No Trade!

I just looked at the 9 times following a 2 day 8%+ plunge that were followed by the Dow falling on the 3rd day just like today did. The stats for day 4 suggest continued very high volatility and were mostly favorable for a bounce with only 1 really horrible day:

5/12/1915: +4.2% Tue

11/14/1929: +9.4% Thu (12th largest gain ever)

9/22/1931: -1.3% Tue

1/6/1932: +7.1% Wed

9/15/1932: +3.1% Thu

7/22/1933: -0.3% Sat

7/24/1933: +6.6% Mon

10/9/2008: -7.3% Thu (16th largest drop ever)

10/13/2008: +11.1% Mon (6th largest gain ever)

- 2/3 rose and 1/3 dropped

- avg of all nine: +3.6%.

- all 6 gains 3.1%+ with 4 of 6 huge (6.6%+) and 2 in the top 12 ever!

- So, this along with the Dow futures being up a whopping 626 gives reasonable hope for a very strong Tue.

Thanks, Mike!!!

Larry,

Thanks for the stats.

7 of the 9 were more than 90 years ago. The other 2 were in 2008.

We are trading mostly news and emotions.

For instance, if Trump came out tomorrow and softened his extreme position, the market would likely rally. Or if more negative news hits, it might sell off more.

Mike said:

“For instance, if Trump came out tomorrow and softened his extreme position, the market would likely rally. Or if more negative news hits, it might sell off more.”

———————

Bingo front row! He increased Chinese tariffs to 104% effective tonight! Before that the markets were very strong (up ~4%)! Then they fell most of the rest of the day.

————————-

Ok more stats you may find interesting keeping in mind that what Trump says tomorrow would likely have the biggest impact:

For the 29 times that the Dow crashed 8%+ over a two day period before now, only 3 of the 29 had down days also on both of days 3 & 4. Today makes only the 4th time ever! So, this is very rarified territory!

Those other 3 cases:

-9/18-22/1931 Fri-Tue; Wed was +6.0%

-7/19-22/1933 Wed-Sat; Mon was +6.6%

-10/6-9/2008 Mon-Thu; Fri was -1.5%

The positive cases for each of days 3 and 4, which have been in an ~2/3 majority, have not been coming through although today early on looked promising obviously until Trump increased the Chinese tariff to 104%. So, day 5 also had 2 of 3 closing in the green with the two greens having very strong days. But the tiny sample size of 3 means credibility is nil.

Thanks again, Larry.

Trump's actions are most in control of the stock market right now.

So, day 5 also had 2 of 3 closing in the green with the two greens having very strong days. But the tiny sample size of 3 means credibility is nil.

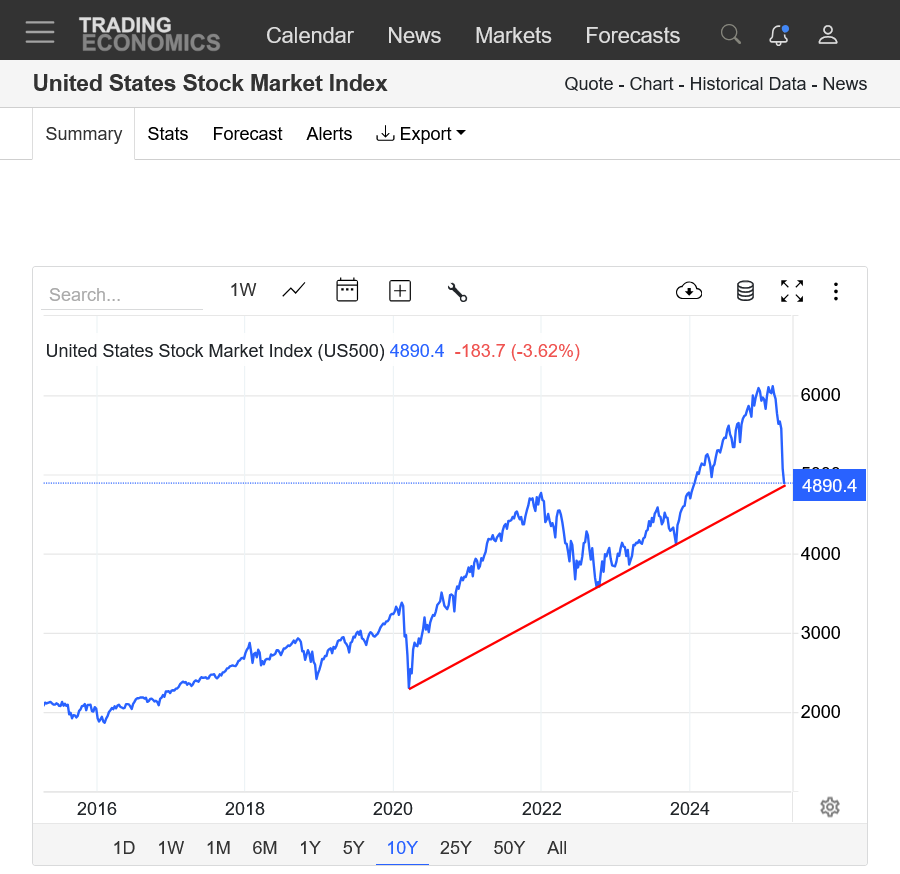

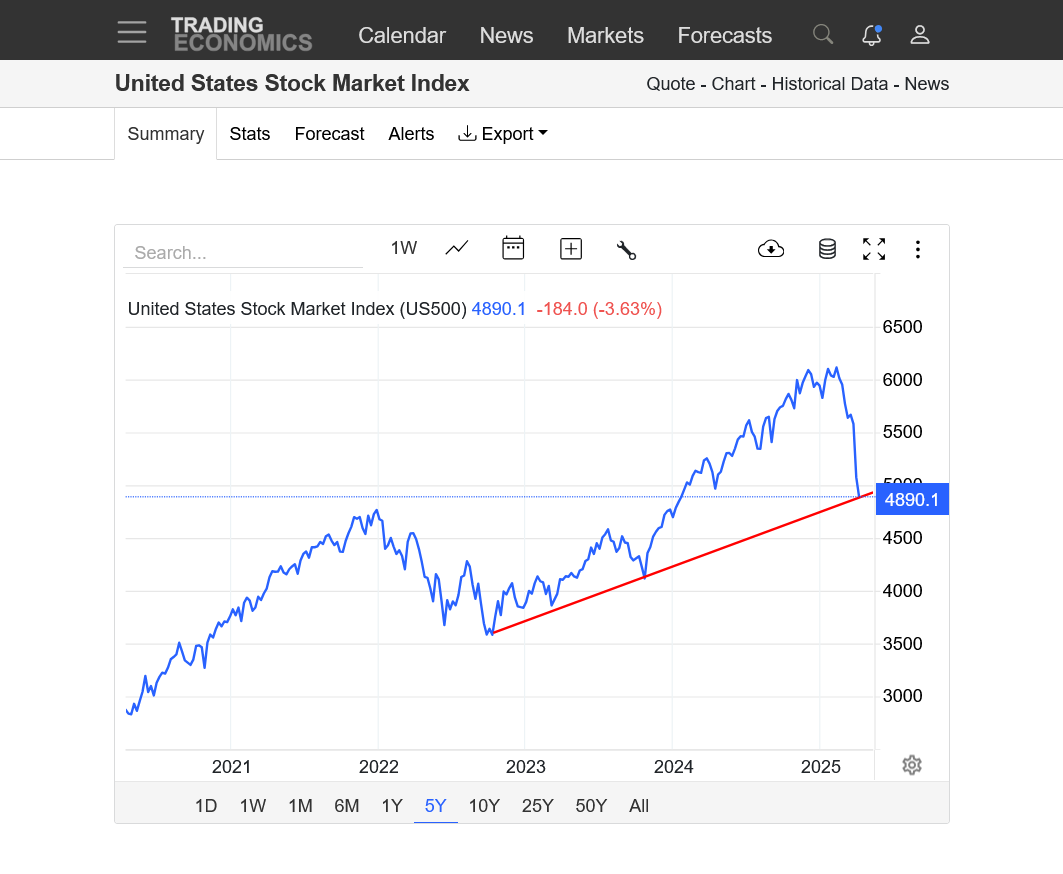

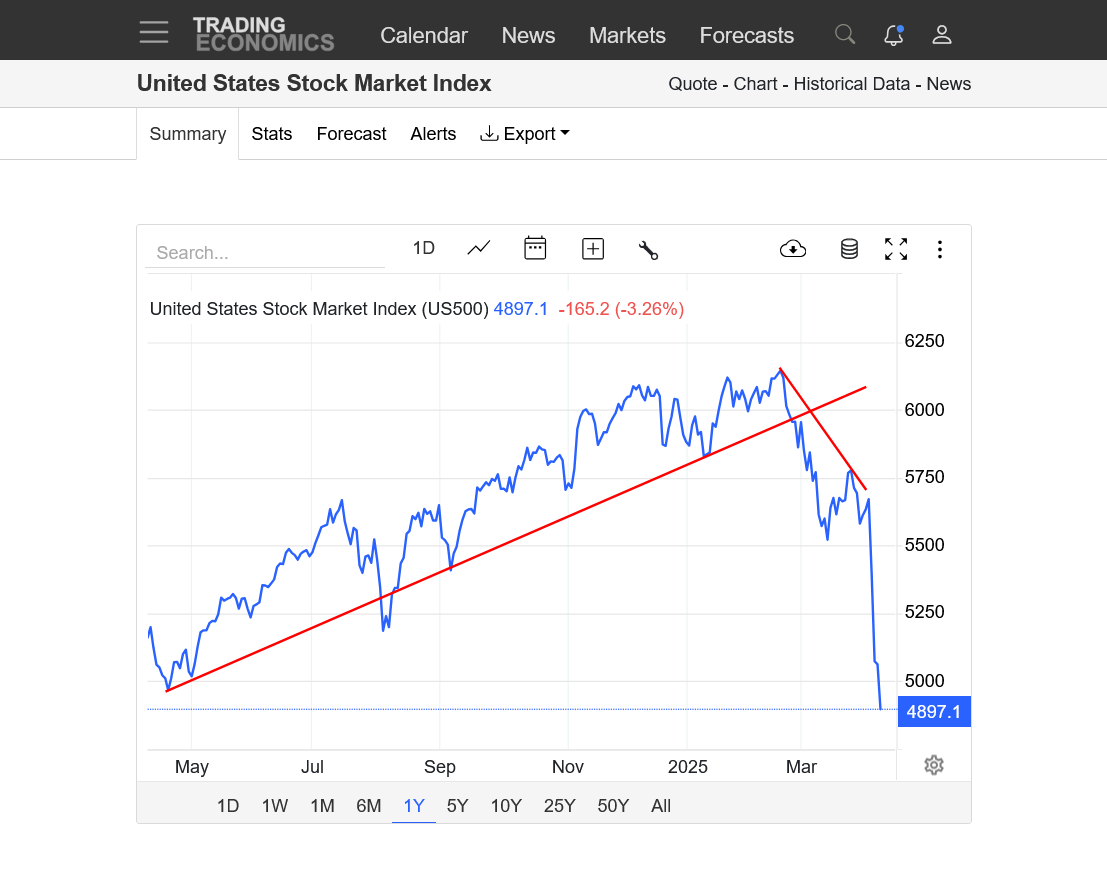

Trend lines don't mean as much in a volatile, emotional market trading news/dialing in the severity of the upcoming Trump recession.

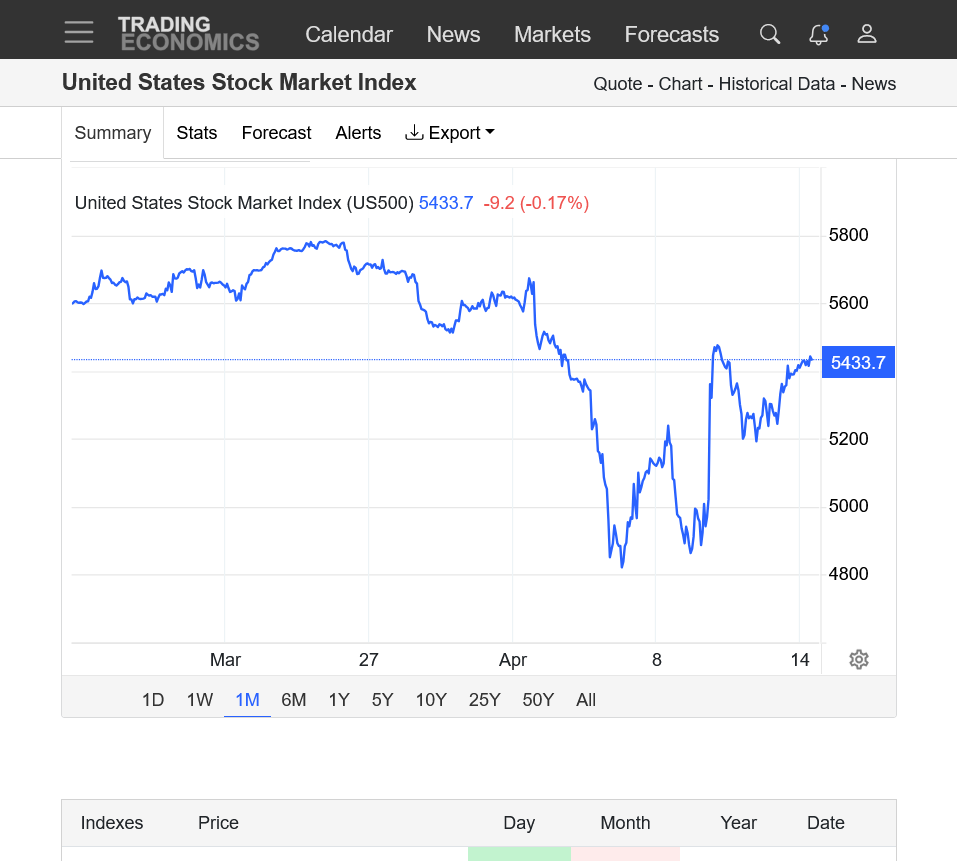

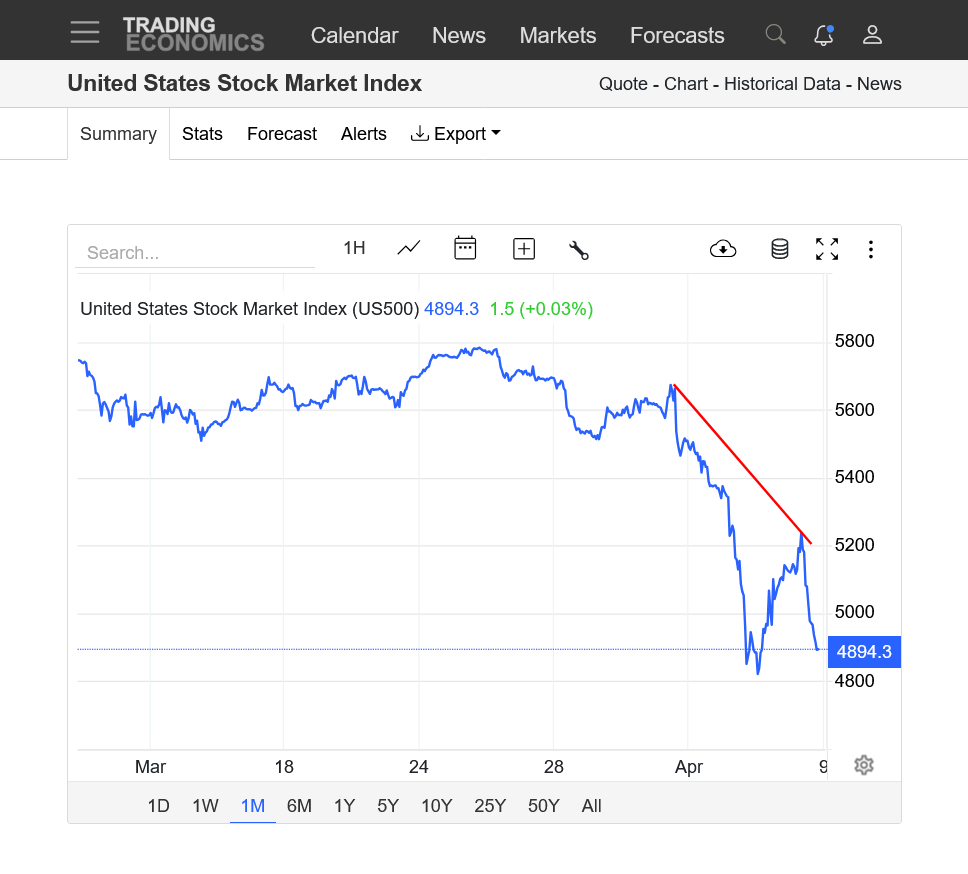

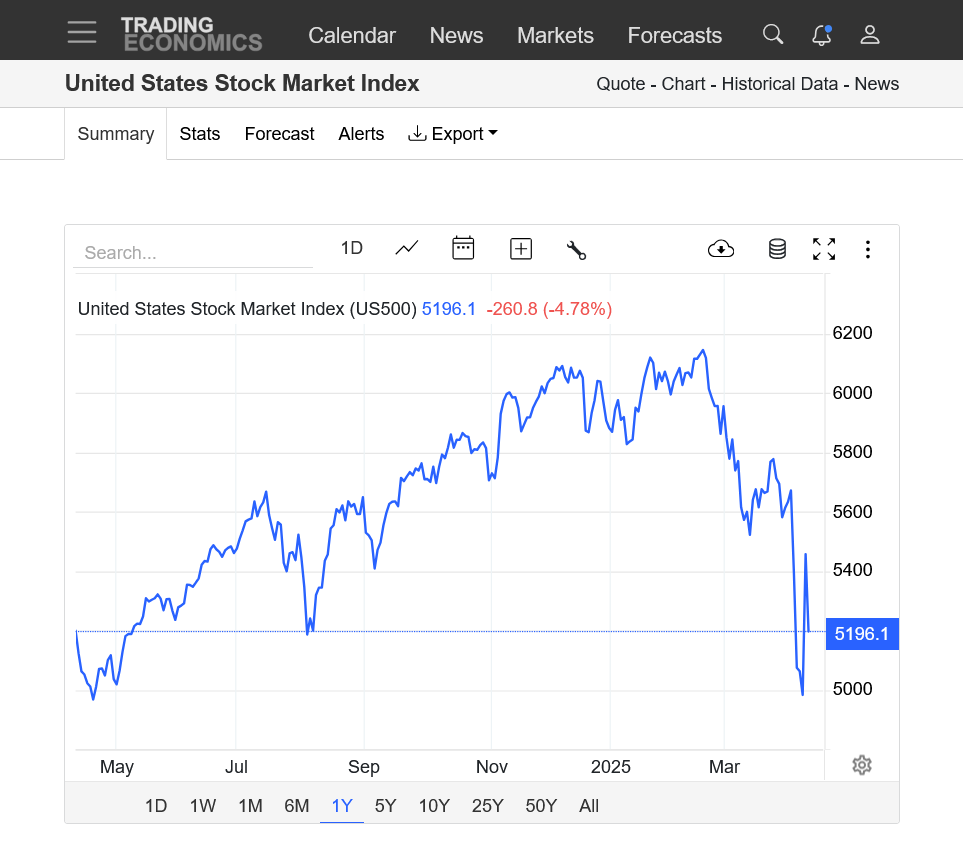

https://tradingeconomics.com/united-states/stock-market

1. 10 year

2. 5 year

3. 1 year

4. 1 month

At least Musk sees it!

‘Truly a moron’: Elon Musk escalates spat with Trump adviser Peter Navarro over tariffs

https://finance.yahoo.com/news/truly-moron-elon-musk-escalates-183647032.html?fr=yhssrp_catchall

Musk’s Tuesday remarks come after he posted, and then deleted, a comment saying Navarro’s PhD from Harvard is a “bad thing,” and that he hasn’t “built sh*t.”

It’s not the first time Musk has disagreed with Trump on a policy or personnel pick. But the split over tariffs is one of the more significant differences in perspective between the president and his biggest booster and top adviser.

I posted this already on the NTR forum but want the trade related EXACT REASONING for my position to be crystal clear using INDISPUTABLE FACTS, since some think its because we just don't understand Trump's brilliant plan.

https://www.marketforum.com/forum/topic/110958/#110994

Trump has clearly violated the Constitution with his fake tariff nonsense to fix the big trade imbalances that are not fixable because of the indisputable laws of economics between poor countries and rich country production costs.

At the very least, Congress and the Supreme Court should immediately take actions to make what he did illegal and reverse all of it.

https://www.usconstitution.net/executive-tariff-authority/

These powers are not absolute. The Supreme Court has consistently underscored the need for an “intelligible principle” guiding the exercise of any delegated authority. This judicial oversight ensures that the President’s tariff-related powers align with congressional intent and constitutional mandates.

While the President possesses significant authority to impose tariffs under certain conditions, this power is framed by statutory directives and constitutional principles that uphold the balance of powers. The legislative branch retains its critical oversight role, ensuring that tariffs are used judiciously in accordance with national interests and the rule of law.

+++++++++++++++++

What Trump did is clearly in violation of the Constitution but even if he had this power, what he just did shows that he's not able to connect basic, global economic laws to the authentic realities and accept them.

1. Poor countries will ALWAYS have much lower production costs(especially labor). They will make and sell things much cheaper than rich countries. They will ALWAYS have much less money to buy things, especially higher priced things from rich countries.

2. Rich countries will always make things using much higher input costs (especially labor) and sell them at much higher prices. They will always have MUCH MORE money to buy things, including cheaply priced things from poor countries.

3. There are other factors too. A shortage of skilled labor workers in the US. Companies need to build or retrofit facilities, purchase equipment and invest in technology to compete with the advanced manufacturing capabilities of their overseas counterparts. This level of investment is risky, particularly in a volatile global economy.

4. These irrefutable global economic laws will always cause a trade imbalance between poor and rich countries in favor of the poor countries.

5. Which, as it turns out is not always a bad thing since it helps balance the great inequities between the rich and poor countries. Rich countries because they are rich can afford to pay more, along with all the other massive material world benefits they have surrounding them FROM THEIR OWN COUNTRIES. Poor countries don't have material world diddly squat, including money. They work extremely hard for dirt cheap labor prices to generate exports to rich countries just to survive.

Trump is abusing his power, trying to make this invalid. Insanely referring to the above, indisputable trade imbalances as "tariffs" and claiming that he will not only make them go away by decree, he will cause the manufacturing industries in the poor countries (that are there to take advantage of cheap production costs) come to the United States where we have very high production costs.

Complete lack of understanding in the most basic economic principles by Trump. Why should we give this any time to work?

Trusting in Trump is not going to make the impossible happen!

Volatility Index.

Approaching COVID level volatility. I don't think this will be as bad.

2008/9 also featured crazy high volatility when the markets crashed.

This time is entirely self inflicted.

https://tradingeconomics.com/vix:ind

%20-%20Index%20Price%20Live%20Quote%20Historical%20Chart.png)

Followup regarding “day 5”:

Here are the 4 cases with 8%+ Dow drops first two days combined followed by further drops days 3 and 4:

-9/18-22/1931 Fri-Tue; Wed (day 5) was +6.0%

-7/19-22/1933 Wed-Sat; Mon (day 5) was +6.6%

-10/6-9/2008 Mon-Thu; Fri (day 5) was -1.5%

-10/3-8/2025 Th-Tue; Wed (day 5) was +7.9%

What did day 6, which would correspond to today (Thu), do for the two remaining cases (excluding the current one)? These are the only two cases other than the current one that had an 8%+ drop for days 1-2 combined, further drops days 3 and 4, and a gain on day 5:

-9/18-22/1931 Fri-Wed (days 1-5): day 6 (9/23 Thu) had a 7.1% drop to new low!

-7/19-24/1933 Wed-Mon (days 1-5): day 6 (7/25 Tue) had a 1.5% drop; but days 7-8 rose a combined 3.4% to a short term high

Regardless, there being only two cases and both from way back during the Great Depression means virtually no statistical credibility, of course, and the outcome will be largely influenced by what Trump says/does tomorrow as we know.

Thanks, Larry,

Ive been busy cleaning up the damage from the snapped tree in front of our house thajust confirmed as a tornado yesterday by the local NWS survey.

Your love for statistics is 1 that I share and we are blessed to have you sharing your work here…..not just on this topic, where the data is not going to help us predict today but is still interesting but on many other topics, especially weather.

Ive learned a few things from others here but by far the most from your posts, especially when you do a statistical analysis like this.

Maybe Trump will announce a deal with China and the markets spike back up? Seems doubtful but the Omnipotent Bloviator has caused serious damage to market psychology and markets no longer trust the most powerful man on the planet or decisions he makes related to the US and Global economies since he just proved to the world that he has no clue. His pathological, delusions of grandeur thinking has turned him into a 1 man wrecking ball.

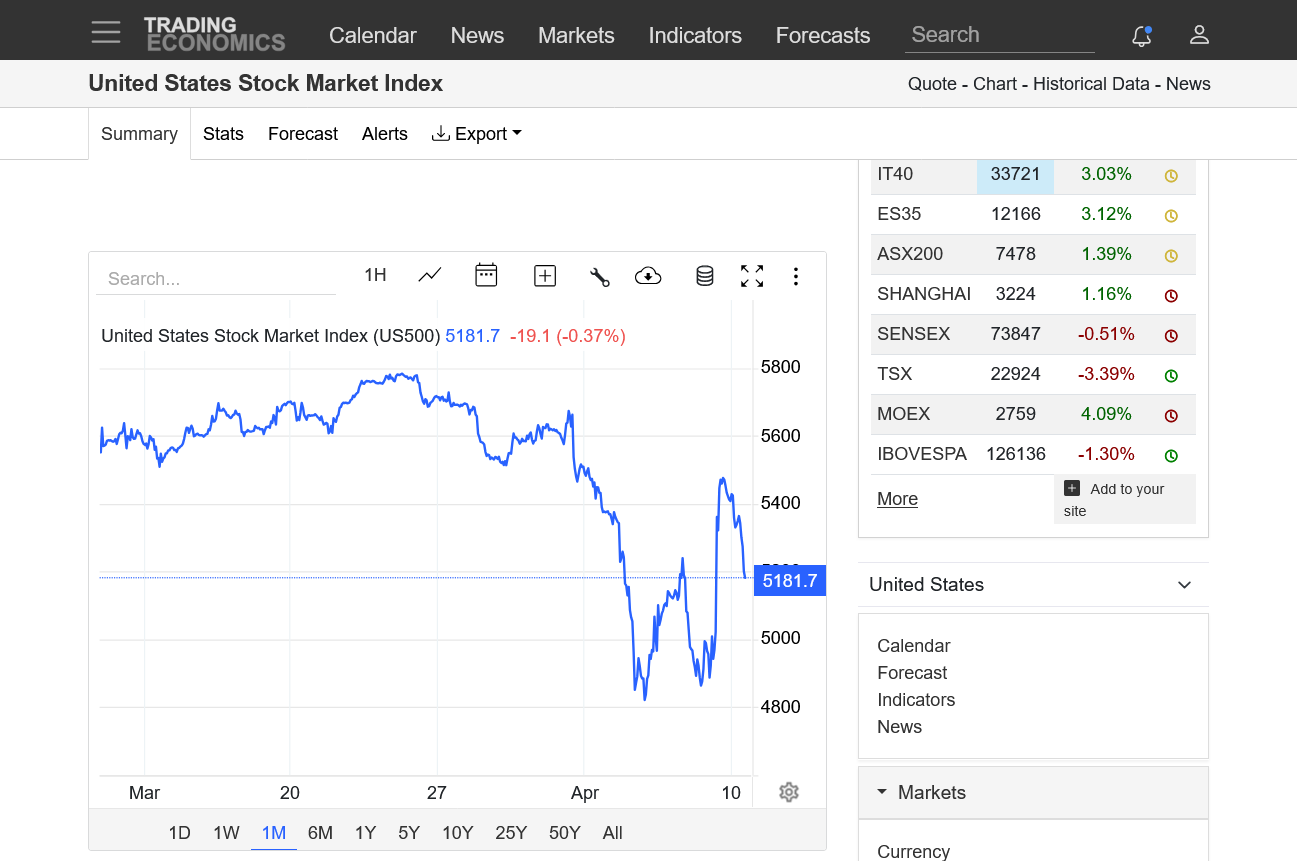

https://tradingeconomics.com/united-states/stock-market

The stock market is starting the week off strong!

Poised to break out above last weeks highs!

Or those highs could act as resistance?

https://tradingeconomics.com/united-states/stock-market