Tomorrow, Oct 11th, the next monthly USDA Crop Production report will be released. Mike and I had a great discussion about Francine (perhaps more from rain) and Helene (very likely mainly from wind) damaging CT due to most bolls being open. Based on those discussions, I’ve concluded that most of the Francine damage was done in AR while most of the Helene damage was in GA. Of course there are always other factors intertwined.

How much lower, if any, are you folks guessing the Oct 1st AR and GA crops will be vs Sep. 1st? Related to this, will Helene’s damage be largely incorporated in tomorrow’s report being that the damage wasn’t done til the night of 9/26-7? Inquiring minds want to know.

Thanks for this idea.

The cotton crop condition dropped 11 points in the good to excellent during that period.

Fair condition was up 4%

Poor to Very poor was +7%

Besides the hurricane damage, number 1 producer, TX, saw their crop rating fall by 19% in the g/e category from the start of sep. to the start of oct.

the p/vp rating in TX went up +18% during that time Because of the drought.

TX counts much more than any other state.

If the USDA is using the weekly crop ratings for most of their assessment, the cut could be substantial……which I would go with.

the cotton market is modestly higher overnight so maybe the market is expecting this too.

Long calls and future

Thanks Mike and cutworm for your replies. I’m not trading (haven’t in quite awhile) and certainly am not making any trade recommendations.

Has anyone seen the average expectation for the Oct 1st US CT crop? Does it already assume a large drop in the crop size? In other words, is this potential bullishness already in the price? I don’t have access to the news I used to have.

I see that CT is up ~1% about 1.5 hrs before the report release.

Previous posts about this.

Scroll down from this post:

Re: Potential NW Caribbean/GOM TC formation next wk

By WxFollower - Oct. 8, 2024, 10:10 a.m.

This is the DECEMBER contract. Earlier this week, this product was messed up because of the expiring OCTOBER contract.

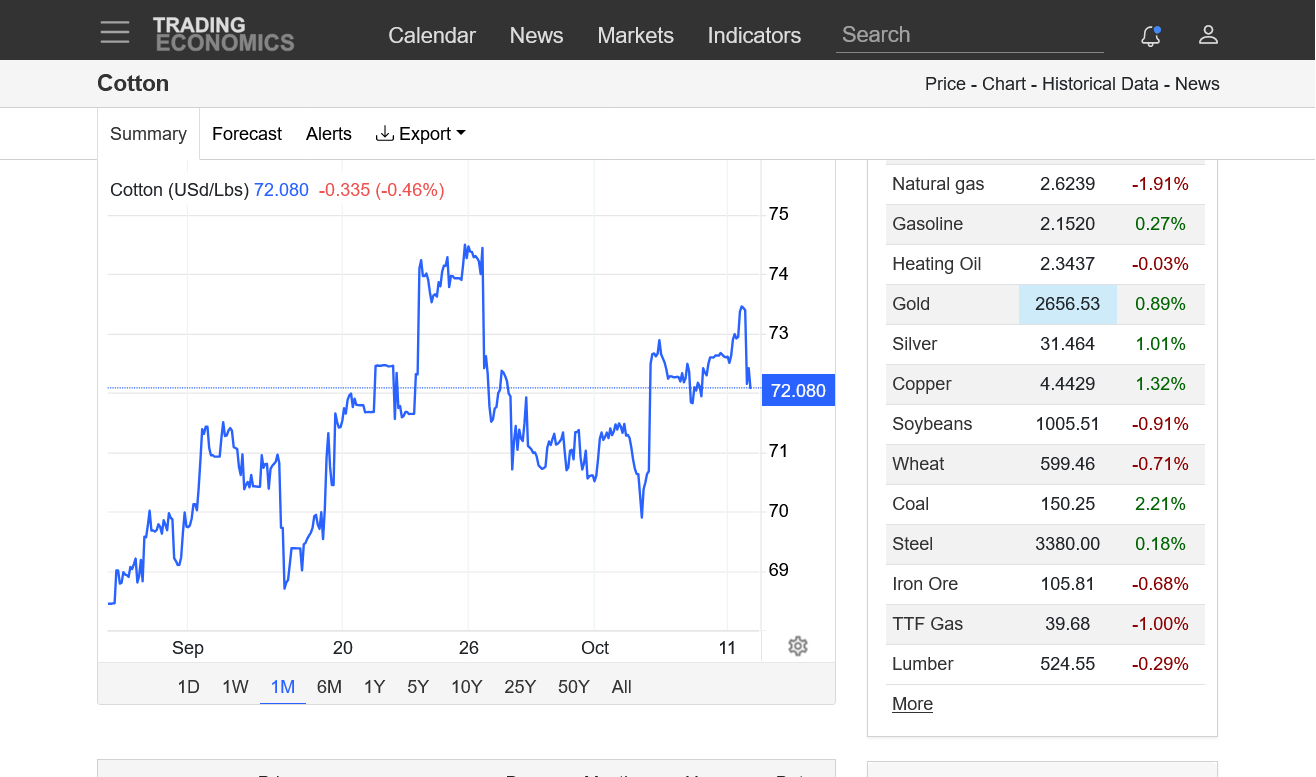

https://tradingeconomics.com/commodity/cotton

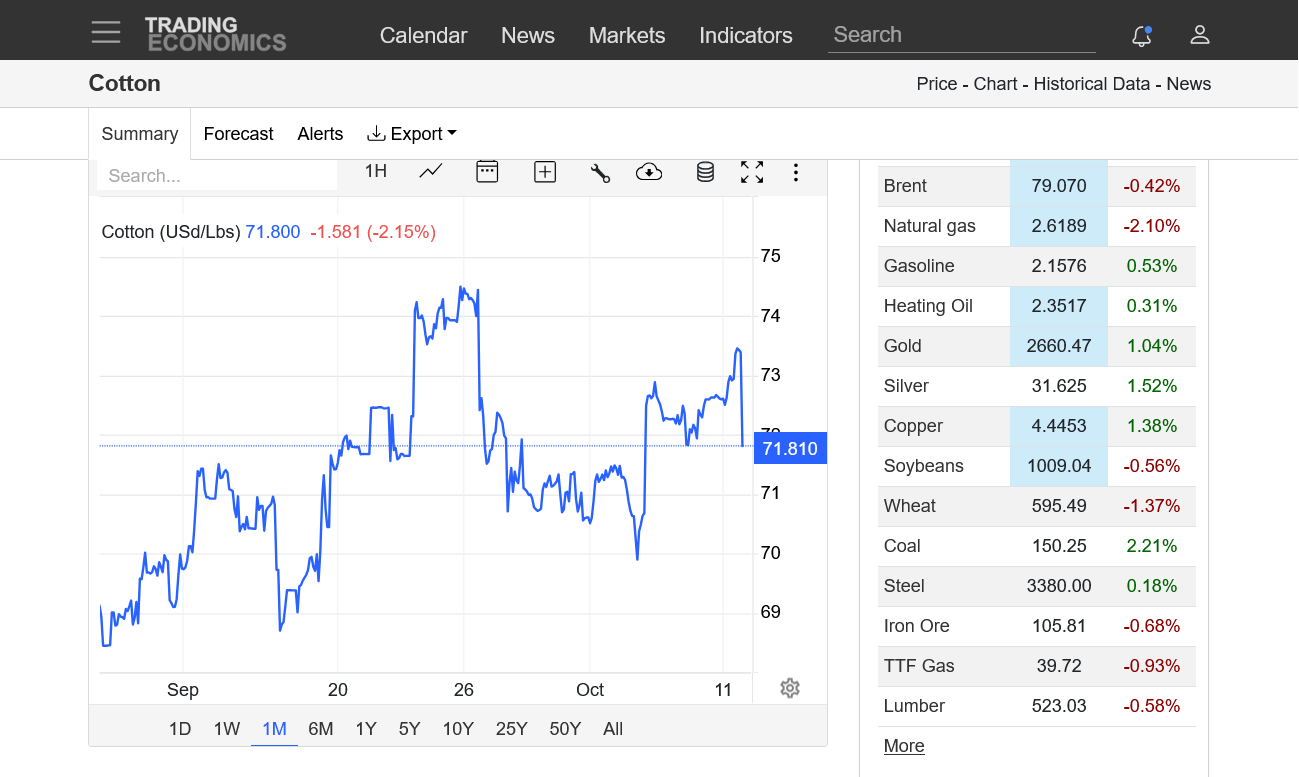

1. 1 week-trading at highs for this week

2. 1 month-uptrend but still below late Sept highs-will the report cause us to break out?

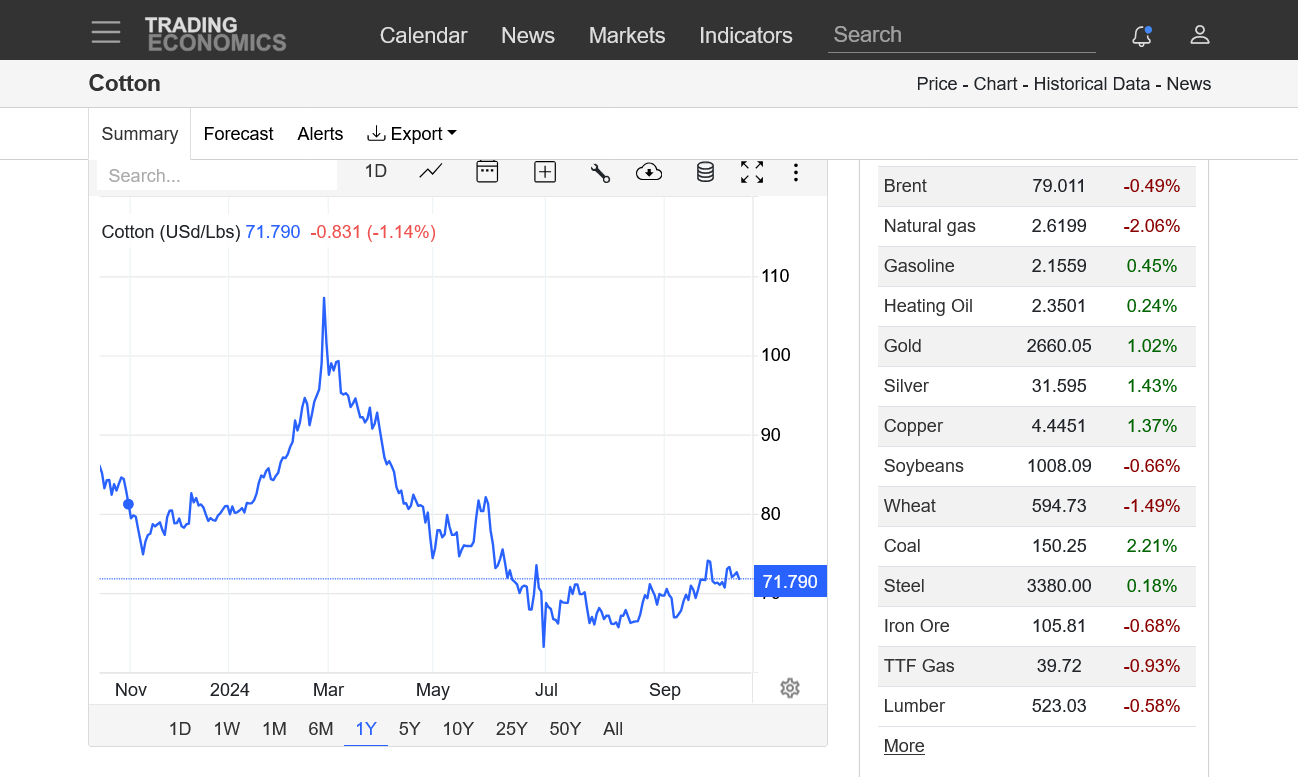

3. 1 year-Feb. 28 highs near 1.08. Spike low June 28 near 63c. Uptrend since then.

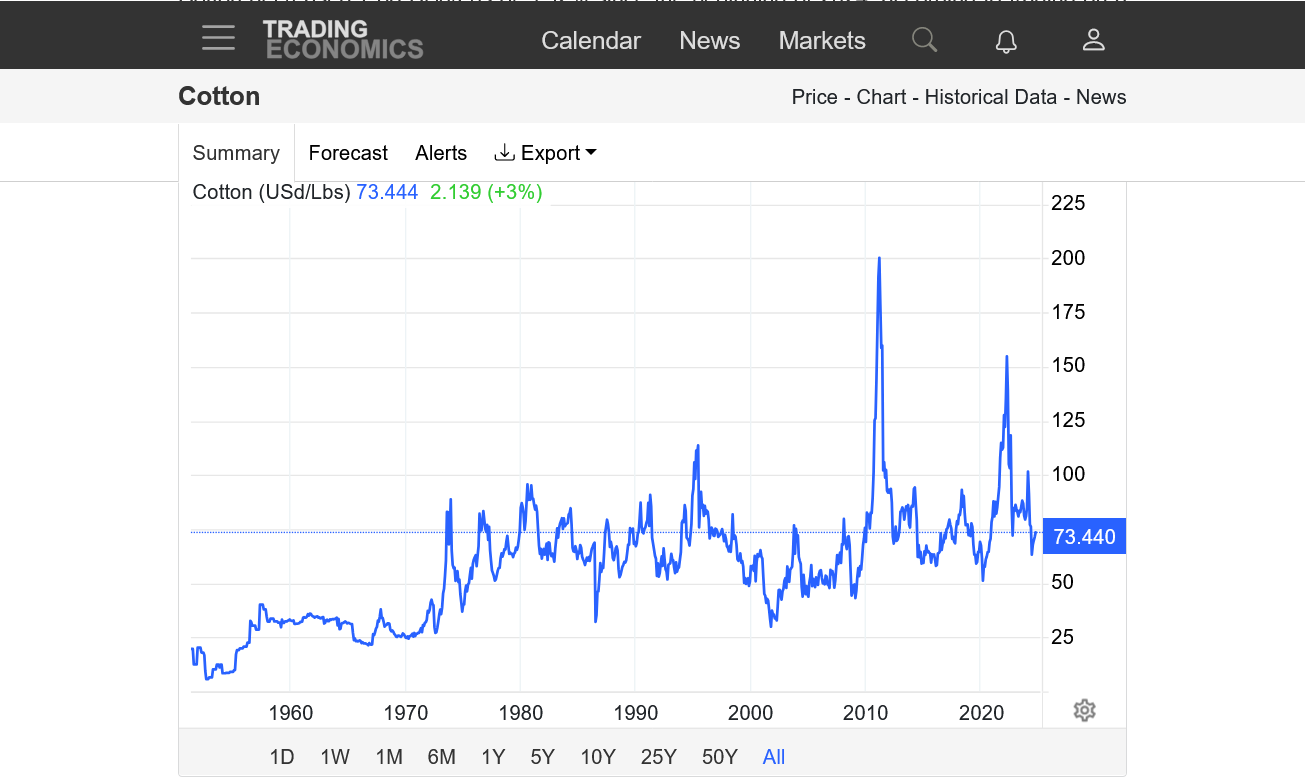

4. 10 years-April 2022 price hit near 1.55

6. 60 years-Mar 2011 al-time high near $2

Thanks, Larry!

tjc is not cutworm

Good question on how much of the damage is already in the price because we increased 10c since the lows. The bottom happened at the end of June when drought started impacting TX?

Then, around a 7c hurricane spike higher that everybody has known about for weeks.

So we are really trading what the USDA will say BEFORE the damaged crop is harvested.

Not until the crop is harvested will we have the REAL answer.

If the USDA doesn't dial in as much damage as the market thinks...........we might spike lower, even if the USDA IS WRONG OR WAITS for more information.

Or we could have a buy the rumor, sell the fact if the estimate matches the market estimates.

Looks like the USDA already made some cuts in September from the ratings dropping and drought:

According to the USDA's September 2024 World Agricultural Supply and Demand Estimates (WASDE) report, the U.S. cotton production estimate for 2024/25 is 14.5 million bales. This is a decrease of about 600,000 bales from the previous month. The all-cotton yield forecast is 807 pounds per acre, which is 33 pounds lower than the previous month.

Here are some other details from the USDA's September 2024 WASDE report:

+++++++++++++++

I've not traded or followed cotton closely for a very long time and could be overlooking a key item.

I'm tempted to be long for a gamble based on our assessments but these assessments are not necessarily an edge because everybody else has this information and the big traders might know even more than we do.

Larry,

The best trade, high confidence for somebody that trades weather was the one that you described BEFORE Helene hit on the previous thread. BEFORE the market reacted to the hurricane damage ahead of the event.

The event is weeks old now.

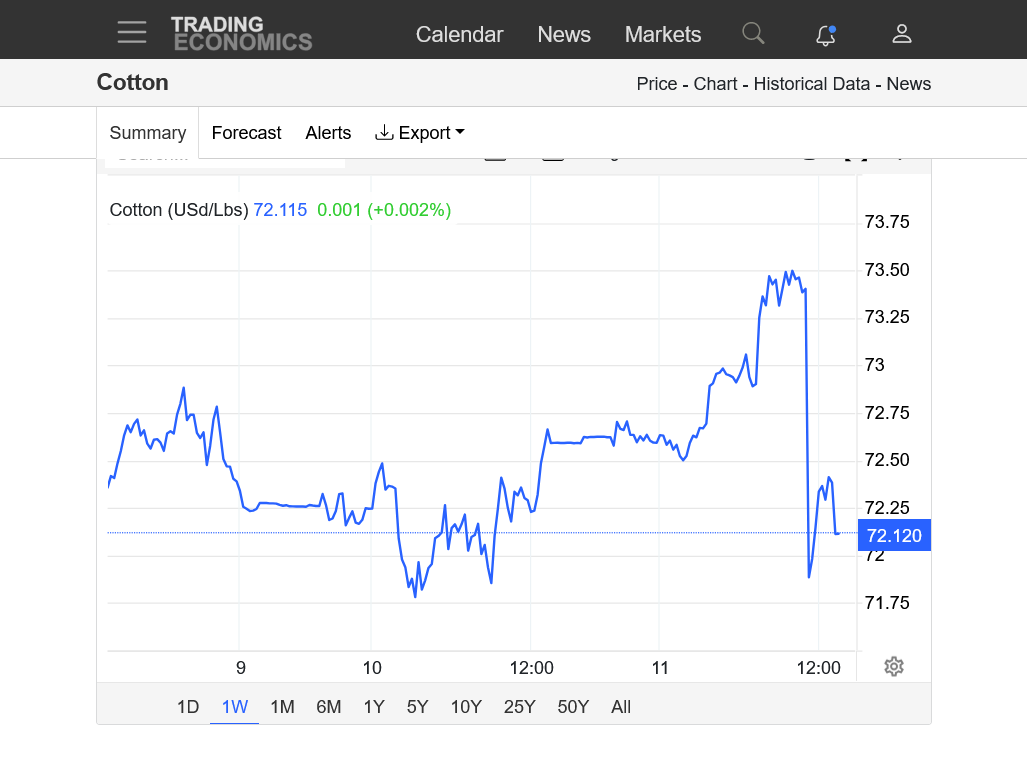

We gave up all the daily gains in this session, the first minute after the report so the market is thinking its bearish!!!

Now, we are a bit lower for the day after being modestly higher before the report.

Glad I didn't "gamble"

Now, we are modestly lower with the drop continuing the first 7 minutes after the release of the USDA numbers.

tjc,

I apologize for calling you by the wrong name. I know y’all aren’t the same person. I’m not sure why I did that lol.

US crop down 2%. My guess is that the average guess was for a higher drop. That’s why I was asking how much crop drop was in the price.

Larry,

I called Jean, "Julie" a few times in the middle of conversations

Despite the knee jerk(bearish) down reaction to the USDA report that failed to match bullish expectations, the lows are in and the uptrend remains intact:

If I had to guess, I would guess we might hold support in this area based on the chart pattern below.

https://tradingeconomics.com/commodity/cotton

1. 1 day

2. 1 month

3. 1 year

I had said:

“Related to this, will Helene’s damage be largely incorporated in tomorrow’s report being that the damage wasn’t done til the night of 9/26-7?”

——————-

From the report:

The extent of damage to the cotton crop after Hurricane Helene is not yet known as power outages, communication challenges, and road blockages prevented a full evaluation in many areas.

I finally got to see state by state changes since Sep report:

GA dropped pretty substantially from 2,050 to 1,650, a drop of 400 (20%). My prediction is for a drop of 500-600. News reports had 400-800. Also, keep in mind what I just posted: full extent of Helene damage not yet known due to communication problems, outages, and road blockages keeping in mind that the damage was done mainly on Sep 27th, very late in the month. So, this 400 drop could rise some more due to incomplete assessments.

AR (Francine affected) dropped only from 1,650 to 1,600. But keep in mind that AR damage is probably more quality than quantity related due to heavy rains rather than high winds.

TX (drought) actually rose from 4,100 to 4,400 despite worse crop conditions! That’s why overall crop size dropped only 2% and probably why the price drop.

TX Crop Conditions as of Sep 1st/Sep 29th

VP: 16; P: 15; F: 33; G: 31; E: 5

VP: 25; P: 25; F: 30; G: 18; E: 2

So, VP to P rose a whopping 19 while G/E dropped a whopping 16! Why the big disconnect?

GA went up 13 in VP/P and down 23 in G/E. So, the 20% crop size drop there kind of jibes.

AR went up 13 in VP/P and down 12 in G/E.

Sad to say this but I don't trust USDA reports.

A few years back, I did some tracking and found that their updates would often go from higher than the market expected to lower than the market expected.

It would be like shooting a gun to hit a target and going wide to the left. Then adjusting the site and going wide to the right on the next shot, instead of getting closer to the target from the same side, even missing the entire target completely at times.

The market has some pretty astute people and contacts with millions of dollars at stake so the market is often pretty tuned into the growing crop conditions.

It didn't make sense (at least during that period) for the market guesses to be so wrong by so much so many times.

I concluded that people in the USDA, knowing, the pre report guesses and the number that will come out as a surprise, have a tremendous amount to gain with a position before the release.

Obviously there are very strict guidelines that prevent them from trading personally.

However, its IMPOSSIBLE to keep them, like sequestered jurors during a big trial from being in contact with other people that can positive to make a bundle on the surprise numbers.

Knowing what I do today about politicians and other corruption in government, I would actually be surprised to know that the USDA has the only saints in our government that would never exploit their advantages for self enrichment.

One of my favorite movies:

https://en.wikipedia.org/wiki/Trading_Places

During the firm's Christmas party, Winthorpe plants drugs in Valentine's desk, attempting to frame him, and brandishes a gun to escape. Later, the Dukes discuss their experiment and settle their wager for $1. They plot to return Valentine to the streets, but have no intention of taking back Winthorpe. Valentine overhears the conversation and seeks out Winthorpe, who has attempted suicide by overdosing. Valentine, Ophelia, and Winthorpe's butler Coleman nurse him back to health and inform him of the experiment. Watching a television news broadcast, they learn that Beeks is transporting a secret United States Department of Agriculture (USDA) report on orange crop forecasts. Remembering large payments made to Beeks by the Dukes, Winthorpe and Valentine decide to foil the brothers' plan to obtain the report early and use it to corner the market on frozen concentrated orange juice.

On New Year's Eve, the four board Beeks' train in disguise, intending to switch the original report with a forgery that predicts low orange crop yields. Beeks uncovers their scheme and attempts to kill them, but is knocked unconscious by a gorilla being transported on the train. The four dress him in a gorilla suit and cage him with the real gorilla. They deliver the forged report to the Dukes in Beeks' place and collect the payment intended for him. After sharing a kiss with Ophelia, Winthorpe travels to New York City with Valentine, pooling the money with the life savings of Ophelia and Coleman to carry out their plan.

On the commodities trading floor, the Dukes invest heavily in buying frozen concentrated orange juice futures contracts, legally committing themselves to purchase the commodity at a later date. Other traders follow their lead, driving the price up; Valentine and Winthorpe short-sell juice futures contracts at the inflated price. Following the broadcast of the actual crop report and its prediction of a normal harvest, the price of juice futures plummets. As the traders frantically sell their futures, Valentine and Winthorpe buy at the lower price from everyone except the Dukes, fulfilling the contracts they had short-sold earlier and turning an immense profit.

After the closing bell, Valentine and Winthorpe explain to the Dukes that they made a wager on whether they could get rich and make the Dukes poor at the same time, and Winthorpe pays Valentine his winnings of $1. When the Dukes prove unable to pay the $394 million required to satisfy their margin call, the exchange manager orders their seats sold and their corporate and personal assets confiscated, effectively bankrupting them. Randolph collapses holding his chest and Mortimer shouts at the others, demanding the floor be reopened in a futile plea to recoup their losses.

++++++++++++

Larry,

The only reason to mention this is that the USDA increasing the TX crop made ZERO sense unless there is something profound that we and the rest of the INFORMED MARKET don't know about.........or there was funny business going on by the USDA.

I lean towards the funny business. If this USDA estimate is correct for TX, after the drop in conditions then why was the previous one so low for TX???

If they do LOWER the size of the TX crop in the next report, then why didn't they do it in October, WHEN THE MARKET DIALED THAT INTO THE PRICE AND GOT A BEARISH SURPRISE???

I would not be surprised to see the next report be a BULLISH surprise based on previous USDA reports. This is how people that know what the number will be can maximize their profits.

I can’t prove a word of this and it’s purely speculative.

We DID hold support after the spike lower tested it.

Great work in this thread, Larry!

Wonderful trading discussion!

And neither of us is trading cotton!!

Cotton is a bit lower again tonight . But off the lows. Damage to the US crop from hurricanes and drought could be enough to keep us from falling too much more?

stocks are important in determining price. Im not sure where we are at there. despite weather issues in recent months, this years crop has 6% less rated in the poor/very poor category.

rhe price a year ago looks like it was around 12c higher than now.

++++++

cotton on the lows, down 1c at 4;30 am.

Evidence to support my previous assertion about the USDA.

I'm really sorry to have this speculative position and wish it wasn't probably the case.

By metmike - Oct. 14, 2024, 5:06 p.m.

I want to emphasize the significance of what Karen stated above.

In this age of technology, with dozens of firms that use it to try to ascertain the crop size for many thousands of traders with billions of dollars on the line, ALL OF THEM WERE WRONG on guessing the USDA's final yield report almost half the time.

In other words, all the previous USDA reports meant nothing in the end because almost half the time the USDA came out with a surprise so big that it was completely outside all firms guess.

How can that happen???

I explained it last Friday, after they made a shocking increase to the TX crop with crop ratings plunging during that period.

CT: Any guess on how much Francine/Helene reduced AR/GA?

By metmike - Oct. 11, 2024, 2:32 p.m.

+++++++++++

I feel really bad to suggest this because the USDA provides us with so much useful information. On the other hand, there just isn't another explanation that makes sense and if true, they have cost people many billions of dollars over the years using a strategy to enrich themselves.

Gee, they are part of the government, who would have guessed

+++++++++++

How is this costly to traders and the market?

On Friday, anybody long going into the USDA October cotton report BASED ON ACCURATE ASSESSMENTS of the bullish weather and falling crop ratings got their balls busted badly because of what the USDA did in TX and maybe other places but not so extreme.

I was almost tempted to be long but remembered, over 2 decades ago to swearing that I would NEVER have a position thru a USDA report because they often do whacko things that make no sense that traders can't possibly anticipate.

In the vast majority of times, I LOST MONEY by using weather and crop conditions to estimate the crop and USDA numbers because of their surprises, that would be reversed on the next report.

If it isn't intentional then its incompetence. I love the USDA and the vast majority of their wonderful information but thats just my opinion.

The G/E number in cotton jumped 5% the last week!!!!

P/VP decreased by 1%.

Full USDA crop condition report:

TX and AR had sig improvements

Not sure what to attribute that to since it’s too late for rain to hlp and there was no rain.

except that it may have something to do with this last stage of development before harvest and an aspect of that which suggests a better condition than before that stage.

what do you think, Larry?