https://www.cnn.com/2025/06/25/investing/us-dollar-decline-currency-markets

“The consensus out there is that US growth is slowing owing to uncertainty around Trump’s tariffs and other things,” Eichengreen said. “The weakness of the dollar may also reflect new doubts about the currency’s safe haven status.”

The dollar’s decline reflects a crisis of confidence in the United States, said Arun Sai, senior multi asset strategist at Pictet Asset Management. “If you cannot with certainty take a view on the position of the US administration, it’s hard to commit capital,” Sai said. “What we’ve seen with the current administration in the last few months is that this notion of the US being a default destination for global capital is being challenged.”

The Trump administration’s flip-flopping on tariffs has been “detrimental to confidence” in the US dollar, according to Sai.

https://tradingeconomics.com/united-states/currency

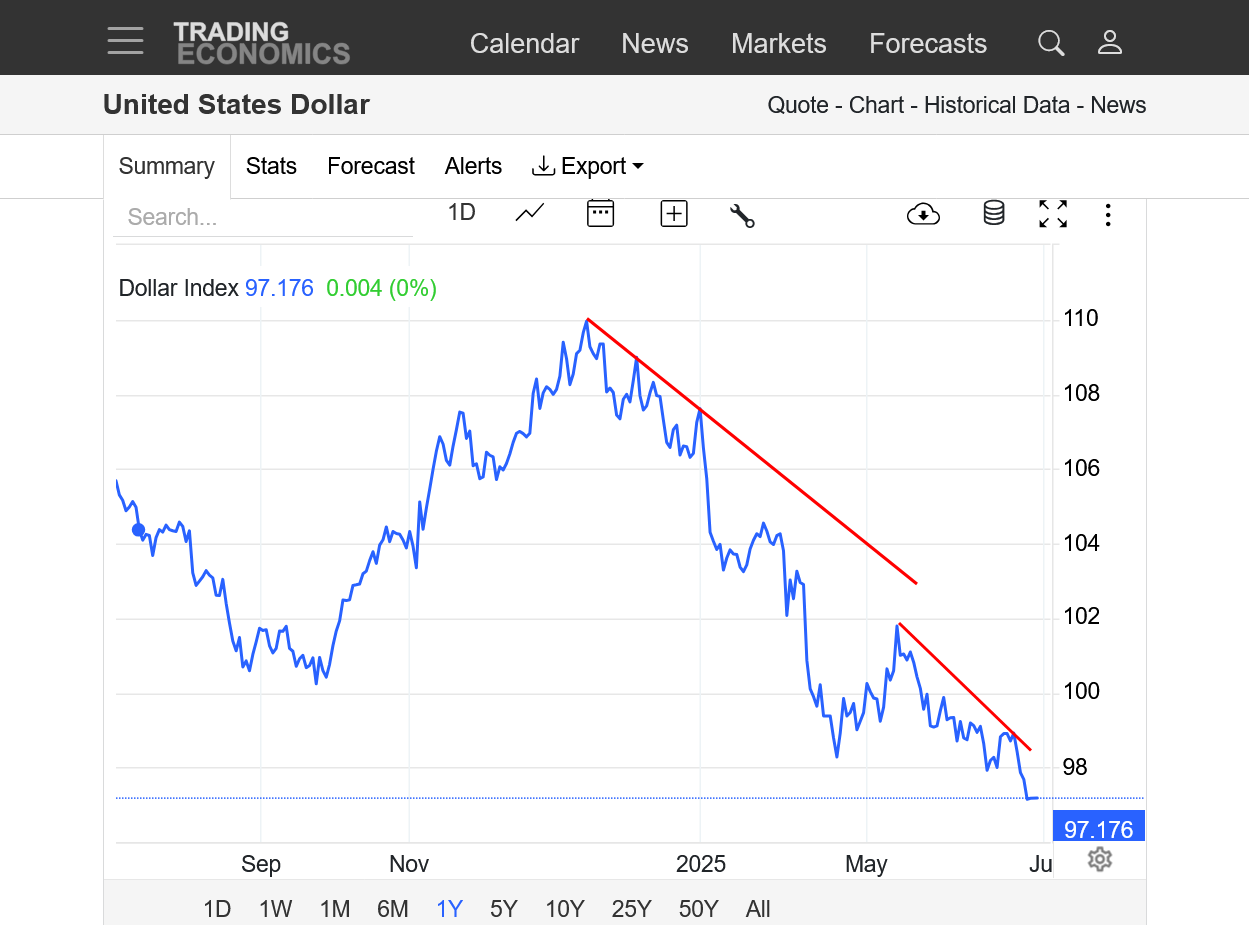

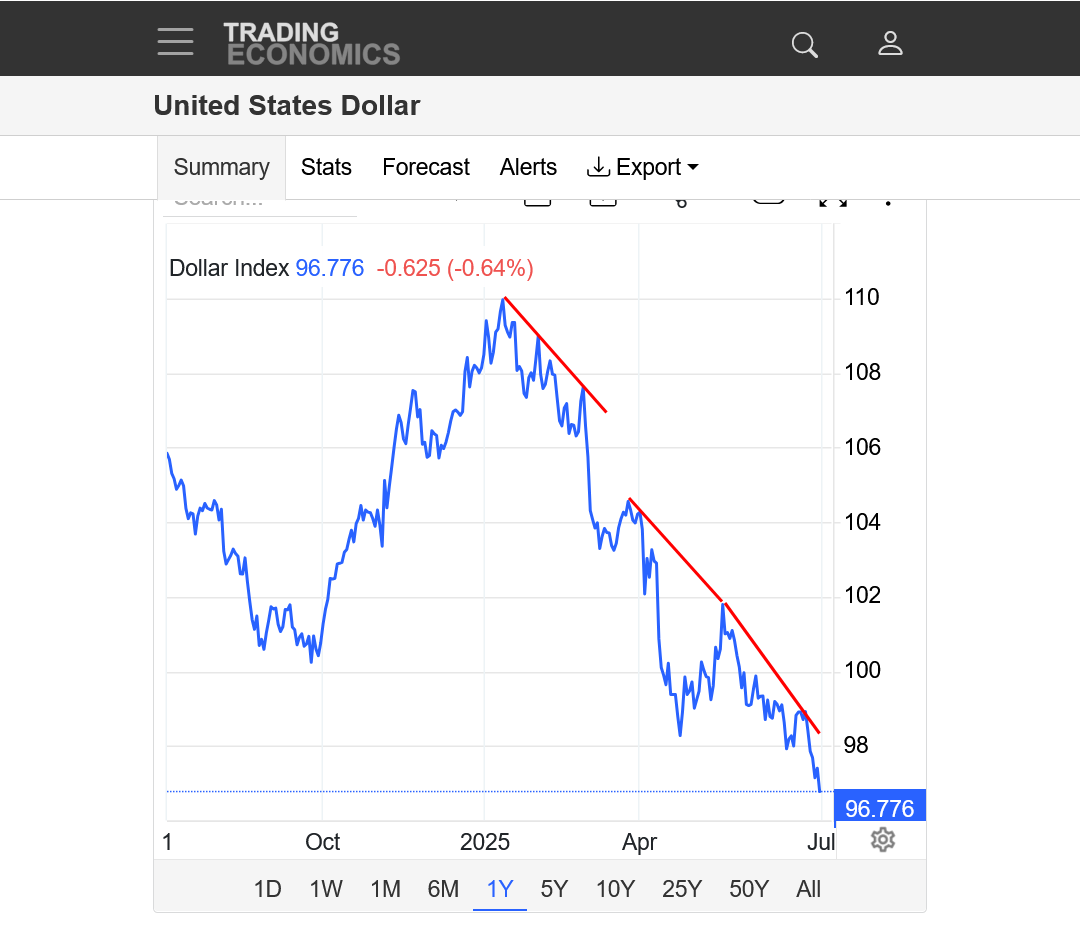

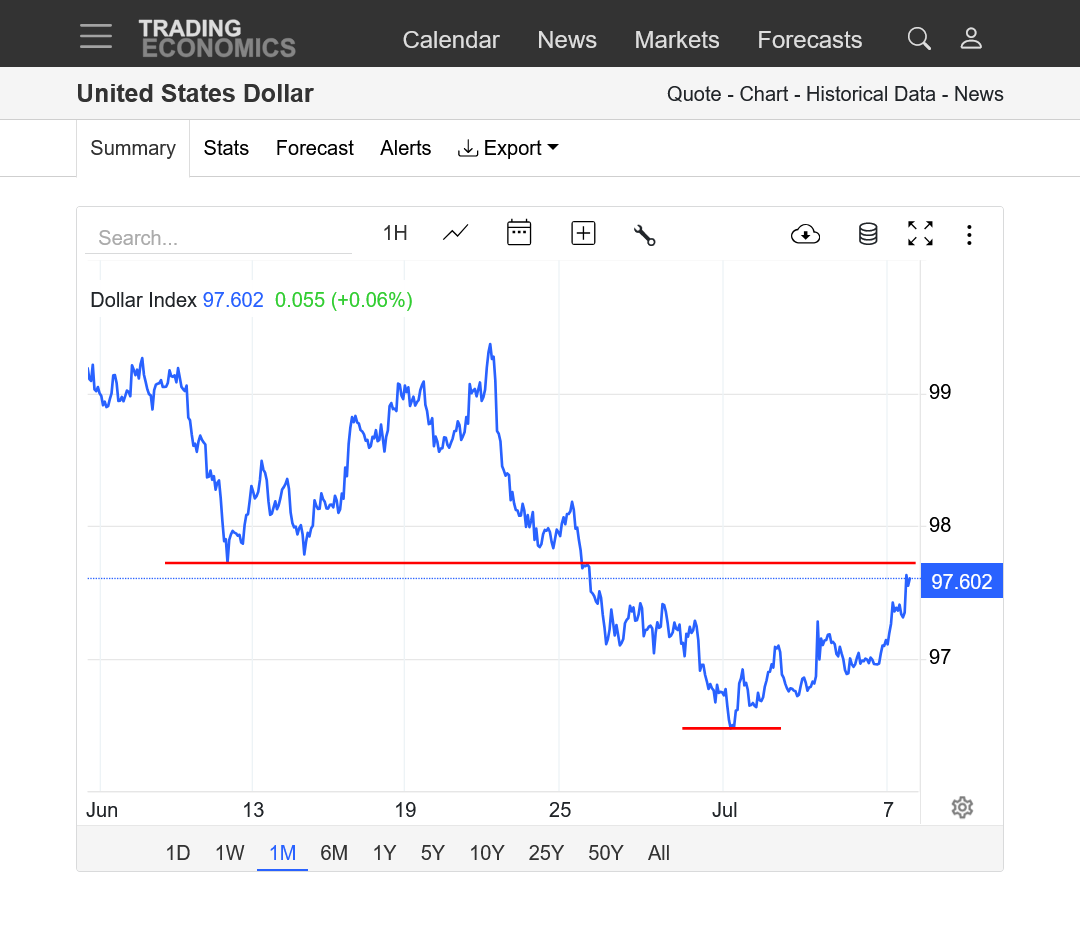

1. 6 months: (since Trump took office)-VERY strong downtrend. Dropping from 110 to 97 in a short period. Below the April low.

2. 1 year: Downside breakout below 100 AND below the April spike low. High of 110 in early January. Current price just above 97.

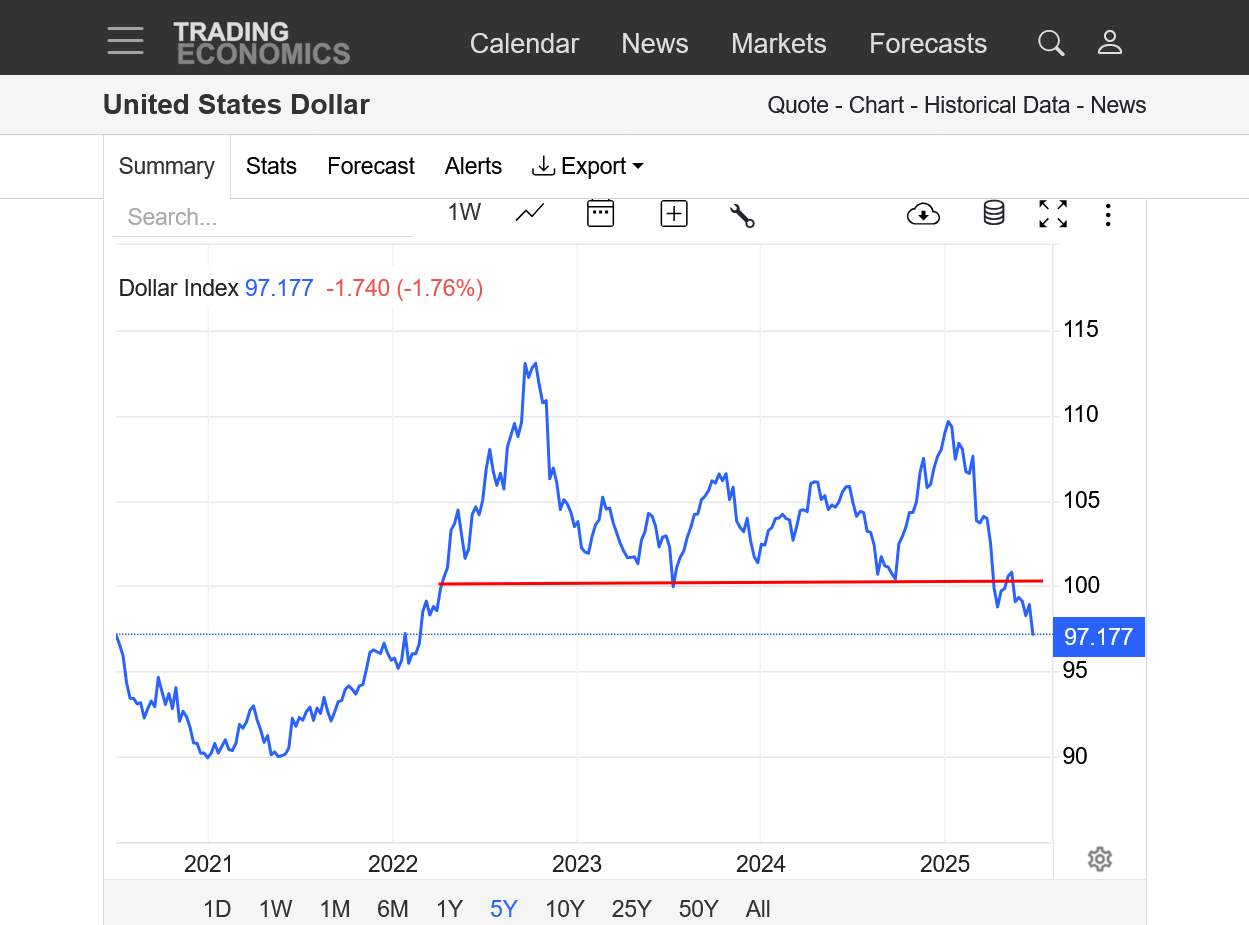

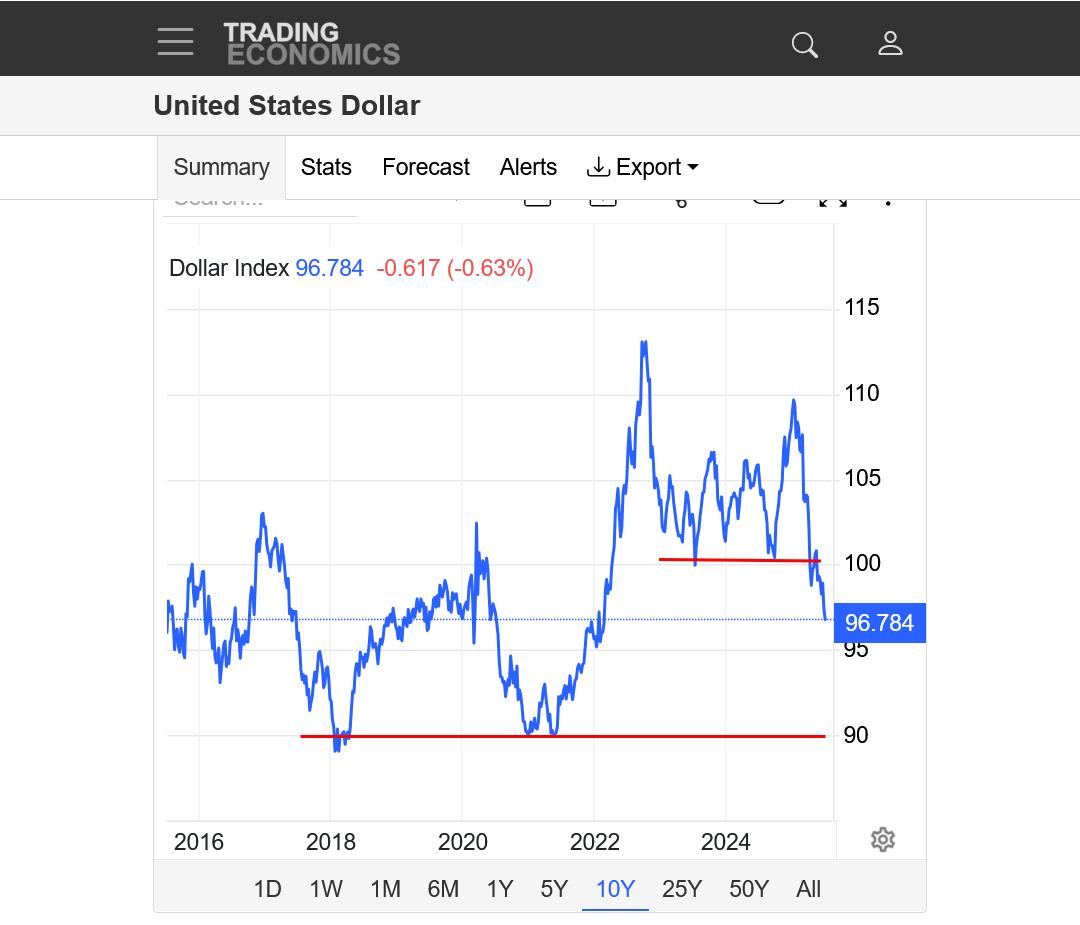

2. 10 years: Highs in 2022-113 Lower high Jan 2025-110. MEGA support 90! Will Trump's greatly flawed leadership cause the US dollar to drop that far???

Previous threads:

Analysis of the end of the petro $

Started by cutworm - July 23, 2024, 7:52 a.m.

https://www.marketforum.com/forum/topic/106138/

+++++++++++++++++

US Dollar

Started by metmike - Aug. 3, 2024, 6:08 p.m.

https://www.marketforum.com/forum/topic/106393/

China/France/US Dollar

Started by metmike - May 10, 2024, 8:39 a.m.

The world has lost confidence in US leadership. Biggest drop for the US dollar during the start(first 6 months) of a new administration in history.

https://tradingeconomics.com/commodity/natural-gas

1. 1 year-Fastest 6 month plunge in history!

2. 5 year-Downside break out this month! VERY strong dollar during early Biden years that hung on till the end(yes, that surprised me too)

3. 10 years-Downside break out below 100. Next MAJOR support is way down at 90, which came at the end of COVID 2020 and Trumps last year of his first term. The US dollar had its biggest/fastest rise at the start of a new administration during President Biden's first 18 months. Part of this was a relief from the chaos of Trump 1.

The dollar continues to crash to new lows for this historically fast drop lower.

https://tradingeconomics.com/united-states/currency

Late afternoon update:

https://tradingeconomics.com/united-states/currency

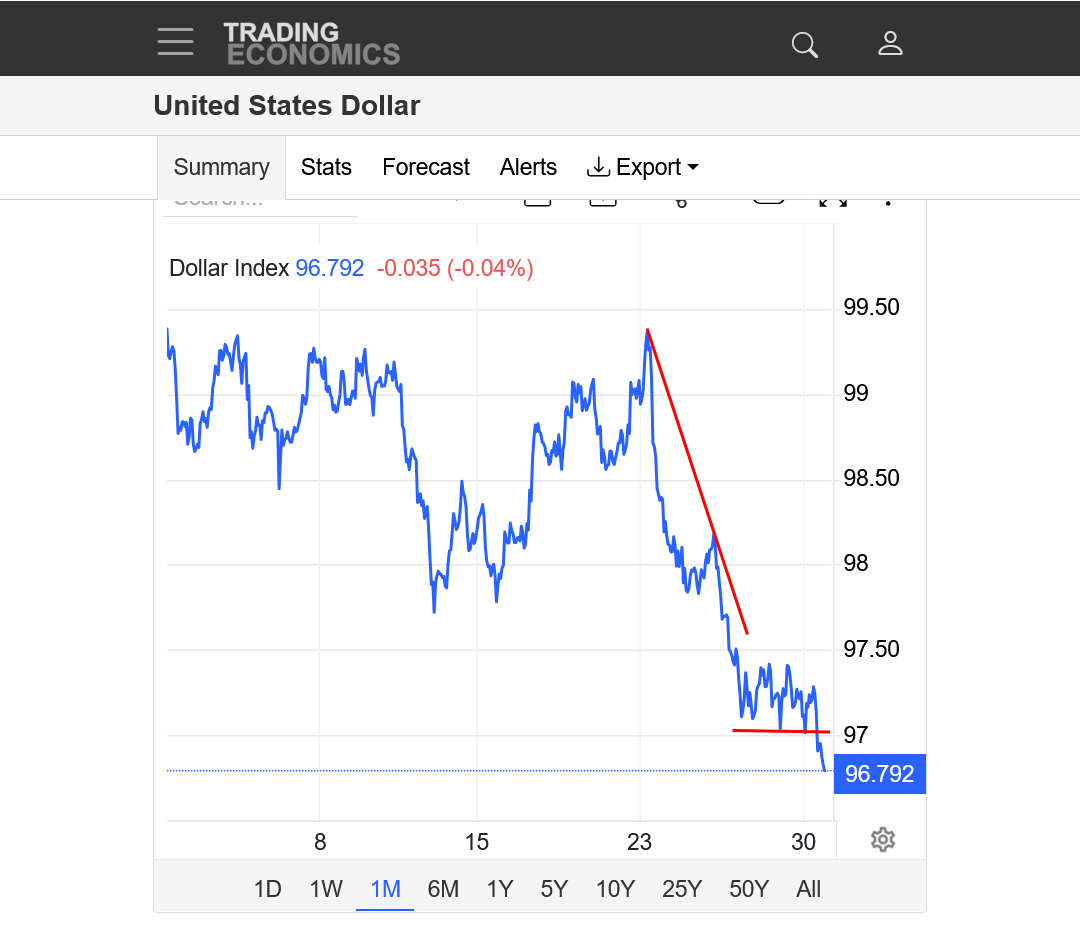

1. 1 month-New downside break out right now after a bear flag.

2. 1 year-historic plunge this year in just 6 months. Extremely steep slope of the downtrend.

3. 10 years-Huge downside break out below 100. Will we plunge all the way down to 90 and super-mega support???

" 1 year-Fastest 6-month plunge in history!"

Let's take another look from 1-17-25 to 6-27-25 the $ fell from 110.015 high to 96.605, a 13.41 drop in 23 weeks, or .58304/week average. (this is the second leg down in the current down trend)

from 9-30-22 to 2-3-23 the $ fell from 114.745 to 102.850 a drop of 11.895 in 18 weeks or an average of .66083/week. (this was the first leg down of the current down trend)

the longest fall of this magnitude was 1-31-2002 to 12-31-2004 when the $ fell from 120.800 to 80.480 a 40.32 drop in 96 weeks and .42 / week

*Numbers from continuous charts at https://futures.tradingcharts.com/chart/US/M

this fall while not complete is not the first time we have seen this. In my opinion there are many causes.

$36 trillion deficit

The deficit and the big bill $5 trillion budget deficit

the trade deficit. this is unsustainable.

BRIXS is another

Blame who you want but these problems have been going on for decades and may have reached a breaking point.

My approach to markets is to be nimble. I'm small but that is an advantage if I can be one of the first to get out of the theater when someone yells "fire". I'm mostly technically oriented. Fundamentals that I'm aware of are usually discounted. Once in a while (not often) I perceive something that I think is not discounted and I am willing to take a risk on it.

One example was in the first month of the pandemic when many were calling for shelter in place. For 2 or 3 weeks people complied. I would go out for a bike ride each day and I found it almost spooky that there were no cars on the road except for the occasional ambulance. Then, one day while out for a bike ride I noticed that there were more cars than usual on the road. Then it dawned on me. People aren't going to stay cooped up in their homes. Crude oil, which had gone negative previously was on the rebound. I should have bought crude. Instead I took a more conservative play. I bought Exxon. Trading around $32 / share, down from 100 the stock was yielding a 10% dividend at that depressed level. That worked out nicely. It was almost like I had gleaned inside information on my morning bike ride.

Why am I saying all of this in a thread about the US$? I'm not certain what the real fundamentals are for the US$ decline currently underway, as opposed to what the pundits are saying, which may or may not be the case. Is it anticipation of Fed rate cuts? Is is fiscal deficit expansion of "the big beautiful bill"? Is it growth scares from the upcoming tariffs?

I'm looking at the Spring of 2026. That is when the current term of Fed chairman Powell will be up. Trump calls him stupid for not cutting rates. But he won't fire him because if the economy does go south he can blame Powell. But I expect Trump to replace him with a loyalist (of course) next Spring who will do exactly what Trump wants which is to cut rates aggressively. (more aggressively than expected of Powell in the coming months). That will goose the economy short term but hurt the US$. This may be partly in the market with the current down trend. But I think it has a ways to go. Probably a low to be put in next Spring. (sell the rumor, buy the fact). Also, buy gold, which is hard to do at these high levels.

Every one of those are great points!

We can't keep going straight down without bounces. Maybe a buy the fact rally after the Big(NOT) Beautiful Bill is passed? Regardless, this is one market sending us some crystal clear messages about it's expectations for the United States in the coming months+ that include elements of cutworm and joj's comments.

https://tradingeconomics.com/united-states/currency

" 1 year-Fastest 6-month plunge in history!"

+++++++++++++++++++++

Thanks, cutworm,

I appreciate all the math and research but you confirmed the actual point that I was making. Your examples do apply to the quote above that you picked out but that wasn't the point that I was making.

Please use the point that I was making. I copied the ENTIRE quote from that page below that makes it historical.

Re: Re: US dollar getting crushed

By metmike - June 29, 2025, 7:49 p.m.

The world has lost confidence in US leadership. Biggest drop for the US dollar during the start(first 6 months) of a new administration in history.

https://tradingeconomics.com/commodity/natural-gas

1. 1 year-Fastest 6 month plunge in history!

Re: Re: US dollar getting crushed

joj,

Great job buying Exxon Mobile. At $32/share and the low for this stock, this was a brilliant deduction that you used for timing the entry point.

You more than tripled your money on that investment!

Ignore the Tesla at the top of this chart below. It's the 10 year chart for Exxon Mobile.

The confidence in leadership happened in other times. It could also be a lack of leadership in congress. This down trend started sept of 2022.

I would not call it being 'crushed' as we moved from rare highs to a normal trading range. looking at a chart 1985 to present it looks to me that we spent a large amount of time below this current price.

Let me say it is a down trend where it may end I have no idea.

Thanks very much cutworm!

I just make observations, do objective analysis, then try to explain likely reasons, especially the most obvious ones. This is almost entirely rooted in authentic facts, but I do speculate at times.

When it comes to the drop in the confidence in the dollar, for sure there will be speculation, with you and joj adding some insightful thoughts.

I don't affiliate strongly with either party and politics never impacts my thinking, although both parties think that must be it when my analysis disagrees with their party.

There is just 1 party(almost entirely 1 authoritarian person) controlling everything in our country right now, so my analysis is going to be almost entirely about that persons role in stating whether the policies are good or whether they are bad for America and the world.

Again, as you know from me mentioning it a dozen times here, I voted for President Trump last November.

And I will tell you something else. I decided to vote straight Republican ticket last November. Every R got my vote in every race. Much of this was tied to my outrage over the D leadership during the Biden/Harris tenure.

I haven't decided whether to vote the complete opposite in the next election yet because its still early but that's what I would do if the election were held today!

Obviously not because I affiliate with that party( since I voted 100% against every D in 2024) its BASED ON PERFORMANCE!

Elon Musk is a great charlatan who specializes in marketing himself and exploiting circumstances for his advantage. A master opportunist.........who has made some big blunders in the last year.

However, his huge flip from supporting Trump/Rs to opposing them on the One Big(NOT) Beautiful Bill, which seems flippant and a betrayal to Republicans is something that I solidly support and for his exact reasoning.

Musk may be partly motivated by the cuts in his government subsidies but he has the right position for America. Our current leader, crystal clearly does not.

Sorry for the politics even though they are extremely relevant right now.

MY TWO CENTS:

The dollar is in its 40th week since its last weekly cycle low, a time frame for a LOW.

The dollar, to me, appears to have put in a daily cycle low Tuesday (yesterday), 36 days from its last daily cycle low on May 26. (Daily cycle could extend into next week)

Time to get long!

Thanks much, tjc!

After the biggest 6 month drop at the start of a new administration in history, one would think that this is not sustainable indefinitely and there are usually short covering rallies, even in the steepest downtrends.

News is a big driver for this market though. Unlike things that are grown, like corn and beans that are physical products that can trade mainly on fundamentals of supply/demand.........or natural gas this is pumped out of the ground and used up to heat and cool homes...............the US Dollar trades off of things that are not so tangible.

I never traded the DX and am just having fun analyzing it and sharing the analysis with like minded traders......who are sharing some of THEIR great thoughts too in this thread.

https://tradingeconomics.com/united-states/currency

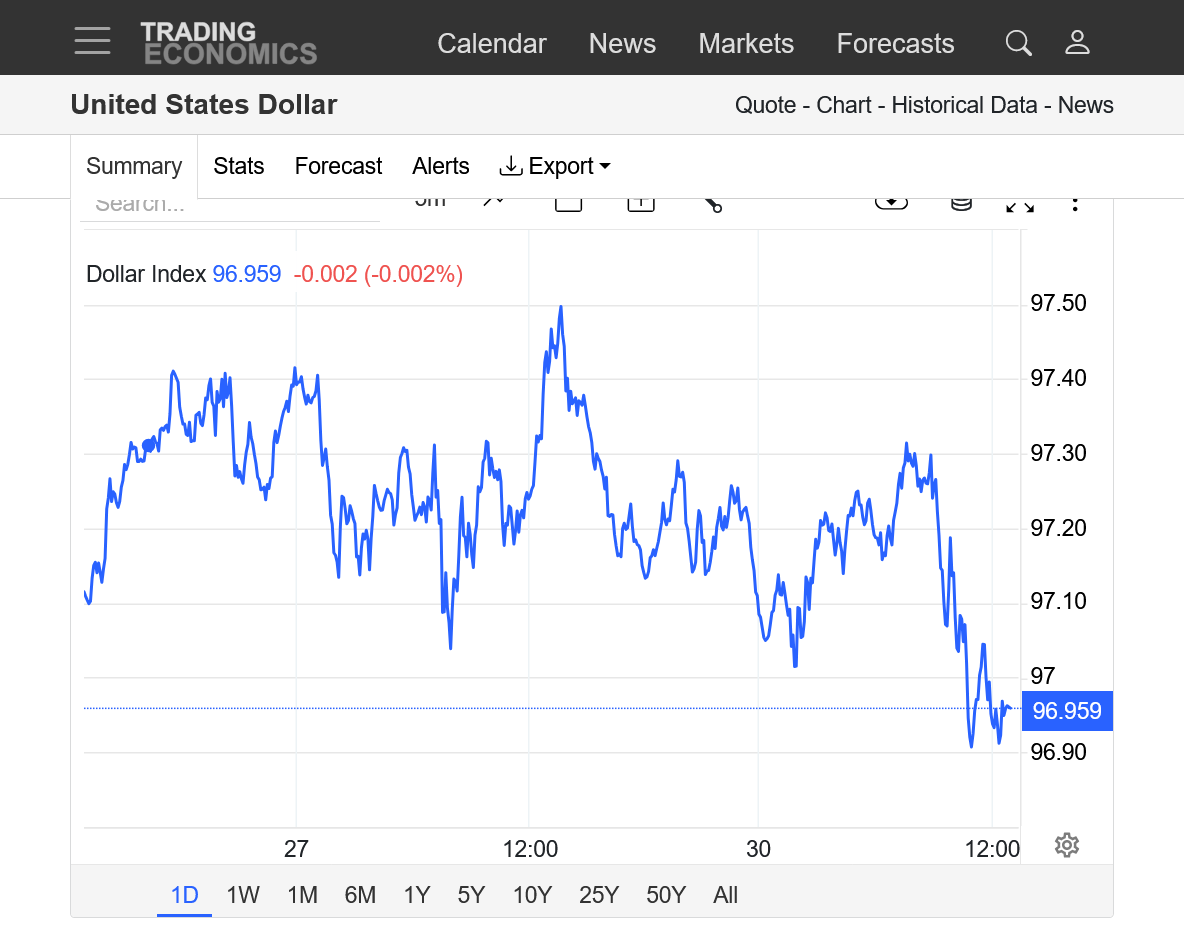

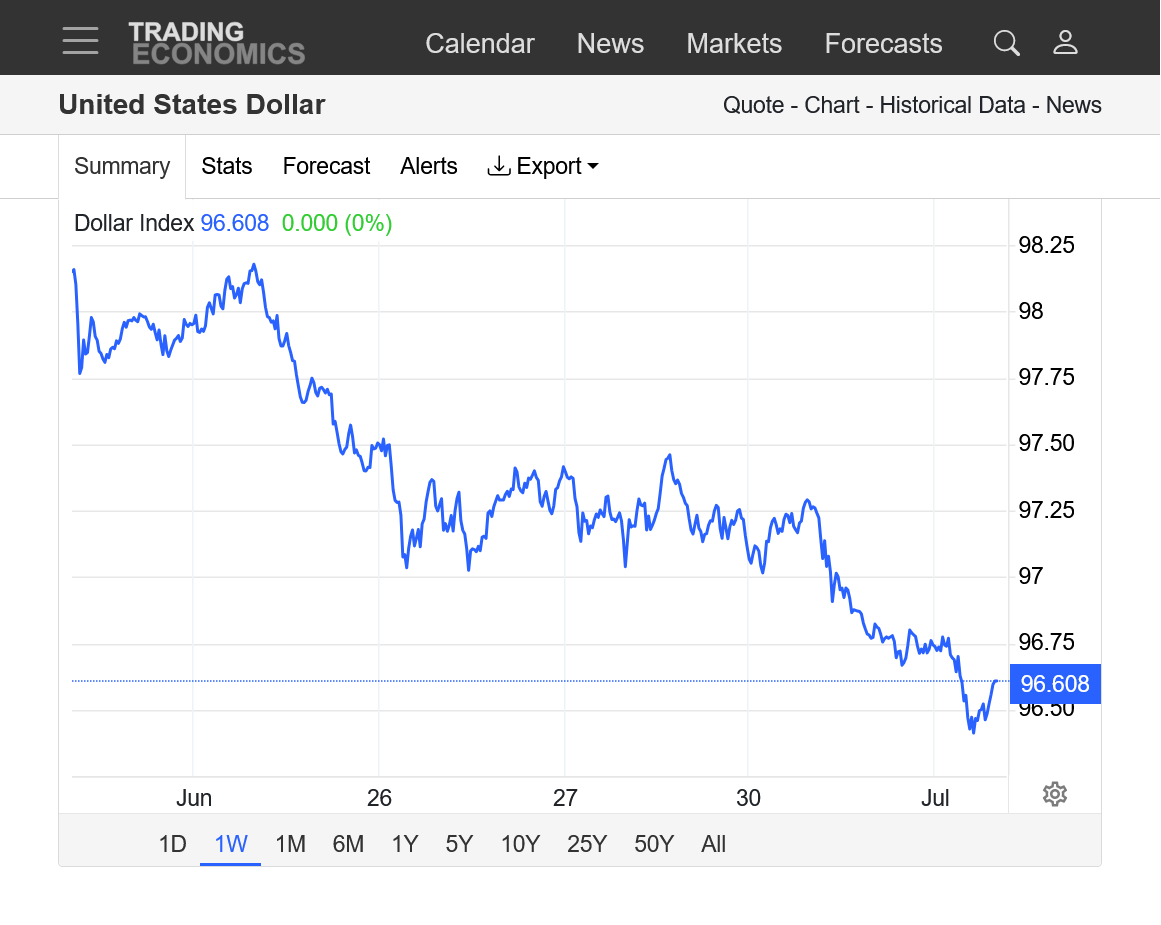

1, 1 week-Is this, at least a short term bottom?

2. 6 months since Trump took over. I drew some support lines that marked the VERY BRIEF opportunities for traders to try to make money from the long side.

Traders who stayed short made a killing. The trend is your friend!

However, I'm just like you tjc. I look for way overdone markets(that trade weather) to pick bottoms and tops(based on weather pattern changes).

Short term, spike low on July 1st. Good call tjc. Dead cat bounce or major low?

Approaching some modest resistance here on the 1 month chart(previous lows).

https://tradingeconomics.com/united-states/currency

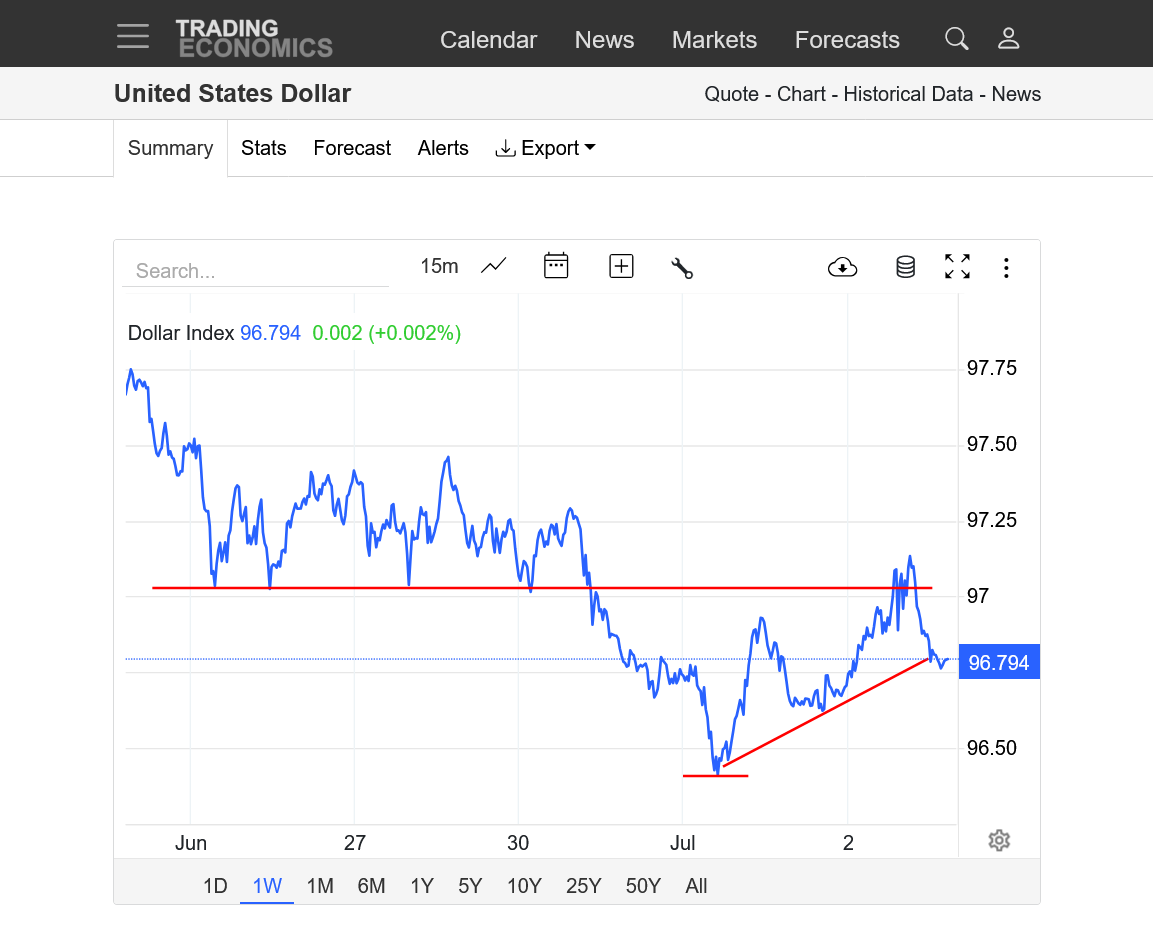

Very interesting place short term for DX right here.

Clear bottom on July 1st after the market had a selling exhaustion, that tjc called, followed by well defined up trend/channel but now facing some key resistance(previously violated key support).

Was this a MAJOR low or is it another bear flag? A bear flag is a trend CONTINUATION formation.

Like usual, potential/speculative chart signatures need time to mature in order to turn into realities/confirmations.

This is the price over the last month.

https://tradingeconomics.com/united-states/currency

Buy dollar on a dip tonight/tomorrow (or sell yen and BP

At 9pm cst, not sure a dip occurs. Bought 9746

Good luck, tjc!

Do you have exit strategies? Risk/profits?

Are we breaking out to the upside here above some strong resistance(previous support)? Or is this a bear flag?

https://tradingeconomics.com/united-states/currency

Yesterday evening around 8-8:30 the majors spiked down and the dollar ,a little less, rallied.

Cant find any reason why an acute move like that would have happened.

I thought another war had broken out or new major tariff news was released!???

Anyone have a clue?

John

Hi John,

That's exactly when the Asian markets open(8pm CDT). Their open often features some volatility in the global/US markets.

Not sure if that was it for sure but the timing suggests it.

Good point Mike but a move like I saw would need a catalyst also.

Hmmmmmmmmmmmmm

Or it could just be a fat finger or "the markets" in general!

Thanks, John,

I agree. I'm sure there WAS a catalyst, as there is for most market moves. The same catalyst that gets all dialed in at once when a closed market opens as opposed to getting gradually dialed in when those markets are open.

I don't know what the news was but it doesn't seem to have any BIG follow thru, unless I'm missing something.

DX closing on the highs for the week......VERY STRONG and on the verge of an upside break out. However, there is some hefty selling here at resistance/previous support thats keeping the market from fulfilling its POTENTIAL upside breakout chart formation.

Will we gap higher on Sunday Night?

This can still end up being a bear flag.

Was not a gap up, but firmed throughout the night. I was 'fairly' confident of dollar strength by the 'appearance' of foreign currencies chart closing at/near weekly lows. Just getting started.

Buy $, sell Pound

Thanks, tjc!

Dollar is struggling up here. I redrew the resistance level. We still have a solid bottom on the chart and a short term uptrend.

The biggest wild card is another surprise, deranged tweet or message from the loose cannon, most powerful man in the world, who is jerking around markets to feed his galaxy sized ego.

https://tradingeconomics.com/united-states/currency

1. 1 day

2. 1 month. I redrew the resistance zone as we appear to be encountering increased selling up here.

3. I've never traded the DX before, so consider any analysis to be from such a person.

DX is having a HUGE day up!

Congrats tjc on great analysis, call and sharing the trade in real time with us. I’ll post a chart when back home on the computer late today.

5pm:

https://tradingeconomics.com/united-states/currency

1. 1 month- Significant selling exhaustion Low on July 1, called by tjc. Steady move up, then spike higher, decisive break out today.

2. 1 year-main trend still strongly down although we broke up thru the accelerated version of the most recent downtrend line. Downside break out below 100

3. 10 years-Downside break out below 100.

FYI

Looking to cover tomorrow

Thanks and congrats, tjc!!

OUT Will reload next week

Great trading tjc. Thanks for sharing!

Time to re-enter long $

Good luck, tjc!

I've never traded the DX. The chart suggests this was a bear flag which is a continuation pattern of the prevailing trend which is DOWN. All this bounce did was test previous broken support, now resistance and it failed, now we're going lower again with the very strong downtrend.

This COULD be a bottom too. Charts only tell us what has already happened, which does have some predictive power based on market reactions in the past. This one, applying the "trend is your friend" is saying lower prices.

Probably some support at the lows from earlier this month.

https://tradingeconomics.com/united-states/currency

Dollar long benefitting from Sunday announcements. Stop RAISED

Yes, thanks tjc!

This is definitely a news driven market!