Thanks very much, cutworm!

That's exactly what I suspected but couldn't find anything at the time.

A person needs to be following Truth Social to get the latest market impacting Trump Tirade.

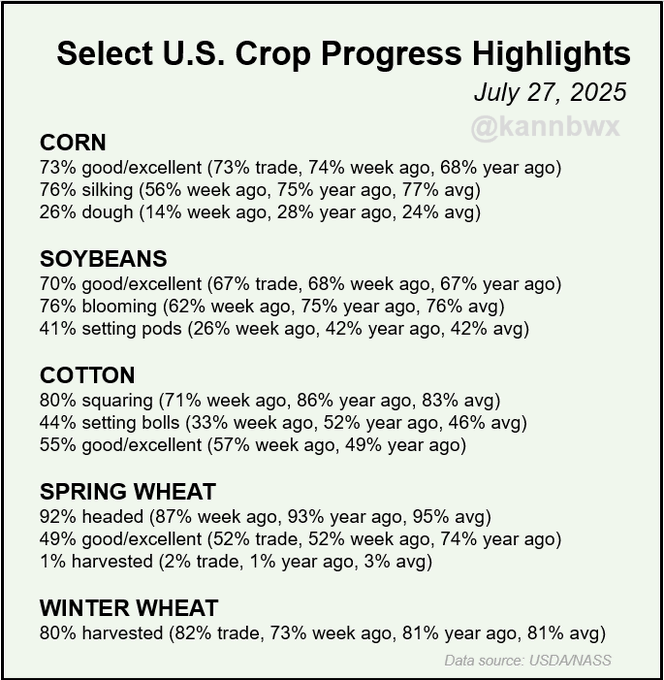

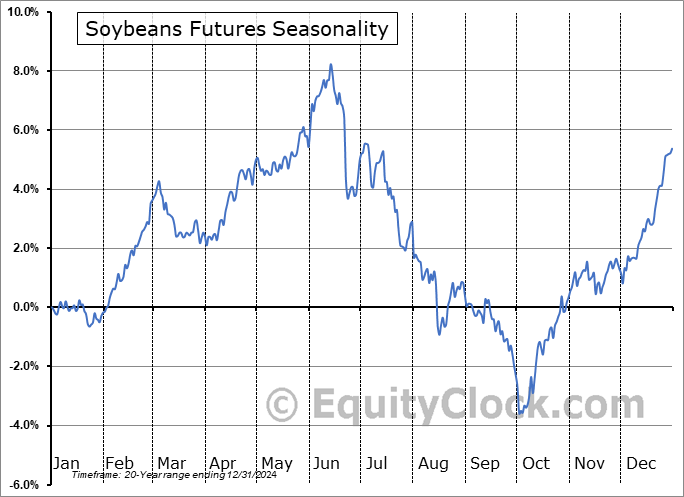

Trump pushes China to quadruple soybean orders ahead of truce tariff expiration

https://thehill.com/business/5445836-trump-china-trade-deficit/

++++++++++++++++++++

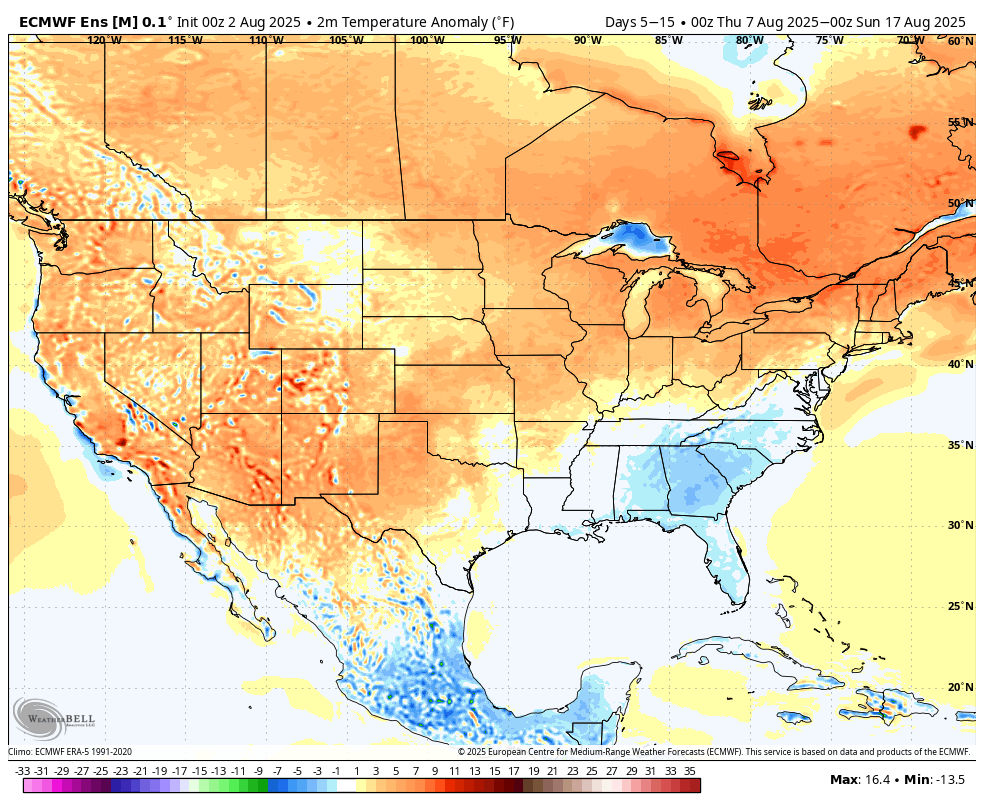

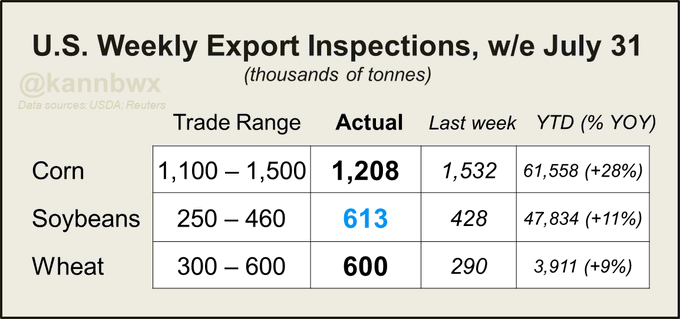

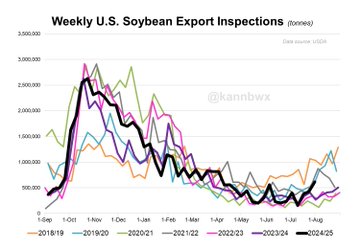

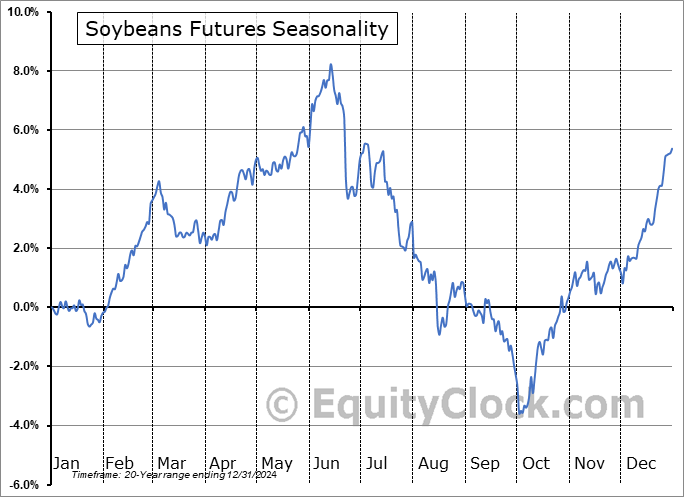

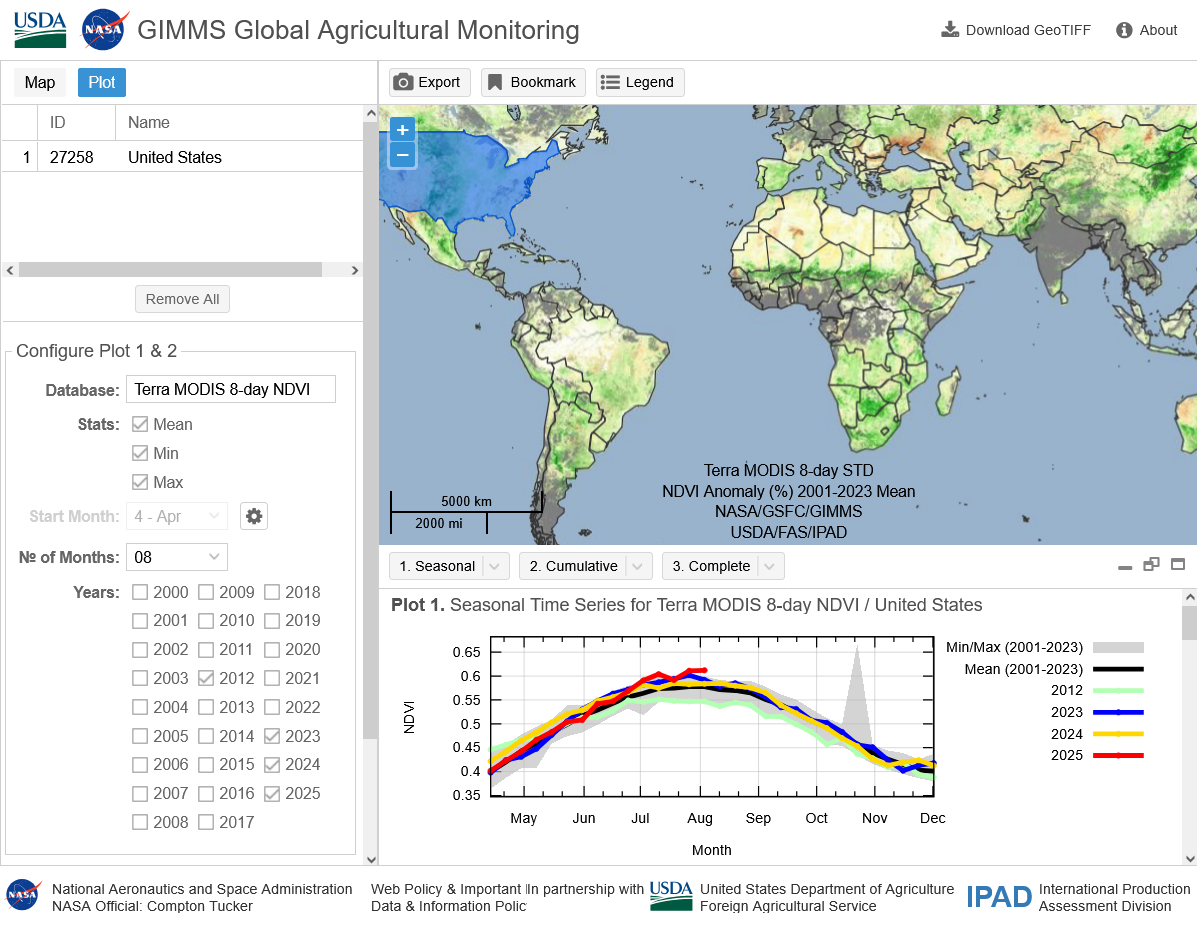

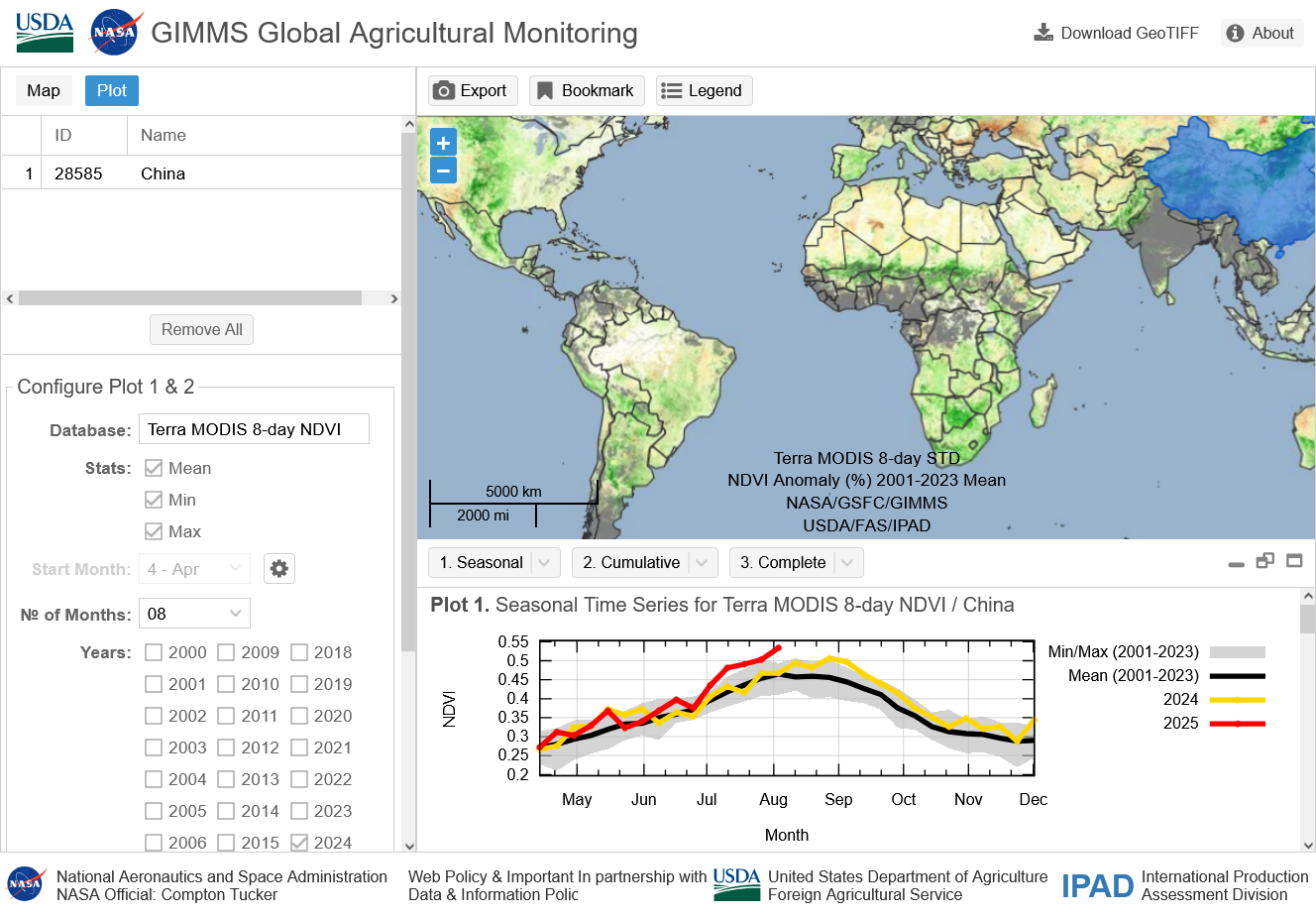

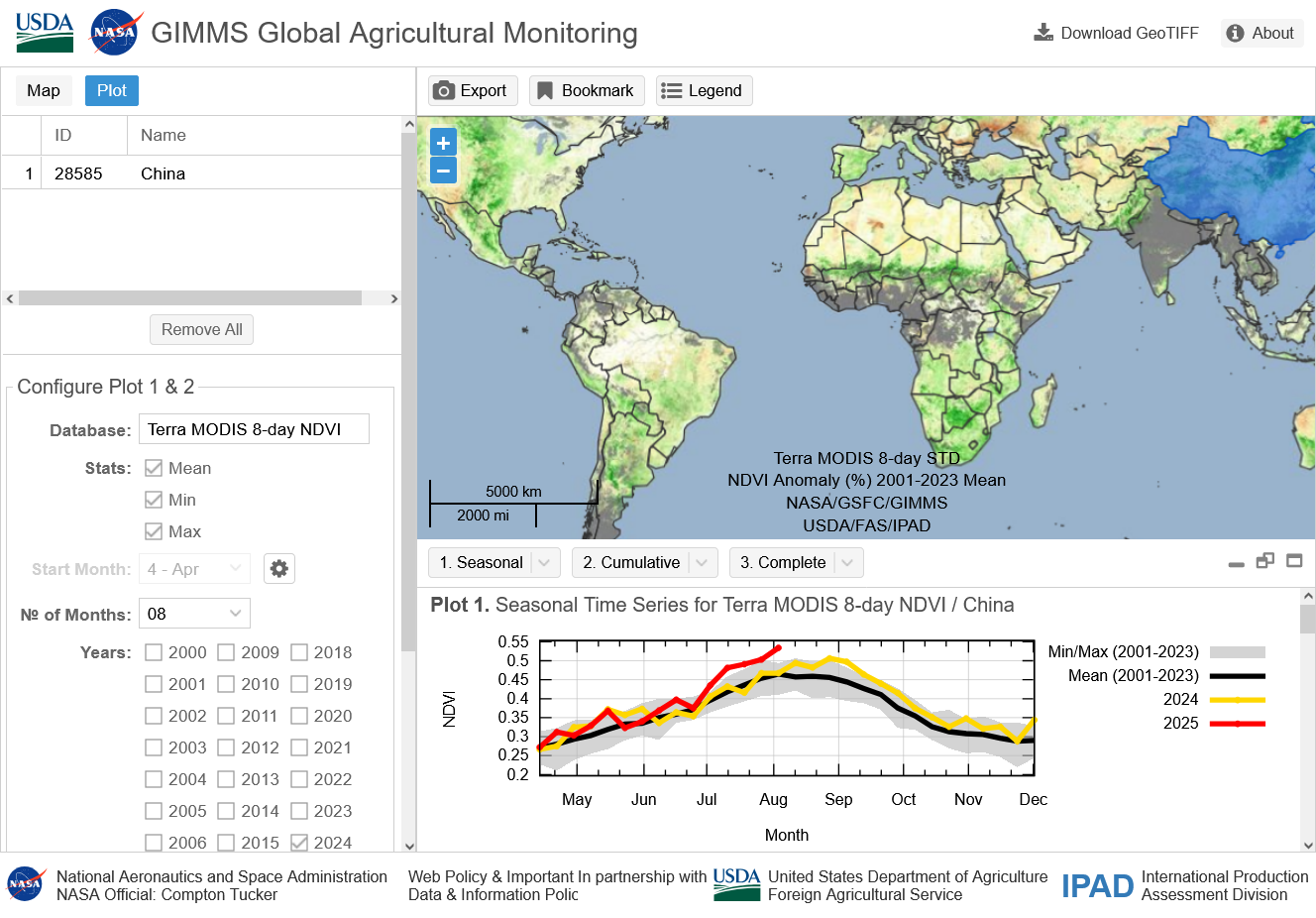

Ironic that as the damage mounts from Trump's disastrous tariffs policies, he KNOWS that this is why China(our number 1 buyer) has bought 0.....ZERO soybeans for many months because of them.

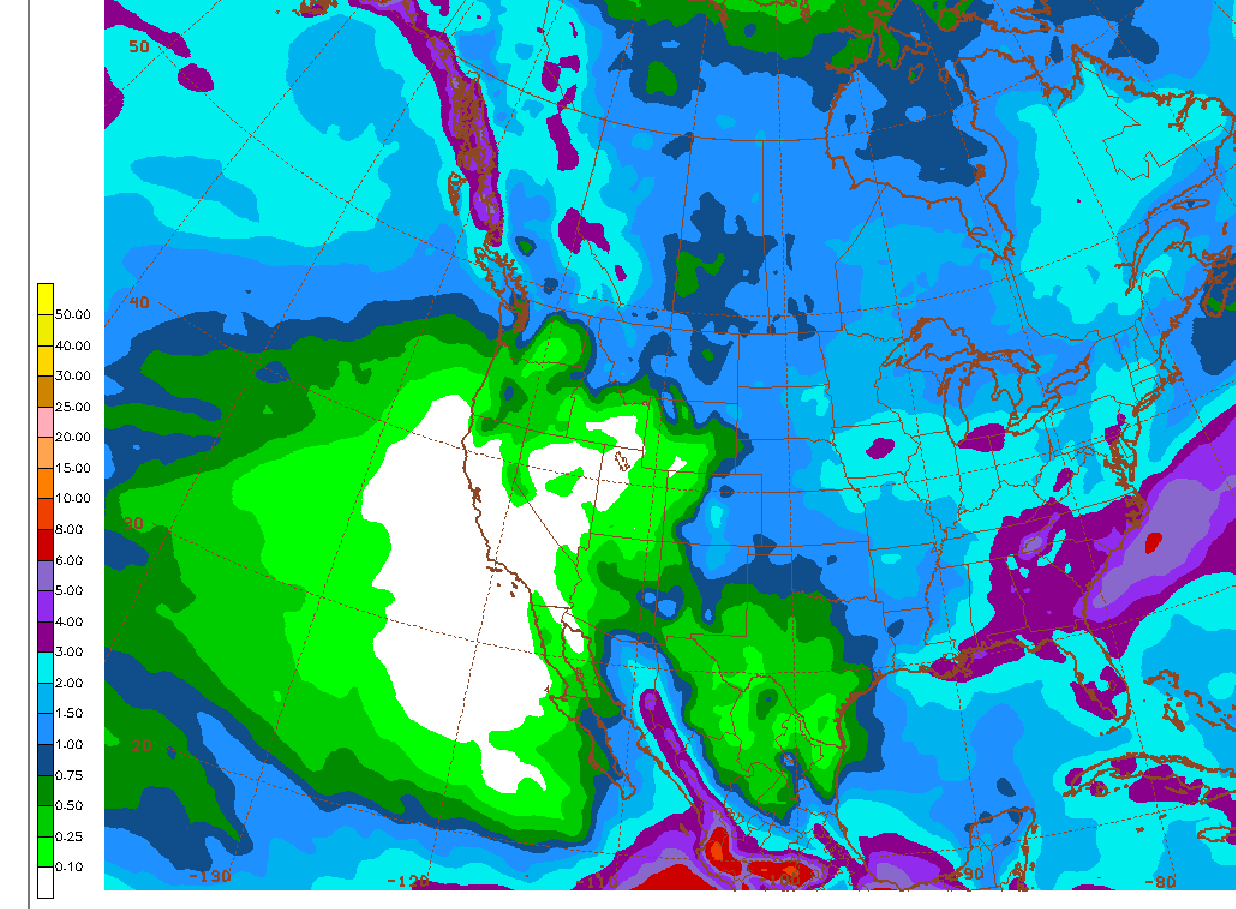

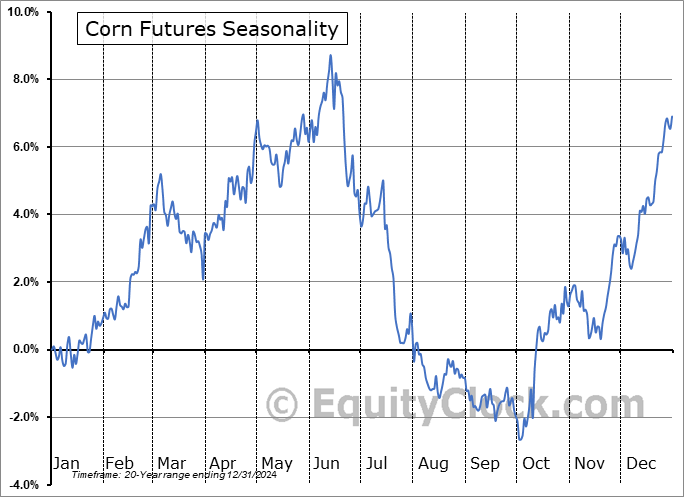

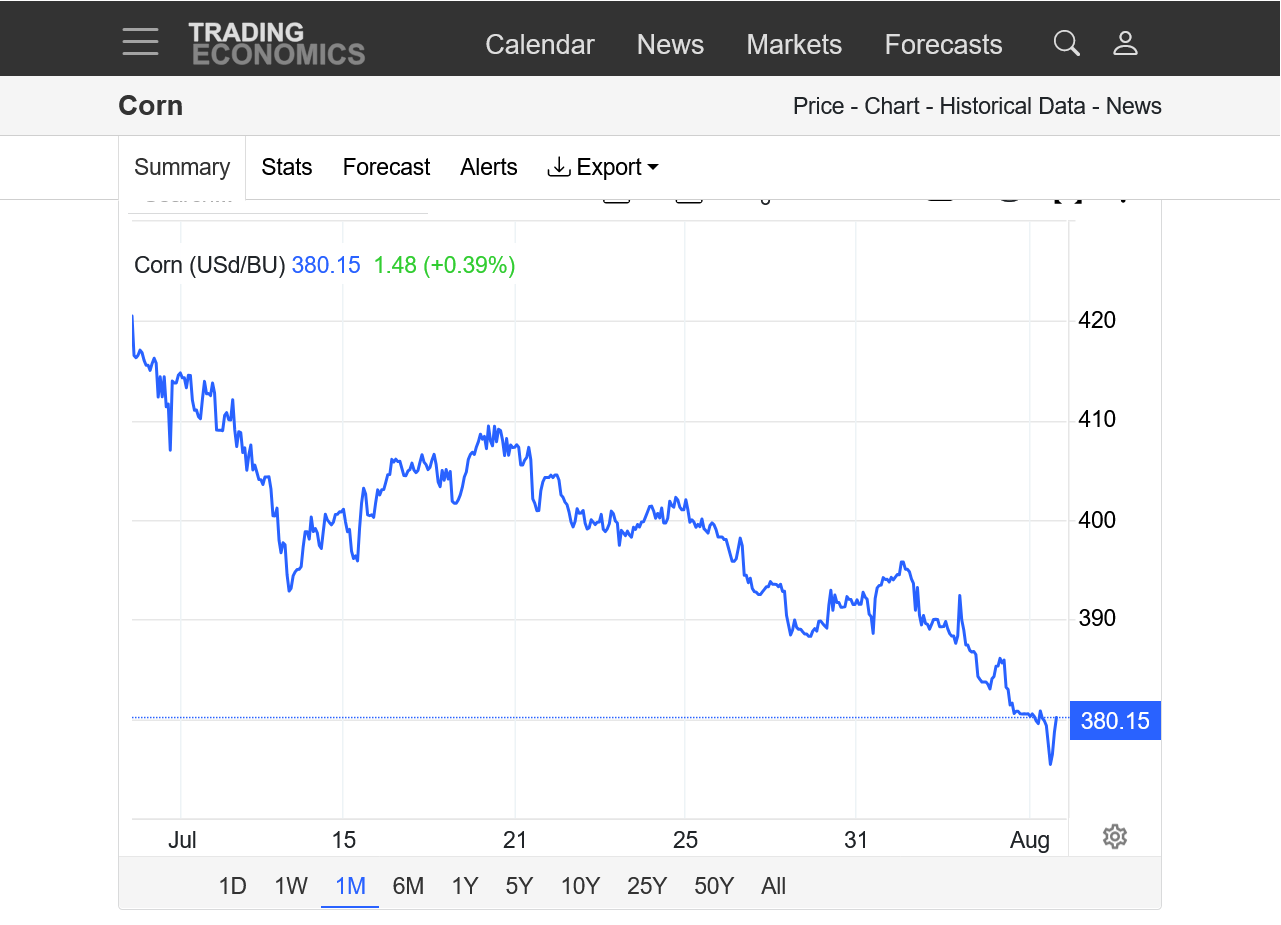

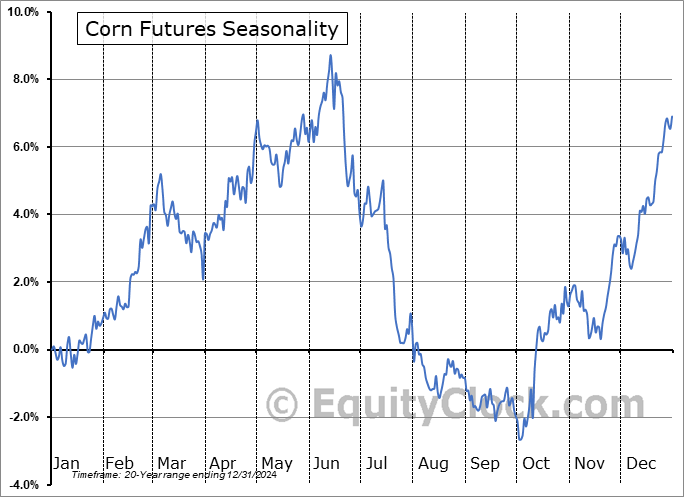

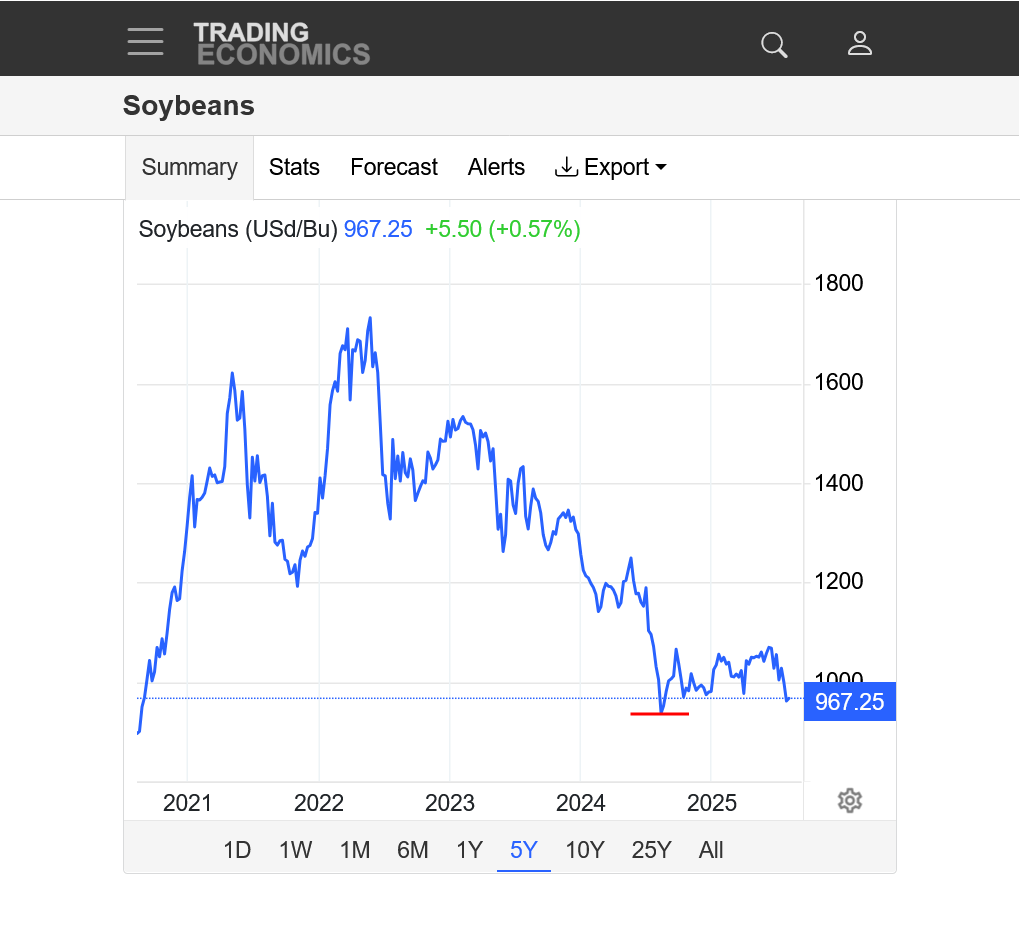

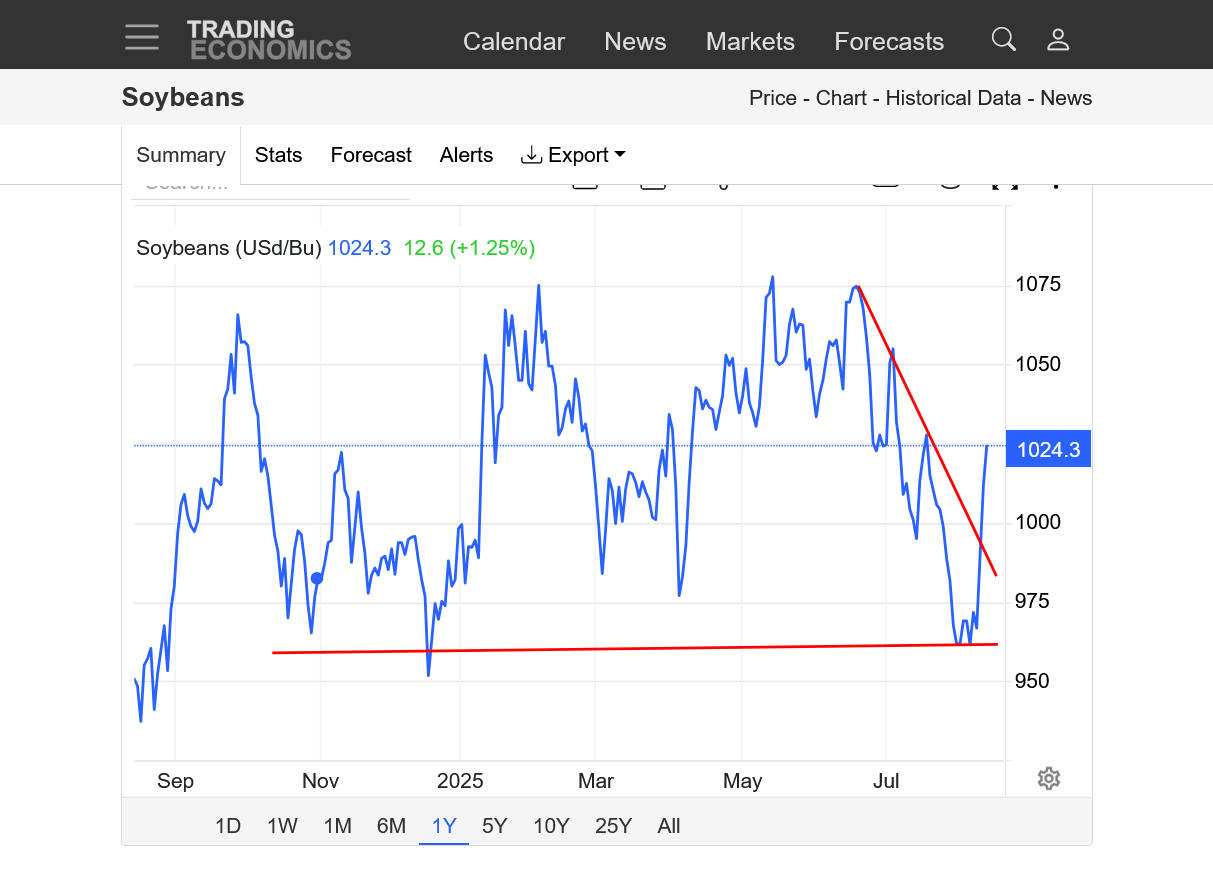

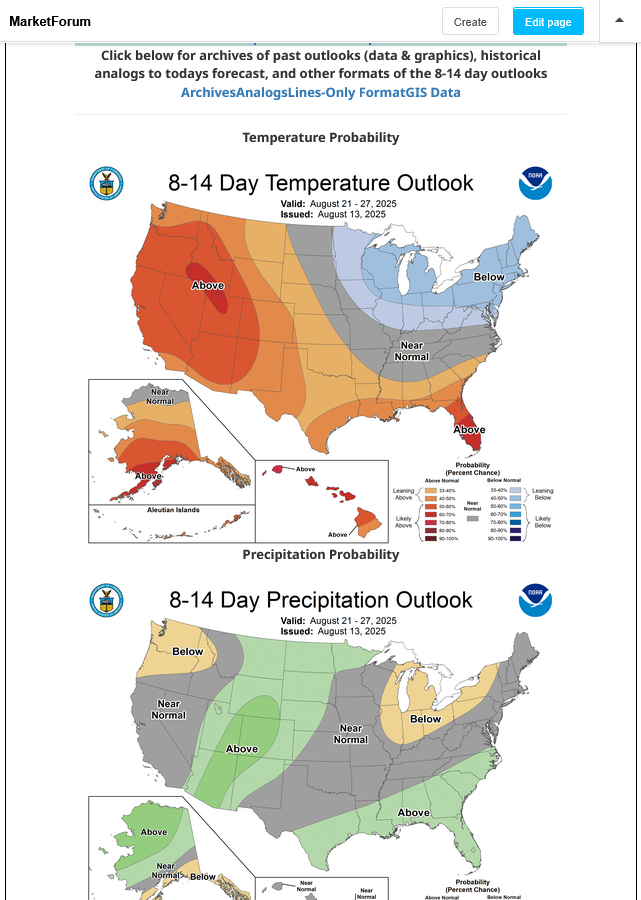

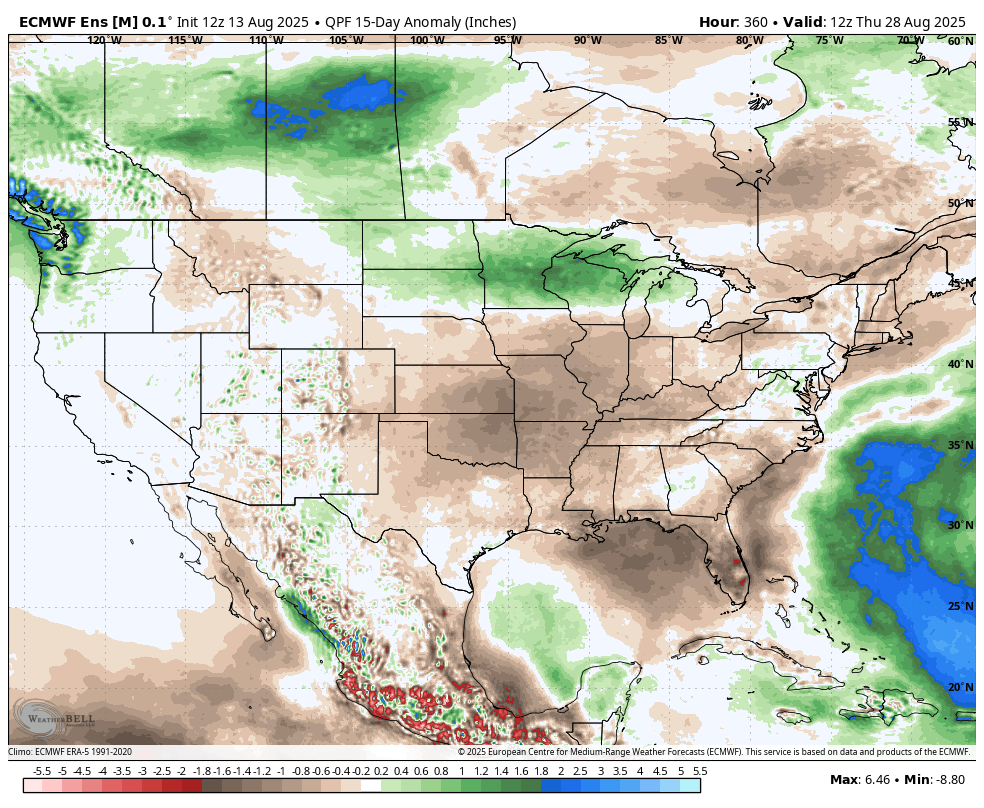

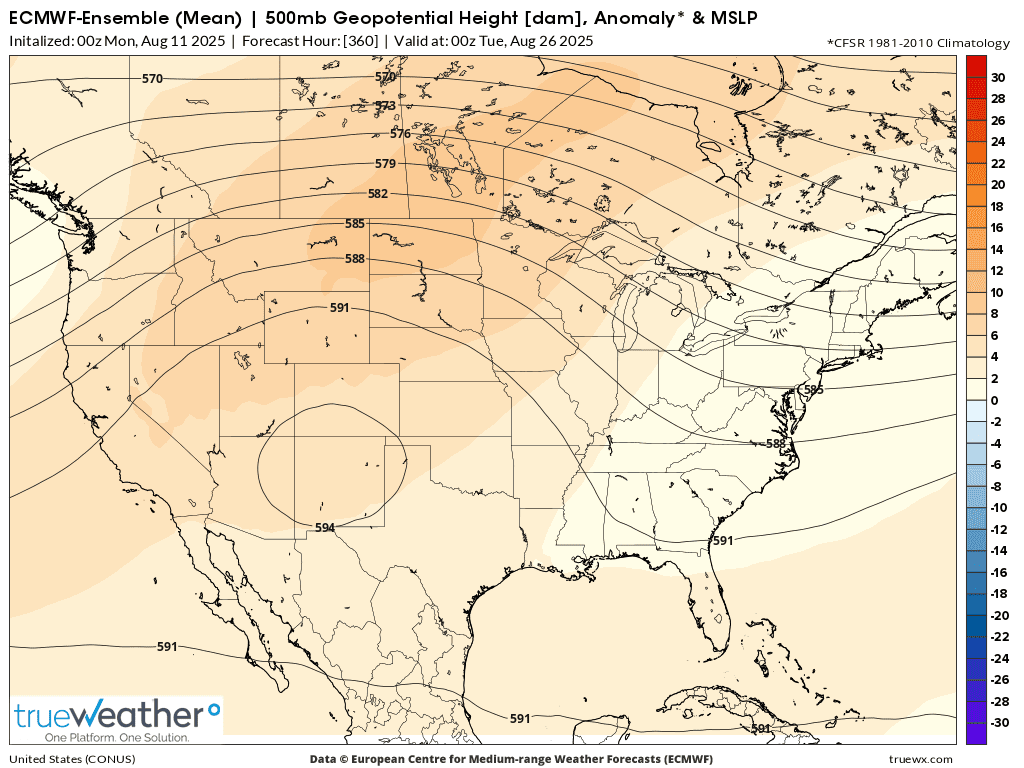

We can't get those sales back, man! They went to South America and China was even willing to pay as much as $1/bushel MORE for them. Our soybeans are this cheap BECAUSE OF TRUMP on top of the huge crop/production.

So he jawbones and as always, pretends he's for the US farmer with his American last, Trump first policies.

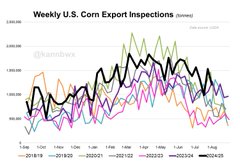

You want to be for US producers that depend on foreign trade and exports?

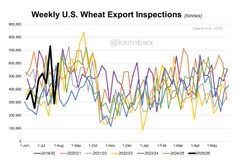

Encourage free trade and INCREASE incentives to boost that from both sides, instead of doing the 100%, diametrically opposed, polar opposite by stifling trade from both sides. Encouraging our long lived trading partners with relationships backed by trust to NO LONGER TRUST US. No longer be able to count on anything because Trump constantly moves the goal posts and penalties using rationale that makes no sense and always harms the trading relationship. Mostly because he has decided that collecting the tariffs is a great way to collect money for the government.

Our trading partners are being forced to REPLACE US as sources for their products(soybeans are just 1 good example)

At the same time, our consumers and US companies are punished because, Ironically its the US companies that are the ones that pay the tariff. When a foreign country has a tariff on them, they don't pay, IT'S OUR PEOPLE THAT PAY. US companies pay the tariff and pass it on to US consumers.

So US companies MAKE LESS MONEY. US consumers face higher inflation. Not maybe, just how bad?

US consumers, especially lower income consumers PAY MORE MONEY. It's only starting to impact our market/economy. It's already hurt soybean farmers.

While that government collects tariffs and Trump pretends that it isn't a massive tax, that is most impactful on the lower income brackets. The extremely meager gains from wimpy agreements caused by the tariffs are a drop in the bucket compared to the mounting damage, which could really hit the fan later this year.

The magnitude of the damage is speculative at this point and based on Trump's latest decisions to move the goal posts and roil the markets again but make no mistake, Donald Trump is completely unable to comprehend the basic principles and massive benefits of free trading between countries, FOR BOTH SIDES!!!! especially those that are not as rich as the United States.

He is supposed to be for less government and for free markets but his ruinous tariffs policies have maximized government intention to interfere with free market global trading on a scale not seen before during out life time.

He wants to capture tariff money FOR THE US GOVERNMENT and punish everybody else from both sides of the trading.

And the longer this persists, the more permanent some of the losses will be as importers AND exporters find other markets/countries to sell their products and find other markets/countries to buy their products TO REPLACE THE UNITED STATES.

Even if Trump rescinded all of his counter productive tariff nonsense tomorrow, there has been X amount of damage.

Ironically it comes from the guy claiming this:

.

Here in 2025, for leaders of all countries and most organizations that rely on trust and rational thinking, if one wants to use the actions of our new president, they can use President Trump's actions and words as the quintessential example of exactly what NOT TO DO to make deals.

I could type another few pages on why he is doing it exactly wrong but will stop here.