Insanely high prices!

https://tradingeconomics.com/commodity/cocoa

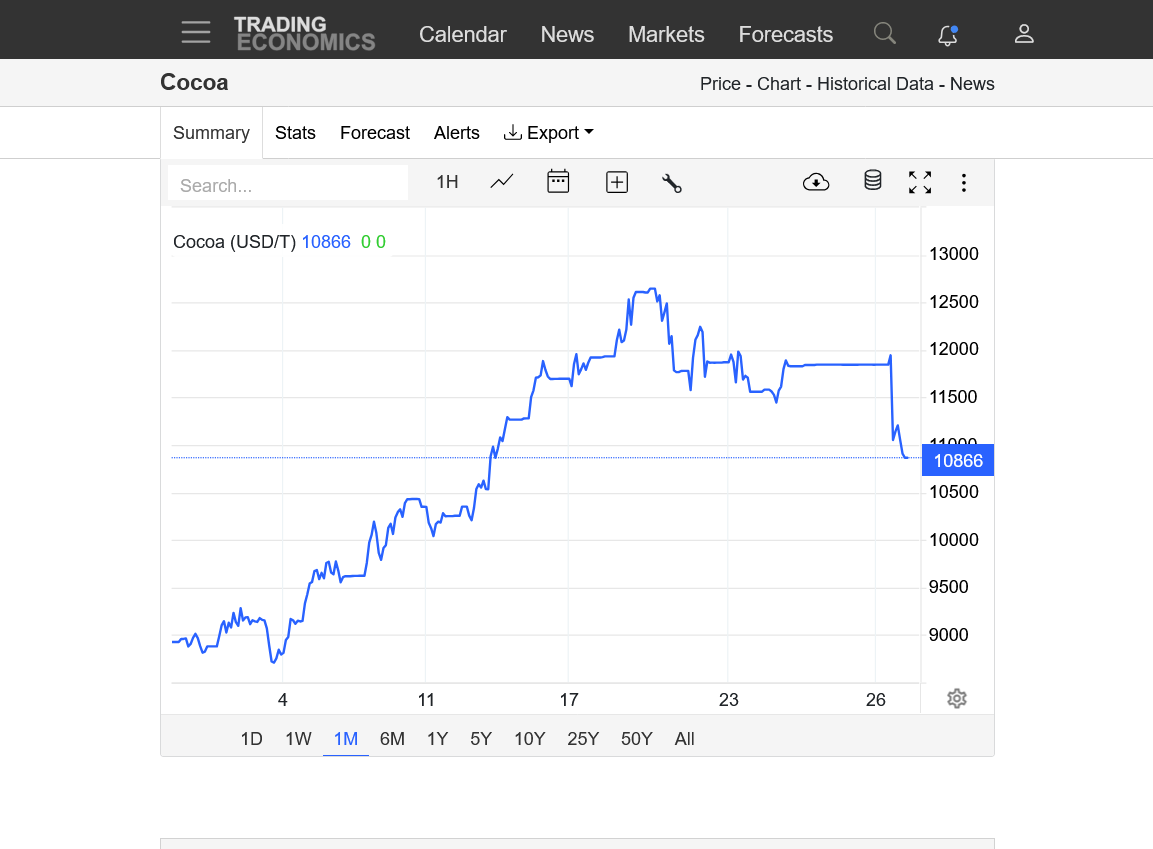

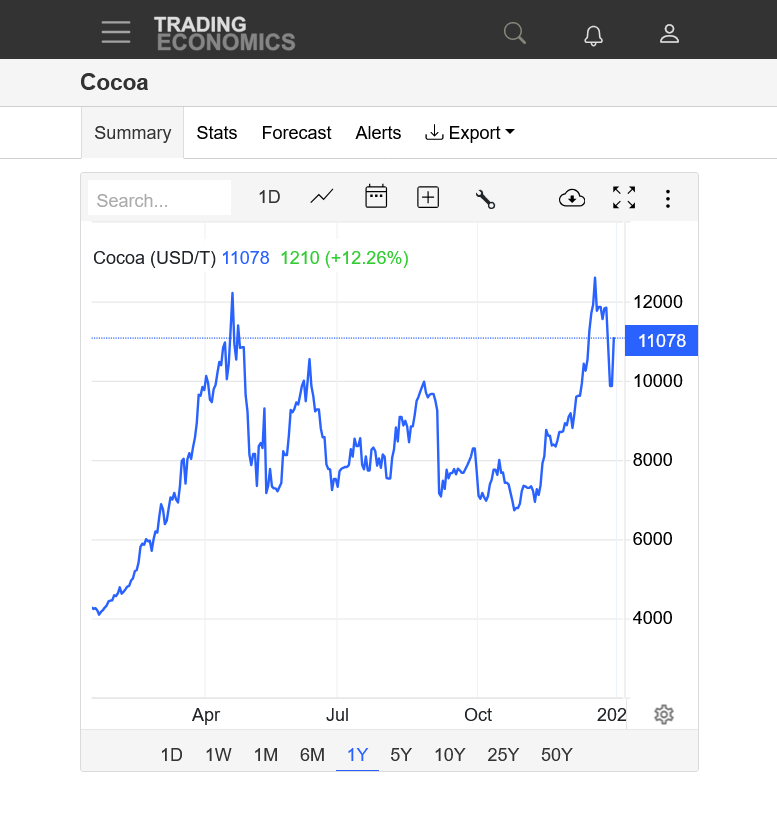

1. 1 month-almost straight up

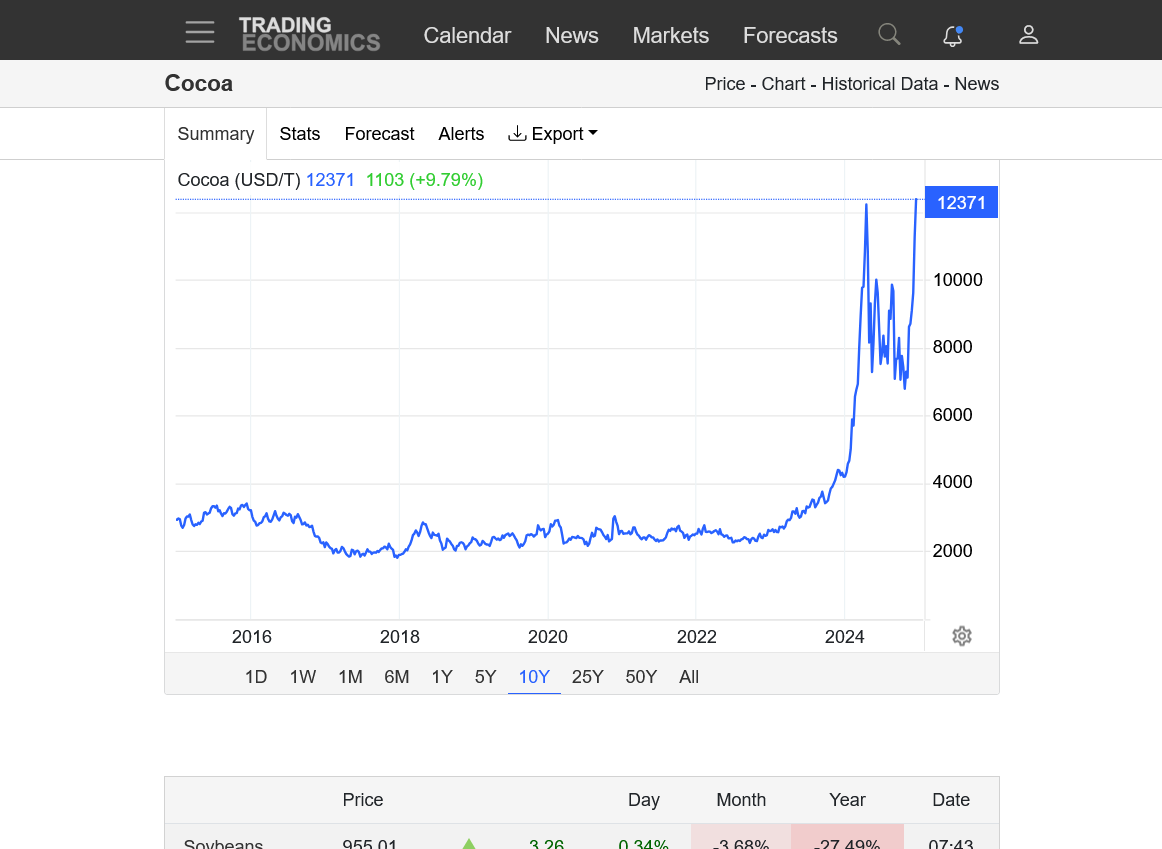

2. 1 year-new record high, exceeding the April 2023 high

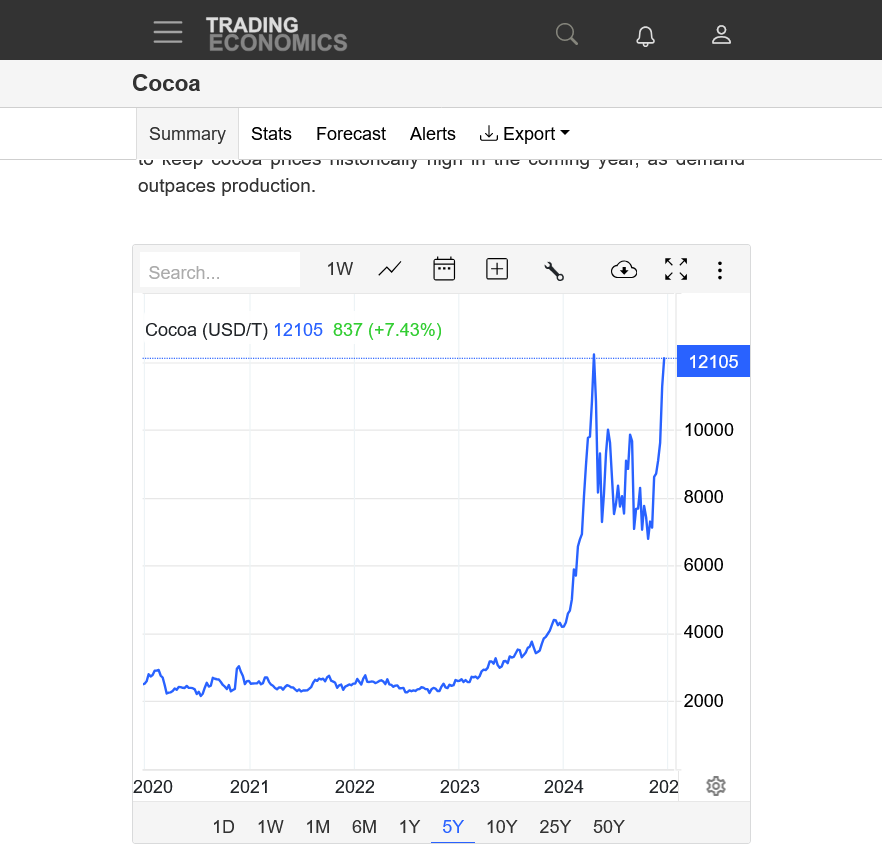

3. 10 years-recent price is around 6 times higher than what it was until 2023

4. 60 years-3 times higher now than what the previous record high was prior to 2024

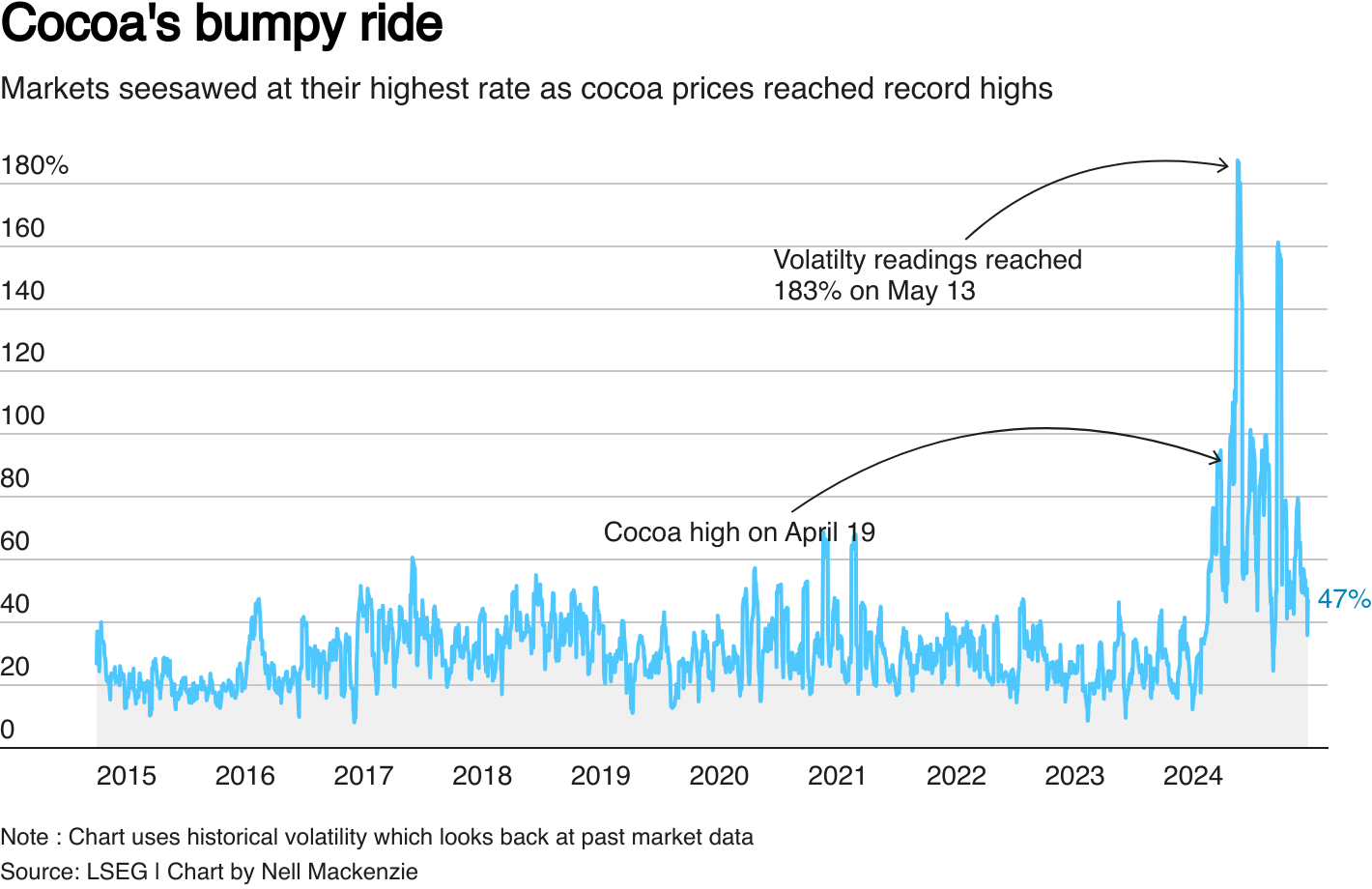

Not only record high, today marked a range of 1100 points with a huge 450 point reversal.

Was today the TOP?

EXTREMELY difficult to trade.

Thanks, tjc!

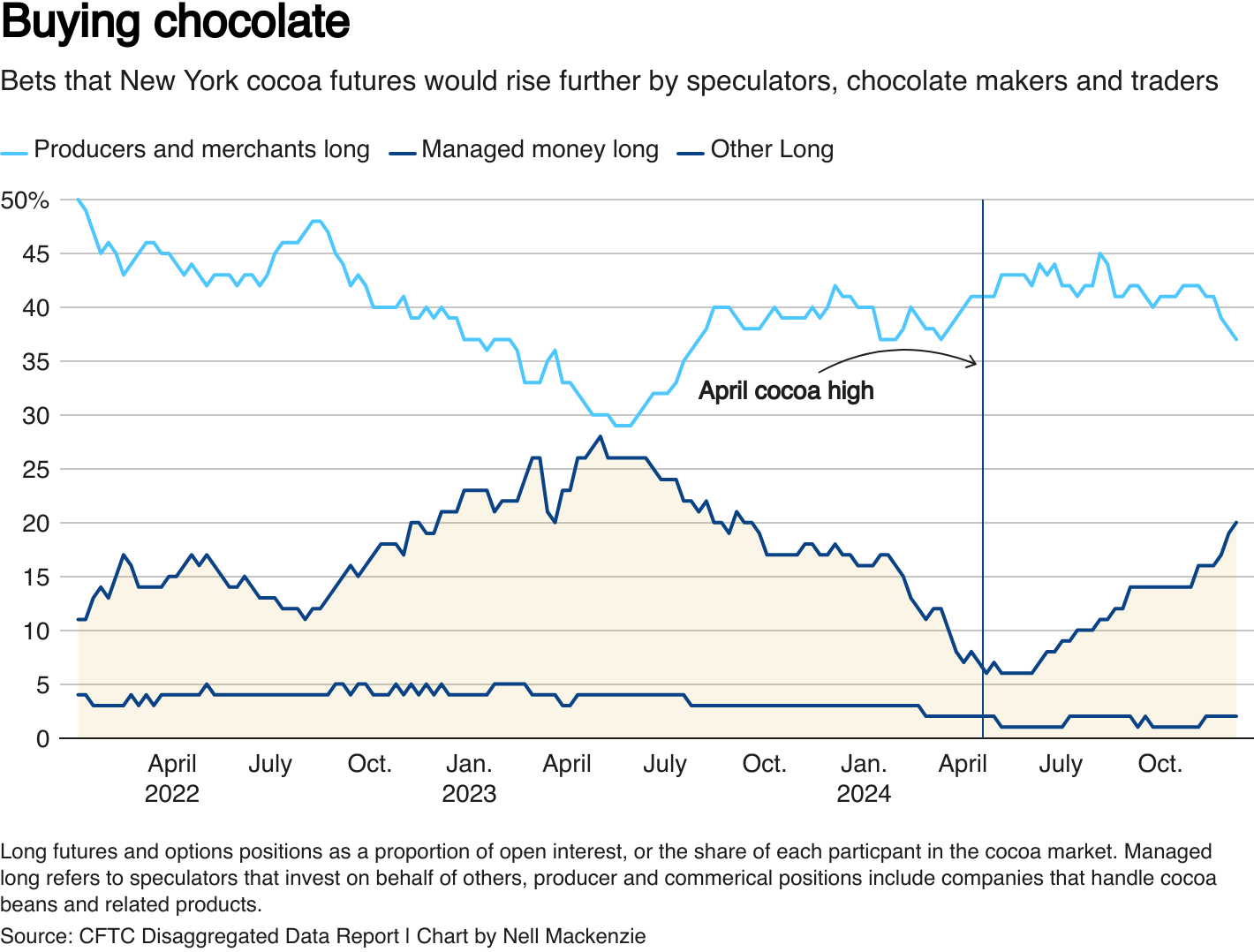

Sure looks like a potential double top formation but could just be a technical response and traders taking profits.

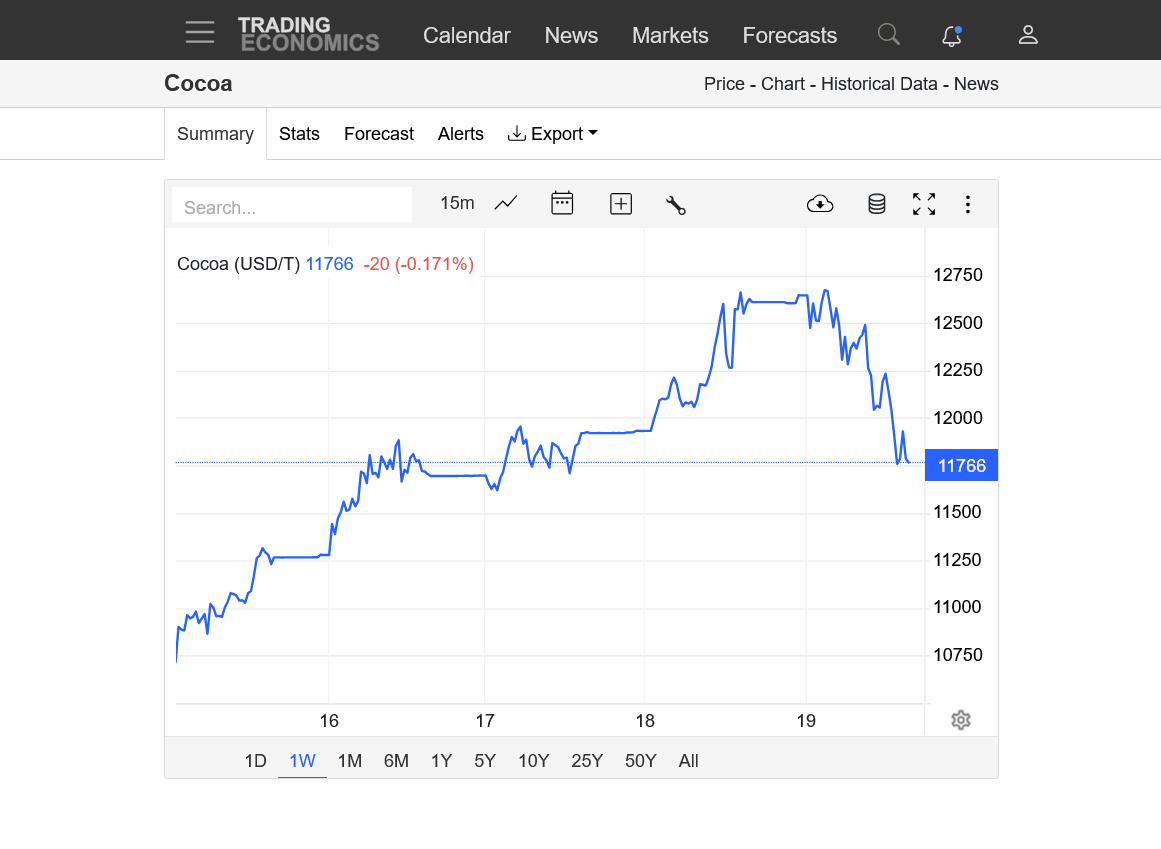

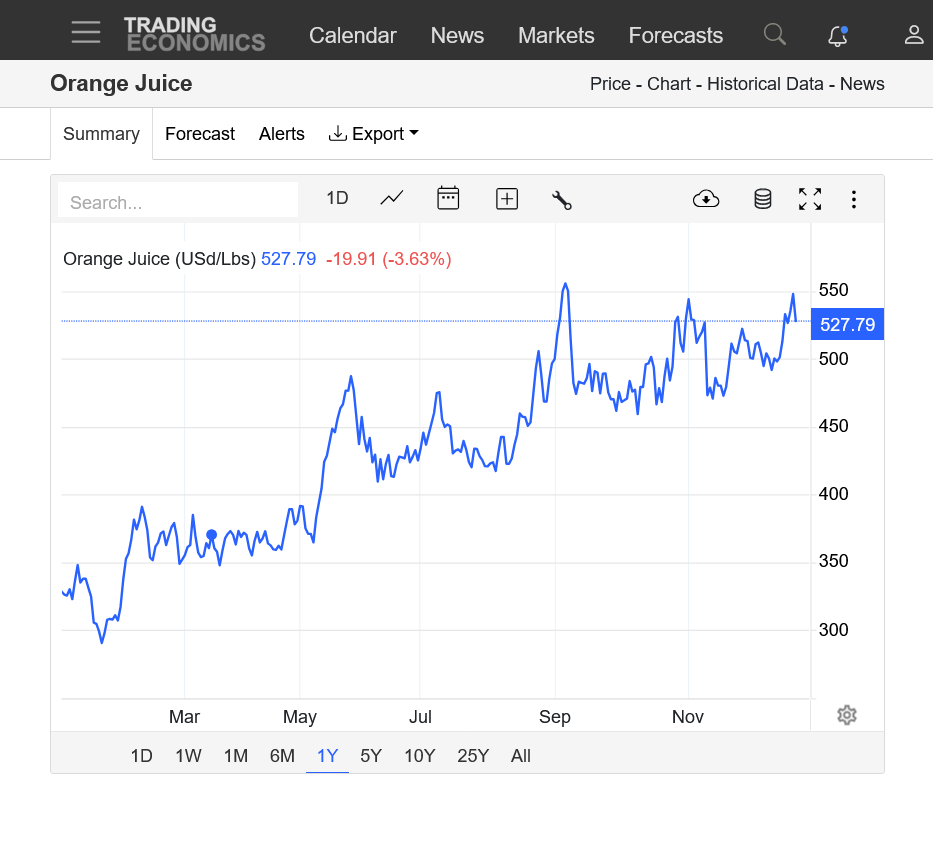

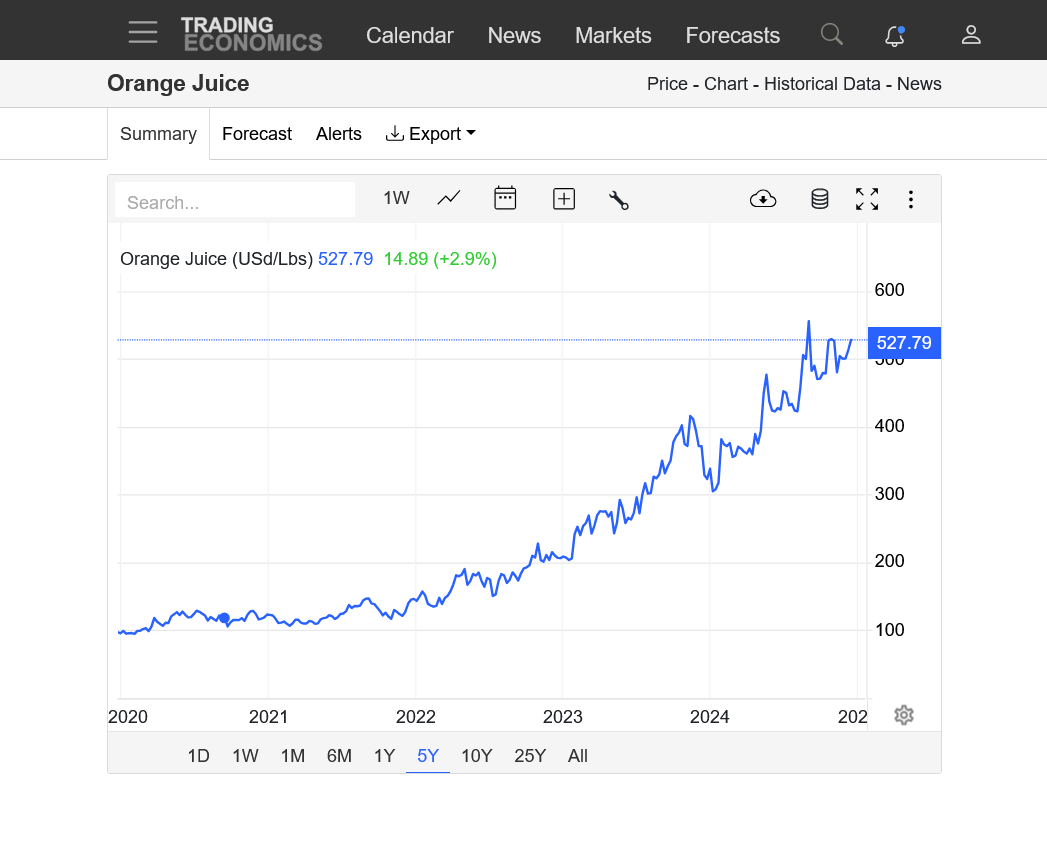

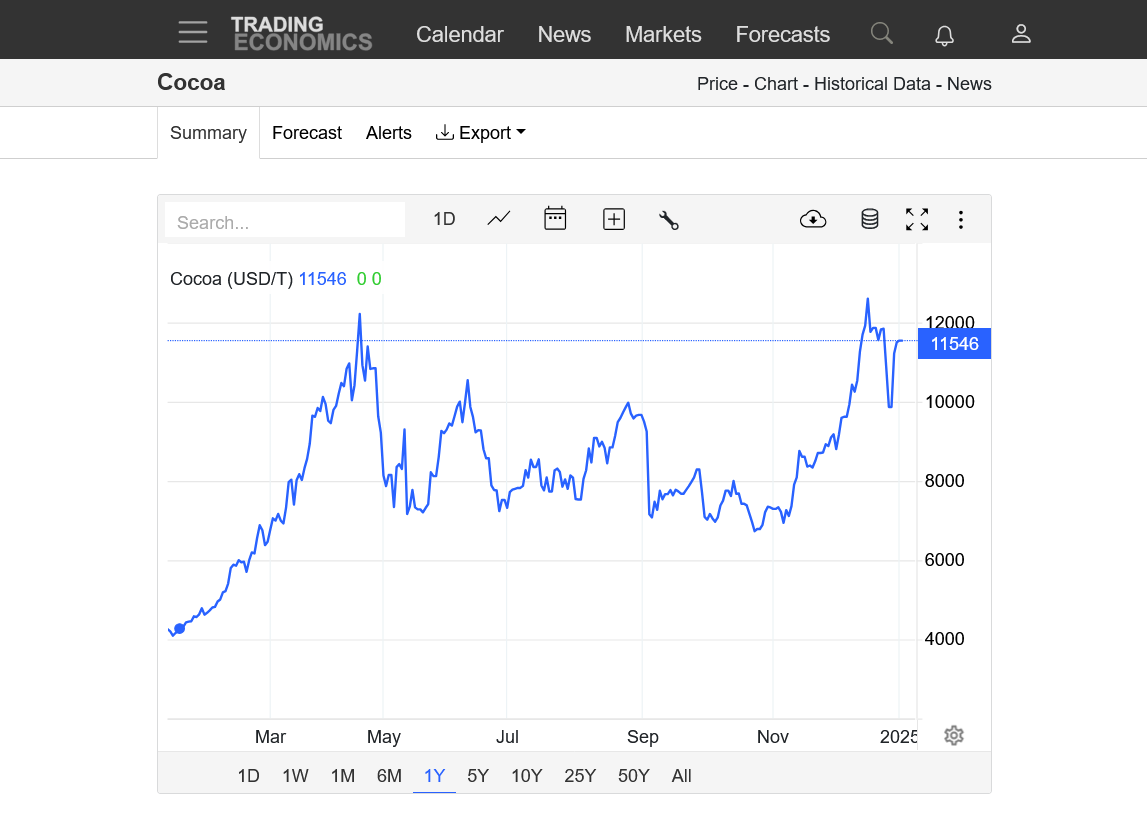

1. 1 week

2. 1 year

https://tradingeconomics.com/commodity/cocoa

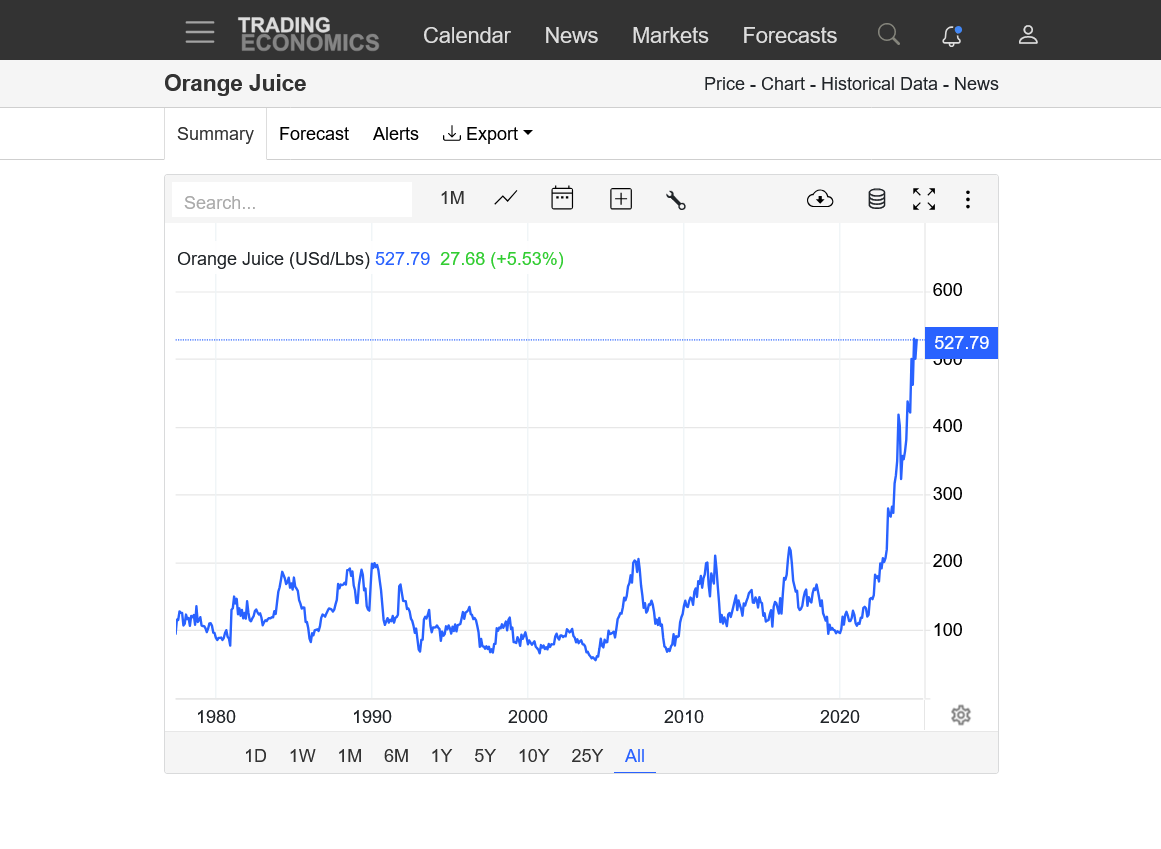

OJ is also at all time highs

both of these as the $ moves higher

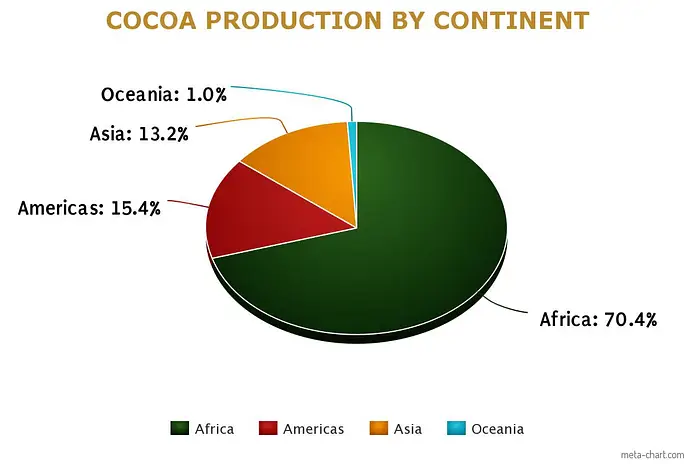

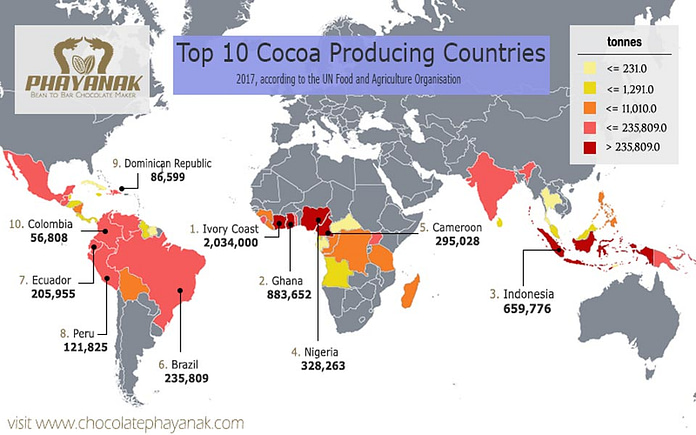

Has there been any adverse weather in the Ivory Coast, Ghana, or Indonesia affecting production of cocoa? I’m wondering if this price increase may have been tradable in advance from a wx perspective.

I know many of the softs are traded on wx such as OJ, KC, CT, and sugar perhaps to a lesser extent. But I don’t recall Mike or anyone else here discussing wx related trades for cocoa.

I vaguely recall that Craig Solberg did make a few cocoa trading recommendations back when I was following him.

As a fellow weather trader, I was thinking the same thing, Larry.

However, I'm not sure where a good entry point would be with low risk. This one might have been a good options play. I never do options because most of them expire worthless but for sure this is mostly from weather and you are right on about that!

Correction: This is NOT mostly from weather!

https://tradingeconomics.com/commodity/cocoa

https://chocolatephayanak.com/unkategorisiert/cocoa-production/

Last 30 days compared to average below

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.30day.figb.gif

Last 90 days compared to average below

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.90day.figb.gif

Last 180 days compared to average below

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.180day.figb.gif

365 day anomaly below

https://www.cpc.ncep.noaa.gov/products/Global_Monsoons/gl_obs.shtml

Great point, cutworm!! Citrus greening disease!!!!

Dangerous time to trade/OJ

https://www.marketforum.com/forum/topic/107818/

++++++++++++++++

https://tradingeconomics.com/commodity/orange-juice

1. 1 year

2. 10 years

3. 50 years

CRB Index. Lower energy prices are 1 reason why we are not challenging the 2008 record highs. Grains/beans are also much lower than prices in recent years.

https://tradingeconomics.com/commodity/crb

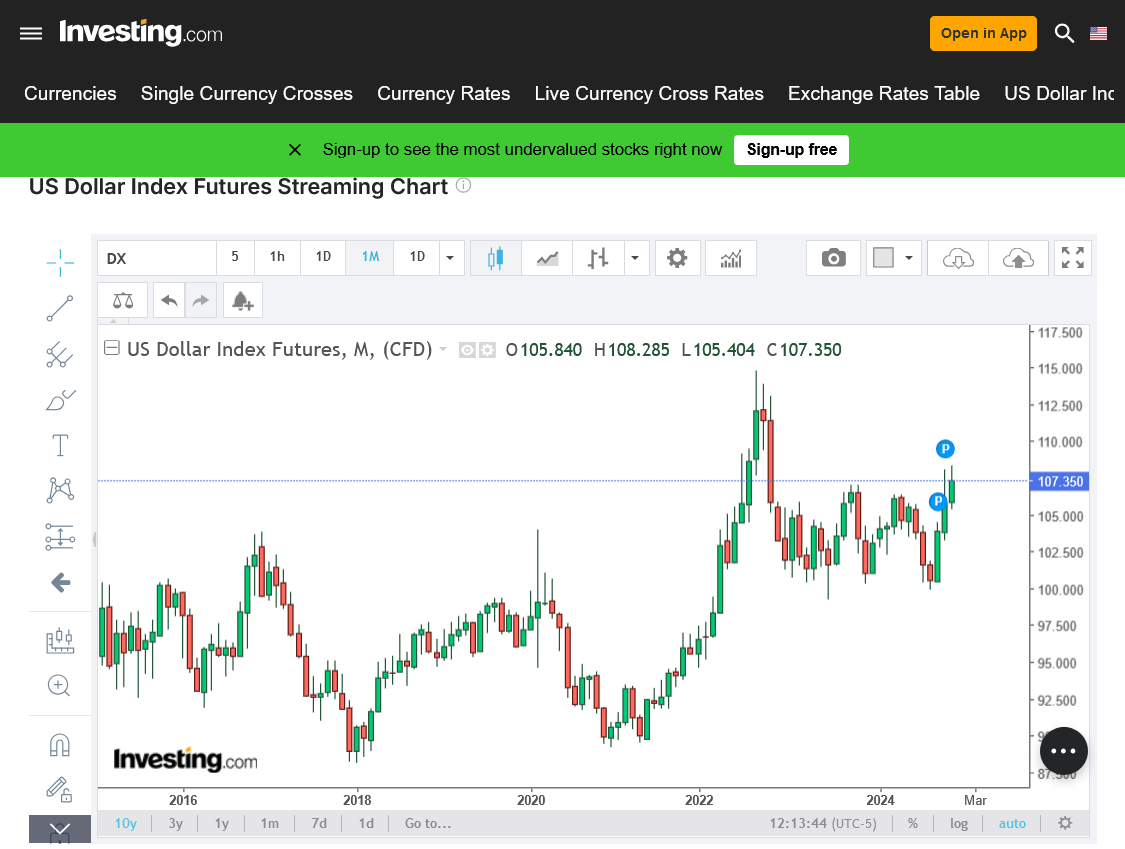

Dollar has been increasing as cutworm noted and breaking out to the upside!

This usually puts downward pressure on US priced commodities.

https://www.tradingview.com/symbols/TVC-DXY/

https://www.investing.com/currencies/us-dollar-index-streaming-chart

The General Rules Might Be Changing

https://www.thebalancemoney.com/how-the-dollar-impacts-commodity-prices-809294

Previous dollar threads:

US Dollar

Started by metmike - Aug. 3, 2024, 6:08 p.m.

https://www.marketforum.com/forum/topic/106393/

China/France/US Dollar

Started by metmike - May 10, 2024, 8:39 a.m.

https://www.marketforum.com/forum/topic/103917/

By cutworm - April 12, 2024, 7:39 p.m.

to me it seems unusual that the $ index should be going up at the same time as gold. Is a dark swan event near at hand? I have absolutely no idea.

$

Started by cutworm - Nov. 7, 2023, 7:51 a.m.

https://www.marketforum.com/forum/topic/100392/

Old thread discussing the DX:

US Dollar DX

5 responses |

Started by metmike - July 27, 2020, 10:39 a.m.

https://www.marketforum.com/forum/topic/56847/

Cocoa having its biggest 1 day loss in history at 1 point today.

OJ also taking a huge beating.

+++++++++++++++

December 20, 2024

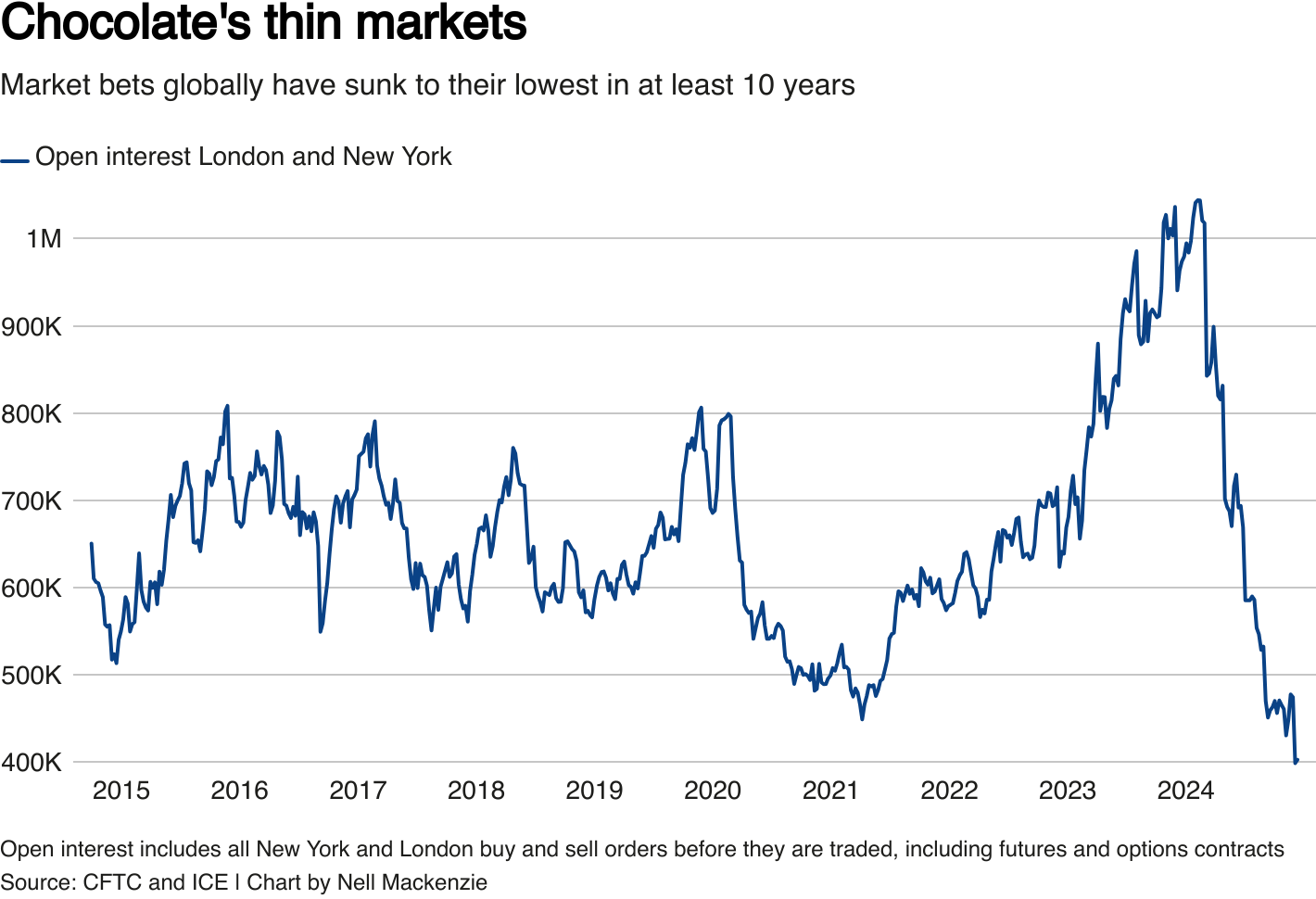

Absolute Return Capital Management in Chicago, said the cost of trading a single cocoa futures contract soared from $1,980 in January to $25,971 by June.

metmike: HOLY COW, I've NEVER a margin increase anywhere close to that extreme!!!!!!!

+++++++++++++++++

Some hedge funds have returned to the market. Along with other speculators that trade using investors' cash, they accounted for 22% of futures trading this month, according to the global data. But buying and selling in the cocoa market's altered landscape has become harder.

Zientek, the trading associate at StoneX, said bid-ask spreads can now top 20 "ticks" - $200 per contract - compared to about 2-4 ticks before cocoa's rally to record highs.

"This makes larger orders tougher to execute without seeing an immediate distortion in the market," he said.

Daniel Mackenzie, managing director of Cocoa Hub, a UK-based company that sources and sells cocoa beans to artisan chocolate makers, said higher and more volatile prices were forcing small and medium-sized makers to decide between passing costs to clients or reducing product sizes.

One chocolate maker he worked with has been shuttered and another sold, he said, without providing further details.

As hedge funds exited, short-term investors such as day-traders – which buy and sell assets within a single trading day – have stayed in the market, the European broker and the broker at the agri-commodities bank said.

The cohort that includes day-traders this month accounted for 5% of the market, about the same as the start of the year, the global data show.

Day-traders cannot fulfill the liquidity-provision role traditionally played by hedge funds, the two brokers said.

"I like to call them 'cocoa tourists' - they move in, hold a position for a day or two, then move out," the European broker said.

Correction to previous statement. I hadn't fully researched it early but just assumed this was from weather based on all the stories blaming weather and "climate change".

Turns out that this is false. My apologies since I should have known better.

Re: Re: Cocoa- all time record highs

By metmike - Dec. 20, 2024, 10:42 a.m.

As a fellow weather trader, I was thinking the same thing, Larry.

However, I'm not sure where a good entry point would be with low risk. This one might have been a good options play. I never do options because most of them expire worthless but for sure this is mostly from weather and you are right on about that!

Correction: This is NOT mostly from weather!

++++++++++++

In fact, the increase in CO2 is, like most crops massively increasing production. However, I was surprised that the number of studies for cocoa trees was so low.

http://www.co2science.org/data/plant_growth/dry/dry_subject.php

http://www.co2science.org/data/plant_growth/dry/dry_subject_c.php

http://www.co2science.org/data/plant_growth/dry/t/theobromac.php

Theobroma cacao [Cacao Tree]

Statistics

| 300 ppm | 600 ppm | 900 ppm | |

| Number of Results | 3 | | |

| Arithmetic Mean | 31.7% | | |

| Standard Error | 10.4% | | |

Re: Re: Cocoa- all time record highs

By metmike - Dec. 19, 2024, 2:48 p.m.

Thanks, tjc!

Sure looks like a potential double top formation but could just be a technical response and traders taking profits.

+++++++++++++++++++++

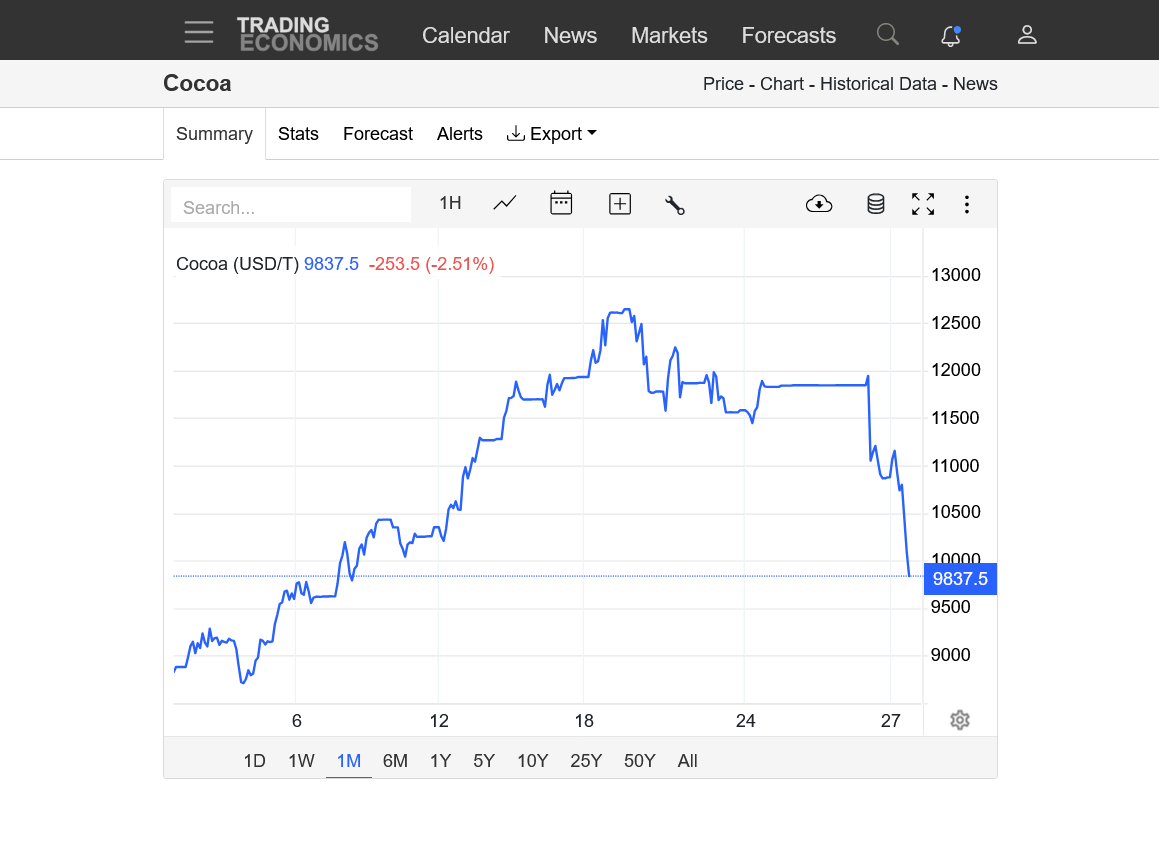

Now it REALLY looks like a double top on the price charts!

https://tradingeconomics.com/commodity/cocoa

Finally, after ten days of torture, my put is working.

Congrats, tjc!!!

https://tradingeconomics.com/commodity/cocoa

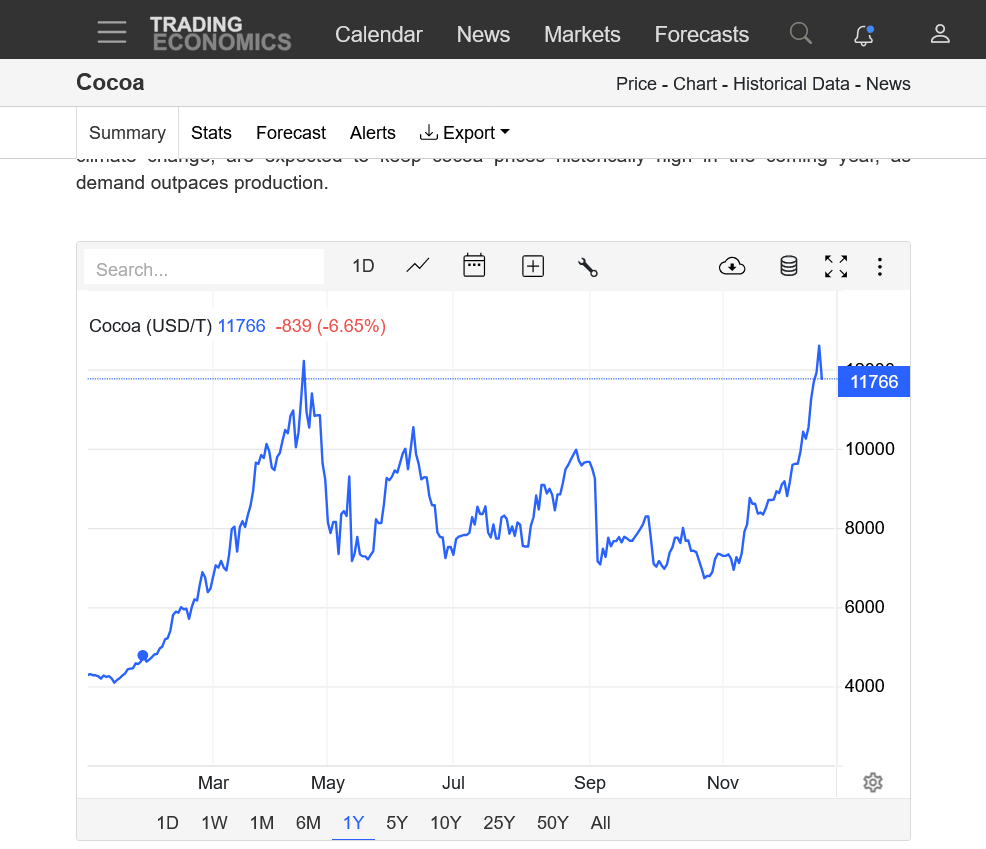

1. 1 year-DOUBLE TOP IS NOW CRYSTAL CLEAR-making money required taking a risk/chance by selling BEFORE IT WAS CRYSTAL CLEAR, when the risks were pretty extreme!

2. 1 month-the horizontal line was just the market being closed for the holiday during that time

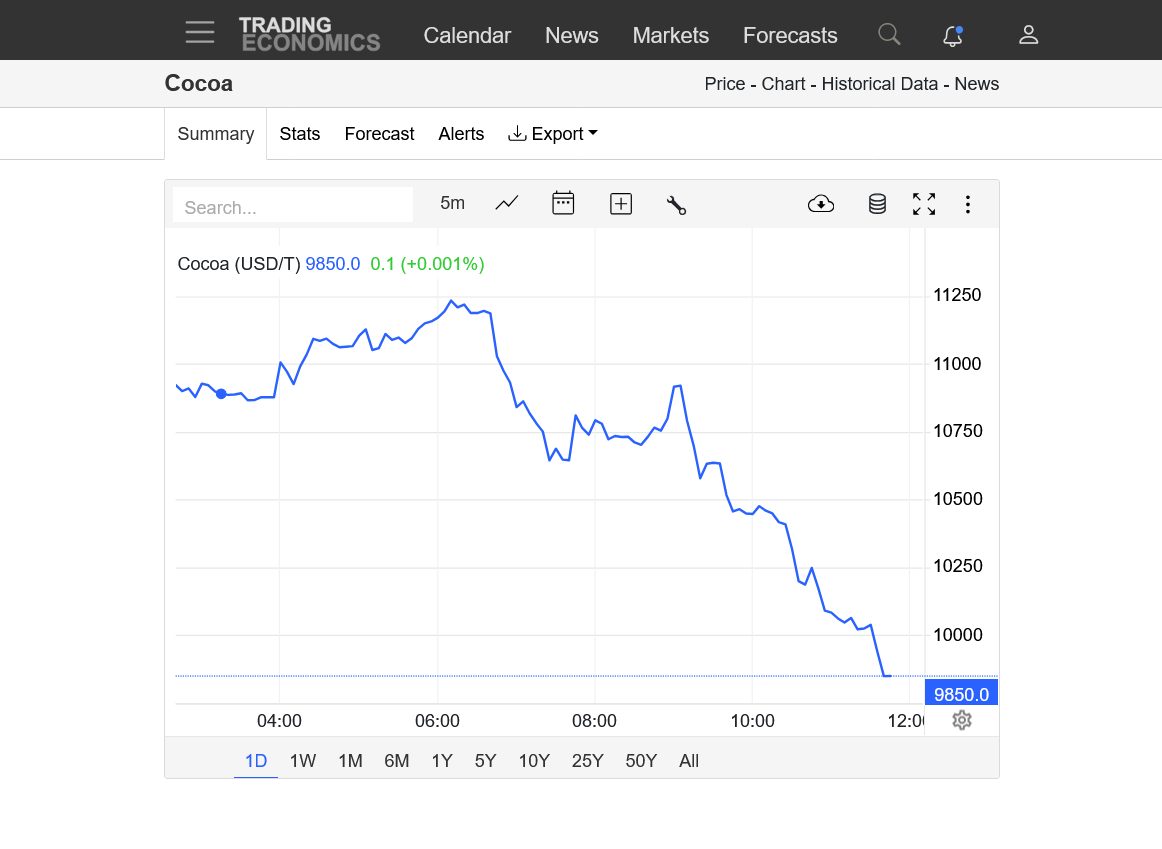

3. 1 day-historical downward plunge continues, going down even faster than it went up!

4. It wouldn't be a shock for some sort of recovery but this market is really insane. With weather having no impact, its not for me to trade but sure is fun to analyze and track. I also dump tons of jet black, dark cocoa in my nightly, plain, fat free yogurt(I buy it online in 5 lb bags that last less than 5 months).

+++++++++++++++++++++++

More research by me is confirming that this historic supply disruption is absolutely NOT because of the fake climate crisis or weather as noted by numerous sources. That's complete hogwash!

Most of it is tied to a yield sapping, major disease/virus. Similar to citrus greening that is decimating the orange groves.

The good news is that these prices are providing financial incentive for places in the world with tropical climates to plant alot of cocoa trees.

Unfortunately, it takes 4 years after planting for them to begin producing.

https://www.dw.com/en/christmas-chocolate-prices-soar-while-cocoa-farmers-struggle/a-70959142

At the heart of the issue is a major shortage of cocoa, after a catastrophic harvest in West Africa caused by cacao swollen shoot virus (CCSV), which spreads from tree to tree and can cause a 50% reduction in crop yields over as little as two years.

|

This is what I buy at least every 5 months. The 5 lb bags.

I found it cheaper at another site in November but this purchase in June, only lasted me until early November.

Too bad I didn't stock up(for most people, 5 lbs would last numerous years and WOULD BE stocking up). This size is no longer available because of the supply crisis.

I'm surprised that 1lb is still only $14.99 which is only double the price of a couple of years ago. I easily go thru a pound+ every month.

%20Bake%20the%20Darkest%20Chocolate%20Baked%20Goods%20Achieve%20Rich%20Chocolate%20Flavor%20Natural%20Substitute%20for%20Black%20Food%20Coloring%20Dutch-Processed%20Cocoa%20Powder%20Unsweetene[...].png)

+++++++++++

https://www.gygiblog.com/blog/2023/01/05/choosing-the-best-cocoa-powder/

+++++

https://www.healthline.com/nutrition/cocoa-powder-nutrition-benefits

++++++++++

I eat it entirely for the taste, not any benefits. I've loved super dark chocolate my entire life. I actually am concerned about consuming so much that it could be increasing some toxic heavy metals to a dangerous level.

Consumer Reports found dangerous heavy metals in chocolate from Hershey's, Theo, Trader Joe's, and other popular brands. Here are the ones that had the most, and some that are safer.

https://www.consumerreports.org/health/food-safety/lead-and-cadmium-in-dark-chocolate-a8480295550/

++++++++++

https://www.frontiersin.org/journals/nutrition/articles/10.3389/fnut.2024.1366231/full

The results of our analysis suggest that many products contain Pb and Cd in amounts that may exceed certain, stringent regulatory requirements (Prop 65). Therefore, enhanced surveillance may be warranted. Further, additional research into cumulative heavy metal exposure from the diet as a whole would help put this work into context to best inform public health policy and interventions. For instance, if contaminated products as a whole are consumed in small amounts and infrequently by most, these contaminants may not be a public health concern (though, perhaps still an individual concern); in contrast, if many such products are consumed fairly regularly by the average consumer, the additive exposure may be a public health concern. However, high mean contamination and the presence of outliers with greater contamination should motivate greater testing of all consumer products, particularly cocoa, to better address significant gaps in quality control. Additionally, this must be placed in the context of dietary patterns and public health concern.

Massive gains/recovery today after the recent, record losses after putting in a significant double top formation on the charts earlier this month.

The range of the biggest loss and gain days this past week is MORE THAN the range for an entire year in the past!

https://tradingeconomics.com/commodity/cocoa

I'm thinking that today's gain is over $10,000/contract!!

Covered my put on Friday--the only trade for the 10400 put. The drop was just too much not to try to exit.

I think I will let CC trade without me!

Congrats, tjc!!!

This is completely insane. I can't see any way for me to trade this market for a high confidence weather trade.

It would just be pure gambling because the set ups that I use are being blown away by the historical supply shortage and reasons that are trumping weather.

But it is still fun to follow and analyze here.

Appreciate you sharing with us!

Today's HUGE recovery makes Friday 'look' like a daily cycle low. IF SO, a rally to at least test high is in order. Projecting a test by Friday or next mon/tues. Friday is option expiration, but not much open interest one way or the other.

Thanks, tjc!

Where will this insane market go next?

1. 1 year-double top, then a ferocious spike down but was that a bull flag?

2. 60 years-this unprecedented price spike higher is almost 3 times the previous record high. Recently, some of the DAILY ranges in price have exceeded the range for many entire years in the past.

https://tradingeconomics.com/commodity/cocoa

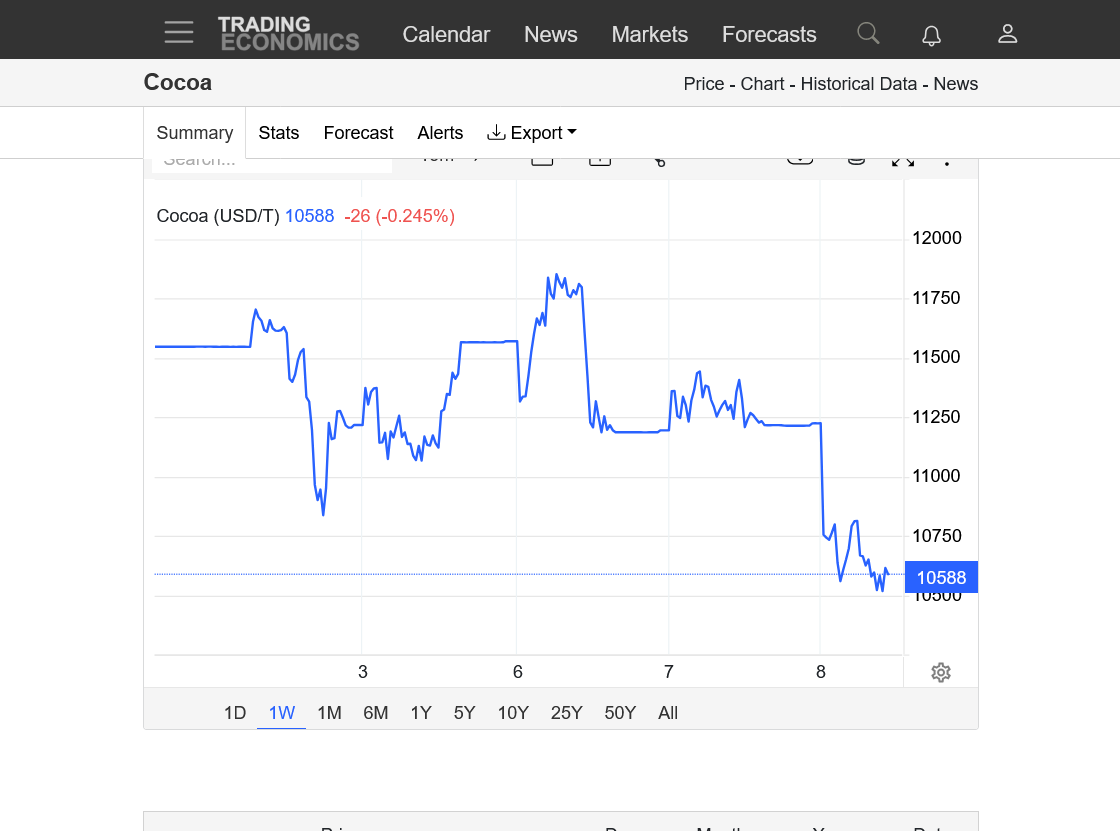

Double top looking more and more likely in this insane market!

https://tradingeconomics.com/commodity/cocoa

1. 1 week-DOWN

2. 1 year-double top with April 19, 2024 high and December 18, 2024 high!!

3. 60 years-extreme parabolic move(slope of uptrend steepens to more and more extremes-never sustainable but almost impossible to predict the end because of the volatility)

Just covered my Feb OJ 500 put by buying futures at 462. I was one of two open interest, having bought the put at 5.5. Option expires tomorrow. For many days, I was wrong, then the massive drop started.

Currently long two feb lumber calls.

Once again, CC just too hard to trade.

Thanks, tjc!

That's pretty interesting. Covering with 1 day to go and the open interest was 2.

You can always exercise that call or put and become long or short at that strike price, right?

I exercised so as to capture the equity---exercise put (short at 500) and cover at 462 with futures long results in 38 x $150 profit on the offset. Due to the short time period and the distance from the strike, there was no premium to be had by waiting or exercising 'early'.

I had targetted the 460-465 area as support, so i ACTED!!

Account Rep and I talked about using futures to cover as there was NO bid/ask in the option, and with one day to go, I did not want to further speculate that I would cover better than 19.20 down(limit is 20). Futures closed down 16, so my timing was good.

Thanks for explaining that so well, tjc!!!

https://www.sciencedaily.com/releases/2024/04/240423155910.htm

+++++++++++++++++++++++++++++++

The impacts from increasing CO2 have been much more POSITIVE for cocoa as it is for all food production:

Death by GREENING!

Started by metmike - May 11, 2021, 2:31 p.m.

https://www.marketforum.com/forum/topic/69258/

https://www.marketforum.com/forum/topic/109062/#109173

+++++++++++++++++++++++++++++

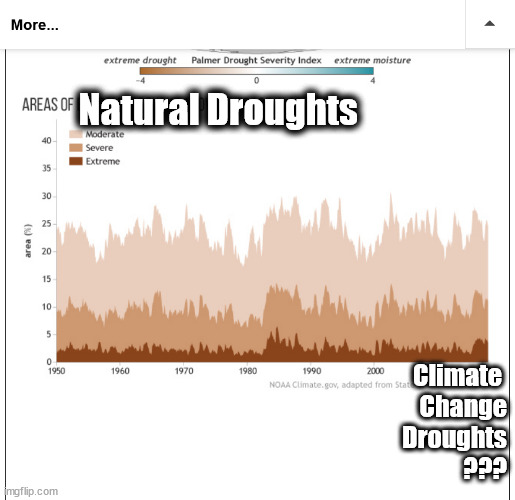

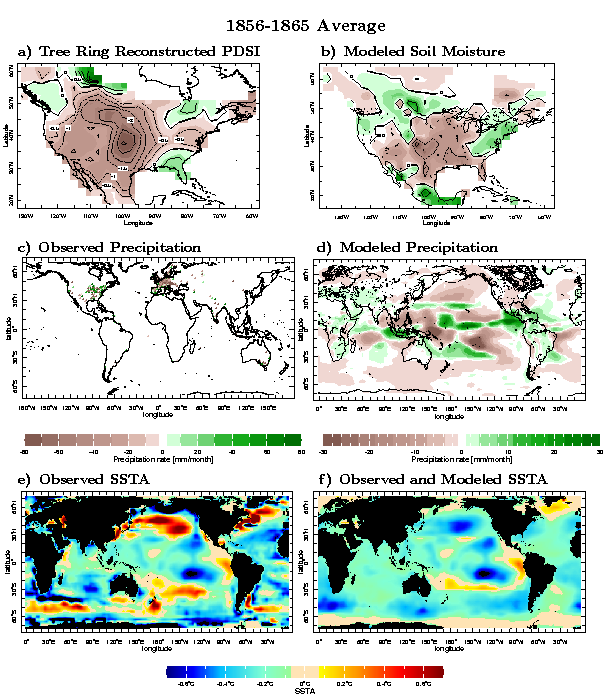

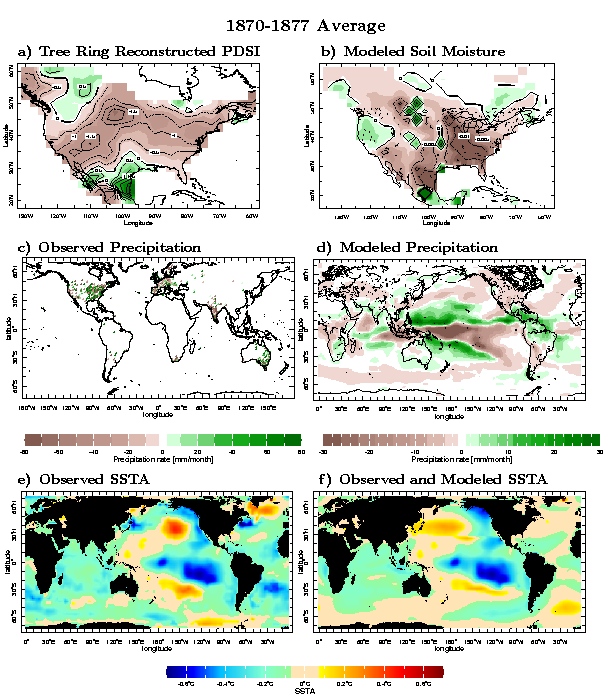

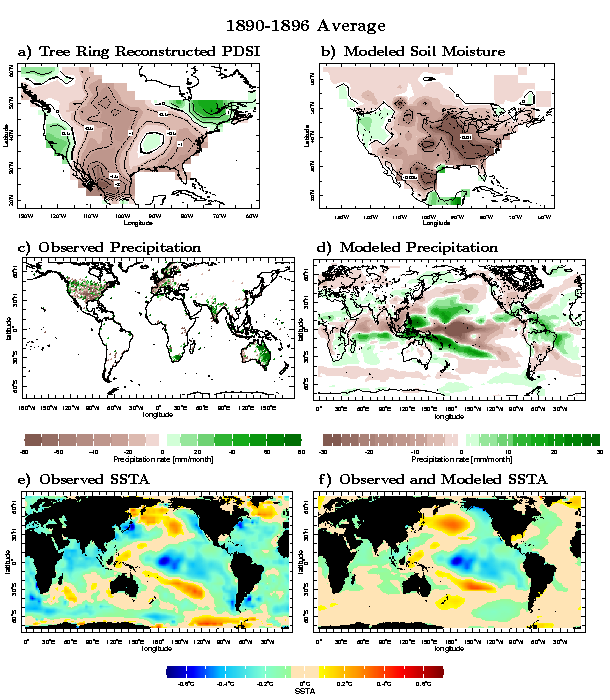

Here's a perfect example of why they get it so wrong using the global drought graph below. Please tell me where on this graph below, that the climate change droughts are and where the natural droughts are since the year 2000? Impossible because the pattern is THE EXACT SAME! The MSM, in 2025 tells us that EVERY drought is now caused by or made much worse by climate change to the point that they use the terms interchangeably.

https://www.climate.gov/news-features/featured-images/2017-state-climate-global-drought

+++++++++++++++++++++++

Global cooling and LOW CO2 levels are what cause widespread, extremely long lasting droughts with catastrophic global and huge regional famines!

Here in 2025, we are living in a climate optimum with absolute, scientific certainty!!

Causes and consequences of nineteenth century droughts in North America

https://ocp.ldeo.columbia.edu/res/div/ocp/drought/nineteenth.shtml

++++++++++++++++++++++++++++++++++++++++

It really boils down to this, once again(Cliff Mass can be counted on as an elite source for using objective, authentic science)

https://cliffmass.blogspot.com/2016/03/the-golden-rule-of-climate-extremes.html

The GoldenRule

Considering the substantial confusion in the media about this critical issue, let me provide the GOLDENRULE OF CLIMATE EXTREMES. Here it is:

The more extreme a climate or weather record is, the greater the contribution of natural variability.

Or to put it a different way, the larger or more unusual an extreme, the higher proportion of the extreme is due to natural variability.

Climate change in the United States, with 100% certainty is helping to protect us from widespread severe droughts.

Summer Climate Change in the Midwest and Great Plains due to Agricultural Development during the Twentieth Century

https://journals.ametsoc.org/view/journals/clim/32/17/jcli-d-19-0096.1.xml

++++++++++++++++++++++++++++++++++++++++++++++++++++

We are indisputably living in a climate optimum for most life on this planet(that would still prefer a bit more warmth and a lot more CO2) and for growing crops in the United States!