The trade looks weak. Down we go after the report. It is inevitable.

corn 3-18-2025

Managed Money

Disaggregated Commitments of Traders - Futures Only, March 18, 2025

Long : Short :Spreading

243,695 139,265 352,693

lots and lot of bearish feelings about corn and beans. But if you step back from the market since last fall even with a huge crop latest carryout numbers are down. Farmers try to stay optimistic for the coming year and this year is n doubt going to be tough on farm financials by the billion. So we better do a much wiser job marketing this crop in 25

Time to get MarketForum in tune with this upcoming growing season after a 3 week drought in substantial posting on it:

https://www.marketforum.com/forum/topic/109667/

Thanks for leading the way with this thread/discussion!

++++++++++++

All the constantly updated weather:

https://www.marketforum.com/forum/topic/83844/

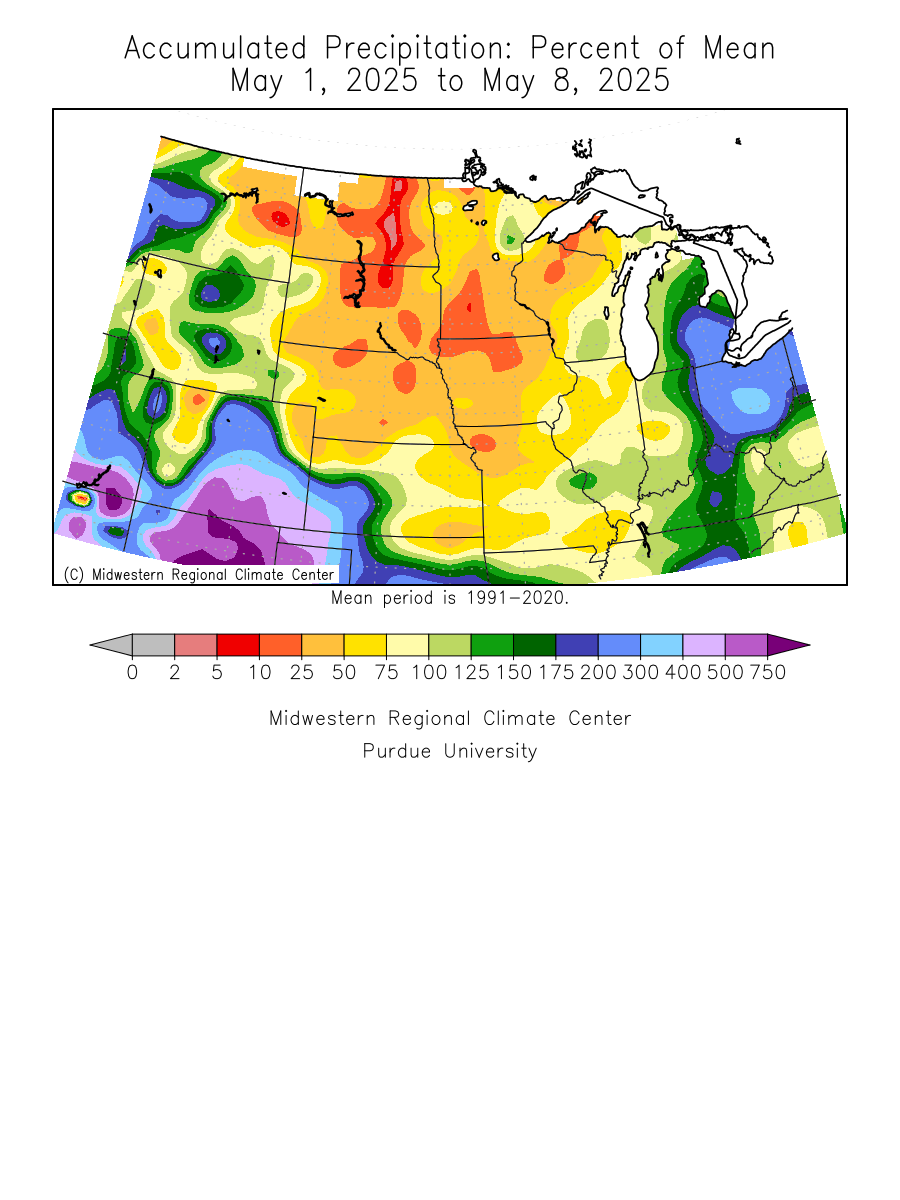

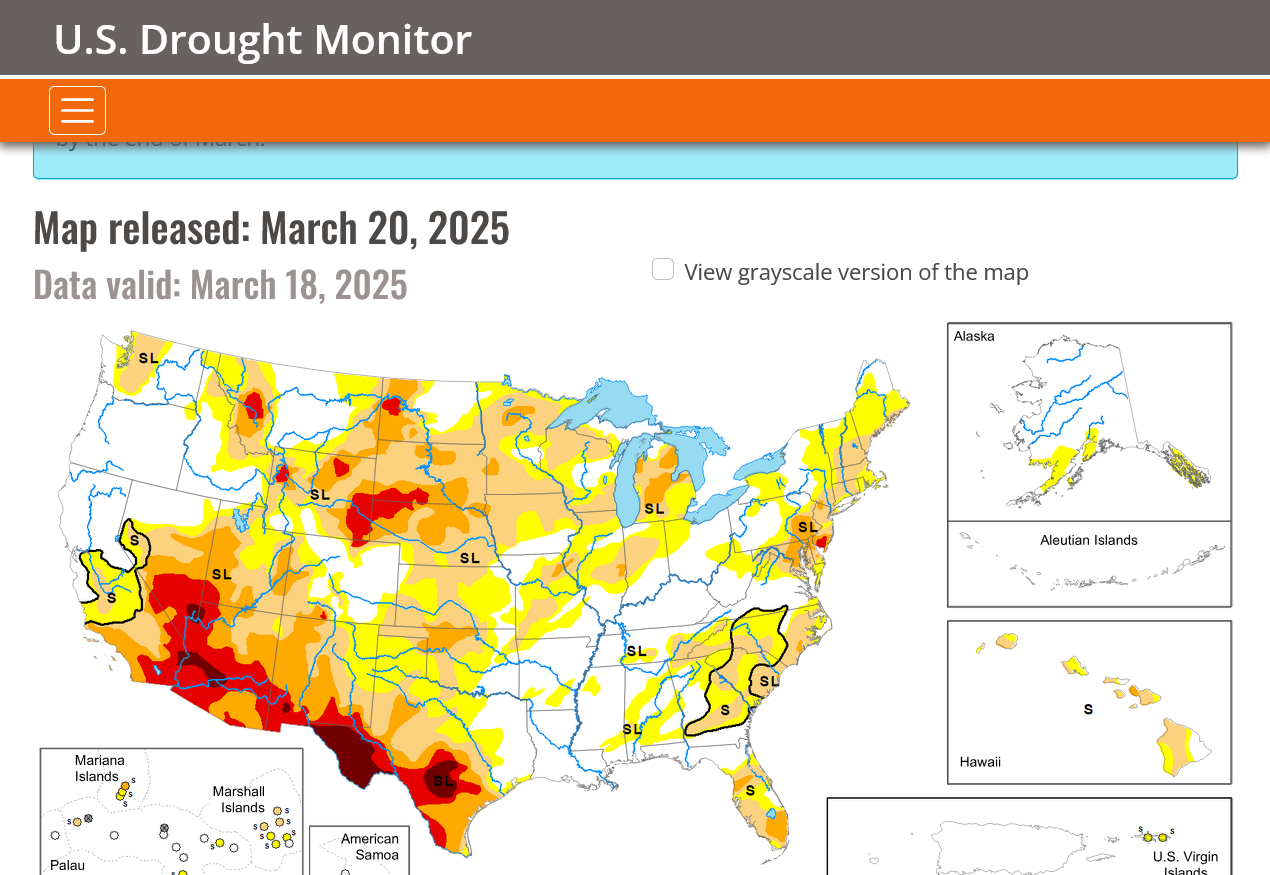

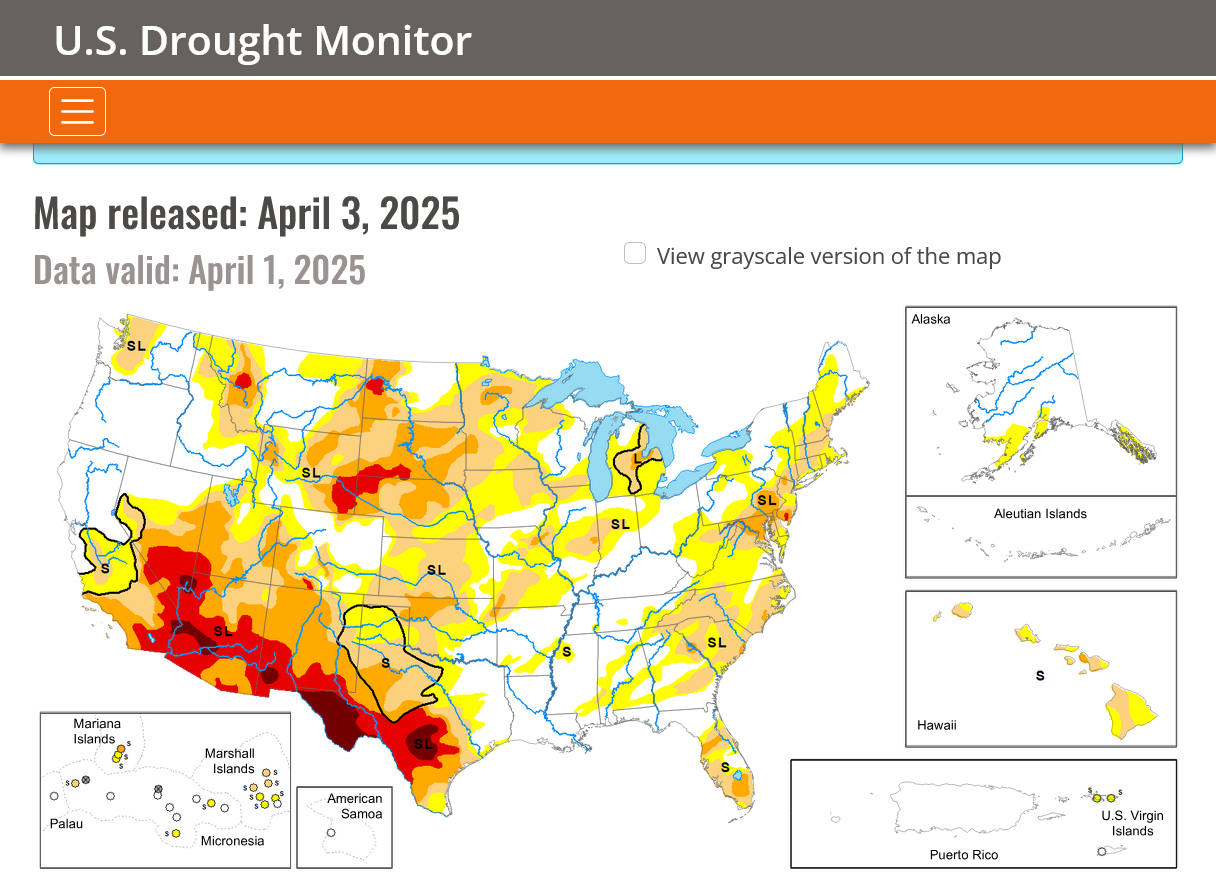

Drought indicators:

https://www.marketforum.com/forum/topic/83844/#83853

Soilmoisture anomaly:

These maps sometimes take a day to catch up to incorporate the latest data(the bottom map is only updated once a week).

https://www.cpc.ncep.noaa.gov/products/Soilmst_Monitoring/US/Soilmst/Soilmst.shtml#

++++++++++++++++++++++++++++

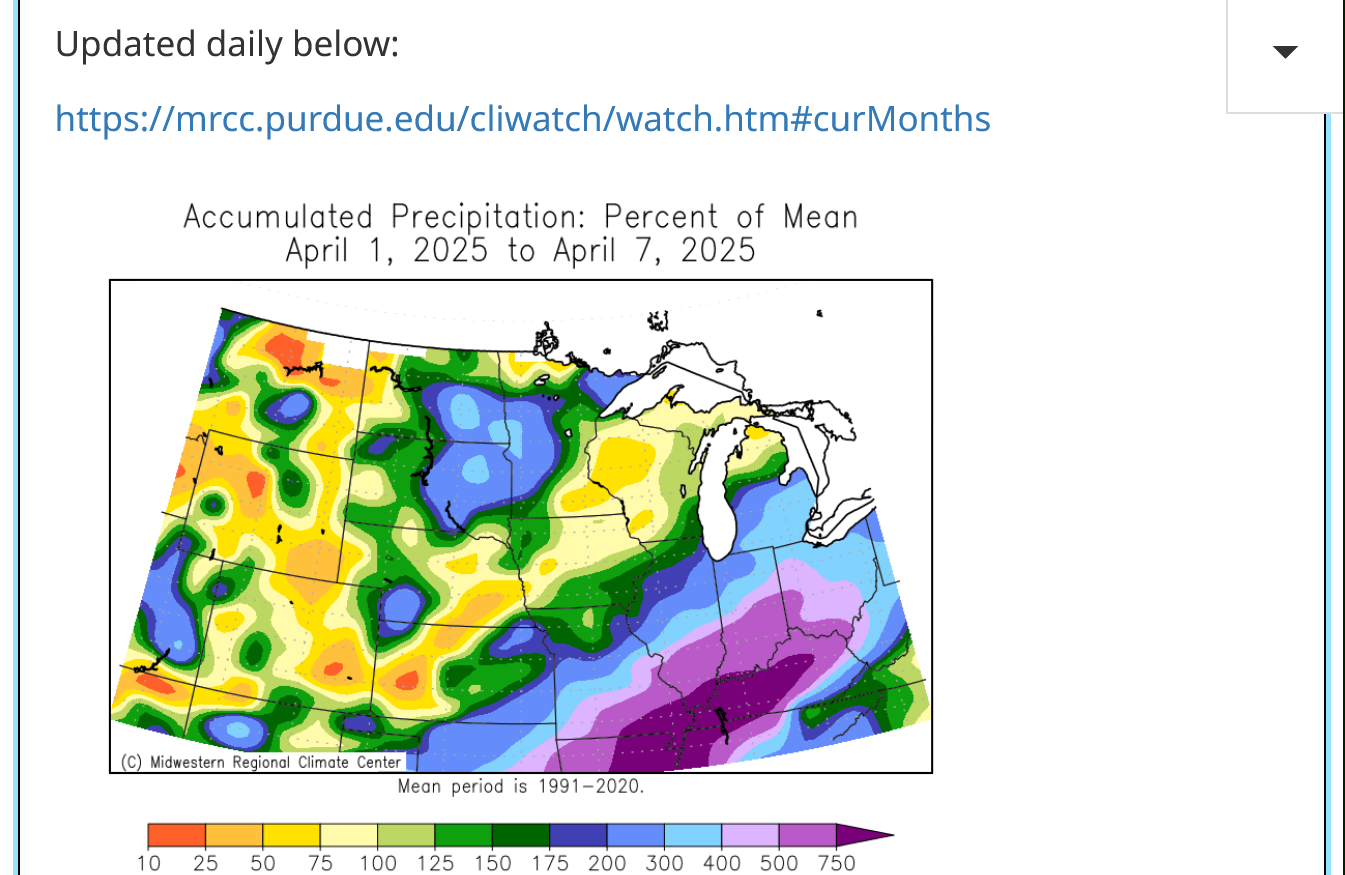

Updated daily below:

https://mrcc.purdue.edu/cliwatch/watch.htm#curMonths

NEW LINK:

https://www.drought.gov/current-conditions

DROUGHT MONITOR

https://droughtmonitor.unl.edu/

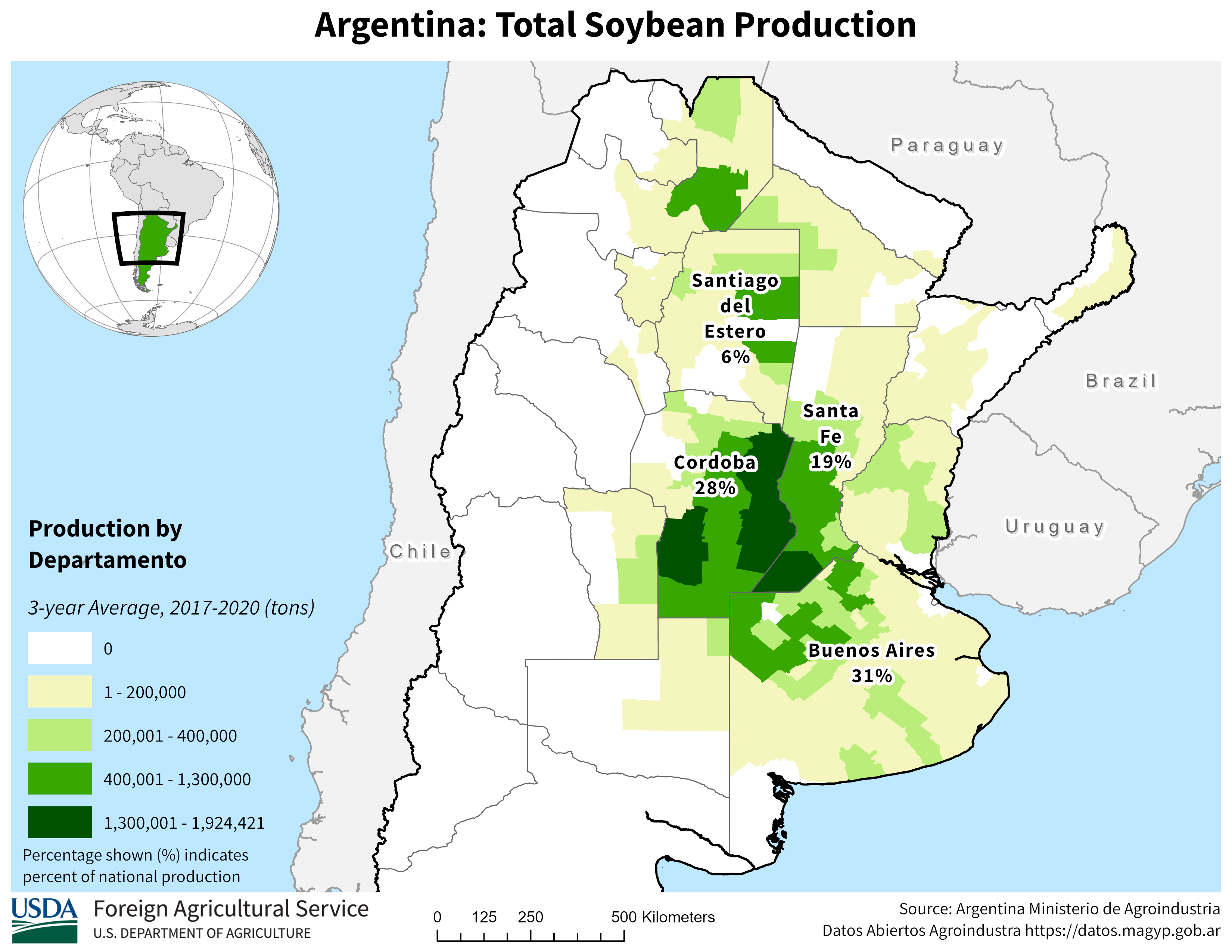

Great rains the last month have help to save the Argentina bean crop that was being decimated by drought.

Conditions for #soybeans in Argentina have improved over the last month (now 29% good/excellent versus 17% a month ago). But 27% of the crop remains in poor health, which is likely why harvest estimates are steady to lower despite recent rains for many areas.

30 day precip map 2 months ago: Bone dry across most of Argentina:

Latest 30 day precip map: Area of green, with MUCH ABOVE RAIN right on top of key southern and central Argentina bean country:

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.30day.figb.gif

++++++++++++

We should note on the same 30 day precip map above, that Southern Brazil turned extremely dry to end their growing season. So late pod filling was horrible, meaning the seeds in the pods are smaller than usual.

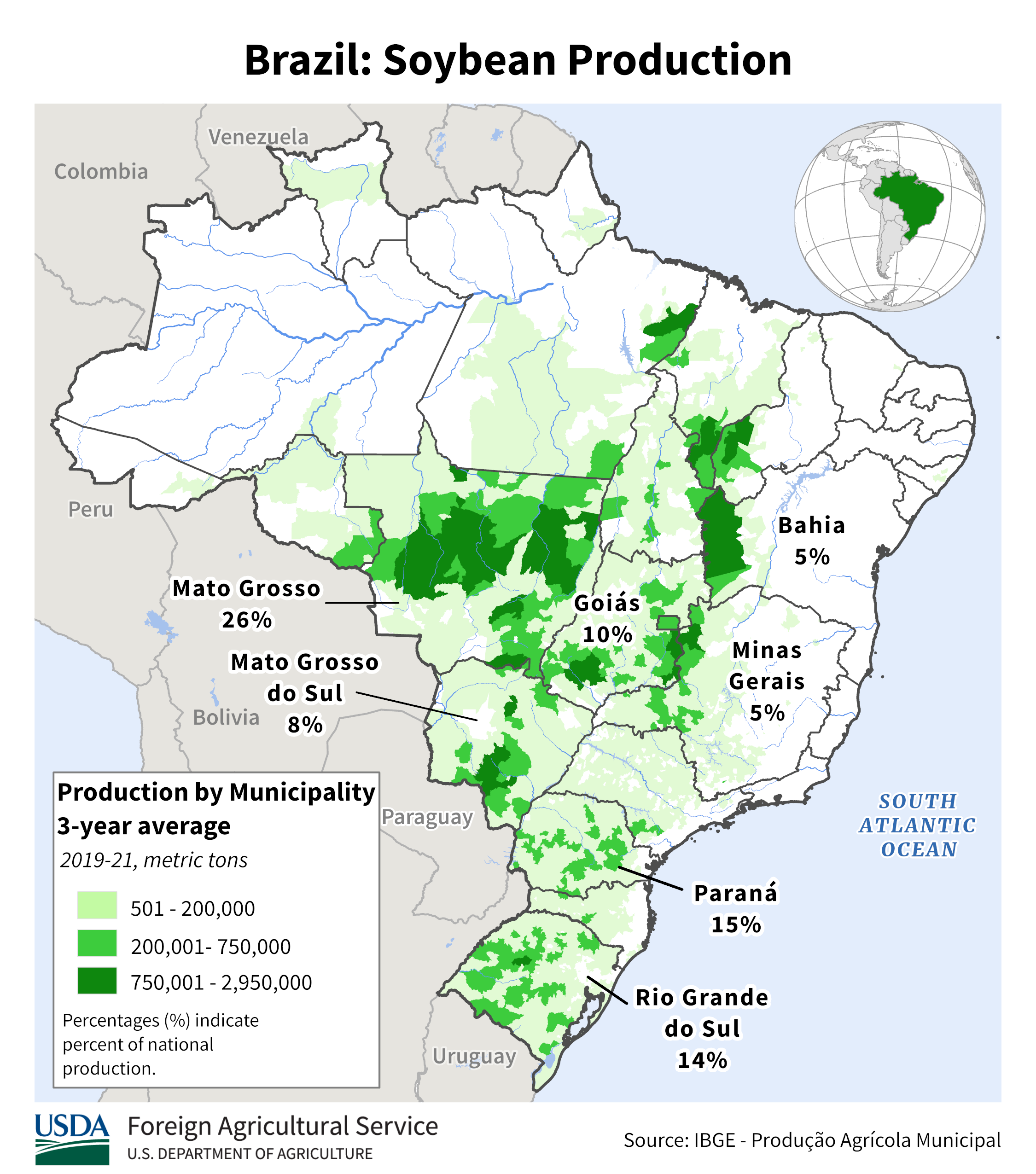

AgRural cuts Brazil's 2024/25 harvest of #soybeans to 165.9 million metric tons from 168.2 mmt estimated previously due to drought in the south. Around 80% of the crop is now harvested.

https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/Brazil/Municipality/Brazil_Soybean.png

Money managers continued selling CBOT #corn in the week ended March 18, though not as heavily as in the prior two weeks. Their net long of 107,720 fut&opt contracts compares with 337,454 on Feb. 25. Corn futures fell 7% during these three weeks.

U.S. #wheat export inspections were strong for a second consecutive week last week, and #soybeans were near the top end of expectations (about half were to China). #Corn inspections cooled to a three-week low (31% was to Mexico), but recent volumes have been well above average.

Nice to not see beans tanking right now (tho what happens when China's balance is shipped? ). Wheat got in some good volumes after junky ones in recent weeks. Corn inspections are going well despite the lower # this wk, esp w/o China (which propped up the green year - 20/21).

Each year is different but seasonals are extremely positive here for beans.

We have the tariffs and big bearish boost to the end of the Argentina growing season (and losses in Brazil) as just 2 unique variables in March 2025

https://www.seasonalcharts.com/future_farmprodukte_soybean.html

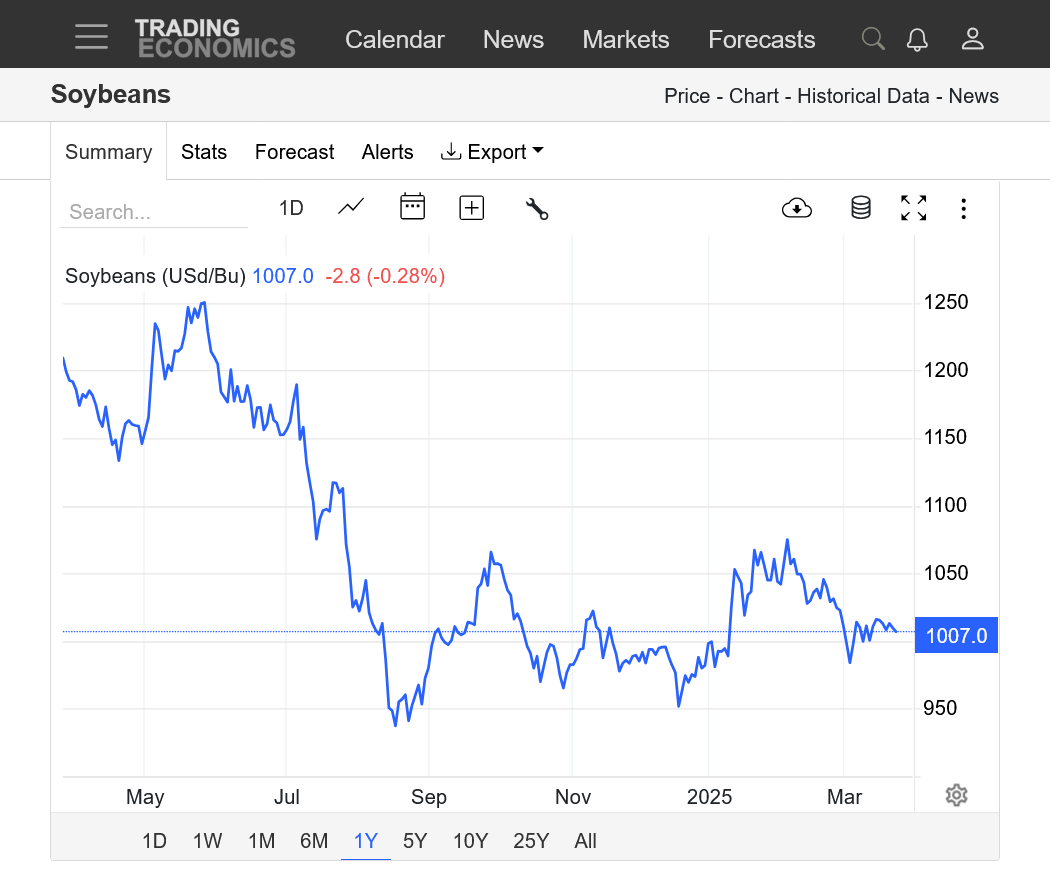

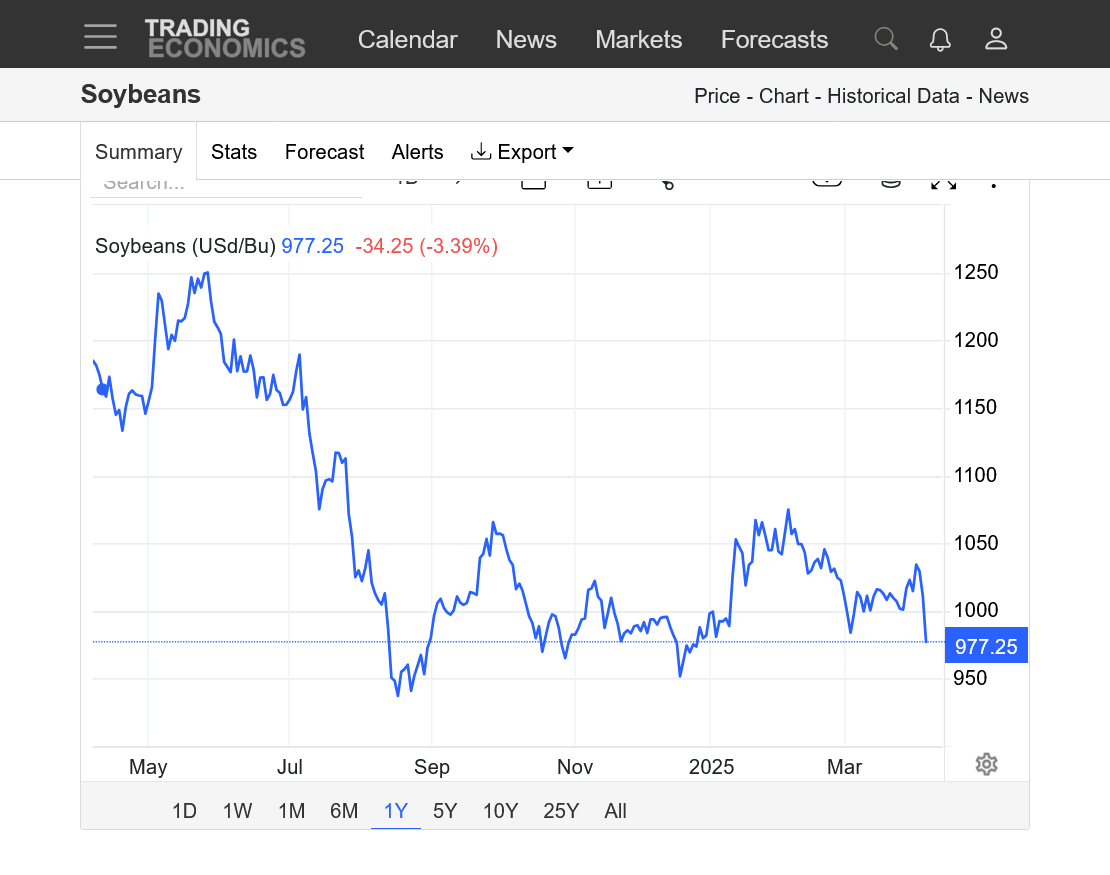

https://tradingeconomics.com/commodity/soybeans

1. 10 years

2. 1 year

+++++++++++++++++++++

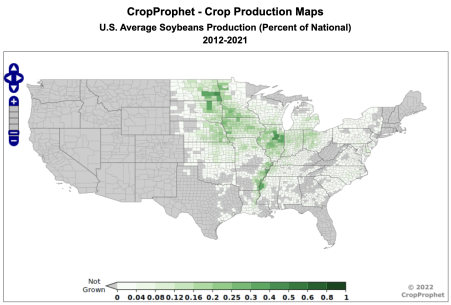

https://www.cropprophet.com/soybean-production-by-state-top-11/

As of March 13, U.S. exporters had sold just under 300,000 tonnes of #soybeans for shipment in 2025/26, the date's smallest in 20 years and slightly worse than a year ago. It's too early for serious concerns as anything can still happen, but it's not at all an exciting stat.

The U.S. on Tuesday said separate agreements were reached with Russia and Ukraine to ensure safe navigation in the Black Sea and to ban attacks on each other's energy facilities.

Both the attache and official USDA have underestimated Brazilian soybean area initially in the last few years. The attache is more aggressive this year versus last, assuming a 1.9% rise in area versus 1.0% a year ago (actual turned out to be about +2.6%).

Monday 3-31 is USDA stocks and planting intentions report.

Thanks, cutworm!

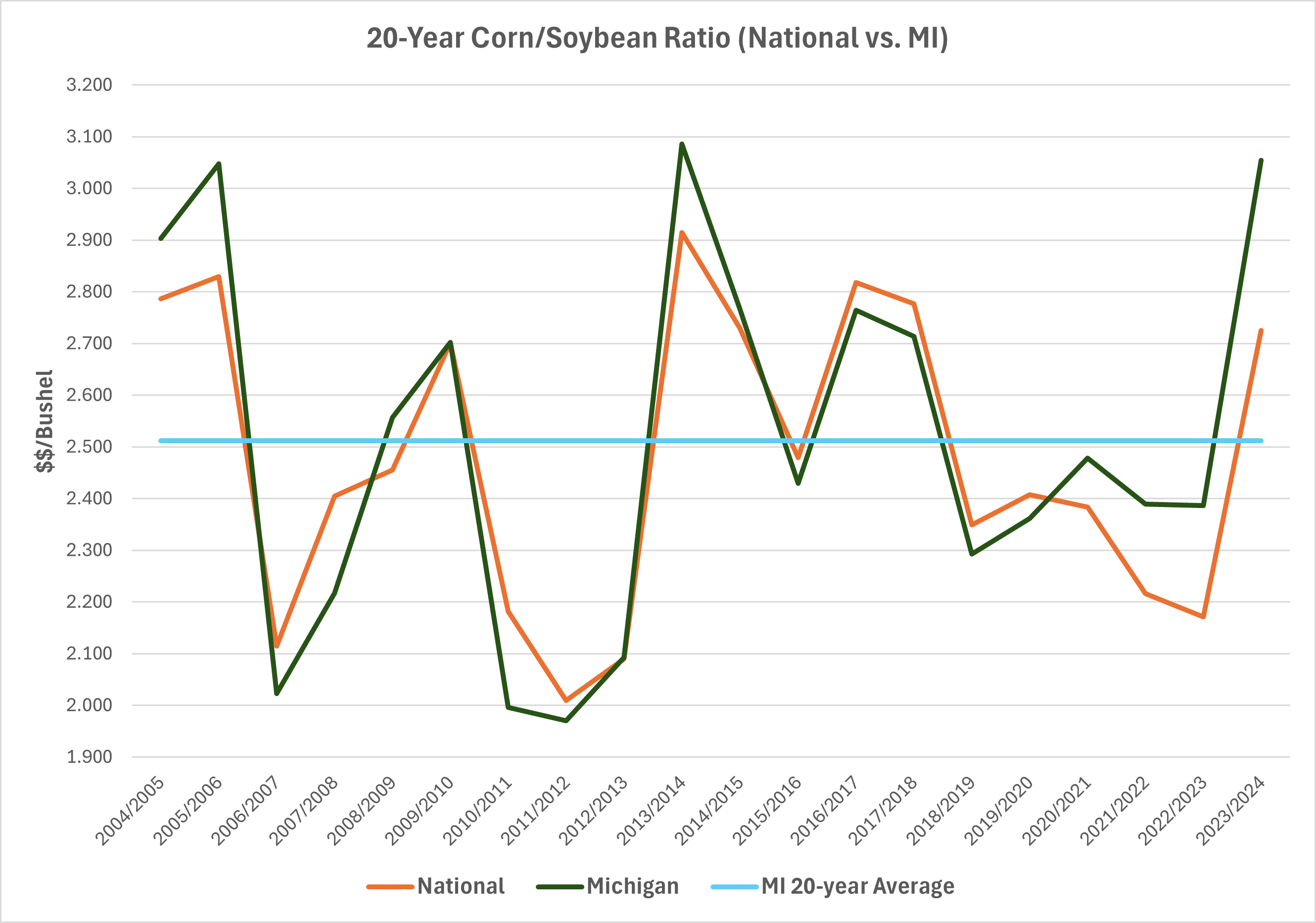

That's always a huge one. Big increase in corn, big decrease in beans coming up because of price differential/ratio.

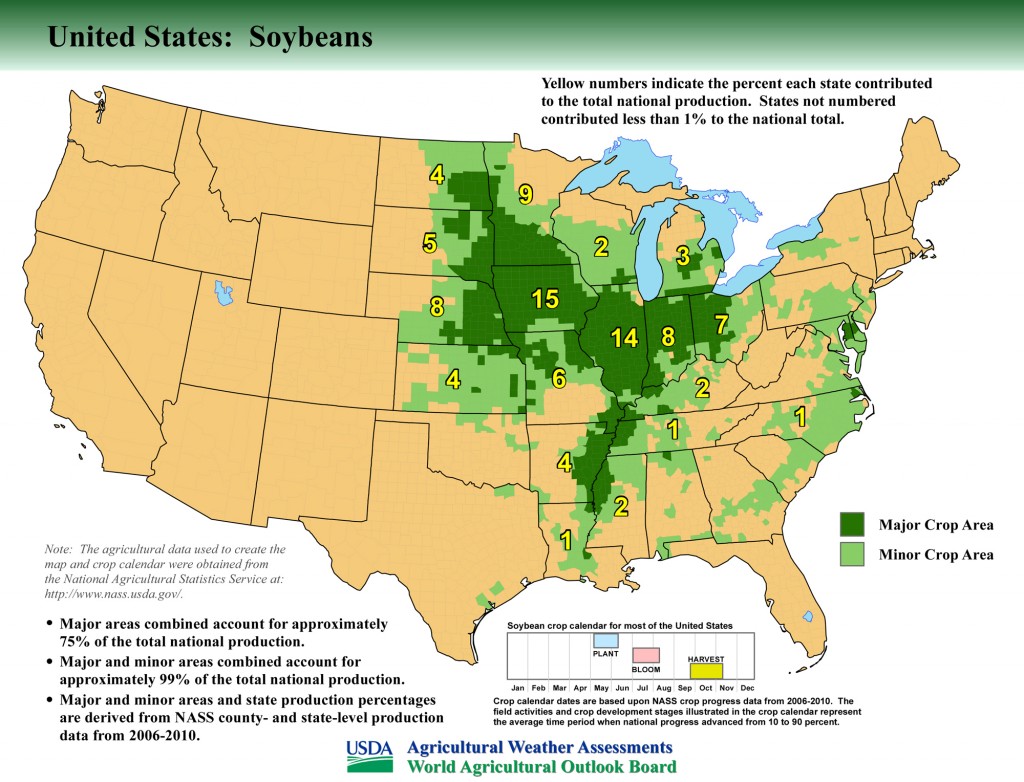

Analysts see 2025 U.S. #corn plantings at 94.36 million acres and #soybeans at 83.76 million.Larger-than-normal range of estimates on corn; 3 of 22 analysts above 95.0M-3.8% predicted drop in soy acres YOY, the largest drop analysts have predicted in March since 2007

Jonathan LaPorte, Michigan State University Extension -

+++++++++++

+++++++++++

The March prospective planting figures report is just the starting point for corn and soybean planted area, pending how fast spring seedings proceed as one can say the start of U.S. growing season begins in a couple of weeks.

As we have witnessed over the past few seasons, Mother Nature can have a large say in whether farmer intentions turn into reality as we have seen big changes in both corn and soybean planted acreage from the March intentions into the June Acreage report and then from there to the final figures given in the annual production report based on the vicissitudes of weather.

+++++++++++++++

Vicissitudes. Been a meteorologist for 4.5 decades and that's a new term for me

I'm not sure that I can even pronounce it

Hope (not a good thing when marketing) it's a sell the rummer but buy the fact. Doesn't look good for farmers.

Thanks, cutworm! I'm usually not good at predicting USDA reports ( and used to be wrong every time I held a position) but last September, nailed the January report, with the USDA finally catching up to the flash drought to end our growing season that reduced yields. .......almost 4 months later!!!

https://www.marketforum.com/forum/topic/109451/#109458

https://www.marketforum.com/forum/topic/109451/#109461

++++++++++++++++++++++++++

Again, not a prediction, just an observation. In the past 2 decades, U.S. #corn acres in March have *never* been bullish (smaller than avg trade guess) when the new-crop CBOT soybean/corn ratio averages 2.3 or lower during February. Feb 2025 ratio = 2.24 Acres >= 94.361M??

USA is still the world's leading #corn exporter, though it had considerably more dominance a couple decades ago. Brazil/Argentina/Ukraine exports surged in 2011/12, again in 2014/15 and again around 2018/19. Recently, these three export about 67% more than ten years ago.

+++++++++++++

USDA last month pegged 2025 U.S. plantings of #corn, #soybeans & #wheat at 225M acres. That compares with: 2021-2024 avg: 224.9M 2015-2018 avg: 226.4M 2011-2014 avg: 227.5M 2001-2004 avg: 213.1M

Through the 23rd, this month was already Argentina's wettest March in 18 years with total rainfall 25% above the full-month average. January precip was 48% below normal and Feb was 6% above. The wetter recent trend should be very beneficial to crops after the rockier start.

Yep, we showed that earlier in this thread:

Last week's U.S. corn & soybean export sales were very average for the time of year, and Mexico was a top buyer of both. Total 2024/25 soybean oil sales are the strongest for the date since 2011. None of the below crops had any notable 2025/26 sales.

Money managers sold CBOT #corn futures & options for a fifth consecutive week through March 25, reducing their net long to 75k from 107k last week and 354k five weeks ago. Next on the radar: U.S. stocks/acres on March 31 and possible new U.S. tariffs on April 2.

Re: Re: Re: Re: USDA January 10, 20

By bowyer - Jan. 11, 2025, 9:49 a.m.

Just wail till the March planting intentions report . 7 million additional corn acres with record yields. Corn limit down. I'm calling it now.

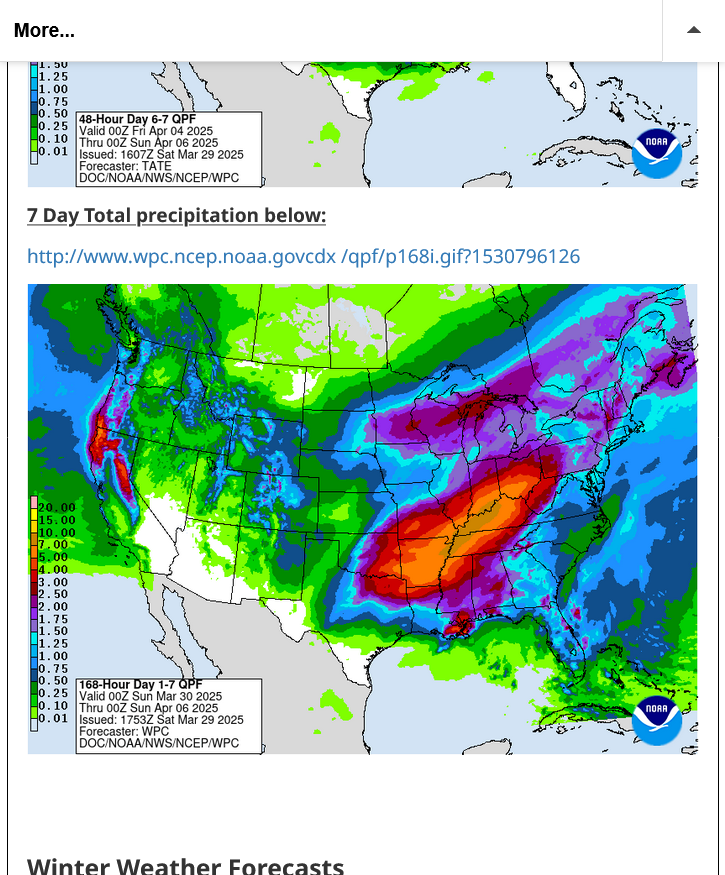

Terrible for early planting in this neck of the woods(along the Ohio River). That dark brown shade is 7 inches of rain the next week!

All the weather:

https://www.marketforum.com/forum/topic/83844/

++++++++++++++++++

Frozen frame image:

Constantly updated image:

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

++++++++++++++++++++

Plenty of time for the pattern to change and we don't count as much as Iowa does!

https://www.marketforum.com/forum/topic/83844/#83852

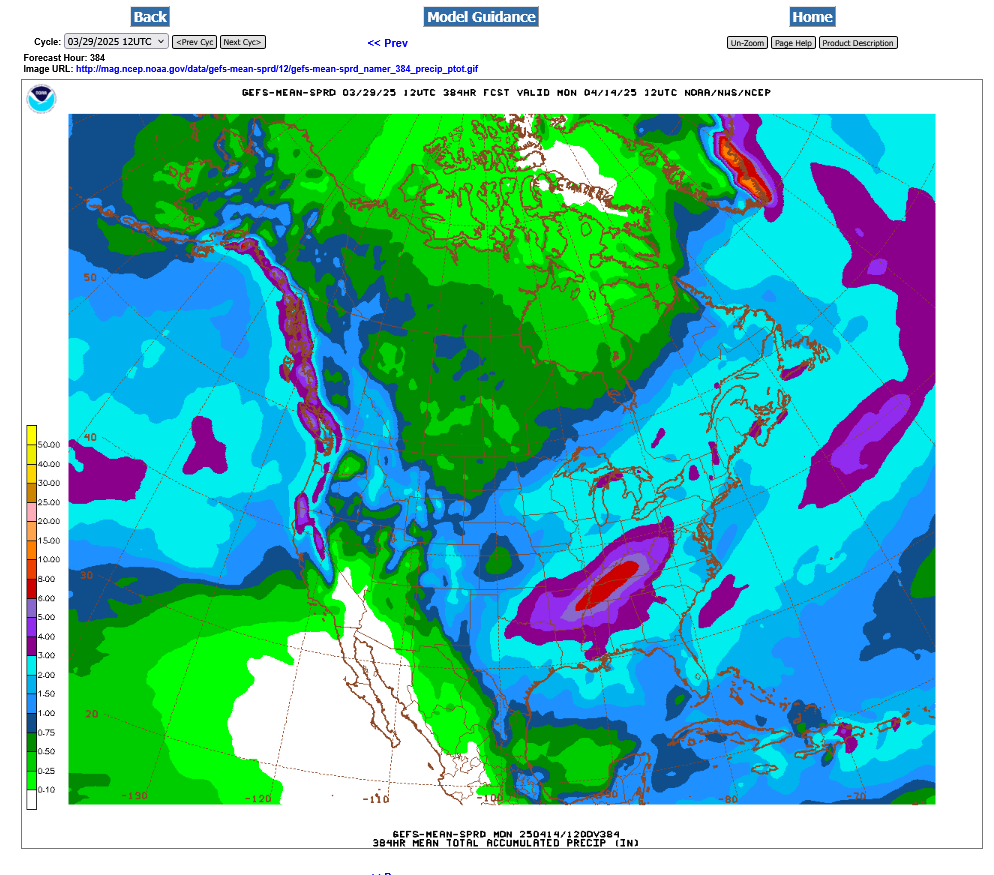

Total 384 hour precip from the last 12z GEFS:

Crop report

Started by vinny - March 31, 2025, 11:34 a.m.

https://www.marketforum.com/forum/topic/110815/

++++++++++++

3-30-25 TORNADO outbreak on 4-2-25

Started by metmike - March 30, 2025, 3:08 p.m.

https://www.marketforum.com/forum/topic/110789/

+++++++++++

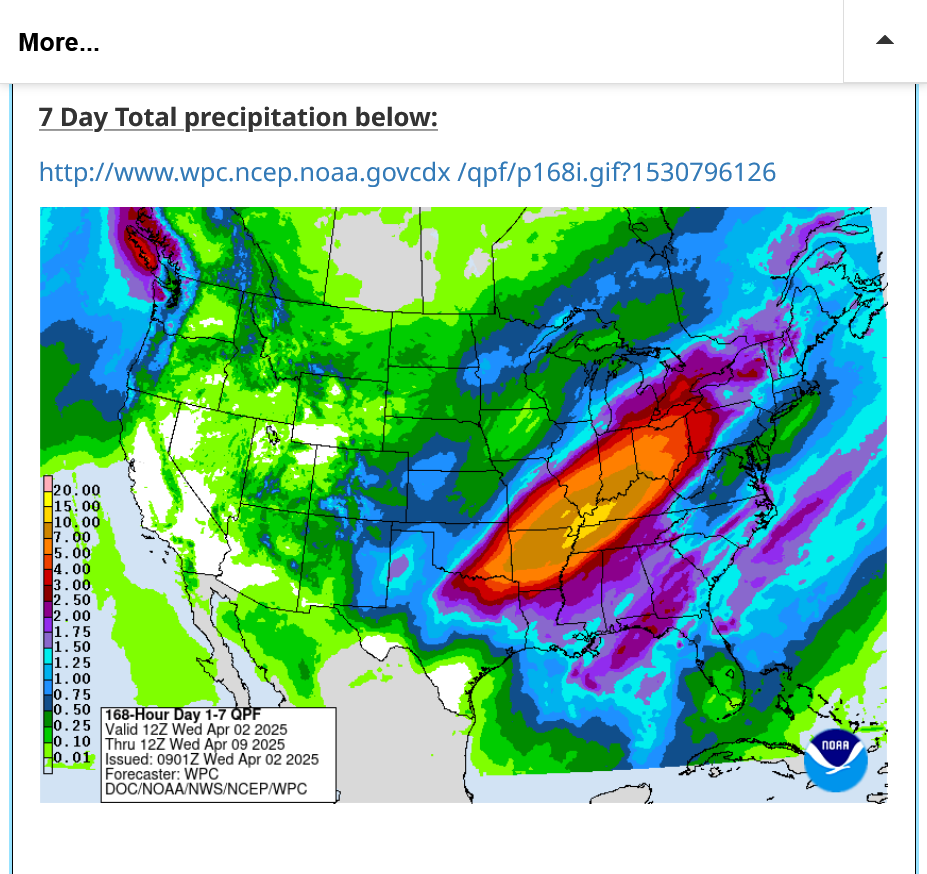

Extremely heavy rains in the Southeast Cornbelt means no planting for at least a couple of weeks.

It's still early though. A rain event like this in June or July would send grain prices thru the roof!

Latest detailed rain forecasts here:

https://www.marketforum.com/forum/topic/83844/#83848

new definition of crazy... https://farmdocdaily.illinois.edu/2025/04/projected-farm-income-for-2025-importance-of-rental-arrangements-on-farm-income.html?utm_source=newsletter&utm_medium=email&utm_term=Wed+Apr+02+2025&utm_campaign=Projected+Farm+Income+for+2025+Importance+of+Rental+Arrangements+on+Farm+Income

what that means is this. If you cash rent ground and most do and grow a great crop of 236B/a and sell it for 4.10/bu you are destined to lose near a $100/a on every acre you plant. Give growers more of that

A tariff war hurts everybody, especially our farmers that depend on exports. China is the #1 destination for exported US soybeans.

https://tradingeconomics.com/commodity/soybeans

1. 1 day. You can see what beans did when the news of China retaliating to Trumps tariffs with a 34% tariff on US imports in China. May beans closed -34c.

2. 1 year: Threatening to break the uptrend since last August's lows, put in because of the flash drought to end the 2024 growing season.

3. 10 year: Potential bear flag and downside break out if we get much lower.

Farmers like most Americans recognize pain and will take pain to save our country. In Fact they will give a new President more than a couple months to straighten out a 50 years mess. Who knows maybe even enough time implement his agenda unlike some here who have quit before the fight has started.

Thanks much, mcfarm!

I sincerely appreciate the enormous risks of farming because of weather and market forces that can't be controlled.

I've had numerous local farming friends and consider you and cutworm here to be some of my best friends, with all of us living in the great state of Indiana!

I'm all about what's best for farmers, who deserve fair compensation for their work and risks.

I'm also all about blasting sources that use, not only farmers but other Americans for their political agenda. Even if they don't realize it, I'm their best friend NOT the sources that are using them.

I know that you have an allegiance to President Trump that can't be shaken and you're willing to bite the bullet for him and our country.

There is tremendous sincerity in your words, mcfarm and I respect you for it.

However, my mission is to defend the truth and expose the charlatans taking advantage of Americans, especially farmers right now. It may appear that we are on opposite sides mcfarm but we aren't.

You want the best for America and farmers and so do I.

The difference is that I don't base my views on trusting what 1, proven charlatan claims when all the evidence contradicts what he says.

I do believe him sometimes.............when the authentic evidence backs him.

You believe him all the time no matter what, even when he is really wrong.

Fortunately, that doesn't need to weaken our friendship. Personally, I think that you guys are really, REALLY wrong here but so what?

A good friendship should not be dependent on sharing ALL the same political views.

Wouldn't it be a sad world if we only hung out with people just like us. It does make some sense because you can connect better with people like you.

But this makes for closed mindedness and stifles growth/understanding of other people and other opinions.

Can cause us to lack empathy for people different than us or far away from us.

In Gaza, for instance, the US and Israel use messaging focused on the remaining, small number of hostages ....while endorsing and enabling a massive genocide and human suffering to 2 million people living there.

Why this polar opposite treatment to humans beings?

They are different. Different religion. Different nationality. We hang out with our same religion/nationality/country and reinforce our flawed thinking which DEHUMANIZES people different than us.

We grow up being indoctrinated in our religions and belief systems and have no idea that we are doing it.

By the way my allegiance is to America not a single man

Thursday at 11:00 am Central time, the USDA will release the next WASDE report. Very few changes are expected.

Thanks, cutworm!!

It's that time of year! The first planting progress report of the season! Had the major flooding last week happened 2 months from now, the markets would have gone nuts!

The Winter Wheat crop was hurt a bit from a rough Winter, now that its coming out from dormancy. It's the HRW crop in the Plains that are doing the worst.

Here's the full report: https://downloads.usda.library.cornell.edu/usda-esmis/files/8336h188j/1v53mt21h/69700x136/prog1425.pdf

+++++++++++

U.S. corn is 2% planted, spring wheat 3% and cotton 4%. Winter wheat is rated 48% good/excellent, down from 55% at the end of Nov but near analyst estimates.

https://www.marketforum.com/forum/topic/83844/#83853

Updated daily below:

https://mrcc.purdue.edu/cliwatch/watch.htm#curMonths

Freeze frame of the first week in April below:

Money managers retained their net long in CBOT #corn fut&opt through April 1, though they cut it to a 21-week low of 57k contracts. The week's move was certainly risk-off in nature, and it wouldn't be surprising if that sentiment continues into next week.

Money managers established a RECORD net short in CBOT #soymeal futures and options as of April 1 at 100,733 contracts. Funds have been bearish meal since November.

Money managers in the week ended April 1 established their most bearish view in CBOT #wheat futures & options since Nov. 2023. The net short of 112,040 contracts is their second largest for the date behind 2017. Funds haven't been bullish wheat since June 2022.

Feb U.S. export data came out on Thursday, and soy exports to China in H1 of 24/25 was the lowest non-trade-war-year total since 12/13. This is why the "China stocking up ahead of possible tariffs" theory late last year bugged me so much. Data just doesn't show it, sorry.

USDA confirms the sale of 198,000 tonnes of U.S. #soybeans for delivery to unknown destinations in 2024/25.

++++++++++++++

This is usually China. Does this mean anything??? Did they have to pay the huge tariff??

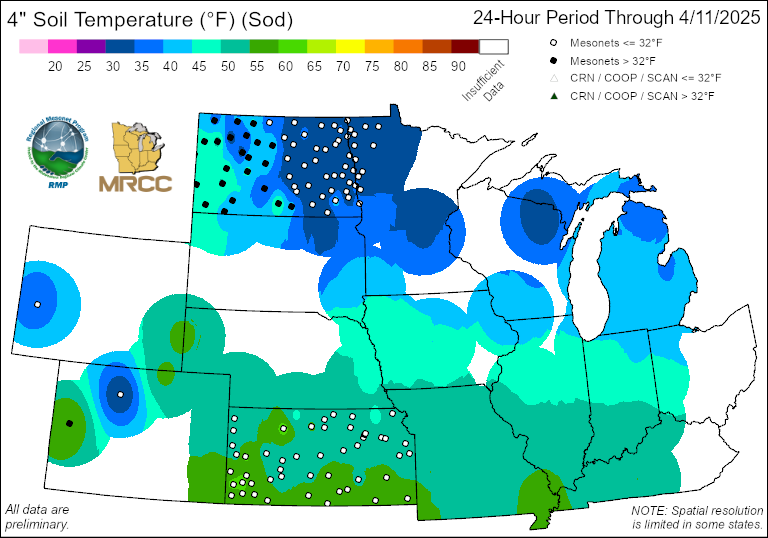

Week 1: Good weather IN SOME PLACE for drying out/warming up so that EARLY planting can proceed! The markets will likely be trading tariff news more than weather.

https://www.marketforum.com/forum/topic/83844/#83848

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

Turning wetter in week 2:

https://www.marketforum.com/forum/topic/83844/#83852

Corn emergence:

https://www.marketforum.com/forum/topic/83844/#83880

https://mrcc.purdue.edu/files/MESONET/meso_d1_02in_Sd_central.png

This chart is quite telling. #China currently accounts for 48% of U.S. soybean export sales for 2024/25, a 17-year low outside of the two trade war years (labeled). China has reduced reliance on U.S. #soybeans, but U.S. exporters still rely very heavily on China.

As of April 3, USA had sold 55 mln tonnes (2.17 bln bu) of #corn for export in 2024/25, the second most for the date in at least 25 years (ever?). That covers 85% of USDA's fresh full-year target of 2.55 bln bu, a little above the ten-year average of 83%.

China's combined imports of #corn & #wheat in 2024/25 are seen plunging nearly 70% on the year, hitting six-year lows. Very sharp pullback from the previous four years, when China accounted for as much as 11% of global corn+wheat imports. Closer to its previous normal, though.