Key Points

Right after this was announced after Friday’s 4PM close, growth stocks fell 1%+ in after hours trading fwiw.

Thanks, Larry.

i noticed that and gold spiking up.

ADDED: Gold was already having a modest bounce from the early low but still closed lower again.

Did Moodys intentionally release the info after the market closed? Probably.

Some markets continue to be driven by news at times. It will be interesting the see how theses markets respond Early this week.

We have a power and cable outage(unrelated to weather) so I can’t post the charts showing this right now.

Here ya go, Larry!

By metmike - May 18, 2025, 3:07 p.m.

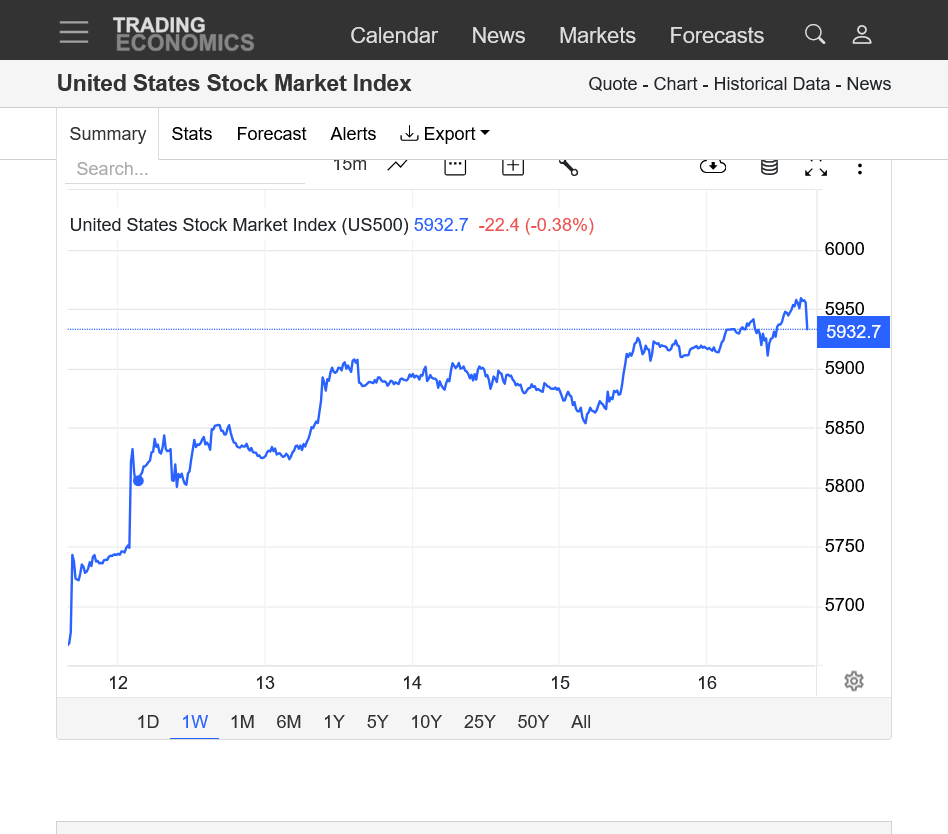

Moody's downgrade for US announced just before the 4pm close caused a small spike lower in the last hour:

https://tradingeconomics.com/united-states/stock-market

Stocks jumped Friday after the latest nonfarm payrolls data came in better than expected, easing concern the economy faces an imminent slowdown.

Those gains came after U.S. payrolls climbed 139,000 in May, the Bureau of Labor Statistics reported Friday, above the Dow Jones forecast of 125,000 for the month but less than the downwardly revised 147,000 in April. The unemployment rate was unchanged at 4.2%.

https://www.cnbc.com/amp/2025/06/05/stock-market-today-live-updates.html

MSFT is at new record high. Even Apple is up strongly. TSLA is up 15/~high of day, but that still pales in comparison to yesterday’s >40 point drop.

Thanks very much, Larry!

I'm getting increasingly concerned with numerous items related to the economy.

The biggest one is that the tariffs are already starting to increase prices which WILL increase inflation.

Another one is that when we have the revisions down in jobs, like this last one that are bigger than the increase it means this initial number is totally unreliable and since they are always much higher than it ends up being, it's being compiled by biased sources that are either incompetent or dishonest for obvious reasons.

Another one is that the stock market bubble is being fueled by massive money, almost like a Ponzi scheme that just keeps pouring it into companies that now have prices that greatly exceed the actual value of the companies.

At some point there will be a reckoning and the correction towards true valuation will be ugly. Until then, the trend has been and might still be our friend...........with INCREASING RISK because Trump's really bad decisions suggest the time frame will be while he is president.

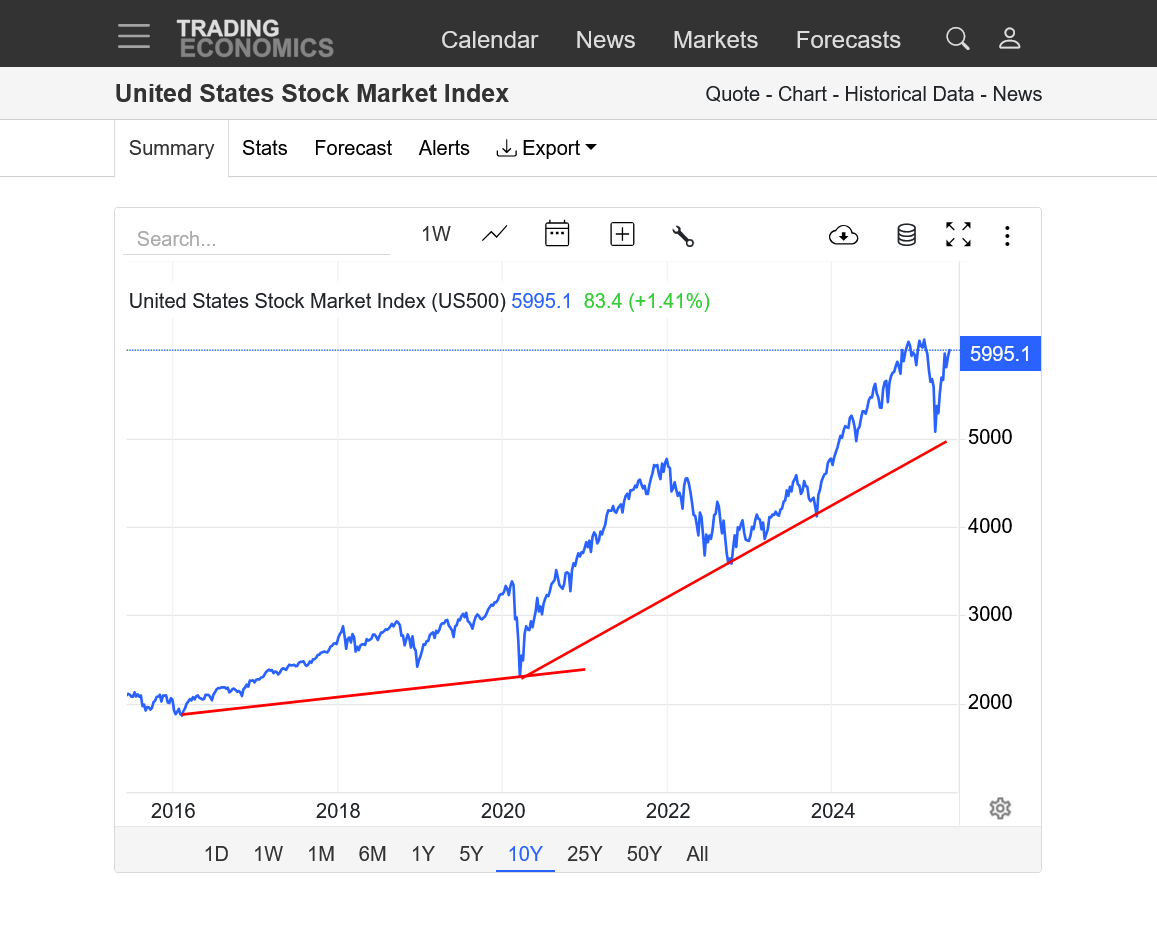

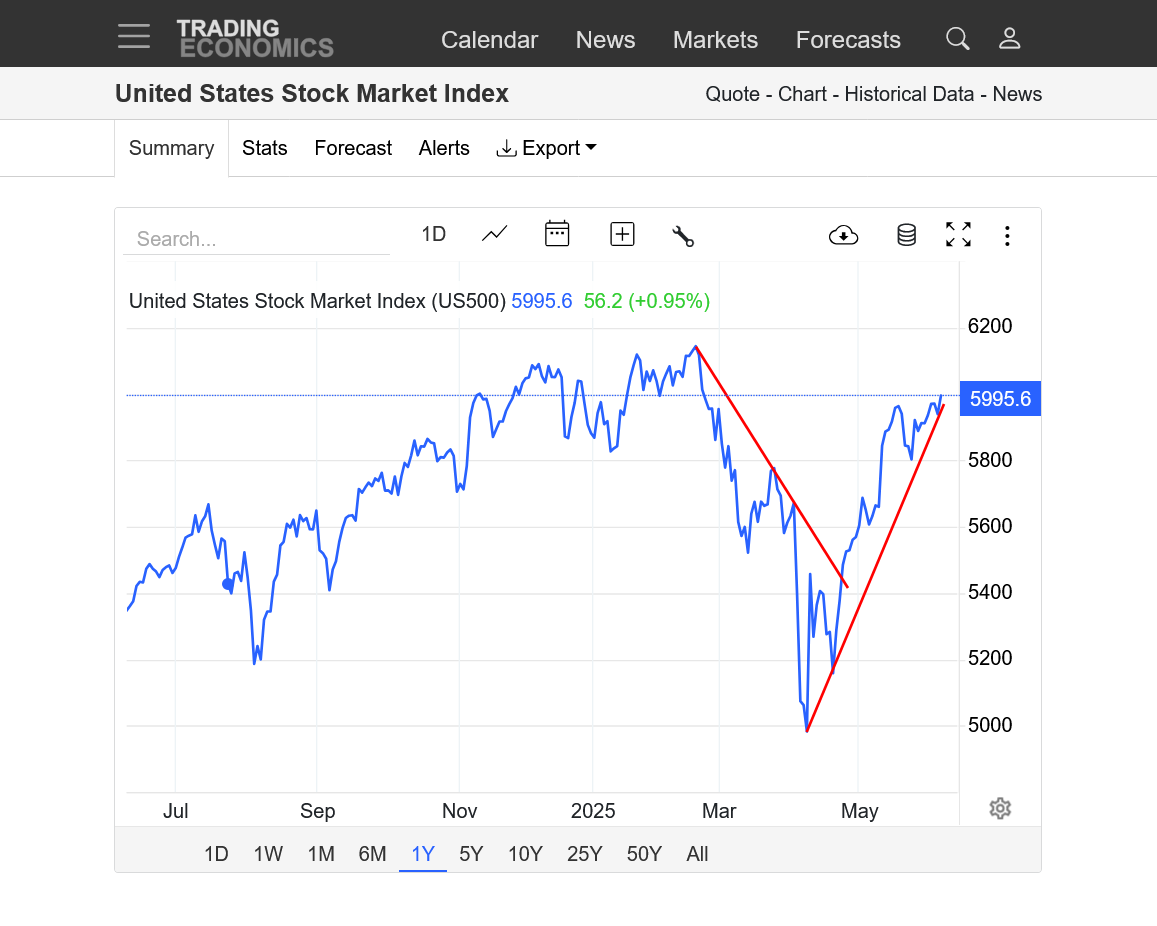

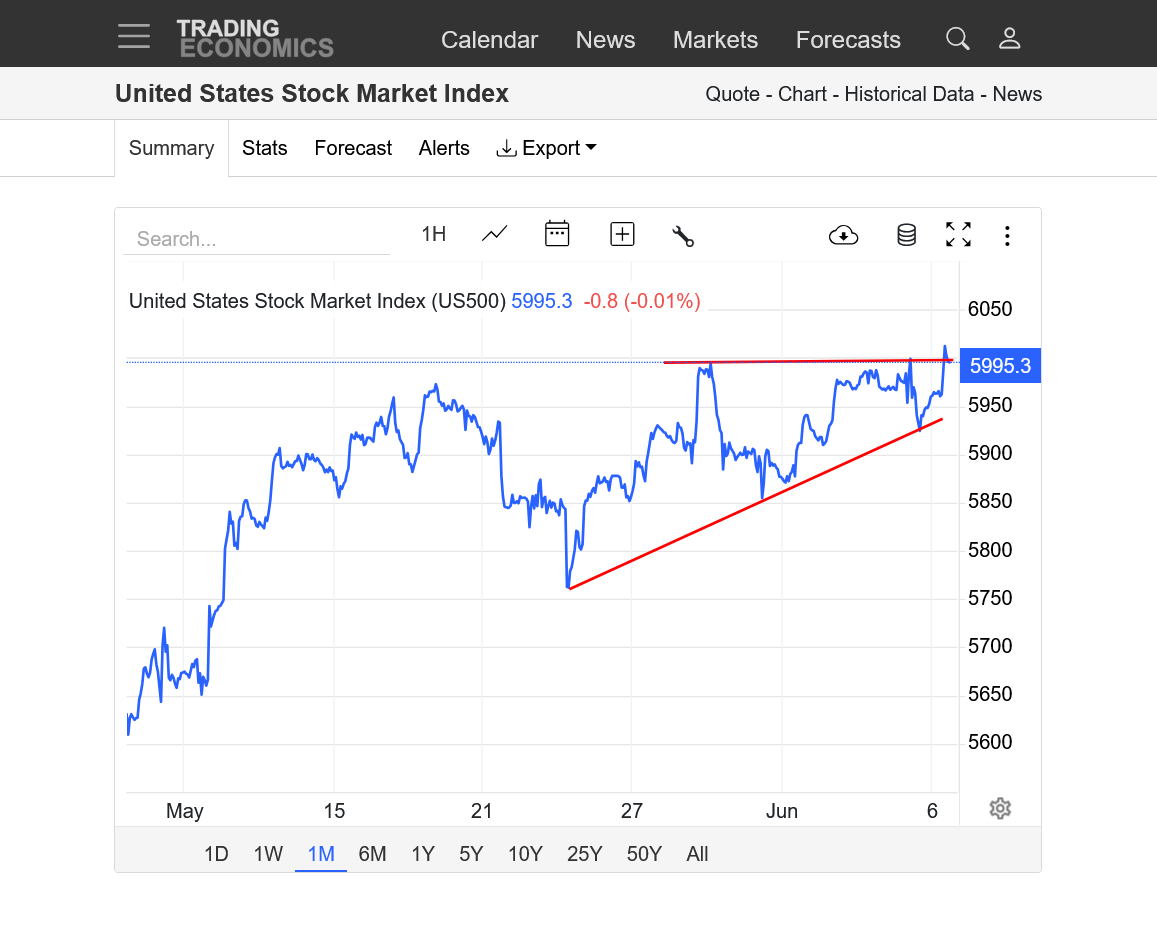

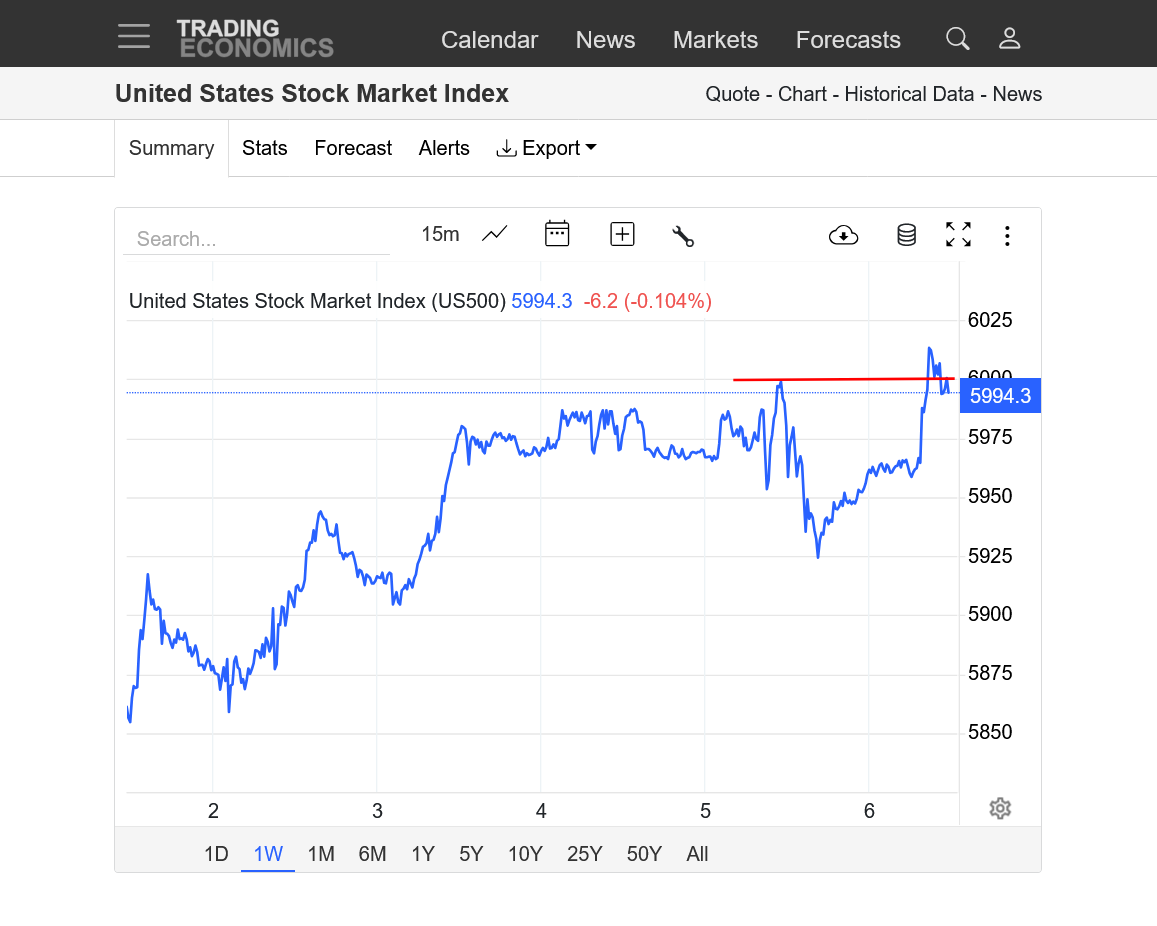

https://tradingeconomics.com/united-states/stock-market

1. 10 years-parabolic move with increasing slope of uptrend continues-approaching all time highs from Feb 2025-a failure looks like a double top

2. 1 year- steep uptrend since the tariff, spike lows in April-possible small bull flag/triangle-failing is a double top formation

3. 1 month-ascending triangle-potential upside break out-at resistance

4. 1 week-at resistance, potentially breaking out to the upside