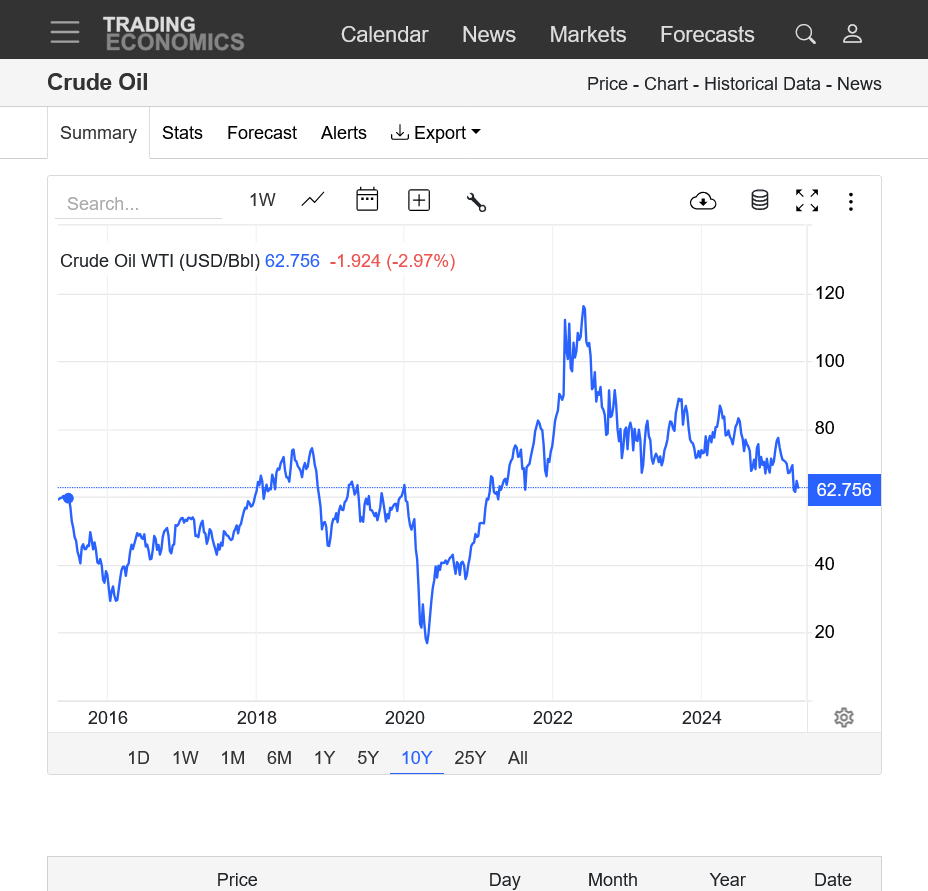

Trumps global recession fears are doing something to the market that has only happened 1 time before similar to this (that was even worse).

COVID in the Spring of 2020. This will NOT be nearly as bad for the markets.

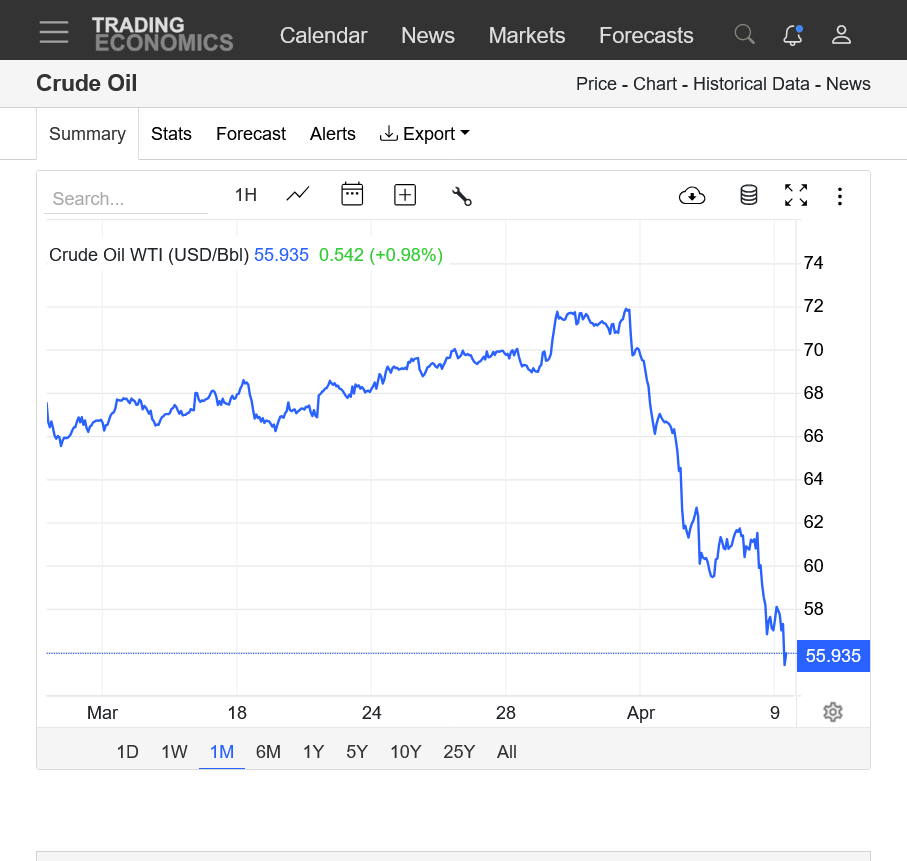

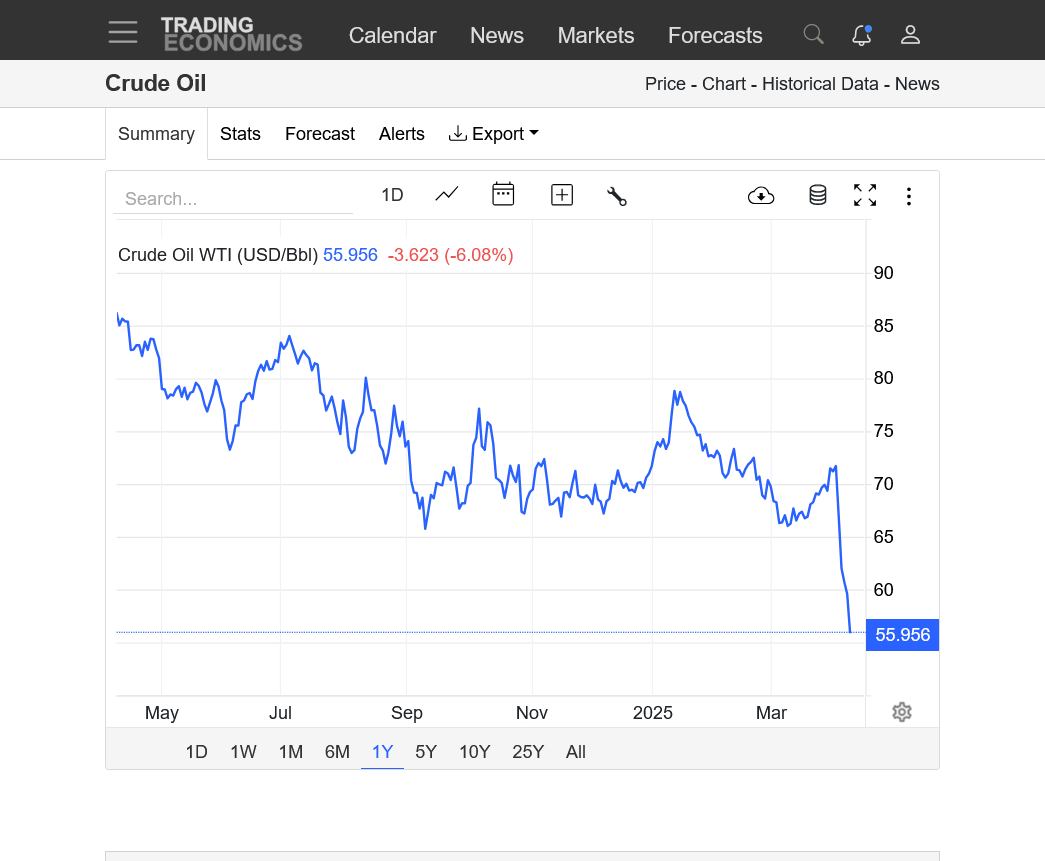

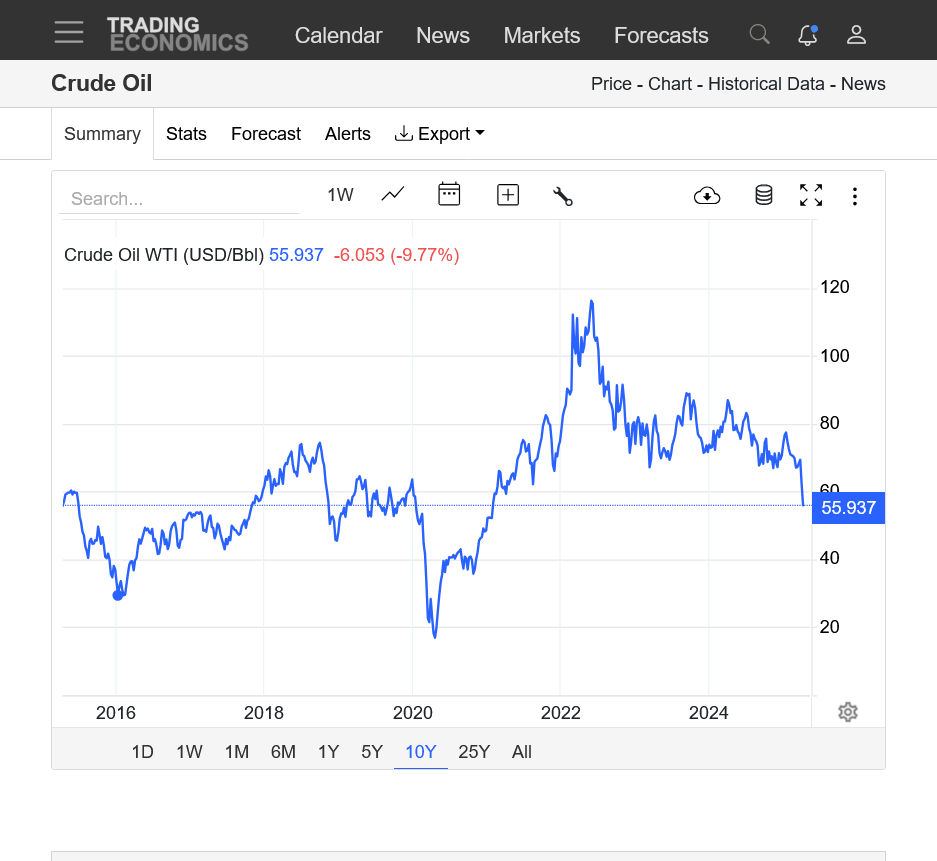

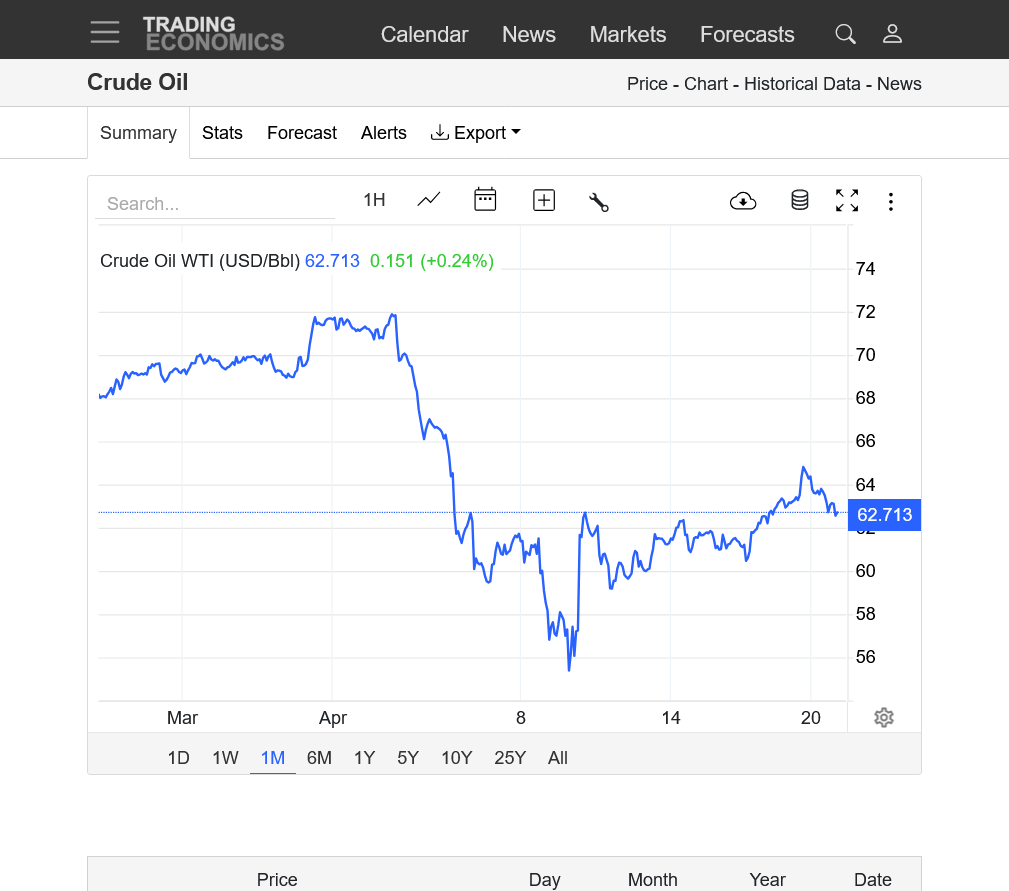

Here is 2025, this is entirely self inflicted, unlike COVID with an intentional policy. The reason for the plunge is expectations of a global recession later this year cutting industrial and other demand for all energies.

https://tradingeconomics.com/commodity/crude-oil

1. 1 month

2. 1 year

3. 10 years

Now would be a great time to refill the SPR with cheap crude that Biden drained for political reasons(war in Ukraine)!!!

Why Have a Strategic Petroleum Reserve?

+++++++++++++

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCSSTUS1&f=W

.png)

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCESTUS1&f=W.png)

++++++++++++++++++++++++++++++

Unleaded stocks:

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGTSTUS1&f=W

.png)

++++++++++++++++++

| Weekly US ending stocks of crude oil. https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRSTUS1&f=W Weekly ending stocks for unleaded gasoline. https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGTSTUS1&f=W Weekly US ending stocks for distillate fuel oil(heating oil-especially used in the Northeast). https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDISTUS1&f=W |

Ive also mentioned this numerous times.

Biden INCREASED our production of crude and natural gas to record levels of production, despite his disingenuous fake green virtue signaling.

https://www.eia.gov/todayinenergy/detail.php?id=61545

.png)

Energy transition is a hoax

46 responses |

Started by metmike - April 15, 2023, 5:50 p.m.

https://www.marketforum.com/forum/topic/94557/

There Is No Energy Transition, Just Energy Addition

https://wattsupwiththat.com/2023/03/12/there-is-no-energy-transition-just-energy-addition/

While wind and solar power are taking a larger piece out of a growing world primary energy pie, fossil fuels are expected to have more absolute growth through 2050.

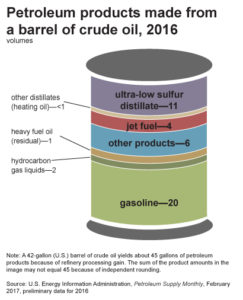

After crude oil is removed from the ground, it is sent to a refinery where different parts of the crude oil are separated into useable petroleum products. These petroleum products include gasoline, distillates such as diesel fuel and heating oil, jet fuel, petrochemical feedstocks, waxes, lubricating oils, and asphalt.

A U.S 42-gallon barrel of crude oil yields about 45 gallons of petroleum products in U.S. refineries because of refinery processing gain. This increase in volume is similar to what happens to popcorn when it is popped.

One 42-gallon barrel of oil creates 19.4 gallons of gasoline. The rest (over half) is used to make things like:

| Solvents | Diesel fuel | Motor Oil | Bearing Grease |

| Ink | Floor Wax | Ballpoint Pens | Football Cleats |

| Upholstery | Sweaters | Boats | Insecticides |

| Bicycle Tires | Sports Car Bodies | Nail Polish | Fishing lures |

| Dresses | Tires | Golf Bags | Perfumes |

| Cassettes | Dishwasher parts | Tool Boxes | Shoe Polish |

| Motorcycle Helmet | Caulking | Petroleum Jelly | Transparent Tape |

| CD Player | Faucet Washers | Antiseptics | Clothesline |

| Curtains | Food Preservatives | Basketballs | Soap |

| Vitamin Capsules | Antihistamines | Purses | Shoes |

| Dashboards | Cortisone | Deodorant | Shoelace Aglets |

| Putty | Dyes | Panty Hose | Refrigerant |

| Percolators | Life Jackets | Rubbing Alcohol | Linings |

| Skis | TV Cabinets | Shag Rugs | Electrician’s Tape |

| Tool Racks | Car Battery Cases | Epoxy | Paint |

| Mops | Slacks | Insect Repellent | Oil Filters |

| Umbrellas | Yarn | Fertilizers | Hair Coloring |

| Roofing | Toilet Seats | Fishing Rods | Lipstick |

| Denture Adhesive | Linoleum | Ice Cube Trays | Synthetic Rubber |

| Speakers | Plastic Wood | Electric Blankets | Glycerin |

| Tennis Rackets | Rubber Cement | Fishing Boots | Dice |

| Nylon Rope | Candles | Trash Bags | House Paint |

| Water Pipes | Hand Lotion | Roller Skates | Surf Boards |

| Shampoo | Wheels | Paint Rollers | Shower Curtains |

| Guitar Strings | Luggage | Aspirin | Safety Glasses |

| Antifreeze | Football Helmets | Awnings | Eyeglasses |

| Clothes | Toothbrushes | Ice Chests | Footballs |

| Combs | CD’s & DVD’s | Paint Brushes | Detergents |

| Vaporizers | Balloons | Sun Glasses | Tents |

| Heart Valves | Crayons | Parachutes | Telephones |

| Enamel | Pillows | Dishes | Cameras |

| Anesthetics | Artificial Turf | Artificial limbs | Bandages |

| Dentures | Model Cars | Folding Doors | Hair Curlers |

| Cold cream | Movie film | Contact lenses | Drinking Cups |

| Fan Belts | Car Enamel | Shaving Cream | Ammonia |

| Refrigerators | Golf Balls | Toothpaste | Gasoline |

metmike: This is a partial list of the 6,000+ products!

Go Coal!

Started by metmike - April 9, 2025, 1:40 a.m.

https://www.eia.gov/petroleum/weekly/gasoline.php

+++++++++

+++++++++

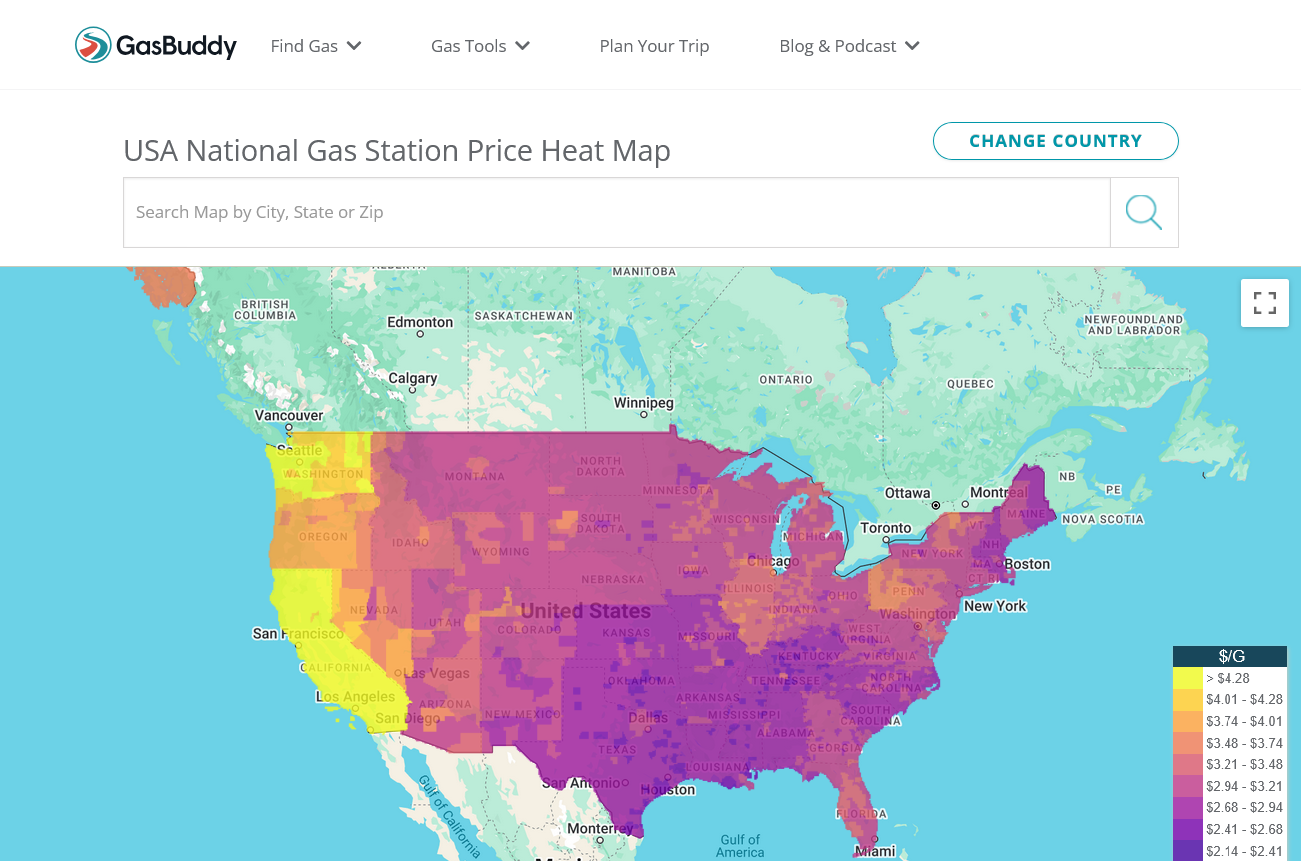

https://www.gasbuddy.com/GasPriceMap?z=4

This map directly below is updated constantly.

++++++++++++++++++

To get this map updated, go to the link:

https://www.gasbuddy.com/GasPriceMap?z=4&lng=-96.591588&lat=38.822395

More evidence that the regional distributors that charge local stations for the price of gas are DISHONEST and price gauge. Note the INCREASE in the price of gas this year AT THE PUMP especially the last 2 weeks after Trump announced his fake tariff scheme that crashed all the markets.

We should note that they use the news to price gouge. Bullish news will often result in prices at the pump jumping immediately. Bearish news and prices? Just look below to see. They will eventually pass them on but not after capturing a massive profit, taking advantage of consumers.

Does this happen very often?

You bet it does because there's nobody REALLY regulating it.

https://www.gasbuddy.com/GasPriceMap?z=4

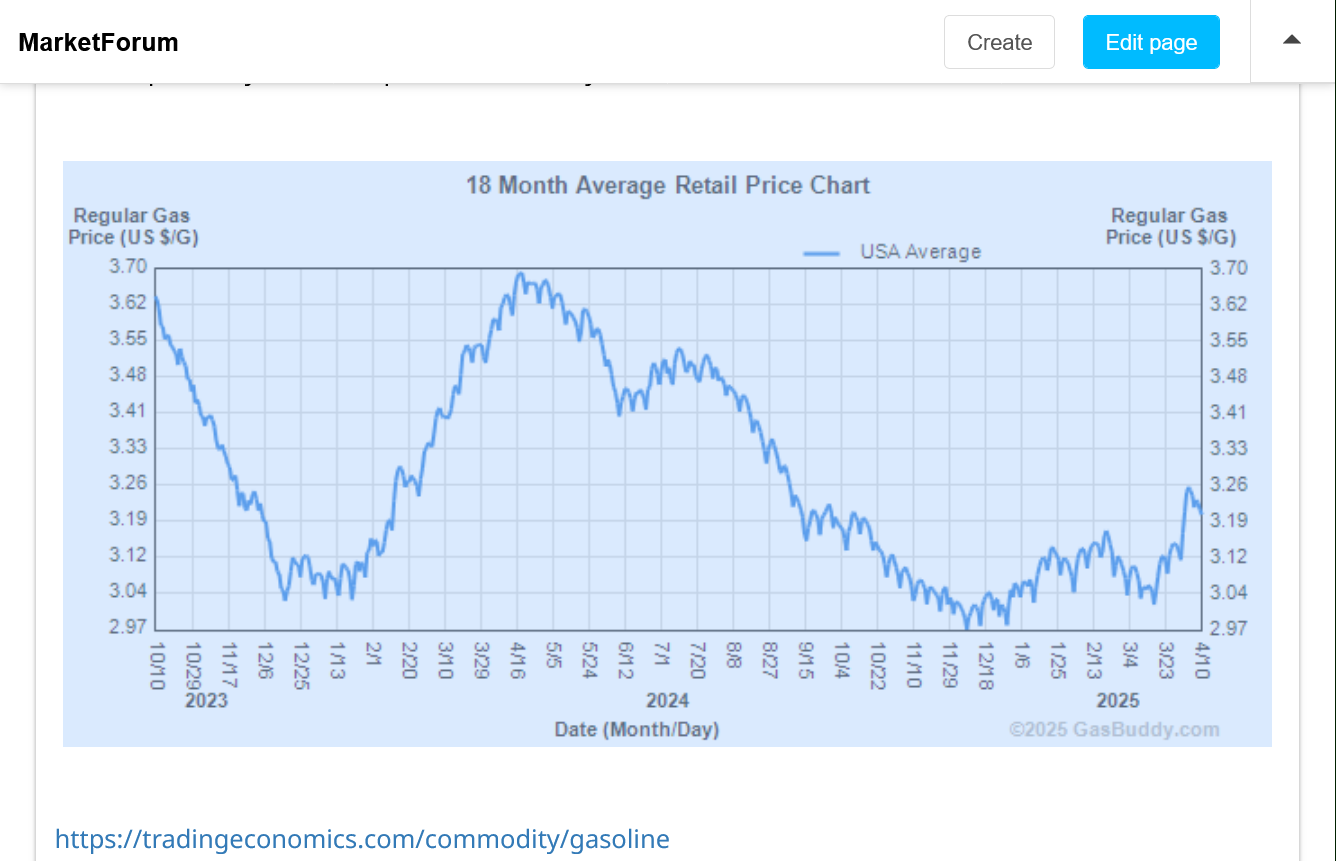

Graph for April 10, 2025.

This graph directly below is updated constantly.

++++++++++++++++++++++++++

Look at the actual price of gas in the front month/cash market that THEY PAID below that. DOWN 35c during the same period. That difference in price equates to their extra profits.

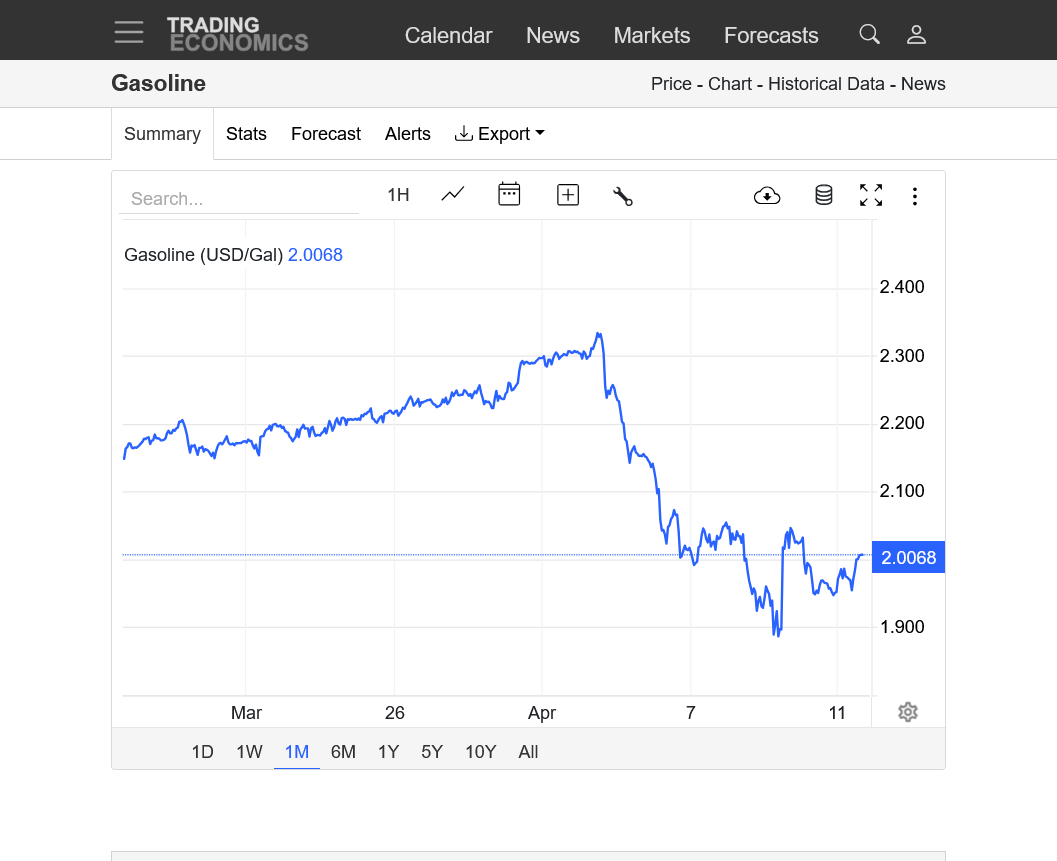

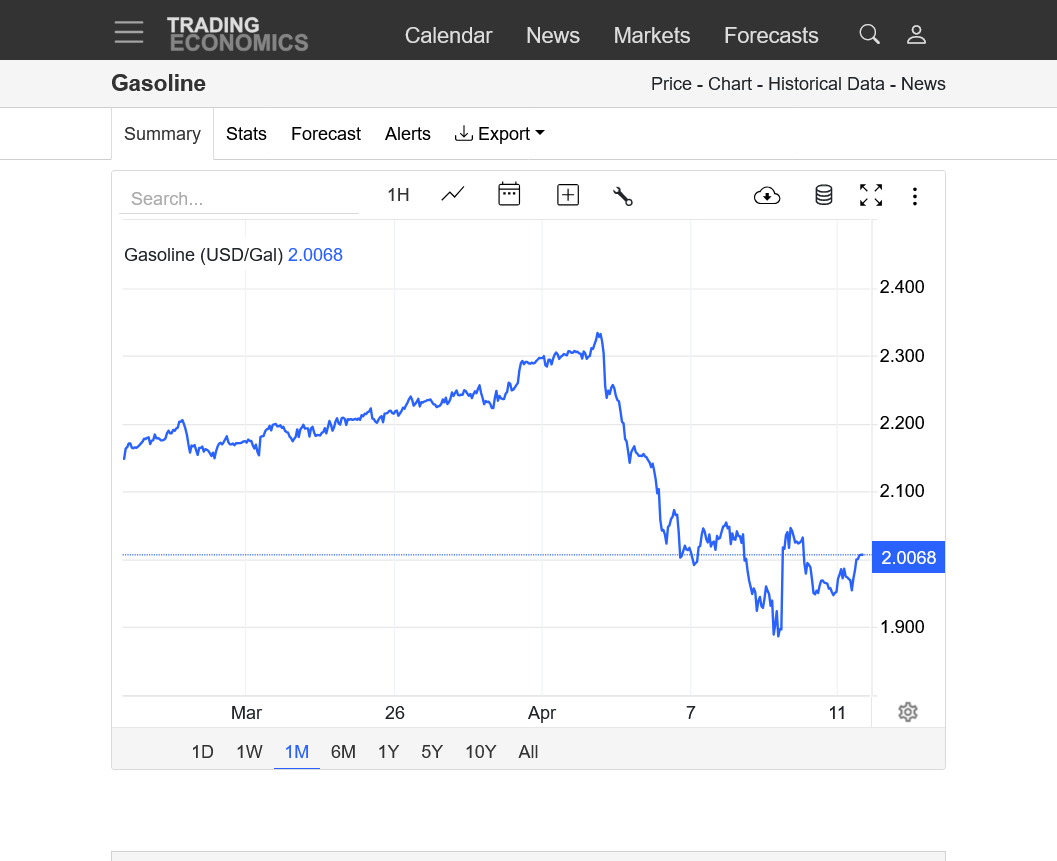

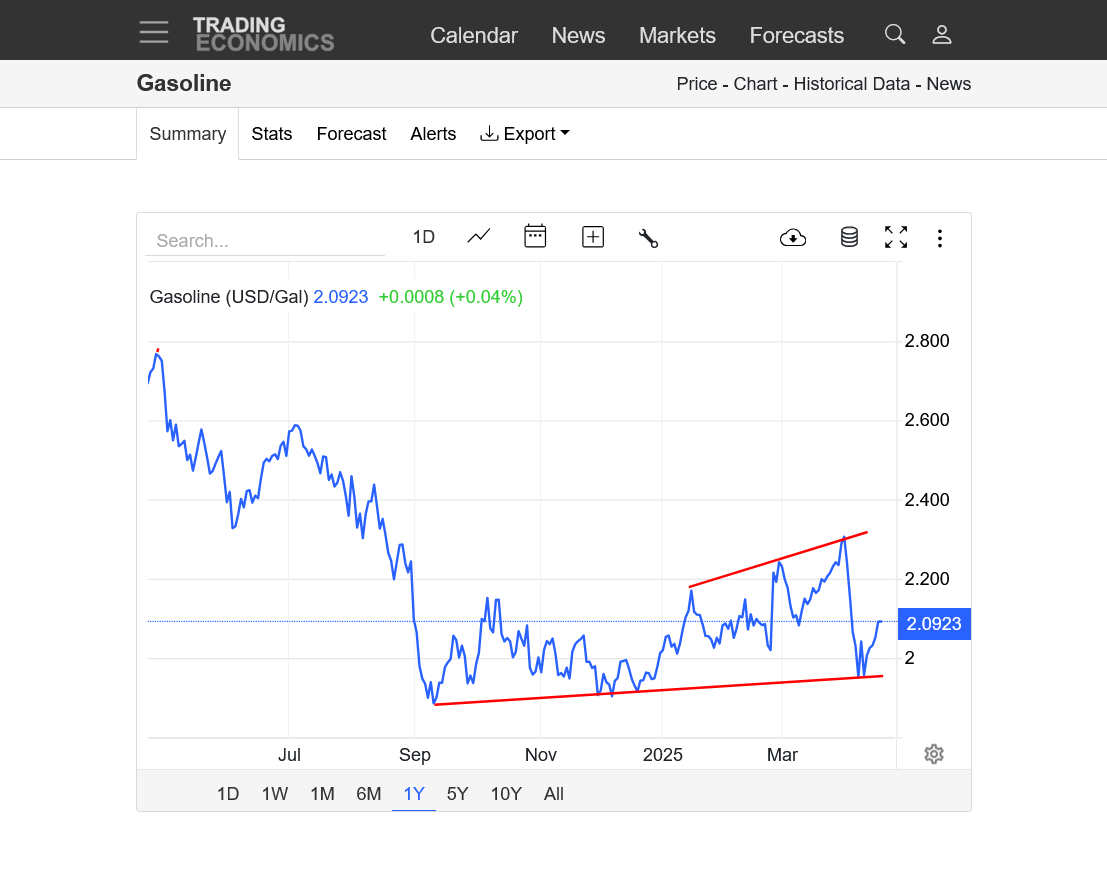

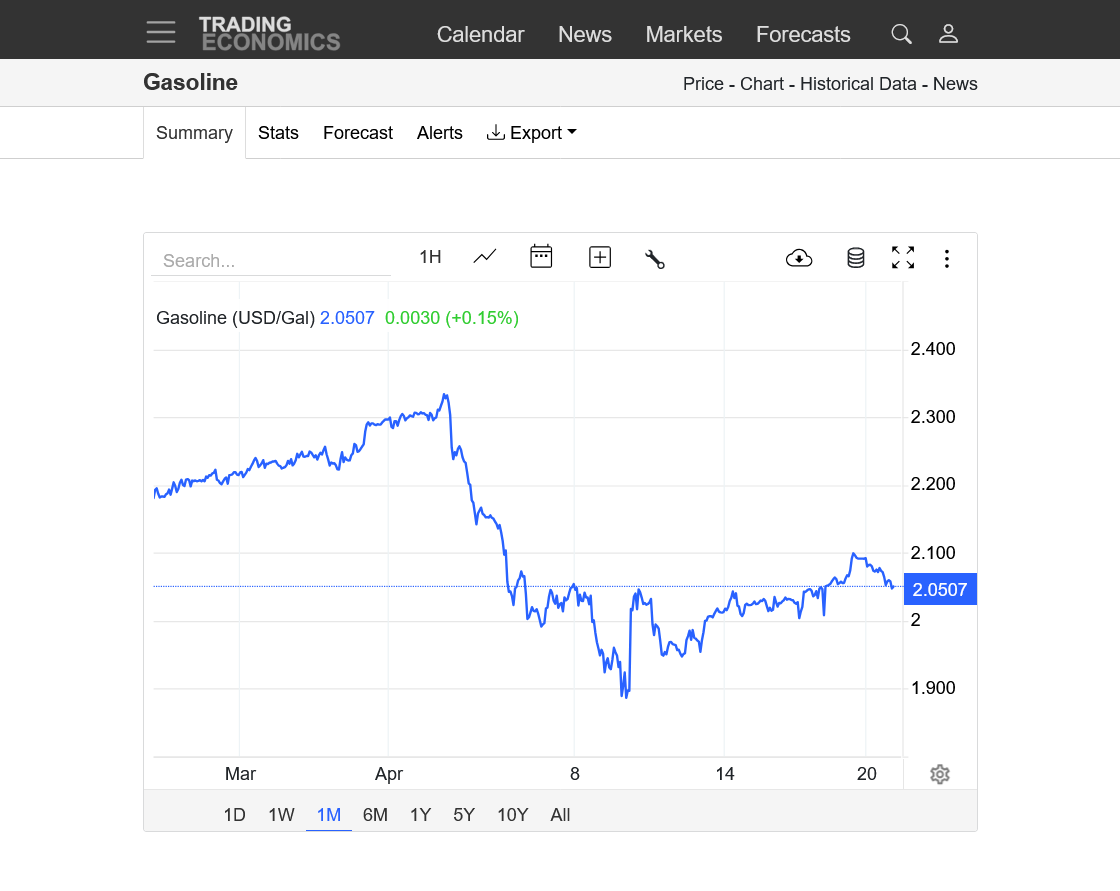

Front month futures. Crashing lower since April 2nd because of Trumps fake tariff scheme and the market dialing in a recession(that causes less demand).

Their cost plunged by 35c, while they hiked the price they charged to us.

https://tradingeconomics.com/commodity/gasoline

You want to eliminate fraud in the United States?

Establish a body that REGULATES PRICE GOUGING LIKE THIS!!!

The reason that we don't have one now is because of the powerful clout and legal bribing/lobby money that this industry has with our politicians.

https://www.newsweek.com/who-controls-oil-gas-prices-united-states-1710982

There's no specific body or policy that regulates the oil and gas industry in the U.S. but federal, state and local governments each regulate various aspects of oil and gas operations. Who regulates what mostly depends on land ownership and whether the territory is covered by federal regulations or state laws.

+++++++++++

The current administration, like all the politicians are well aware this exists.

https://www.opensecrets.org/federal-lobbying/industries/summary?id=E01

Select year: 2024

$153,071,835=Total Spent on Oil & Gas, 2024

196=Number of Clients

729 (62.14%)=Number of Lobbyists/Percent of Former Government Employees

https://www.opensecrets.org/industries/indus?ind=E01

When I was out on Friday, I observed the price of gas, mostly between $2.99 and $3.29.

This seems 20-50c too high considering the cash price is around $1 lower.

Ive been led to believe that the price at the pump should be around 60-70c higher than the cash price in Indiana, in many circumstances. Along the Coasts it’s much higher than that.

Immediately after Trump announced his tariffs, the energy markets plunged to dial in the recession, along with the drop in demand.

https://tradingeconomics.com/commodity/gasoline

1. Unleaded, 1 month chart futures/cash. Plunging 30c since April 2nd.

2. Price at the pump the last 18 months. HIGHER after April 2.

However, note below that the producers that sell to regional distributors HAVE NOT been passing along that lower cost they are paying for that unleaded gas. In fact, they used it as an excuse to RAISE prices that they sold the gas at to their gas stations. Apparently they think people will accept that because the tariffs will mean more inflation down the road. However, recessions are anti inflationary to the energy markets because they cut demand. They also did it because we have no regulatory body that prevents them from price gauging at times like this.

A pretty reliable rule of thumb on energy news that impacts pricing. If it's bullish for prices, they will pass along prices increases very quickly, often by the next day.

If it's bearish for prices, it will take many days, even weeks to get passed on to consumers. While they are purchasing gas at the lower prices, they try to sell it at the old higher prices as long as possible. Their rationale is that the gas consumers are buying right now was purchased at a higher price by them weeks ago.

Funny how that only works 1 way for them. When they pay more, the cheaper gas they bought weeks ago, suddenly is jacked up in price too.

They get away with it because many politicians are bought and paid for by the energy industries lobby money and don't want to bite the hand that feeds them.

H.R.7688 - Consumer Fuel Price Gouging Prevention Act 117th Congress (2021-2022)

https://www.congress.gov/bill/117th-congress/house-bill/7688/text

++++++++++

The problem with this price gouging law is that its only enforceable during emergencies, like after a hurricane.

99% of price gouging is taking place incrementally and very frequently with the evidence on the previous page being a quintessential example of it. Almost nobody checks to see what regional distributors are paying and selling their gas for to gas stations. They just see the price at the pump and often SUSPECT there is price gouging like this but don't know how to tell and the politicians that know...........mostly keep looking the other way because enough of them are getting legal lobby bribes to control legislation.

++++++++++

The other thing is that this law applies to LOCAL conditions.

The price gouging that we are seeing right now is impacting the entire country because its happening at the source for unleaded gasoline for all the regional suppliers.

Let's make this an air tight case with another solid piece of evidence. Here's the top chart again. The price for producers, that sell to regional distributors went DOWN sharply after April 2nd.

Immediately after Trump announced his tariffs, the energy markets plunged to dial in the recession, along with the drop in demand.

https://tradingeconomics.com/commodity/gasoline

1. Unleaded, 1 month chart futures/cash. Plunging 30c since April 2nd.

Now, lets look at the weekly change in price, reported from last week's EIA report for the week ending 4-7-25.

Unleaded gas prices went up 81c during a time when the futures price dropped 30c. Regional distributors made and extra $1.01 for the gas they were buying compared to the gas they were selling. This came after them hiking the price by 47c the week before.

Multiply that by

https://www.eia.gov/petroleum/gasdiesel/

.png)

How much money does this equate to?

Gas sales are about 376 million gallons per day. Multiply that by this huge, temporary mark up and it amounts to hundreds of millions of dollars/day that consumers pay and the producers/entities that sell to the regional distributors rake in.

https://www.eia.gov/energyexplained/gasoline/use-of-gasoline.php

Normally, the profit margins for these entities are pretty slim but during periods like this, they exploit the news, dynamics and LACK OF OVERSIGHT to enrich themselves!

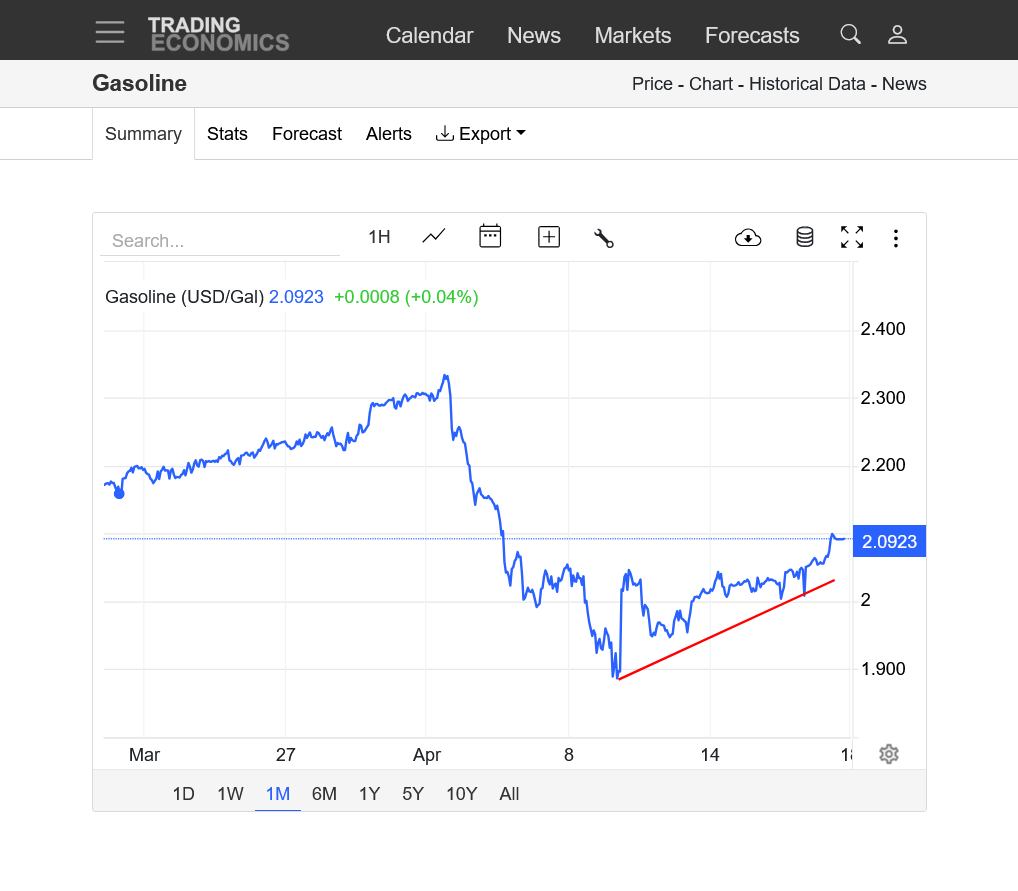

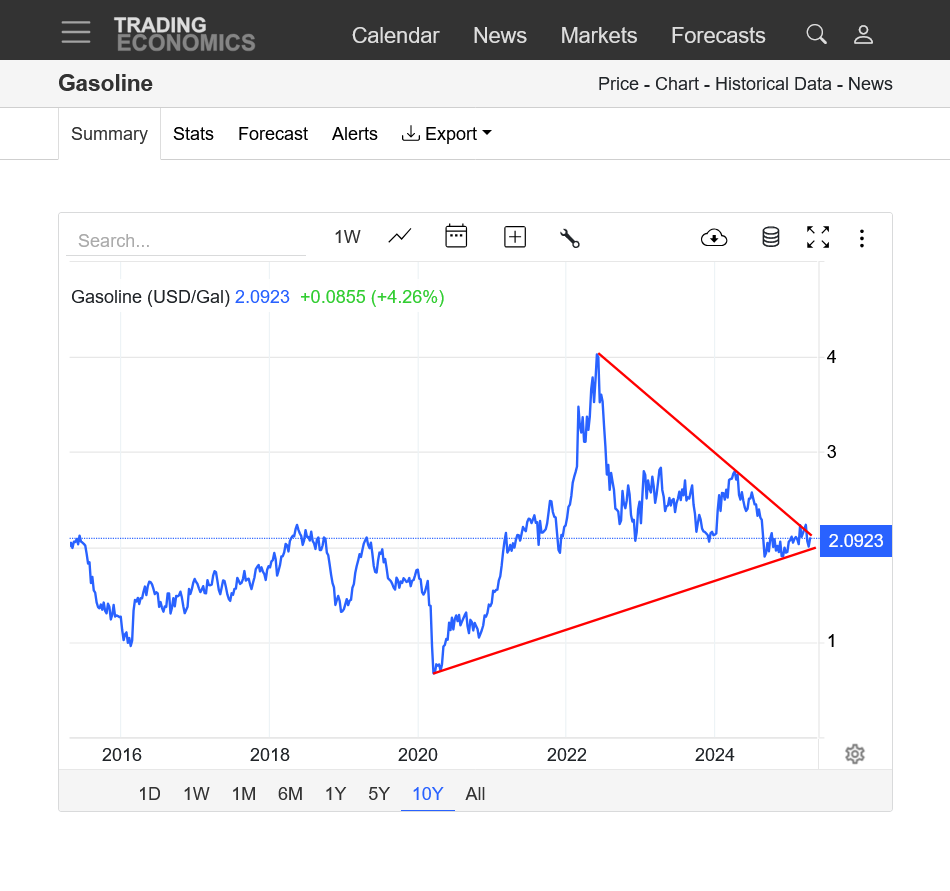

Unleaded. Are the lows in? Looks like it!

We're seeing higher lows and higher highs!

1. 1 month-spike down to sharp bottom now recovered 19c. Closed on the highs for the week

2. 1 year-Triple bottom? Sep-Dec-April lows.

3. 10 years-Huge triangle/wedge-we're at the apex/intersection of the downtrend and uptrend lines. 2020-COVID low. 2022-war in Ukraine spike high. Historically, we're at major support and resistance just above $2!

https://tradingeconomics.com/commodity/gasoline

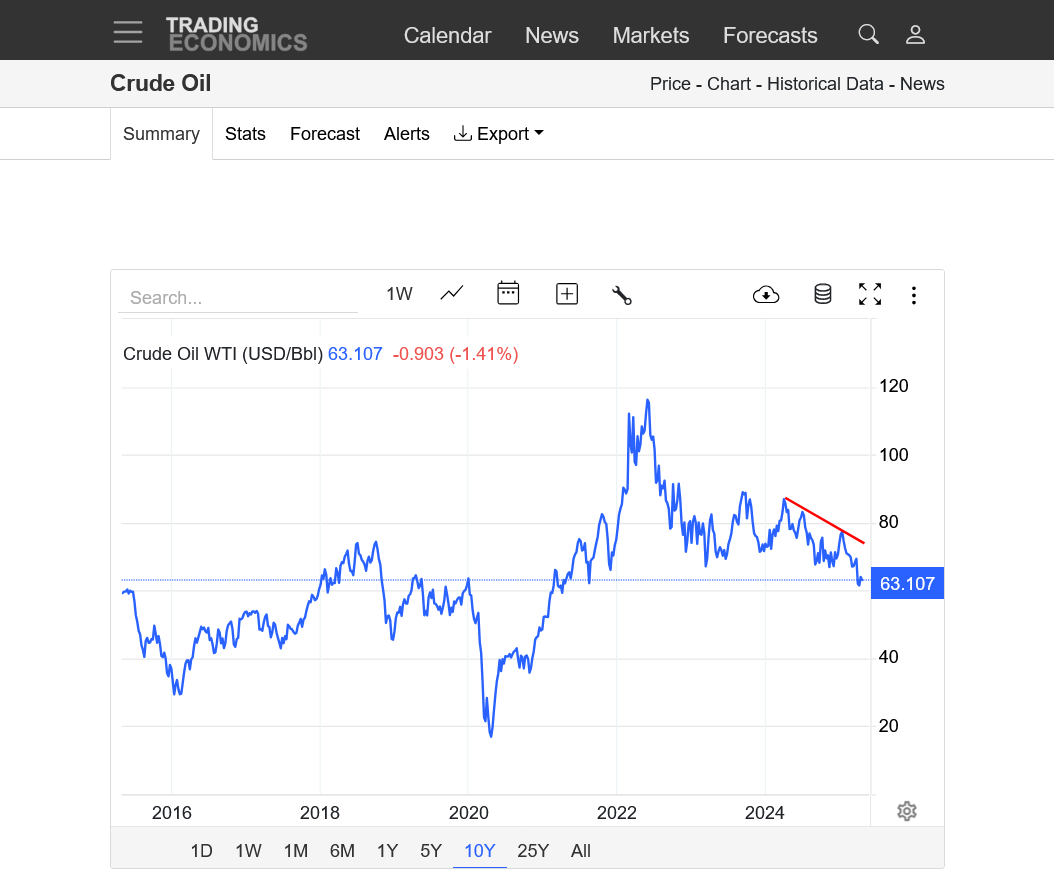

Crude and Unleaded both down sharply to start then new trading week as the market weighs the damage from a Trump tariff policy. He's likely to bail at some point soon rather than incur the brunt of the severe damage his absurd tariff scheme would cause.

1. Crude 1 month

2. Crude 1 year

https://tradingeconomics.com/commodity/crude-oil

1. Unleaded 1 month below

Some strong bearish elements to the crude market. Trump recession/tariffs, Iran oil might be coming on the market, OPEC might increase. Strong bearish down channel on the charts.

1. 1 year=down channel + at MAJOR long term support/previous resistance.

2. $60 is psychological support

https://tradingeconomics.com/commodity/crude-oil

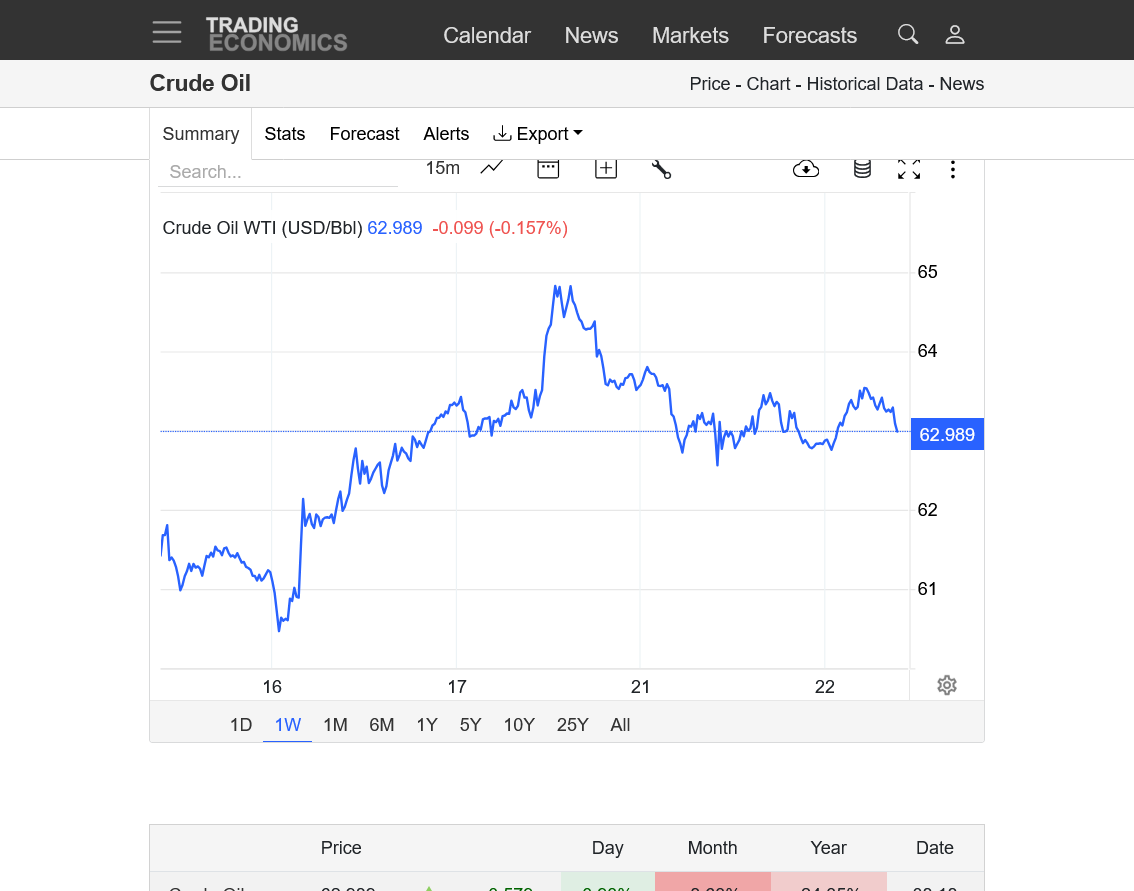

Crude is looking really weak!

1. 1 week-verge of new short term downside break out? Right at short term support!

2. 1 month-April 9 spike low

3. 1 year-already broken out to the downside

4. 10 years-already broken out to the downside-2020 extreme spike lower was from COVID

https://tradingeconomics.com/commodity/crude-oil

Adding to losses of the downside break out. Ironically, this is typically the time of year when energy prices are the strongest.

https://tradingeconomics.com/commodity/crude-oil

+++++++++++++++++

Unleaded is barely holding on to MAJOR support at $2!

https://tradingeconomics.com/commodity/gasoline

Unleaded gas is still more than $3 here = price gouging!!!!!

https://tradingeconomics.com/commodity/crude-oil

1. 1 year-solid DOWNTREND!

2. 10 years-Downside break out! 2020 COVID spike lows were a fluke