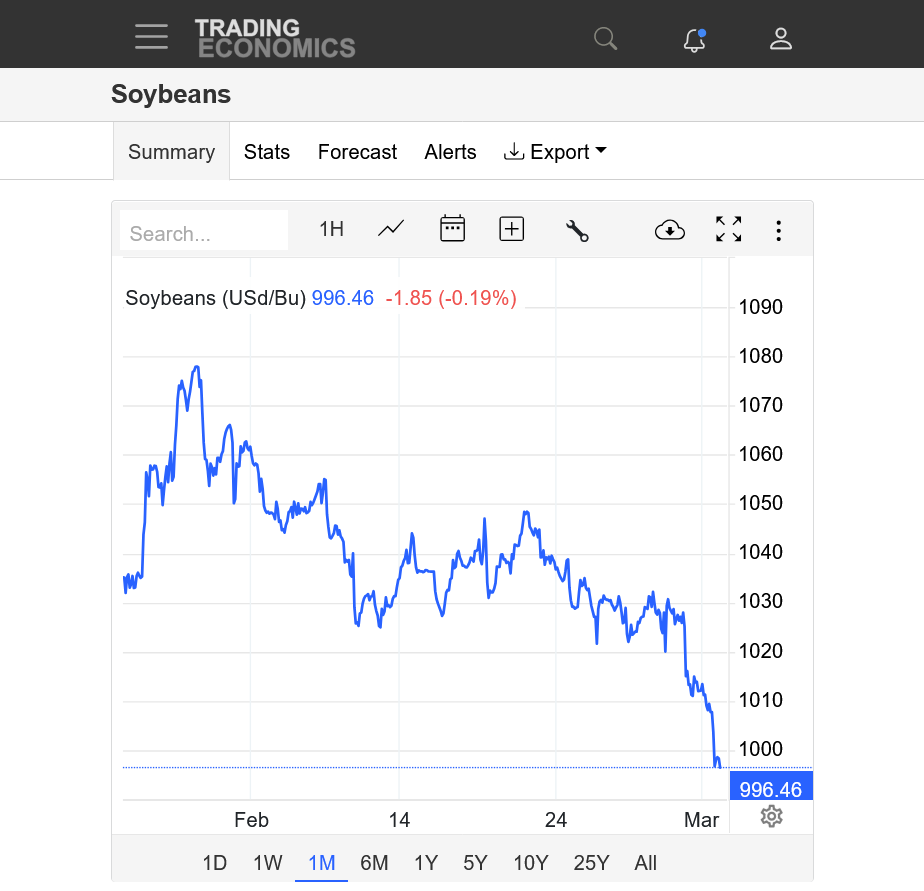

Beans gapped down roughly 14 points? While it’s nice to be on the right side of a move like that, thank goodness….corn gapped lower too.

Seems like a severe move to be weather related at this stage. Tariffs enacted?

Not sure either, Jim.

The open was still within the lower part of the previous days range so not a daily gap lower but it was double digits lower than the close, less than 6 hours earlier.

I checked the Argentina radars..........not much rain.

The forecast didn't change that much either, so it must have been news related on something like you suggested.

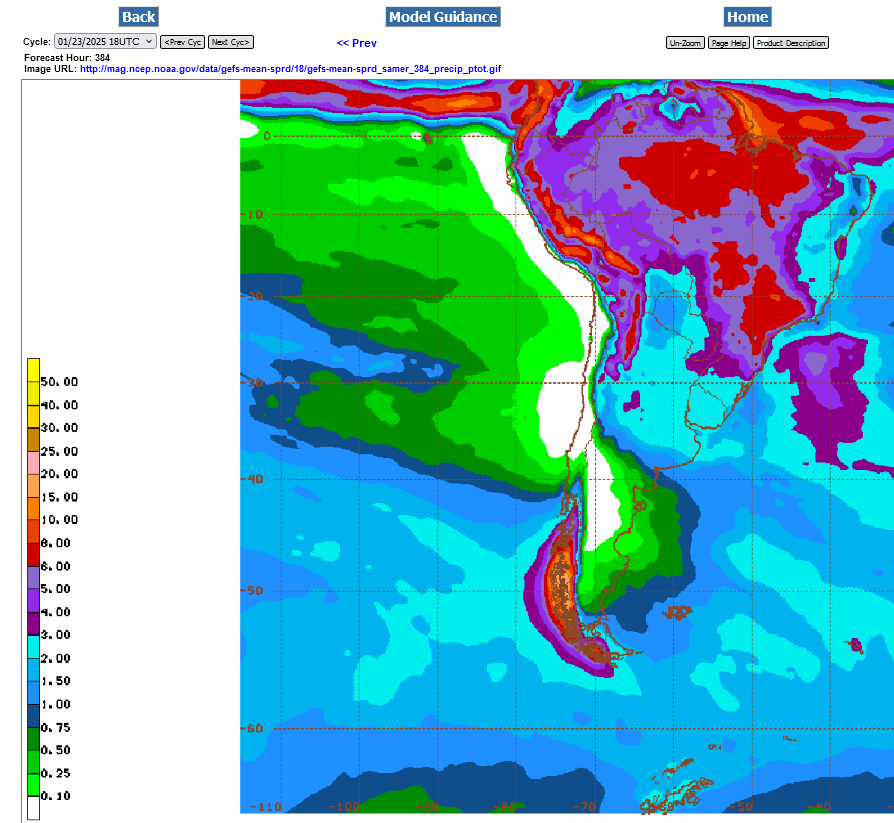

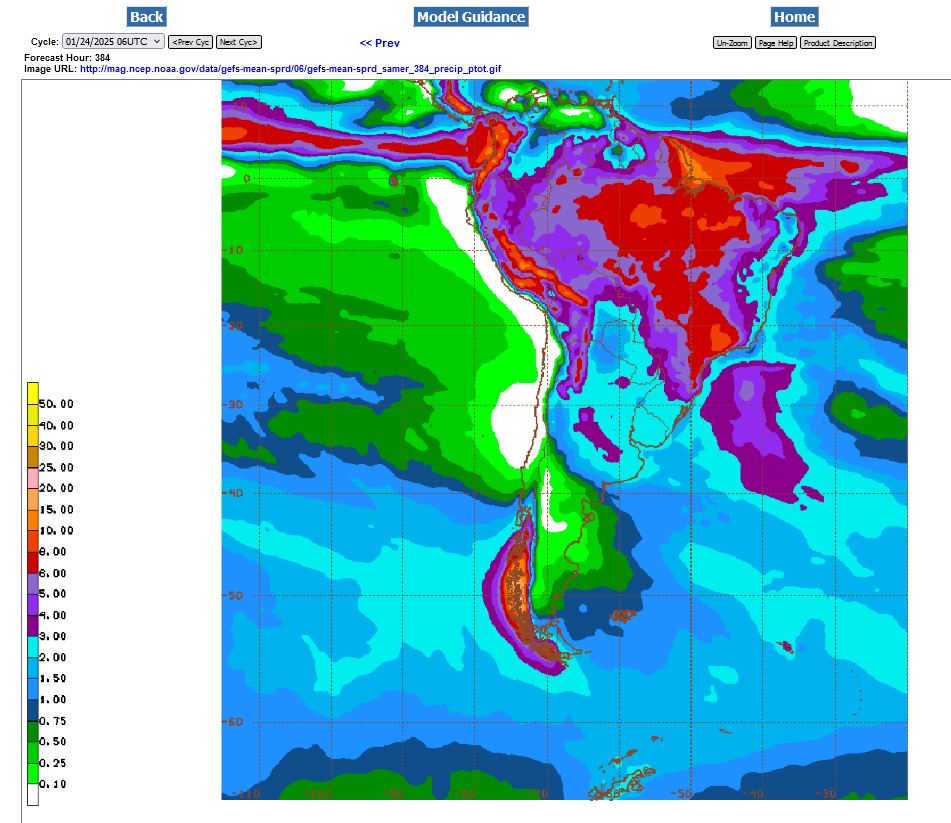

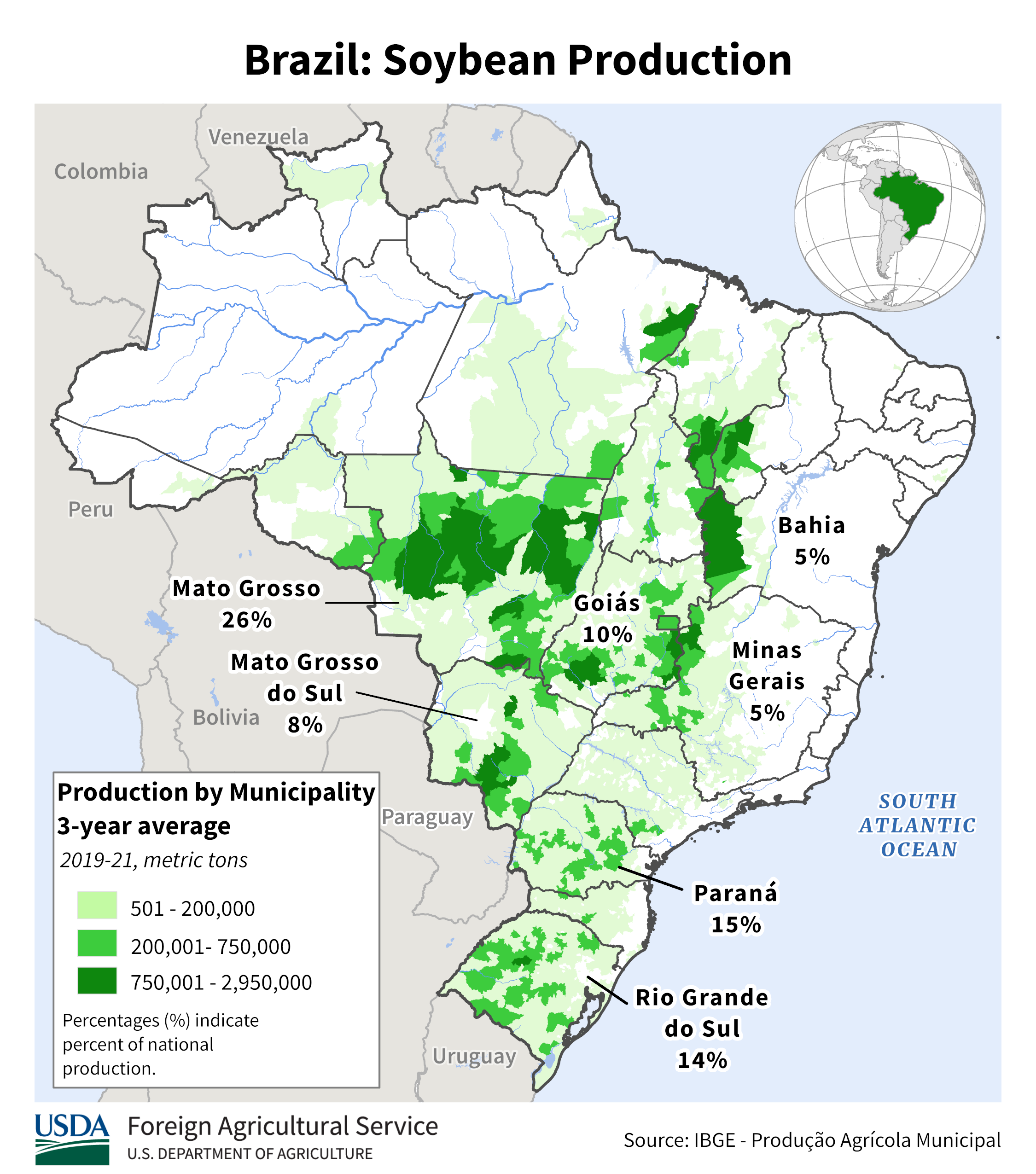

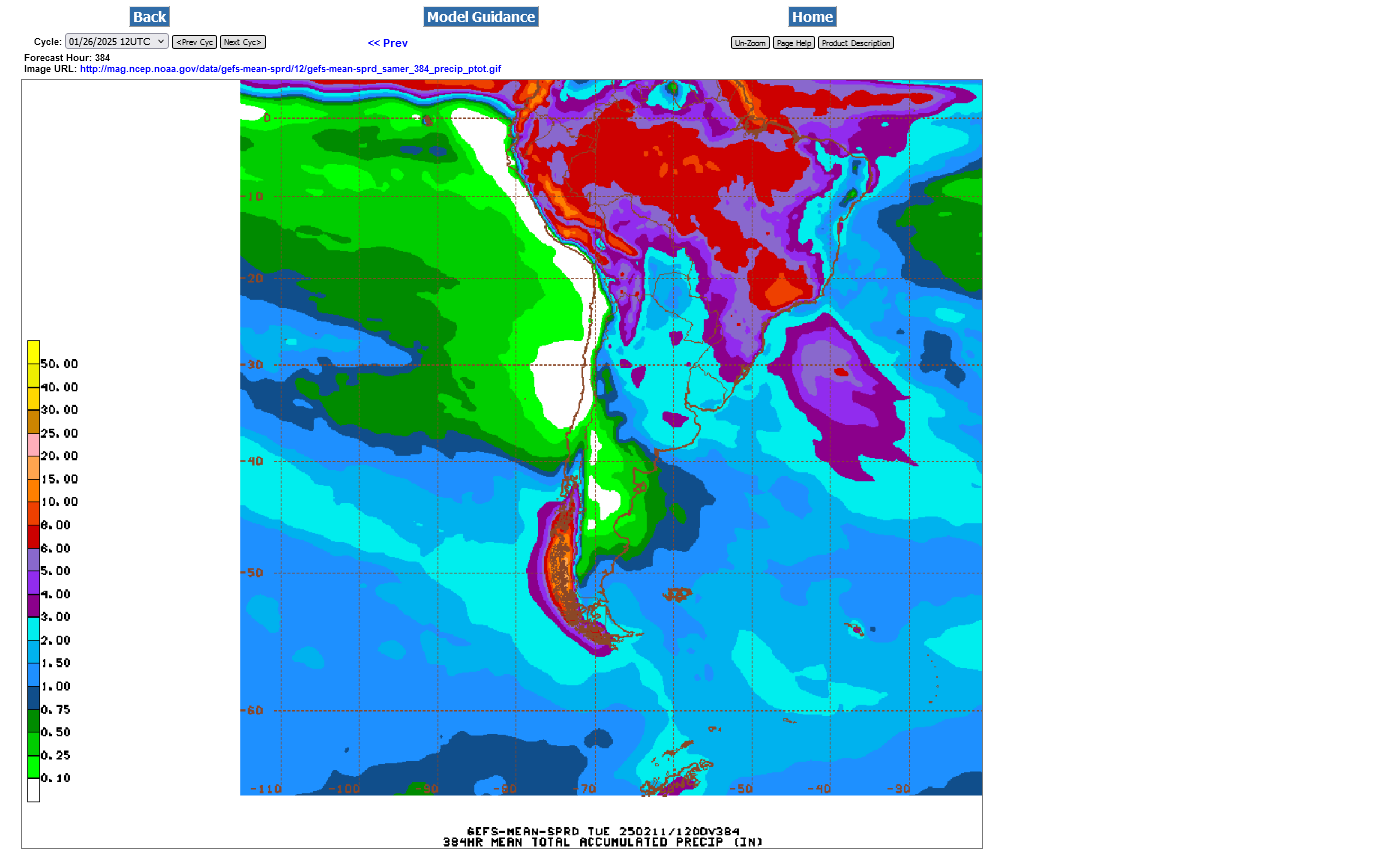

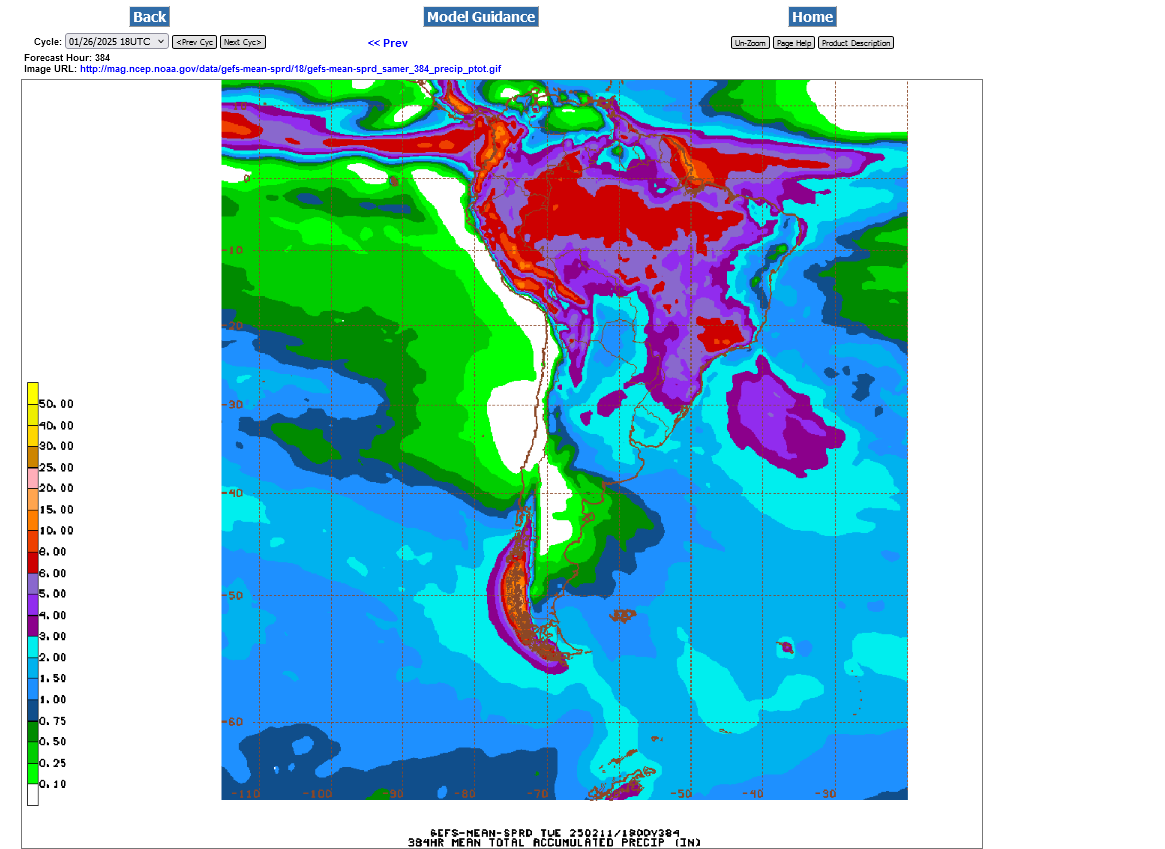

1. This was the last 18z GEFS out just before the open.

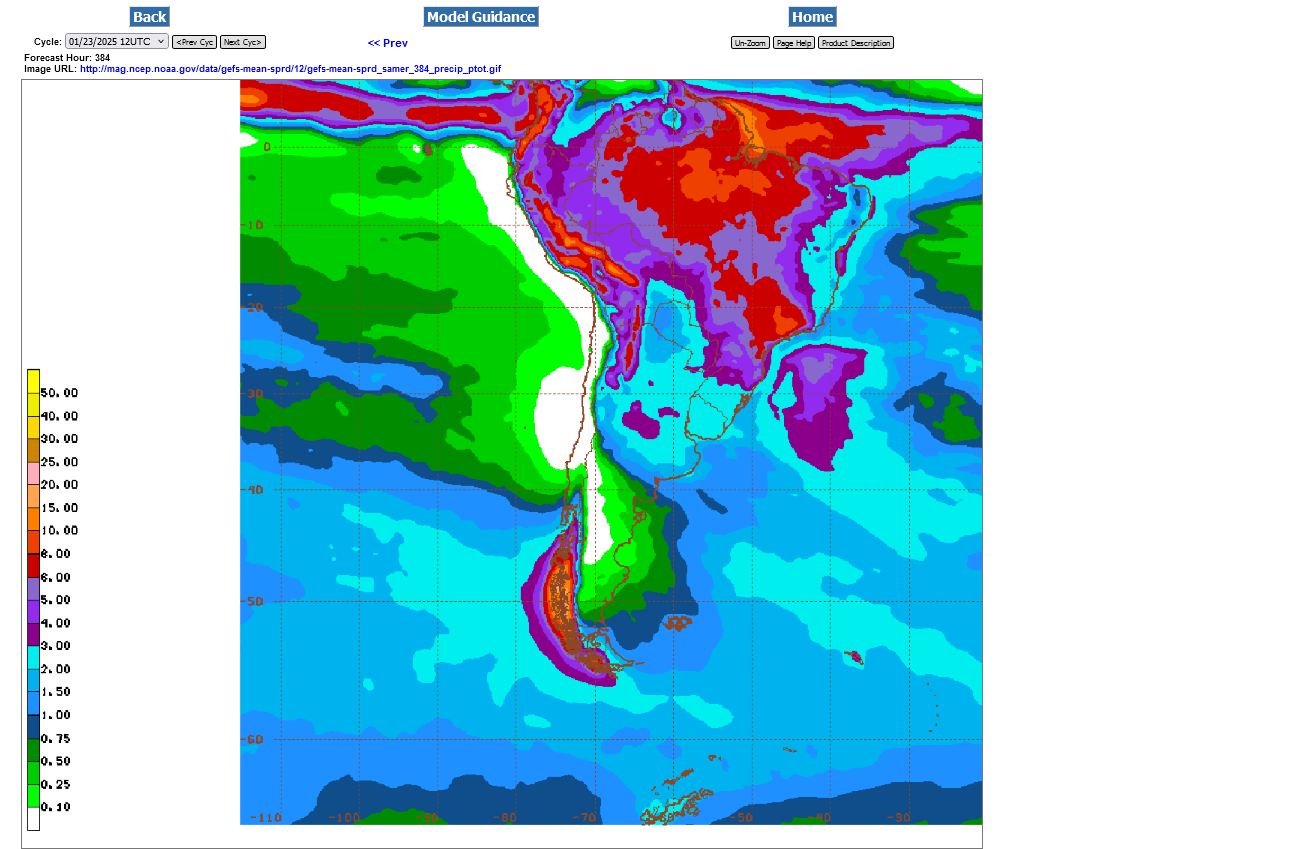

2. Below that, the previous 12z GEFS that came out when the market was trading. If anything, there was a tad LESS rain on the last one but they are both leaning MUCH MORE bearish than earlier this week for Argentina, at least.

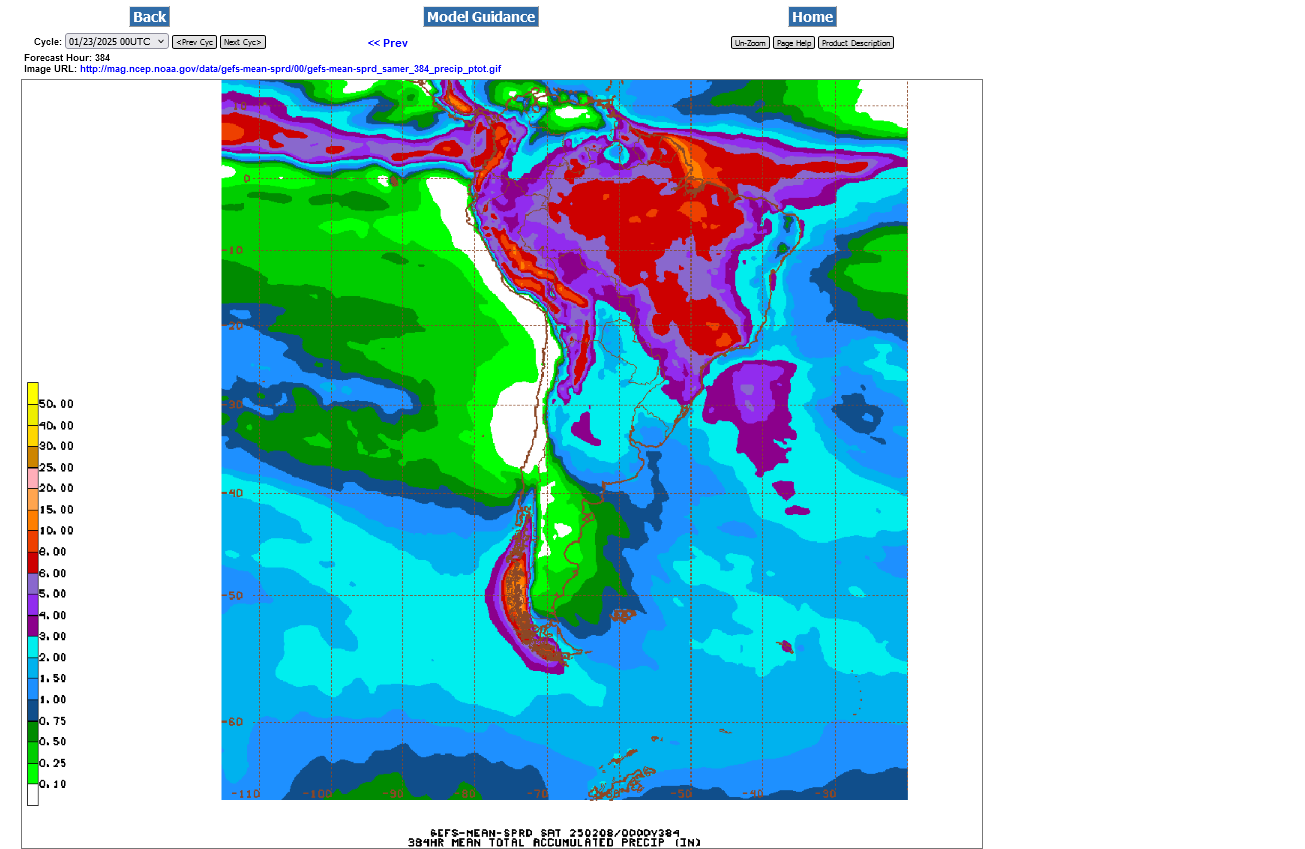

3. 6z GEFS from 12 hours earlier

4. 0z GEFS from 18 hours earlier.

I thought market weakness overnight Wednesday was tied to bearish maps 3 and 4, which first added the rains but we bounced back strong later in the day session with that same forecast. If this is weather, then overnight traders are focused on the increased rains coming to Argentina and day session traders were shrugging it off. on Thursday.

More likely something else but sometimes, the market doesn't behave perfectly like you expect it to on weather, as if there's a formula of rains, where the letters represent the importance of certain regions based on production and dryness: A+2B+3C+4D = T(total rains for South America during the growing season) and you expect that when T goes up, its bearish and when T goes down, its bullish.

Just the opposite can happen, depending on a host of other factors.

1. USDA-demand/supply fundamentals. We had a bullish shocker in the January report which has turned the underlying psychology from BEARISH to BULLISH and from ignoring a month+ of severe weather adversity in Argentina to suddenly, trading on it more than anything else.

2. Technical. Key levels. Trends and indicators.

3. Seasonals. Approaching and during harvest is a huge bearish force for instance. Traders, just knowing this will WANT TO BE short during those periods and want to be long during periods with positive seasons.........the law of the markets self fulfilling prophesies.

4. News about tariffs or other surprises that are very unpredictable, unlike the other stuff above.

5. Positions of the funds. If they are overloaded to one side, it creates an imbalance and fuel for them to cover when the market is hit with news that suggests they are wrong, while at the same time, they love to follow trends and can feed a trend to help sustain it for very long periods.

6. We are always looking for THE reason for daily moves, especially big ones like the much lower open tonight. News reporters and brokers are paid to tell us THE reason because thats their job. They usually have decent sources, and certainly more than the average trader. However, I've seen them completely wrong on occasion on the weather. Everybody is wrong sometimes(that includes me for sure). Everybody is wrong about where the price is going a great deal, especially pertaining to how the weather turned out. I'm talking about being wrong about why the price just acted the way that it did. THE PAST. What happens is that they/we find an explanation that makes good sense and will more often than not, give that one the most weighting because its the first one that got stamped into our brains.

7. If you're a weather trader, this is the most dangerous mistake you can make. For instance, if rains had increased a bunch on this last GEFS(they didn't) I would be convinced that this huge open lower was from that. This would cause me to assume that taking away some of those rains or adding more should have a similar impact. It might have an impact but if the real reason was something different, then I'm missing whats of most importance to the market.

No big rains happening this evening in Argentina., which is extremely dry right now This something that can cause huge price changes when the market it closed. Not this time:

Look how dry its been in Argentina!!!!!

30 days below compared to average:

https://www.cpc.ncep.noaa.gov/products/Global_Monsoons/gl_obs.shtm

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.30day.figb.gif

90 days compared to average

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.90day.figb.gif

The crop in Argentina has lost a tremendous amount of yield with 100% certainty and this has helped drive prices higher, especially since the USDA finally told us the truth about last years crop......in January, 3 months after most of it was harvested!

USDA January 10, 2025/grains

23 responses |

Started by metmike - Jan. 10, 2025, 11:38 a.m.

https://www.marketforum.com/forum/topic/109451/

+++++++++++

Latest thread:

Soybeans/grains/coffee 1/15/2

18 responses |

Started by Jim_M - Jan. 15, 2025, 9:12 a.m.

To your point about the dryness, a big jump up wouldn’t have surprised me. I guess we wait and find out eventually.

they re saying it had nothing to do with weather. Argentina lowered export taxes on beans

Thanks, mcfarm. That makes complete sense for the reason that we had a much lower open on Thursday evening!

The weather has not changed much. Biggest rains in some time to hit Argentina next week. It will be interesting to see how the market reacts to those rain events. Probably volatile based on the radar lighting up over key production areas OR NOT compared to expectations.

1. Last radar

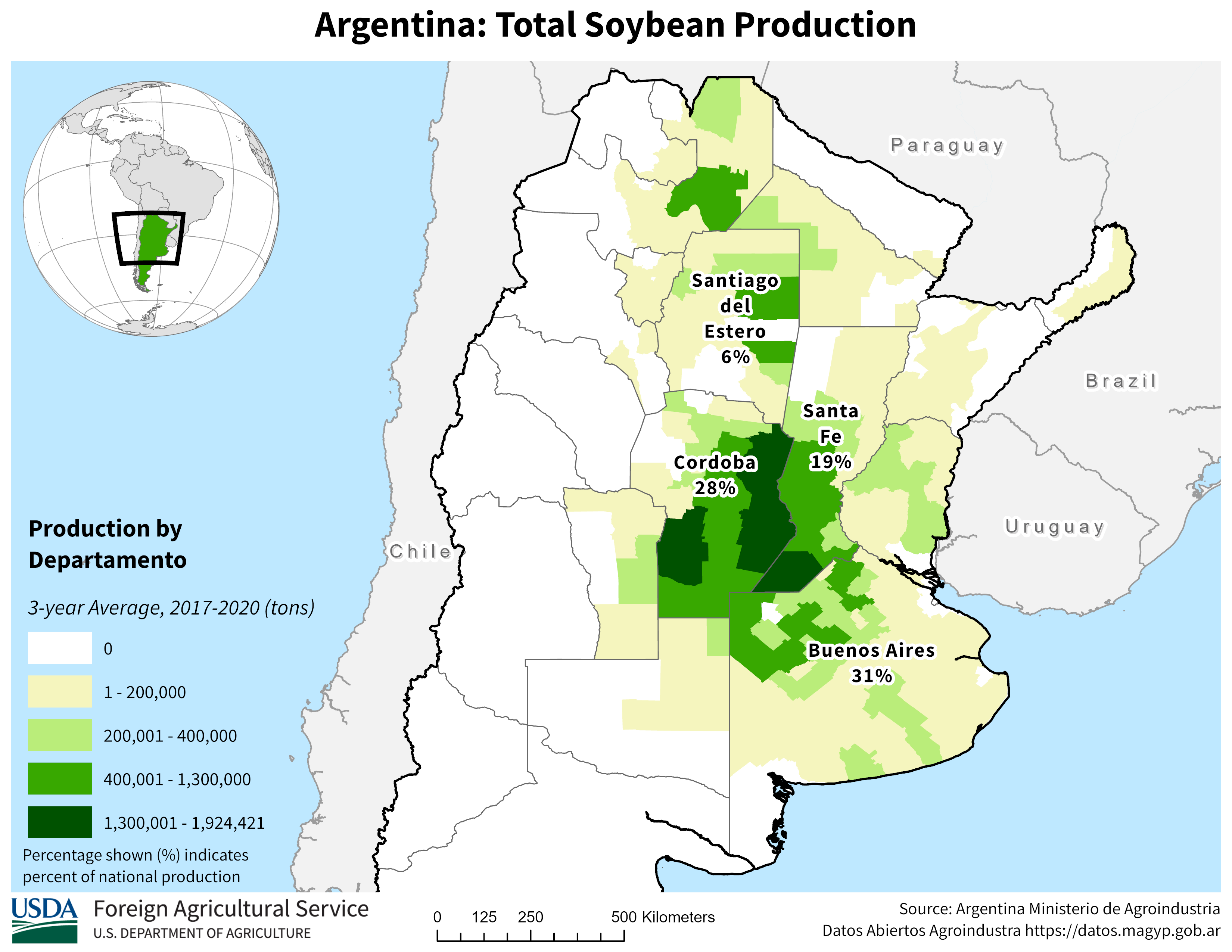

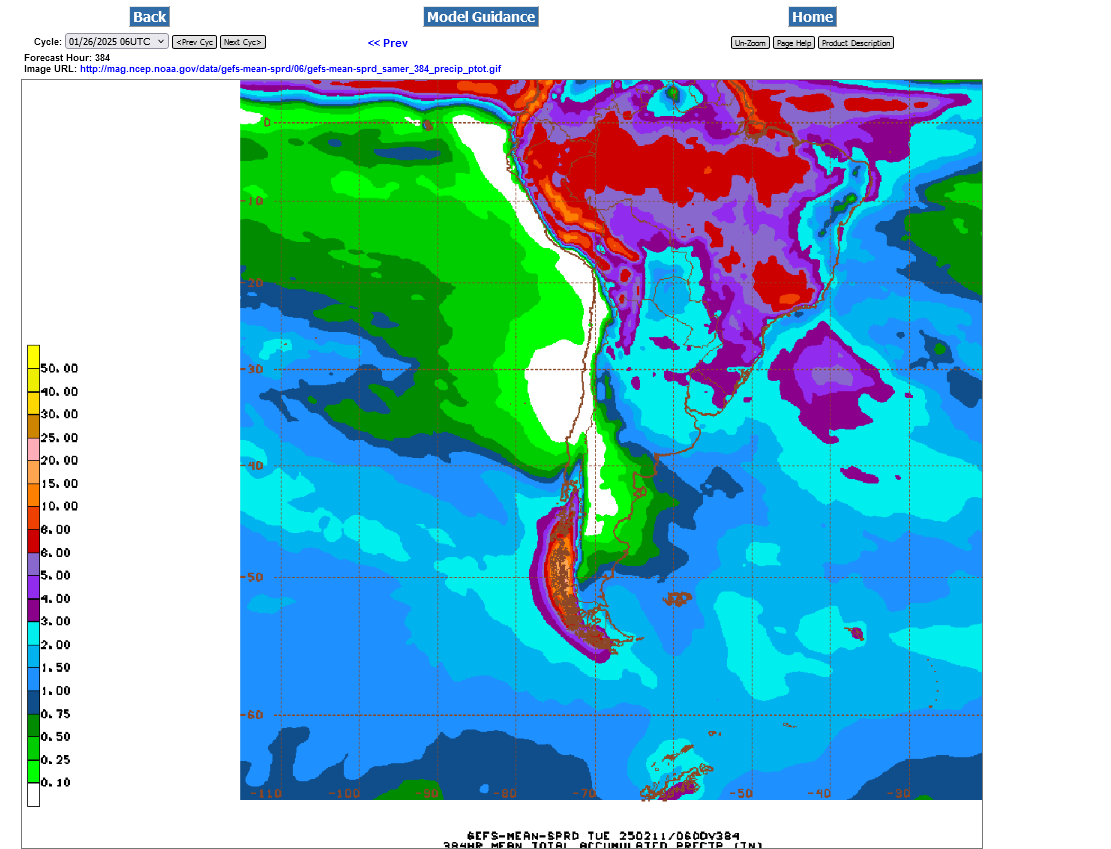

2. 16 day rains

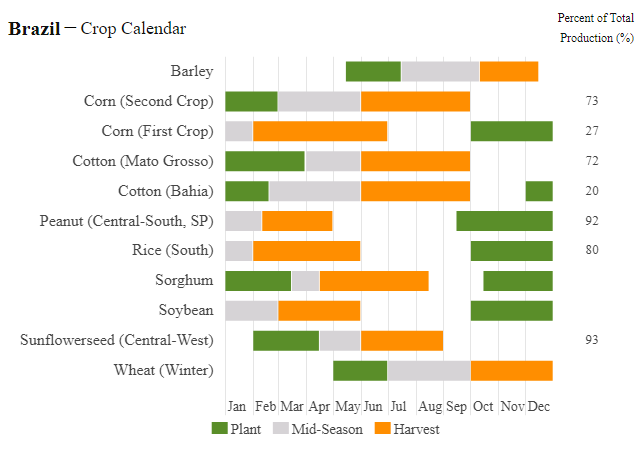

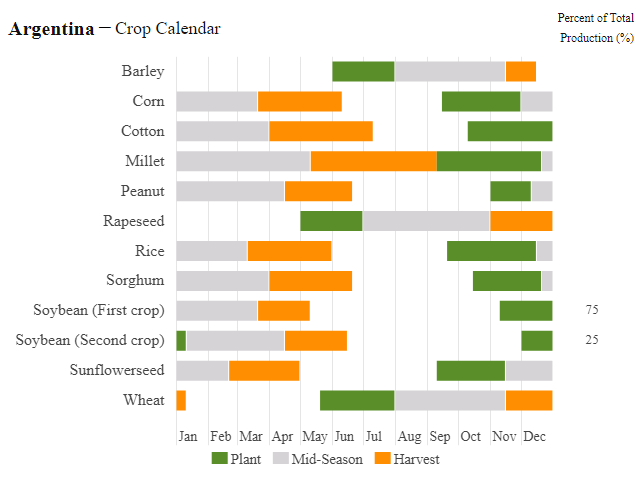

3. Brazil crop calendar

4. Argentina calendar

https://www.accuweather.com/en/ar/rosario/11222/weather-forecast/11222

https://ipad.fas.usda.gov/countrysummary/default.aspx?id=BR

https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/Brazil/Municipality/Brazil_Soybean.png

https://ipad.fas.usda.gov/countrysummary/default.aspx?id=AR

Last 6z run of the GEFS. Not much different than what the market had on Friday. More bearish than not for Argentina!

February is getting late in the growing season for some areas in South America, so I'm not sure anything but extreme weather can dominate price determination:

3pm update:

Last 12z run:

The early evening 18z GEFS added a tad more rain to Argentina's already bearish forecast for total rains going out 384 hours.

The Agriculture Outlook Forum meets this Thursday and Friday. The forum will announce the 10-year baseline projections from the World Outlook Board. The projections are based on economic analysis, not survey information. These projections are used to help develop government budgets. This will be the first insight into what the USDA believes acres will be and they will also project supply and demand. The results that the board releases are not surveys and do not hold as much importance as the March 31st Projected Planting Report or the monthly WASDE reports. The report does give an idea of what the USDA will use for trend yields in the May WASDE.

Thanks, cutworm!

Thats a big one. Great post!

South America weather is no longer that important to the crop that is at the end of the growing season.

metmike: This has been expected from the huge increase in rains in Argentina this month!

Note the small green blob on the map below which was right on top of key c and s production areas in Argentina:

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.30day.figb.gif

Conditions for #soybeans in Argentina rose to 24% good/excellent from 17% a week ago, #corn rose to 21% g/e from 18% a week ago. This comes after an improvement in weather. However, it is interesting to note that the portion of crops in poor condition did not change much.

56% of U.S. #corn areas are currently experiencing drought conditions, up sharply from 45% a week ago. That is the week's third highest since 2000 and above the five-year average of 25%.

There's some good news: only 6% of corn areas are in severe or worse drought classification, the week's LOWEST in five years (year-ago was 15%). Also, per CPC's latest forecast, some of this could be alleviated this spring (more so in the east vs west).

Snippets from USDA's 2025/26 U.S. balance sheets ahead of its Ag Outlook Forum:

USDA tentatively pegs 2025 U.S. corn, soybean and wheat plantings relatively close to the average trade estimates - corn & wheat a bit above, soybeans a bit below.

Bean/corn ratio analysis didn't work in 2021 as corn acres were unusually strong vs bean acres given the high ratio. ALSO in 2021, the trade was WAY closer to final corn acres than USDA/farmers were in March. Trade was 310k acres too high, USDA 1.76M too low in March 2021.

https://agindrought.unl.edu/RowCrops.aspx

See the drought monitor history here:

LOOKING to get long tomorrow! 1002 level

NOT expecting a NG result! haha

Thanks much, tjc!

Each year is different but seasonals are extremely positive here.

We have the tariffs and big bearish boost to the end of the Argentina growing season as just 2 unique variables in March 2025

https://www.seasonalcharts.com/future_farmprodukte_soybean.html

++++++++++++

This is the March front month below. The source has NOT updated to the May contract but we should always be grateful for free sources and this one is awesome.

https://tradingeconomics.com/commodity/soybeans

1. 1 month-collapsing lower

2. 1 year-double top with the Sept 27, 2024 and Feb 4, 2025 highs. Still holding the August 12, 2024 lows(put in from the widespread flash drought end to the 2025 growing season during late pod fill that caused the seeds inside the pods to be dinky instead of robust).

3. 10 years-Record high price in May 2022, over $17 and a strong downtrend since then with half a dozen bear flags/triangles/wedges. Each of them ending with a downside break out. Is this just another one of them??? I have no clue. When US weather becomes important to price discovery, then I'll have some clues.