• The latest employment snapshot from the Bureau of Labor Statistics paints a bleak picture of the current state of the economy under President Donald Trump.

• Labor market deterioration: Just 22,0000 jobs were added in August, dramatically lower than economists’ expectations for 76,500 new roles.

• Negative job growth: For the first time in nearly four years, the economy lost jobs, with a decline of 13,000 positions in June.

• Rising unemployment: The jobless rate rose to 4.3%, the highest level since 2021.

• Stagnation: The data underscores the extent to which consumers and businesses are struggling to accommodate the weight of tariffs, stubborn inflation, the decline in America’s crucial immigrant workforce and overall economic uncertainty.

https://www.cnn.com/business/live-news/us-jobs-report-august-2025

Thanks very much, Larry!

This is more confirmation of what is happening from the ruinous policies of a pathologically thinking person making really bad economic decisions!

We can use your post to start a new thread on this topic as 2 of the other ones were getting extremely long. Thanks!

50% tariffs on EU starting June 1

61 responses |

Started by metmike - May 23, 2025, 8:13 a.m.

https://www.marketforum.com/forum/topic/112084/

evolution of Atlanta fed est. of GDP...shocking

30 responses |

Started by mcfarm - June 6, 2025, 6:

https://www.marketforum.com/forum/topic/112363/

China and India pledge to be 'partners not rivals'

7 responses |

Started by metmike - Aug. 31, 2025, 5:18 p.

https://www.marketforum.com/forum/topic/114312/

Micro Nasdaq

35 responses |

Started by mikempt -

https://www.cnn.com/business/live-news/us-jobs-report-august-2025

https://www.newsweek.com/trump-gets-abysmal-jobs-figures-after-firing-bls-chief-2125087

The Bureau of Labor Statistics (BLS) has again handed President Donald Trump a bleak set of jobs numbers, just one month after he fired the agency's commissioner over weak employment data.

Last month, President Trump said the bad numbers were because of the person that was the head of the statistics department intentionally targeting him with fake numbers to make him look bad, after giving the market fake good numbers last year to try to get Biden elected.

So he fired her.

This month, the bad numbers are the fault of the Fed for not lowering interest rates TO HELP FIX WHAT HE CAUSED WITH HIS BAD POLICIES THAT ARE WRECKING THE ECONOMY.

He already fired 1 of those interest rate setting governors that disagreed with him.

What next?

+++++

The revised number for June showed that there was a net LOSS in jobs. The first net loss in jobs since 2020, when it happened because of the COVID virus in December 2020.

The time previous to that was September 2010. So months when our economy actually loses jobs dont happen too often.

In 2025, the economy is being negatively impacted by THE TRUMP VIRUS!

https://www.cnbc.com/2025/09/05/job-seekers-face-worst-game-of-musical-chairs.html

++++++

We could be witnessing the early stages of a Trump caused global train wreck in slow motion.

If Trump doesn’t do something fast to reverse many of his tariffs, I predict a high probability of a USA and global recession.

If he continues them into early 2026, then a moderate confidence chance of a severe USA and global recession.

It’s just a stone cold fact that the health of our global economy is extremely dependent on FREE TRADE.

Trumps tariffs which greatly stifle the buying and selling of many billions in goods WILL(not maybe) stifle global and USA GDP.

How can that not happen? Of course it will!!

I don't remember if I posted this obvious observation here or elsewhere but I knew he wouldn't fire Powell. He will (is) scapegoating him. "Too late Powell"...

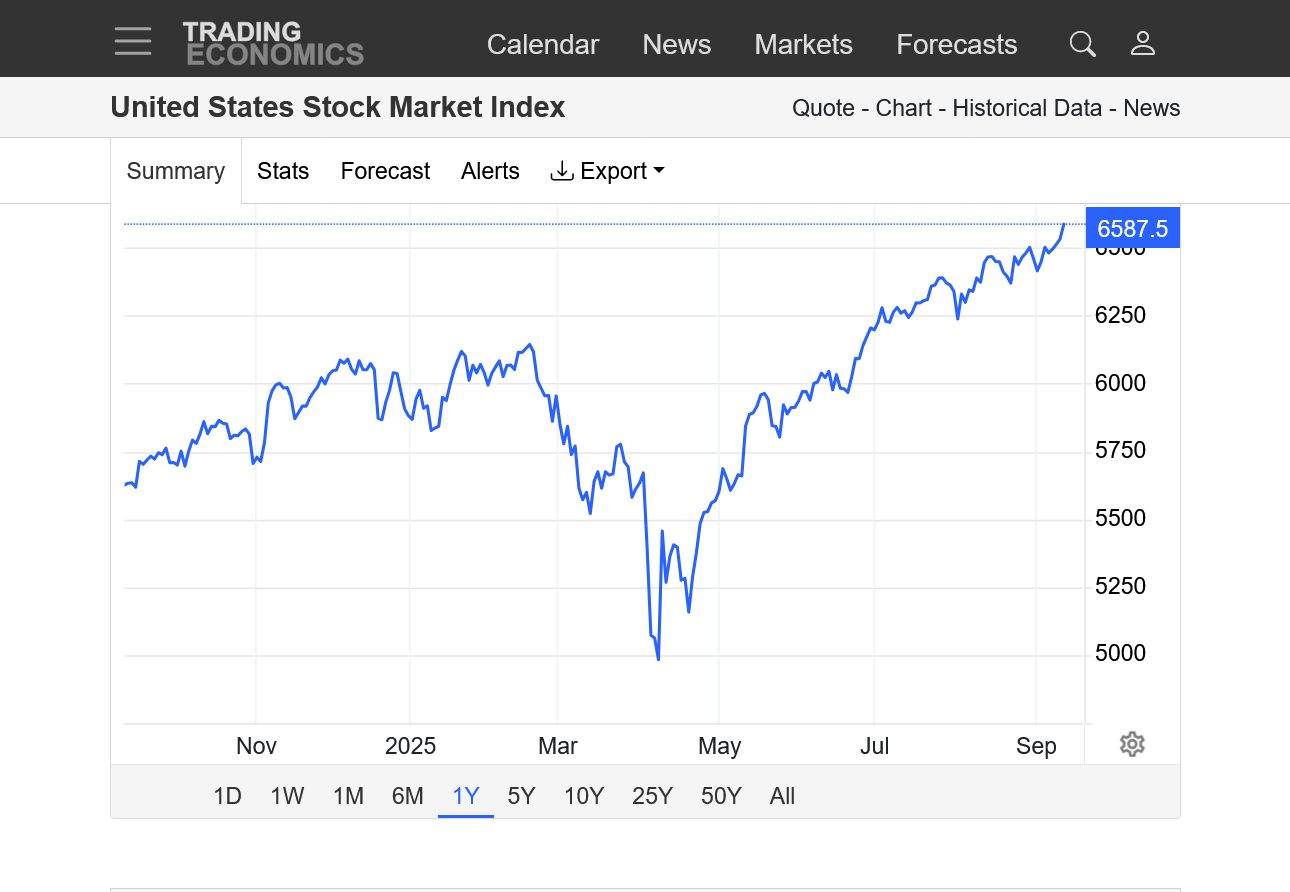

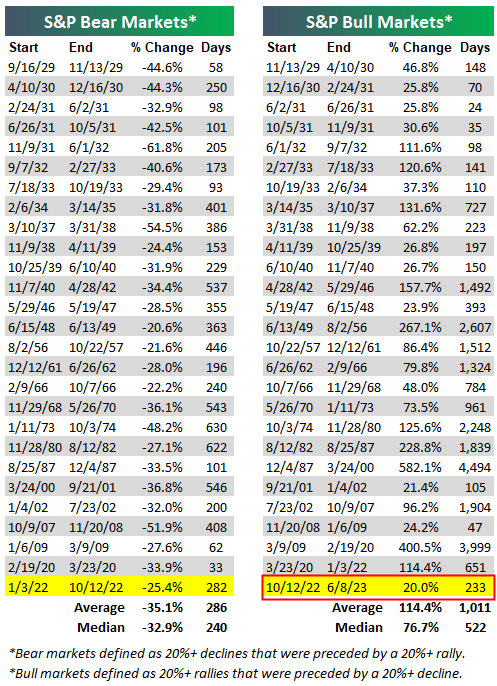

I don't agree with this ill conceived policy (regressive to boot), nor the illegal manner in which he usurped power. But, in the interest of honesty, I must point out that the stock market seems resilient in the face of all this. If you told me these economic numbers were coming from the beginning of the year I would have guessed the market would be much lower than here.

Why??

This is a great question, joj!

I do remember you stating that he would not fire Powell, who's term expires early next year.

On the stock market, yes indeed. I've discussed this contradiction several times here with a speculative but informed opinion but will try to briefly summarize it.

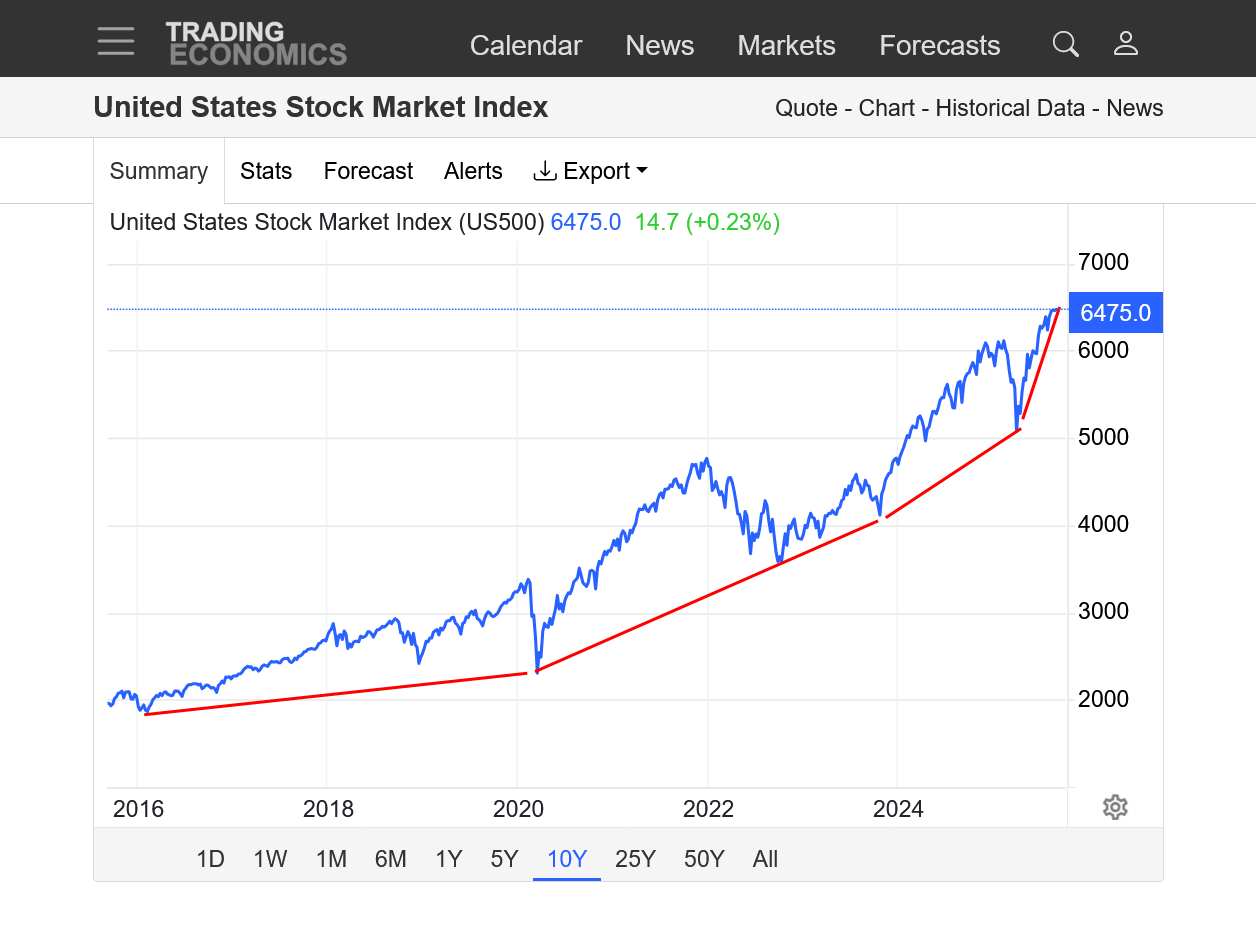

1. The stock market is clearly NOT trading authentic value since most of it is more than double the actual intrinsic value. The stock market is detached from objective financial data but also uses more than market sentiment to trump that. In investing, it's the estimated true value of a stock or company, derived from expected future cash flows, earnings, or assets that is SUPPOSED to drive stock prices but that's of lesser importance than the "rising tide,lifting all boats" phenomena.

2. A huge part of this is that the stock market is driven by a self fulfilling prophesy dynamic. Unlike almost all other(commodities) that I've followed closely for over 3 decades that trade on demand/supply fundamentals, the stock market doesn't have supply like oil and soybeans or buyers that use up those products. And contracts that expire with the buyers and sellers matching up with the real world, holding these markets accountable to the intrinsic value.

3. Not being tethered to intrinsic value has allowed the stock market to turn into a Ponzi Scheme for Wealthy people. As long as they keep buying corrections and adding to already over leveraged long positions, they can keep it going higher indefinitely. They give less weight to bad news and more weight to good news and as always, follow the trend and assumption that for the past 100 years, if you buy the stock market and hold on you will always make money(despite corrections). The vast majority of investors and speculators assuming that makes it the self fulfilling prophesy.

4. I discussed those 3 items numerous times in the stock market thread but will add something new, THE MOST IMPORTANT ONE that directly relates to your wonderful point.

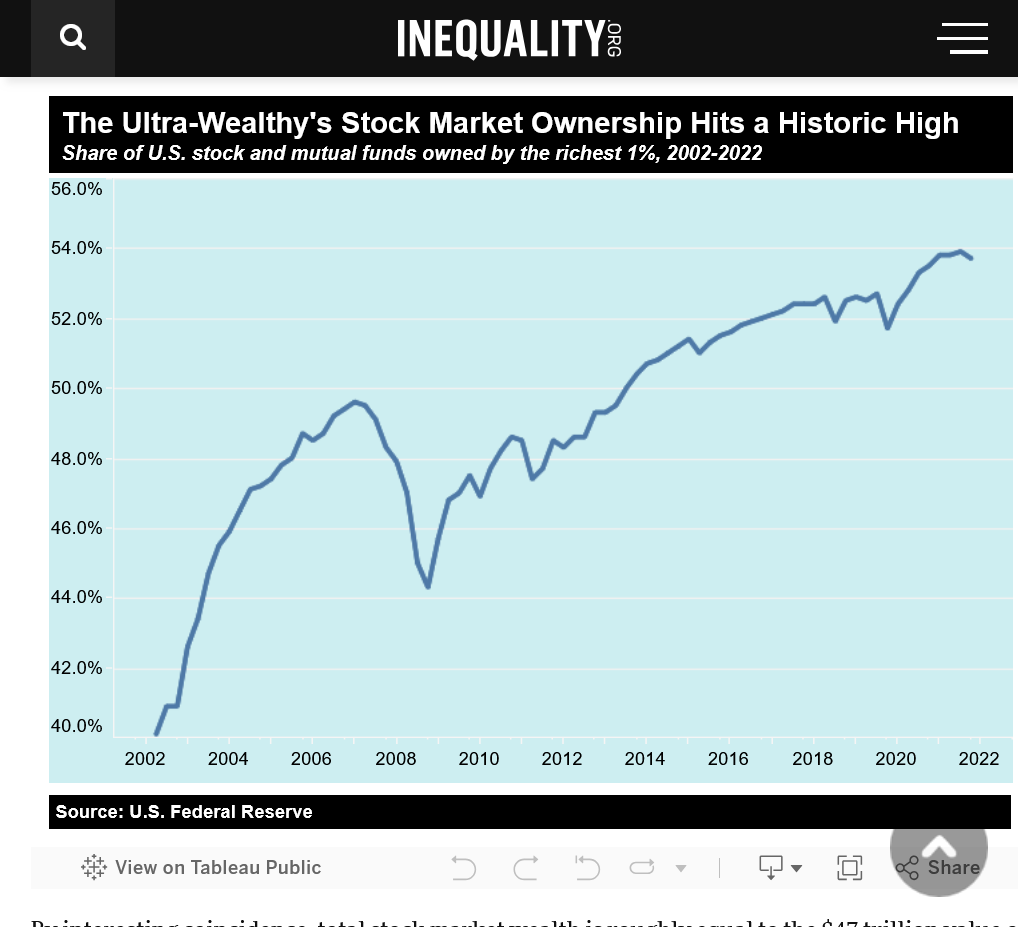

Baby bonds are one effective strategy for addressing the fact that only 1 percent of stock market wealth is owned by the bottom half of households.

https://inequality.org/article/stock-ownership-concentration/

The U.S. stock market is where major wealth gains have been achieved. The estimated current valuation of the U.S. stock market is $46.2 trillion, according to Siblis Research. This value has tripled over the last 20 years. (In 2003, the total value was $14.2 trillion.) Based on this estimate, the richest 10 percent of U.S. households own roughly $42.7 trillion in stock market wealth, with the richest 1 percent owning $25 trillion. The bottom half of U.S. households own less than half a trillion dollars in stock market wealth.

This fact is the biggest reason for the stock market to keep making new highs, DESPITE bad news for MOST OF US and for the US economy.

The Big(NOT) Beautiful Bill for instance will do things to make the rich even richer and the poor even more poor. The majority of money in the stock market is trading something a bit DIFFERENT than the rest of us because the top 1% doesn't care about millions losing heath care for instance. They have so much control of this Ponzi Scheme, with a common interest that they can sort of collude to keep prices going higher.

+++++++++++

I mentioned that commodity markets don't do this but actually, they sometimes do.

Large specs are such a high % of the thinly traded wheat market that they can often make it go in a direction that defies fundamentals and keep it at that level for long periods that don't make sense.

When powerful fundamentals suddenly change against their position, the spike from the long/short covering of their large spec positions can be enormous.

It makes them extremely vulnerable when the fundamentals get so powerful against them, that they all bail at the same time in a thinly traded market which causes enormous spikes.

The stock market is NOT thinly traded by any means but the % controlled by a like minded group, being over 50% is allowing that group to push it where they want it to go DESPITE the fundamentals that most of us look at for OUR economy.

I've been sounding a warning about this vulnerability for the past 2 weeks or so that is especially high the next 2 months.

By metmike - Aug. 24, 2025, 7:44 p.m.

+++++++++++++

Despite that, I'll continue to do technical/chart analysis based on what the charts say.........which is a good look at what the top 1% of US people are doing with their money because of what THEY think Trump will do for them!!

Sadly, as mentioned previously, Trump watches the stock market and considers this strength as a positive reinforcement and justification to double and triple down on his most ruinous policies, especially tariffs.

Is there something that I'm totally oblivious to that only the 1% most wealthy Americans know about related to the future of our economy, which is fact is going to set record highs for GDP and productivity that matches the record high stock market?

Could be...........and I look for it every day.

And that Fox News and Donald Trump are totally right about the economy and I just can't see it?

That might be a first but I encourage people to fill me in on the big secret which none of the authentic data/evidence indicates.

If its authentic, I'll celebrate being enlightened with a huge thanks and quickly dial that into my analysis!!!!

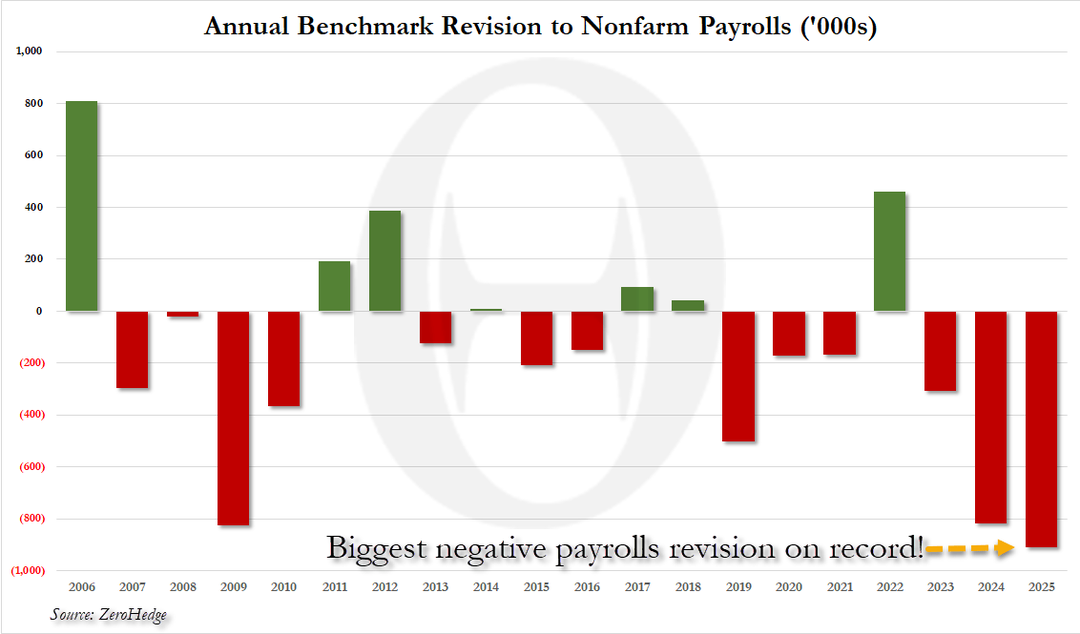

The downward revision appears to be the largest ever recorded.

++++++++++++++++++++++++++++++

Re: evolution of Atlanta fed est. of GDP...shocking

By metmike - June 7, 2025, 8:27 a.m.

Thank you, mcfarm!

From your article:

https://ijr.com/fed-offers-up-prediction-that-spells-good-news-for-trumps-economy/

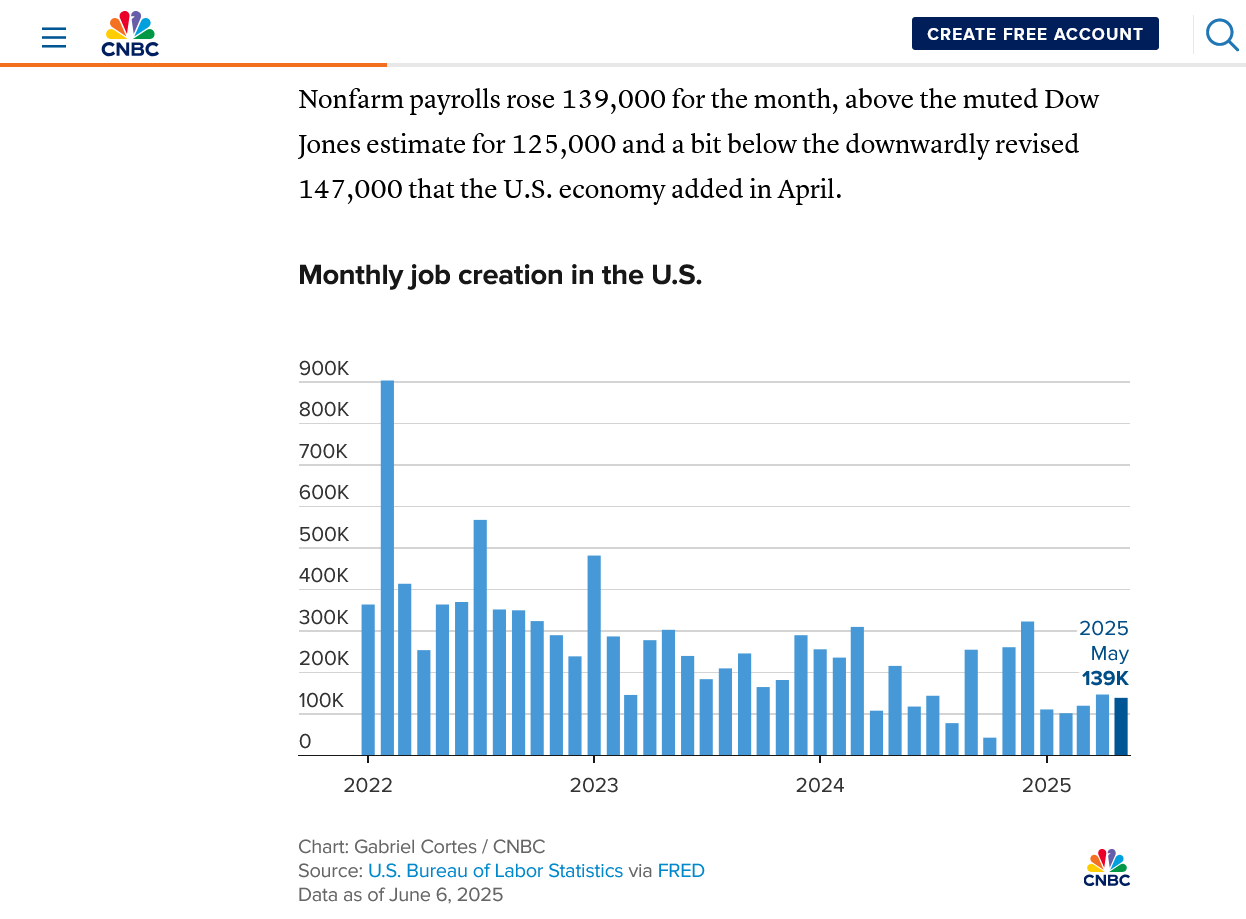

The Atlanta Fed’s latest GDPNow model estimate comes after U.S. consumer confidence increased by 12.3 points in May, marking the first increase in five months, according to the Conference Board. Moreover, the U.S. economy added 177,000 jobs in April, beating economists’ expectations.

+++++++++++++++++

These monthly jobs reports continue to be FAKE NEWS!

Let's just do the math on this.

REPORTED May Jobs gained +139,000

Revised(final) April jobs lost -147,000

Change in jobs from previous report -8,000

+++++++++++++++++++++++++++++++++++

Re: Re: evolution of Atlanta fed est. of GDP...shocking

By metmike - June 7, 2025, 8:35 a.m.

They did the exact same thing while Biden was in office.

The Labor Department estimated that job growth averaged 174,000 a month in the year that ended in March — a drop of 68,000 a month from the 242,000 that were initially reported. The revisions released Wednesday were preliminary, with final numbers to be issued in February next year.

+++++++++++++++++++++

Let me show you that graph again. Take away the fake, small increase in jobs in 2025 and we have a serious problem.........now THAT is shocking!

Re: Re: Re: evolution of Atlanta fed est. of GDP...shocking

By metmike - June 7, 2025, 8:45 a.m.

Almost every month we get an intentionally bloated estimate of XXX,XXX new jobs that make the headline news and everybody celebrates over how bullish it is to the economy and stock market.

Then, when the next month comes out with the latest intentionally bloated estimate, they tell the truth about the previous month with a downward revision that takes away many of those jobs they told us were created -XXX,XXX jobs, for instance in the revision this last time.

It happens over and over and over.

Entities reporting honest statistics don't repeat errors from the same side each time.

How many coins do you know that land on heads with every 1st flip.............then on the 2nd flip they always lands on tails???

+++++++++++++

metmike, September 9, 2025: I agree with President Trump that these extremely unreliable statistics need to be fixed. The method that they use should be changed.

However, knowing how Trump always operates as in ALWAYS with no exceptions, his version of fixing the situation and mine are completely different. I suggest changing the process/methods of gathering the statistics so that the earliest estimates are not almost always too high. The actors and sources compiling these numbers clearly have free reign to exercise a bullish bias when they accumulate and submit the initial data that doesn't need to conform to realistic accountability or authentic justification. They can't be high to too high almost every time and get adjusted downward after that if that were not the case.

What Trump is doing, like he always does is fire the person in charge and replace them with a person that pledges allegiance to Donald Trump and to Donald Trump's agenda.

Trump insisted that the old numbers were manufactured to make Ds/Biden look good/get elected and for him to look bad. What he will do to fix that, using Trump justice is put somebody in charge who's main objective is to make Donald Trump look good........NOT provide more accurate data.

He's done that with the justice department. He's done that with his cabinet. He's appointed and hired people that swear allegiance to Donald Trump. Extremely biased people that helped him get elected. NOT people that are experienced or qualified.

https://www.yahoo.com/news/21-fox-news-personalities-contributors-221718333.html

Then he fills all positions with people that he knows will have their #1 priority being this: Fulfill all of Donald Trumps wishes, never disagree with him and constantly tell the world how great Donald Trump is.

For more evidence of economic malaise, see the U.S. Census Bureau’s report released Tuesday on household income for 2024. Real median household incomes rose last year by a mere $1,040, which wasn’t statistically significant. Real median incomes for blacks fell $2,060.

The rich continued to do well, but most Americans treaded water. Real incomes among the top 5% increased by $11,500 on average last year (which notably doesn’t include capital gains), but barely budged for the bottom 50%. This is why Americans elected Mr. Trump: To lift real wages as he did during his first term with tax cuts and deregulation.

His border taxes and deportations are doing the opposite. Job growth stalled this summer amid his tariff barrage. The BLS establishment survey showed that an average of 27,000 jobs were created over the last four months. The number of Americans not in the labor force has increased by 1.2 million since April, more than half of whom said they want a job. The share of teens who are employed has fallen 2.1 percentage points since April, and they are usually the first let go when employers do layoffs.

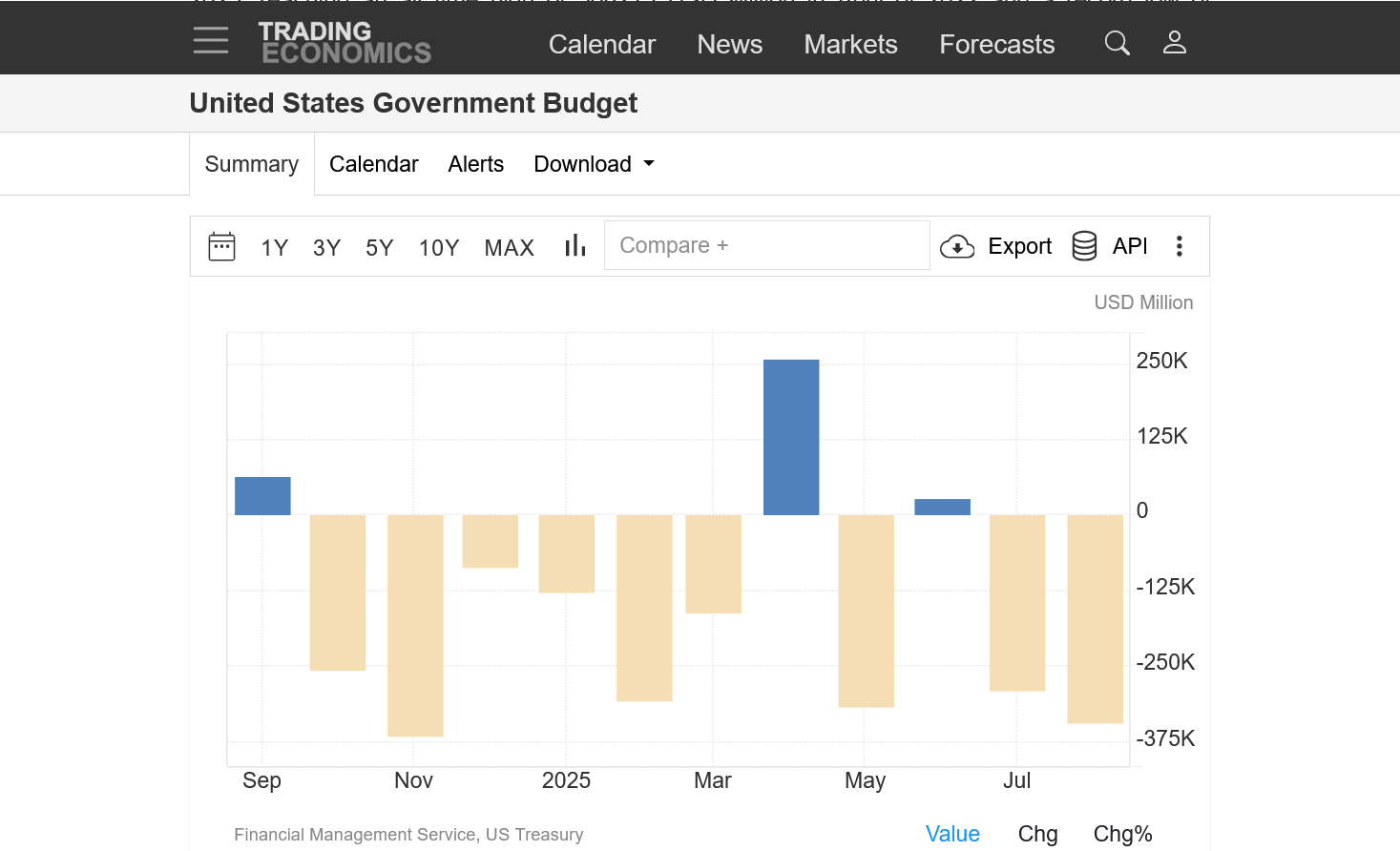

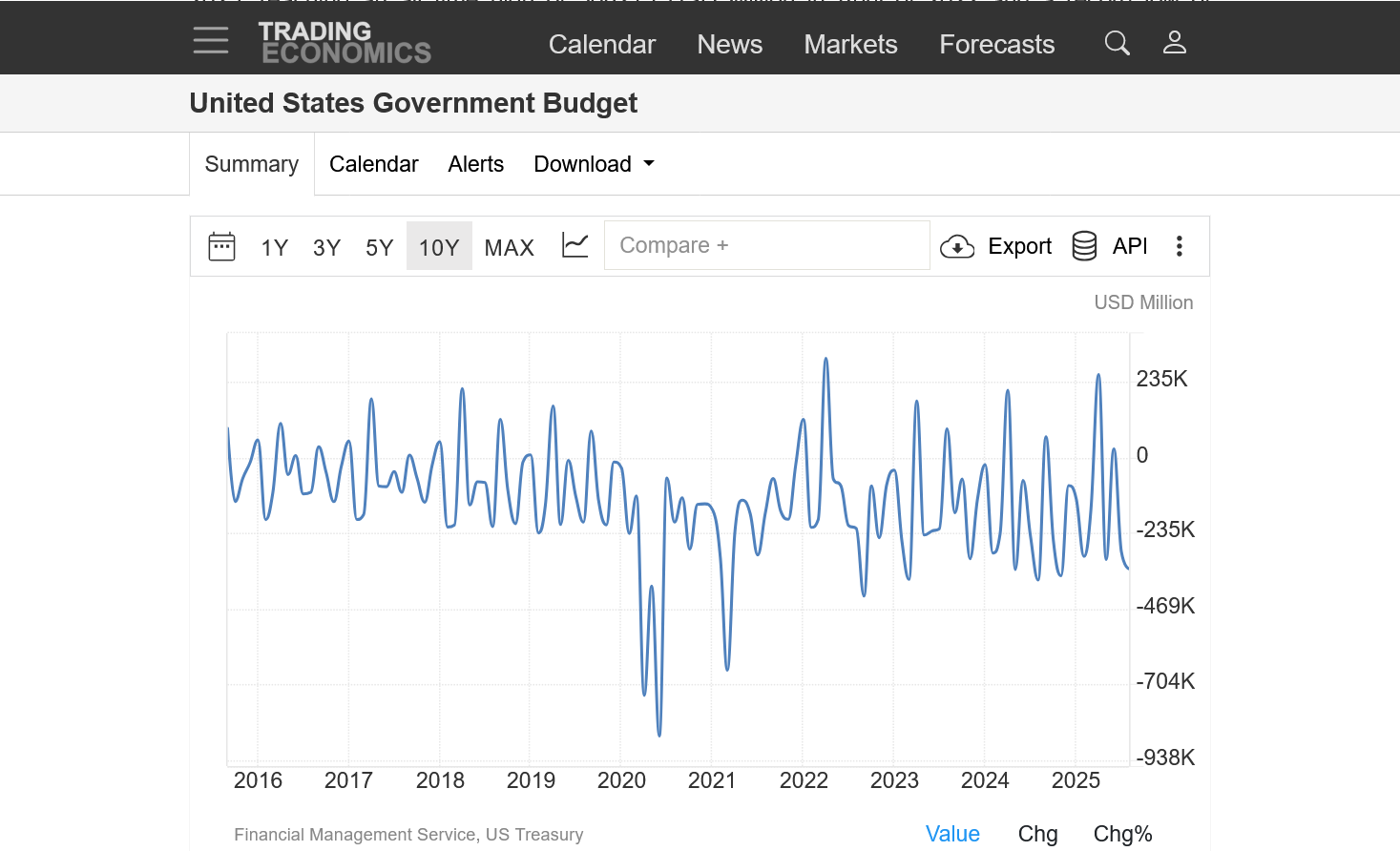

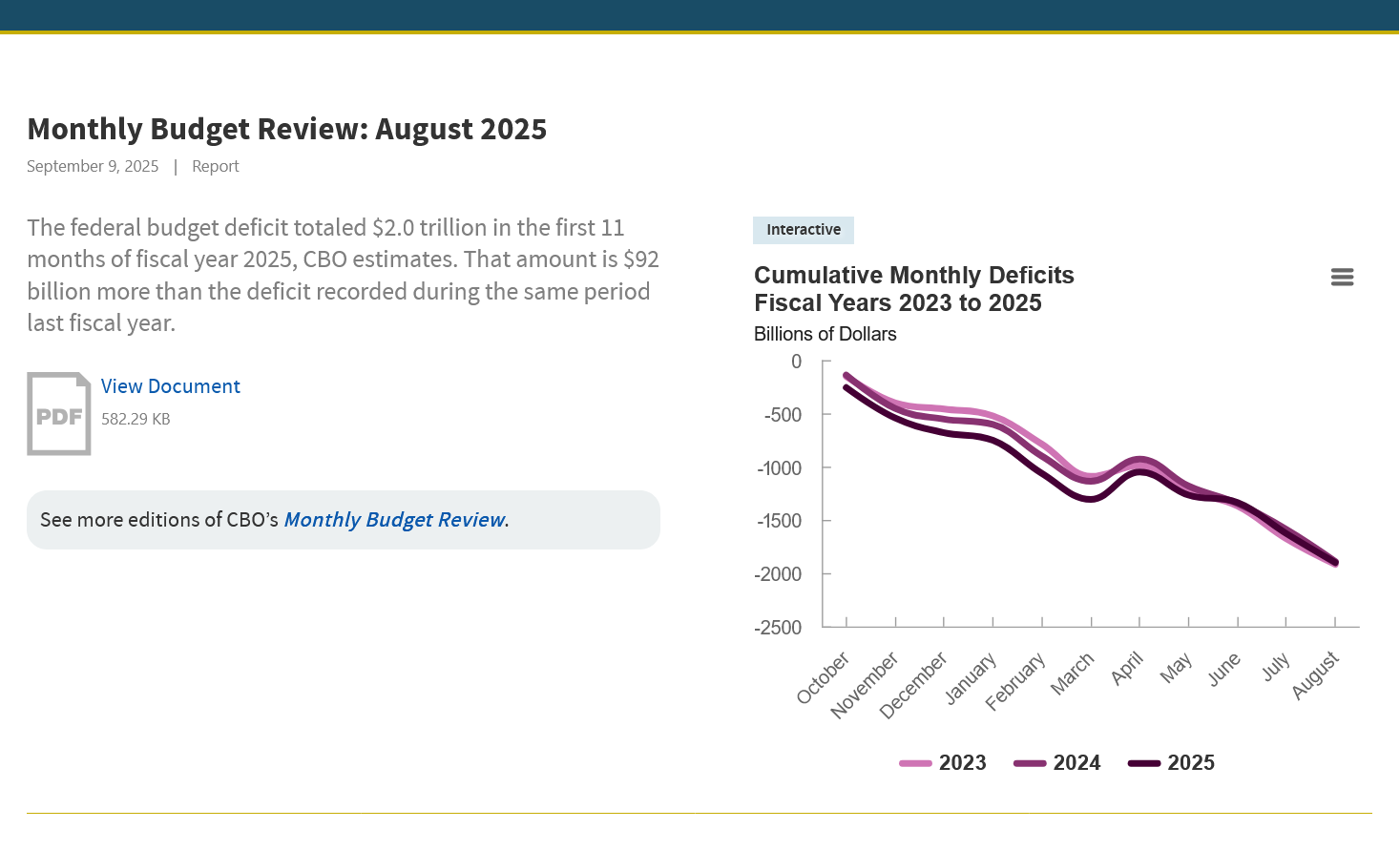

The budget deficit GREW in August, despite the tariff collecting that was supposedly going to REDUCE that number and the only potentially positive thing about the tariffs!

DOGE cuts were also supposed to reduce government spending to improve that number.

https://tradingeconomics.com/united-states/government-budget-value

https://www.cbo.gov/publication/61305

The federal budget deficit totaled $2.0 trillion in the first 11 months of fiscal year 2025, CBO estimates. That amount is $92 billion more than the deficit recorded during the same period last fiscal year

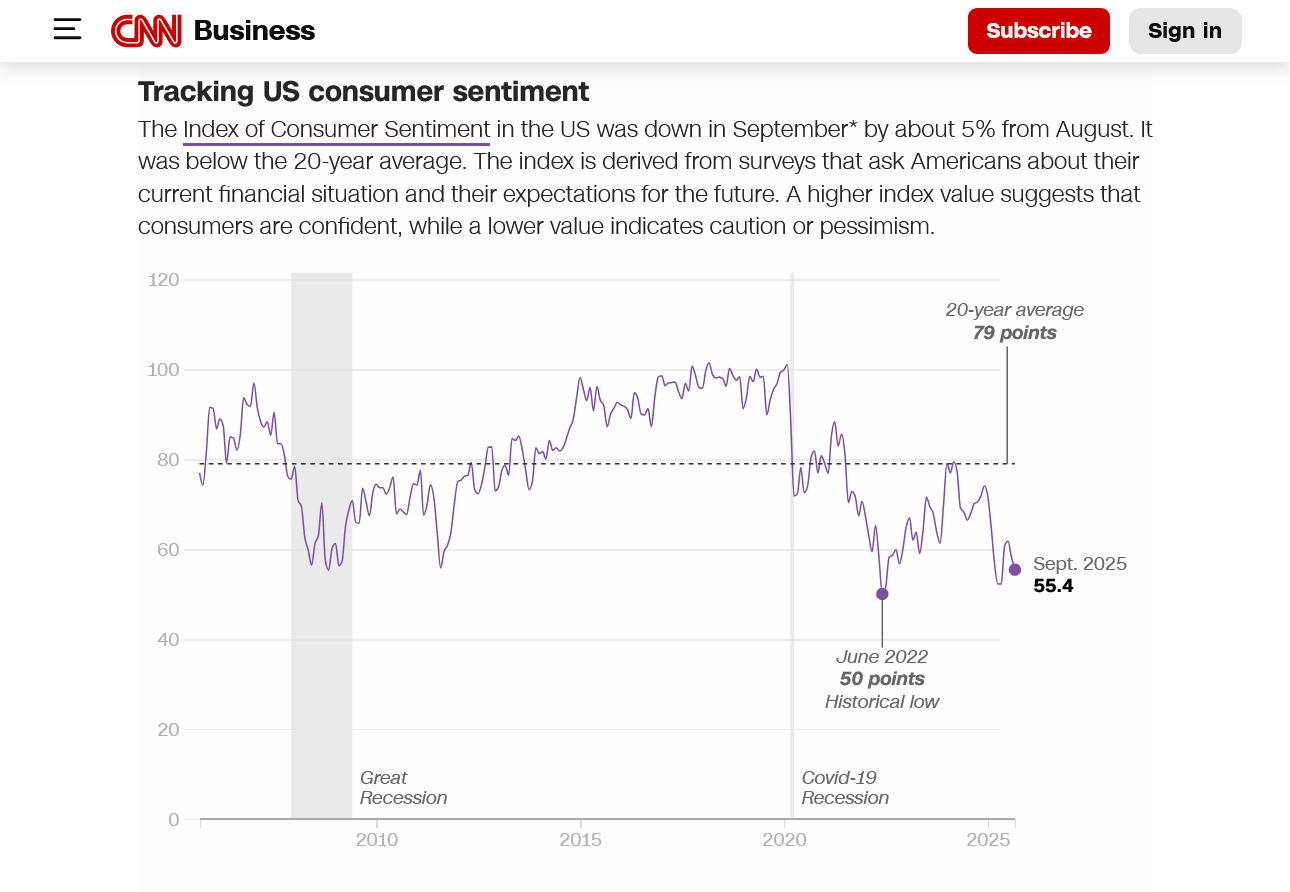

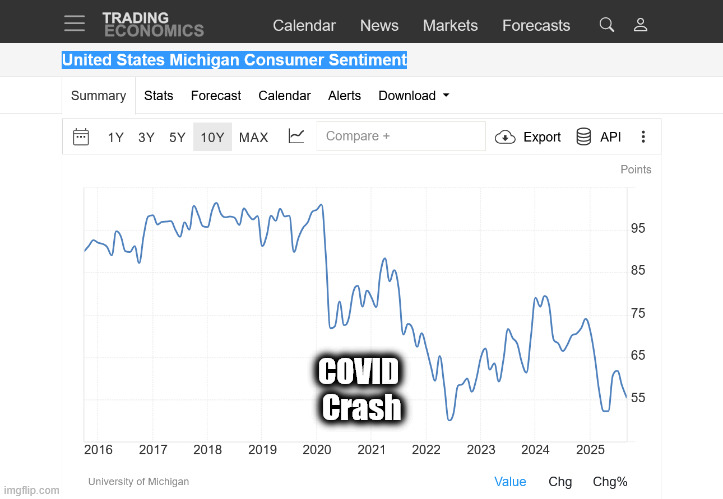

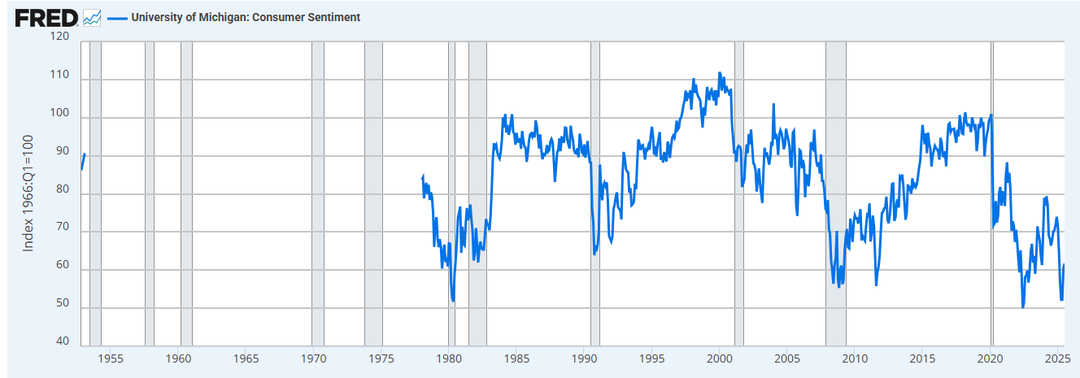

https://www.cnn.com/2025/09/12/economy/september-consumer-sentiment

Above, is the measure of sentiment from Americans that are not wealthy...most of us!

++++++++++++++++++++=

Below is the measure of sentiment of RICH Americans that are benefiting from the Trump economy:

By metmike - Sept. 11, 2025, 8:25 p.m.

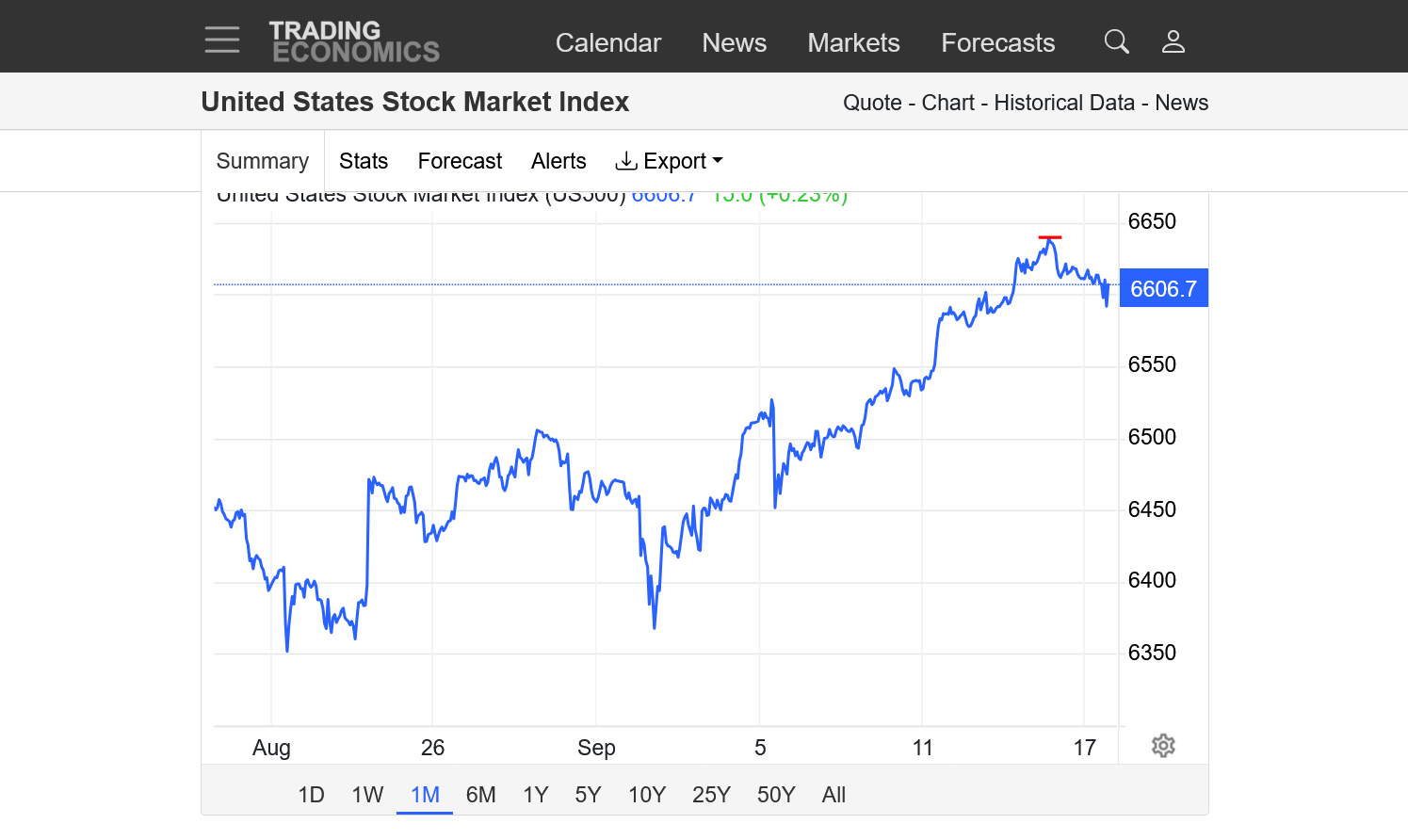

New record highs for the stock market indices on Thursday!

Bad news for the economy and the majority of people in the US is GOOD NEWS for rich people and the stock market that want the lower interest rates to stimulate the weak economy that will send more money to the stock market.

https://tradingeconomics.com/united-states/stock-market

https://tradingeconomics.com/united-states/consumer-confidence

++++++++++++++++

Be looking for some crazy "buy the rumor, sell the fact" market action, immediately after the rate cut news hits. A surprise bigger than expected cut might make things especially interesting. This is the most discussed cut that I can remember in recent years, with the build up to it, possibly being much greater than previous cuts.

If there is little buy the rumor, sell the fact, on the expected rate cut, I’ll be surprised. But then again, if this scenario is anticipated by too many, maybe that’s a sign it won’t actually happen.

You were right , Larry at least after 6 minutes the small cut DID spike us higher……now let’s see if we reverse lower than the price at the time of release.

WX

Nice assumption!

Im glad cause i find myself on the right side.

I had a short on the CAD going in because I planned to trade that reaction,but had a safe stop and planned to "reaction trade" afterwards.

So far so good.

Who thinks the White House is happy with the meager cut?

Just starting a conversation-not an argument.

John

Hey John,

Whether they’re happy or not they’ll probably act like it’s not enough for political points.

https://tradingeconomics.com/united-states/stock-market

1. 1 day: Red line marks the release of the interest rate cut

2. 1 month

3. 1 year

4 10 years

https://www.realtor.com/news/trends/fed-rate-cut-decision-jerome-powell-speech/

During a Fox News appearance last week, the president boasted, “We have the best economy we’ve ever had.” The claim was plainly ridiculous, and it made him appear spectacularly out of touch with public frustrations on the issue.

This week, during Trump’s trip to the U.K., he told reporters, “You know, we’ve already solved inflation. We’ve solved prices.”

If that weren’t enough, at the same press conference with British Prime Minister Keir Starmer, the Republican said in reference to his own country’s economy, “Jobs are at a record.”

So why would the president point to one of his failures as a success? Because his solution to the Trump Slump is to manufacture an alternate reality and hope people play along.

For his part, Trump said in his latest Fox News interview said he expects the impact of his trade agenda to “kick in probably in a year or so.”

That’s difficult to believe, but it’s worth appreciating the disorienting rhetorical push: Ignoring what the public actually believes, the White House is arguing simultaneously that the economy is already great and that the economy will eventually be great at some point, maybe next year.

Is it any wonder why the polls look so ugly for Trump?

https://finance.yahoo.com/news/trumps-tariffs-already-hurt-economy-204313536.html

From 2010 to 2019, American gross domestic product (GDP) grew by an average of 2.4 percent per year. In 2024, it grew by 2.8 percent. Now, the OECD projects that the economy will grow by only 1.8 percent in 2025 and 1.5 percent in 2026, "owing to higher tariff rates [and] moderating net immigration," among other factors.

https://www.bbc.com/news/articles/cjedze7e95lo

++++++++++++++++

Moving forward, we can no longer trust economic numbers because Trump is abusing his power and is exerting his influence on the entities releasing the numbers.

https://www.npr.org/2025/08/08/1256971798/bls-bureau-labor-statistics-greece-argentina

After President Trump fired the head of the Bureau of Labor Statistics, economists and statisticians across the board were horrified. Because the firing raises the spectre of potential manipulation – and it raises the worry that, in the future, the numbers won't be as trustworthy.

So: we looked at two countries that have some experience with data manipulation. To ask what happens when governments get tempted to cook the books. And...once they cook the books... how hard is it to UN-cook them?

https://www.cbsnews.com/news/adp-report-private-payrolls-32000-decline-september-bls-jobs-report/

+++++++++++++++

+50,000 was expected but -32,000 was reported!

ADP National Employment Report: Private Sector Employment Shed 32,000 Jobs in September

October 1, 2025

JOBS REPORT

Private employers shed 32,000 jobs in September

ADP conducted its annual preliminary rebenchmarking of the National Employment Report in September based on the full-year 2024 results of the Quarterly Census of Employment and Wages. This recalibration resulted in a reduction of 43,000 jobs in September compared to pre-benchmarked data. The trend was unchanged; job creation continued to lose momentum across most sectors.

Change in U.S. Private Employment: -32,000

Change by Industry

- Goods-producing: -3,000

- Service-providing: -28,000

++++++++++++++++=

This is the Trump economy!

https://seekingalpha.com/article/4823290-5-clear-signs-us-likely-heading-into-recession-next-year

The average new home price is below the average existing home price for the first time since records have been kept. Housing affordability levels are near historic lows. A 25 bps cut to the Fed Funds rate or several will be only of marginal help on this front, as mortgage rates have already front-run the FOMC decision this week and are at their lowest levels since last October.

Trumps tariffs have made this much worse!

++++++++++++++++++++++++++

In short, the signs of a potential recession in 2026 are growing, and the chance of an economic contraction in the coming year appears to be higher than it has been for many years. And a recession on the near-term horizon is certainly not priced into the current market that is trading at extreme levels using a variety of historical valuation metrics.

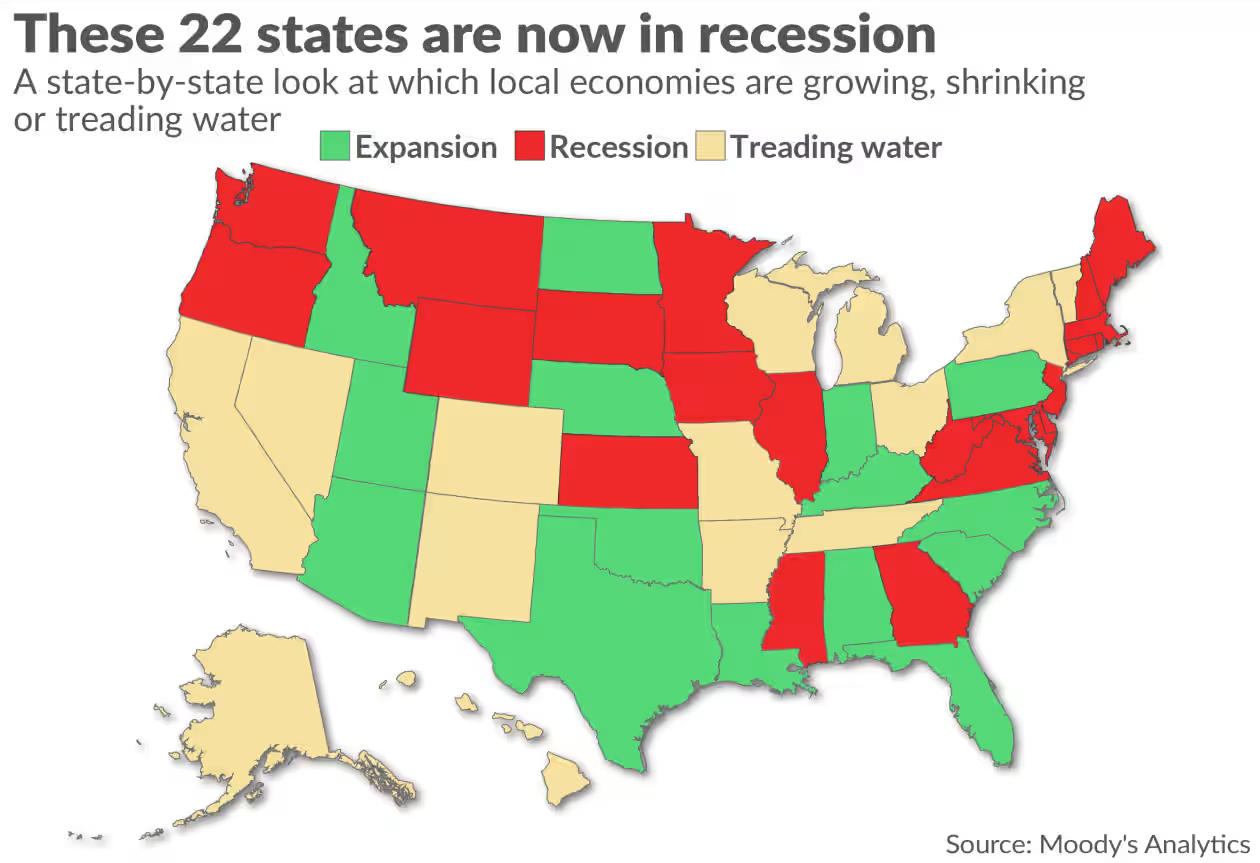

https://www.marketwatch.com/story/are-we-in-a-reccession-yes-if-you-live-in-one-of-these-22-states-3947b4cd?gaa_at=eafs&gaa_n=ASWzDAge6zvYDb0HOhy3enTO9V6flkhYbSRipcuJazjB7cOeOWwbzKJm3WDJXlcs-aE%3D&gaa_ts=68e13dcc&gaa_sig=8XEpWBQg9w6_-RT1ybOXq2ENKQveoB5_n9WoZpS0r40uSRsOko4xm93W6Jb5g97h3XumhjmDck5e4zjAaIRquQ%3D%3D

https://finance.yahoo.com/news/economy-looks-better-feels-inflation-144117914.html

From your article above

Richard Moody, chief economist at Regions Bank, noted that third-quarter U.S. GDP is estimated to show the economy growing at a 3.8% annual rate. The latest data on business investment, jobless claims and consumer spending have been decent, he added. “Nothing suggests the economy is rolling over,” Moody said in an interview.

The most recent data released by the government before the federal shutdown surprised to the upside and showed the broader economy was in pretty good shape.

Are we in a recession? Yes — if you live in one of these 22 states. - MarketWatch

So we have differences of opinion

Thanks very much, cutworm. Excellent points!

I agree that there is going to be the biggest difference in opinions about how the economy is doing in history for the foreseeable future.

For instance, nobody can deny the stock market hit new record highs today and rich people with money in the stock market are doing especially well because of that.

Here's a stat that I mentioned last weekend in the stock market thread:

Here's an interesting stat about the people who own these stocks based on their income level:

Re: Re: Re: Re: A word of caution

By metmike - Oct. 20, 2025, 8:11 a.m.

No question that Donald Trump follows this and his agenda revolves around these people. The top 10% are all millionaires by the way.

Interestingly, I was almost a millionaire just over 20 years ago but had some bad stuff happen to us, including all my money being taken at MF Global by Jon Corzine on October 31, 2011, when he raided the segregated accounts to make a huge margin call on a billion dollar European bond position and bankrupted them. Then, after opening a new account at PFGBest with borrowed money immediately after that...they went bankrupt in July 2012!

I had started with just $2,000 in January 1992, our only savings at the time.

The only good thing is that I got to deduct those fraud losses on my tax returns for a few years using a new law that was passed by the IRS after so many investors were ripped off by Bernie Madoff's ponzi scheme.

https://bradfordtaxinstitute.com/Content/Ponzi.aspx

I only have a low 5 figure account today and haven't traded much lately.

Anyways, when I was making the most money (6 figures in numerous years-I was politically the most R in my life and was an R for a good 2 decades).

I was raised a D from Detroit and remained with that party thru most of the 1980's but its amazing how making massive amounts of money and having to pay taxes on it can play a role in altering your political outlook.

I've considered myself an independent for the past decade, though I voted for Trump in 2016 and every R on the ballot in 2024 to protest Biden/Harris. I wasn't going to vote at all, then my wife guilt tripped me by pointing out that a person who spends so much time making political posts on MarketForum that doesn't even vote is a hypocrite. I believed Trump would end the war in Ukraine fast and used that as a huge reason to vote for him.

++++++++++

I wonder how much the 40% in the middle have?

Thanks, cutworm!

I wonder how much the 40% in the middle have?

Answer: Not much.

The top 10% have 87% of the stock holdings which leaves only 13% for the remaining 90% of people in the country.

So we know it must be much less than 13%.

https://en.wikipedia.org/wiki/American_middle_class

Depending on the class model used, the middle class constitutes anywhere from 25% to 75% of households.

+++++++++++++++++

I'll take a stab at guessing:

Top 10% = 87%

10-25% =8%??? Guess

Top 25% = Upper class =95%??? Guess

Middle class= 25-75% =4%??? Guess

Bottom 50% = 1% and likely, most of that 1% is those in the middle class 25-50% middle class. So the 50-75% middle class having 3% seems reasonable but a guess. It might be 1% higher?

hmmm I would have thought that all the 401's would have been more. guess I was wrong

cutworm,

Maybe it is more! I'm just making a guess based on stats that I read. That's a really good point because that seems like it would be a lot of money.

Regarding that money. It would not impact day to day, week to week or even month to month gyrations in the stock market because its a pretty constant flow, correct?

When we had the spike low in April for instance, it wasn't from 401 K investors suddenly pulling their money out of the market.

So it would be a sustained buying and underlying bullish factor, correct? On the other hand, after people retire they liquidate and use that money. I never thought about this.............such a great point by you, thanks!

https://www.crews.bank/blog/charts/more-stocks-than-ever-in-401k

.png)

https://www.newsnationnow.com/vargasreports/trump-sounding-biden-denial-economy/

++++++++++++++

A top economist says Trump is doing industrial policy all wrong.

+++++++++++++++++

Mariana Mazzucato, an economist who has advised governments around the globe, said Trump’s policies, taken together, are more like “an idiosyncratic hodgepodge.”

I think he’s doing it to show strength. He puts up walls, he uses tariffs, he wants this all to make him look mighty and strong while he’s actually weakening the economy by eliminating the very industrial strategy that led, in the past 50 to 100 years, companies like Intel to be born.

Baby bonds are one effective strategy for addressing the fact that only 1 percent of stock market wealth is owned by the bottom half of households.

Why would you expect the bottom half to own stocks? Aren't there about 42 million receiving Snap benefits? They are thinking about now not the future.

There are even fewer that own commodities.

JMHO

That make great sense, cutworm!

Mark Levin was on tonight telling viewers that ALL the inflation is being caused by Ds.

To prove it, he compared prices in states with lots of big cities run by Ds to prices in rural states where Rs are in control.

Conveniently, totally ignoring that the average income of people in big cities is higher than those living in rural areas.

Maybe Huffpost should run a story that only shows income and claim that living in big cities run by Ds with the higher incomes proves that they are superior at rewarding workers with the highest wages.

++++++++++++

Don't be surprised if President Trump uses this. Besides hiring 23 Fox people to key positions, he watches Fox a lot and will often repeat things they made up and he heard it on Fox.

Since Trump fired the head/commissioner of the bureau of the department of statistics and replaced them with a hack that answers to Donald Trump, we can no longer trust most of what is coming out.

This does NOT bode well for affordability for heating and cooling of our houses (electricity generated by burning natural gas) or for the cost of ng used for industrial demand.

By metmike - Dec. 3, 2025, noon

https://tradingeconomics.com/commodity/natural-gas

1. 1 day: Marching higher, with some minor spikes by natural gas standards.

2. 10 years: MAJOR upside breakout from a symmetrical triangle/wedge(higher lows-lower highs). AND above long term resistance. Very bullish.