Changing it up today,buying some SPY options

Just got a terrible fill on the 4-17-25 (SPY) 545 call at $4.08, bought 5 calls

Thanks, Mike!

I imagine just about everybody buying options recently is getting "bad fills" and those selling options are getting "good fills" although volatility has tamed since earlier this month.

I don't trade this and don't know what the historical average price would be. Hopefully the stock markets will break out to the upside in the next 2 days(they are poised to do that) and your calls will pay off.

https://tradingeconomics.com/vix:ind

%20-%20Index%20Price%20Live%20Quote%20Historical%20Chart.png)

Again, I've never traded the stock market and only sold options a few times in the futures market but we can all learn some things about this type of trading.

tjc posts all the time about his long options trades.

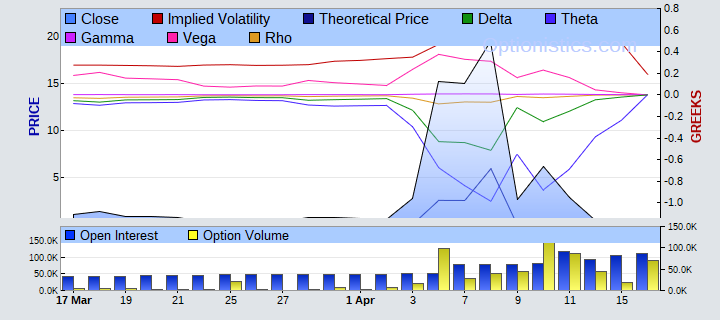

This site shows the history of these calls and doesn't appear to be updated with todays data. We should note, when the market was trading well above this strike price(5,450) before the April 2 crash lower and it was in the money, the value of the calls was greater by an amount of it being in the money at the time.

However, then the price crashed and these calls were out of the money and their value plunged BUT the volatility of the market increased greatly and this resulted in the premium for implied volatility going up(red line). So buyers of options were getting crappy prices historically as sellers demanded higher prices because of the added risk(volatility).

Note too at the bottom, that these calls had very little open interest and volume UNTIL they became out of the money and much cheaper. The last bar shows volume to be greater than 20K just for this strike price (when it barely showed up before April 2). OI has also been building. These options that Mike bought expire in 2 days.

https://www.optionistics.com/quotes/option-prices

%20Price%20History%20&%20Volatility%20Data.png)

https://www.stockoptionschannel.com/slideshows/seven-myths/cheap-options-less-risky/

Market volatility is settling back down so options are getting cheaper.

https://tradingeconomics.com/vix:ind

%20-%20Index%20Price%20Live%20Quote%20Historical%20Chart.png)

%20-%20Index%20Price%20Live%20Quote%20Historical%20Chart.png)

https://www.investopedia.com/articles/optioninvestor/05/020205.asp

Let's say an option expires IN THE MONEY, like the 500 call below. What value is left?

Only the intrinsic value. Everything else goes to 0. Somebody that bought a 500 call, has the right to be long at that price when the option expires. The owner, exercising that right has a LONG futures position worth whatever the market price is trading at after the option expires.

https://www.optionistics.com/quotes/option-prices

%20Price%20History%20%26%20Volatility%20Data.png)

Here's the 500 put that expired worthless, including no intrinsic value because the price at expiration was HIGHER than the put's strike price. (a put gives you the right to be short at that strike price upon expiration-if the market is trading higher than the strike price, than the intrinsic value is 0)