Re: Re: Re: Re: Soyb/coffee/oj

By Jim_M - Nov. 5, 2024, 11:50 a.m.

Time for a new thread

+++++++++++++++++

As you requested, Jim!

I'll be in Detroit again, visiting my 99 year old dad for around 10 days, starting later this week.

Previous thread:

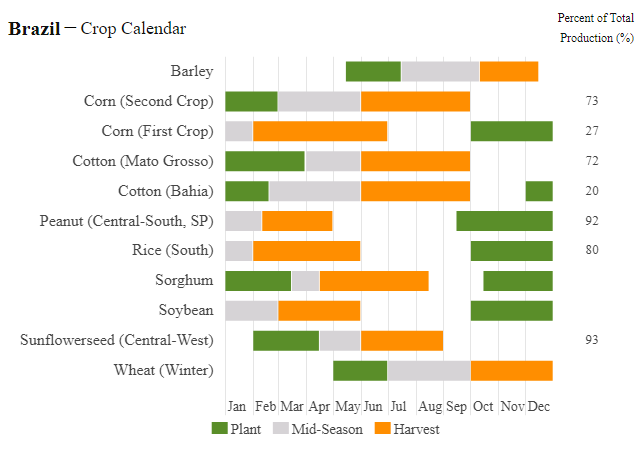

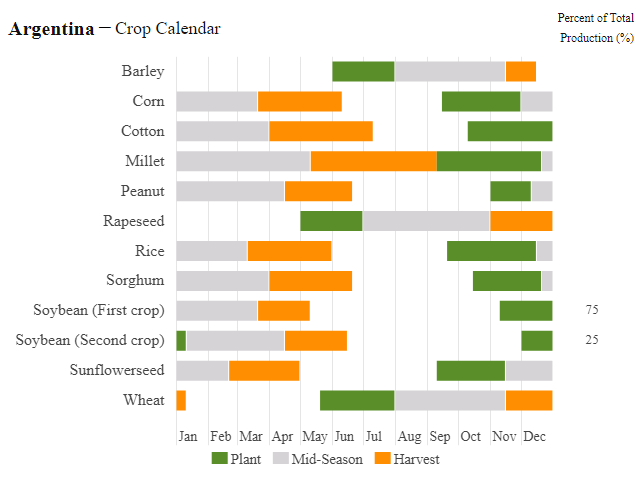

Soyb

66 responses |

Started by baker - Aug. 25, 2024, 10:45 p.m.

https://www.marketforum.com/forum/topic/106950/

99….that is amazing. Enjoy your time.

Thanks, Jim!

He's been going downhill pretty fast this year. Hopefully he can still play some chess. I've given him my queen the past 20 years and he could still beat me some times as recently as this Summer.

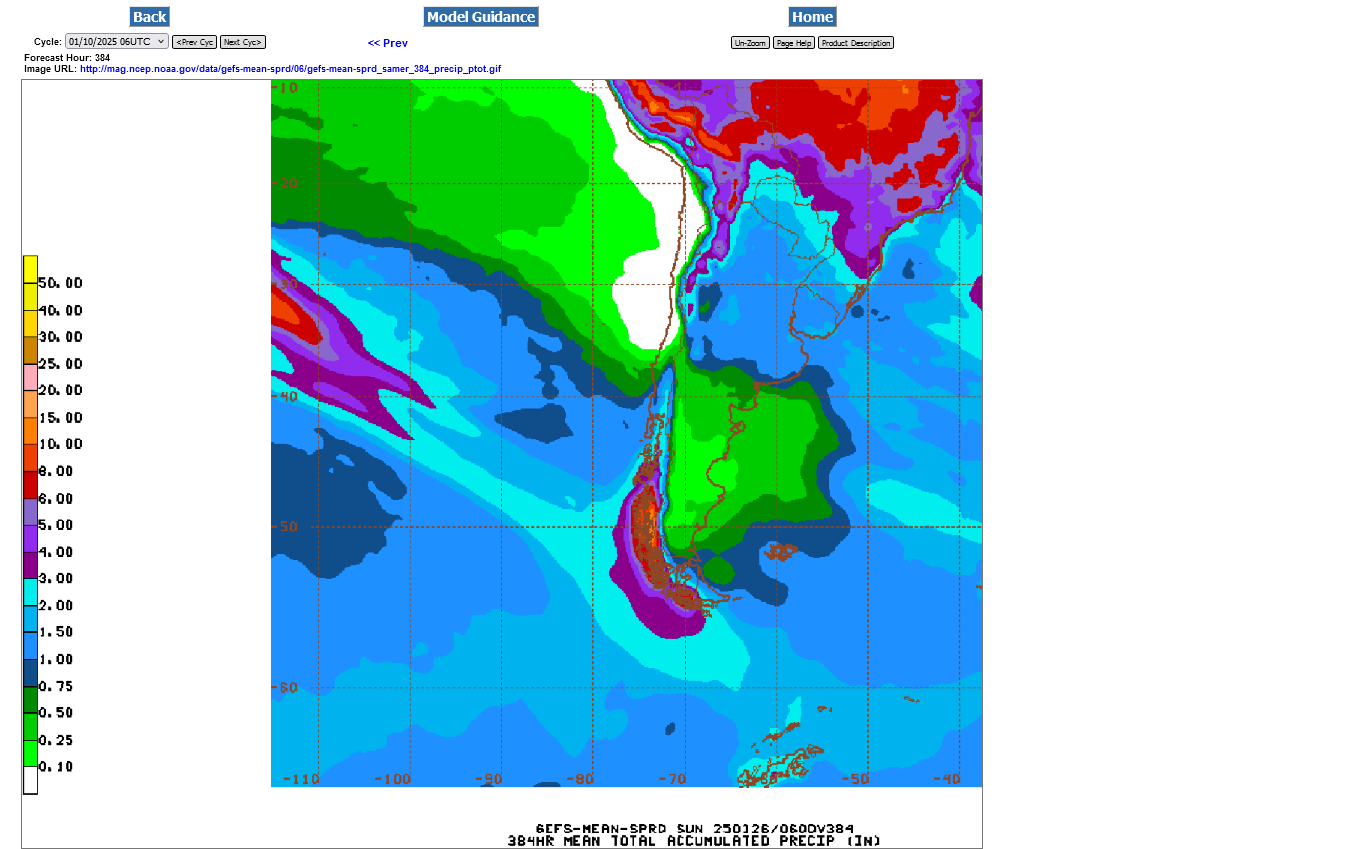

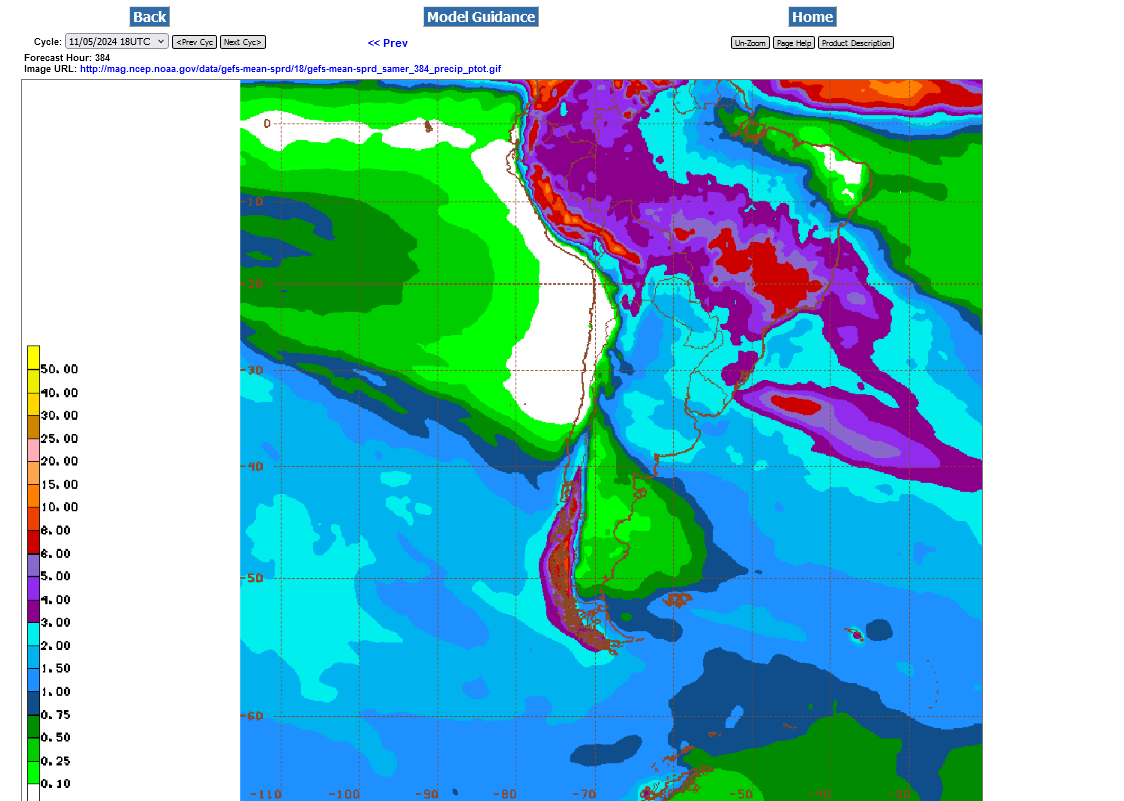

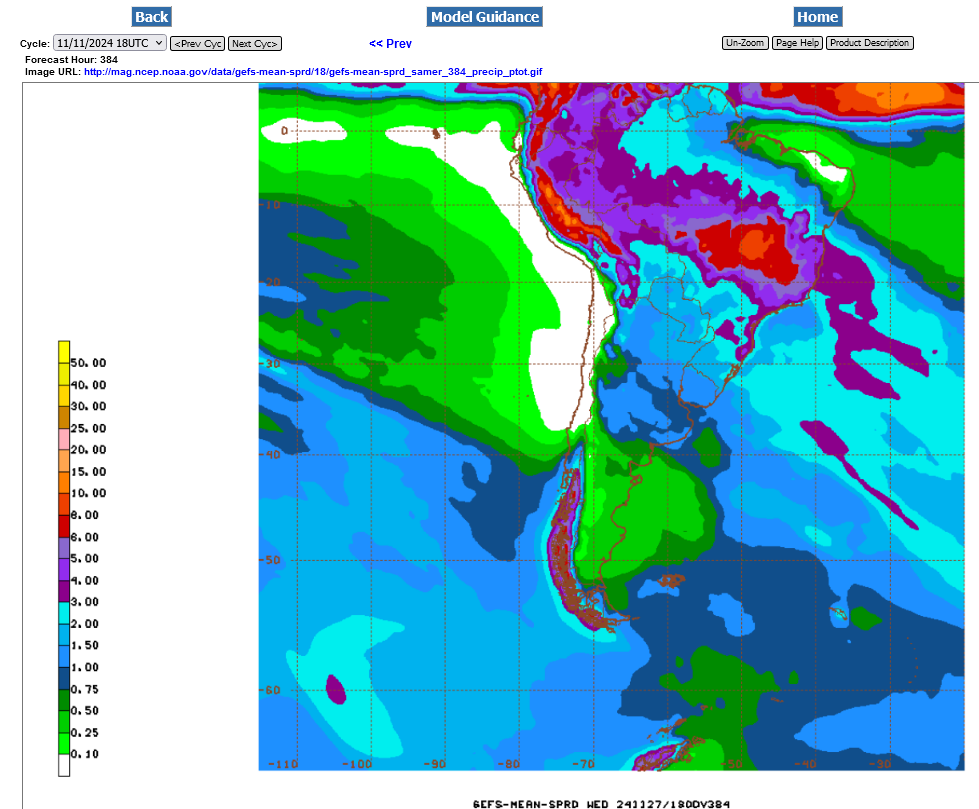

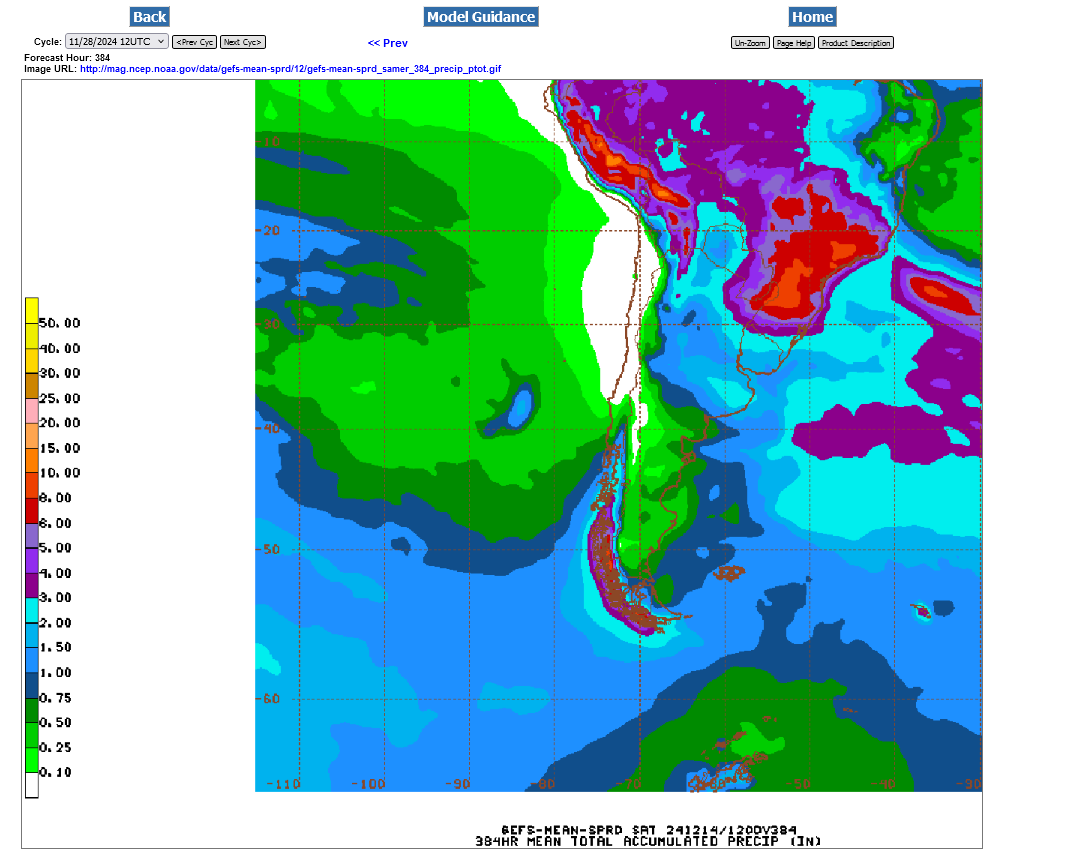

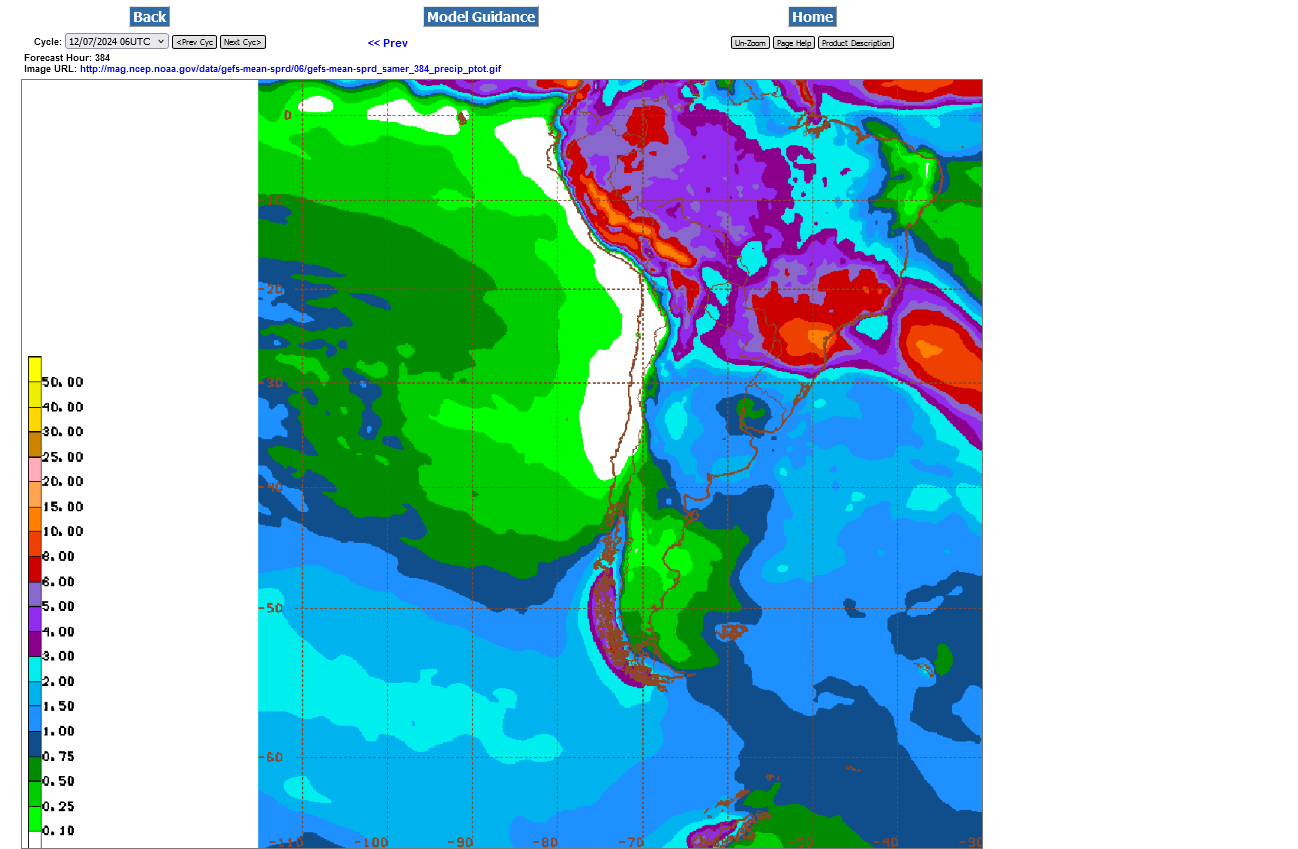

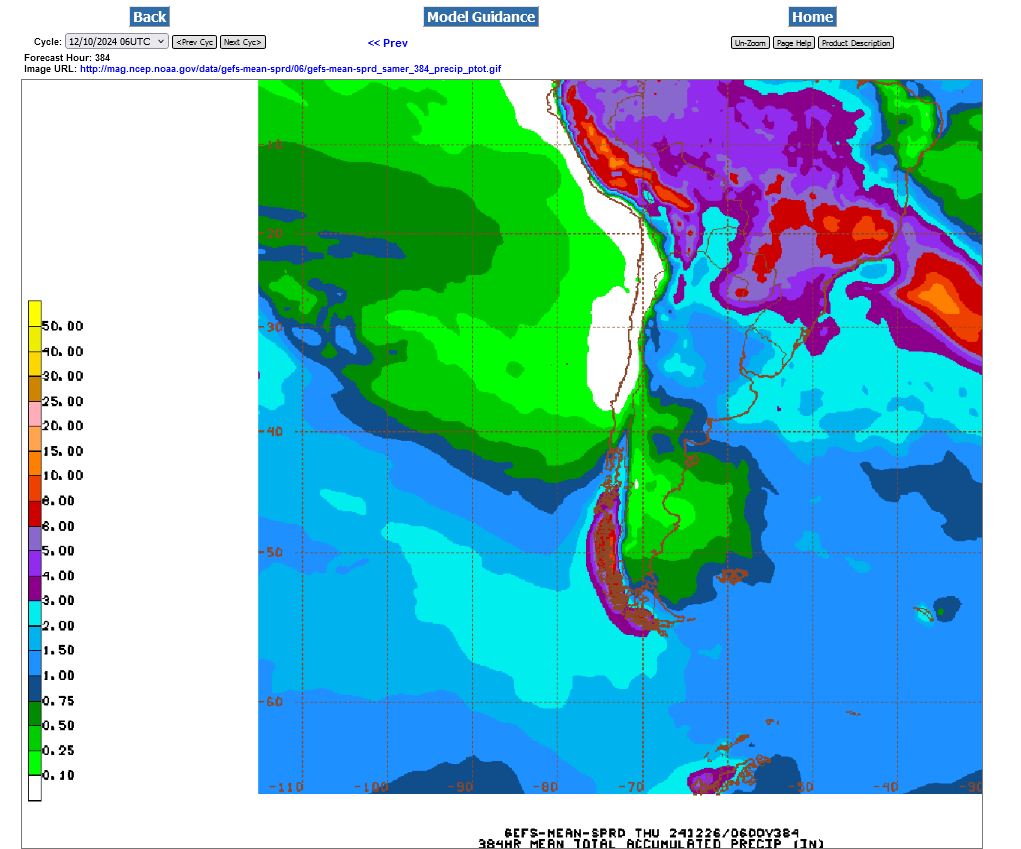

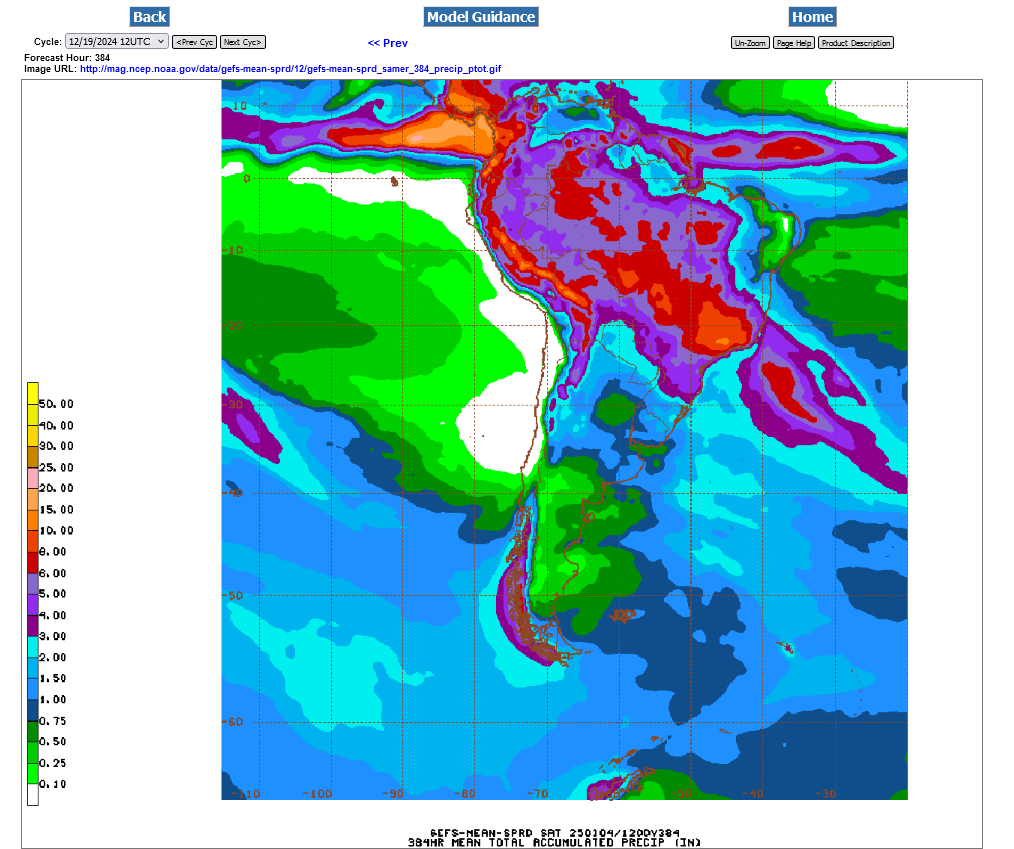

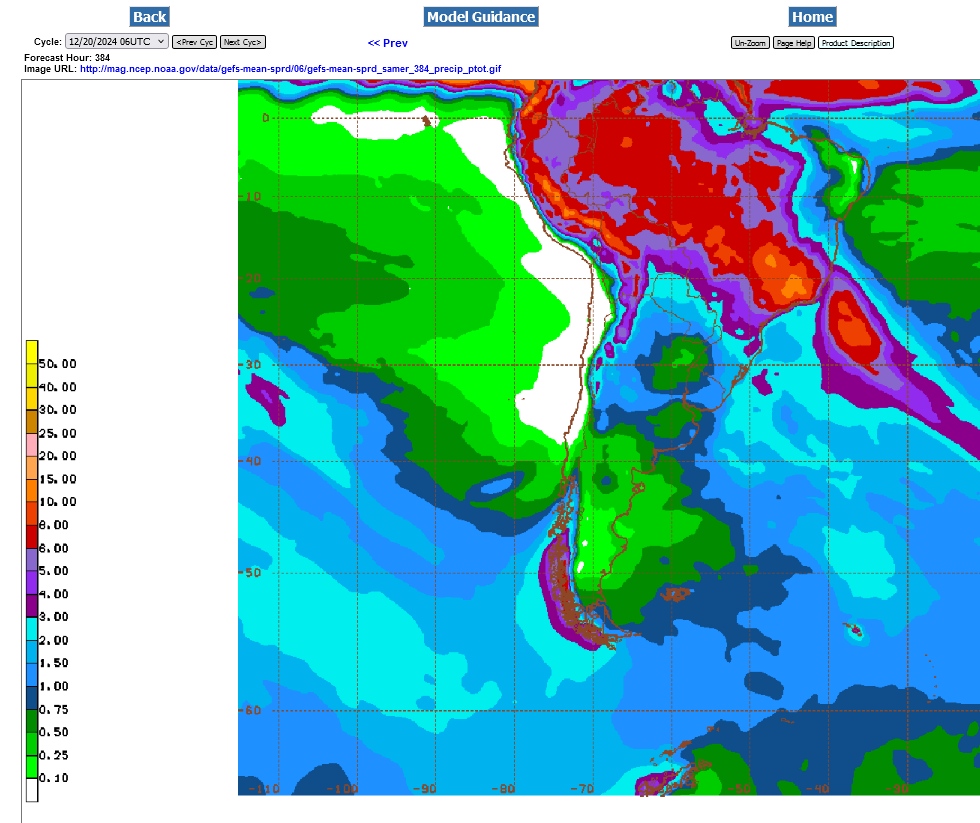

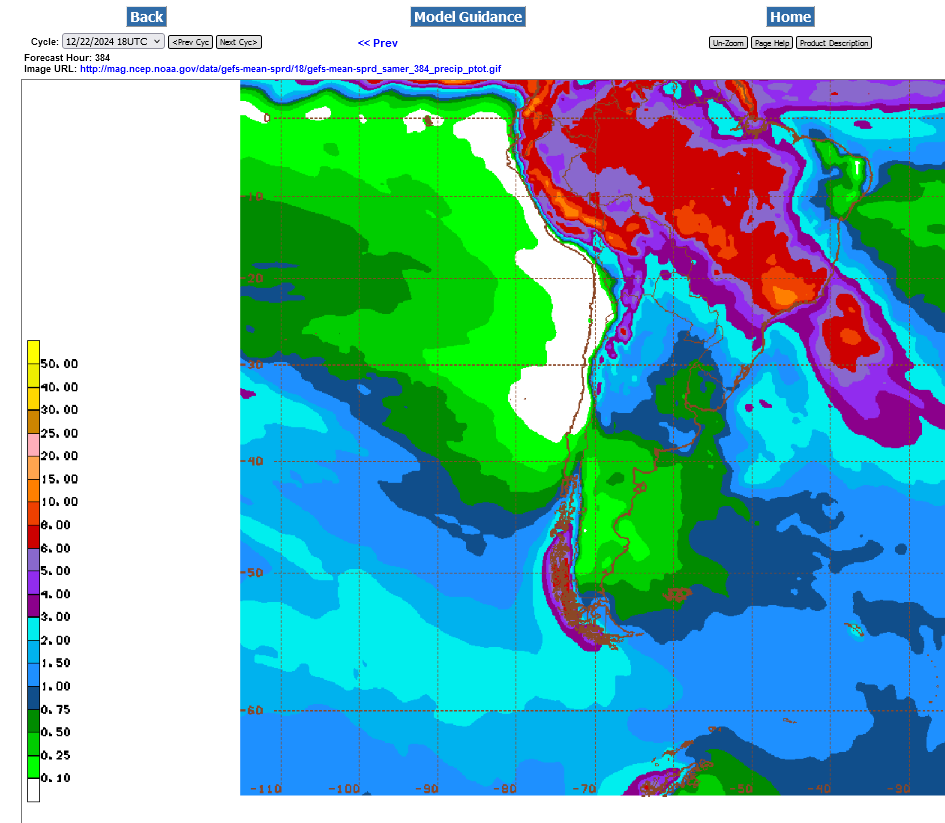

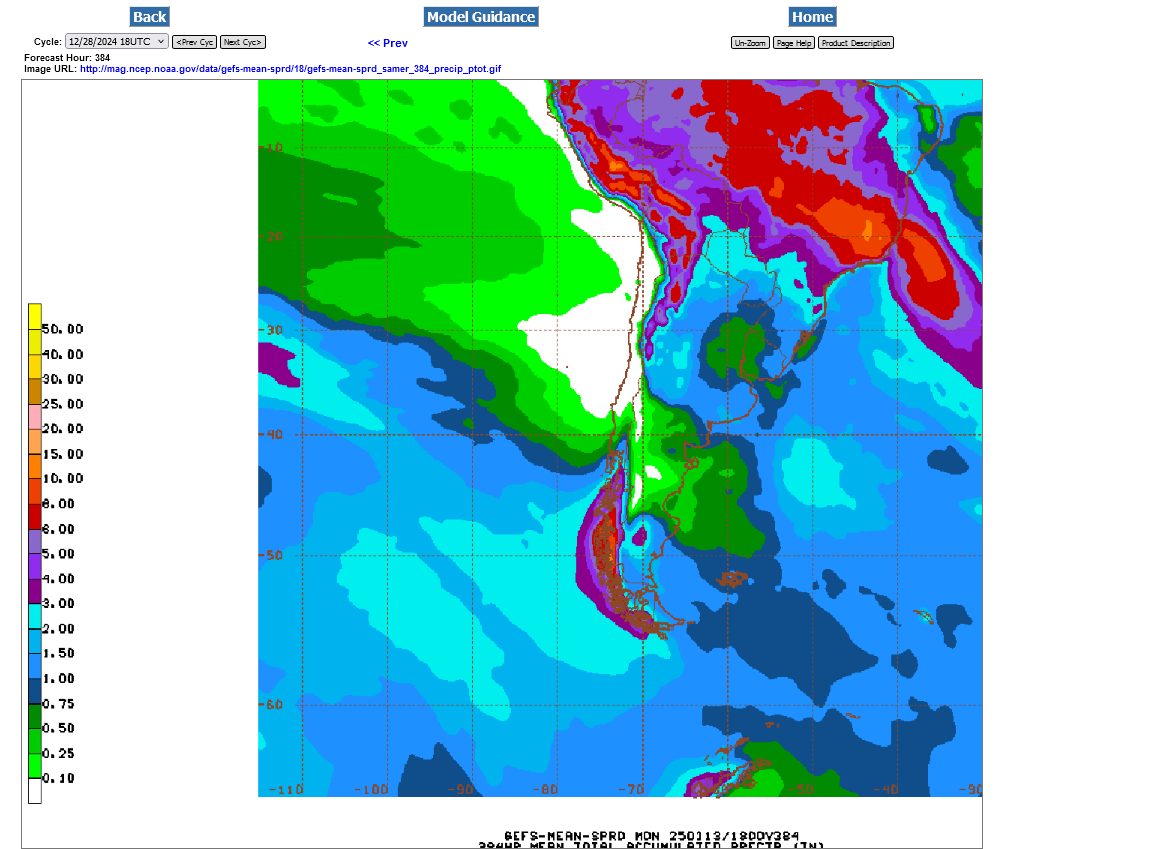

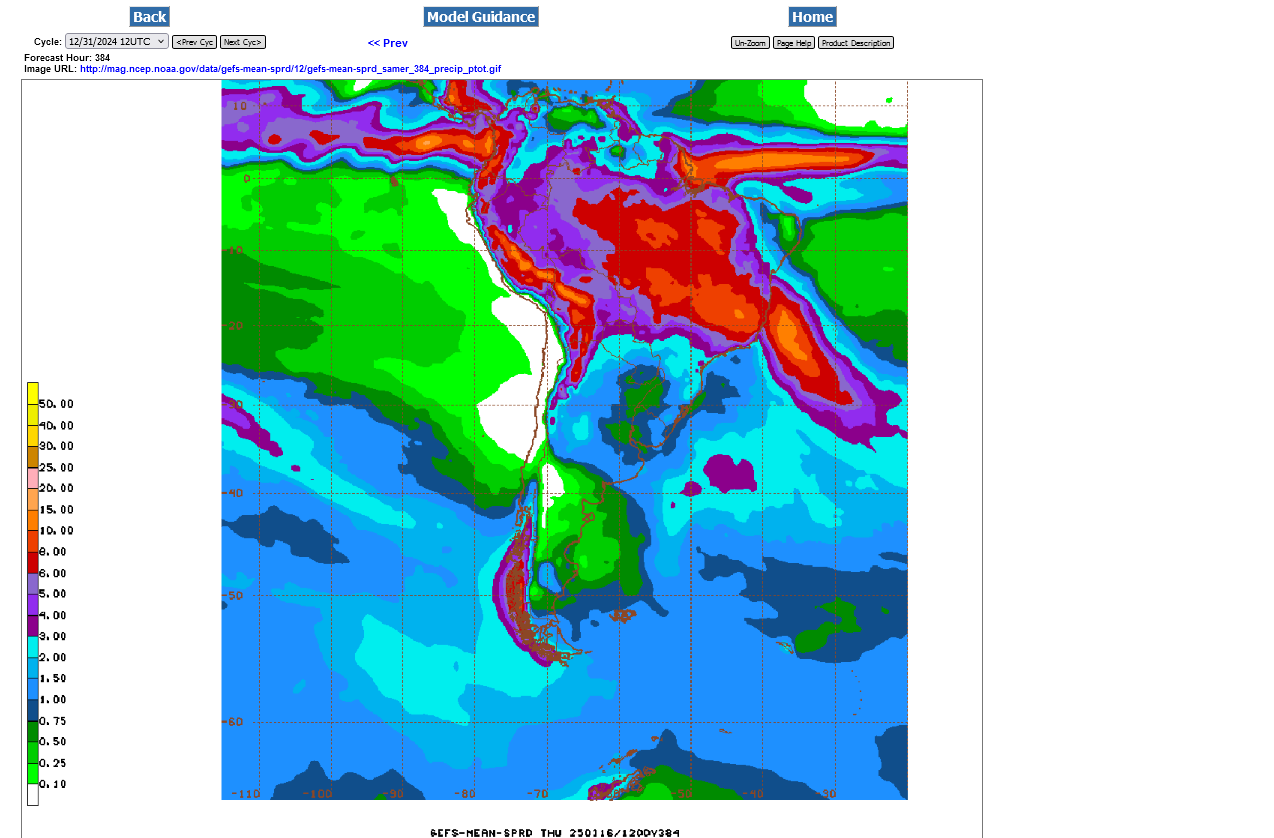

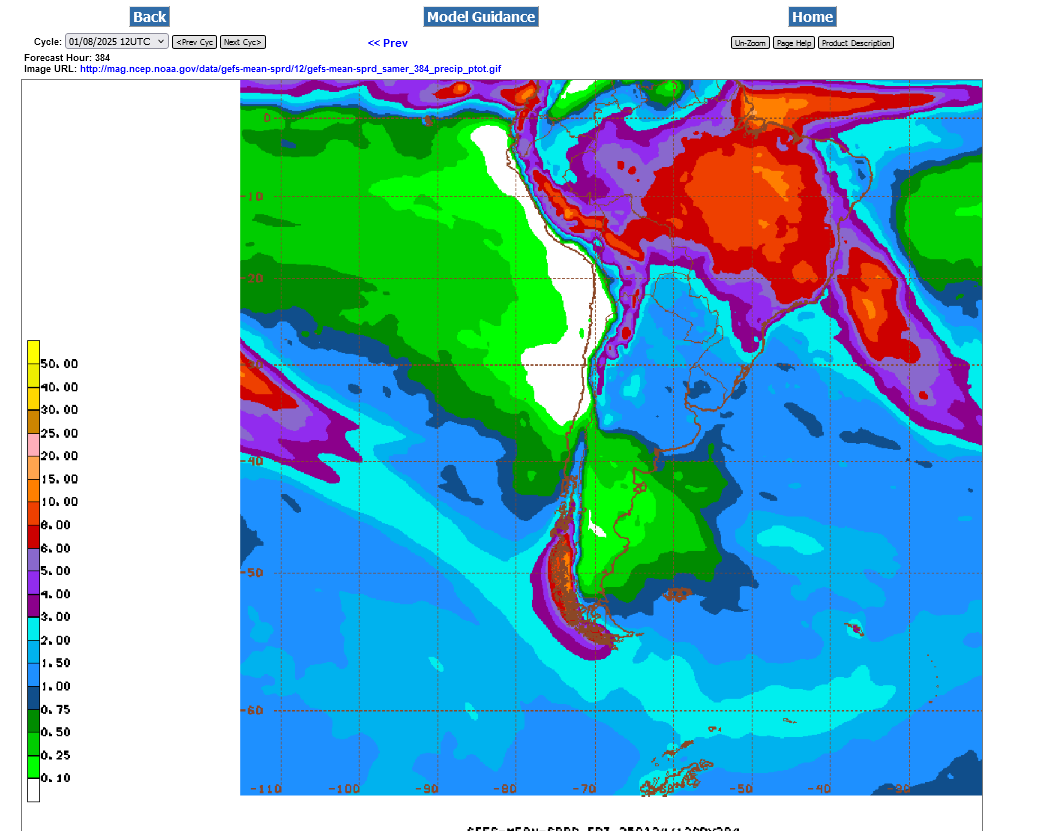

Still tons of rain for all of Brazil and the amount of rain for Argentina, that had been shrinking this week, just almost doubled on this last 18z GEFS run out thru 384 hours.

https://ipad.fas.usda.gov/countrysummary/default.aspx?id=BR

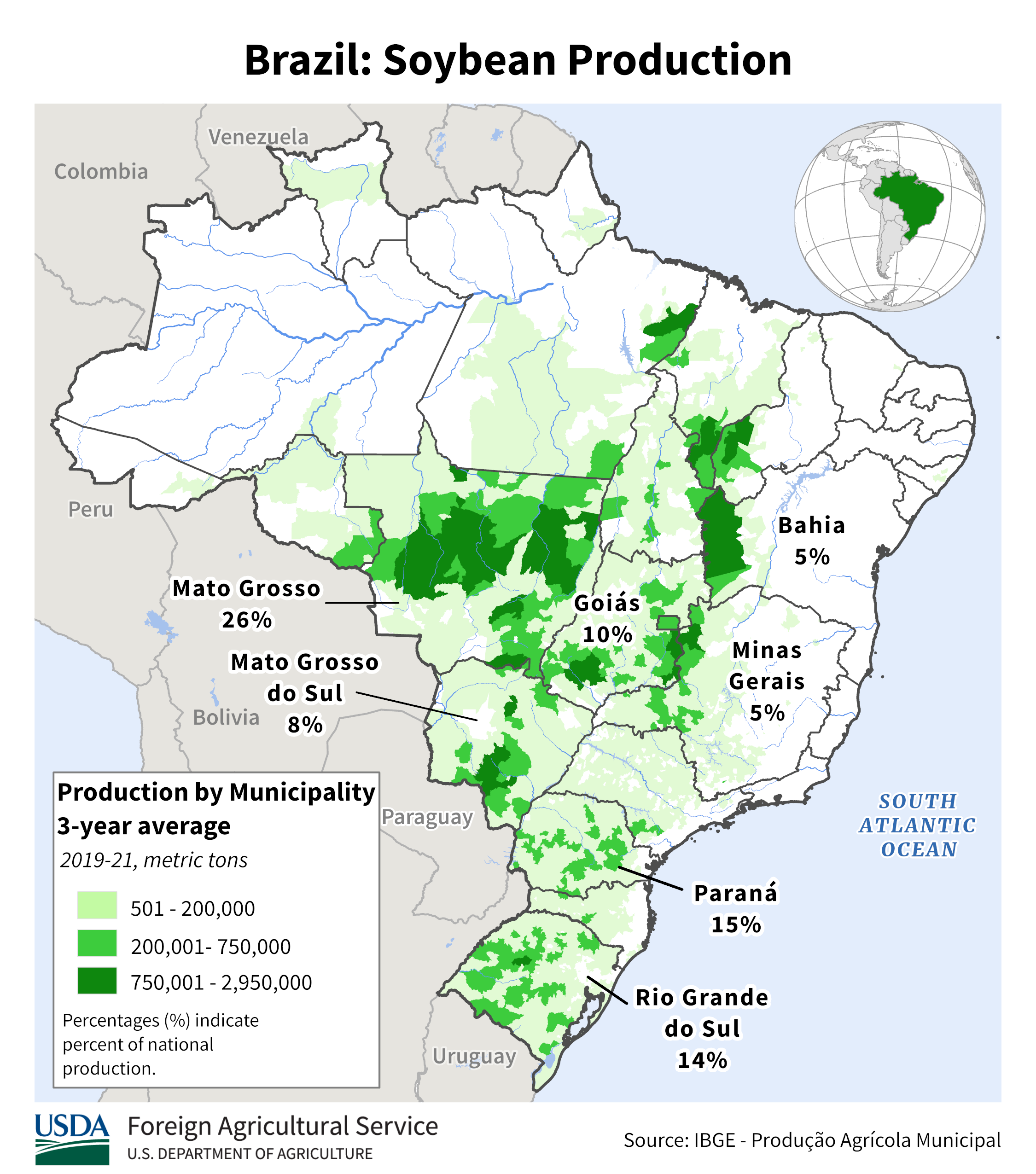

https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/Brazil/Municipality/Brazil_Soybean.png

https://ipad.fas.usda.gov/countrysummary/default.aspx?id=AR

https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/Brazil/Municipality/Brazil_Total_Coffee.png

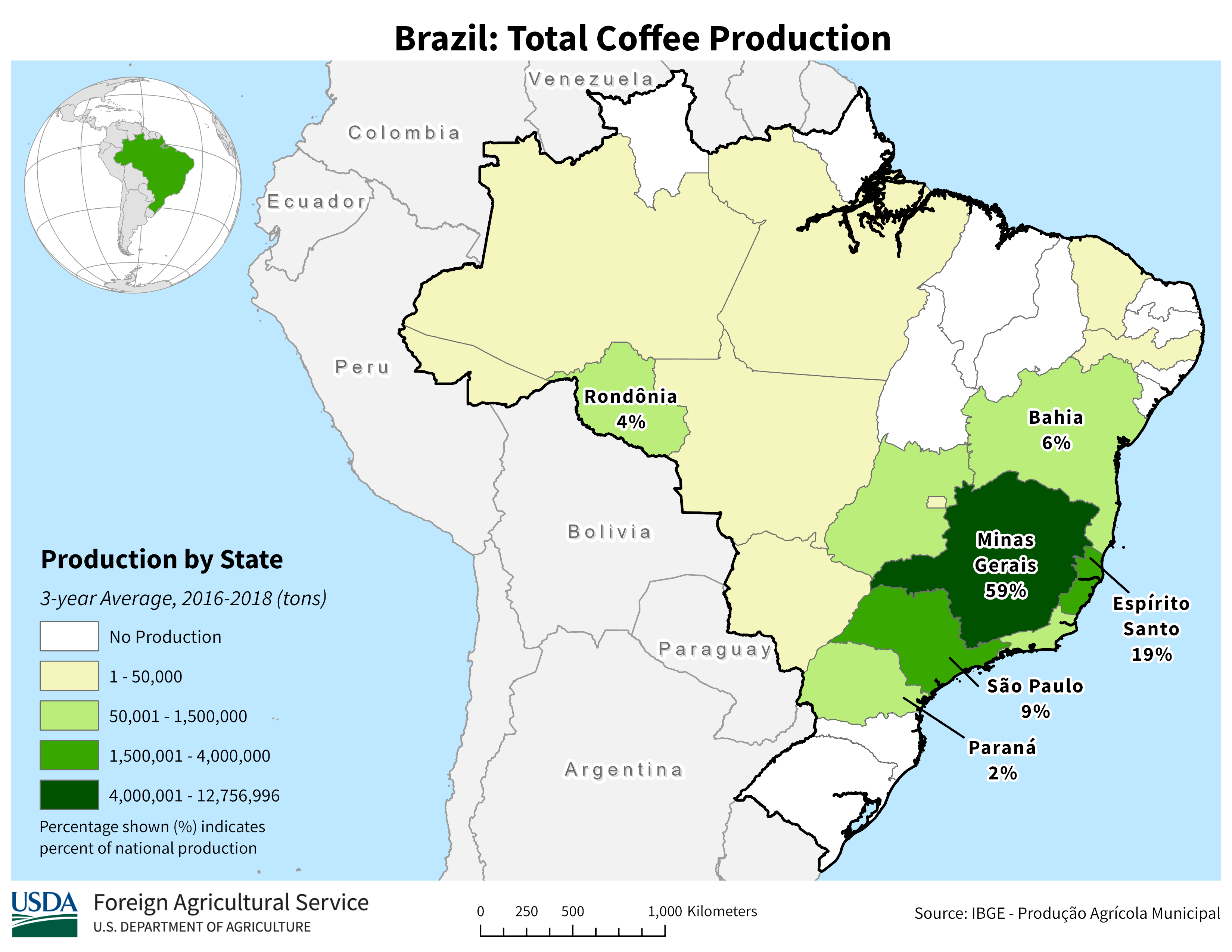

Minas Gerais weather counts the most!

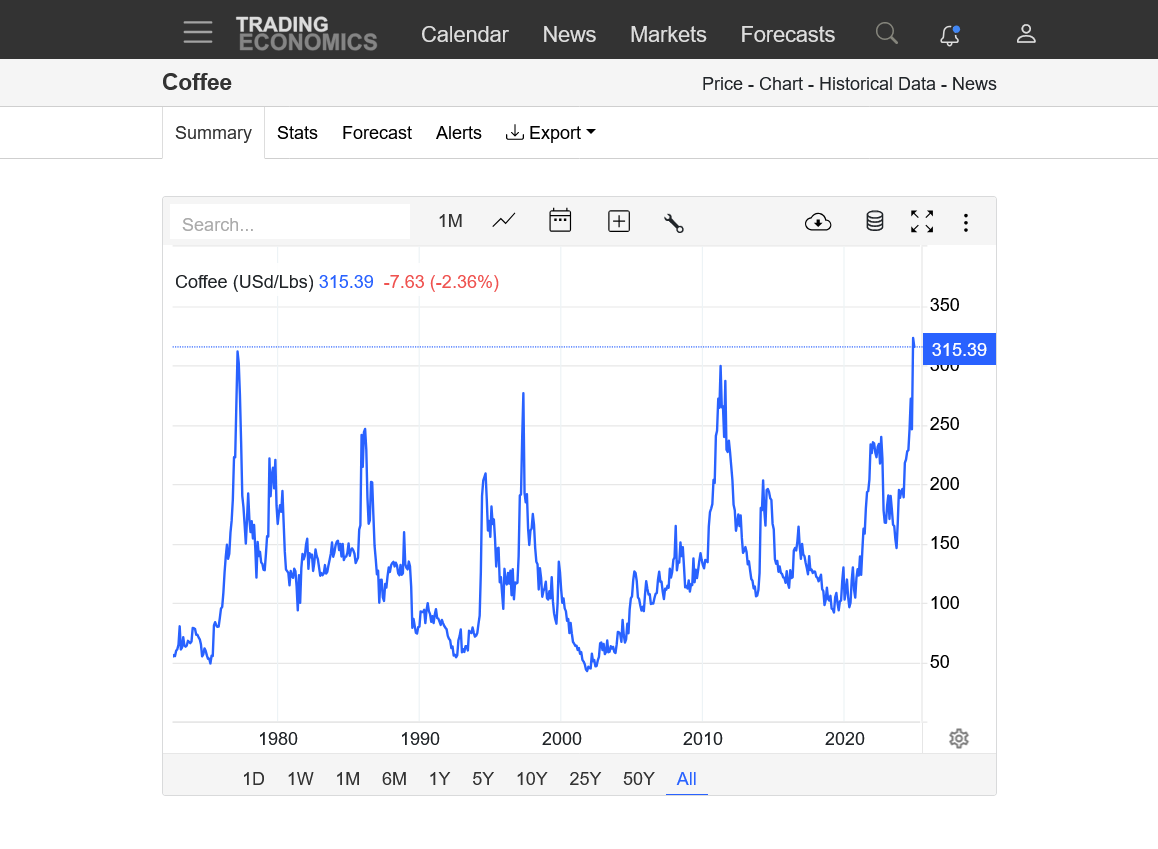

https://tradingeconomics.com/commodity/coffee

1. 1 month

2. 1 year

3. 10 years

4. 50 years

https://tradingeconomics.com/commodity/coffee

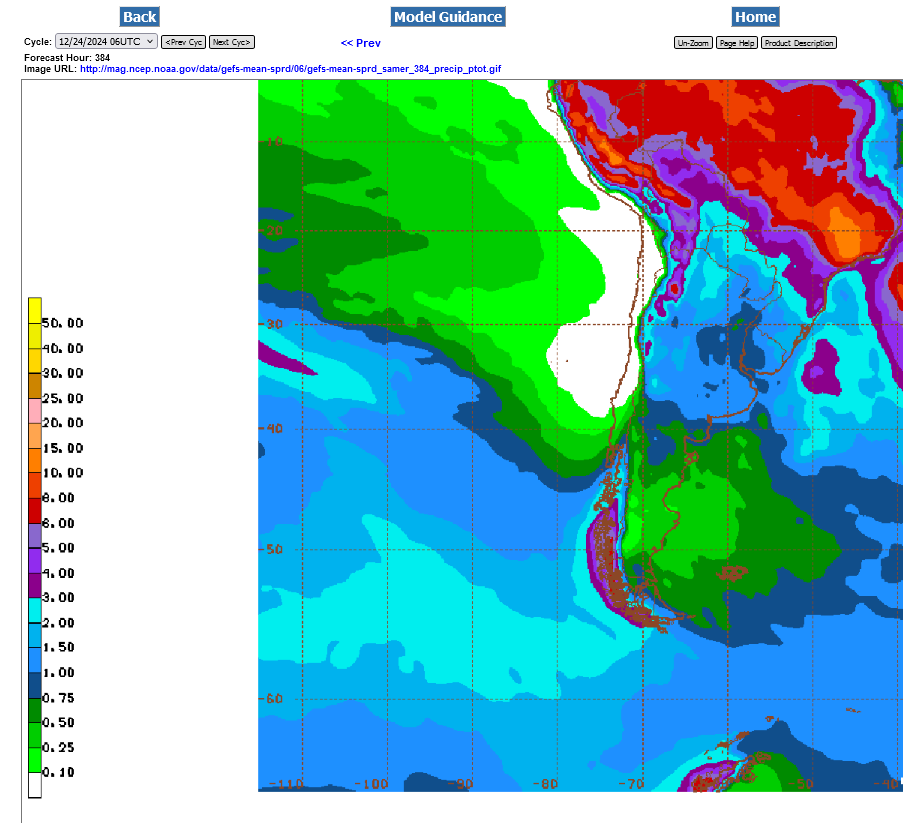

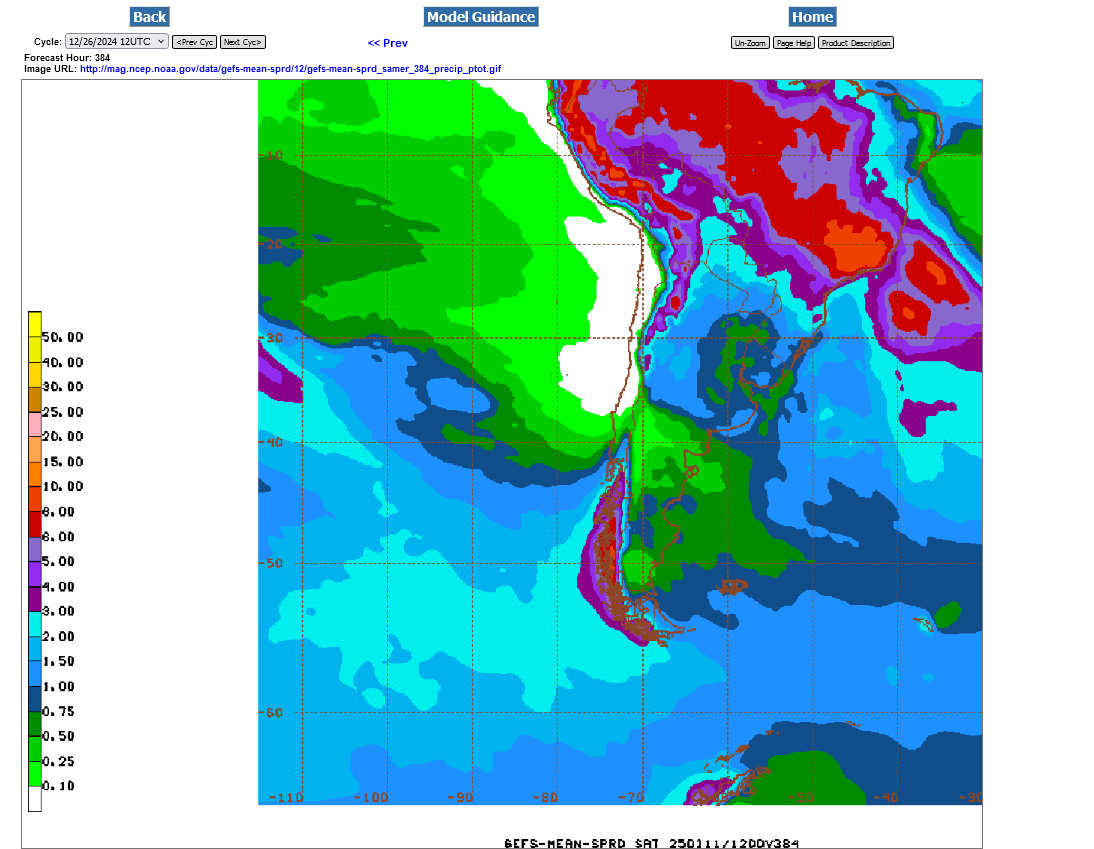

A bit light on rains for southern Argentina but OK in northern Argentina and great in Brazil. Beans double digit gains don't appear to be related to SA weather. 384 hour rains below:

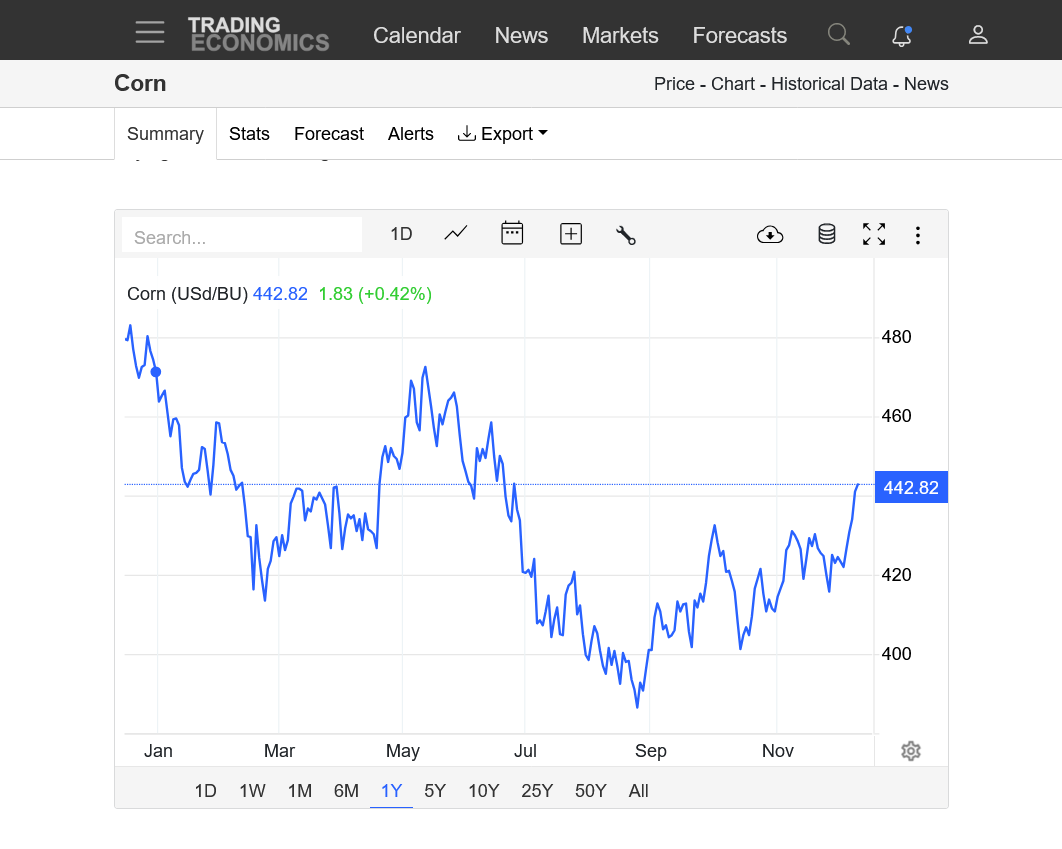

Corn has been on a tear as well.

Thanks, Jim!

Argentina's weather forecast has become even DRIER! Brazil is great.

2 week rains below. I suppose that if the rain goes away completely over the weekend in Argentina, beans could take off next week but that's NOT a prediction. Overall SA weather is not bullish yet.

It's still just early November and I'll need to spend more time studying it over the weekend but since I'll be traveling and out of town, that will be challenging.

I forgot about the November USDA report until a short while ago:

VERY BULLISH FOR BEANS!!!!

USDA November 8, 2024

Started by metmike - Nov. 8, 2024, 1:26 p.m.

https://www.marketforum.com/forum/topic/108545/

+++++++++++++++

Can you tell when the USDA released the bullish, updated soybean production number on the 1 day chart below?

https://tradingeconomics.com/commodity/soybeans

Interesting reaction. Huge spike up but then dropping 20c+ on profit taking from people like me that KNEW the report would be bullish and covered their spec longs. Then back higher. Now at +6c for the January. This is a plot of the November contract which is barely still trading. SF25 is at 1032 right now.

Last 12z GEFS has a tad more rain for Argentina, which still has below average rains the next 2 weeks. Weather is not bullish yet for SA but the very bullish USDA November report makes SA weather MUCH MORE IMPORTANT NOW!

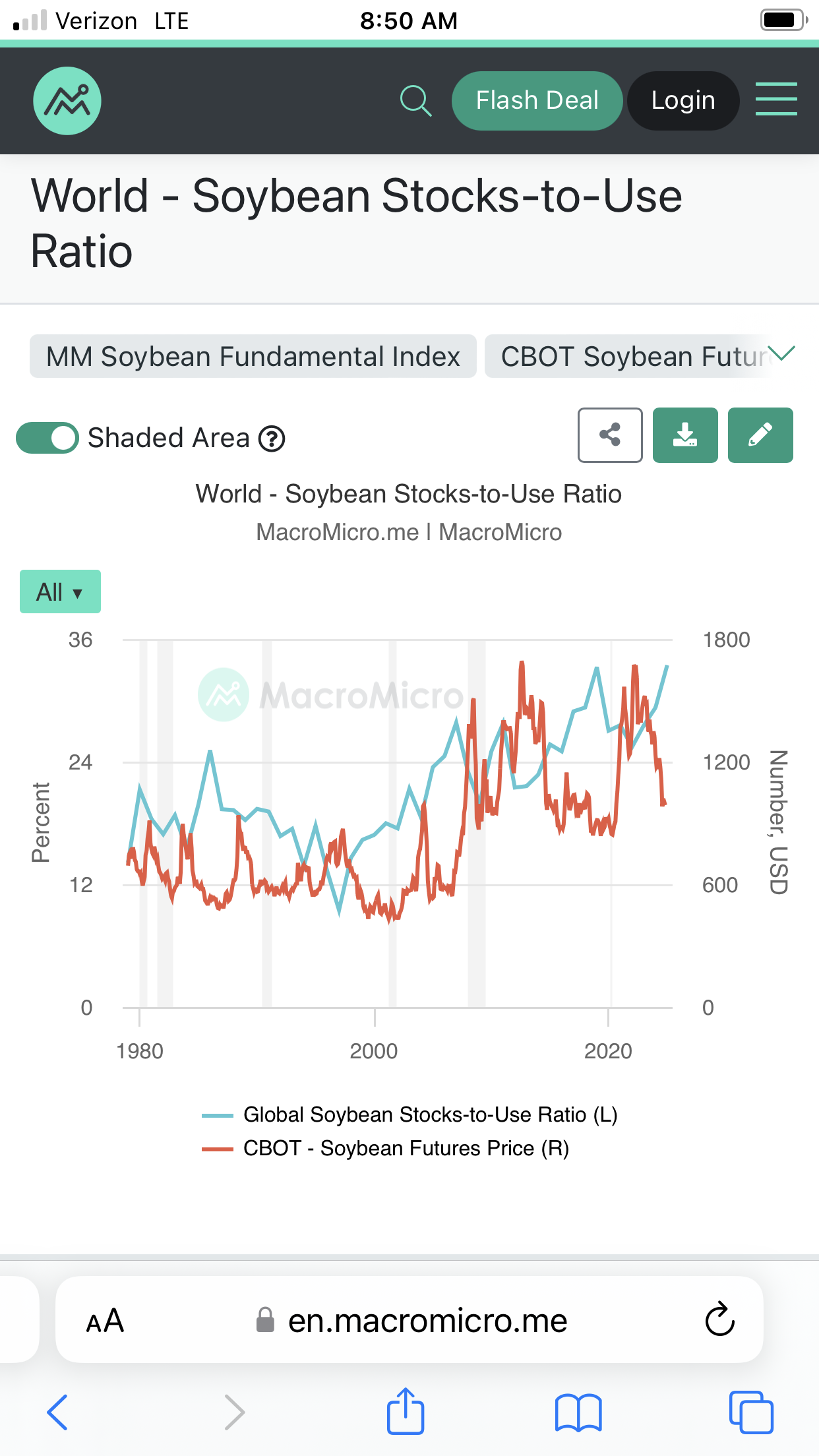

The report was a little bullish but we are hardly in danger of running out of food.

Thanks Jim.

good points on the stocks but this is a futures market, not PASTures.

also, your graph was from BEFORE the USDA report. The market traded what’s ion your graph over 2 months ago!

I disagree about the amount of bullishness Of the report.

when you suddenly take over 100 million bushels away from supply, much more than anybody expected it’s VERY bullish.

Add in the fact that it’s getting drier in Argentina and I do NOT want to be short this market.

I see what you did there Mike.

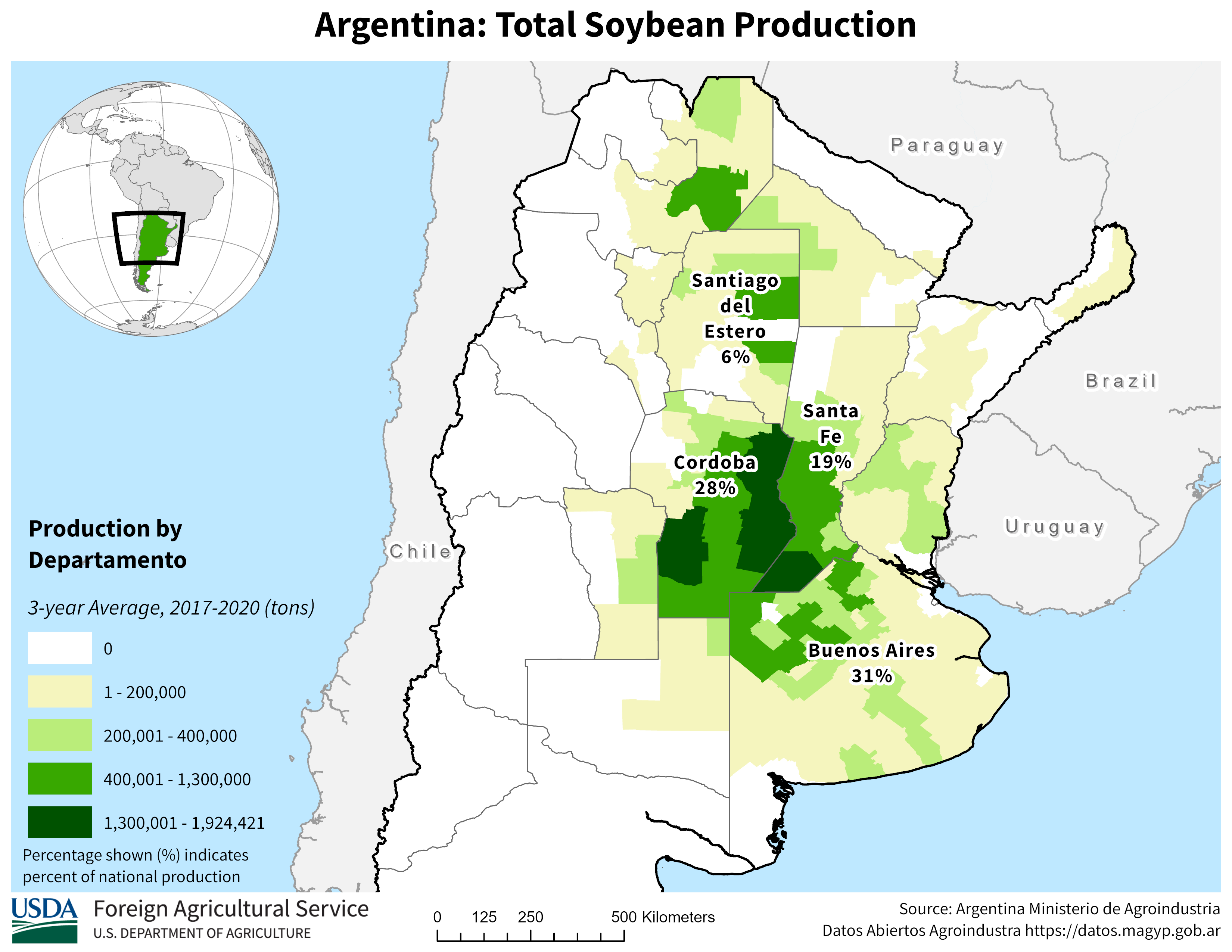

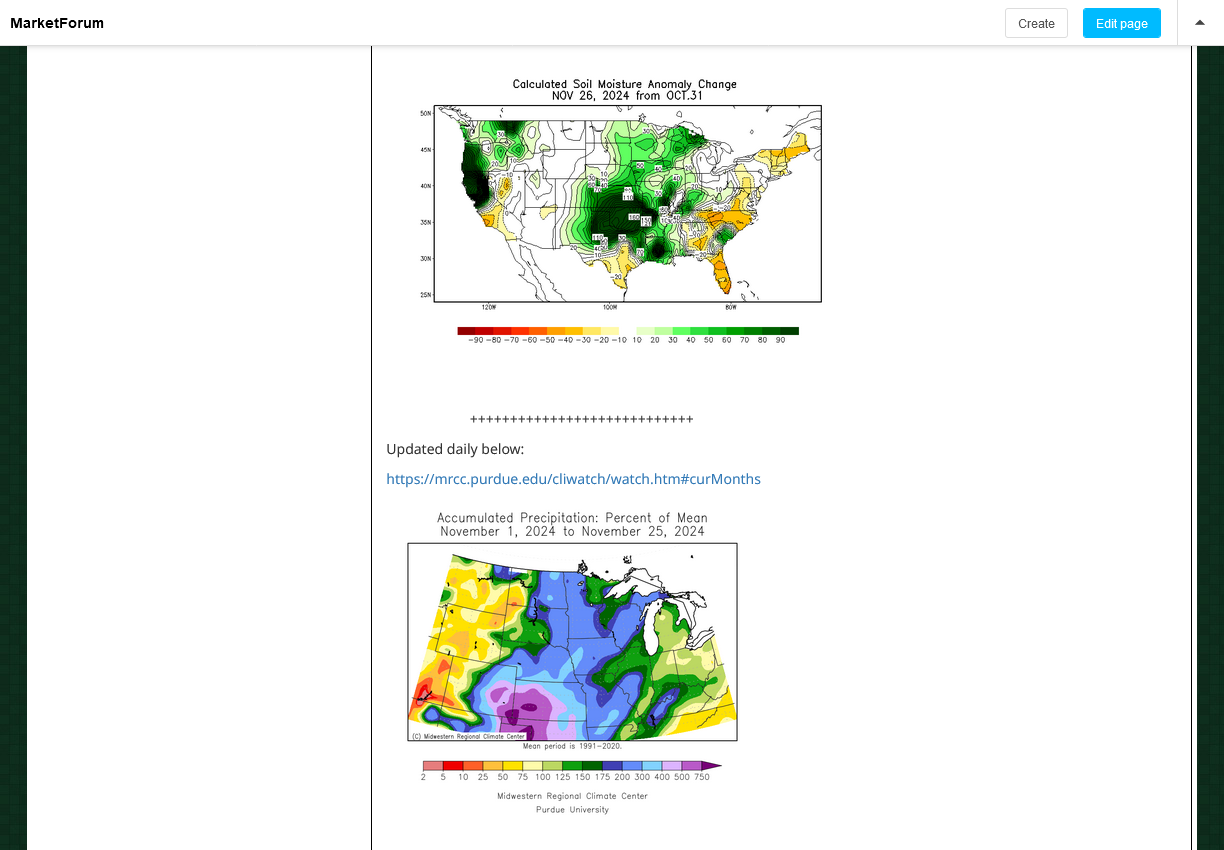

Still plenty of rain in Brazil but on the dry south, especially southern growing area of Argentina. As Jim stated, we still have a huge surplus/cushion with US and global soybean stocks. But SHRINKING surplus.

Markets usually trade changes compared to what was expected.

When the crop size is shrinking or stocks going lower, the market usually goes higher and vice versa until thats dialed in.

HEY, I figured out to draw trend lines at the site I've been using for price charts!!!

https://tradingeconomics.com/commodity/soybeans

1. 1 year-down trend but with a solid low in late August from flash drought.New uptrend forming?

2. 5 year-down trend since 2022 high still remains

3. 45 years-uptrend from Jan 2002 low, to 2020 COVID low to August 2024 low. Also a triple top from 2008 high, 2012 high and 2022 high. You could also make a case for that to be a head and shoulders top too

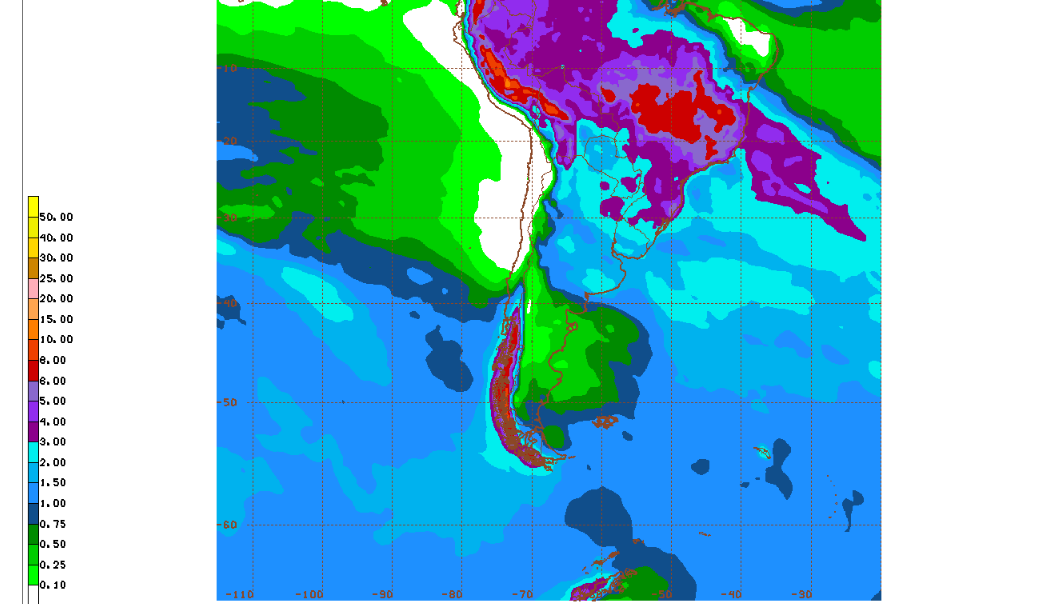

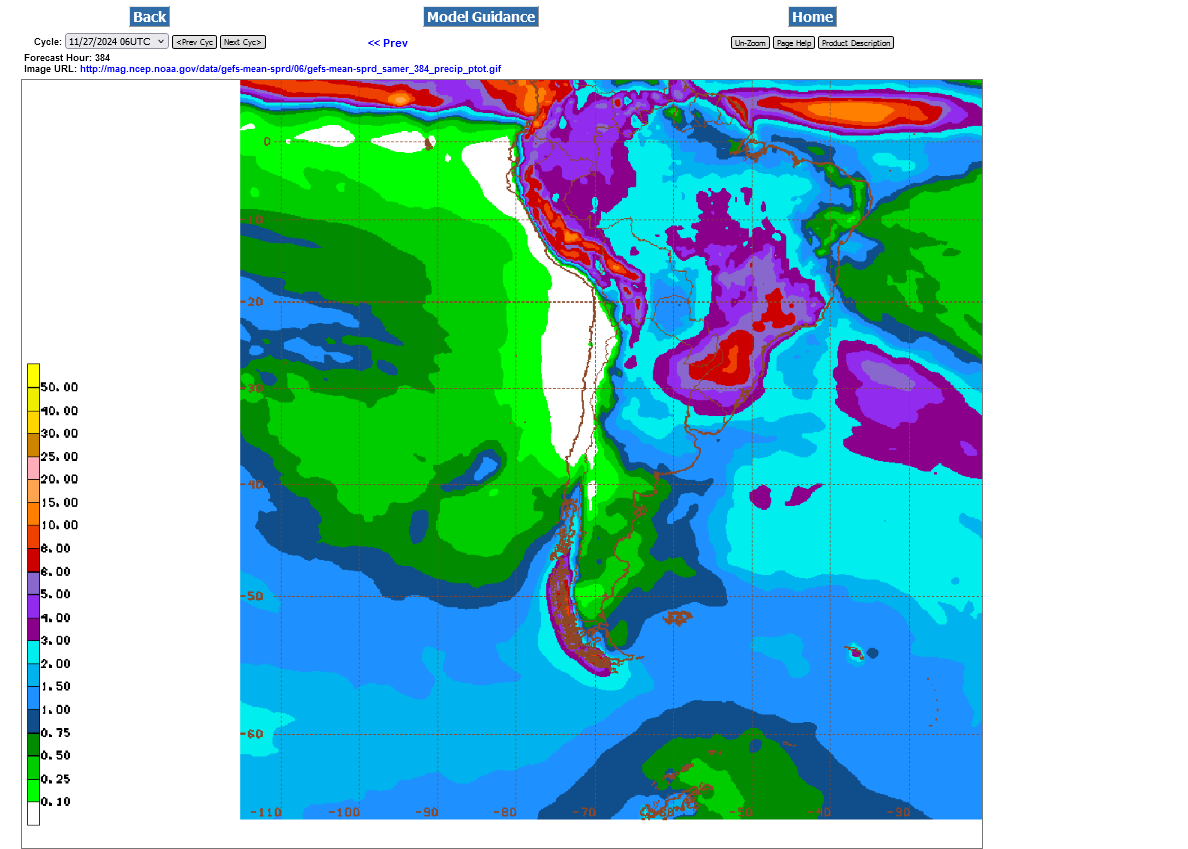

Perfect weather continues for Brazil. We added a bit of rain for Argentina overnight but are still on the light side. This was the rain forecast total for the next 384 hours on the last 6z GEFS model solution.

Brazil coffee 2 week rains. Pretty robust..........and for beans too.

Argentina rains INCREASING=BEARISH!

Great rains in brazil the next 2 weeks. A bit below in s.argentina but not too bad.

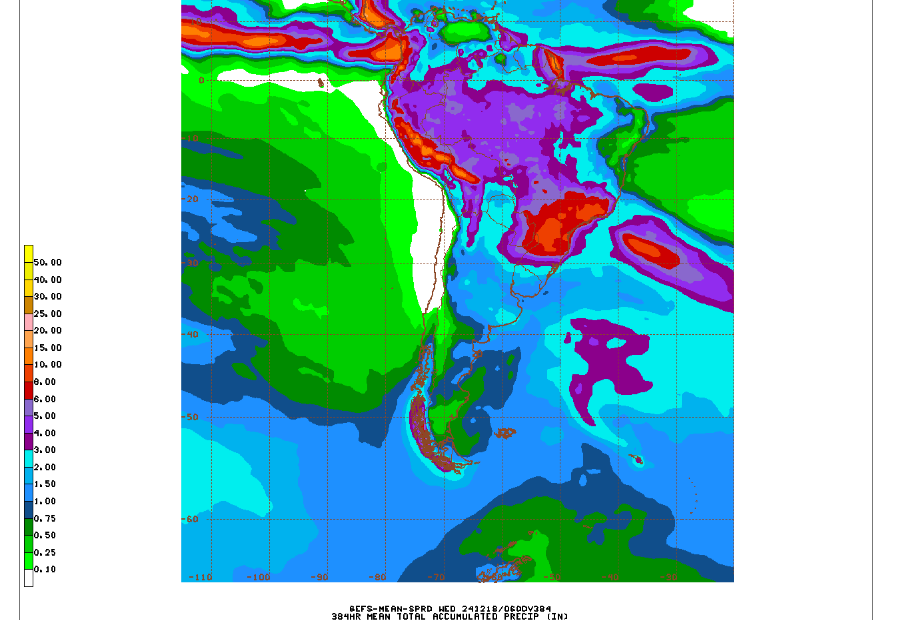

last 18z GEFS below.

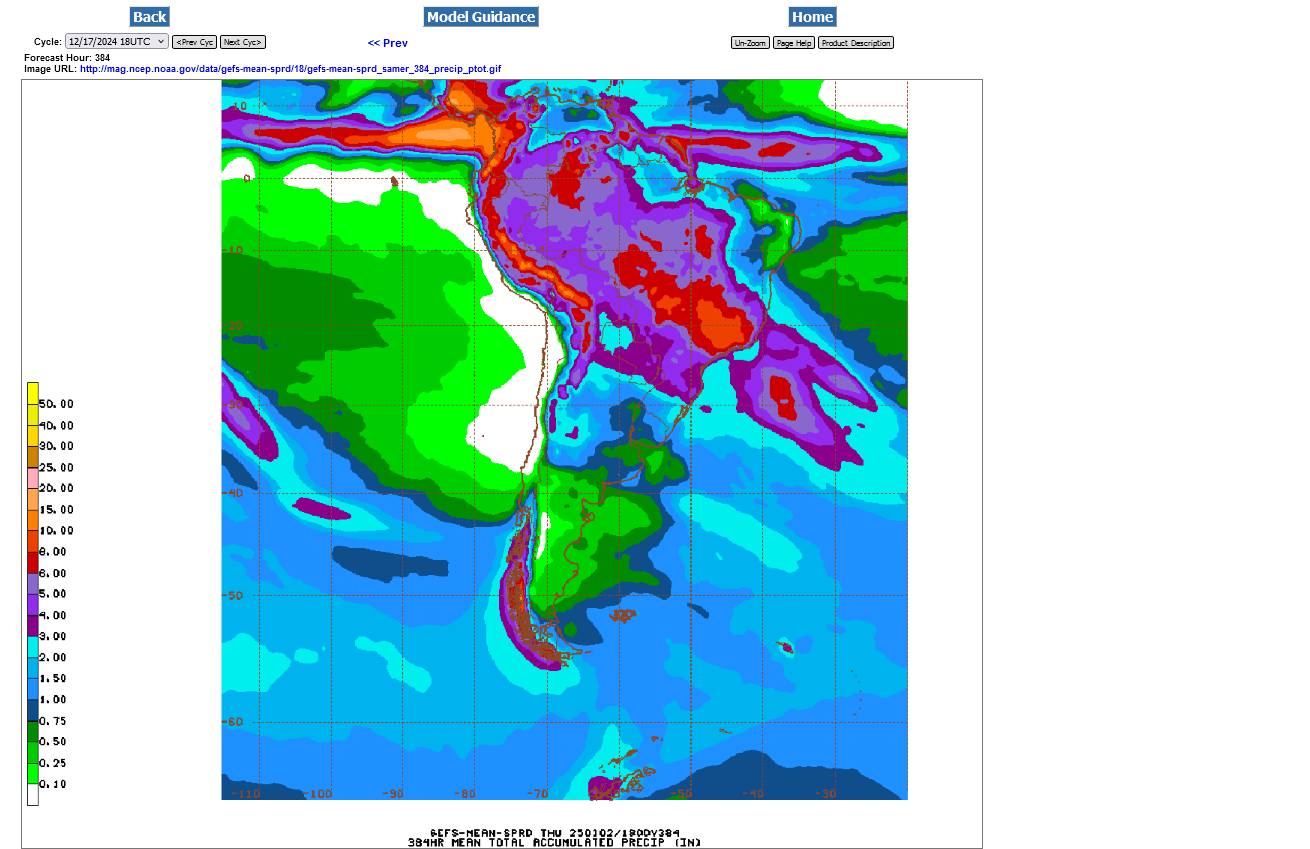

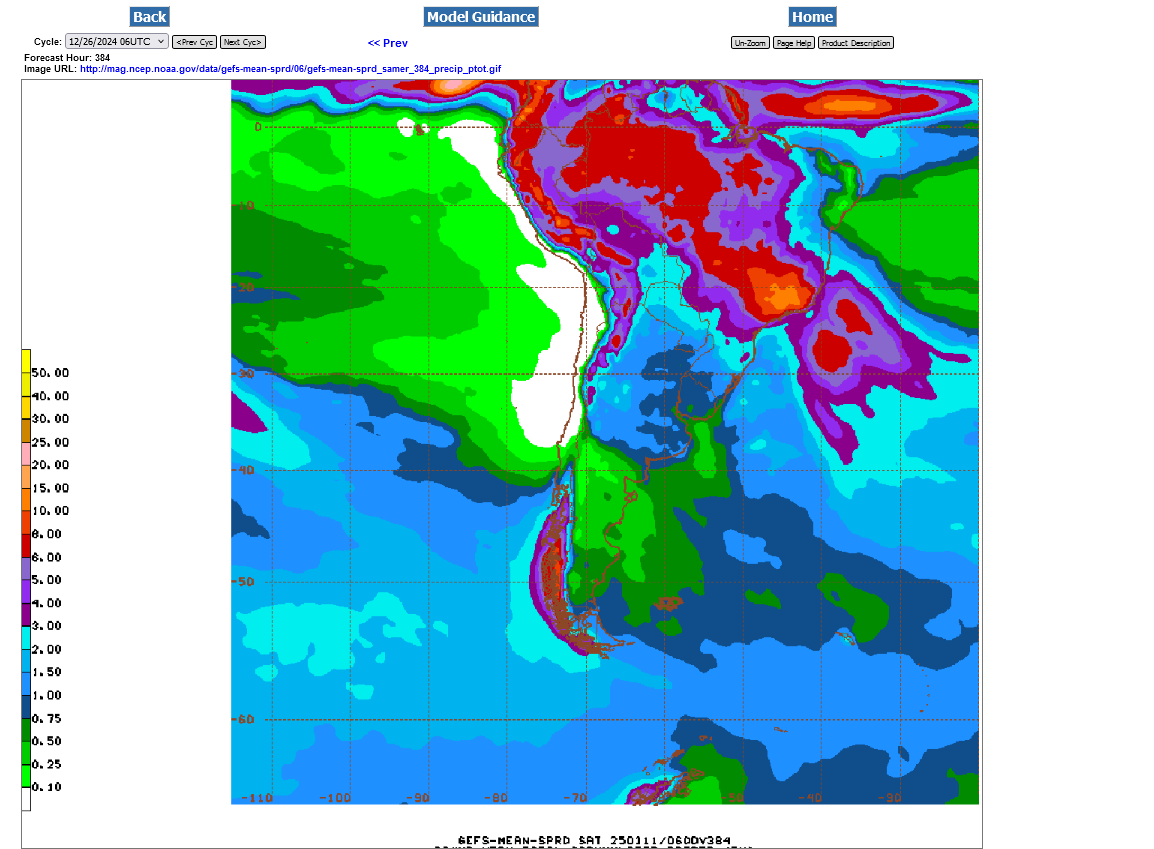

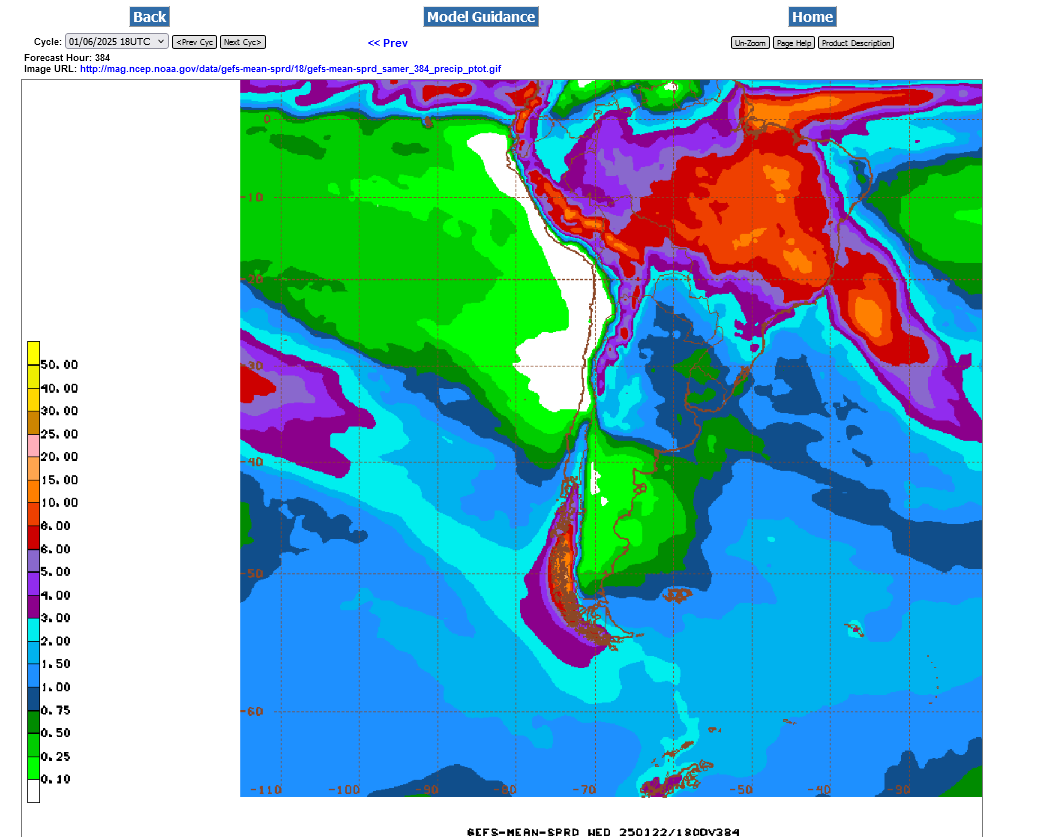

384 hour rain totals on the Just out 6z GEFS. Good rains everywhere in South America and bearish weather.

Coffee looks like a key reversal on the daily chart

Thanks, cutworm!

I'll post coffee charts when I get the chance. Been with my Dad most of the time.

Seasonals or not, there just seems to be too much bearish elements for soybeans to muster much of a bullish trend. Unless the weather gets bad we will see $9.00 before we see $11.00

thanks, Jim!

Maximum bearish weather right now. 2 weeks of rain on the last 6z GEFS:

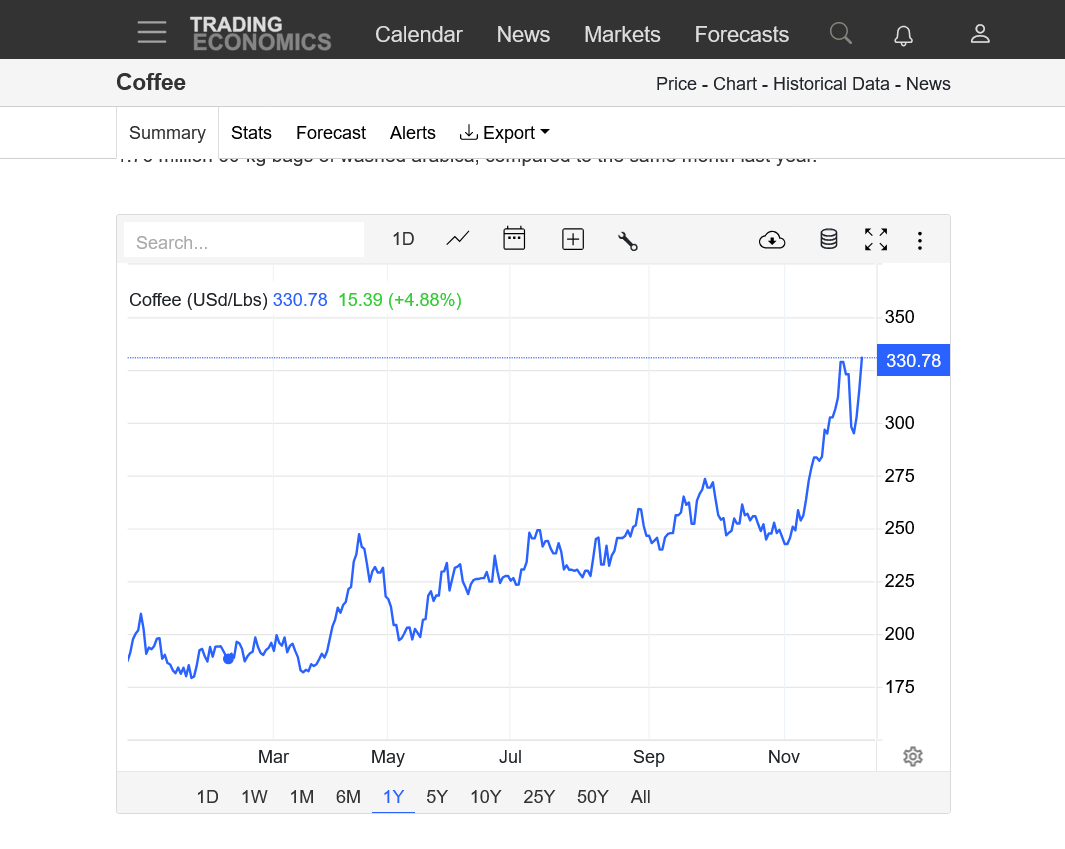

the daily reversal pattern in coffee on the 18th did not verify. It broke to new highs today, looks like it's going to go parabolic.

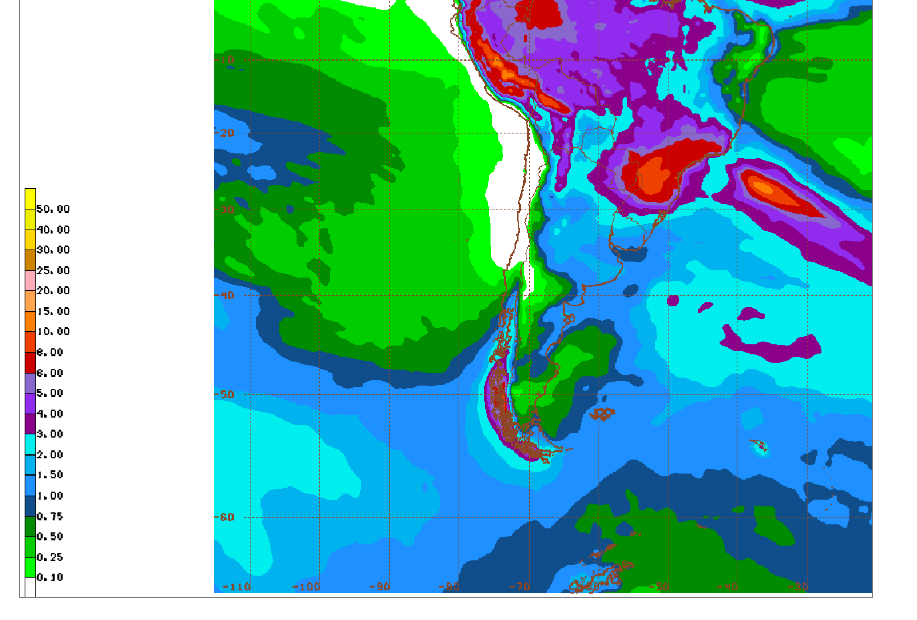

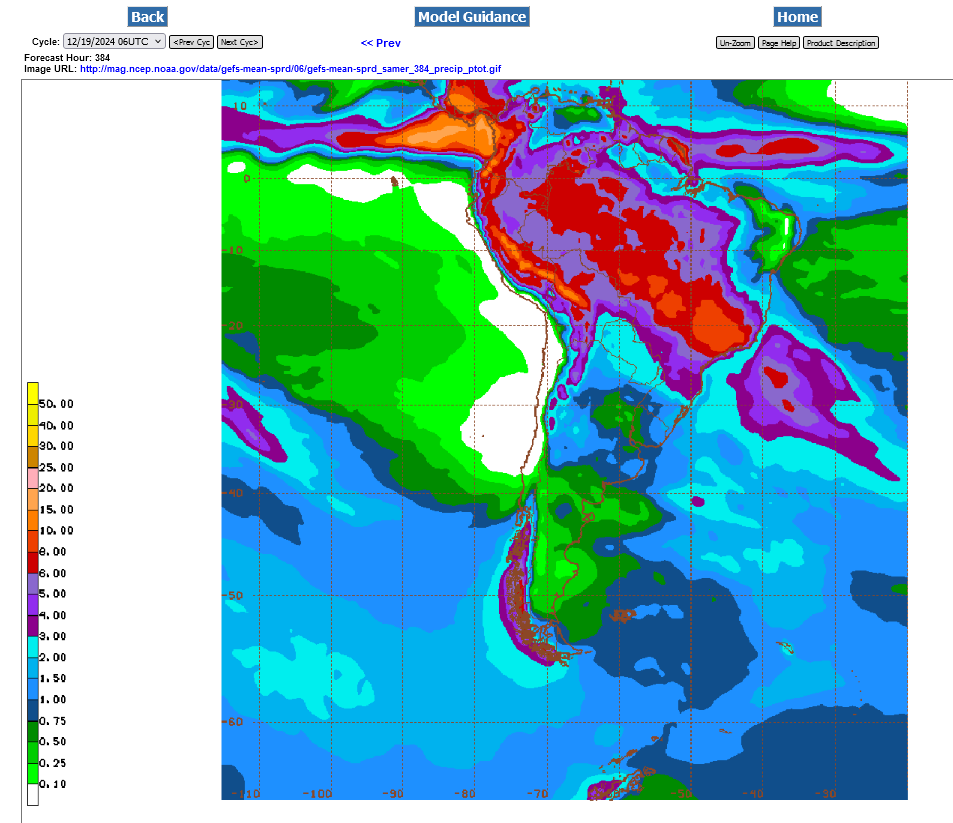

384 hour rains in SA from the just out 6z GEFS. Mostly good. A little light on the periphery/outside edges.

U.S. winter #wheat conditions surged 6 pts on the week to 55% good/excellent (above all trade estimates). That is up a massive 17 points since late October. The biggest improvement ever seen in that period had been +8 pts in 1992 for the 1993 crop.

Dry-ish in Argentina. Tons of rain in Brazil(a bit too wet in the southeast).

Last 12z GEFS total rains thru 384 hours.

Compare the forecast rains with the maps for key growing areas:

https://www.marketforum.com/forum/topic/108473/#108489

Note that seasonals this time of year (based on historical tendencies) are solidly positive....but each year is different.

METMIKE

Must be a HUGE change in weather in COFFEE producing areas. Any update? Any thoughts on when/where to buy coffee back?

(This type of weather event affecting a commodity reminds me of your predictive prowess leading up to, during hurricanes!)

Thanks tj!

Yes, i noticed coffee's enormous collapse lower from record high prices. Not sure how much weather is involved because the forecast didnt suddenly change, though I've been busy with Dads death and not following extremely close.

The latest forecast is bearish for rains of course. The drought mainly ended earlier this Fall.

At these record high prices, coffee demand is getting stifled and the extreme bull move higher may just have run out of steam.

https://tradingeconomics.com/commodity/natural-gas

1. 1 year-reversal lower

2. 50 years-record highs, now reversing lower

Great rains in Brazil. Too dry in at least the southern half of Argentina.

Mostly bearish wx in south america but a bit dry in southern Argentina.

Coffee has bounced back up to the bottom of the big gap lower that happened at the start of the week.

Coffee:

1. 50 year chart

2. 1 month chart:

https://tradingeconomics.com/commodity/coffee

+++++++++++++++++++++

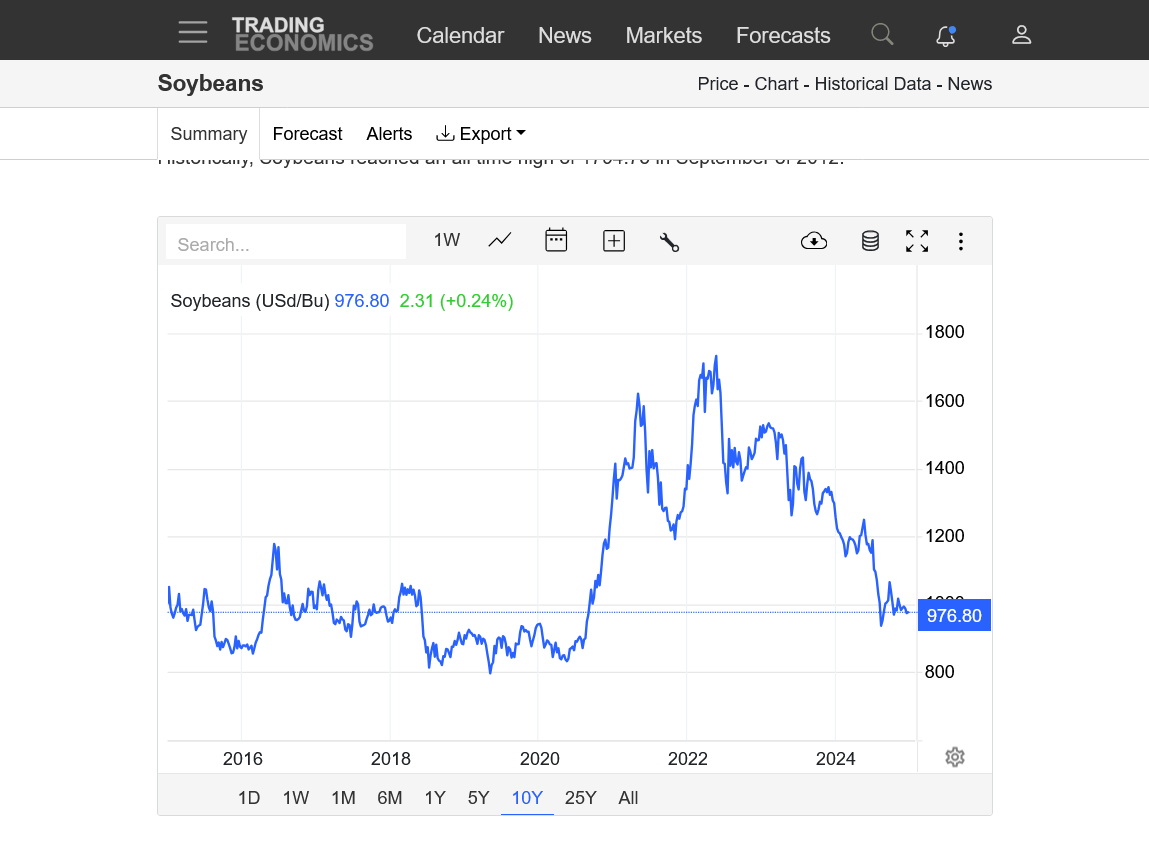

Beans: 1 year chart:

https://tradingeconomics.com/commodity/soybeans

Thanks for the update Mike.

YW, Jim!

Coffee filled that gap lower today and is making new highs, so its become a gap and crap, selling exhaustion formation that is mainly valid at the end of downtrend. In this case, the original gap was a downside breakaway gap formation that is potentially extremely bearish. At the very least, filling that gap today NEGATES any negative implications from that gap.

https://tradingeconomics.com/commodity/coffee

1. 1 year-new alltime highs after the extreme, short lived, spike down bear flag

2. Parabolic, extreme move higher to all time highs with increasing slope of the uptrend-unsustainable but impossible to predict the end point. Many thought the bearish, downside breakaway gap lower on Monday marked the top......NOPE. One would think that record high prices will start to stifle demand at some point.The cure for high prices is............HIGH PRICES!

Very well summarized, MetMike.

I had bought 2 kc puts, 3 days too early, and thought them to be worthless. Covered them Tuesday at small profit. Bought 2 calls on Tuesday. Sold them Thursday and immediately bought two at a higher strike (captured profit, BUT paid more premium). Sold the two calls today before the close, NOT wanting the "JULY 4" scenario to possibly occur.

VERY difficult to trade futures as market opens at 3am and who wants to baby sit trade at that time of morning. Also, due to extreme margin (two increases in last two weeks), very large account needed. Options are available, but only 'monthlys' (weeklys have zero volume). Monthlys have wide spreads. Suffice to say, stressful as the never ending fear of sudden, violent reversal.

Thinking i "shoulda" went home this weekend with two more higher strike calls. Looking for extreme, say 30-40 point spike to buy puts. January options expire Friday, 13th. Thereafter the premiums for the February will be SO high, KC will be untradeable.

Probably will open at least on eye around 4am Monday!!

Thanks for sharing, tjc!

Congrats on your success and I know the compelling challenge and competitive drive that sometimes motivates a speculative trader at times like this, using some astute observational skills and experience.

It's crazy! More crazy than at any other time in coffee history by an extremely wide margin. This is what you would expect with prices at all time historic highs.

The power of this move up was seen this week. Coffee had every reason to go down after the reversal down at the end of last week, then break away/bearish gap lower to start this week after a very long lived uptrend that spiked briefly to all time highs last week.

This was the exact recipe for a technical top! Traders piled on, selling this technical top formation..............THEN, buyers came in at $3 and overwhelmed the market with demand that crushed technically driven and other sellers.....and we closed at NEW highs for the historic move higher.

WOW!!!

Weather turning BULLISH for Argentina beans/corn! Not much rain with increasing heat!

I’m not sure “Agrinews” has an objective view. There might he just a hint of bias there.

Thanks Jim!

Do you disagree?

I have my own biases. Trump initiated tariffs against China in his first term and the reaction was loud. But Biden didn’t roll them back and you rarely heard about it. The CCP is not our friend. The US is under China’s thumb in a variety of industries. Rare earth metals, medical supplies, China is WAY to close to Taiwan and our chip supply. etc etc. China would bury our car industry if we let them. How many lives are lost every year from fentanyl OD? Let’s not forget the covid fiasco. We need to be careful that we aren’t being manipulated by media just because it’s Trump. I am aware that some pain might be inflicted but becoming more self reliant (or other supply channels) would be worth it in countless ways.

Thanks, Jim good discussion!

You make great points.

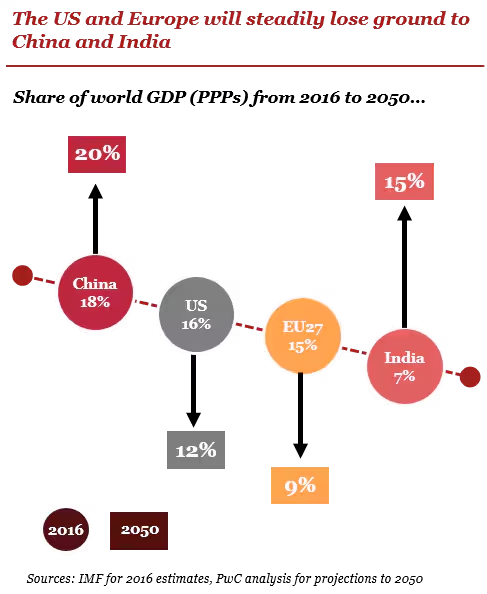

The reality is that China and India have a total of 2.8 billion very bright people.

Asian Countries by population (2024)

https://www.worldometers.info/population/countries-in-asia-by-population/

| # | Country (or dependency) | Population (2024) | Yearly Change | Net Change | Density (P/Km²) | Land Area (Km²) | Migrants (net) | Fert. Rate | Med. Age | Urban Pop % | World Share |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | India | 1,450,935,791 | 0.89 % | 12,866,195 | 488 | 2,973,190 | -630,830 | 2.0 | 28 | 37 % | 17.78 % |

| 2 | China | 1,419,321,278 | -0.23 % | -3,263,655 | 151 | 9,388,211 | -318,992 | 1.0 | 40 | 66 % | 17.39 % |

| 3 | Indonesia | 283,487,931 | 0.82 % | 2,297,864 | 156 | 1,811,570 | -38,469 | 2.1 | 30 | 59 % | 3.47 % |

| 4 | Pakistan | 251,269,164 | 1.52 % | 3,764,669 | 326 | 770,880 | -1,401,173 | 3.5 | 20 | 34 % | 3.08 % |

| 5 | Bangladesh | 173,562,364 | 1.22 % | 2,095,374 | 1,333 | 130,170 | -473,362 | 2.1 | 26 | 42 % | 2.13 % |

| 6 | Japan | 123,753,041 | -0.50 % | -617,906 | 339 | 364,555 | 153,357 | 1.2 | 49 | 93 % | 1.52 % |

| 7 | Philippines | 115,843,670 | 0.83 % | 952,471 | 389 | 298,170 | -160,373 | 1.9 | 26 | 49 % | 1.42 % |

| 8 | Vietnam | 100,987,686 | 0.63 % | 635,494 | 326 | 310,070 | -59,645 | 1.9 | 33 | 41 % | 1.24 % |

| 9 | Iran | 91,567,738 | 1.06 % | 959,031 | 56 | 1,628,550 | 190,156 | 1.7 | 33 | 73 % | 1.12 % |

| 10 | Turkey | 87,473,805 | 0.23 % | 203,304 | 114 | 769,630 | -275,952 | 1.6 | 33 | 76 % | 1.07 % |

| 11 | Thailand | 71,668,011 | -0.05 % | -34,424 | 140 | 510,890 | 23,321 | 1.2 | 40 | 53 % | 0.88 % |

Compare that to the United States:

https://www.worldometers.info/world-population/us-population/

%20-%20Worldometer.png)

+++++++++++++++++++++++

That comes out to 8 times more people, just in those 2 countries than in our country, most of them with MUCH greater incentive to work much harder for much less pay than our workers. Again, they are SMART PEOPLE!

There are different ways to manage this but there is no way to stop it. I'm not sure if tariffs are one of the best ways to manage it in the long run. For sure focus on cheap, reliable energy(the lifeblood of all developed economies) and on obtaining ownership in rare earth metals, medical supplies, micro chips, other industries of the future...... just like you mentioned.

And for Pete's sake PAY DOWN THE DEBT THAT WILL CRUSH OUR CHILDREN'S FUTURE!!!!!!!

The long view: how will the global economic order change by 2050?

https://www.pwc.com/gx/en/research-insights/economy/the-world-in-2050.html

WASDE report today at 11 central time

Thanks, cutworm! I was unaware of this!

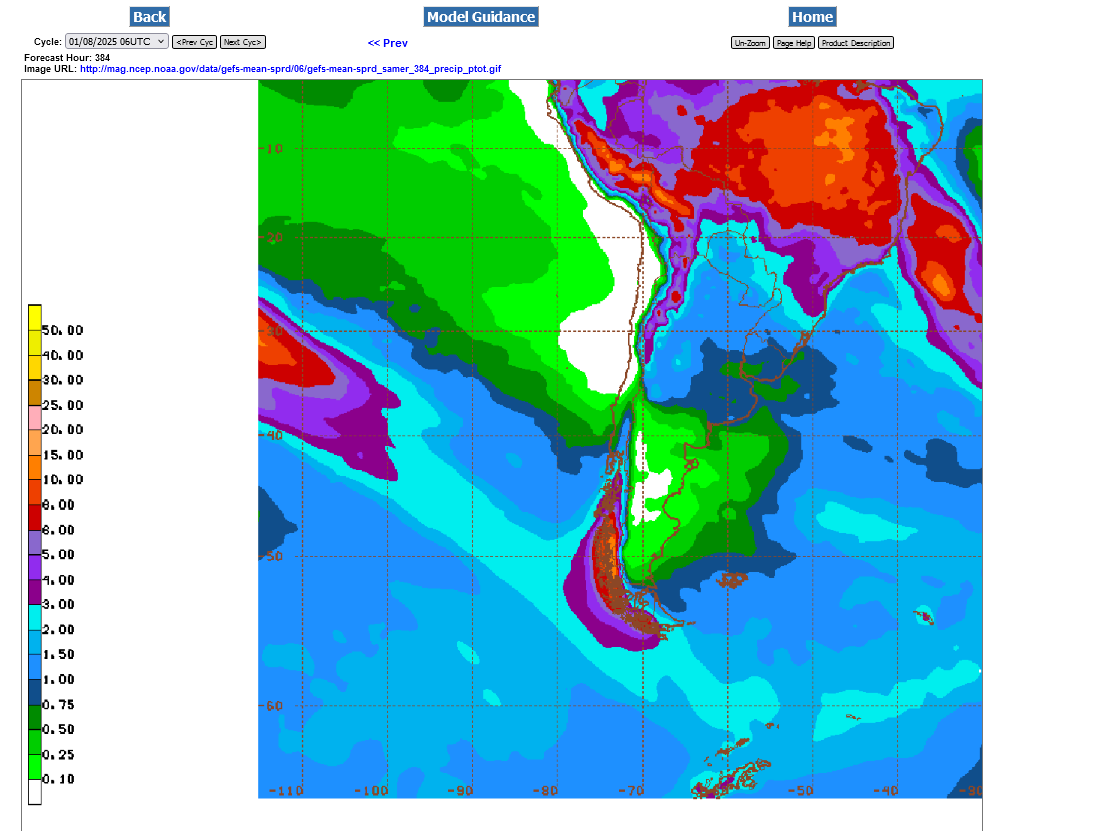

Latest 6z GEFS for total 384 rains. Still dry-ish in at least the southern half of Argentina! Great elsewhere.

Must have been BULLISH for corn!

Looks like a break out from a triangle but resistance is layered here at about 4.50to 4.53

above the 20 day and 100 day averages, also up to the 200 day moving avg

can it move above this resistance. might be enough for now?

Just some ramblings.

The monthly WASDE report from this morning showed a massive 200 mbu cut to the US corn ending stocks numbers to 1.738 billion bushels. That came via a 50 mbu increase to the ethanol side of the balance sheet, as well as a 150 mbu increase to exports.

https://www.barchart.com/story/news/29991525/corn-rallies-on-tuesday-as-usda-cuts-stocks

Thanks for all that great info.

ill try to follow up with more info on the corn on Wednesday.

If you remember, the whole reason we went into trade with China was to bring about political change in China and get access to all those consumers. Neither happened and now we have a huge trade deficit with them. As you say, tariffs might not be the final answer but it is a start. The CCP is not our friend and they want to hurt us. They may never attack us militarily but that won’t stop them from trying to hurt us in numerous other ways. They aren’t buying up land around our military bases because they want to bring our soldiers flowers. They aren't flying weather balloons over our country because they like our scenery.

Unfortunately, this site only does the front month, December which is not the one to trade and they don't have the March.

https://tradingeconomics.com/commodity/corn

Added: As cutworm mentioned, above $4.50 March is mega resistance!

Thanks, Jim!

That's all true.

Another advantage they have is a dictator that will usually do whats best for China even if it gives the people no say.

In the US, we have a democracy but most of the people we elect are more concerned with self enriching and doing whats best for THEM instead of our country.

That gets a ❤️ Mike

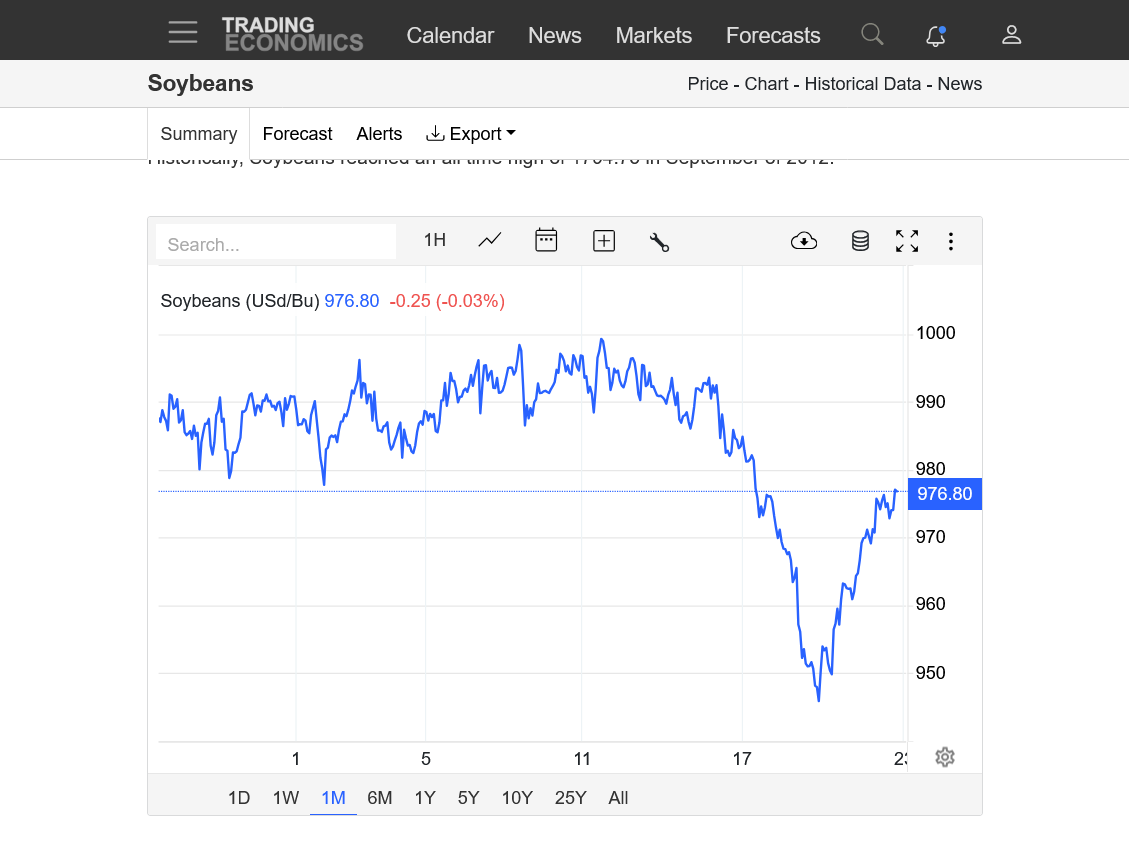

Soybeans have broken to new lows. Talk of an 8 being in front of the price.

lowest since sept 2020

Bean stocks are good and going to grow without a weather issue.

thanks!

I was thinking earlier this month that southern Argentina was going to get dry. Guess I was wrong. The models still show a tendency for dryness in the southeast parts of Argentina with perfect weather elsewhere.

I'm going to take another speculative stab at predicting MUCH OF Argentina being too dry causing enough bullishness to put in a bottom here.

The lows are in, unless this pattern changes in Argentina!

Weather still looks bullish for Argentina the next 2 weeks. Beans have double digit gains today from this.

Still bullish for Argentina but a tad more rain sneaking in and beans have already bounced 30c from the lows last week.

https://tradingeconomics.com/commodity/soybeans

1. 1 month

2. 1 year

3. 10 years

4. 50 years

Still looks bullish weather for Argentina the next 10+ days.

Maybe morphing back to more bearish after that?

Total 2 week rains on the last 6z GEFS. Too much rain for parts of Central Brazil?

Still looking bullish for Argentina weather the next week for sure. Most of the rain in the forecast below, from the last 6z GEFS is week 2 rain and even that is not enough.

Added: Beans gave us a huge head fake just after the open. A modest gap higher........then funds came in and sold it hard to close the gap and take us back to UNCH. Then straight up after that. Currently +13c just before 10am.

++++++++++

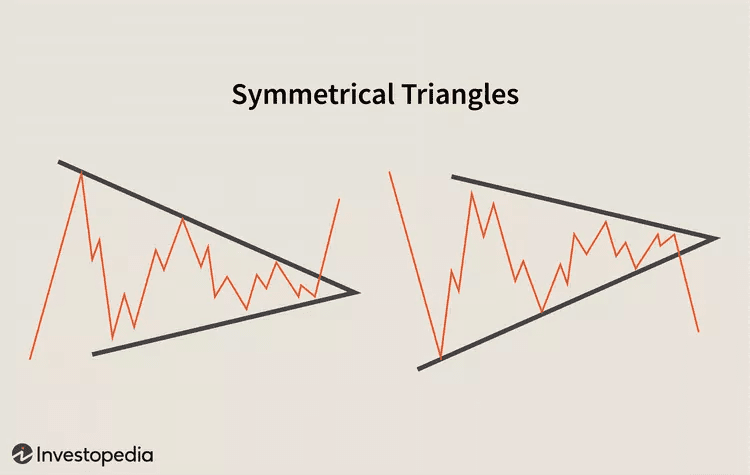

Potential upside break out of symmetrical triangle pattern.

https://tradingeconomics.com/commodity/soybeans

+++++++++

What Is a Symmetrical Triangle Pattern? Definition and Trading

https://www.investopedia.com/terms/s/symmetricaltriangle.asp

Current soybean chart pattern is potentially tracing out the example on the left/below. There is the chance for a false break out, however as well as for this to act as resistance from the down trending, lower highs line. We probably need a close above 998-ish to confirm the breakout on the charts(previous high) as well as +$10 psychological resistance.

this is for the January contract on the graph above. March soybeans have MORE THAN DOUBLE the trading volume of January which makes them the best indicator. SH25 is up 14c, leading SF25 that’s only +12c right now.

Real world illustration of a symmetrical triangle below.

Looks like the market agreed with your weather forecast.

Thanks, Jim!

Pretty much the same on this last 12z GEFS which kept the bulls fed during the last few hours of trading.

Bulls will need the forecast to stay dry-ish in Argentina and add more heat looking out beyond 2 weeks.

Soybeans

World supply is large (report on world supply Jan 10th I think)

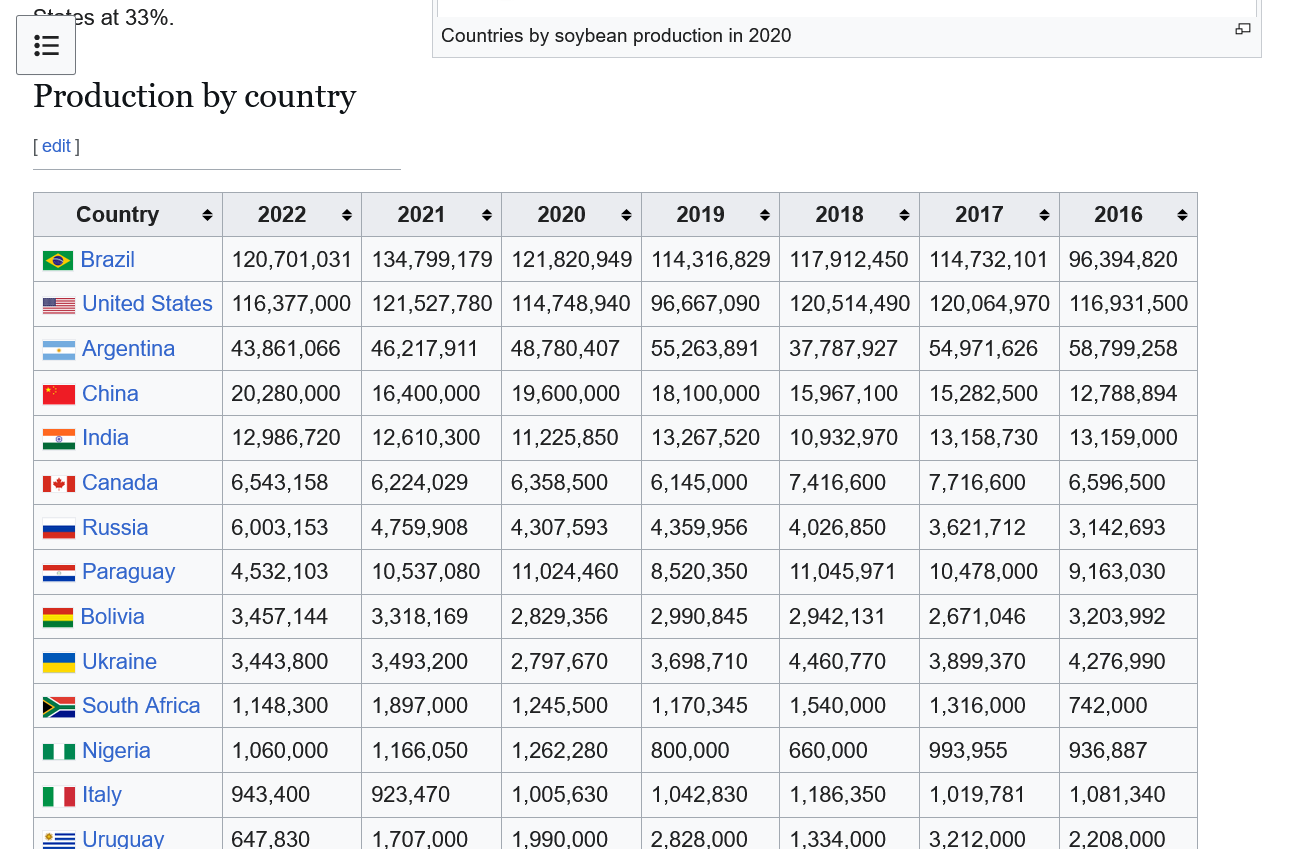

Argentina produces much less than Brazil which is having plenty of rain, maybe off setting some of Argentina's possible loses.

Argentina crushes a lot of their beans and sells the meal

Bean meal went up this week maybe because of this?

Just some thoughts

Great thoughts, cutworm! Thanks for sharing! I hope you're having a wonderful Christmas season.

I forgot about the January crop report.

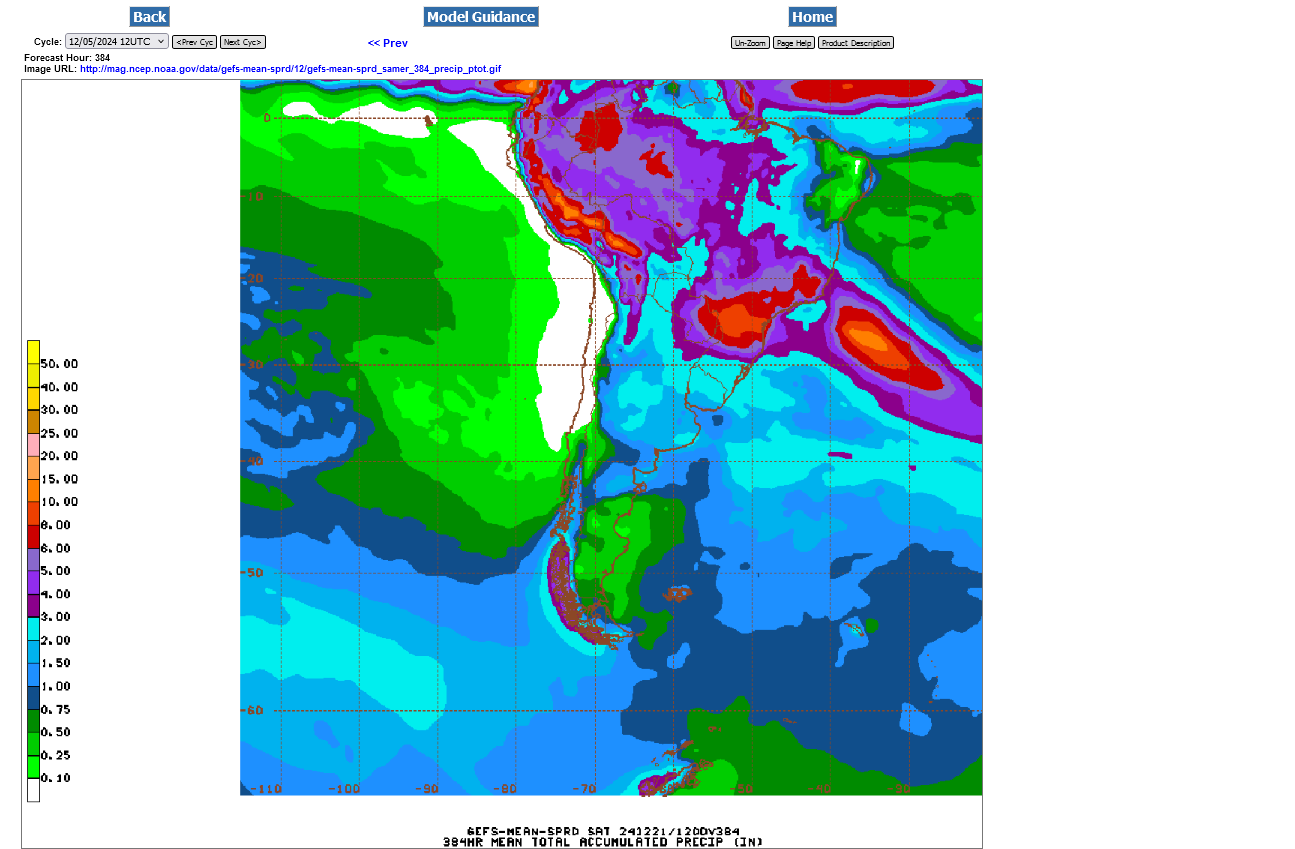

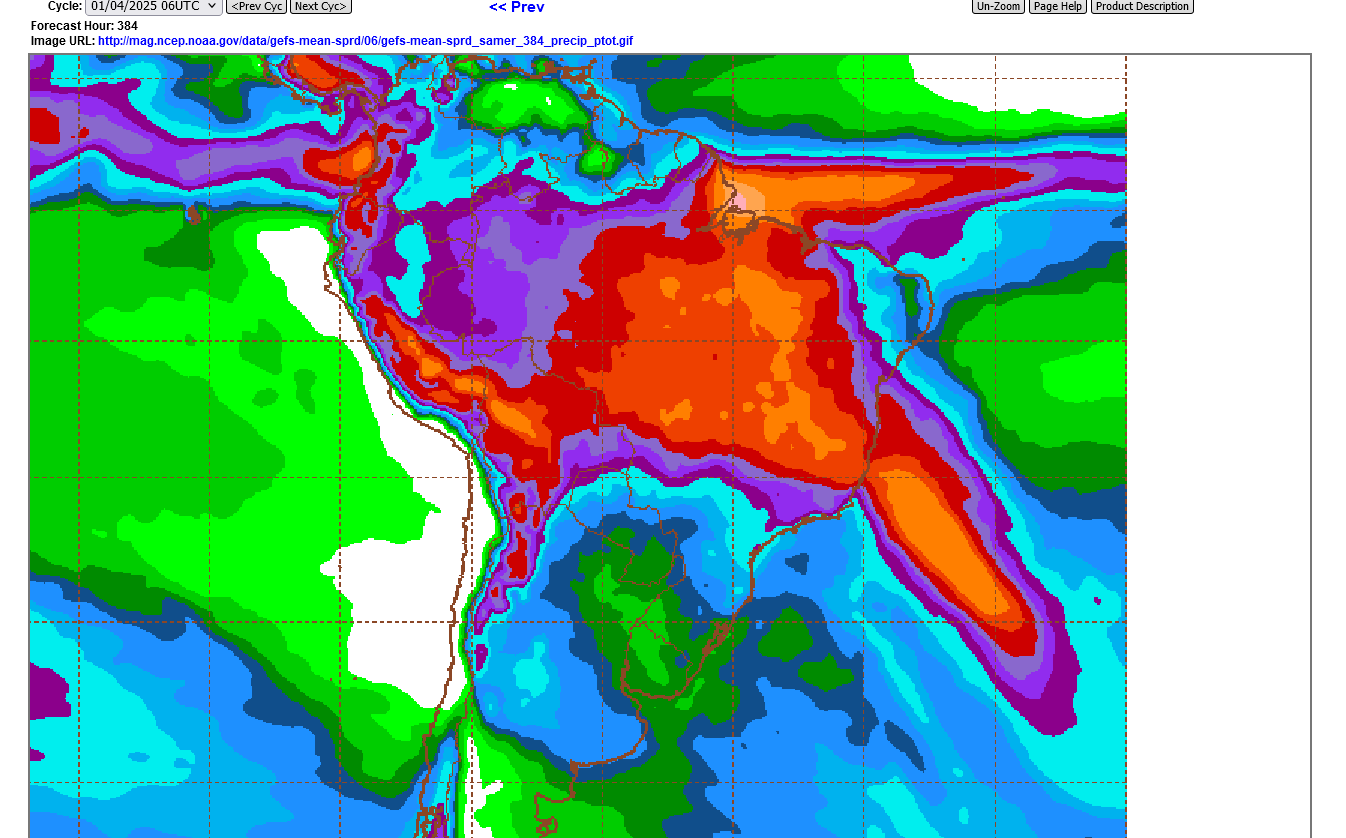

This was the last 18z GEFS total rain for 384 hours. Argentina will see net drying the next 2 weeks.

+++++++++

Like you said, Brazil produces 3 times more beans than Argentina. Even a bit more than the US. And their weather will be near perfect, along with huge global stocks.

https://en.wikipedia.org/wiki/List_of_countries_by_soybean_production

I read something a week or two ago that certain areas in Argentina finally got some rain and they were able to finish their corn planting.

I usually lean bearish everything all the time, but dry and a new crop, I am not a seller here. When the market was diving towards $9, that would have made sense with a total good soybean crop in SA. Running dry in Arg and now we are talking a 30-40 m tons. And a crop not much bigger than last years if Brazil's continues on its path.

Good or bad, the market will see that as bad. At least that is my initial impression. We might open down 30 cents tonight.... because I am just that good at calling the market.

Thanks very much for your thoughts, Jim!

No change in the weather outlook for SA. Still looks bullish for Argentina the next 2 weeks which provided some buying incentive overnight but that just can't get much traction with the factors that cutworm mentioned hanging over the market.

The March contract now has almost 4 times the volume of the January contract.

Last 6z GEFS below:

I think price action has more to do with end of year trading.

That's probably a factor too, Jim!

U.S. export inspections were in line with expectations last week, including #soybeans near the high end. Soy volumes have picked up versus last year in recent weeks (YOY was +16% four weeks ago, now +23%). Also four weeks ago, #corn was +31% YOY and #wheat +32%.

+++++++++++++++

USDA's attache raised its outlook for Brazil's 2024/25 soybean crop to 165 mmt from 161 mmt a couple months ago, mostly on an increase in area. USDA's official view is 169 mmt, though many industry estimates are comfortably above 170 mmt.

Argentina's Buenos Aires Grains Exchange upped #corn plantings to 6.6M hectares from 6.3M, but it cut #soybeans to 18.4M hectares from 18.6M previously. Soybeans were about 85% planted and corn 81% as of late last week.

t? kory melby reposted

Eduardo Vanin * @EduardoVanin4•1d

Too much rain for Northern Brazil, especially MT, Goias and Minas Gerais - acummulated volumes of 150-300 mm for 15 days. Lack of rain for Southern Paraná, RGDS, Southern PY and Argentina for 15 days. Producers in Goias and MT are concerned about the safrinha window, which is already 10-15 days behind schedule. Very few trades reported for CFR China last week. Rumors of April and June (Brz).

In Brz, soybean farmer selling for 2026 is active.

Brokers reported trades last week in Mato Grosso for Feb/26 - more trades reported for Mar 26 Fob Paguá. Some estimates of more than 1 million tons traded in the interior so far. keep reading...

go.agrinvest.agr.br/noticias/detai.

Accumulated rains (mm). Last 5 days up to Dec 29

instituto Nacional de Meteorologia - INMET

Precipitação Acumulada nos últimos 5 dias

Mapa do dia 29/12/2024

INMET

+

No change in my Argentina bullish weather forecast. I guess the market finally decided to pay attention today! Turning dry-ish too for far southern Brazil.

Normal January rains in Central Brazil are close to 12 inches, so those spots with 8 inches in 2 weeks, that are minor bean growing areas are a bit too wet.

This was the last 12z GEFS for Tuesday morning.

Still bullish on beans because of dry weather in Argentina and far southern Brazil:

This was the last 18z GEFS solution. Total rains for 384 hours which is 16 days.

I was surprised at the magnitude of the losses on Friday!

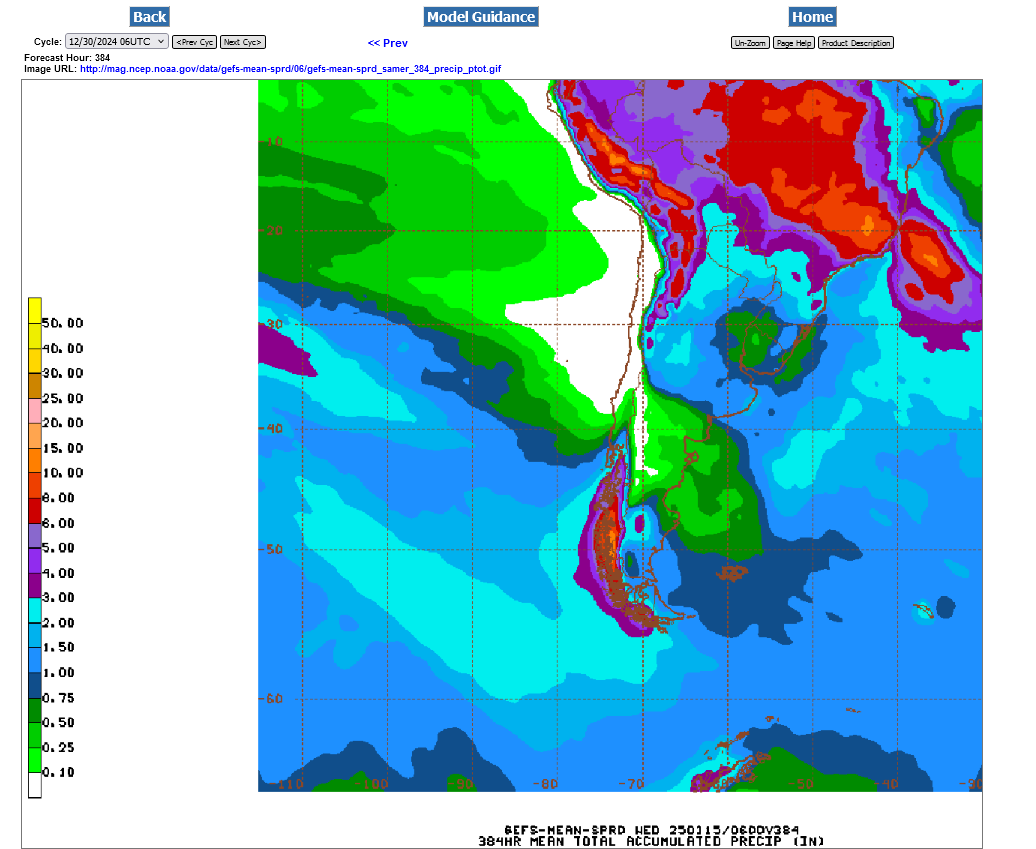

I guess that rains coming back in to the Southern growing areas of Argentina at the end of week 2 were a factor??? These were total 384 hour rains from the last 6z GEFS.

Last nights actions for beans and corn, really calls into question what in the world was going on Friday

Agree, Jim!

I can’t explain it from the bullish Argentina weather view that hasn’t changed. Glad I was busy focusing on the approach of our huge winter storm on friday and not trying to buy beans then.

Did you get a lot of snow?

Jim,

we were out of power for awhile with no internet, phone or cable ant time the last 12 hours except for that message to you earlier that some phone went out from my phone.

im tethering off my sons Verizon phone right now and will tell you more when service is restored.

we got 6 inches to state sunday morning, the sleet, then over half and inch of freezing rain, then 2+ inches of snow this morning.

been shoveling the drive the past 3.5 hours.

You got it pretty bad!

Yep, really bad. More about that coming up here:

https://www.marketforum.com/forum/topic/109322/#109365

++++++++

We did add a bit of rain to the Argentina forecast(18z GEFS=384 hour rain totals) since last night but its still not bearish.

Friday at 11:00 am Central time will be the January WASDE report. The December Grain Stocks report will also be released, which will give us some insight into feed usage. The USDA will also release the winter wheat acreage estimates.

Thanks a trillion, cutworm!!!

I totally forgot about that.

Rain amounts have been edging higher for Argentina the last few days. This was the 384 hour total rain from the last 6z GEFS model.

Still drier than average for all of Argentina and BULLISH weather but I think position squaring ahead of the USDA report on Friday is likely more important since there's no definitive rain event in the short term forecast.

Noon Thursday: A bit more rain, mainly week 2:

Rains amounts in week 2 continue to creep higher in Argentina but are still below average and next weeks weather will be brutally hot!

USDA report out at 11am is what matters though!