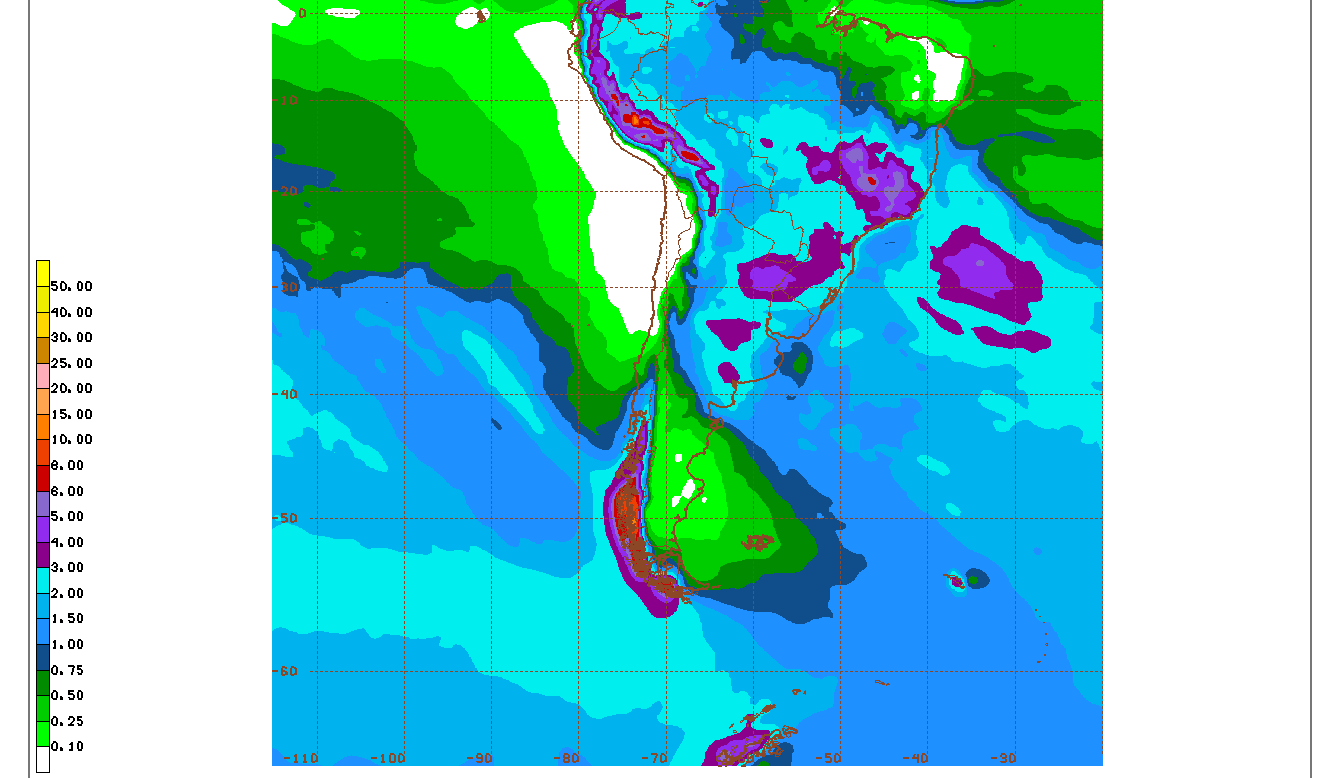

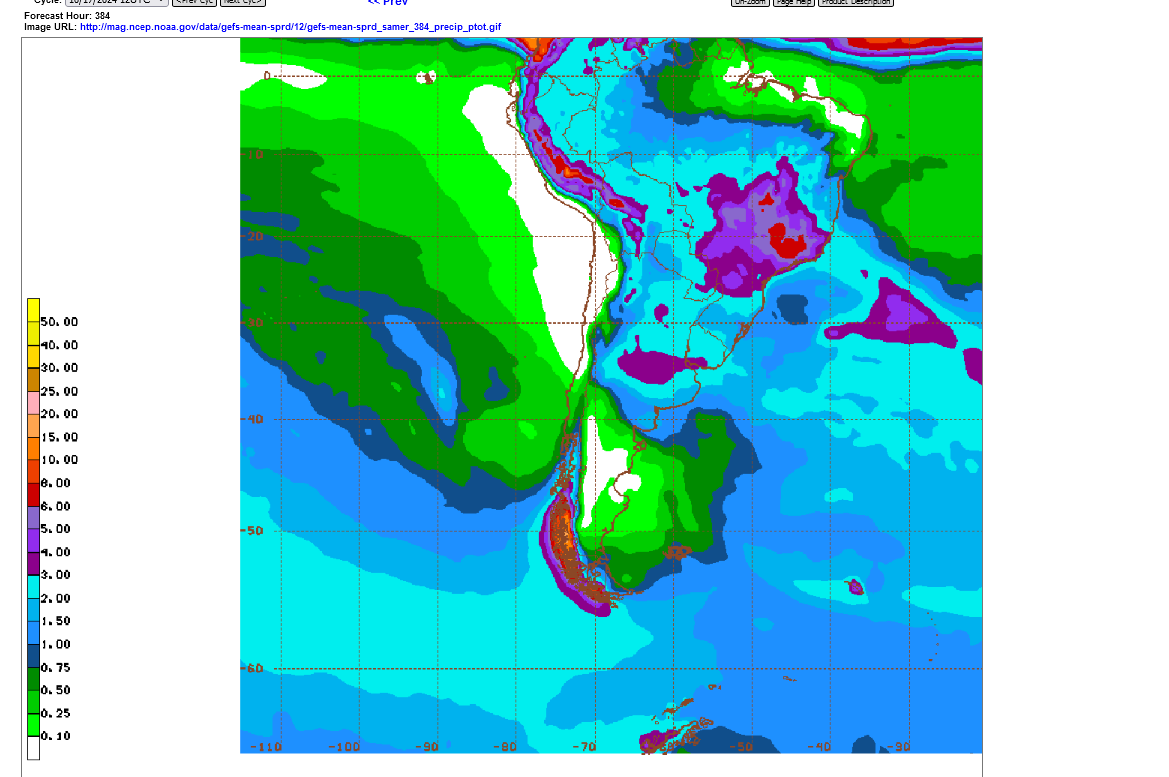

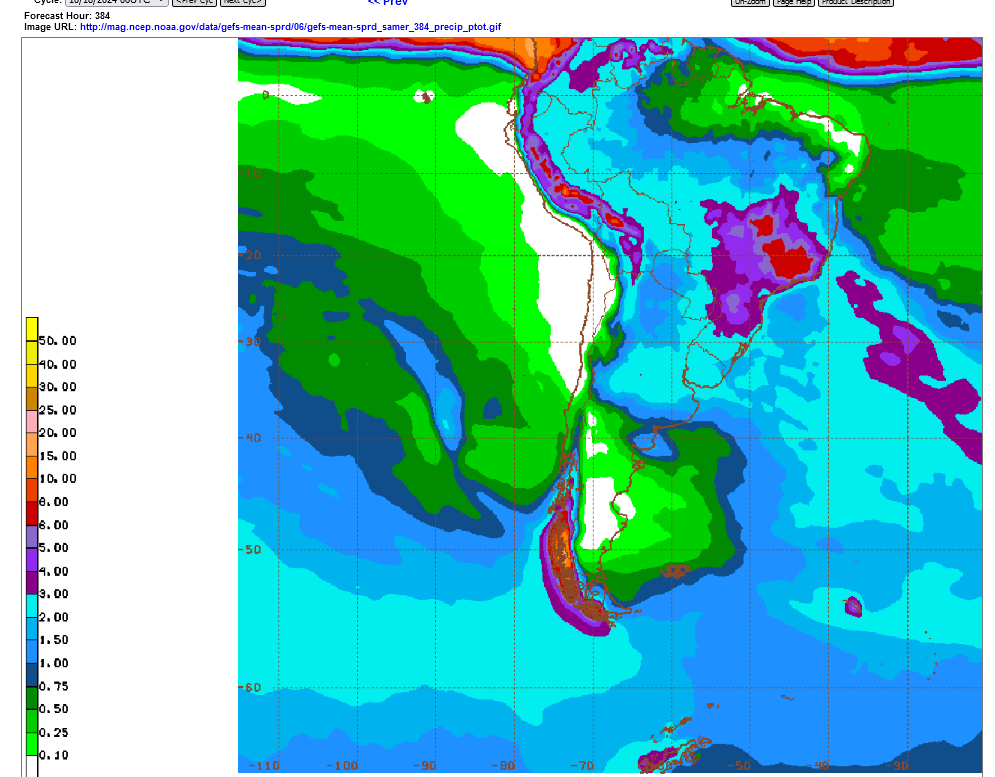

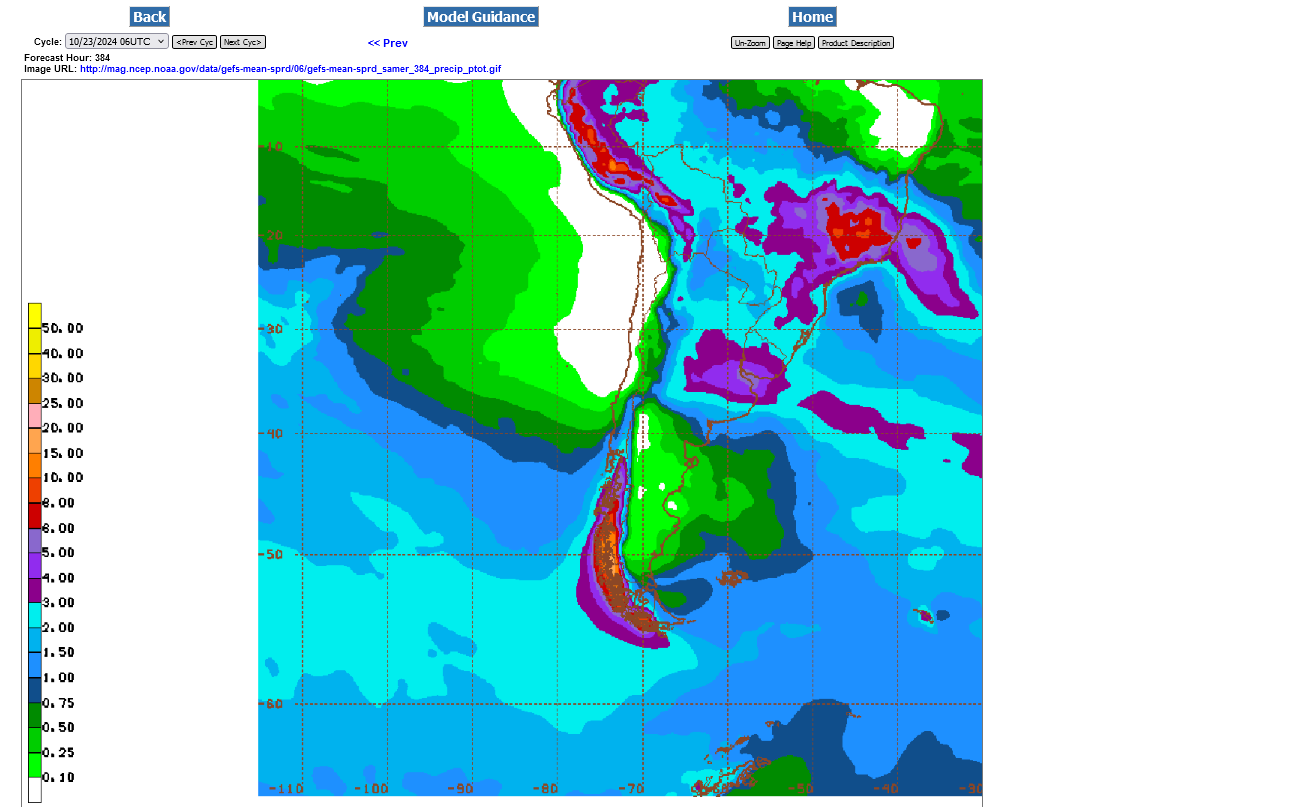

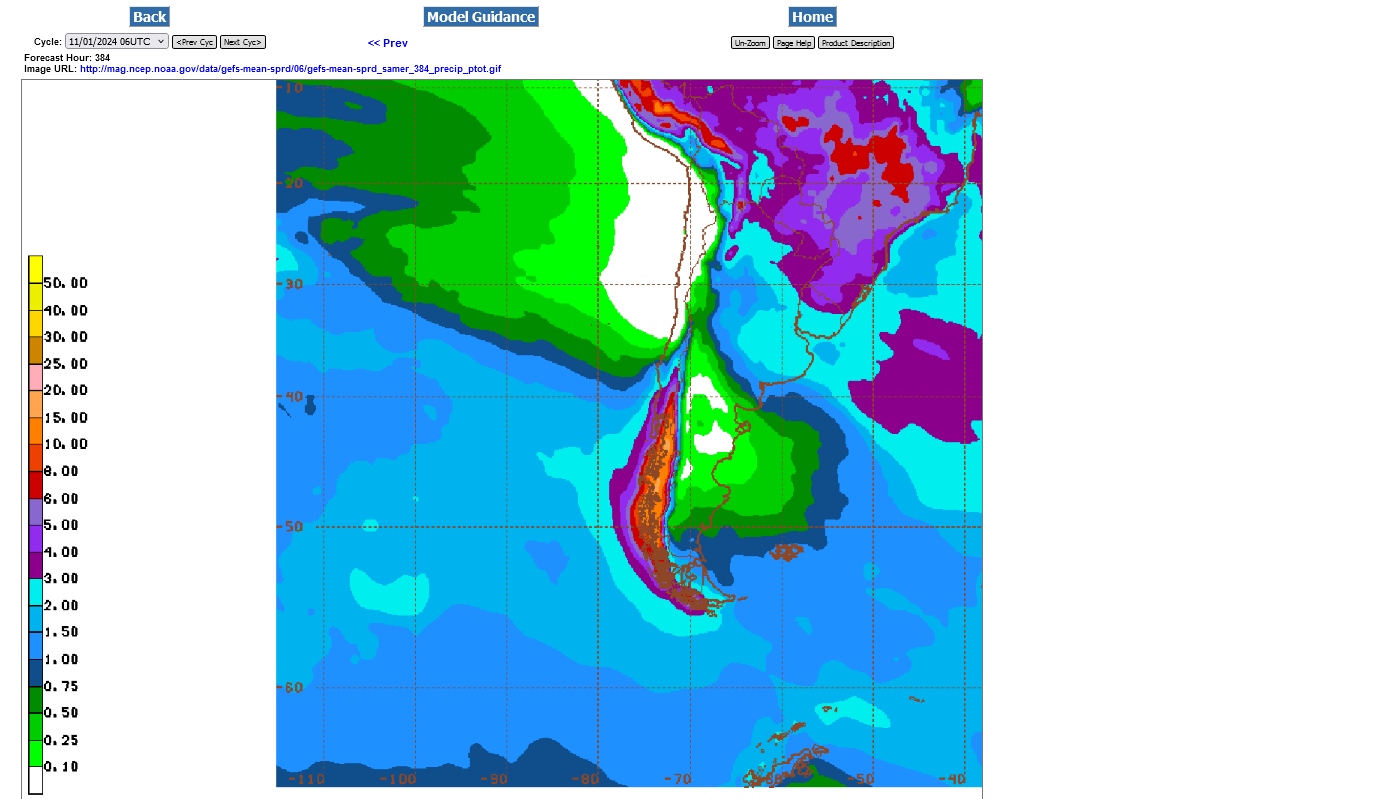

2 week rains from the last 18z GEFS

Here's some help to find Mato Grosso on that map above:

Re: Re: Re: South America WX/coffee

One the toughest things for me to do is pick out where Mato Grosso is on a global weather map. This may help you. It's basically between 9 south to 18 south latitude and 60 west to 51 west longitude.

https://www.alamy.com/mato-grosso-red-highlighted-in-map-of-brazil-image363417132.html

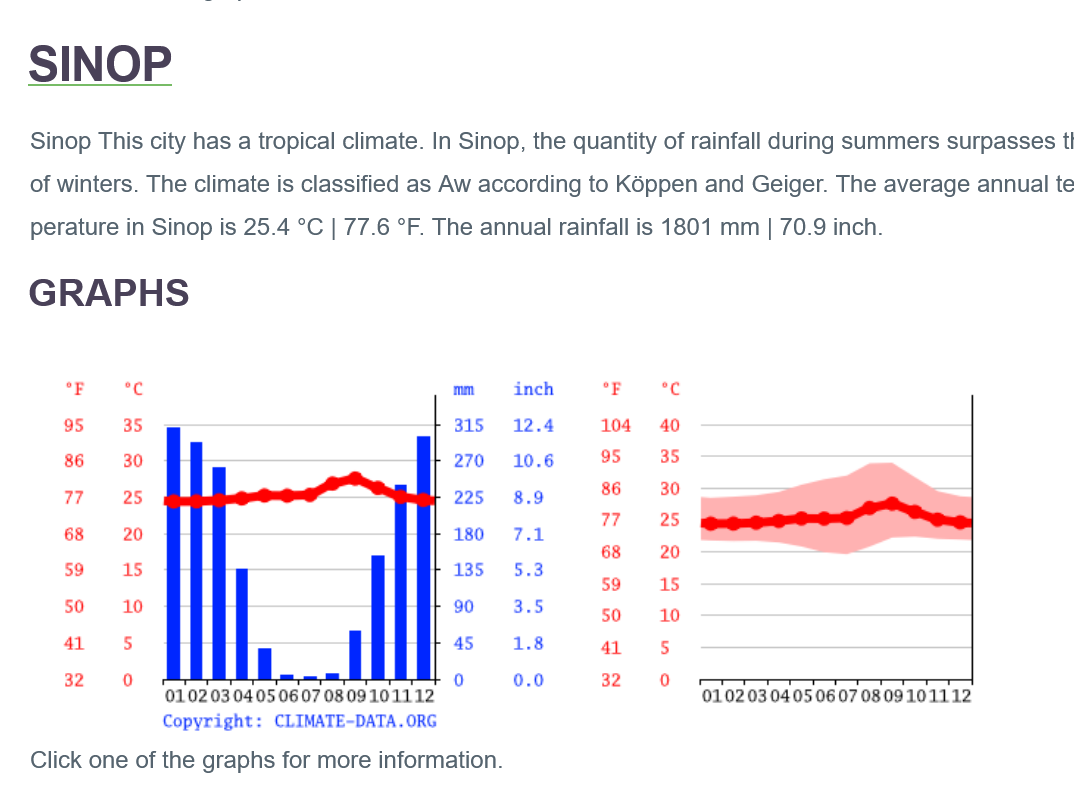

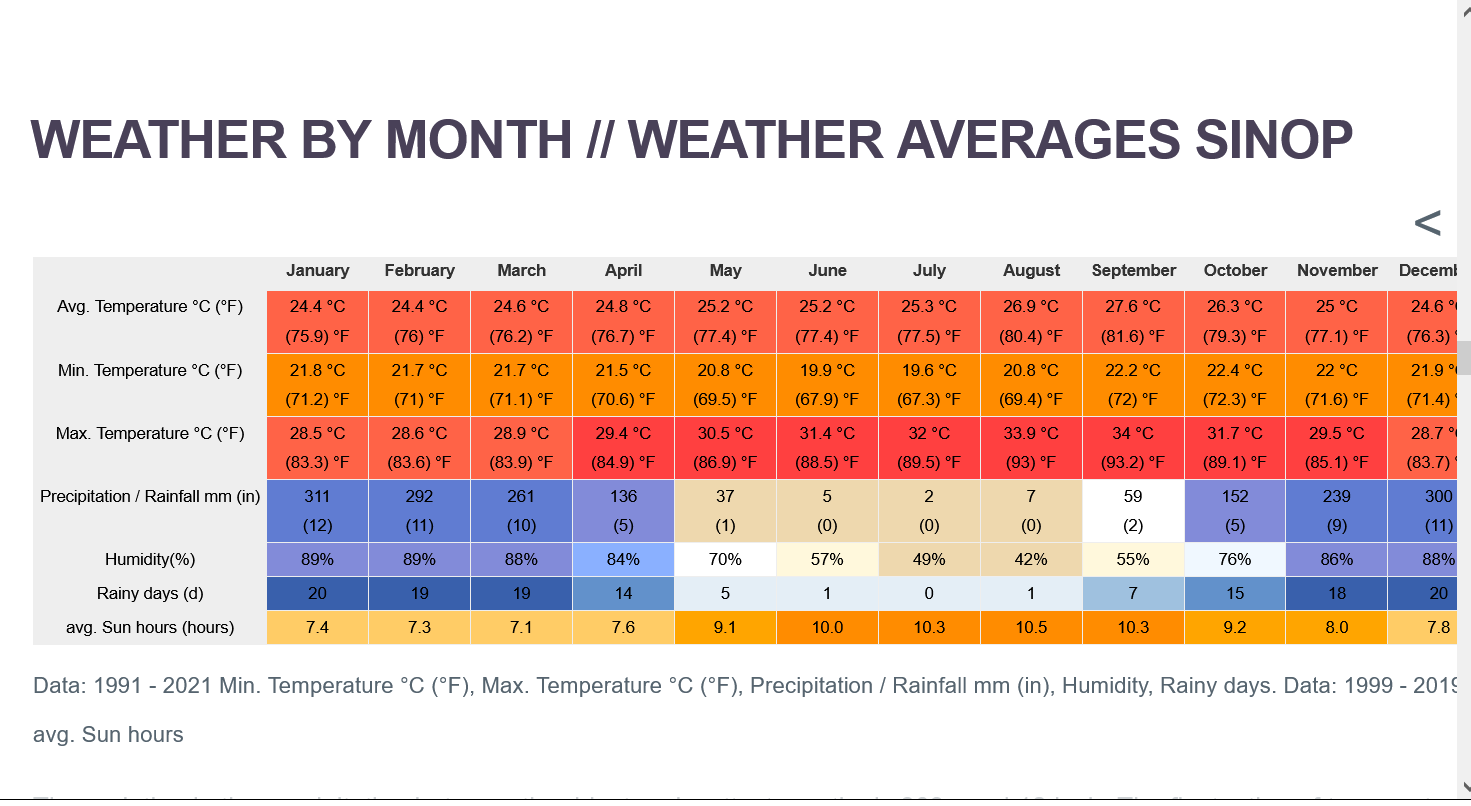

The biggest city that I could find in this area was Sinop which just inside the northern periphery of the soybean belt in northcentral MG.

This area has a tropical climate with warm temperatures all year.

They see bone dry Winters and wet Summers. Keep in mind that the soils in Brazil don't hold moisture as well as our soils, so they need almost double the rain that we do in their growing season in a place like this with a tropical climate.

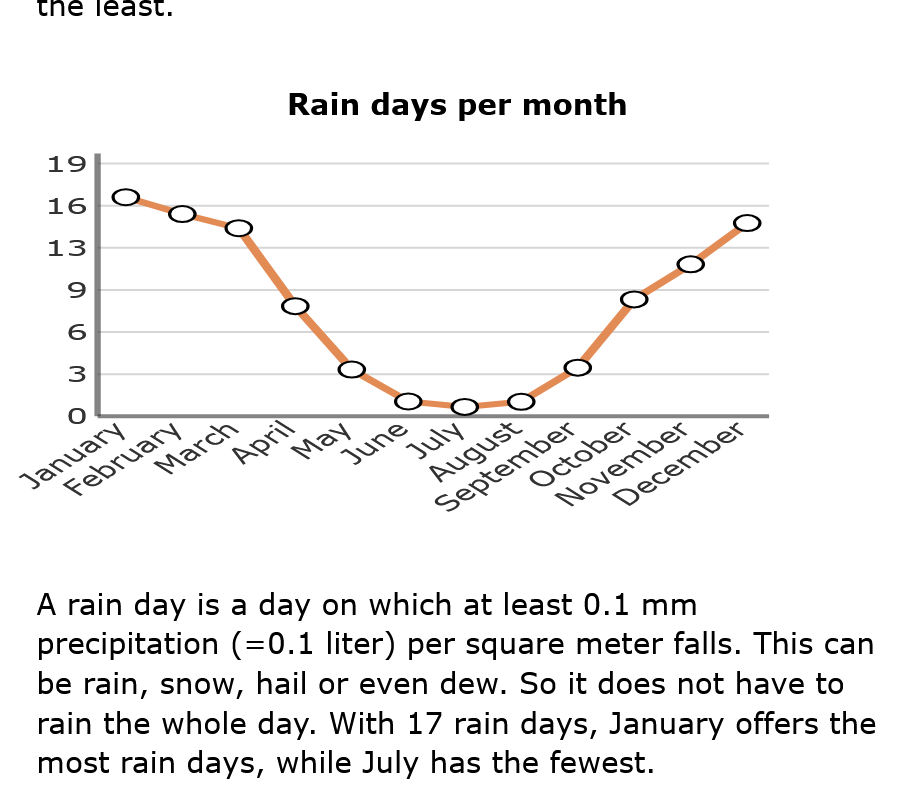

The average rainfall ramps up like this:

August near 0.

September 2+ inches.

October 5+ inches

November 9 inches! That's 2 inches/week. 18 days with rain

December 11.5 inches! That's 2.5 inches/week. 20 days with rain.

January 12.4 inches! That's 3 inches/week.

February 11.5 inches! That's 2.5 inches/week.

https://en.climate-data.org/south-america/brazil/mato-grosso-168/

https://en.climate-data.org/south-america/brazil/mato-grosso/sinop-4077/

++++++++++++++

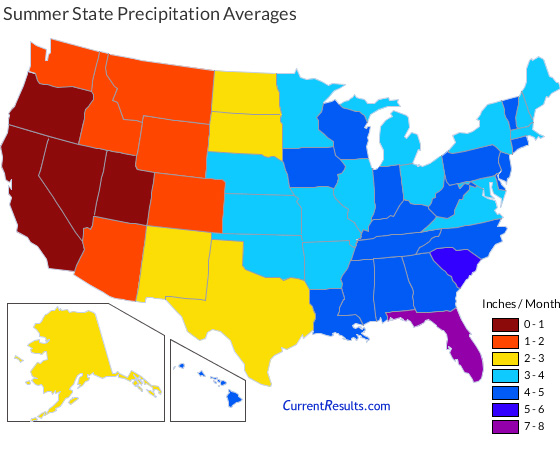

How does that compare to our Cornbelt during out growing season?

Mato Grosso gets almost 3 times the rain that we do in their key growing season Dec-Jan-Feb!

https://www.currentresults.com/Weather/US/average-state-precipitation-in-summer.php

Great info mike!!!! Thanks

Do you have a link directly to the speculative positions?

Thanks, cutworm,

I copied the one I got it from which was just obtained from googling soybeans COT.

I haven't been following the COT for many years and only did so recently to add additional insight here for us to understand why the beans are trading the way they are.

https://www.investing.com/economic-calendar/cftc-soybeans-speculative-positions-1811

++++++++++++

Here's the main page for the COT information:

https://www.cftc.gov/MarketReports/CommitmentsofTraders/index.htm

MetMike and Others

Is Helen and her extended movement into large area , say Tn, KY, and east, going to be very disruptive to beans?

I believe Thursday a significant UP

Great to read you, tjc,

My thinking is almost no impact.

it will cause some slight harvest delays in minor production areas without much loss to the crop in those spots.

I’m thinking the market is focusing on Brazil weather now.

If rains didn’t materialize for over a month in central Brazil we would have a lot of potential upside. That has happened before but it probably would just mean the crop in those spots is planted late.

plenty of time for the usual pattern change to monsoonal rains kicking in, which often shows up in October.

In the background is still the cuts in,production coming on future USDA reports because of the flash drought during late pod fill.

When the late beans are harvested, reports of much lower than expected yields are also something that will hit before the USDA makes the adjustments.

The smart money has known this for a month when the flash drought was in its infancy and was buying early.

Still no substantial rain the next 2 weeks from this last 6z GEFS rain forecast for Mato Grosso in Central South America.

No change on the last 2 runs.

Any update on Brazil for sx, cz, sbh, kcz?

yes big report out tomorrow, good weather for the week, lots of old crop corn came in making this harvest a trick to get out of the field, so corn dn 2 and beans down 9 now

Rains are starting to increase a bit for Central Brazil on the extended forecasts. Here's some forecasts, starting with last Friday(which was similar to the other days last week-not much rain) in order to compare this week's runs too.

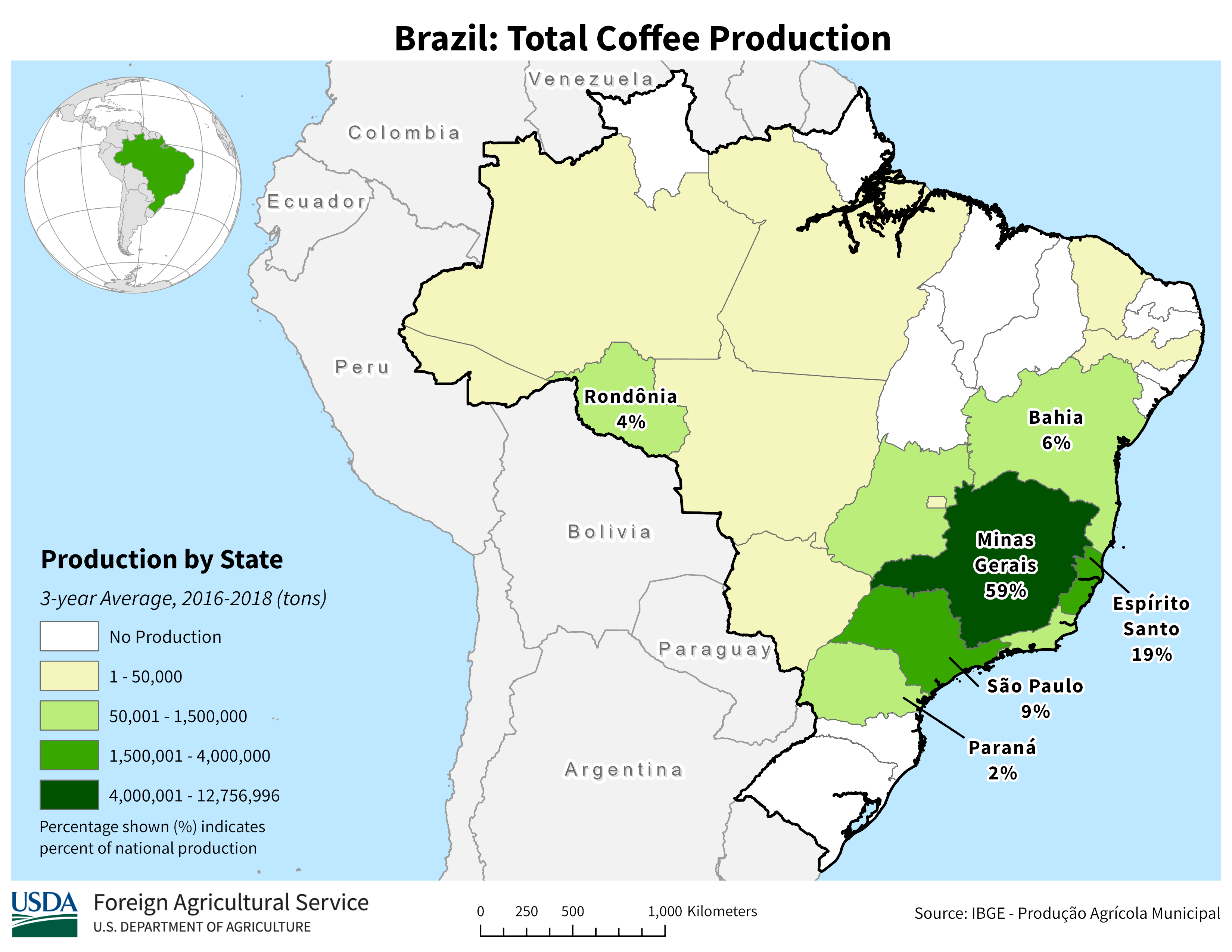

USE THESE MAPS FOR THE COFFEE FORECAST TOO.

https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/Brazil/Municipality/Brazil_Total_Coffee.png

This is where #1 SOYBEAN producing Mato Grosso is located:

6z Friday: Not much rain

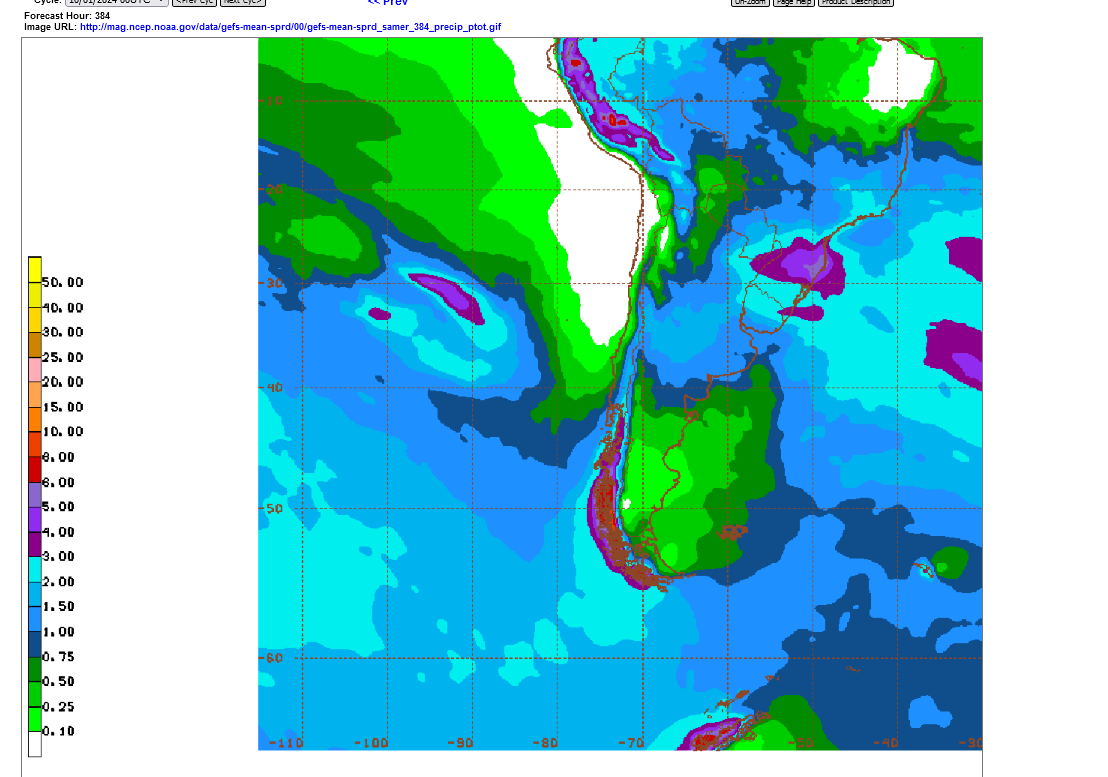

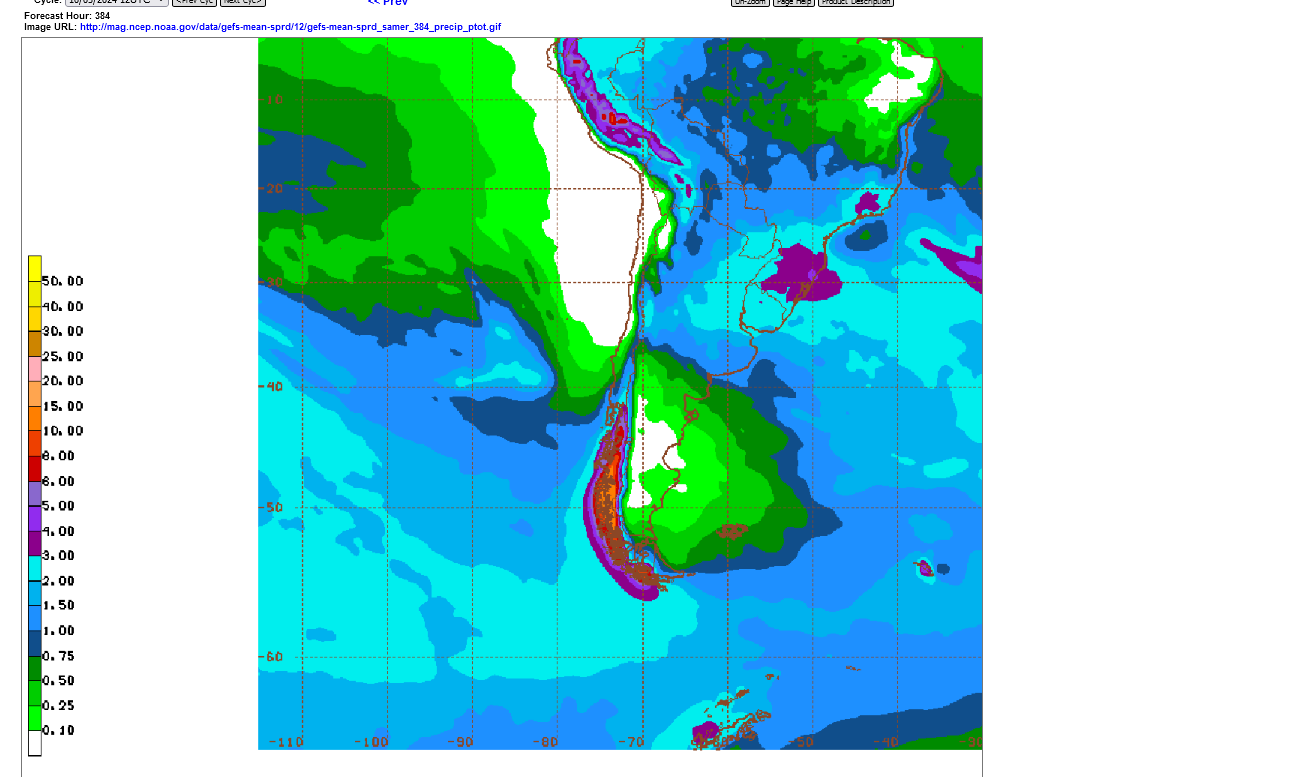

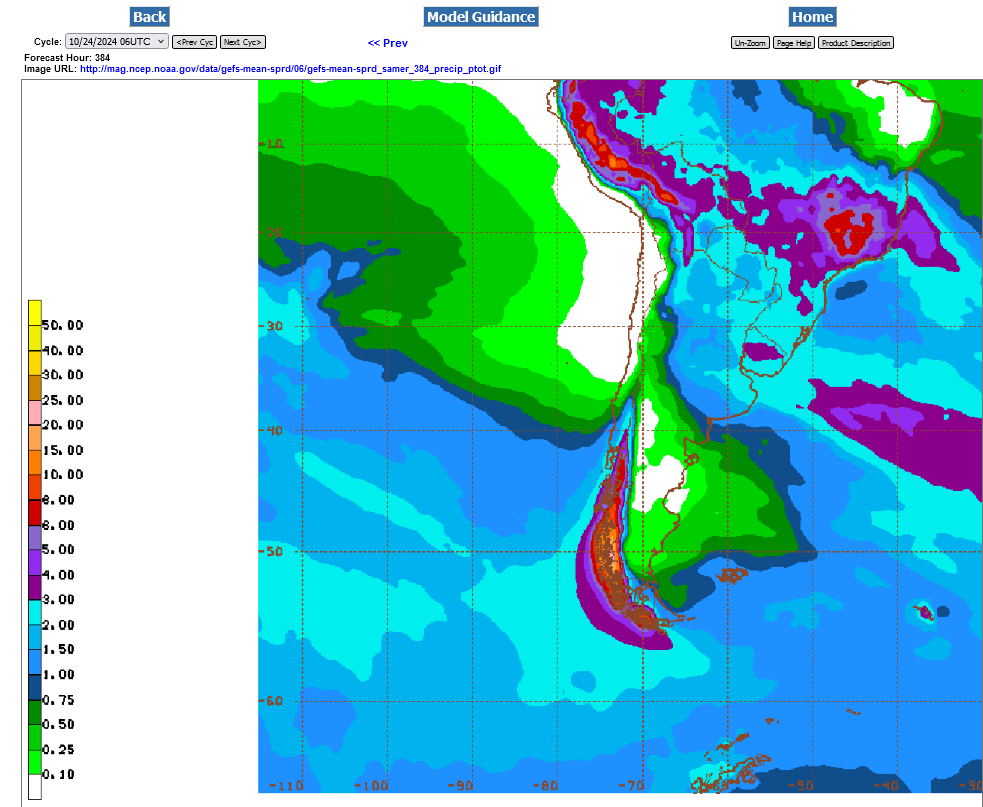

6z Monday: SOME rains starting to close the dry gap.

12z Monday: A bit more rain. Increasing indication of the wet monsoon kicking in by mid October

18z Monday: A tad more rain

0z Tuesday: A bit more rain.......beans under pressure/selling

6z Tuesday: A bit less rain.......beans getting support/buying

12z Tuesday: Continued with a bit less rain: Bullish

6z Wednesday: ADDED RAINS for #1 producing Mato Grosso: Bearish(previous 0z and 18z runs were also a bit wetter (but the market ignored it until around 5am, when this run was coming out, the last one before the day session). 1"+ band now covers a big chunk of Mato Grosso. Still no enough rain but an increasing trend!

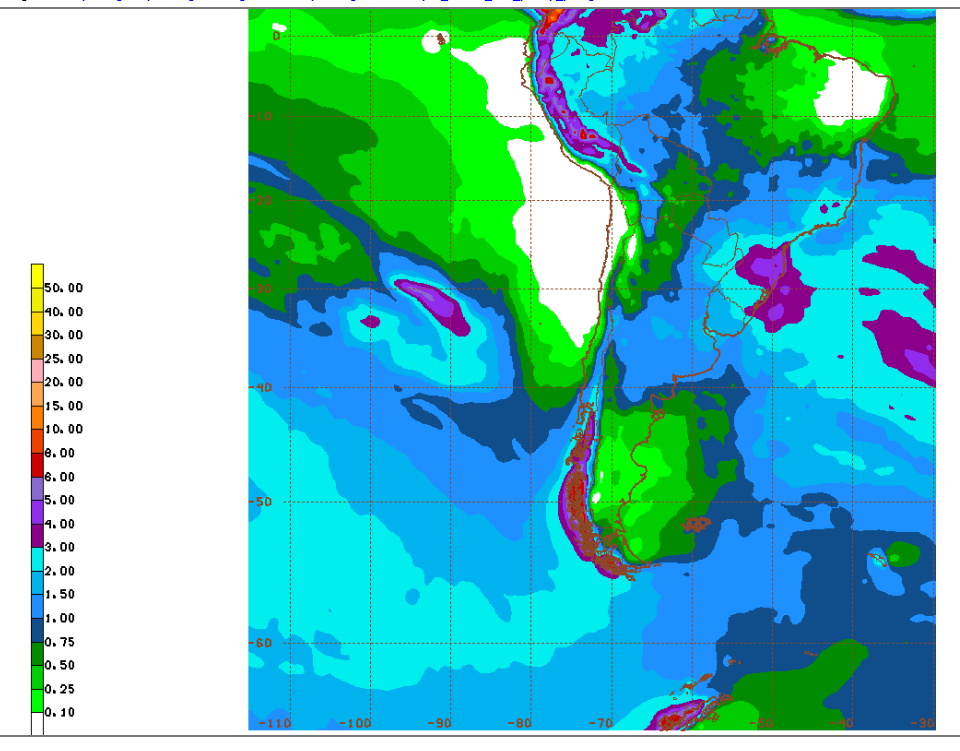

The 12z GEFS(mid day run Thursday) took out some rain and beans spiked to + on the day after being over 10c lower. They fell back during the rest of the session with the market realizing its just 1 solution on 1 model. The next, 18z run put the rain back in but still not enough.

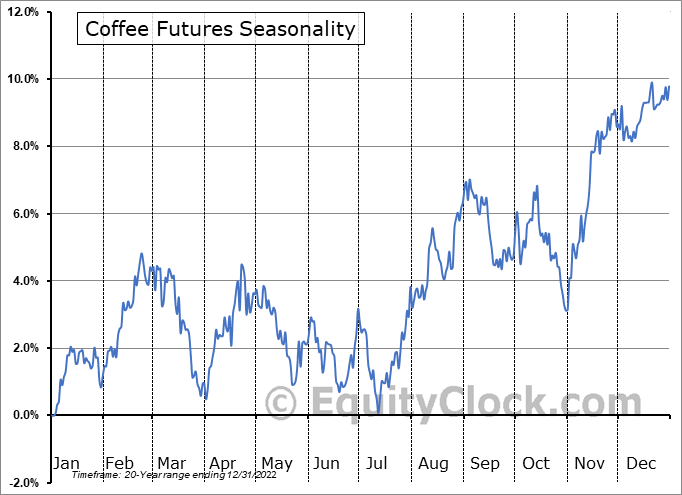

2 week rains have increased nicely this week for the southeastern parts of COFFEE COUNTRY, with 2-3+ inches. Last week, 2 week rains were UNDER 2 inches everywhere. STILL NOT ENOUGH!

Last 6z Fri GEFS for South America: A bit more rain for Central Brazil but still far short of whats needed. Coffee is +5c and getting impatient for rains to expand northward. And coffee had dropped 20c already earlier this week just from increased rains in the southeast coffee growing region.

Coffee needs robust rains in October to trigger the flowering on plants after the 6+ month long dry season.

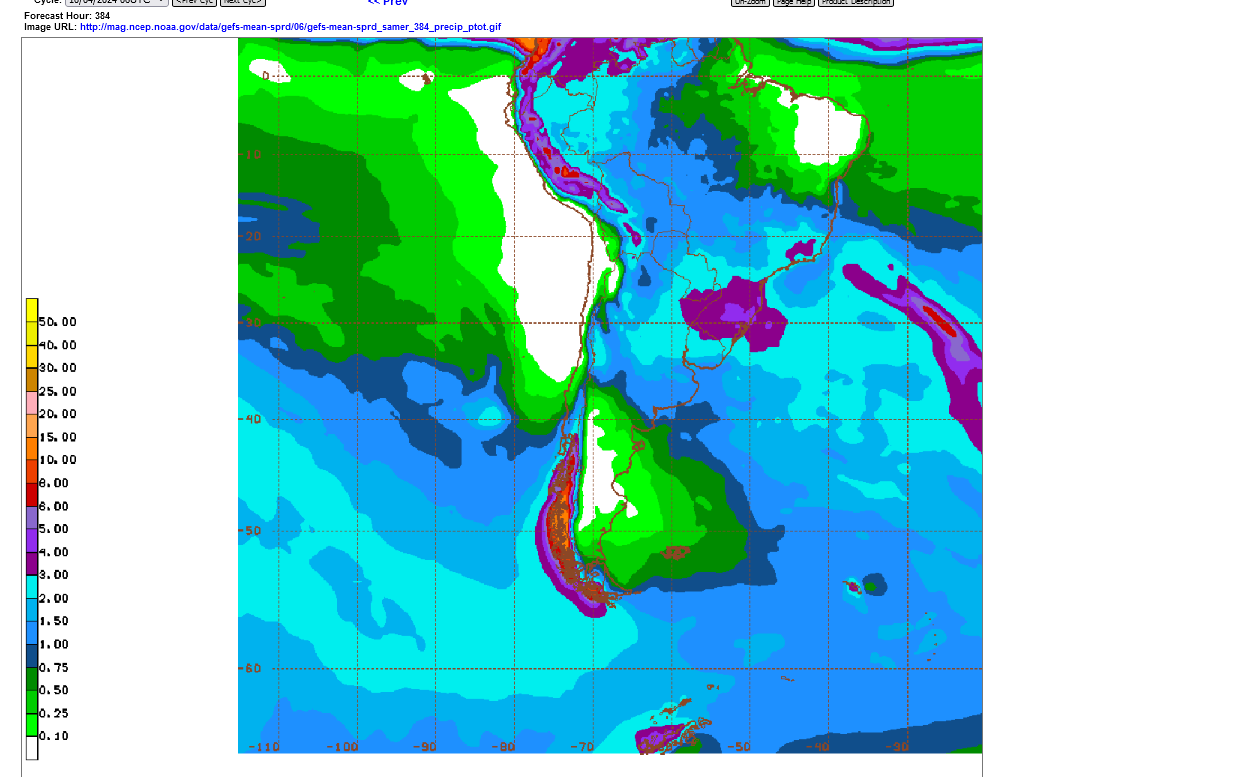

Latest 6z GEFS model on Saturday below: Increase in rains in Mato Grosso/beans. BIG increase/expansion northward for coffee country. A bit too much rain in far S. Brazil?

12z Saturday GEFS below. 2 inch band showing up in Mato Grosso:

12z Sunday below. Rains slowly increasing but still have a ways to go, especially the northern parts of the key growing areas for beans and coffee that we've identified on the maps at the top of this post.

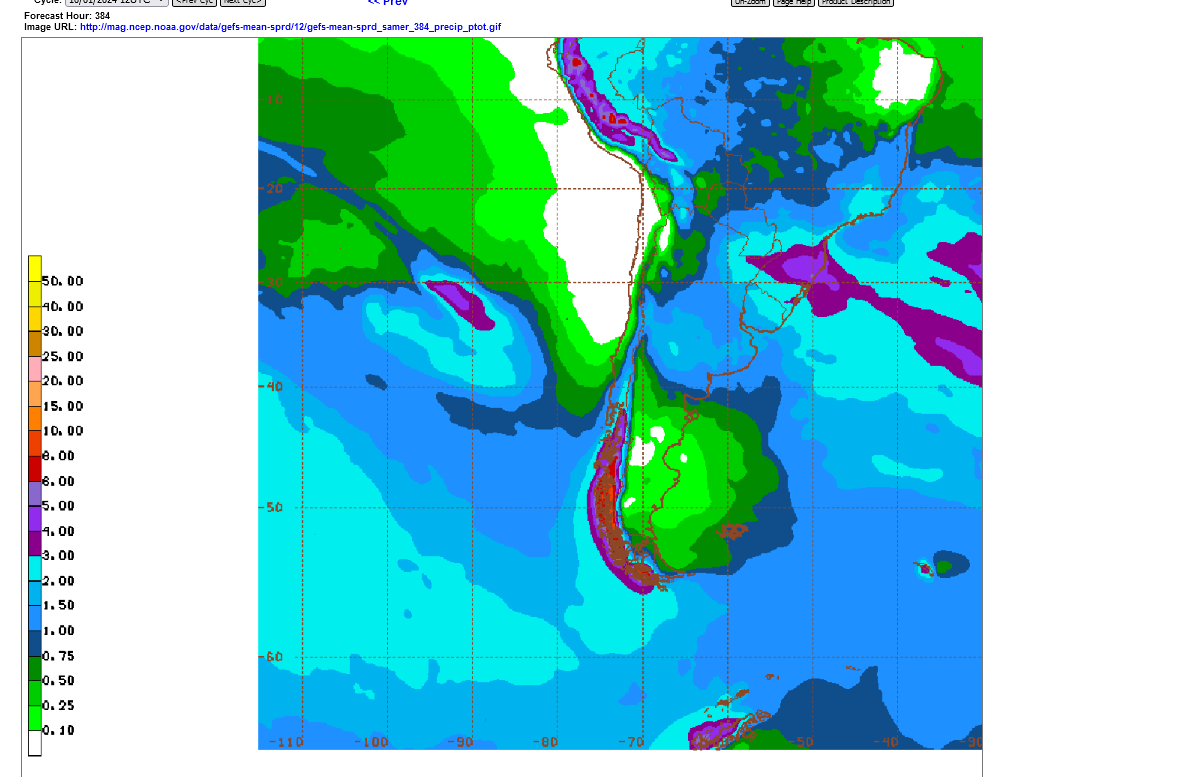

I forgot to add the update earlier but now have the 12z Monday 2 week rains below:

This gets us out thru October 23rd. Still plenty of time for the wet monsoon season to get started in Central Brazil but the light blue 2+ rain band should be covering up ALL OF Mato Grosso, right now not just the southeast corner.

There is at least 1 inch of rain, however which may be enough to moisten the very porous soils (compared to ours) to get the seeds germinated But they need much more than that.

Coffee prices collapsed lower today. The amount of rains there are slightly more than last Friday. Coffee prices have been near historic highs recently.

18z Tuesday: I was surprised that beans sold off so much today, considering that rains for Mato Grosso are having a hard time picking up. Rains the next 2 weeks are mostly around 1-1.5" Average October rains should be 5"+ so this around half the average rain. There's still time. However if this is the same forecast in 2 weeks, I'll be shocked if beans are not XXc higher.

6Z Wednesday: For sure an uptick in rains in Mato Grosso on this last model run. This caused beans to sell off 10c after 6am, when it came out but we've recovered much of that. More rains for coffee-land too for flowering but the northern areas still miss out.

18z Wed: Slow increase in rains for Central Brazil

6Z Friday: Gradual uptick in rains for Central Brazil continues. Now getting pretty robust. I'm guessing the price collapse earlier this month was partly on week 3 predictions for this. This model only goes out 16 days. This indicates a pattern change with the seasonal wet monsoon kicking in before the end of the month.

USDA

Started by metmike - Sept. 30, 2024, 12:06 p.m.

Harvest of U.S. #corn and #soybeans is ahead of the five-year average pace, but farmers chose to go harder on soybeans versus corn last week than analysts predicted. Progress should be strong this week with warm and dry conditions across the entire Corn Belt.

The flash drought caused producers to get beans out of the field quickly because drying out too much will cause yields losses for beans(pod shattering). These were the earlier planted beans that will have the highest yields. The later planted beans had more pod filling during the flash drought. Yields WILL drop in the 2nd half of the bean harvest.

Complete report:

I'm updating the forecast on this 1 page to make it easier to compare the changes over time:

After having a bit less rain on Tuesday's mid day maps, models overnight added rain to the Central Brazil forecast.

Coffee needs robust rains to trigger flowering after the 6+ month of dry weather and plants going dormant.

October is the best month to do that! The approach of flowering rains and then occurring, often sees coffee prices dropping in Sept/Oct. Lack of them in October can result in a contra seasonal move up.

Minas Gerais weather counts the most!

https://charts.equityclock.com/coffee-futures-kc-seasonal-chart

https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/Brazil/Municipality/Brazil_Total_Coffee.png

++++++++++++

The updated models being shown are only for the GEFS model going out 384 hours(16 days). These maps show all of South America's soybean and corn weather as well as all the weather for coffee, grown only in Brazil.

Continuing to update the GEFS rain forecast, with rains slowly increasing in the 2 week forecast but still a ways to go, ON THIS MODEL FOR THIS TIME FRAME.

I'm currently not following the weeks 3-4 forecast for South America but if it turns wet or dry, the market, being especially sensitive to weather forecasts at the start of the wet monsoon could move sharply from those forecasts.

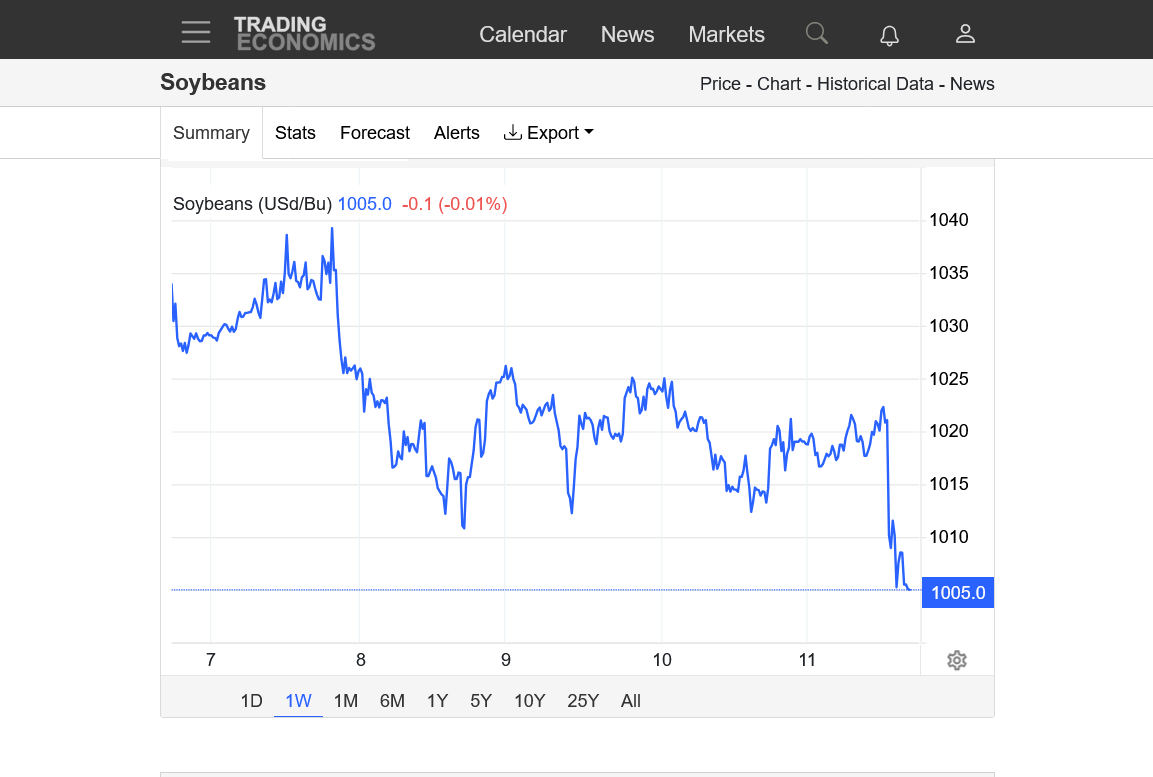

Beans gapped lower on the open this evening. Gap lower on the daily and weekly charts.

Downside breakaway gap formation and potentially very bearish. Possibly on expectations for rains to spread into Brazils biggest soybean production areas in Central Brazil later this month.(I think we have a ways to go before calling this a weather pattern that turns the wet monsoon spicket on).

The source below does NOT show gaps as they connect all price bars, even with gaps. Looks like the high this evening was 933.5 and the low Fri/last week was 936. Trading above 936 would not just negate the downside breakaway gap, it would be a "gap and crap" signature which is bullish.

https://tradingeconomics.com/commodity/soybeans

1. 1 week

2. 1 month

3. 5 years

4. 50 years

Previous, detailed technical analysis for soybeans:

The main change is this downward reversal and gap lower.

By metmike - Sept. 22, 2024, 8:41 p.m.

U.S. farmers focused harvest efforts on #soybeans more than #corn last week - to a larger degree than the trade expected. 47% of beans were harvested as of Sunday, well above the recent average. Winter #wheat planting has reached the halfway point.

metmike: The flash drought is drying beans extremely quickly and there will be yield losses, including pod shattering and lower weights if they leave in the field too long. Corn requires much more drying in the field.

Winter wheat planting has slowed down. Lack of a rain will result in weak stands going into dormancy and more vulnerability to Winter Kill this Winter.

Here's the complete report:

Forecast continuing to be updated:

USDA forecast at 11am

ADDED: The market sold off after this mostly bearish report:

USDA October 11, 2024

Started by metmike - Oct. 11, 2024, 11:31 a.m.

I'm moving the last 6z GEFS forecast down here to the last post because it doesn't need to be compared to previous forecasts anymore to judge changes in rain amounts.

It clearly shows the wet season monsoon kicking in for Central Brazil later this month. This is good for coffee plant flowering and for increasing soil moisture in Mato Grosso for soybean planting/germination/establishment(which is behind-waiting for these rains)

Previous page with rains going back 2+ weeks:

https://www.marketforum.com/forum/topic/106950/#107748

Good stuff. Thanks Mike.

YW, Jim!

The latest 12z GEFS shows MASSIVE rains in Central Brazil for both Mato Grosso and Coffee Country.

The S and Coffee were selling off big time earlier this month and I will guess that it was from week 3 forecasts that carried this huge pattern change that turns the wet monsoon season spicket wide open.

If beans had been going up on dryness, this would be a high confidence, aggressive short from the pattern change on the open tonight. But beans have already dropped 65c from their spike high on September 30. Still the weather is Brazil is now BEARISH!

I'm still convinced we lost a couple of bushels off the crop between early August and mid September from the widespread flash drought.

https://tradingeconomics.com/commodity/soybeans

1. 1 week-USDA report crash lower on Friday

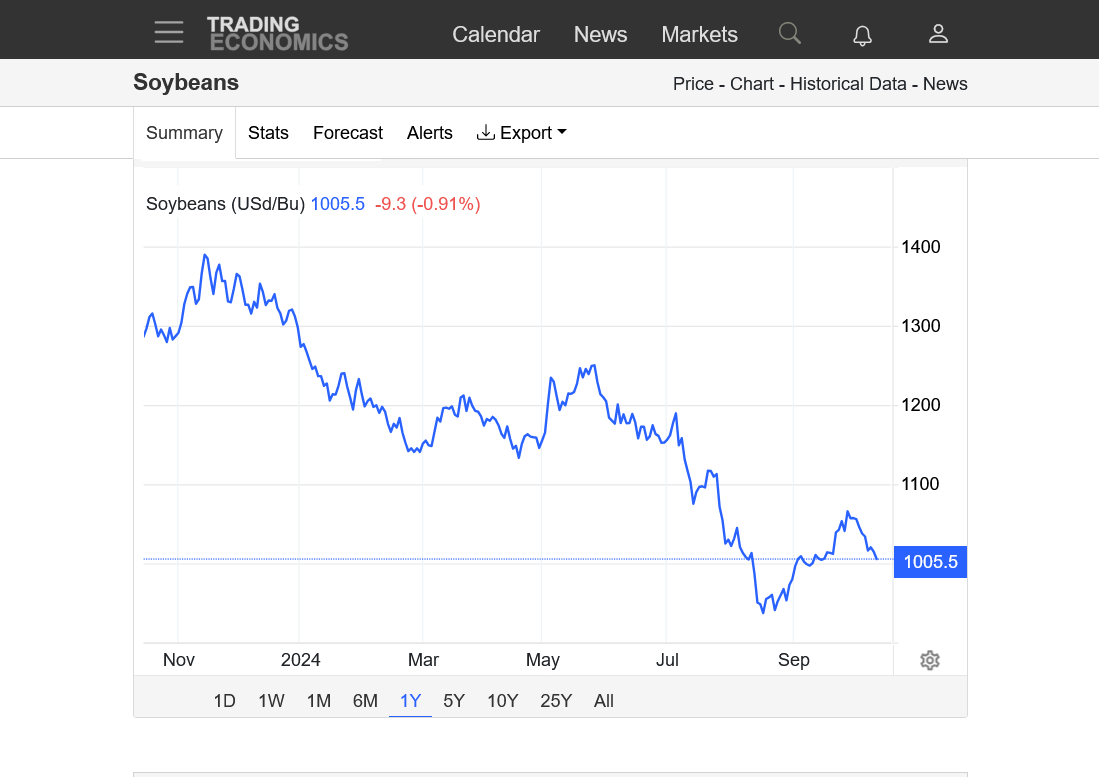

2. 1 month-end of Sept high 1079.

3. 1 year- August 16, flash drought low 935. still in a downtrend, was this a bear flag??

4. 5 years-May 2022 high at 1730.........downtrend since then

5. 46 years-Summer 2012 drought, all time spike high ~1760!

Beans opened with a small gap lower on the daily chart and also the weekly chart. Probably from the increase in rains for Mato Grosso over the weekend.

The signature is a potential downside breakaway gap. If filled, it becomes a potential gap and crap selling exhaustion formation without great significance here. I'm not predicting anything.

Beans sold off on Monday and that continues this evening. South American weather is BEARISH!

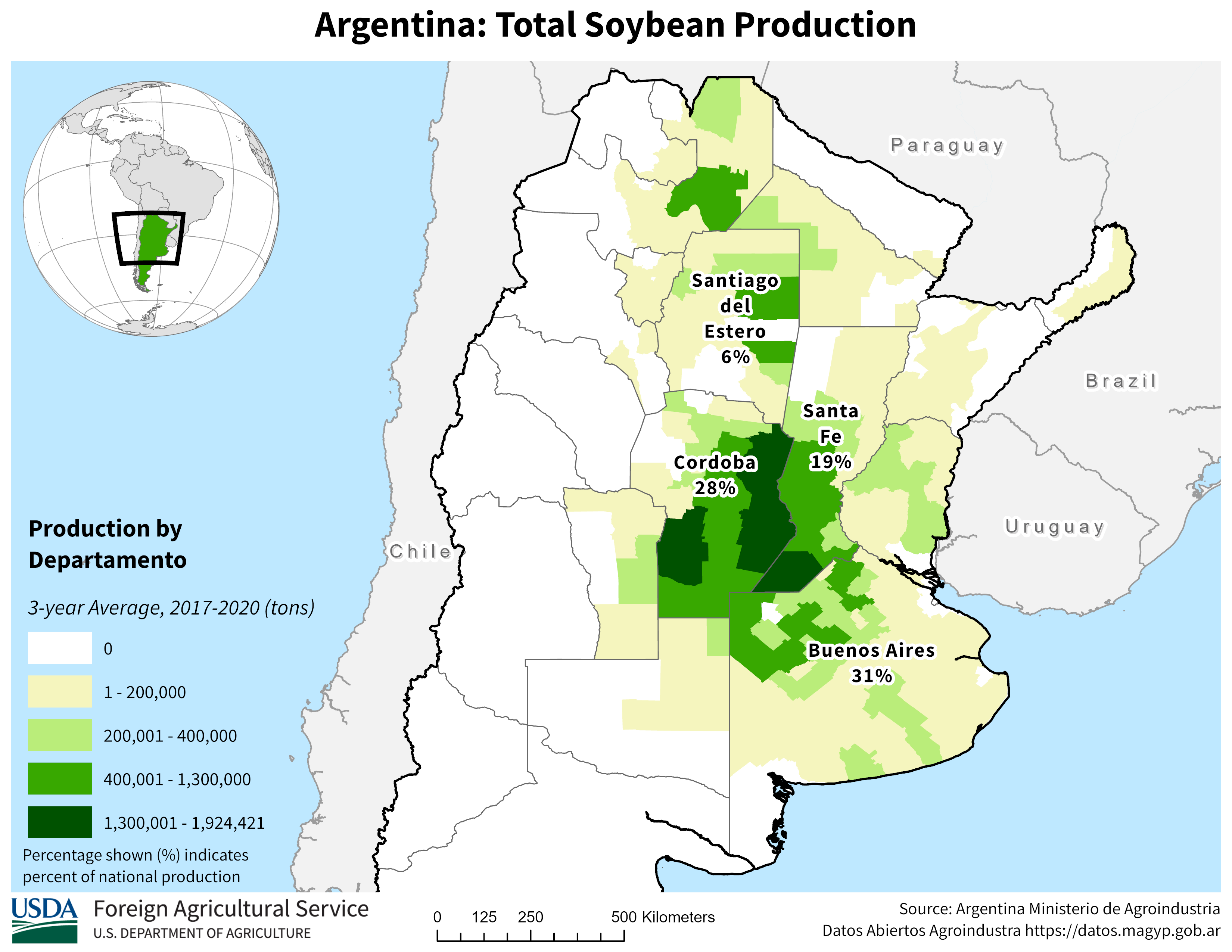

This is why that much wetter weather in #1 producer, Mato Grosso is BEARISH!

#Brazil's #soybeans were 8.2% planted as of Thursday, below last year's 17% and the slowest pace for the date in four years. Efforts are still lagging in Mato Grosso where more rains are needed.

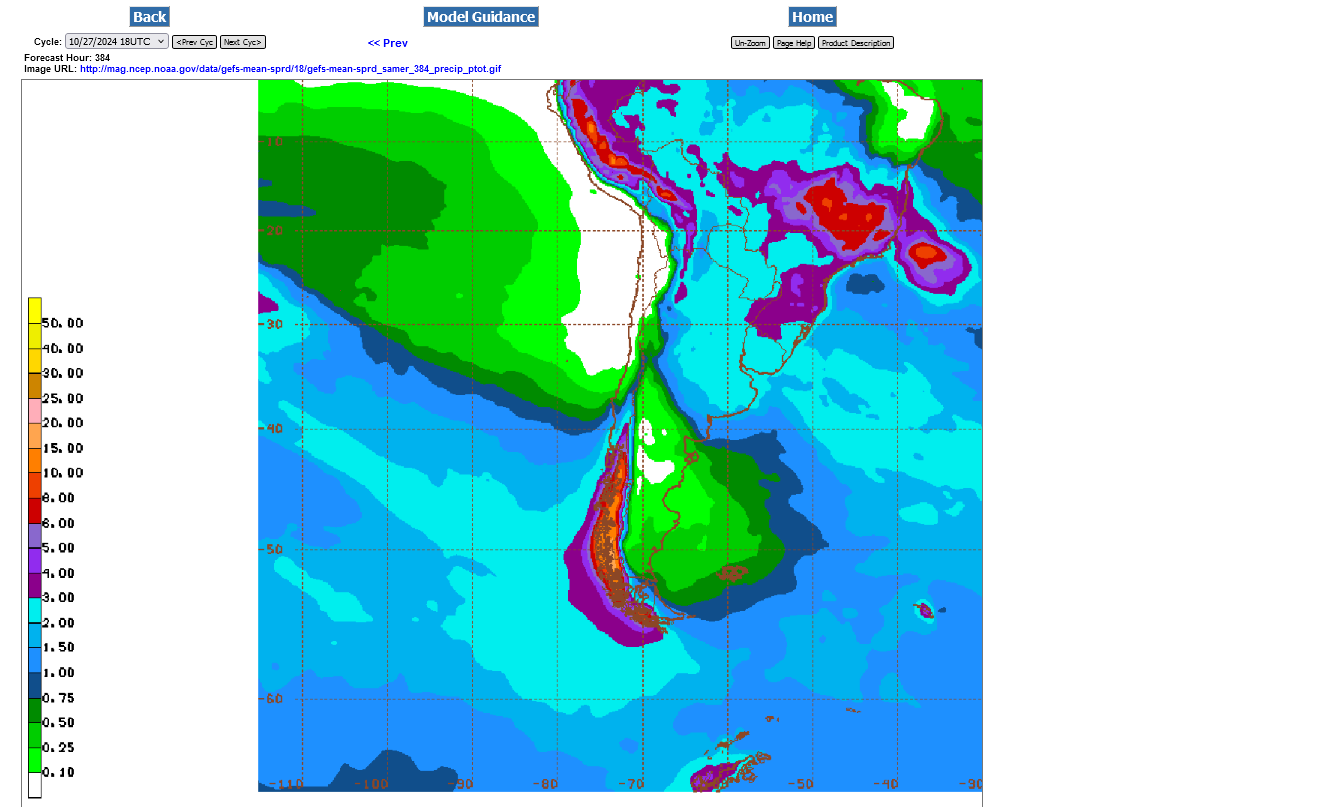

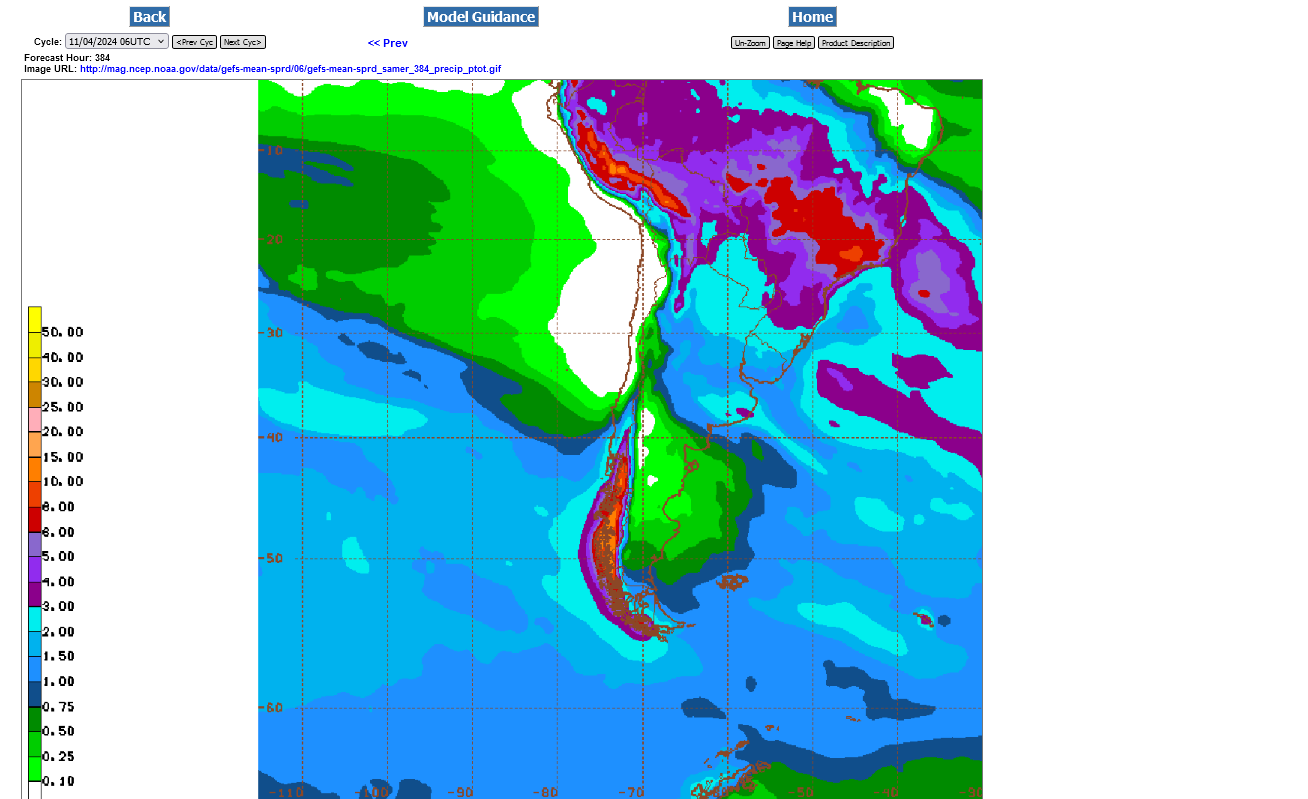

Big rains everywhere is Brazil on this last 6z GEFS going out 384 hours total....the rest of October.

#China imported 11.37 million tonnes (418 mln bu) of #soybeans in September, up 59% from a year ago and easily record-high for the month. That follows August's all-time monthly record. Jan-Sept. imports are up 8% over the same period a year ago, which was record at the time.

9am Tuesday

USDA confirms the following U.S. export sales for delivery in 2024/25:

131,000 tonnes of #soybeans to China

120,000 tonnes of soft red winter #wheat to Mexico

Rains have shifted south so the northern parts of Mato Grosso are not as wet. Shifting another 500 miles south would turn extremely bullish.

Good rains still for Mato Grosso.......but need to watch the far north. Good rains for dry areas of Argentina. Maybe too dry for far southeast sector.

After covering shorts in Sept/early Oct, funds have been back to selling again, putting pressure on prices recently.

https://www.investing.com/economic-calendar/cftc-soybeans-speculative-positions-1811

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Oct 25, 2024 | 15:30 | -65.4K | |||

| Oct 18, 2024 | 15:30 | -65.4K | -51.2K | ||

| Oct 11, 2024 | 15:30 | -51.2K | -73.7K | ||

| Oct 04, 2024 | 15:30 | -73.7K | -93.4K | ||

| Sep 27, 2024 | 15:30 | -93.4K | -134.6K | ||

| Sep 20, 2024 | 15:30 | -134.6K | -144.2K |

https://tradingeconomics.com/commodity/soybeans

1. 1 year-will we test the Sept lows? I think the flash drought late in pod filling hurt more than the USDA thinks.

2. 10 year-still in a very steep downtrend from record production thanks to climate change and higher CO2 levels/photosynthesis but approaching strong support.

3. We can't keep dropping like this much longer? Potential support areas ahead but South America's weather looks great right now EVERYWHERE!

Tons of rain almost everywhere they grow soybeans in Brazil and Argentina!!

Same for OJ(Sao Paulo) and Coffee(Minas Gerais).......except far Northeast 6-10% of coffee is still a bit dry.

This is the place that has the VAST majority of the world's OJ production:

Rains for far northern parts of Mato Grosso have dried up a bit on the last 6z GEFS, 2 week forecast below.

Not sure if that's why beans are modestly higher.

Is not Midwest, etc dry enough to cause concern?

2011then 2012 crop (or was it 2012/2013 )

Fall field work not being done waiting rain!

Thanks for bringing that up, tjc!

The C and S markets are not likely trading the 2025 growing season in October 2024.

For wheat, yes indeed as that crop is being planted and much of it in the ground.

We are following that closely here, with the latest actually being BEARISH because of the first chance of widespread, potentially significant rain in months coming in the week 2 part of the forecast:

https://www.marketforum.com/forum/topic/107127/

https://www.marketforum.com/forum/topic/107127/#108151

The super dry weather this Fall, likely is what accelerated bean harvest so fast. Leaving the beans in the field too long with this weather means moisture levels will drop TOO FAR. This can cause pod shattering and yield loss. Also, very low moisture will lower test weights and assign a lower yield/less value to the crop.

By metmike - Oct. 17, 2024, 4:15 p.m.

++++++++++++++

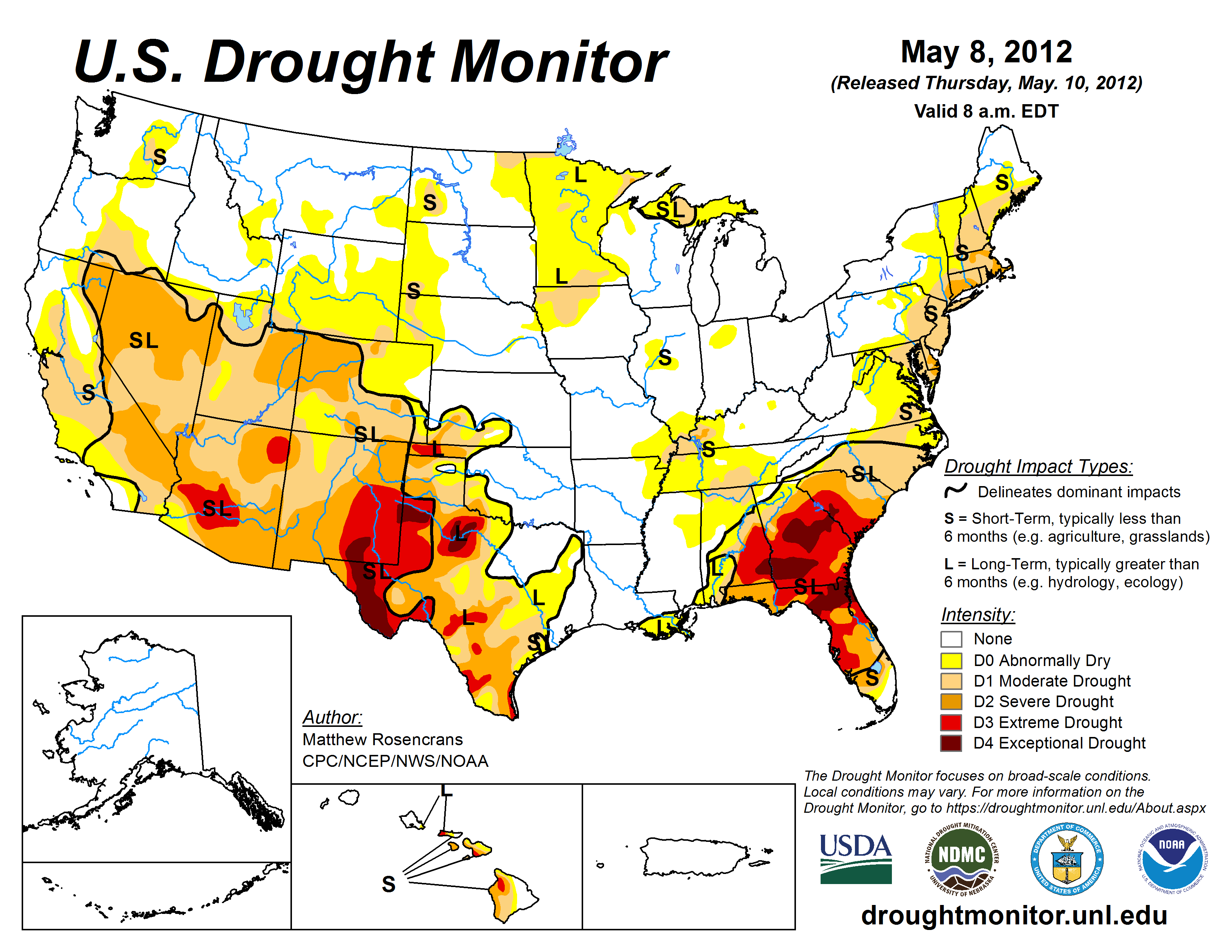

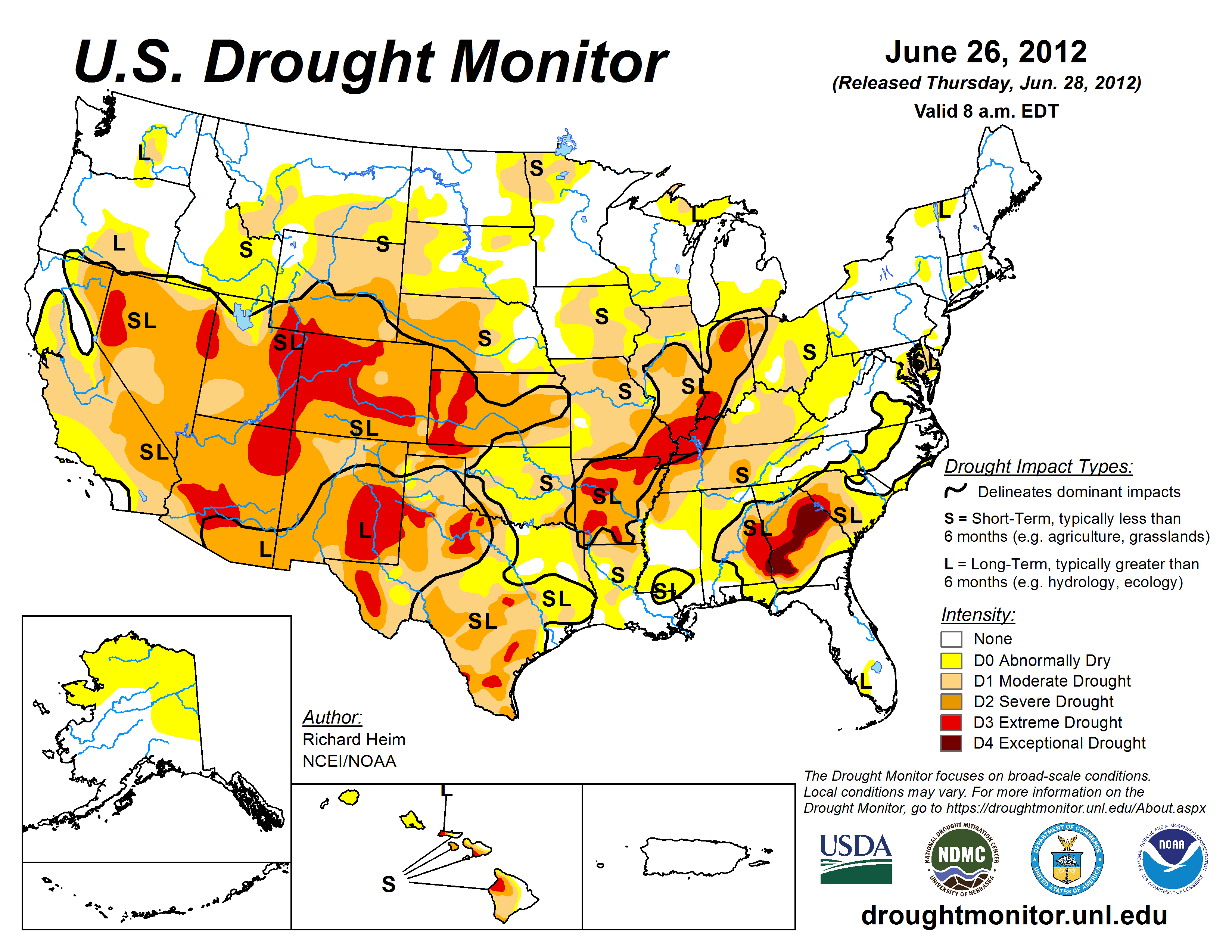

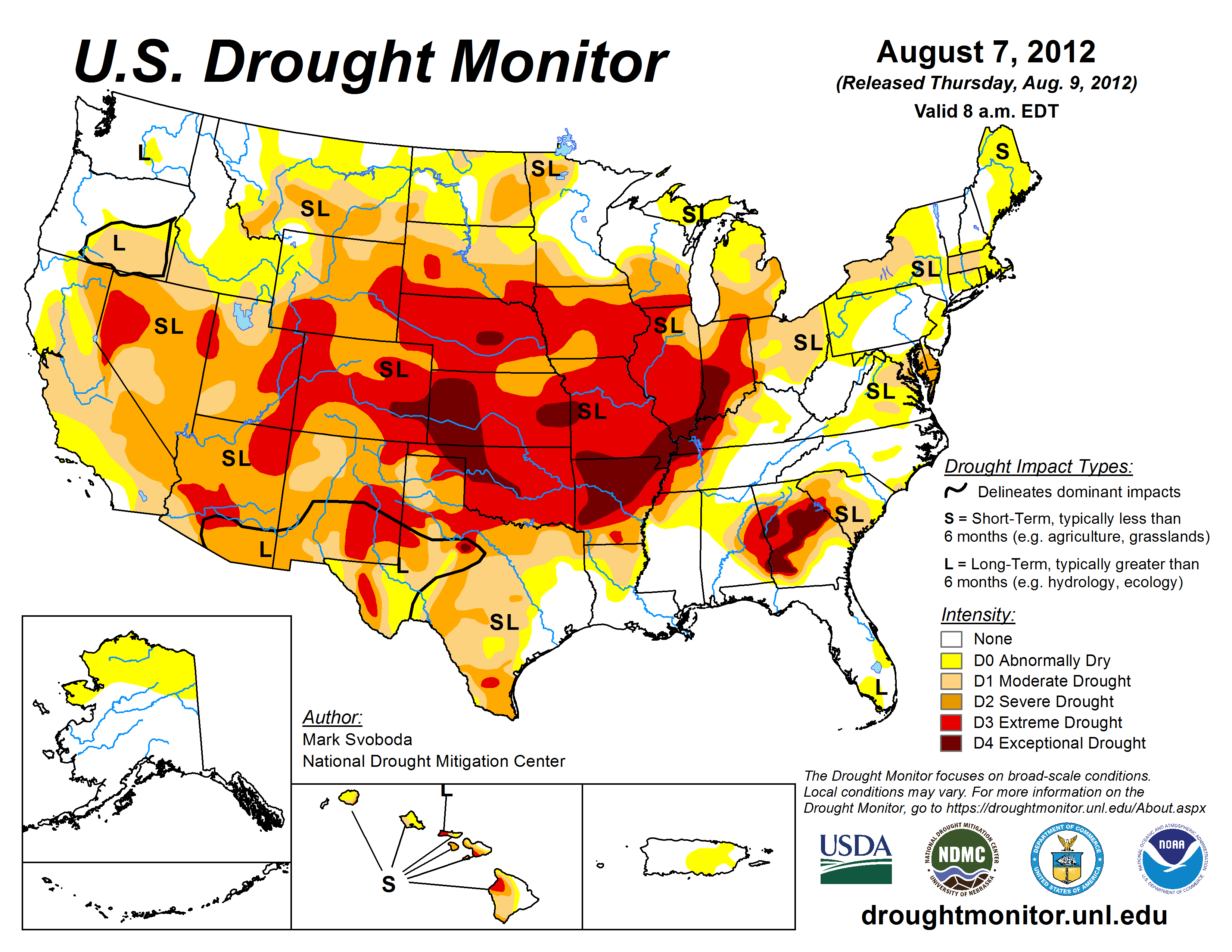

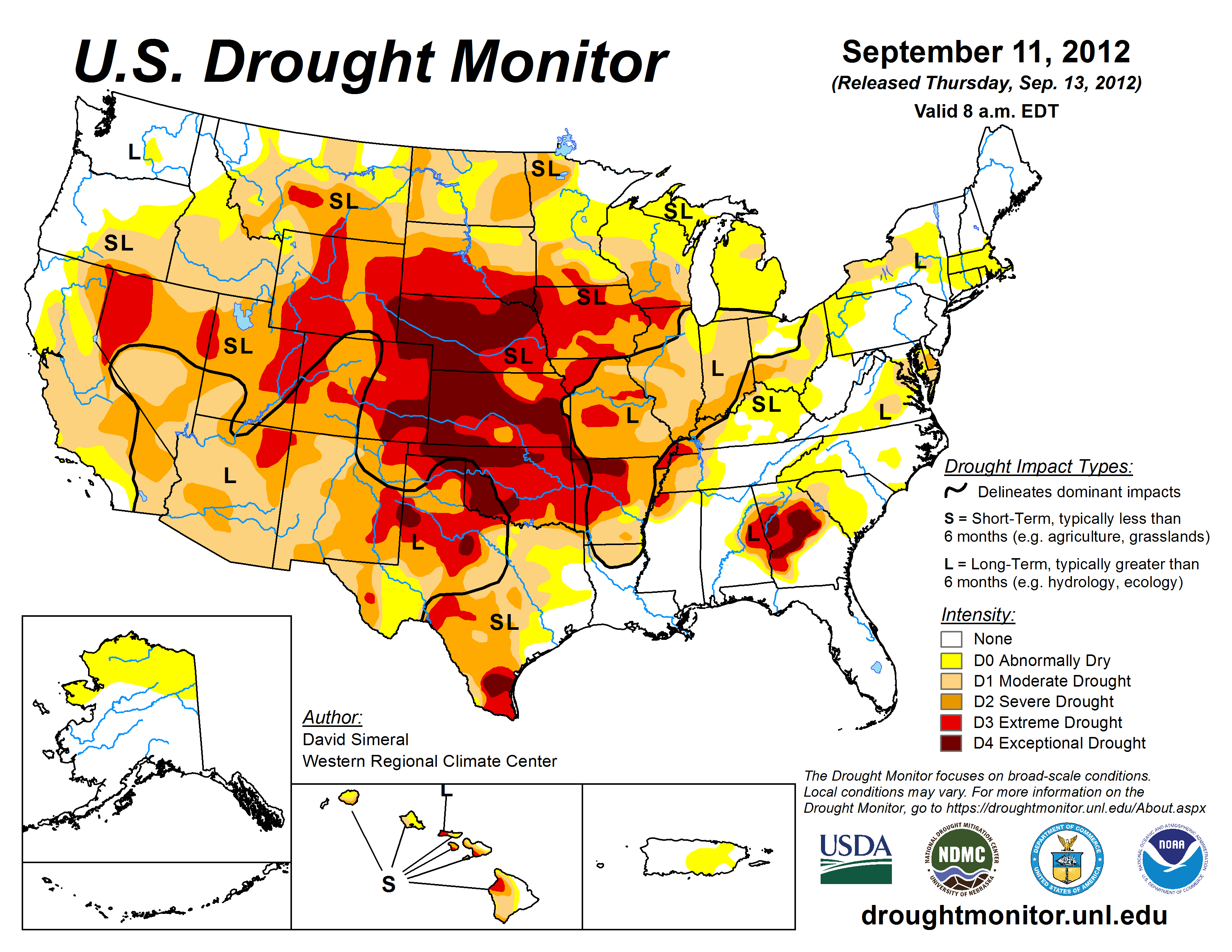

Also, you are right about 2011/2012 being the last widespread severe drought during the key parts of the growing season(June/July).

The drought was actually in the S.Plains in 2010/11 from a La Nina.

Didn't shift into the Midwest until the LATE Spring of 2012.

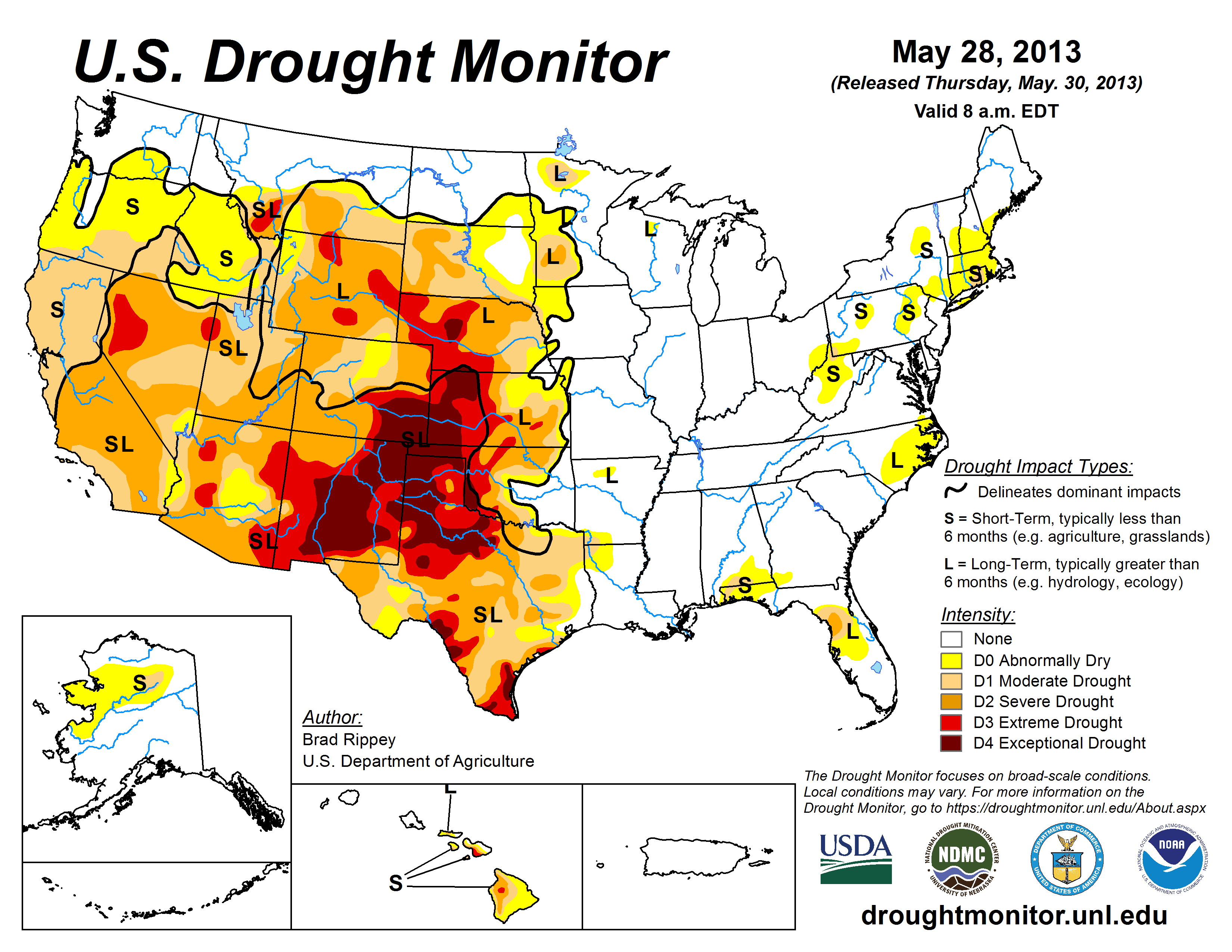

Then La Nina ended by late Summer 2012(borderline weak El Nino) and saved the bean crop in the Eastern Cornbelt with wonderful August rains. Beans that barely hung on thru July by going dormant.........suddenly flowered like crazy on very small plants and had perfect filling to salvage what was a disaster to the west.

Just for you, tjc! A review of 2011-2013 soil moisture. Thanks for bringing this up!

https://droughtmonitor.unl.edu/maps/maparchive.aspx

SEVERE Southern Plains drought in 2011!!!

2012 planting season off to a great start:

Still looking good in early May 2012

Then, extreme heat and very little rain hit and caused a widespread flash drought:

FLASH DROUGHT!!!!

Brutal heat and lack of rain thru July 2012

Rains came to the central and especially eastern Cornbelt in August which provided tremendous relief(for the beans to flower and fill pods on dinky plants that came out of a self preserving dormancy), though not able to completely recharge the entire DEEP soil moisture profile! This pattern change came as ENSO departed from its drought causing La Nina stage by late Summer.

Abundant rains eroded the drought after that and by Spring of 2013, most of the Midwest had the vertical moisture profile completely recharged.

That was NOT the case for the Plains, back to the West which did not experience much precip over the previous Winter as the El NIno sputtered and we saw ENSO NEUTRAL CONDITIONS.

Just a reminder: NONE OF THIS WAS CAUSED BY THE FAKE CLIMATE CRISIS!

Just a reminder: NONE OF THIS WAS CAUSED BY THE FAKE CLIMATE CRISIS!

In fact, climate change is helping to PROTECT THE CORNBELT from extreme droughts.

The last 35 years have featured the best weather/climate and growing conditions in the Midwest in recorded history by a massively wide margin. Before 2012, the previous widespread drought in the growing season was 1988.

Before that time and before the current climate optimum kicked in, the Midwest had been averaging 1 widespread severe drought every 8 years.

The 1930's were in extreme widespread drought for several years. Just that decade featured more crop killing extreme drought than the last 40 years combined.

It's absolutely because of the benefits from increasing CO2, along with the micro-climate created by humans planting tightly packed rows of corn, which result in a massive increase in transpiration and photosynthesis.

Higher levels of CO2 also make plants more drought tolerant because they don't need to open their stomata(underside of leaves) as wide to get CO2, which reduces moisture loss from roots.

More on the authentic science of the climate optimum and why:

https://www.marketforum.com/forum/topic/107639/#107641

https://www.marketforum.com/forum/topic/106670/#106845

https://www.marketforum.com/forum/topic/103492/#103553

https://www.marketforum.com/forum/topic/103492/#103554

Death by GREENING!

Started by metmike - May 11, 2021, 2:31 p.m.

We haven't seen a map/forecast this wet for the middle of the country in a very long time! Months??

Wheat gradually gave up every bit of its +10c early morning gains as the day went on!

Beans are trading South American weather and maybe lower yields coming in from the end of the pod filling 2024 season featuring a flash drought.

https://www.marketforum.com/forum/topic/83844/#83852

+++++++++++++++

Rains continue to get more skinny for northern Mato Grosso Brazil's #1 soy producer!

MetMike

Amazing POST! Drought maps AND first class analysis.

Is there an analogue year that had a dry Fall, Winter, and Spring? (Is the 'new' 14 map a drought buster?)

Thanks, tjc!

In this case, I am just using the La Nina analog, which also dominates the NWS long range outlooks. Fortunately, its looking more like a weak La Nina. As you know, La Ninas increase the chances for drought in the US. The tricky thing is that each La Nina induced drought is different. Some have hit the S.Plains, some in the Midwest, some in the South.

It probably boils down to exactly what the entire Pacific ocean temperature profile is just outside the La Nina region.

La Nina matters but the contrast between La Nina and surrounding Pacific water temps is a big deal too. I have not studied it enough to give my guess on where this one shakes out.

Regardless, I feel that the atmosphere has been in La Nina mode for several months now. The NOAA official La Nina signal only comes after their 3 month average indicator flashes La Nino. SO ITS A LAGGING INDICATOR that tells us La Nina was present, on average for the past 3 months. The atmosphere doesn't wait around until NOAA tells it how to behave.

Almost certainty this widespread FLASH drought we have was caused by La Nina response conditions in the atmosphere, responding to La Nina conditions in the key area of the tropical Pacific that was already experiencing negative temperature anomalies early in the Summer.

Here are all the long range forecasts from the NWS that were just updated 4 days ago. They are mostly based on the assumption of a La Nina this Winter that should fade to neutral next year, which is a good sign for the 2025 growing season. We NEVER want to have a La Nina during our growing season!

|

| OFFICIAL Forecasts |

https://www.cpc.ncep.noaa.gov/products/predictions/90day/

Here's the latest about the La Nina, just updated today:

Ahh, once again very thorough!

I must take exception to your statement "we never want a LA Nina drought". YES we Illinois, Indiana, and Ohio farmers do, so long as it is in Nebraska, Iowa and Minnesota!! AND, especially South America! Great for speculators also! Reduction of the grain reserves not a bad occurrence every 5/6 years.

Rain weakening?

Very funny, tjc.

I used to do some speaking engagements for local farmers and have a few at our church that joked the same way.

Every Spring they would say: "Hey Mike, can you bring us a drought this year? Just aim it at Iowa, not us

Droughts do indeed provide better weather trading opportunities because of wider trading ranges, higher prices and greater sensitivity to weather forecasts.

My first 10 years trading, a couple of my huge losses were from being long out the wazoo over a weekend when the Friday forecast was intense heat and no rain..........and the models changed drastically on Saturday and Sunday, resulting in a sharply lower open to start the next week.

My best position trades in the grains were often being short at the top of a weather scare, when rain showed up in the forecast from a BEARISH PATTERN CHANGE........then staying short.

My biggest loss, by far -256K(half my account) was picking a bottom in July 2 decades ago based on a huge pattern change that I was extremely confident on, BUT was a few days early on and margined out with every cent, with no stops(how I used to trade) and assuming that no way the market could keep going lower. It did keep going lower to NEW lows and me schstting my pants with emotion because of the unexpected losses..so I bailed on longs of 300 corn and 200 beans at THE EXACT LOWS because I didn't want to lose ALL my money.

At the exact point when I should have been buying.........I sold to cover my longs!!

The following week was the worst one of my life. We had an extreme upside reaction and if I'd stayed long for less than 2 weeks, would have made a million on that one trade!!!

+++++++++++++

The days of me having an account that size and trading like that are long gone. Before the internet, I had a satellite dish on my roof and was getting weather data BEFORE the market. And could put on a huge position based on an updated model, then just wait for the market to get the information and let the profits roll in. Time after time.

Today, some places have in house models that run BEFORE the NWS and other sources that kick my arse by at least several minutes in many situations, using my internet sources. There is 100 times more model data too and the markets trade much longer.

Also the markets have extreme gyrations up and down that didn't used to be there before. If you are short, they have algorithms that cause upward spikes which will take out buy stops and vice versa.........take out longs with brief downward spikes that make no sense..........then go back to what makes sense.

So I mostly have fun with the analysis and sharing it with like minded people here adds tremendous value!

+++++++++

This was the last European Ensemble solution for 2 week rain totals, which is the WETTEST by far. Not a drought buster by any means.

The last 6z run for rains in Brazil still shows the dryer northeast to north sector in Mato Grosso:

My greatest loss was the dreaded 3 day July 4 weekend. Dry forecast became rain. Locked 30cents two days before I could exit bean contracts.

Market seems to be trading more than "just" weather. Maybe diminutive yields?

I know what you mean!

Now that you mention it, tjc that enormous loss i described above was over a long, July 4th holiday too.

I was worried the bullish pattern change would be obvious when the market reopened with a gap higher.

instead, it gapped lower. If I wasn’t extremely long already and crapping my pants, I would have been loading the boat long exactly then.

so I put in a really tight stop and it was hit at the exact lows of the entire summer….then went up almost every day for the rest of the month on extremely bullish weather.

i actually think that my huge sell stop order might have put in the selling exhaustion low because some of the contracts were filled at the exact low…….then, there were no more sellers left down there at that price and buyers had to push prices higher to find new sellers…….for the rest of the Month, into August.

If I hadn’t been burned so bad, I would have jumped in to get long, which is what I had always done before after a loss.

But that one decimated my trading psyche in grains for that entire month.

day after day I wanted the price to stop going higher because I tortured myself with updated calculations of how much my profits would be after almost every tick higher.

im sure that you know that horrible feeling well!

Good traders put their losses behind them quickly, then start with an objective, clean slate but selling the exact lows of the Summer on an order of that size was impossible to shrug off.

agree too on other factors here. We are well past the halfway point on harvest pressure which tends to lend some seasonal strength.

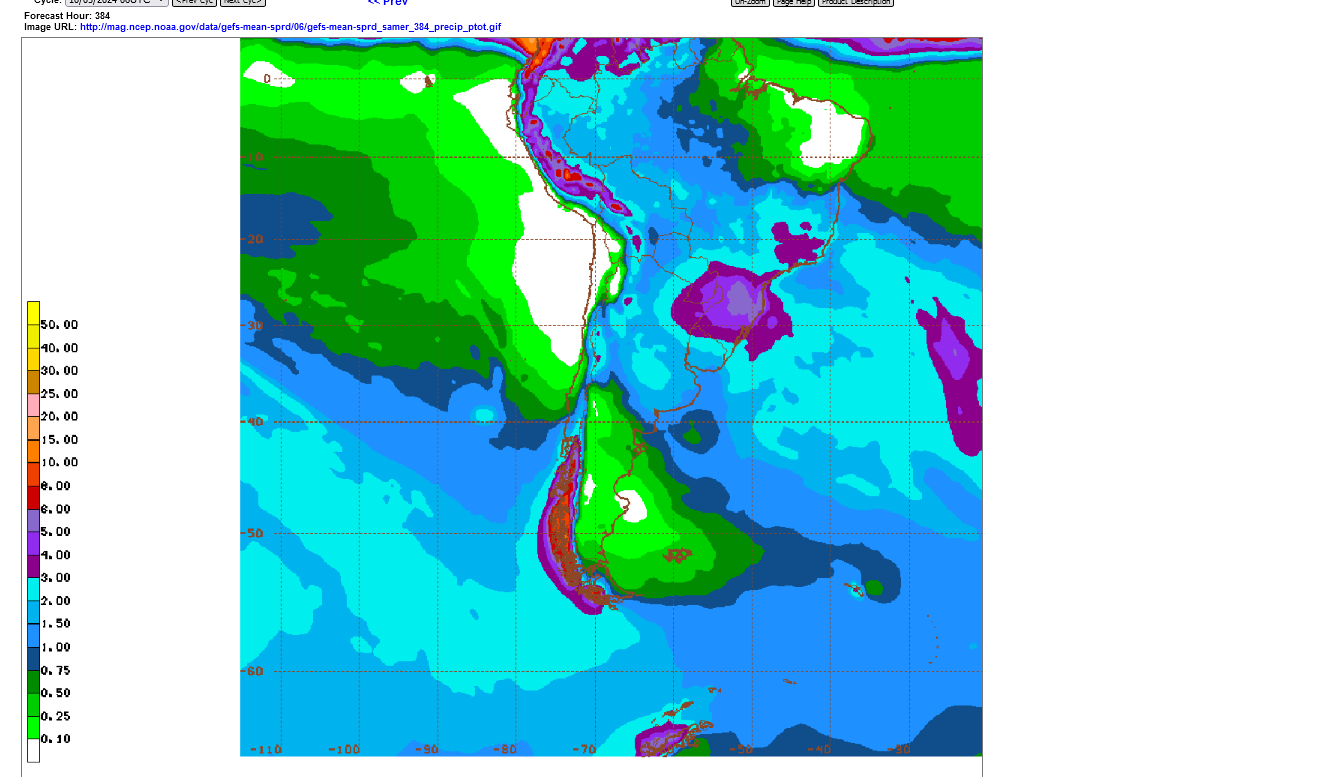

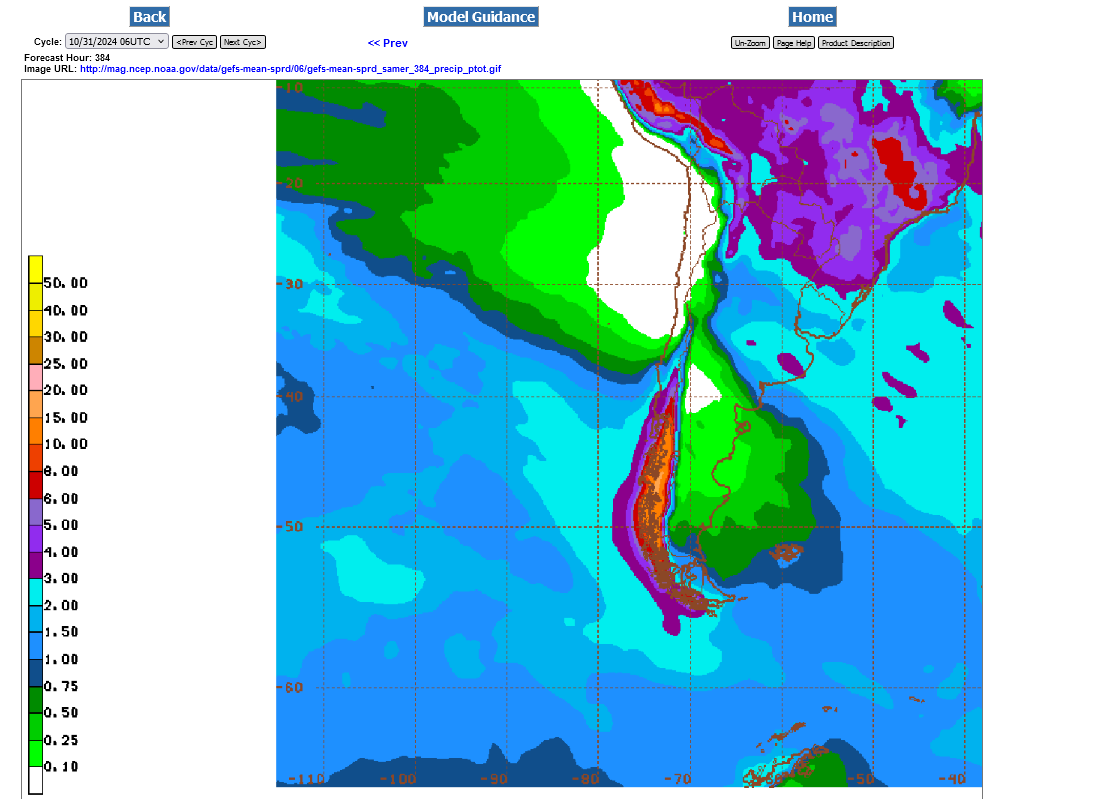

Drier trend for #1 producer, Mato Grosso continues for NORTHERN sections. Other than that area, the rest of Brazil and all of Argentina are WET, so its hard to get extremely bullish on SA weather. Total 384 hour rains on the last 06z GEFS below.

Still a bit too dry for northern Mato Grosso and also parts of Argentina now on the 384 hour total rains from the 6z GEFS.

Total 384 hour rain amounts in Mato Grosso were WAY up on the 12z GEFS here on Friday mid-day.

Huge rains in Central Brazil. Not so much in Argentina. 12z GEFS 10-26-24:

Last 18z GEFS October 27, 2024 Total rains for 384 hours. Good everywhere! Grains on the defensive to start the week.

This was the last GEFS run, with total rains thru 384 hours.

Tons of rain everywhere in Brazil and Argentina. It doesn't get much better than this and more bearish.

The market may very well have dialed this into the price.

WET IN BRAZIL!

A narrow dry-ISH area in Argentina.

Beans continue with solid gains today NOT because of weather. South America will see wonderful rains the next 2 weeks.

do not know if it was the SA forecast or what but beans are 14 cents off the morning highs

I will agree strongly that the weather is very bearish today, mcfarm and has to be a factor in beans reversing lower.

But its not like the forecast suddenly changed to cause that 14c drop.

We were going much higher all week with a similarly wet and beneficial to the SA crop forecast. You can scroll up and see posts that indicated that.

Something else caused us to go up. I still contend that the USDA has the US crop size TOO HIGH because the flash drought while beans were still filling pods, HAD TO HAVE HAD A NEGATIVE IMPACT ON THE SIZE OF THE BEANS IN THEIR PODS.

Plant hybrids are great for maximizing yields and so is the increasing CO2 THAT ALSO INCREASES DROUGHT TOLERANCE(REDUCES MOISTURE REQUIREMENTS) BUT WE NEED MOISTURE IN THE SOIL while the plants are filling pods.

Greatly insufficient soil moisture during pod fill, EVEN TOWARDS THE END OF POD FILL WILL ALWAYS REDUCE YIELDS COMPARED TO GOOD MOISTURE AND COMPARED TO WHAT YIELDS WERE BEFORE A FLASH DROUGHT HIT.

AGRONOMY 101!!!

This would have hit the latest planted and latest harvested beans the most, which would have been the last to be reported.

Beans also have a strong seasonal up after the spike harvest lows.

Regardless of that speculation, the weather forecast in South America remains extremely bearish right now FOR SURE (other than a bit dry in parts of Argentina the next 10 days but this is NOT predicted to last)

Great rains for all of Brazil. OK for some of Argentina but a bit less than average rain in the central growing districts.

Continued WET in Brazil with a dryish forecast for a growing area of Argentina(but still some rains).

Last 12z GEFS 384 hour rain totals. Getting pretty skinny for most of Argentina's key growing areas!

Time for a new thread