With the ongoing, escalating wars in The Middle East between Israel and its neighbors as well as with the US/NATO war with Russia, a knee jerk/spike market reaction to NEWS is extremely high.

Crude is one obvious market because the Middle East is a high production area and the market may react to the potential disruption in supply. However, many other markets react strongly.

By metmike - Oct. 3, 2024, 1:01 p.m.

10 oct might be cyclical time /with planet SDR might catch people off-guard !!

I was once told by an old experienced trader that the symbol in Chinese for dangerous was almost exactly the same as the symbol for opportunity.

joj,

I love it!!

That actually makes sense in some realms. One of them right here.

Trading commodities, for instance is extraordinarily dangerous compared to stocks because you can leverage your money by XX times to amplify the impact of price movements.

You can lose all your money fast............or use it as an opportunity to make a ton of money fast.

The question for crude right now is how much risk premium is in the price that has already dialed in X amount of Iranian crude being taken off the market?

big news will cause knee jerk market reactions with many other markets reacting in sympathy.

let’s not forget the potential for the Ukraine war to have a big news item that impacts many markets.

MetMike

Is Milton, especially for orange juice, TOO hyped up? Or is it really going to be destructive?

Hi tjc,

The OJ market is no longer tradable!

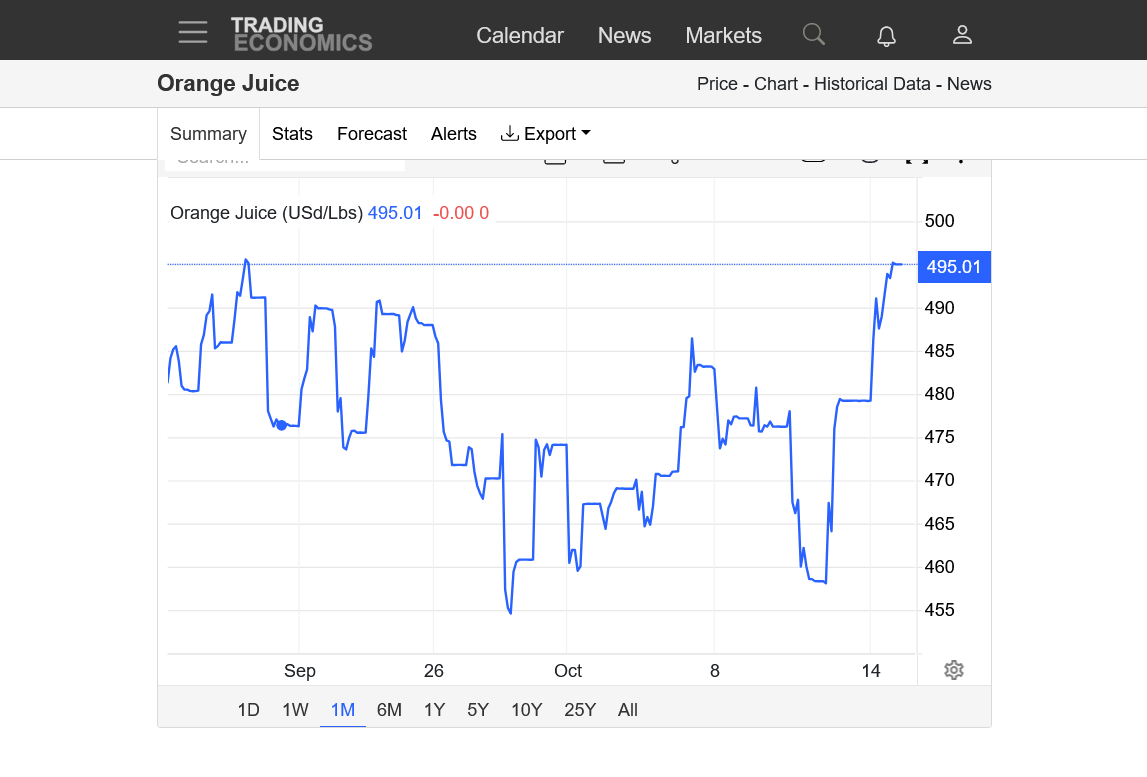

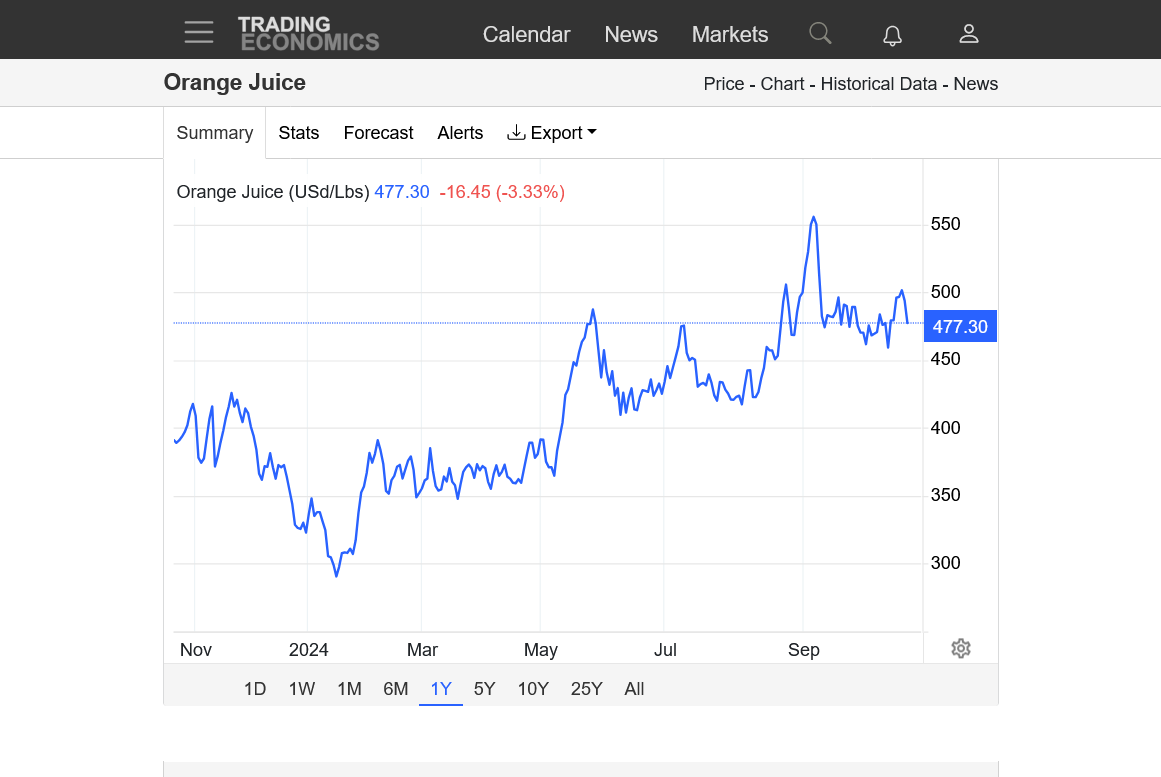

The front month with the most volume, November has a total of 525 contracts traded today and is almost -7c at just over 476.60.

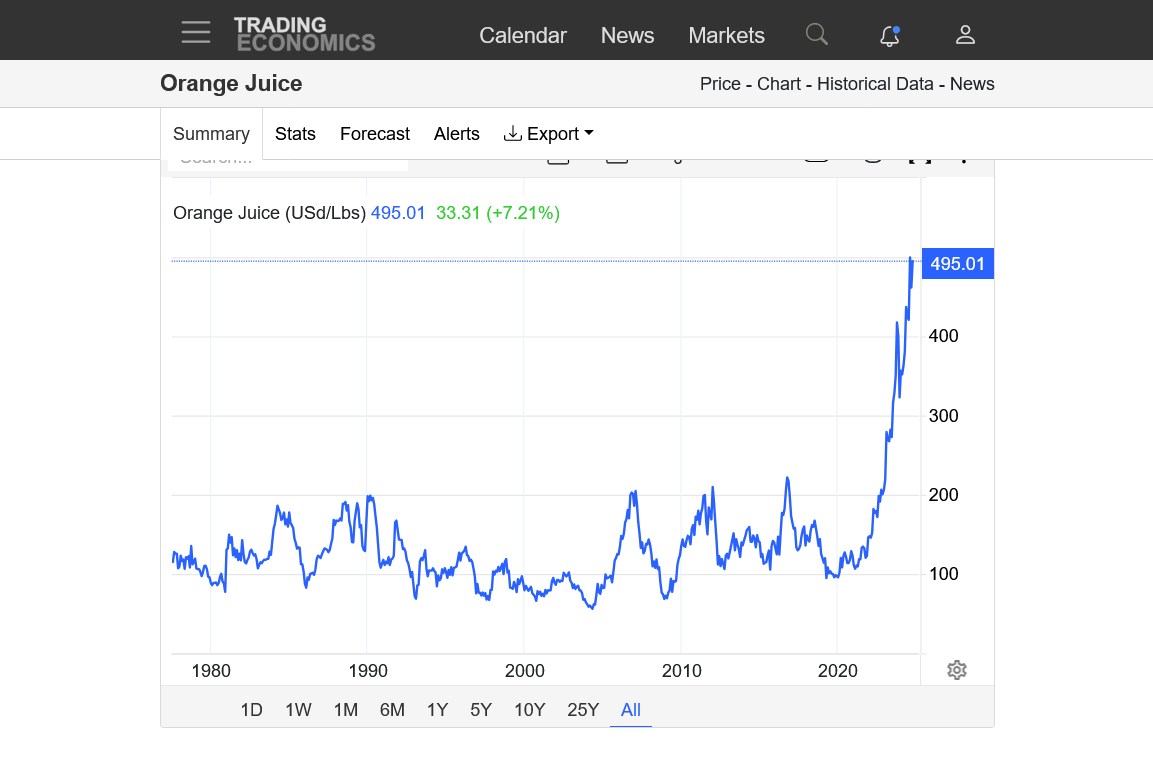

Early in September, OJ hit an incredible 589!!! With this new hurricane showing up, we couldn't come close to approaching that.

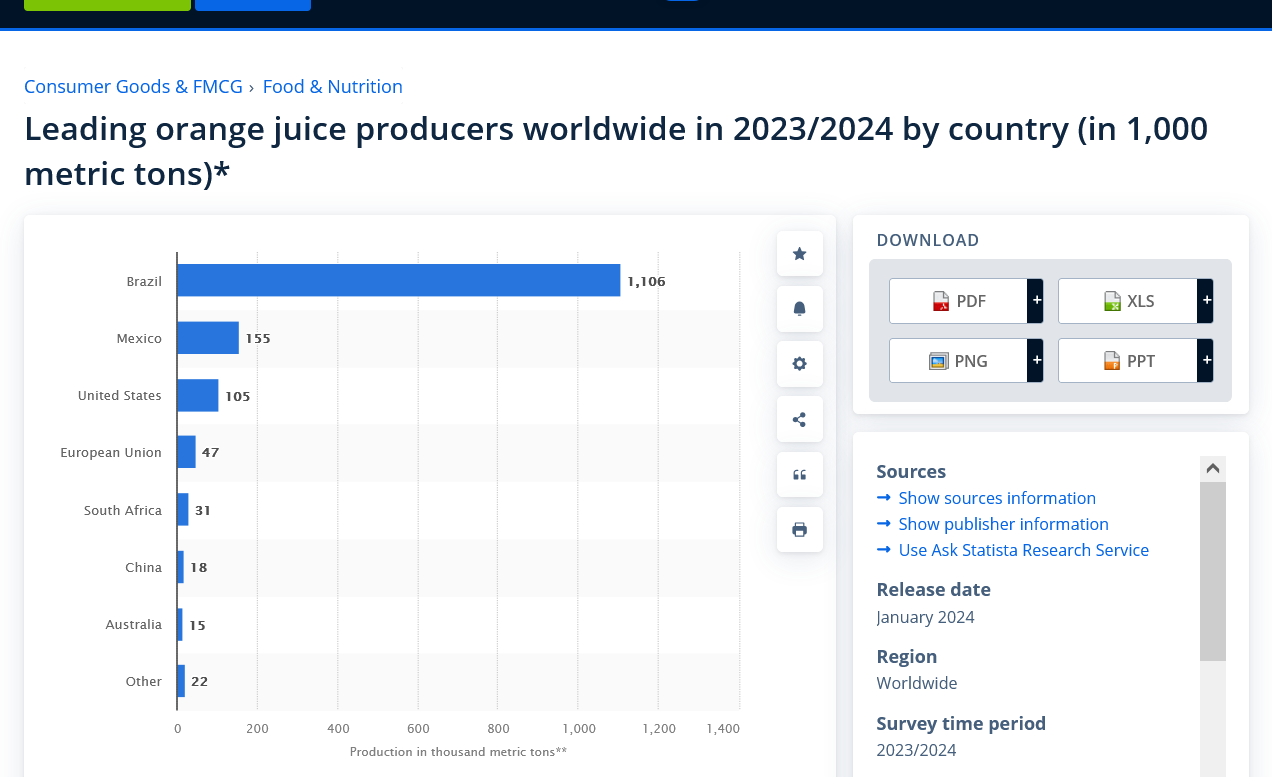

Most of the production in 2024 is in Sao Paolo, Brazil. I'll copy more oj stuff later today.

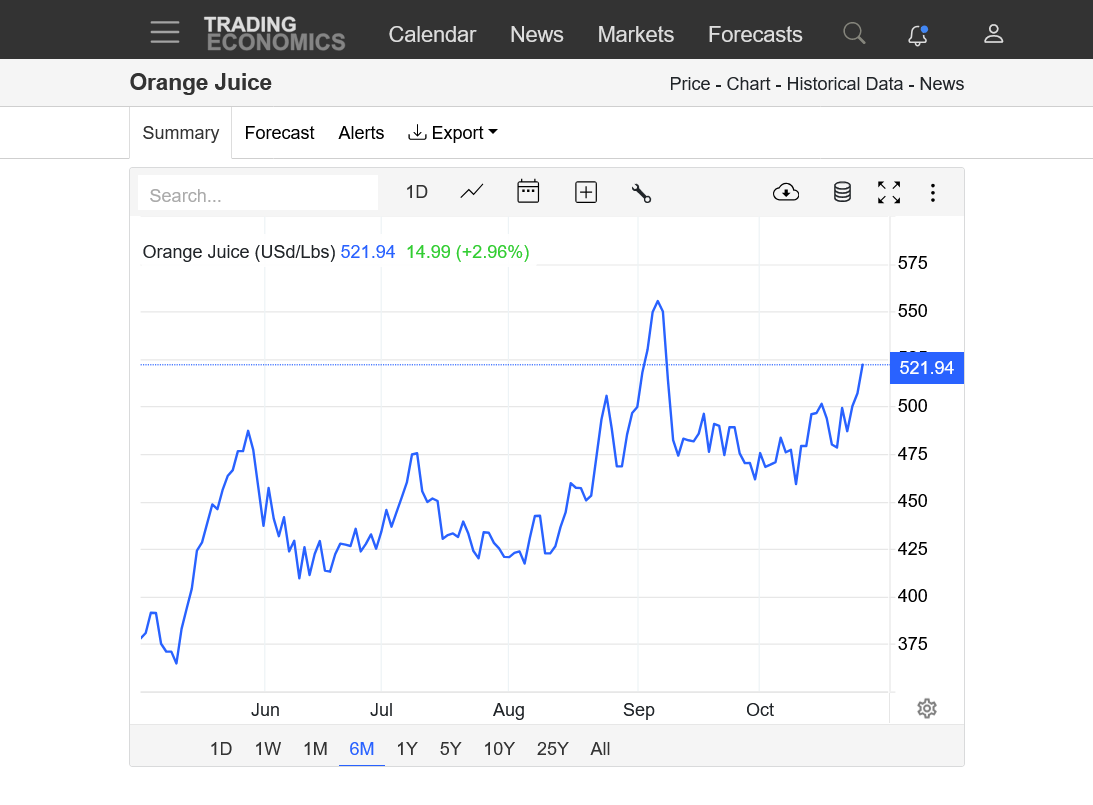

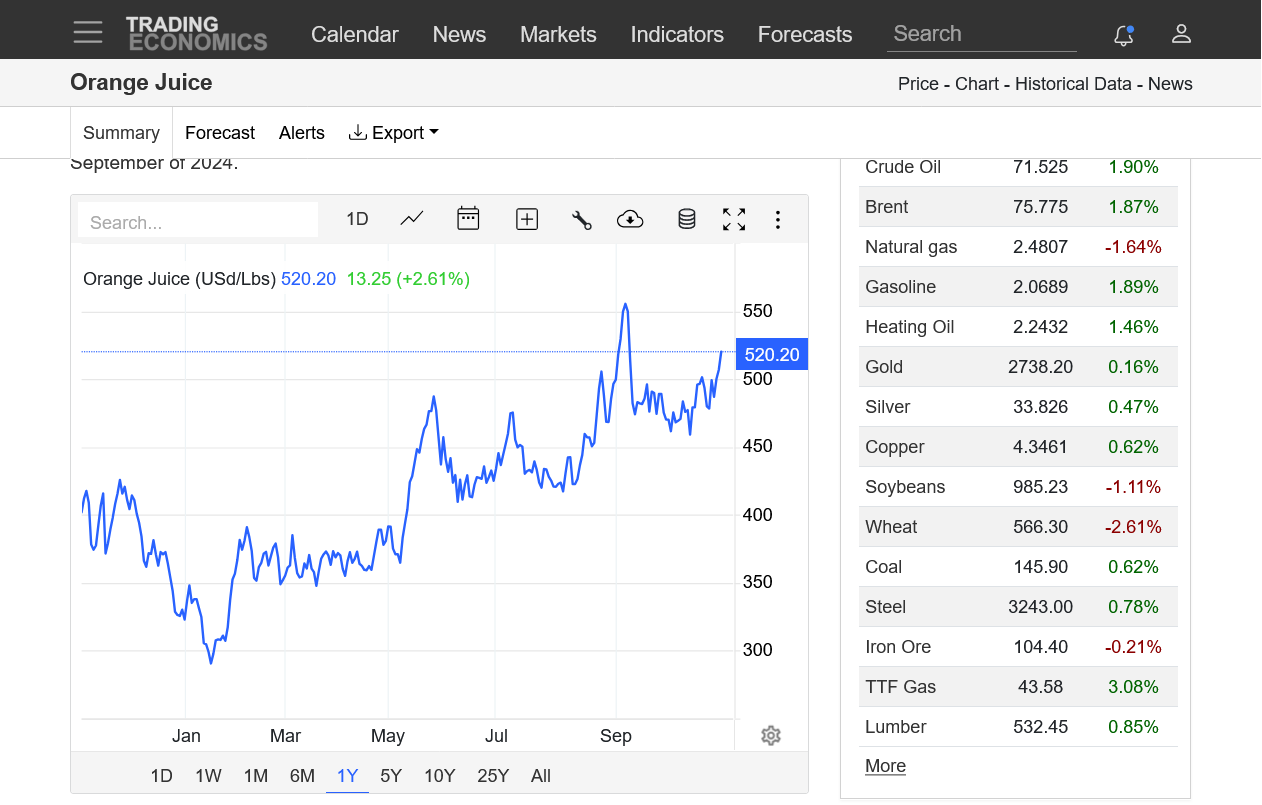

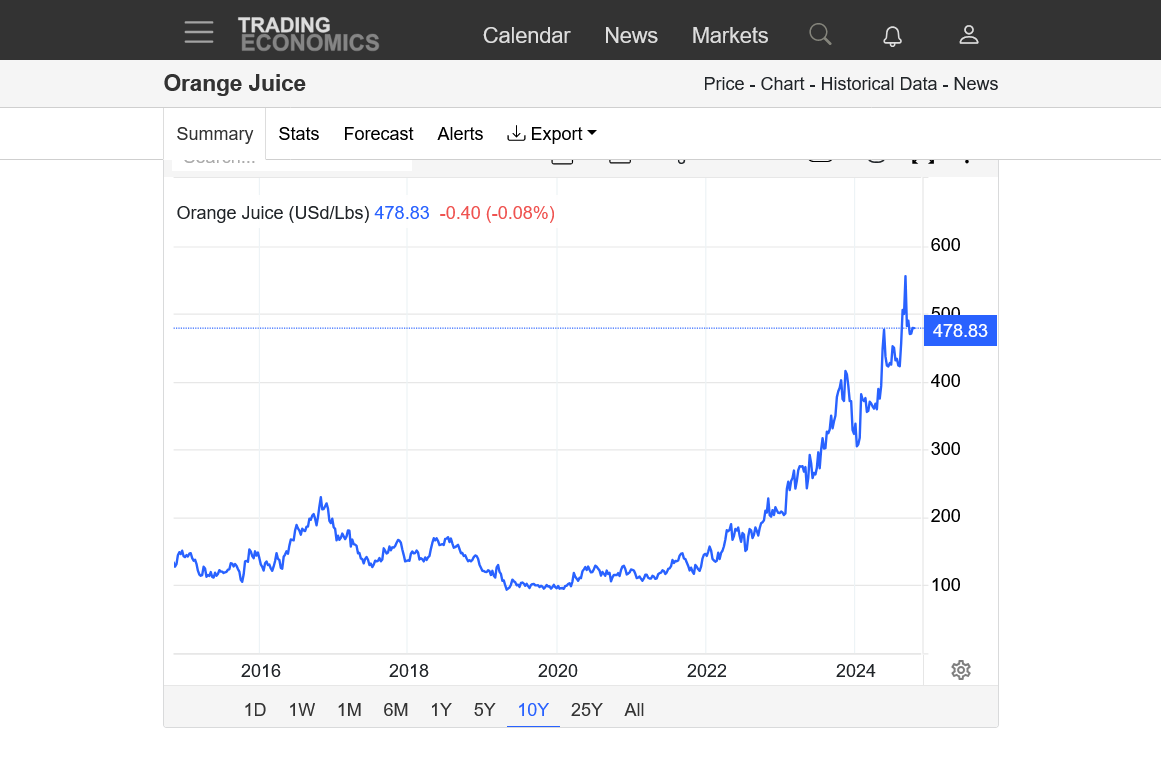

Here's some price charts:

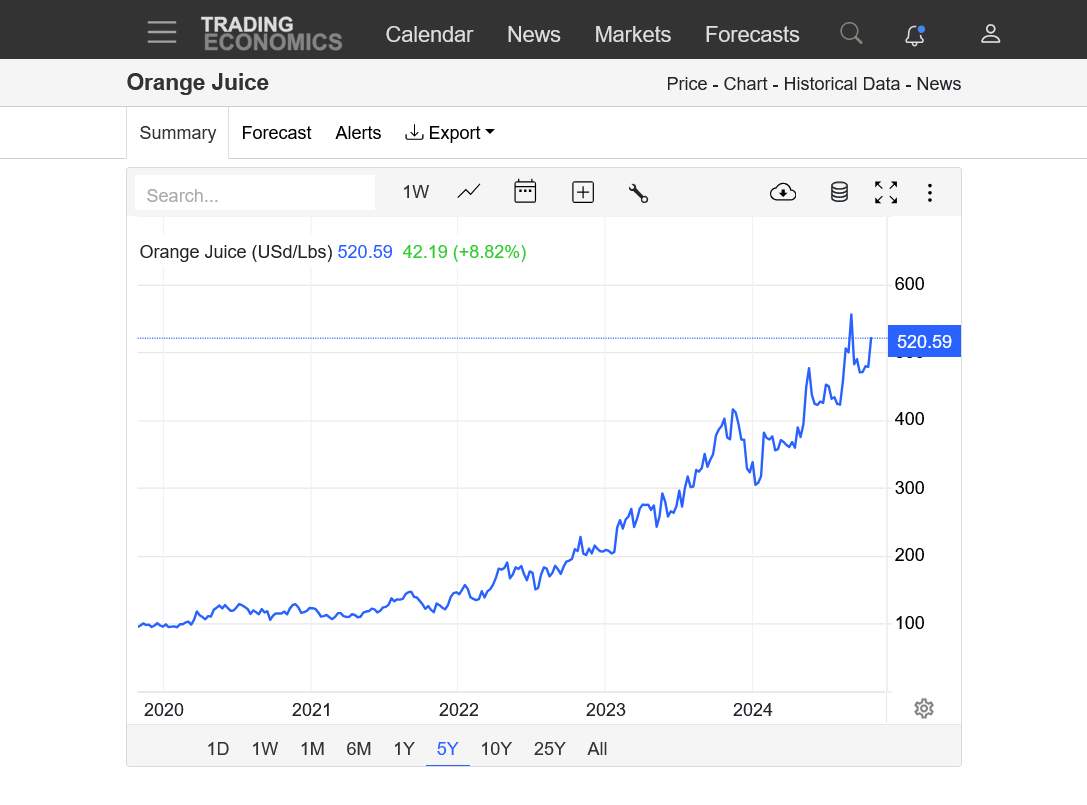

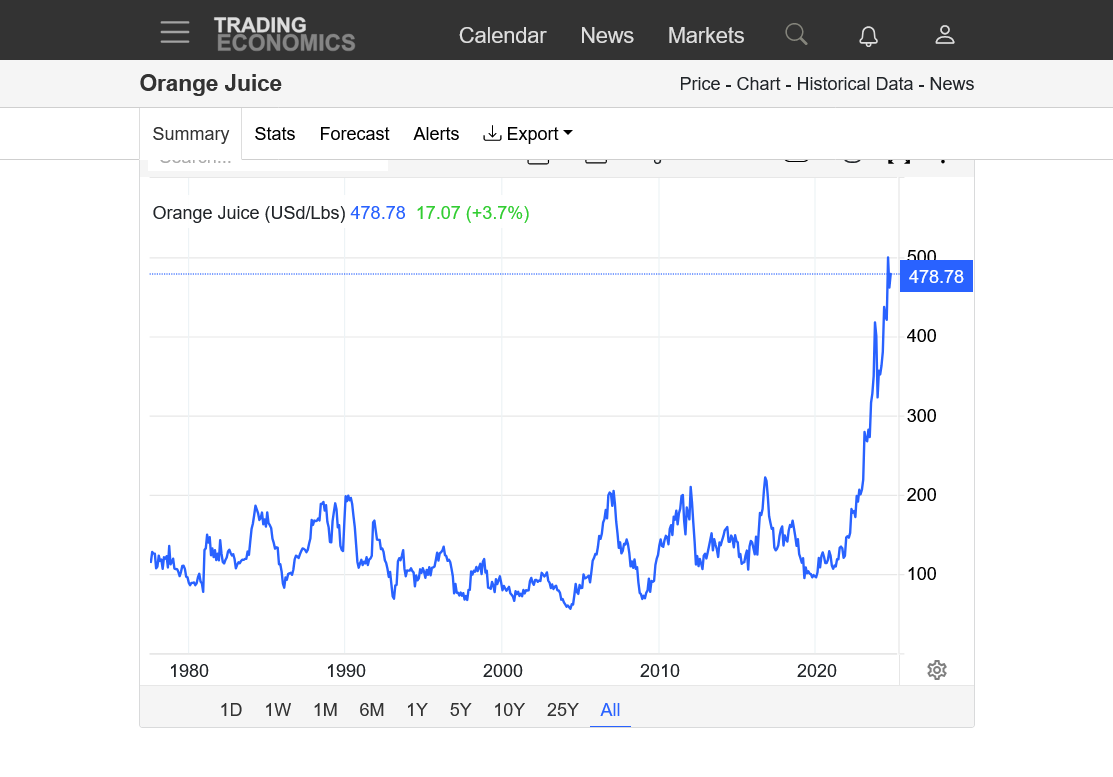

1. 50 years

2. 10 years

3. 1 year

4. 1 month

5. 1 week

https://tradingeconomics.com/commodity/orange-juice

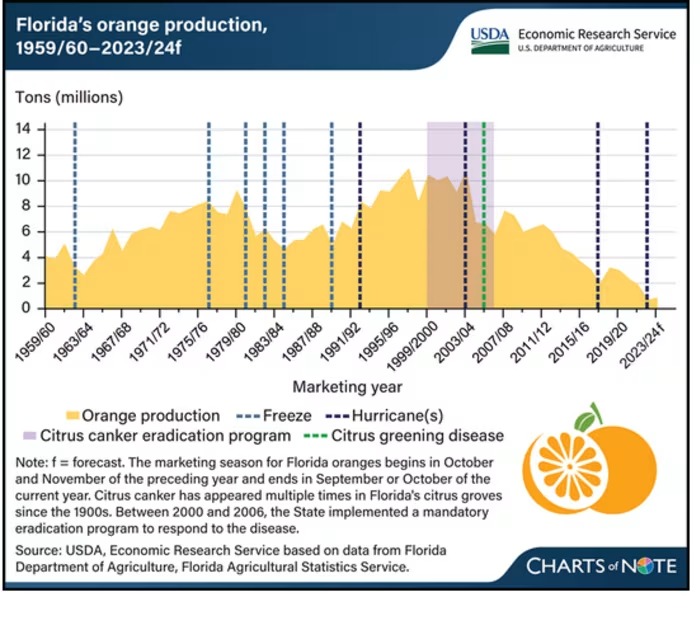

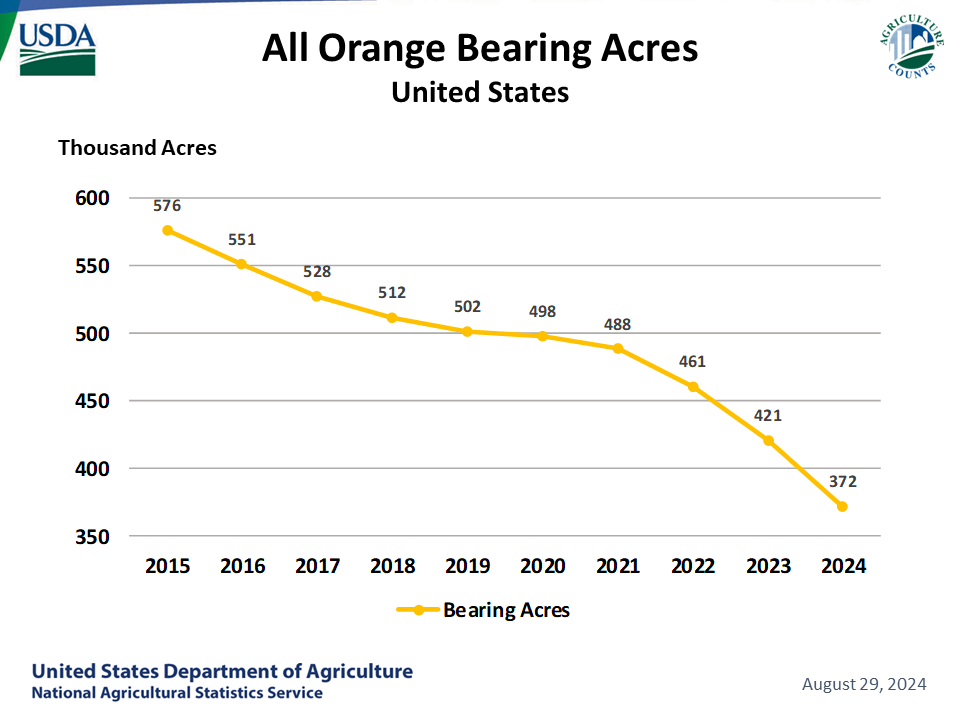

Because of citrus greening disease in Florida, production is something like 15% of what it used to be.

Sao Paolo Brazil produces the vast majority of orange juice. 10 times the production of the US!

https://www.statista.com/statistics/1044896/world-orange-juice-major-producers/

Here's a lengthy thread from late last year that has lots of details on the OJ market.

It's not the OJ market that we traded 2+ decades ago!

https://www.marketforum.com/forum/topic/100189/

OJ is -17c today.

This is -2,550/contract!

OJ is +17.95 today, erasing all the losses from yesterday. $477.15 last trade

Make that 476.30

Total number of contracts traded in the November is 566.

Re: Invest 92L SW Gulf: threat to W FL mid-week!

By WxFollower - Oct. 14, 2024, 12:03 p.m.

OJ is up decently today. I wonder how much of this may be due to estimated damage to the FL orange crop being higher than what was dialed in to the price? Orange drop in concentrated grove areas of SW FL has reportedly/anecdotally been substantial.

Also, did Friday’s Oct USDA Production Report have a smaller than expected FL orange crop? Inquiring minds want to know!

+++++++++++++++++++

Re: Re: Invest 92L SW Gulf: threat to W FL mid-week!

By metmike - Oct. 14, 2024, 12:59 p.m.

Very interesting, Larry!

OJ was almost limit down on Thursday after Milton hit.

On Friday, it was the complete opposite, in fact after the bullish USDA report, OJ stayed LOCK limit up the rest of the session after trading to the limit a few times before the report.

the lock limit up close on Friday ensuredm a gap higher this morning.

we’re up around 14c now. Not sure what the expanded limit is but we won’t get close.

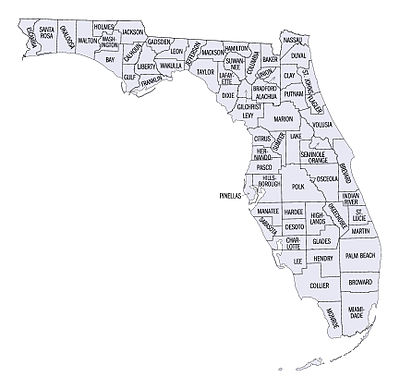

Milton damage probably has something to,do with it but FL production is small in 2024 compared to almost 10 times more 2 decades ago before citrus greening obliterated the orange groves.

sao paolo in Brazil produces 10 times as much OJ as us….but they’re having citrus greening issues are reducing their production, so supplies are historically tight….note the highest picea in history this year.

with such tight supplies, losses is FL would count more.

+++++++++++++++++

metmike: Look below at how small the FL OJ crop is today!!! Citrus Greening!!!!

https://www.nass.usda.gov/Charts_and_Maps/Citrus_Fruits/orghstba.php

https://www.nass.usda.gov/Charts_and_Maps/Citrus_Fruits/orghstba.php

https://www.nass.usda.gov/Charts_and_Maps/Citrus_Fruits/orgmap.php

https://tradingeconomics.com/commodity/orange-juice

1. 1 week-spike down the day after Milton-then spike up on days 2 and 3

2. 1 month-testing 1 month highs

3. 1 year-breaking out to the upside of a bull flag??

4. 47 years.........INSANE! The previous impenetrable top of the range had been around 200. We are trading 2.5 X that value!!!

The power outages from wind, the day after Milton made landfall tell us where the highest winds were with Hurricane Milton:

Invest 92L SW Gulf: threat to W FL mid-week!

By metmike - Oct. 11, 2024, 11:21 a.m.

This was also in much of the highest OJ production areas:

https://en.wikipedia.org/wiki/List_of_counties_in_Florida

OJ down 10c today!

After being up more than 10c shortly after a gap higher on the open Tuesday.

it doesn’t mean as much as usual because OJ Iis so thinly traded, volatile and more than double the price of the previous record high but the pattern would be a gap and crap selling exhaustion……very bearish if at the end of a longer uptrend and in a more stable market with more volume.

This comes from the news inspiring the bulls to aggressively buy with, AT THE MARKET orders running its course and running out of steam. …..running out of bulls .

with everybody that wanted to buy…..already long at a lower price than the current one.

suddenly, when there are no more buyers, the market collapses lower as sellers battle each other to fill new selling orders.

OJ getting"squeezed" today.

-17c. The limit used to be 10c but they obviously have expanded them with the EXTREME trading ranges this year at prices more than double the previous record high.

Volume is 1,045 contracts for front month November.

January is just behind at 945 contracts, so Jan will be passing up Nov in volume, probably next week.

https://tradingeconomics.com/commodity/orange-juice

1. 1 month

2. 6 months

3. 1 year

4. 10 years

5. 50 years

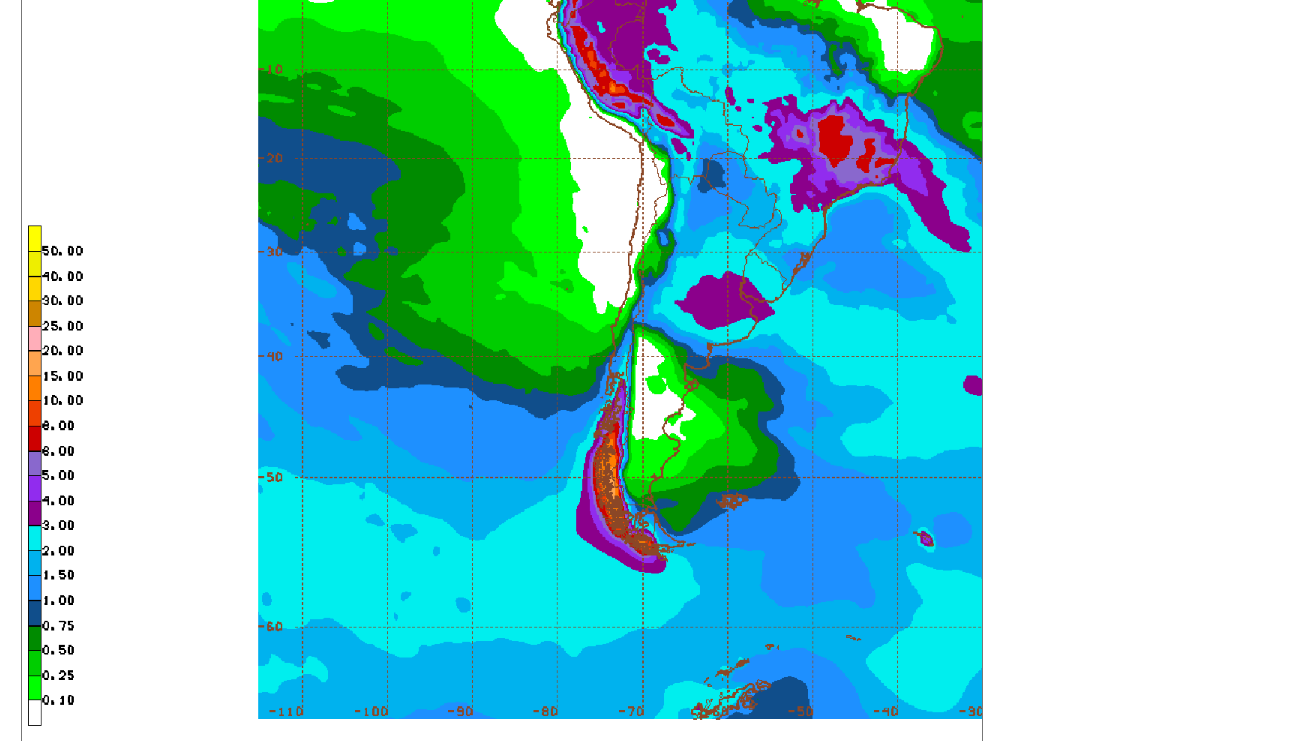

Plenty of rain for OJ(Sao Paulo).

This is the place that has the VAST majority of the world's OJ production:

OJ up nearly 5%! Milton, São Paulo or something else?

Thanks much, Larry!

Milton likely has had some impact because the market has such a huge demand/supply imbalance that losing even a small amount is bullish. The imbalance is from a supply crisis. FL only produces a small amount in 2024 but Sao Paolo is also experiencing citrus greening, which is hurting their production now!!!

https://tradingeconomics.com/commodity/orange-juice

1. 1 month-UPTREND

2. 6 month-STILL BELOW THE SEPT HIGH AROUND 555

3. 1 year-STRONG UPTREND BUT BELOW THE SEPT 2024 HIGH

4. 5 year-RECORD SMASHING UPTREND WITH A PRICE TRADING 3 TIMES HIGHER THAN 3 YEARS AGO!

5. 50 YEARS-INSANE! Normally, the cure for high prices=high prices because of financial incentive to increase production/supply. But with oj, it takes many years for newly planted trees to produce and apparently, citrus greening must be taking out production faster than it can be replaced.