Trump says he's backing off of his original retaliatory tariffs — for 90 days

https://finance.yahoo.com/news/trump-says-hes-backing-off-173943665.html?fr=yhssrp_catchall

++++++++++

How childish/emotional to change course but continue to hold a grudge against China and want to punish only them now.

added: Trumps galactic sized delusional fed ego took a big beating from totally miscalculating with his fake tariffs scheme,especially after the only power on the planet powerful enough to call him out…….DID call him out.

So he had to do what was inevitable…….stop the bleeding from the markets response to knowing his absurd scheme can never work or allow the damage to get worse and worse.

Of course his people spin it as if he actually accomplished something positive instead of appreciating the enormous, maybe long term damages by this deranged stunt.

Creating massive chaos and volatility in the potential Trump BEAR market, fueled by the market now knowing with certainty that the leader of the free world and most powerful man on the planet is against free trade and has no clue about global economics 101 and is more about abusing his power to feed his pathologically driven need to control the world than he is as being a leader with sound judgement that the markets can depend on.

And as a result the Dow skyrocketed on “day 5”of the progression I’ve been following within a very short period to being up 7.5%!! We’ll see if it largely holds as the volatility is through the roof. Thus expect more big down days until volatility gets back down to normal.

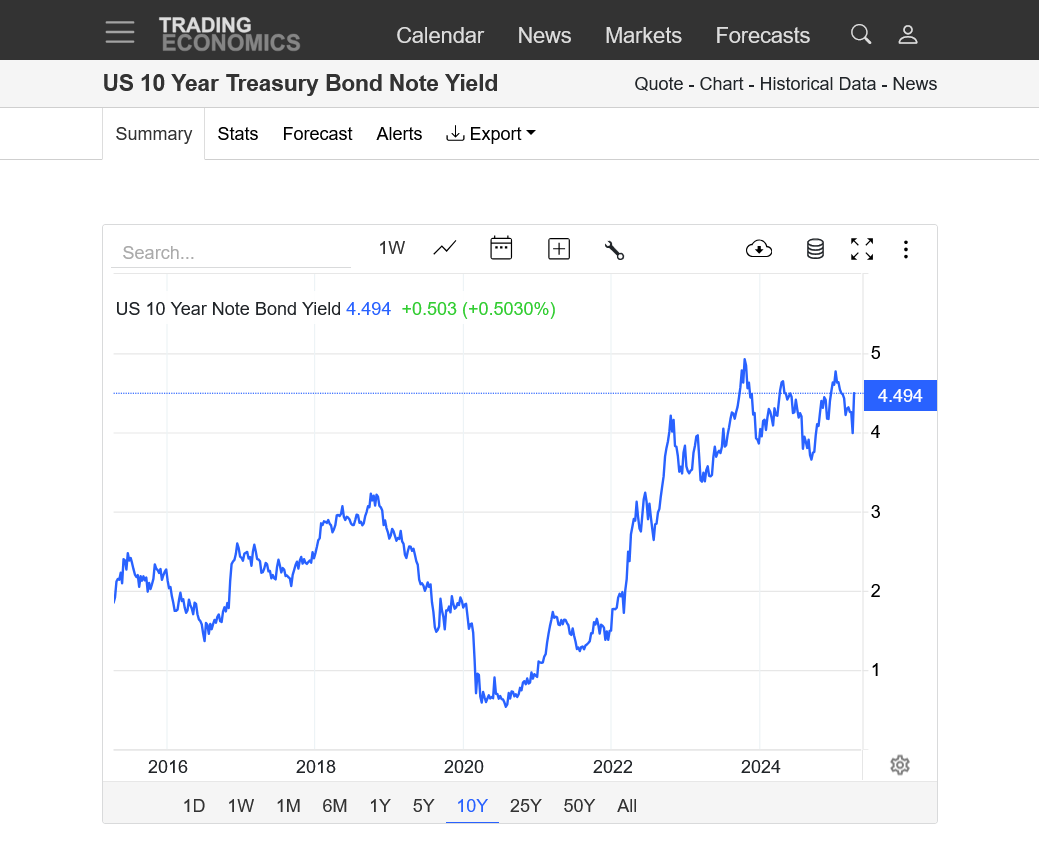

He blinked. Some reporting that made sense to me was that the spike in rates (10 yr @ 4.5 %) scared him. The WH line "75 countries reached out to us so Trump decided to pause and negotiate", doesn't ring true, but serves as a face saving off ramp.

-Dow +7.9% 19th largest gain ever and largest since 3/13/2020

-S&P +9.5% 9th largest gain ever and largest since 10/28/2008

-Nasdaq +12.2% 2nd largest gain ever and largest since 1/3/2001! (keep in mind Nasdaq goes back only to 1971)

-Regardless of today’s huge rise, I’ll remain wary about a possible resumption of big drops at least until overall volatility falls to near normal and the overall tariffs situation is clearer. If so, those could be further careful buying opportunities.

As of this posting the markets think Trump is full of "it".

The algorithms are having fun

Thanks Larry/agree joj!

https://www.yahoo.com/news/billionaire-trump-backer-bill-ackman-213645685.html?fr=yhssrp_catchall

++++++++

Fox News last night was taking this same position. That the world was just dazzled by Trumps brilliance and we should continue to glorify his omnipotence.

If I took this same position about severe weather, I might as well show people "The Wizard of Oz" to teach them about tornadoes

What to Know:

++++++++++++++++++

When Trump backed down from his insane, fake tariff scheme, he had the opportunity to start over, although be it from a very damaged position but his ego would not allow him to do it.

Instead of doing that, he's furious with China and continues to insist that his very broken, initial fake tariff scheme still be imposed on only China, claiming that the rest of the world bowed to his omnipotence.

So he's intentionally singling out China and trying to punish them on an issue where he's already obliterated his credibility in front of the entire world (except MAGA).

China has only responded to his loose cannon, emotional, impulsive and nonsensical decisions by confronting him, making Trump look worse and worse.

China knows that the longer this goes on, the worse it makes Trump look.

Most clear thinking people in the world are not asking: "Why isn't China giving into Trump??" They are thinking: "President Trump is mentally deranged and dangerous, I wonder when he will concede or even do something more damaging?"

+++++++++++++++

This was really a sad thing to happen to President Trump only 3 months into his 2nd term. He will never lose his support from the MAGA people but this truly exposed him. It was the dumbest decision and reasoning by an American president in the history of our country. It clearly showed that Trump either has no clue about how global economics work and why there is a huge trade imbalance between rich and poor countries or else he understands but his advancing delusions of grandeur, pathological thinking is causing him to think that he is so powerful that he can make decrees that defy the laws of economics and currencies and the world will bow down to his omnipotence.

It wasn't even that he did it but the MANNER in which he did it. With his flamboyant presentation of manufactured/fake tariffs based on deranged rationals that he tried to sell. We all witnessed it. There's no going back. Then, when the world and markets violently rejected his nonsense, he was forced to back down(pretending his plan is working) but his ego makes him continue to do the worst thing possible to his credibility............continue forward with something that was completely rejected by the markets/world but now focusing on just China. Since HE LOST trying to control the entire world, now he thinks that he can win if he just fights China with the same nonsense.

Unfortunately, this further destruction of his credibility will make it much tougher for him to be taken seriously on the war in Ukraine. He is battling NATO and Zelensky (that want the war to continue) for control of the war narrative and he just took a huge body blow in front of the entire world from his unforced error because of his monumental blunderous fake tariff scheme.

This goes with some of his other omnipotent, pathological thinking in foreign affairs. Greenland, Gaza and the Panama Canal. Now, who will believe Trump over.......NATO or Zelensky?

He's got most of the 4 years left in this term and my fear is that the amount of chaos that he's already caused will only get worse. The other side, which has already begun the great Resist or Hands Off protesting movement will continue to build momentum because of Trump's ruling manner that includes intentionally maximizing divisiveness that will only add more and more outrage fuel to the fire of people that:

1. Loath President Trump greatly

2. Don't hate him but don't want a deranged, unpredictable dictator that only does things which line up with keeping his MAGA cheerleaders hypnotized because his pathological thinking is driven by his delusions of grandeur.......positively reinforced by coming back and winning the election that made him the most powerful person on the planet. While having the most powerful tv station in the land, Fox News acting as his mouthpiece and the most important high priest in his cult.

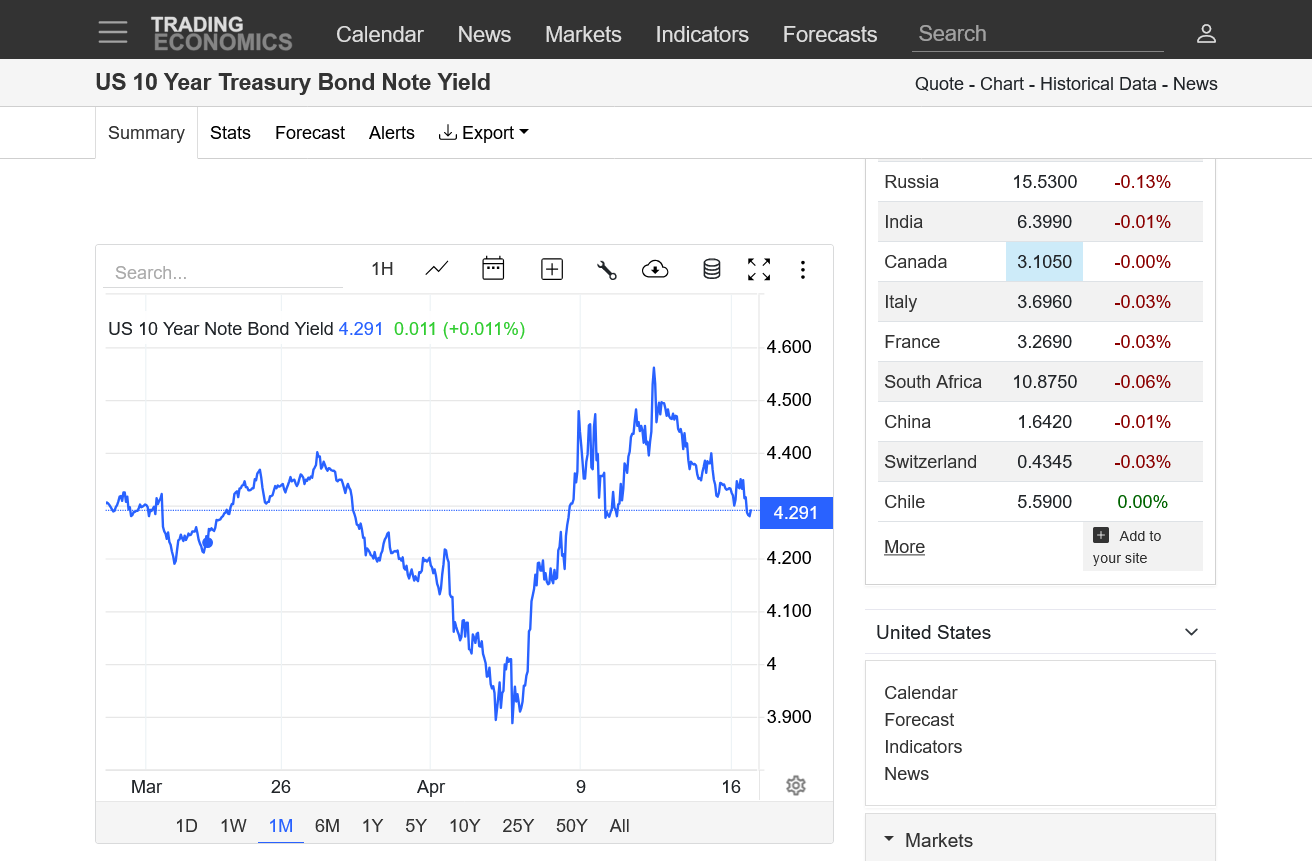

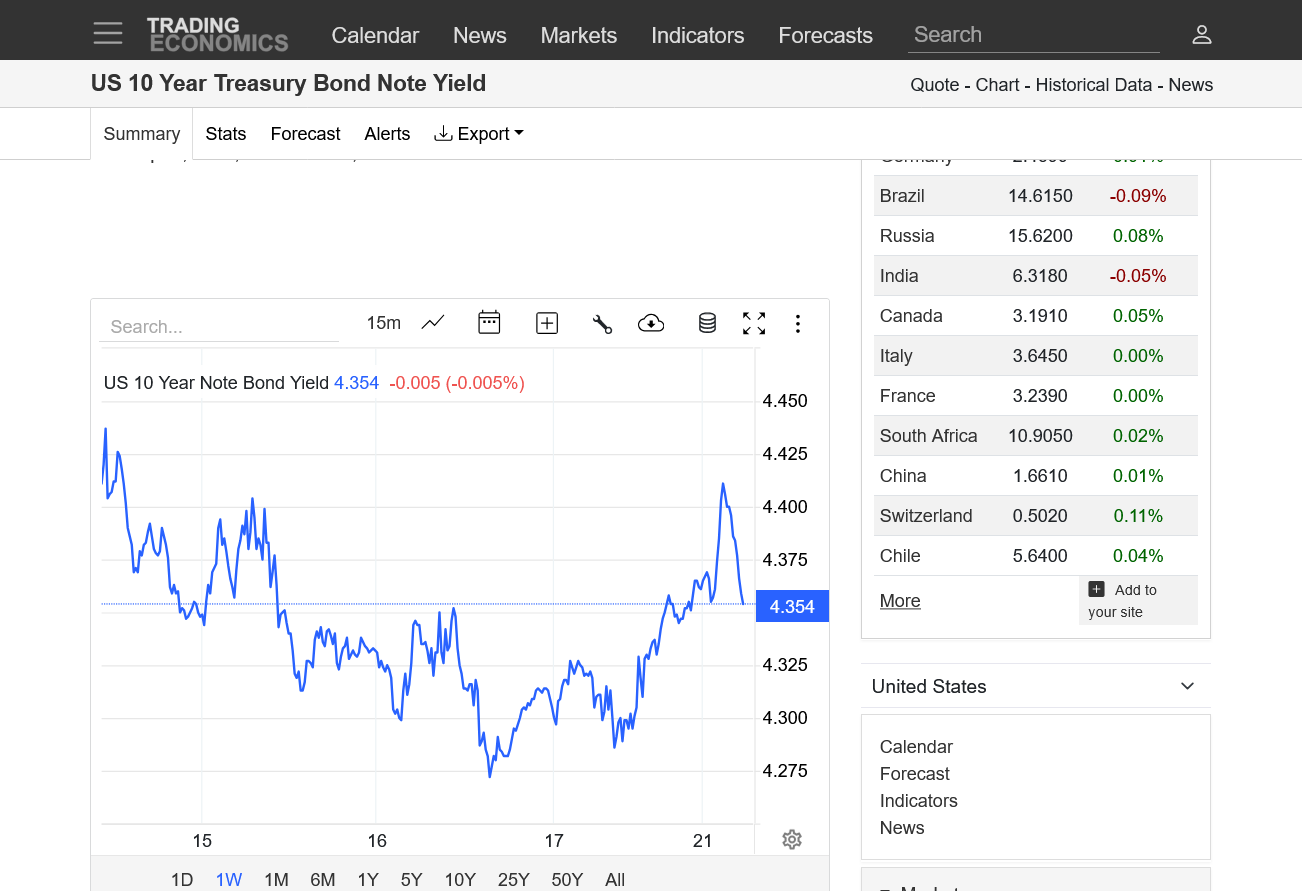

Over the past week, investors have been jolted by a rapid rebound in Treasury yields. The 10-year U.S. Treasury note climbed to 4.40%, a steep jump after weeks of sliding rates. This is flashing a troubling signal: investors are starting to question the stability of U.S. policy and the strength of the dollar.

Behind the scenes, this is about more than just interest rates. Sticky inflation, a nearly $2 trillion federal deficit, and a growing list of new tariffs have created a puzzle that’s hard for bond traders to solve. Meanwhile, nearly $3 trillion in short-term government debt must be refinanced this year, putting pressure on the Treasury to issue new bonds in a market that’s losing confidence.

When bond prices fall and yields spike, it raises the cost of borrowing across the economy. This affects everything from mortgage rates to business loans. It also means the government has to spend more on interest, leaving less room for other programs.

That’s why the bond market matters, even if you’re not trading bonds.

+++++++++++++++++++++

++++++++++++++++

1. US 10 year Bond yield the last 10 years.

https://tradingeconomics.com/united-states/government-bond-yield

The US has bonds worth more than $35 trillion in circulation, much of which is in foreign hands

https://indianexpress.com/article/business/dollar-sinks-us-indian-rupee-currencies-9938418/

On Friday, the dollar slumped as investors ditched US assets in favour of other alternate safe havens including the Swiss franc, the Japanese yen and the euro, as well as gold. (File photo)

US President Donald Trump may have hit the pause on his trade vacillations, but there seems to be a lingering deleterious effect on the American Dollar, which has slumped sharply. Reason: waning confidence in the American economy is leading to a huge flight out of the greenback to other safe haven currencies and gold.

This is reflective of a breakdown of a fundamental assumption underpinning global finance – that when there are serious bouts of volatility in the forex markets and a spike in the VIX (volatility index), it normally leads to a surge in demand for dollar assets. Over the last week, the trend has been exactly the opposite.

On Friday, the dollar slumped as investors ditched US assets in favour of other alternate safe havens including the Swiss franc, the Japanese yen and the euro, as well as gold. Gold recorded a new all-time peak, and the Swiss franc notched a fresh decade high, according to Reuters data.

+++++++++++++++++++

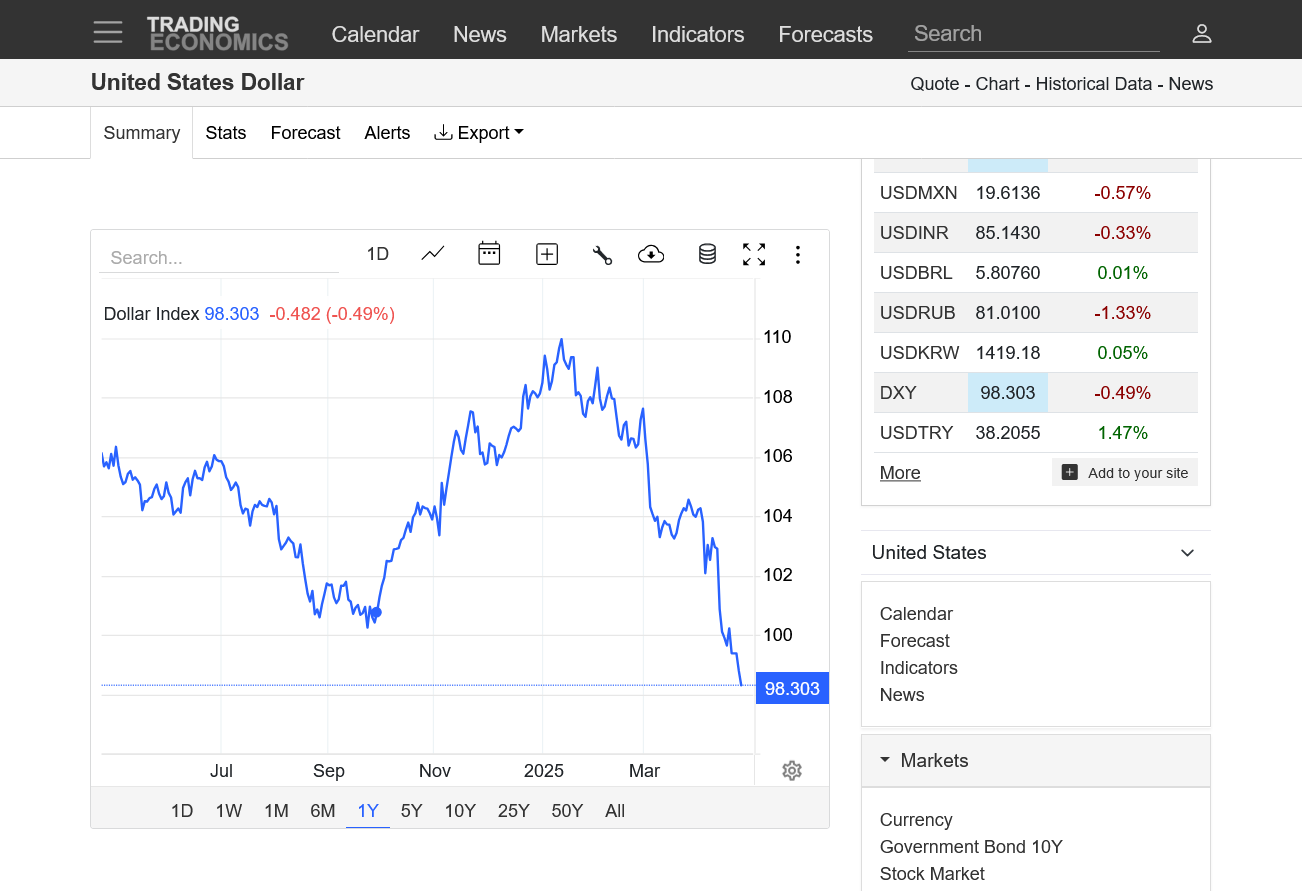

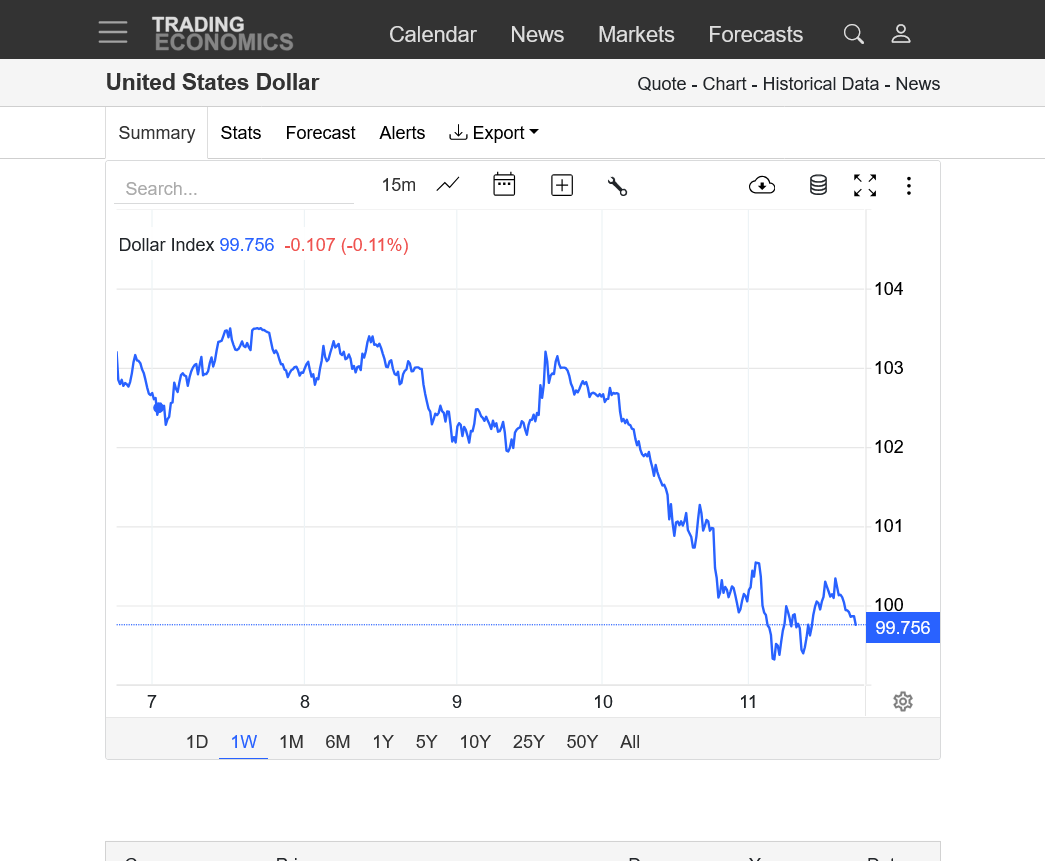

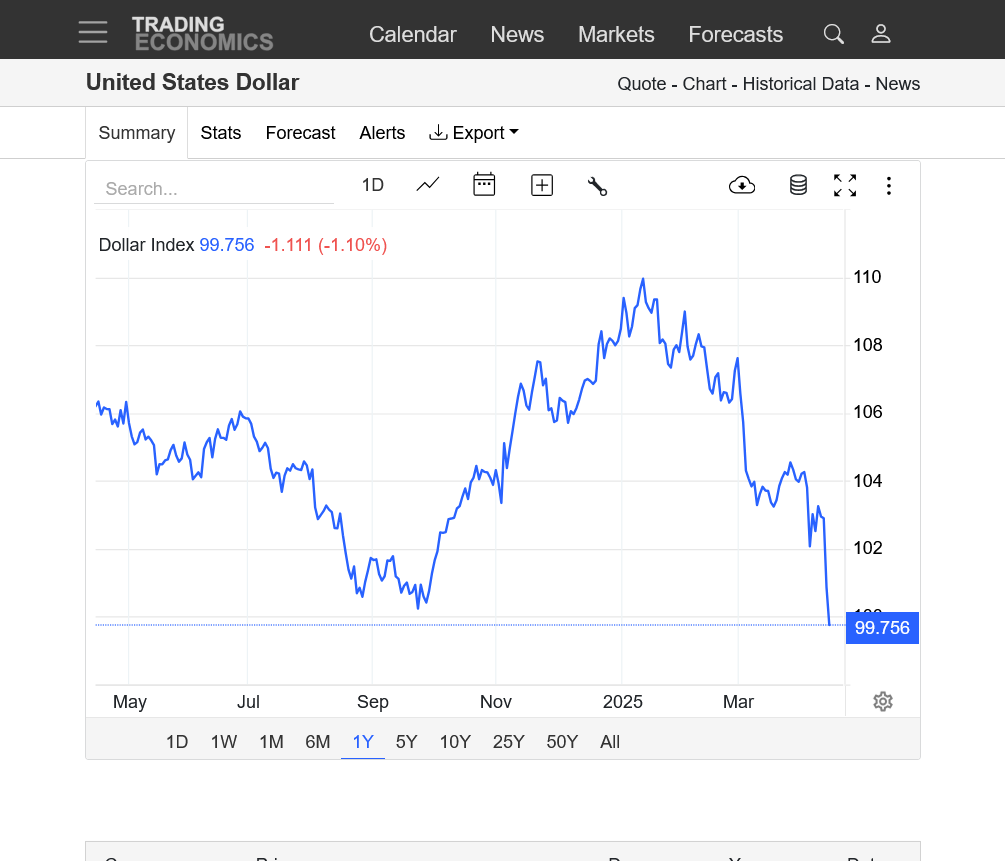

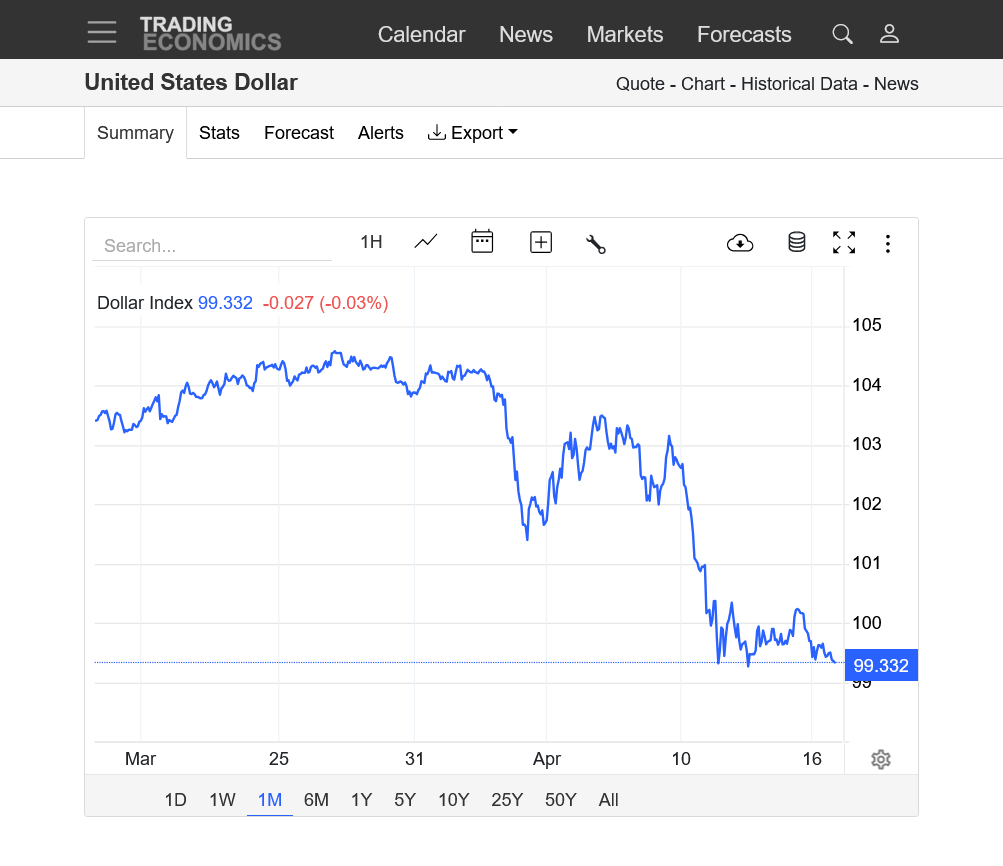

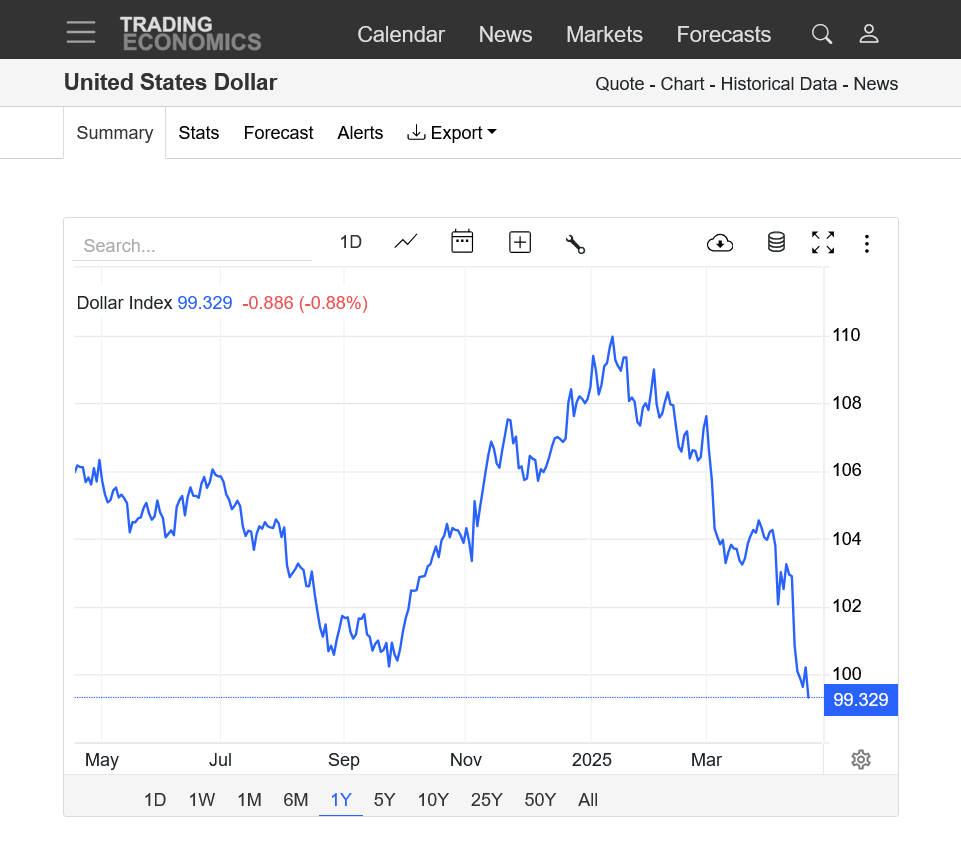

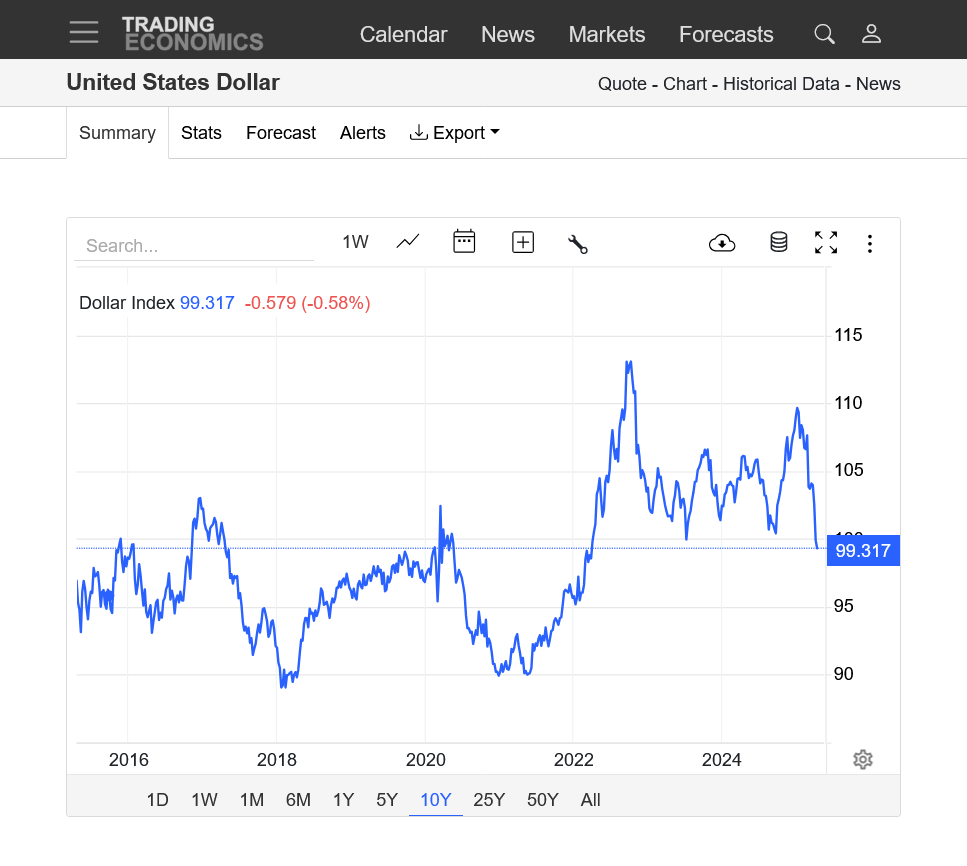

1. 1 week

2. 1 year

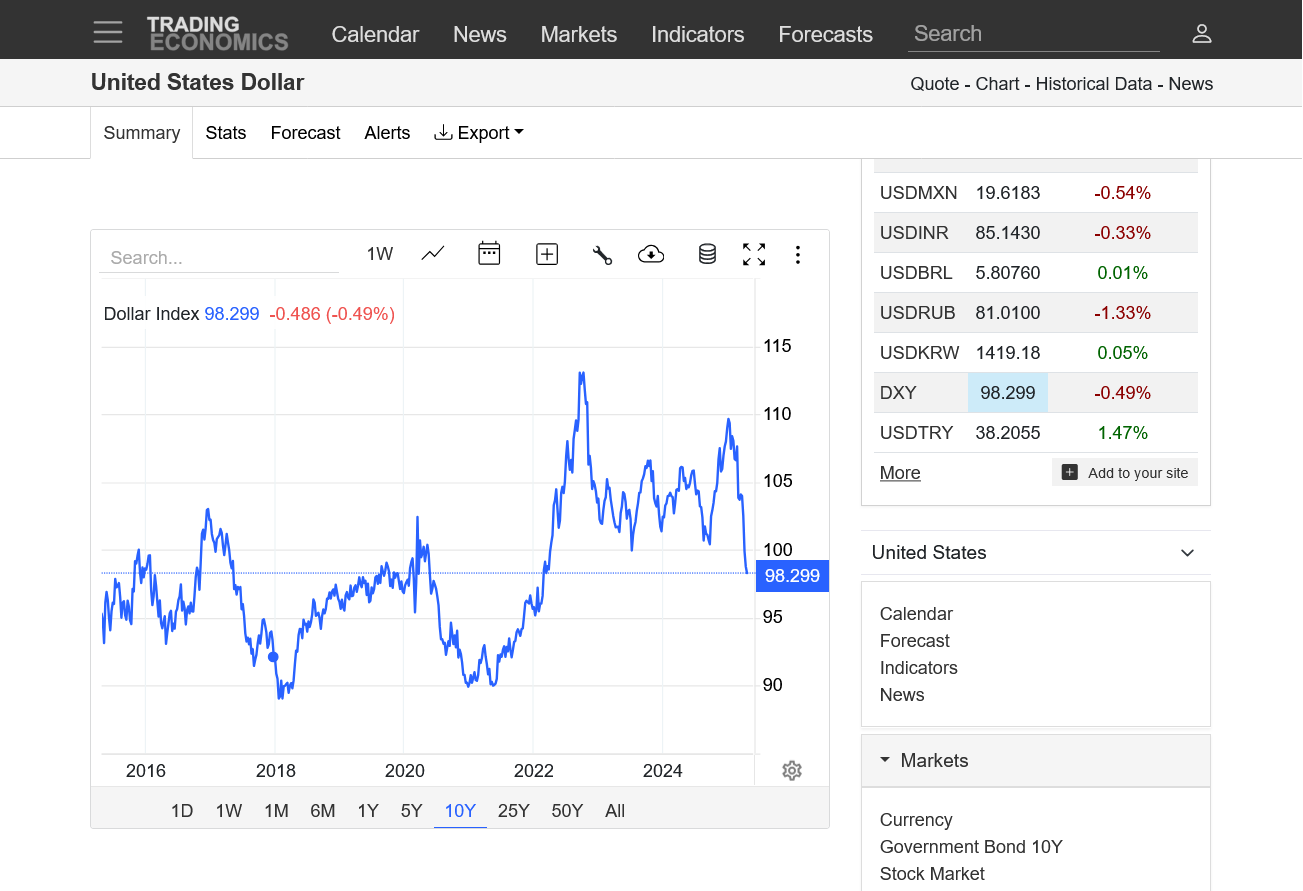

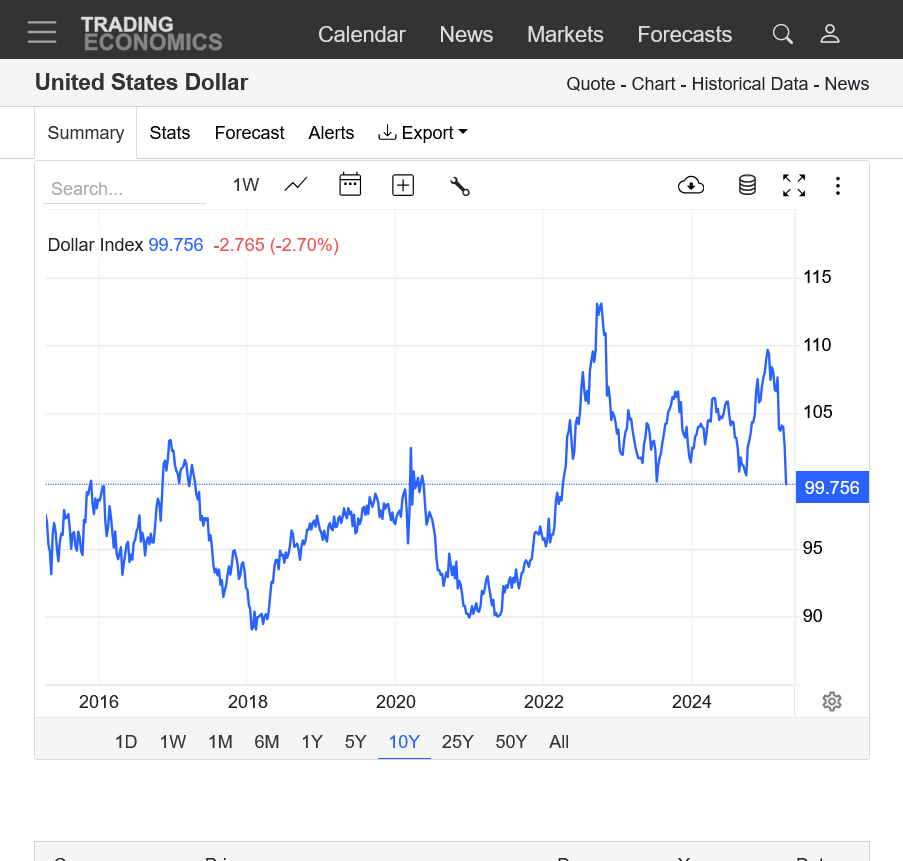

3. 10 years

https://tradingeconomics.com/united-states/currency

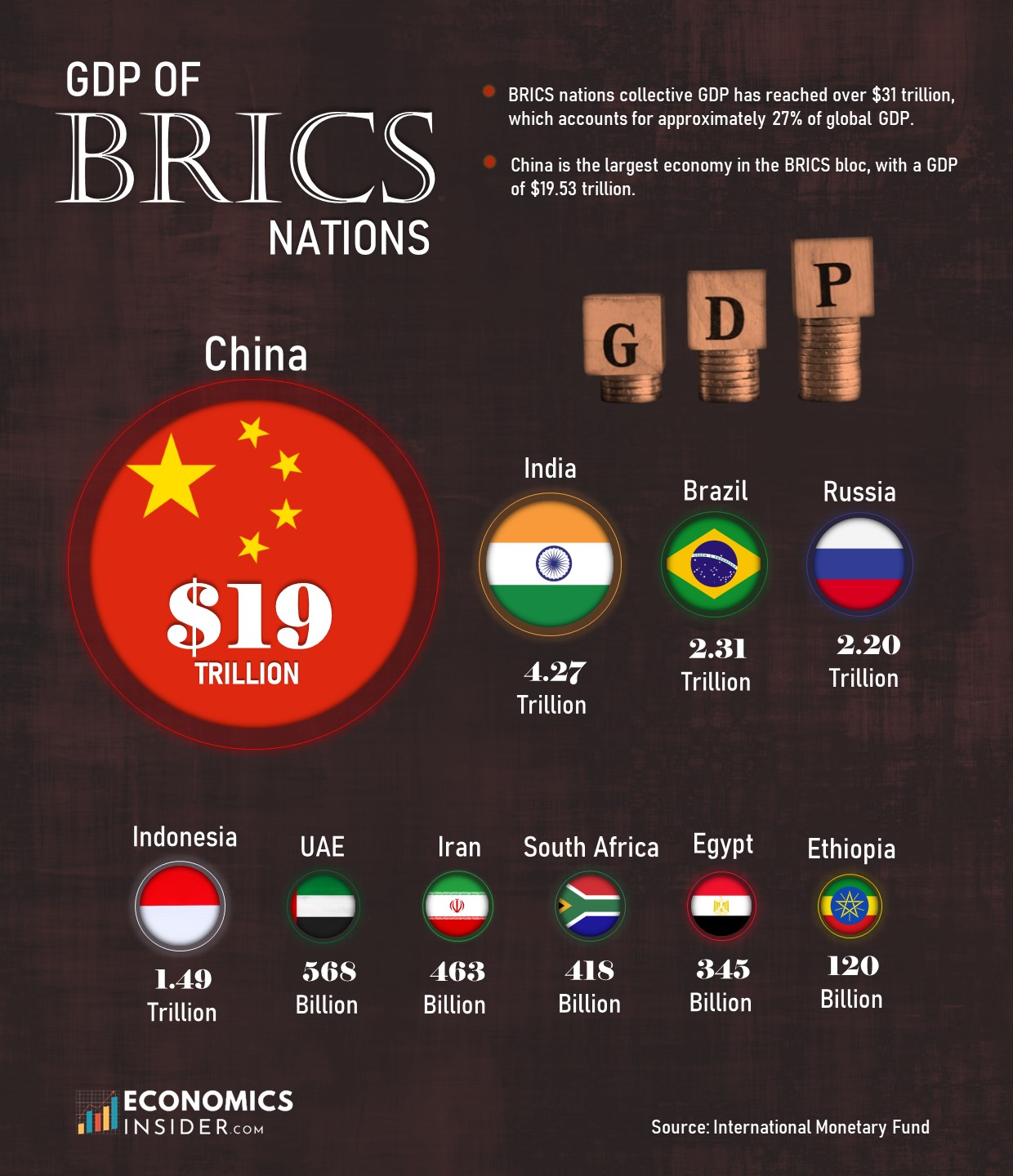

The end of the US dollar, reigning supreme is getting closer.

https://news-pravda.com/world/2025/04/10/1226742.html

++++++++++++++++++++++

https://economicsinsider.com/the-gdp-of-brics-countries/

Previous threads:

Analysis of the end of the petro $

Started by cutworm - July 23, 2024, 7:52 a.m.

https://www.marketforum.com/forum/topic/106138/

+++++++++++++++++

US Dollar

Started by metmike - Aug. 3, 2024, 6:08 p.m.

https://www.marketforum.com/forum/topic/106393/

+++++++++++++++++++++++

China's Historic Dump of $53 Billion US Treasuries is Unprecedented Blow to US Economy

Started by cutworm - June 5, 2024, 7:58 a.m.

https://www.marketforum.com/forum/topic/104589/

++++++++++++++++++

We were amazed at gold soaring higher 16 months ago when it was breaking out above 2000!!

Now, we're breaking out above 3200!!!

Gold

37 responses |

Started by cutworm - Nov. 29, 2023, 8:14 p.m.

https://www.marketforum.com/forum/topic/100943/

https://www.marketforum.com/forum/topic/100943/#102897

https://www.marketforum.com/forum/topic/100943/#102898

https://www.marketforum.com/forum/topic/100943/#102899

https://www.marketforum.com/forum/topic/100943/#102900

Trump has made a grave mistake by taking on China. My guess is that HE will be the one that caves, just like he caved on his ludicrous fake tariffs scheme that has done permanent damage to the US (and pretended that it worked exactly as planned but the markets were getting a little too nervous).

He will(is) back channel Xi to work out a deal, then present it to the world as a great victory for the United States which shows how smart he is and how the rest of the world bows down before him.

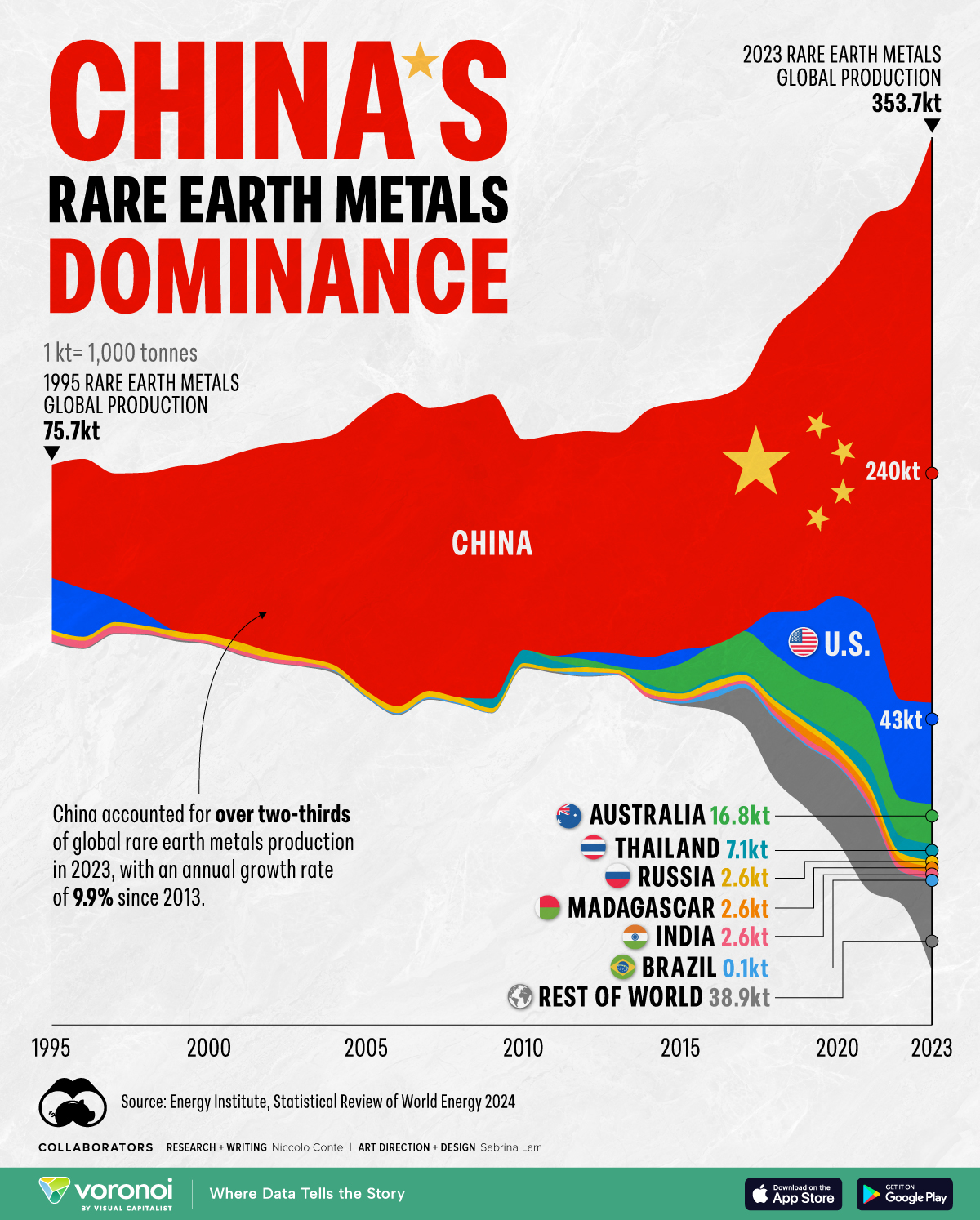

Earth to Donald Trump: The rest of the world now knows with certainty that you're a very dangerous, powerful man that is unpredictable and they are fearful of what your next impulsive move might be based on pathological, delusional thinking. So they are shying AWAY from US bonds and the US Dollar and other US based financial instruments. This is supposed to provide incentive for major manufacturers around the world to move to the United States?

This item by itself, makes Trump's picking a fight of this magnitude with China (adding even more damage to his original galactic mistake) jaw dropping ignorance and reckless.

https://www.visualcapitalist.com/visualizing-global-rare-earth-metals-production-1995-2023/

Trump is very aware of this:

The White House

How Donald Trump's Approval Rating Has Sunk, in Charts - Newsweek

https://thehill.com/homenews/5244399-trump-approval-sliding/

A poll has found President Trump’s approval is sliding as his second term ramps up with new global trade policies.

Just more than half — 51 percent — of Americans surveyed in the Economist/YouGov poll said they disapprove of Trump’s job performance, while 43 percent said they approve, giving him a net approval of negative 8 points.

USA TODAY NETWORK

++++++++++++

I listened to Jesse Watters on Fox telling viewers last week that Trump went UP 4% in the polls since he made his tariffs decree.

Enemy of the people!

+++++++++++++

Donald Trump Suffers Quadruple Approval Rating Blow

+++++++++++++++++

Public skepticism about the tariffs remains high. Fifty-five percent of respondents believe the new policies will negatively impact their own financial well-being, while just 16 percent think they will help. Additionally, 53 percent say the tariffs will harm the overall U.S. economy, only 31 percent expecting any benefit.

A striking 80 percent of Americans expect the tariffs to raise consumer prices, 47 percent predicting a significant increase and 33 percent expecting a more modest rise. This poll has a margin of error of +/- 3 points.

+++++++++++++++++

Does anybody here know of a worse, self inflicted/unforced error by a US president in history??

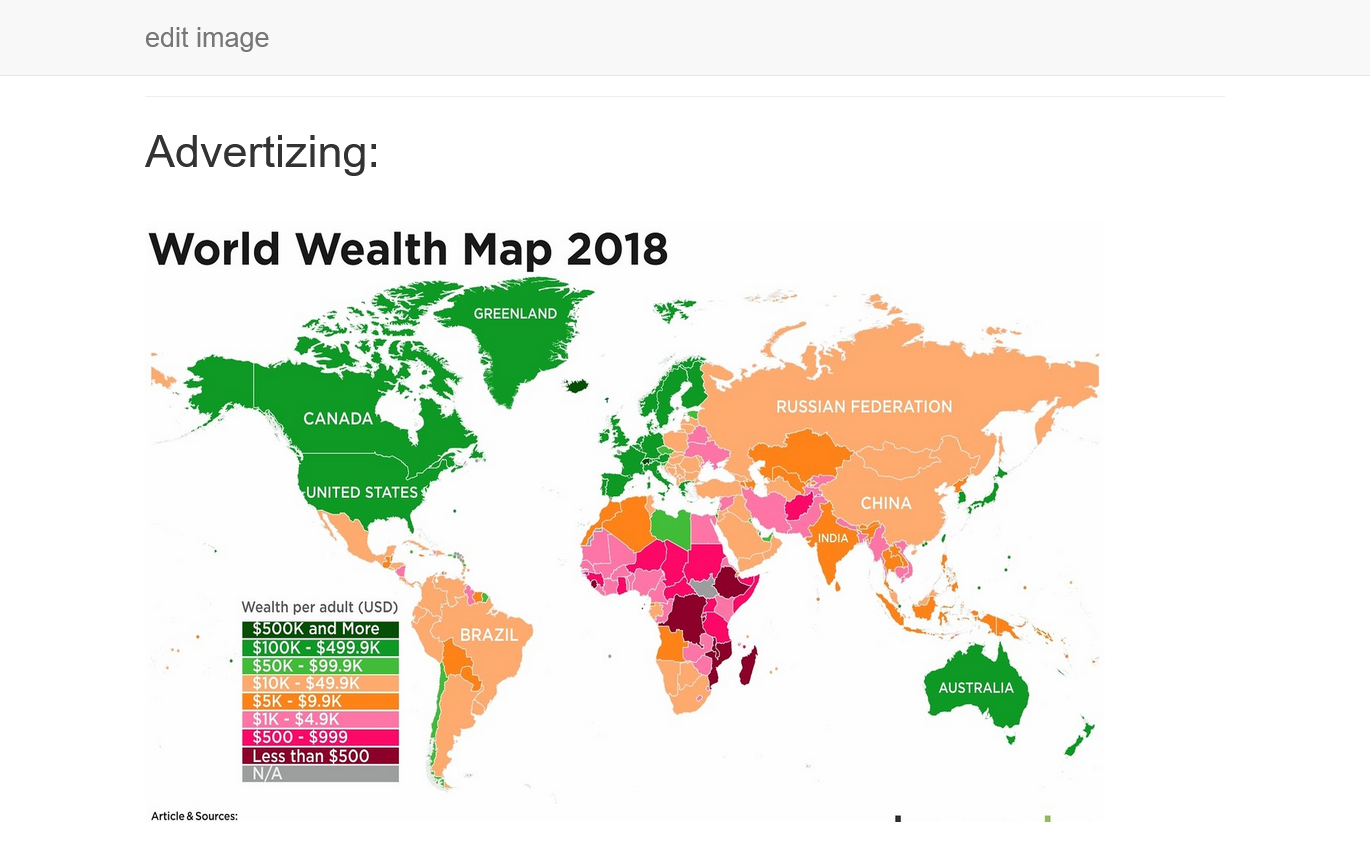

It's pretty hypocritical for Trump to be insisting that the world has been economically taking advantage of the US for decades.

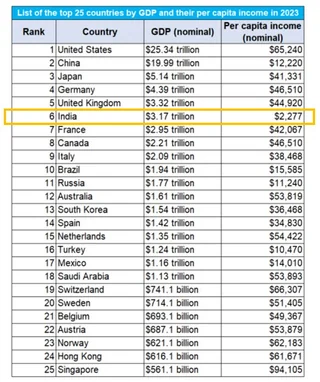

Our GDP and average income per person is in the top 5 countries in the world. We continue to be at the top when it comes to benefiting from the global economy. It's absurd for Trump to crack down on the rest of the world (180 countries) for taking advantage of us with his applying stiff tariffs to offset an impossible to eliminate trade imbalance between the rich and poor countries.

Poor countries don't have the money to buy the same amount of the stuff we make and that we sell at top dollar(because we demand high wages and input costs). We are rich and can buy tons of goods, which they make and sell cheaply just to survive.

When we buy stuff cheap from other countries, its a win-win free trade situation! It gives US consumers good bargains with competitive pricing that helps to keep our inflation down and it helps boost the income/GDP of the poor countries.

++++++++++++++++++++++

https://gfmag.com/data/worlds-richest-and-poorest-countries/

https://gfmag.com/data/worlds-richest-and-poorest-countries/

++++++++++++++++++

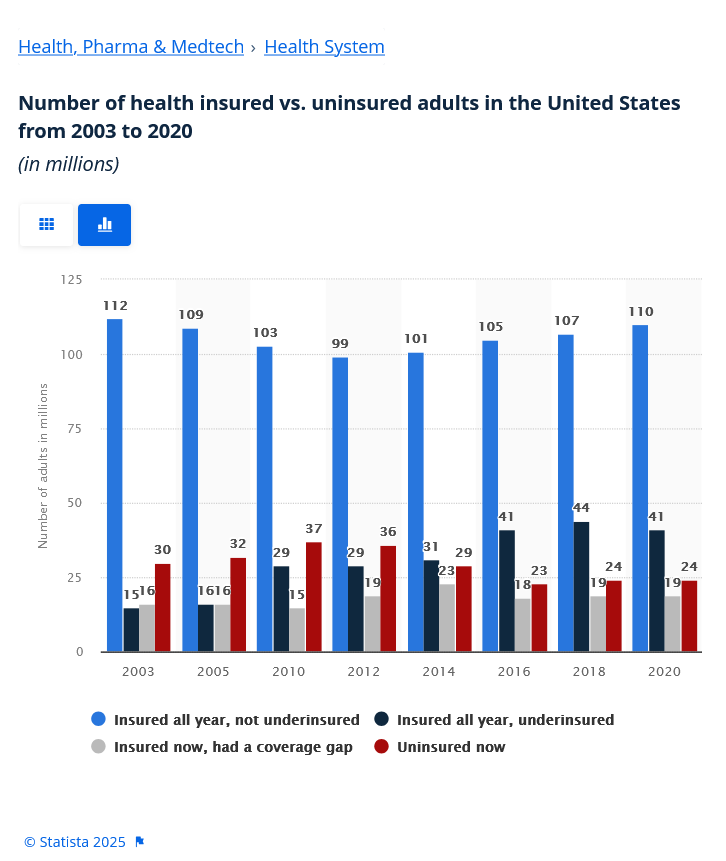

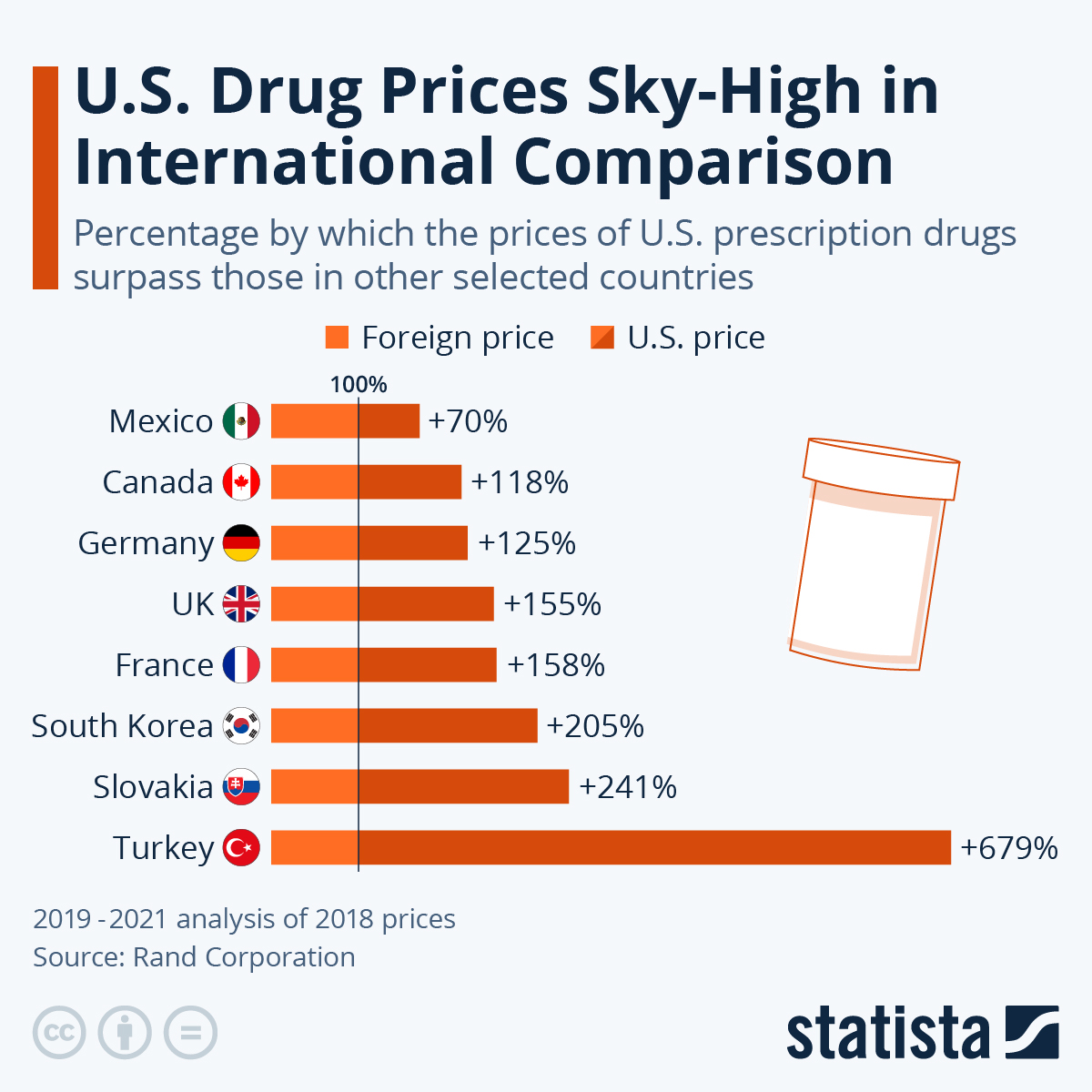

The most ironic thing of all is that it's not our 180+ trading partners that are messing over people in our country, it's the United States doing it to our own citizens!!!

https://www.statista.com/statistics/671672/development-of-uninsured-adults-in-us-by-number/

https://time.com/6246045/collapse-us-health-care-system/

++++++++++++++++++

The US healthcare system handicaps business competitiveness with a crippling 160% increase in employer healthcare costs in the last 20 years, which averages about $14,000 per employee.7 This system also causes downward pressure on employee wages resulting in a 8.9% inflation adjusted decrease in employee household income.8 In addition, it requires many Americans and their families to line up in fields for humanitarian healthcare events mirroring the activities of many third-world countries as well as requiring increasing numbers of citizens to use the ER as their default medical care.

This default is fragmented, costly, inefficient, and a generally poor method of providing care with a total lack of continuity. This healthcare model also drives significant racial disparities in the availability and quality of care, and in the outcomes for these patient populations.

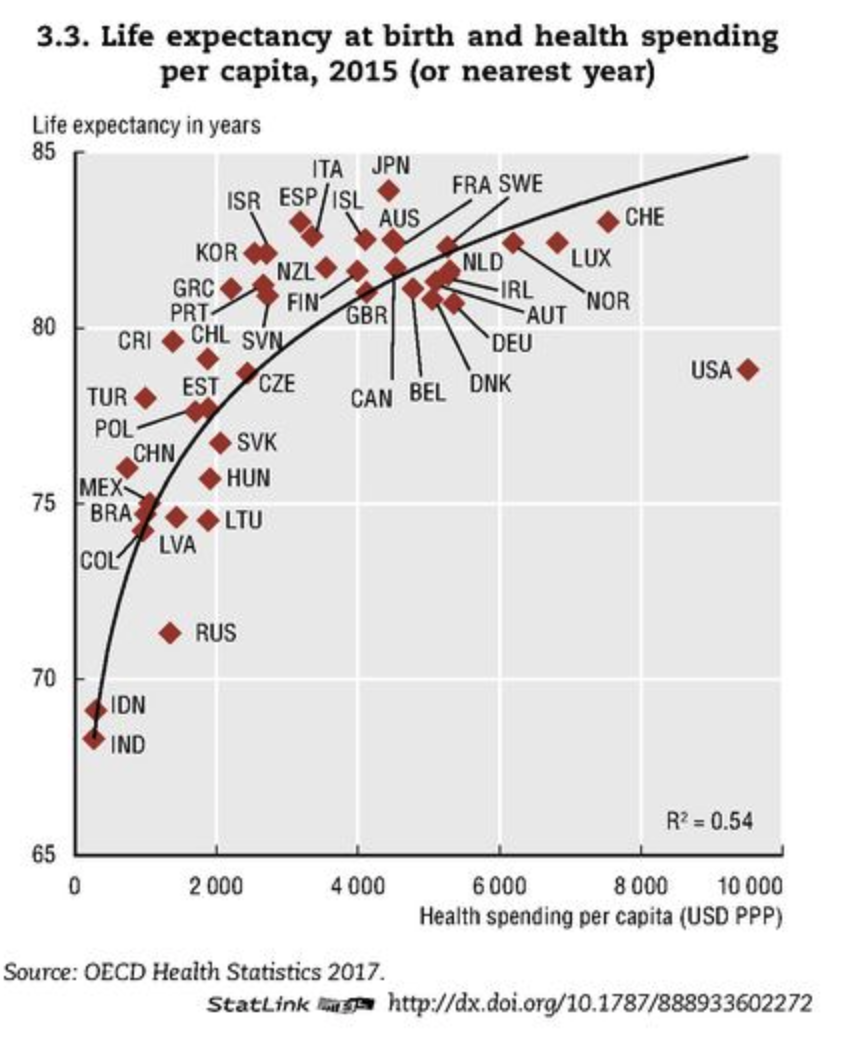

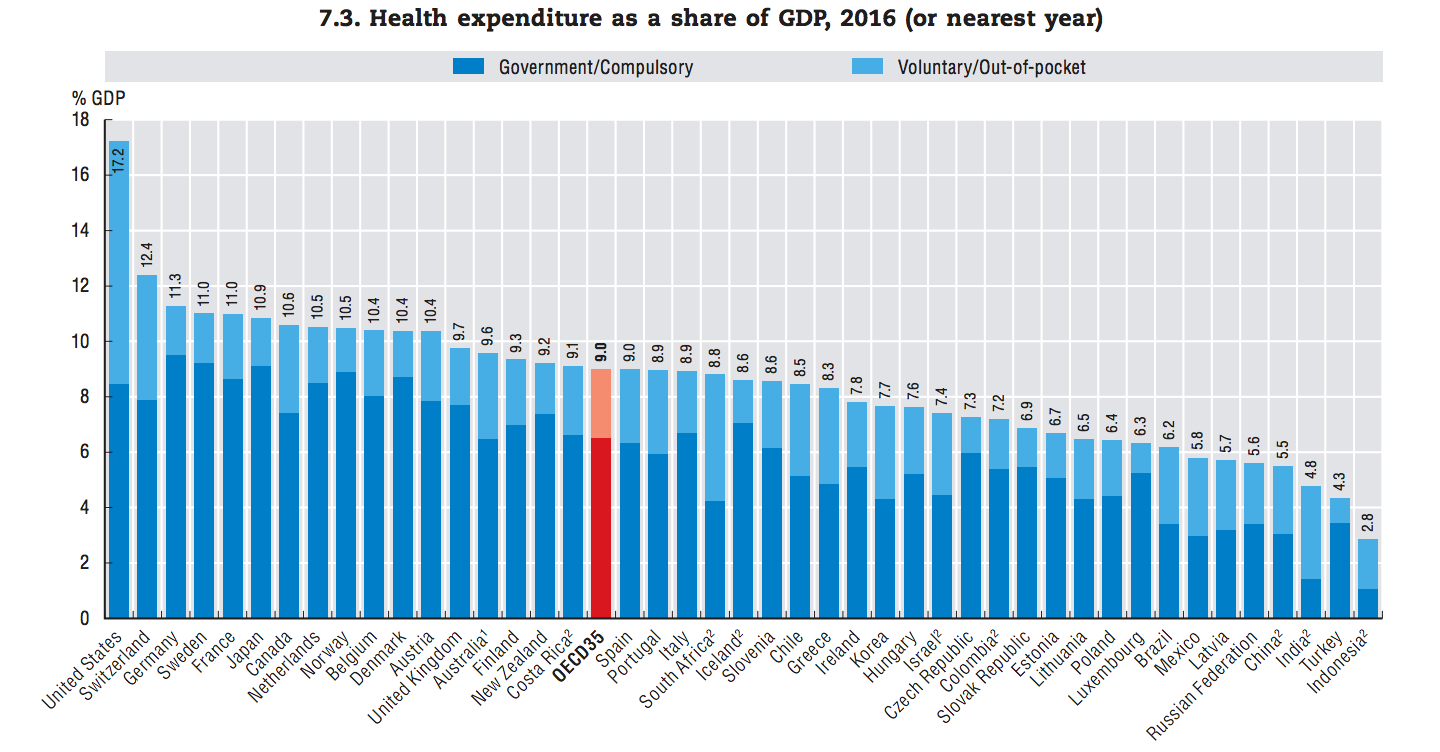

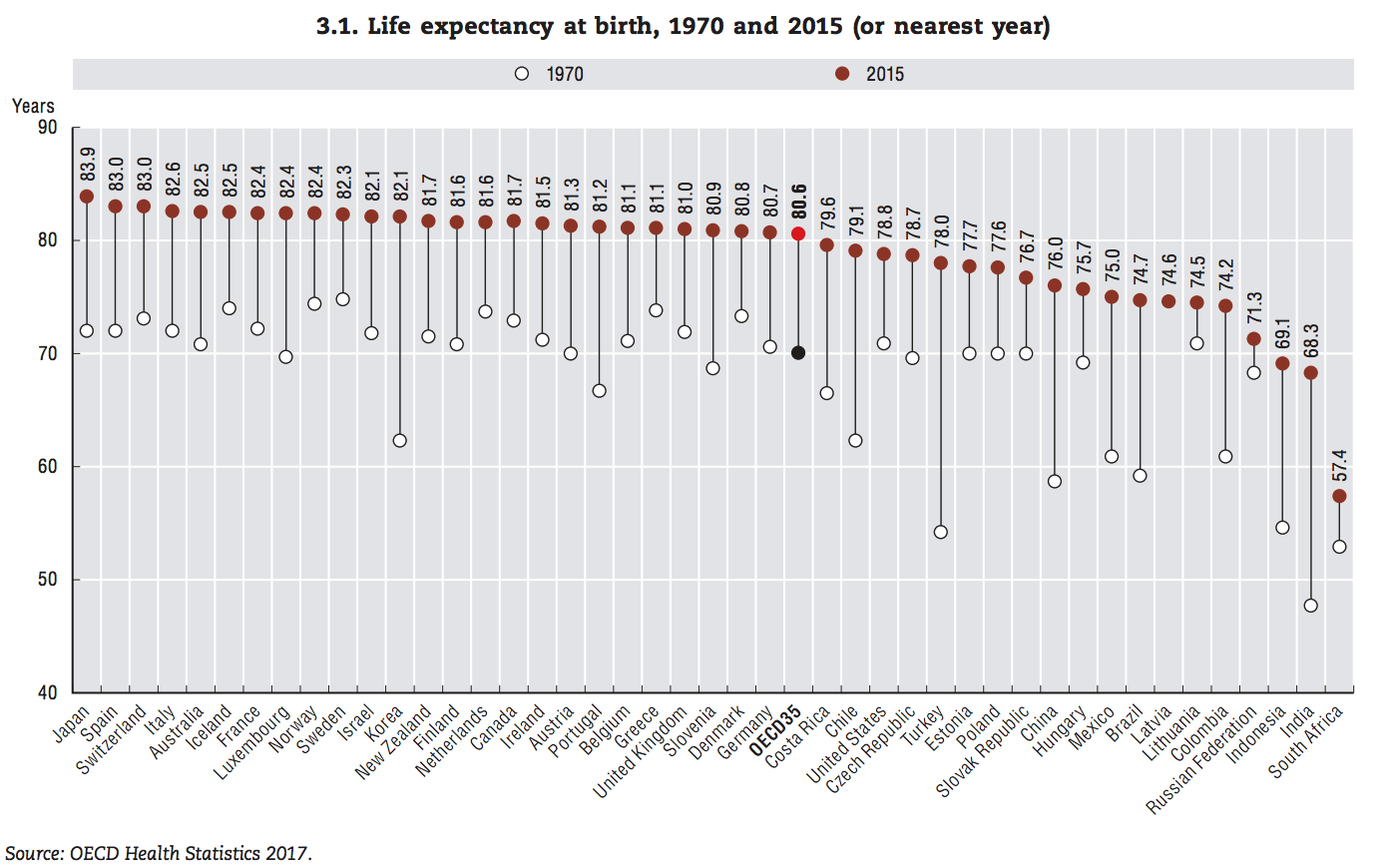

Currently the US, compared to similar Western countries, has the lowest life expectancy at birth, highest reported maternal and infant mortality, highest hospitalization rate from preventable causes, highest death rate for avoidable and treatable conditions, highest suicide rate, and highest chronic disease burden rate in the world.9

In essence, we are spending more than any other civilized country in the world and getting markedly worse results. No other known industry in a competitive or many noncompetitive societies could survive by being twice as expensive while producing markedly inferior products, services, and results.

++++++++++++++++++++

The United States is doing this to themselves!!!

The United States, easily spends much more than any other country for health care.

More than 2 dozen countries have a higher life expectancy at birth than the United States

https://www.comparethemarket.com.au/health-insurance/features/cost-of-medications/

| Branded Drug | Australia | USA | Canada | France | UK | South Africa | Portugal | Sweden | Finland | Mexico |

| Viagra | $38.70 | $2,771.36 | $115.62 | $287.76 | $12.77 | $12.81 | $40.83 | $41.27 | $46.88 | $18.99 |

| Lyrica | $16.62 | $648.87 | $72.30 | $25.62 | $12.77 | $16.15 | $20.12 | $73.68 | $20.70 | $130.93 |

| Lipitor | $14.12 | $1,761.02 | $101.15 | $4.27 | $12.77 | $1.73 | $3.55 | $28.25 | $21.66 | $24.99 |

| Ventolin | $20.12 | $33.42 | $78.72 | $8.31 | $12.77 | $2.14 | $6.74 | $6.16 | $4.21 | $25.00 |

| Zithromax | $5.16 | $103.55 | $68.41 | $8.00 | $12.77 | $7.04 | $6.23 | $8.31 | $10.22 | $5.63 |

| Lantus | $21.17 | $77.16 | $185.95 | $41.73 | $12.77 | $6.84 | $64.10 | $51.31 | $35.89 | – |

| Prograf | $21.17 | $765.98 | $116.57 | $157.13 | $12.77 | $205.15 | $26.11 | $251.49 | $240.04 | $388.99 |

| Yasmin | $18.98 | $416.38 | $127.79 | $0.00* | $12.77 | $5.25 | $12.30 | $22.94 | $37.20 | $65.99 |

| Prozac | $21.17 | $1,503.55 | $120.97 | $2.39 | $12.77 | $2.07 | $15.17 | $11.47 | $6.33 | $198.68 |

| Xanax | $18.52 | $96.30 | $75.81 | $1.79 | – | $1.38 | $1.22 | $4.57 | $1.95 | – |

| Zestril | $17.35 | $423.00 | $81.56 | $3.46 | $12.77 | $1.73 | $15.37 | $6.47 | $4.34 | $38.99 |

| Viread | $21.17 | $1,329.44 | $151.45 | $245.63 | $12.77 | $16.02 | – | $735.93 | $292.46 | – |

https://www.statista.com/chart/27932/us-prescription-drug-prices-in-international-comparison/

https://www.newsweek.com/trump-tariff-surcharges-appear-receipts-2059132

Market chaos signals 'sell America' trade as Trump tariff whipsaw threatens to upend the US economy's soft landing

++++++++++++++

Trump tells us his tariff scheme will bring more investing to America. It's doing the polar opposite. Regardless of how much back tracking Trump does the rest of this year, you can no longer UNsee the jaw dropping ignorance of pathological thinking that defines his decision making.

+++++++++++++++

Bond market sell-off 'severe' as long-term yields notch biggest week since 1982

++++++++++++

The dollar has still been on the weak side but stabilized this week.

Bonds have recovered some buying interest which is a good sign

Bond yields falling, bond value going up.........a good thing.

https://tradingeconomics.com/united-states/government-bond-yield

US dollar looks sick. Bear flag on the verge of a downside break out.

Actually, on the longer term charts it's ALREADY broken out to the downside in a big way!

This could be why the grains are rallying!

1. 1 month

2. 1 year

3. 10 years

https://tradingeconomics.com/united-states/currency

https://www.newsweek.com/trump-tariffs-costing-households-5k-per-year-2061025

A group of top economists is circulating a letter that says Trump's tariffs have 'no basis in economic reality'

+++++++++++++++++

I explained why this can never work from the get go. Trump thinks he can violate Global Economics 101 with his delusional omnipotence and fake tariffs decree.

Previous threads:

Trump tables’ “Tariffs Charged to USA” not really that

7 responses |

Started by WxFollower - April 3, 2025, 2:54 p.m.

https://www.marketforum.com/forum/topic/110890/

Liberation Day

39 responses |

Started by mikempt - April 2, 2025, 8:19 a.m.

https://www.marketforum.com/forum/topic/110853/#110937

Hands off protesting

19 responses |

Started by metmike - April 5, 2025, 10:34 p.m.

https://www.marketforum.com/forum/topic/110958/

Re: Re: Re: Re: Re: Hands off protesting

By metmike - April 7, 2025, 11:12 a.m.

What Trump did is clearly in violation of the Constitution but even if he had this power, what he just did shows that he's not able to connect basic, global economic laws to the authentic realities and accept them.

1. Poor countries will ALWAYS have much lower production costs(especially labor). They will make and sell things much cheaper than rich countries. They will ALWAYS have much less money to buy things, especially higher priced things from rich countries.

2. Rich countries will always make things using much higher input costs (especially labor) and sell them at much higher prices. They will always have MUCH MORE money to buy things, including cheaply priced things from poor countries.

3. There are other factors too. A shortage of skilled labor workers in the US. Companies need to build or retrofit facilities, purchase equipment and invest in technology to compete with the advanced manufacturing capabilities of their overseas counterparts. This level of investment is risky, particularly in a volatile global economy.

4. These irrefutable global economic laws will always cause a trade imbalance between poor and rich countries in favor of the poor countries.

5. Which, as it turns out is not always a bad thing since it helps balance the great inequities between the rich and poor countries. Rich countries because they are rich can afford to pay more, along with all the other massive material world benefits they have surrounding them FROM THEIR OWN COUNTRIES. Poor countries don't have material world diddly squat, including money. They work extremely hard for dirt cheap labor prices to generate exports to rich countries just to survive.

Trump is abusing his power, trying to make this invalid. Insanely referring to the above, indisputable trade imbalances as "tariffs" and claiming that he will not only make them go away by decree, he will cause the manufacturing industries in the poor countries (that are there to take advantage of cheap production costs) come to the United States where we have very high production costs.

Complete lack of understanding in the most basic economic principles by Trump. Why should we give this any time to work?

Trusting in Trump is not going to make the impossible happen!

MM.....Trump tells us tariffs will bring new investment back.....And TDS and weeks since election and fewer since tariffs started tells us that your bias and TDS have given a second to cure a fifty year festering problem. Somebody once said Trump could cure cancer and the biased TDS crowd would say lynch that dictator and its getting closer to factual every day.

Hi mcfarm,

Happy Easter!

I give credit to Trump when he deserves it.

Curing cancer is possible but Trump doesn't need to do that for me to give him credit for accomplishments or good for America agenda.

These are just the 3 that I've mentioned over this weekend.

1. Trump is trying to end the war in Ukraine........which is why I voted for him How many people with TDS would vote for Trump?

2. Trump is fixing the illegal immigrant crisis.

3. Trump is bringing back sanity to the energy markets and busting the fake climate crisis agenda.

This one will NEVER be on the list:

4. Trumps tariffs

The reason why not is the same reason that pigs will never fly. The sun will never rise in the west. Gravity will always keep us on the ground and other indisputable laws. Trump just does not understand global economics and is selling a scheme that violates it. Go ahead and have unwavering trust in everything that Trump does but he is 1 million times more likely to cure cancer because THAT IS POSSIBLE.

We can't wait around to let this disastrous plan fail because the damage will have been done.

That so called "50 years of a festering problem" is not a problem at all.

It's called Global Economics 101! It's how basic global economics works. It always causes a trade imbalance between rich and poor countries.

I explained it again on the previous post.

It's impossible for poor countries to buy as much of our stuff as we buy of theirs. Where will their money come from???

It's impossible for us to make stuff as cheap as they do. Labor costs alone are several times higher and that will never change.

Free trade is good FOR EVERYONE. Poor countries can sell more stuff to us. We can get really good/cheap deals on all those products.

Tariffs hurt everyone. They lose sales, we pay out the wazoo for, not only stuff we make but also stuff they make.

Manufacturing is NOT all coming back here, tariffs or not. Manufacturing costs will still be much higher in the United States. Manufacturing companies are not all going to pack their overseas bags and come here for...........what? To pay much higher input costs producing everything???

The US is having a shrinking % of buying power compared to other countries and that will continue. Trump's really stupid plan is just taking us out quicker.

Causing the rest of the world to push hard to replace the US dollar, which is breaking out to the downside. Sell our bonds. It's more than just the stock market plunging. Everybody knows this..........except MAGA.

Almost everything about this plan is COUNTER productive.

The government will collect money from tariffs but it’s all American consumers paying for it. It’s mega, self imposed, intentional inflation.

Trump claims these natural, indisputable, global economics caused trade imbalances are tariffs or can be fixed by tariffs???

Maybe in the Trump-land world of make believe where he is smarter than everybody and makes decrees that abolish physical and economical principles and replaces them with Trump-land rules.

We live in the real world not Trump-land.

+++++

OK, I exaggerated a bit when comparing Trumps loony tariff plans failing with gravity to make the point but seriously, they will do much more damage than good by a wide margin and with very high confidence.

Bond yields spiked higher overnight but are back close to unchanged.

https://tradingeconomics.com/united-states/government-bond-yield

The Dollar resumed/continued it's Trump crash lower.

Clearly a downside break out at every time frame below.

1. 1 year

2. 10 years

This is probably supporting the grains with an expectation of increased exports with our products being cheaper because of the devalued currency.

https://tradingeconomics.com/united-states/currency