The last thread was getting pretty long!

Previous threads:

A word of caution

81 responses |

Started by kris - Sept. 24, 2025, 10:47 p.m.

https://www.marketforum.com/forum/topic/114902/

++++++++++++

Previous thread:

S & P 500 futures.

47 responses |

Started by mikempt - March 31, 2025, 10:17 a.m.

These were the last posts at those threads to start off the thinking on this new one:

By kris - Oct. 21, 2025, 11:49 p.m.

The DJI and the DJT closed above last weeks' highs today; final gasp maybe ?

Neither the NQ ES or RT followed suit but instead stayed in a rather narrow range which makes today very vulnerable both up or down ....

(he's still whittling .... }

++++++++++++++++++

By kris - Oct. 21, 2025, 11:56 p.m.

++++++++++++++++++++

By kris - Oct. 21, 2025, 11:59 p.m.

The above chart of the daily NQ shows my L to L and H to H counts , both come up with today Tuesday and tomorrow Wednesday as being potential highs, we shall soon have resolution ... !

++++++++++++++++++++++=

By metmike - Oct. 22, 2025, 8:14 p.m.

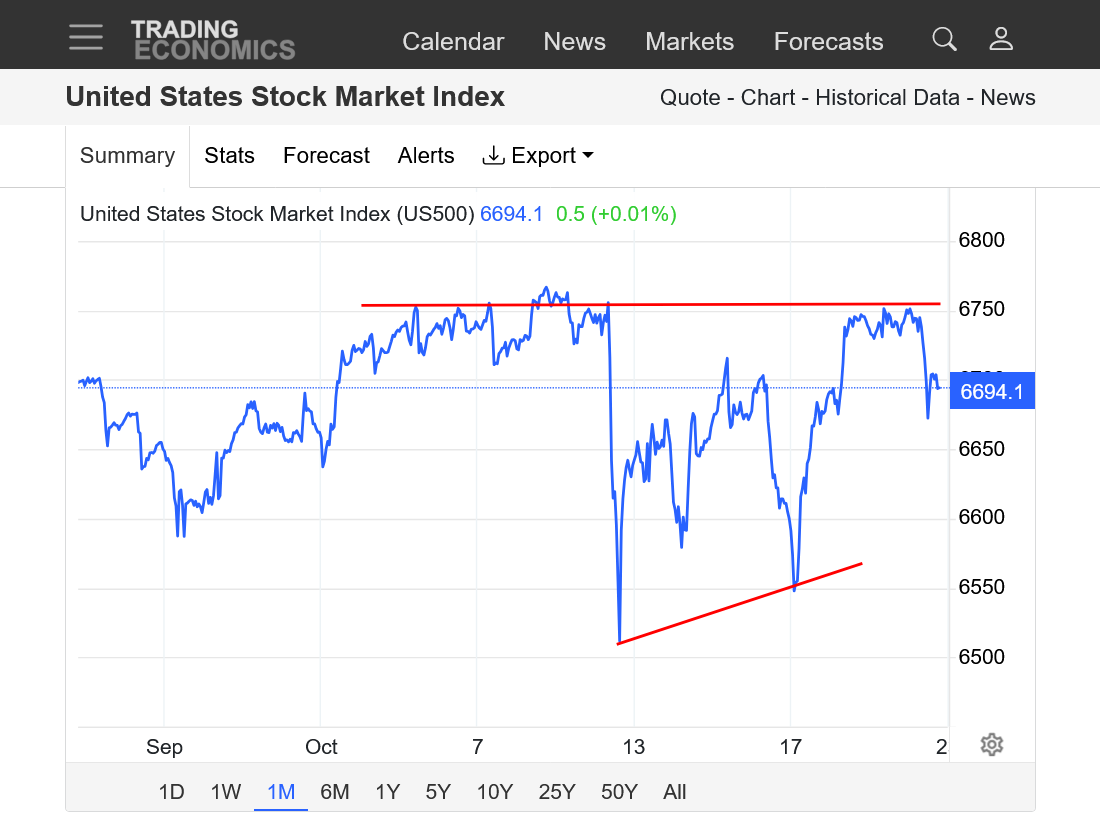

Here was the latest today, a down day!

What do you think, kris?

https://tradingeconomics.com/united-states/stock-market

++++++++++++++++++++++++==

By metmike - Oct. 23, 2025, 7:21 p.m.

I continue to be amazed that the rich people's Ponzi Scheme and their power in being able to control a self fulfilling prophesy, with Trump's policies benefiting them and AI acting as fuel is keeping the stock market up here.

Major tops in most markets usually don't end by treading water for so many days close to record highs like this, then suddenly failing but anything is possible here. I think kris's assessment is probably right based on history and fundamentals. However, a manipulated market doesn't need to follow any of that.

The government shut down and lack of economic data could be part of the market being so quiet here. I've not looked at volume recently but might guess that its reduced with the reduced volatility and lack of big moves expected at near record high prices.

Lots of uncertainty for sure, including mine!

https://tradingeconomics.com/united-states/stock-market

Amazingly long pause at and just below record highs, technically looks like a continuation pattern/bull flag.

News could break us in either direction. News of the government shut down ending would take us to the upside since the extended shut down, negative tariff and economic news has somehow been unable to keep us down.......so far.

++++++++++++++++++

Re: Re: Re: Re: A word of caution

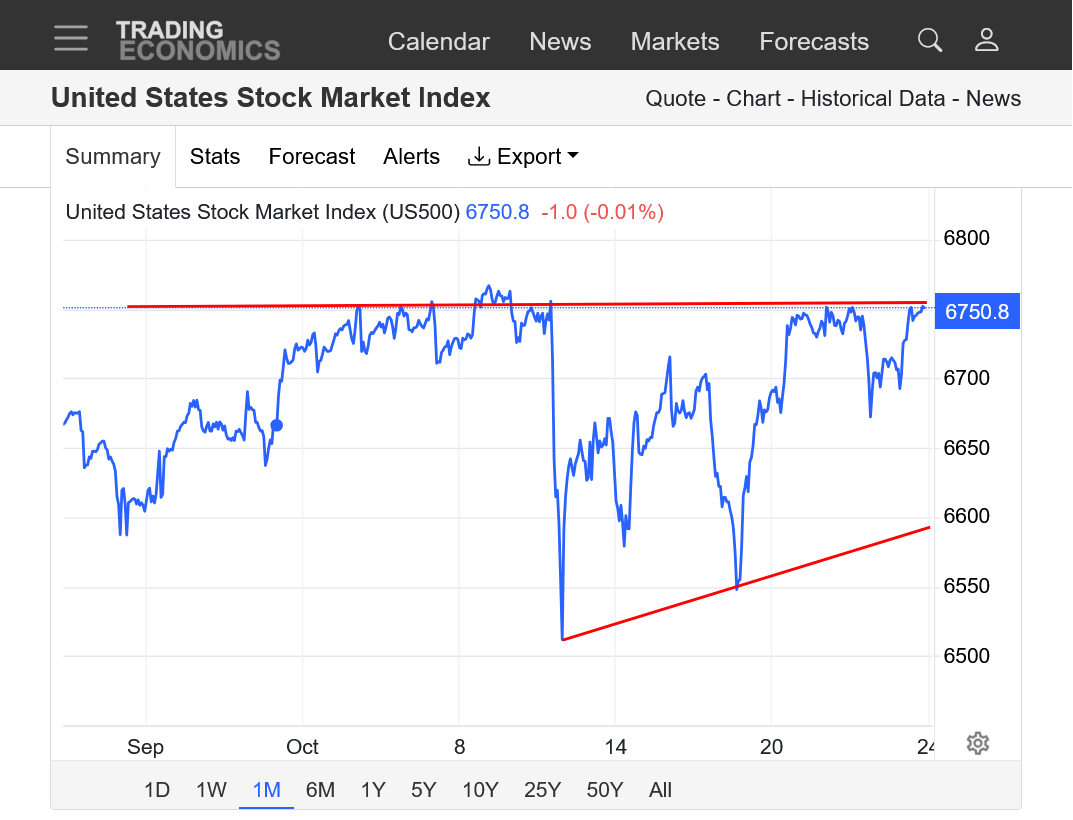

By metmike - Oct. 24, 2025, 9:36 a.m.

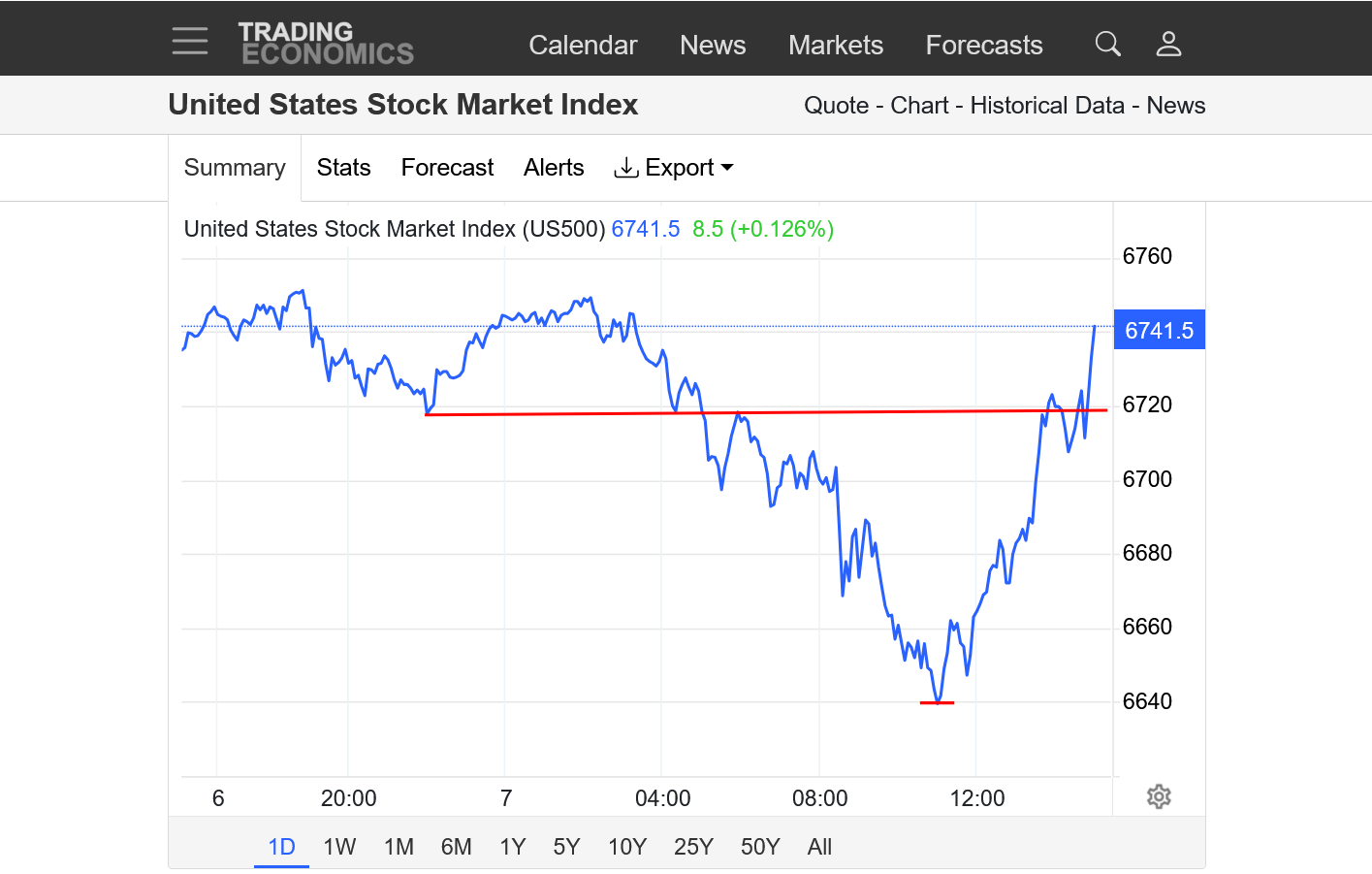

Upside breakout to the bull flag(wedge) pattern identified yesterday.

Bull/bear flags are continuation patterns(temporary pauses in the trend).

https://tradingeconomics.com/united-states/stock-market

+++++++++++++++

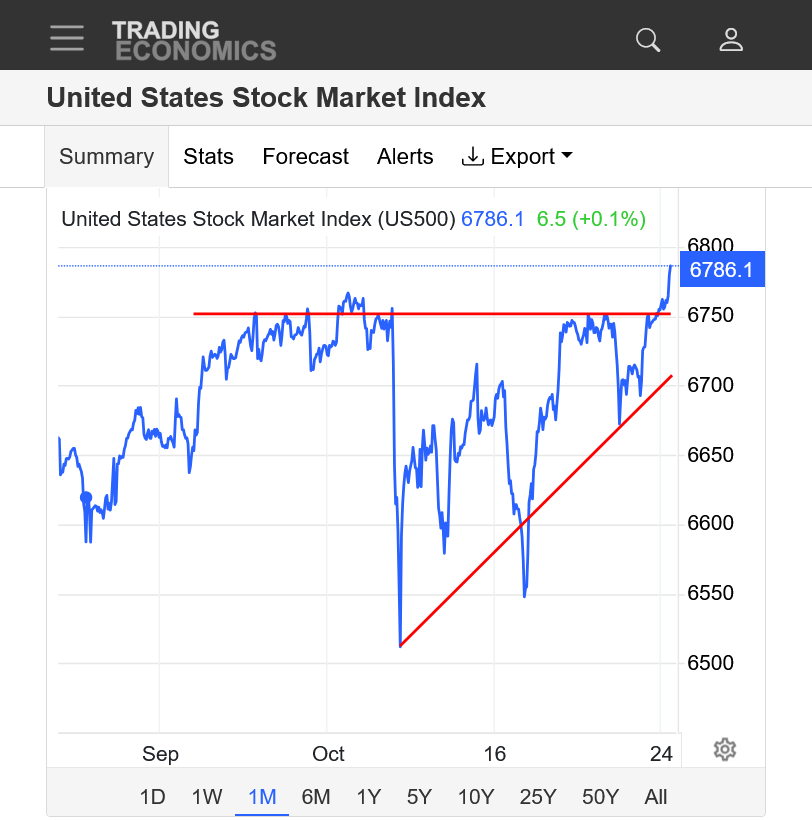

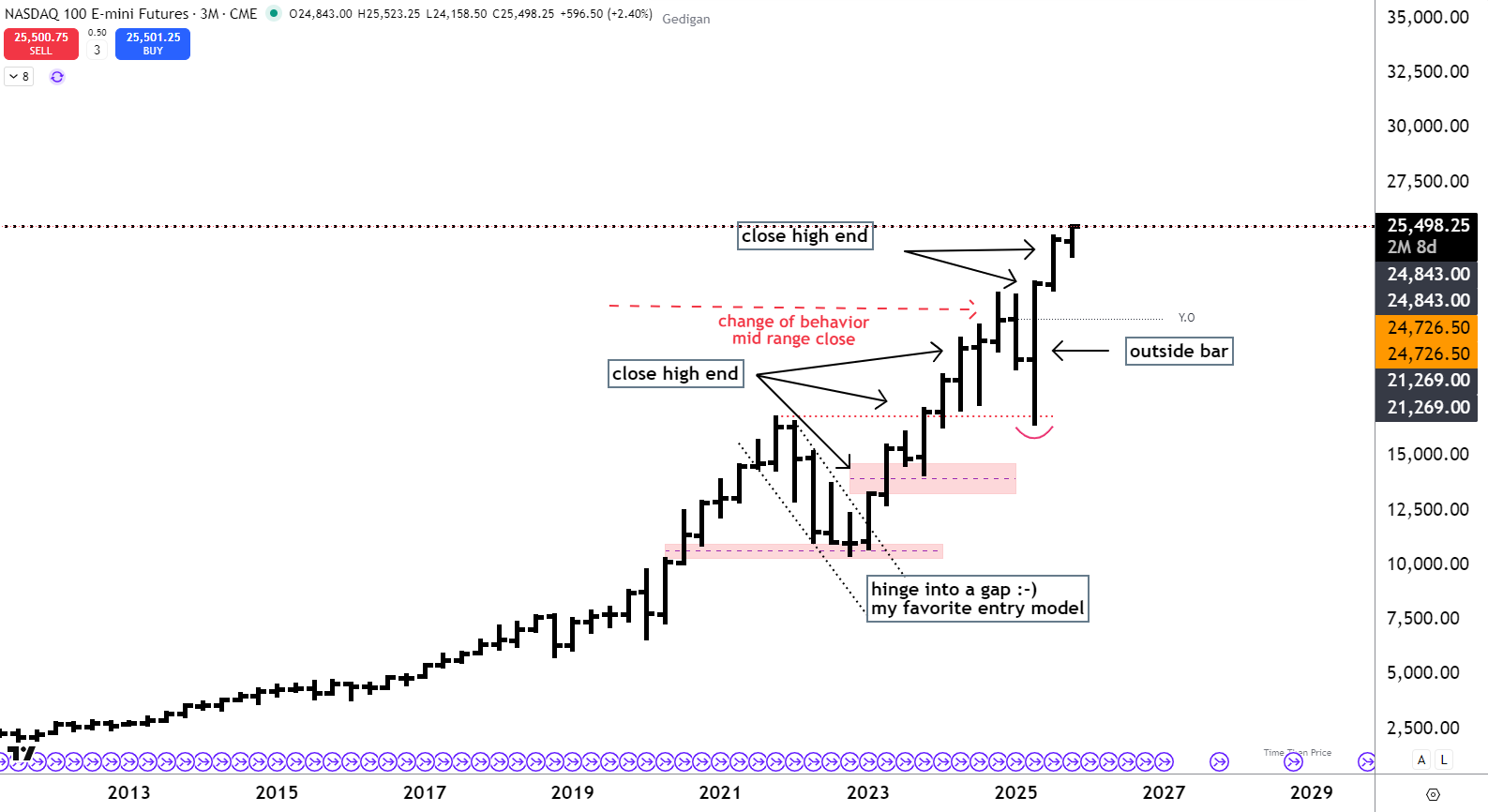

By gedigan - Oct. 24, 2025, 8:45 a.m.

NQ quarterly chart

How many pay attention to this timeframe?

Kinda cuts out lower time frame noise

New highs this am

Thanks, gedigan. Nice chart.

Welcome back!

Closed near the highs and at an all time record!

Typically when this happens, Trump is the most likely to display especially unhinged behavior because he interprets stock market highs as a positive reinforcement signal from the rich people he cares about that he should double down on whatever he's been doing.

I am dead serious!!

"THE STOCK MARKET IS STRONGER THAN EVER BEFORE BECAUSE OF TARIFFS!" Trump wrote on Truth Social.

+++++++++++++

This is the truth about tariffs:

More delusional tariffs!

28 responses |

Started by metmike - Sept. 14, 2025, 5:51 p.m.

I hadn't been following close and didn't realize that Trump was going to China this week. This is THE OBVIOUS REASON for the stock market to hit new highs at the end of last week!!!!

https://www.cnn.com/politics/live-news/trump-asia-trip-china-10-26-25

Not surprising, a big gap higher after the stock market and rich people's mouth piece gave it/them a positive signal with good news about China.

https://tradingeconomics.com/united-states/stock-market

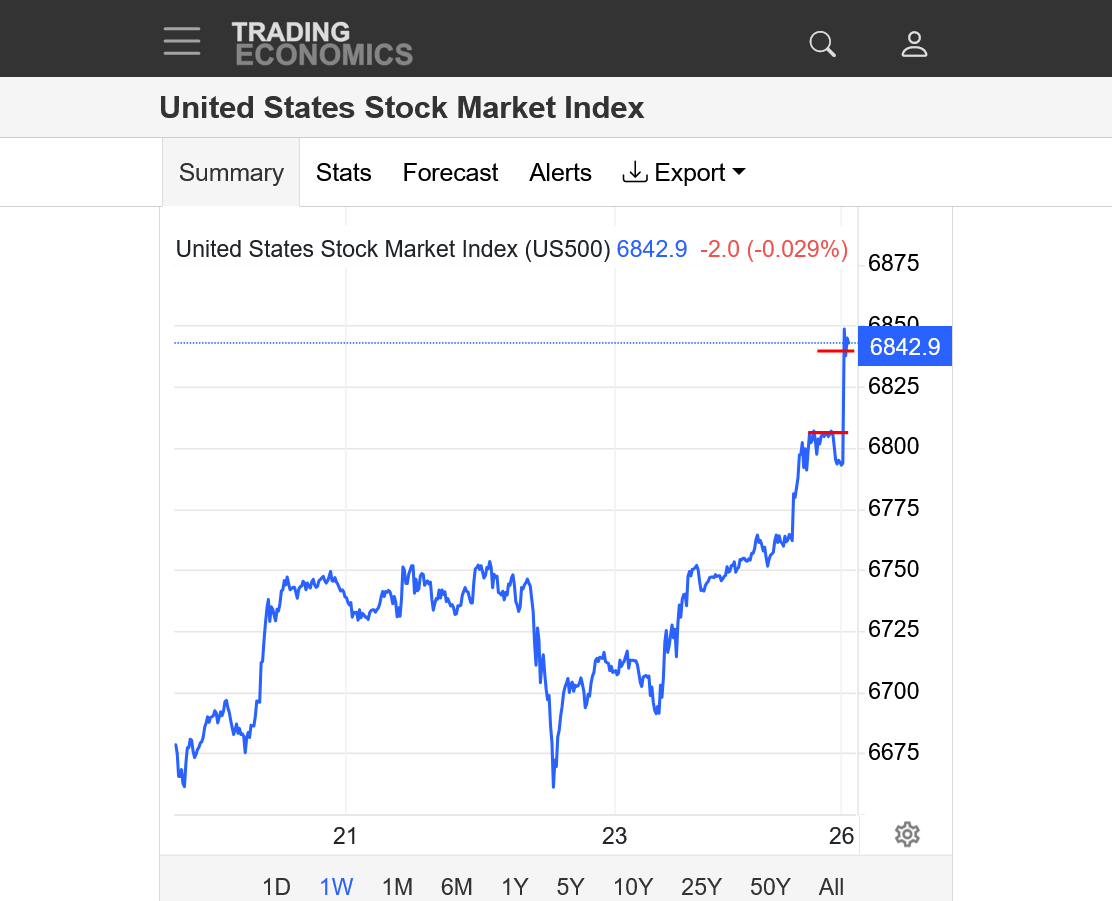

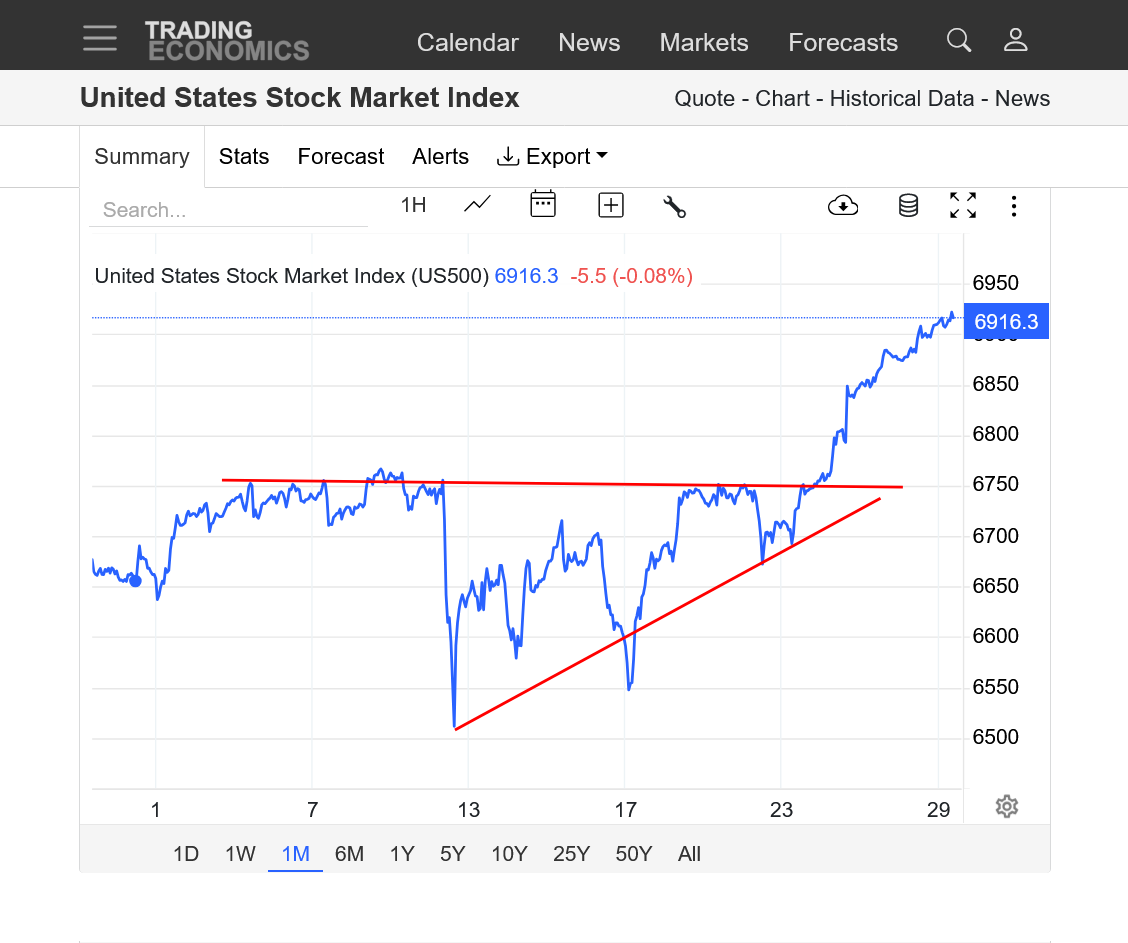

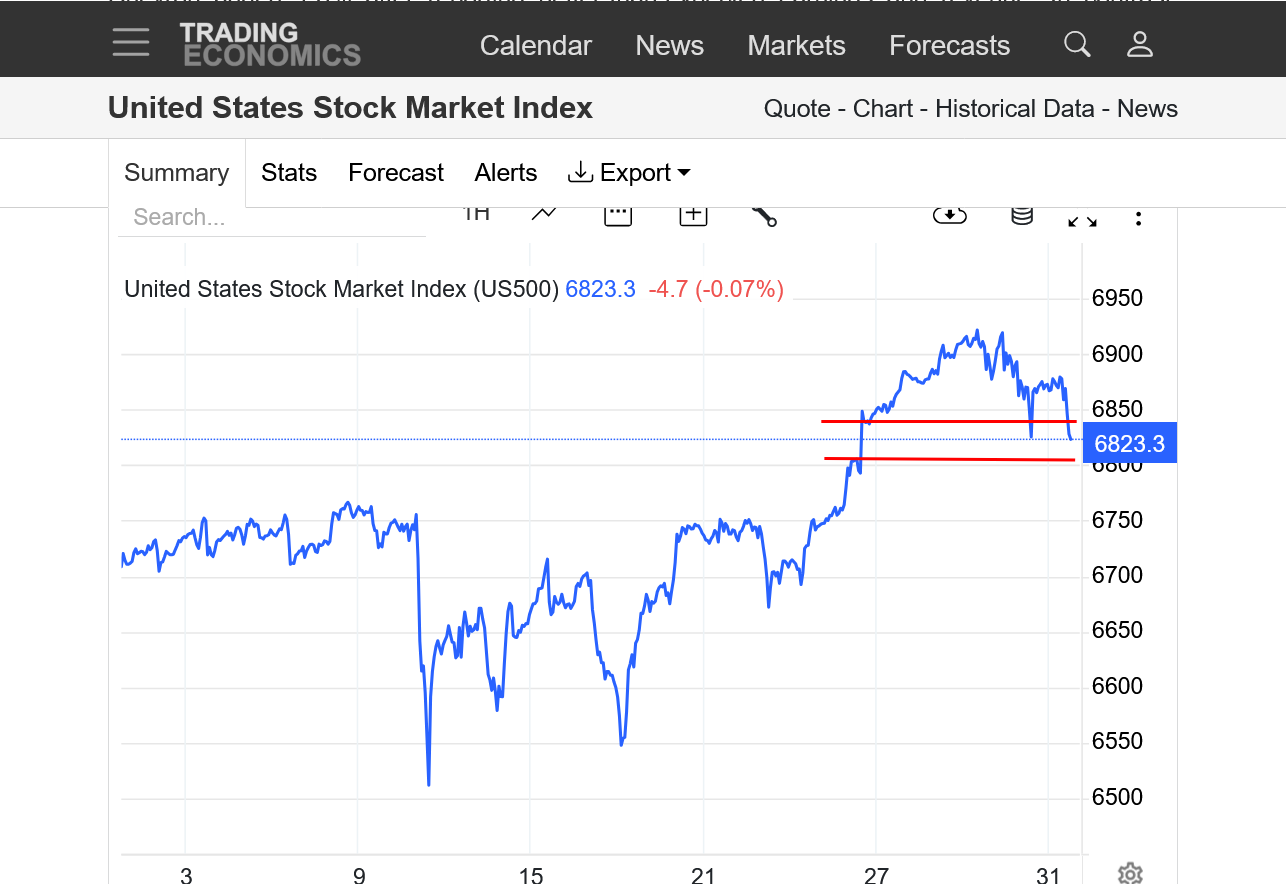

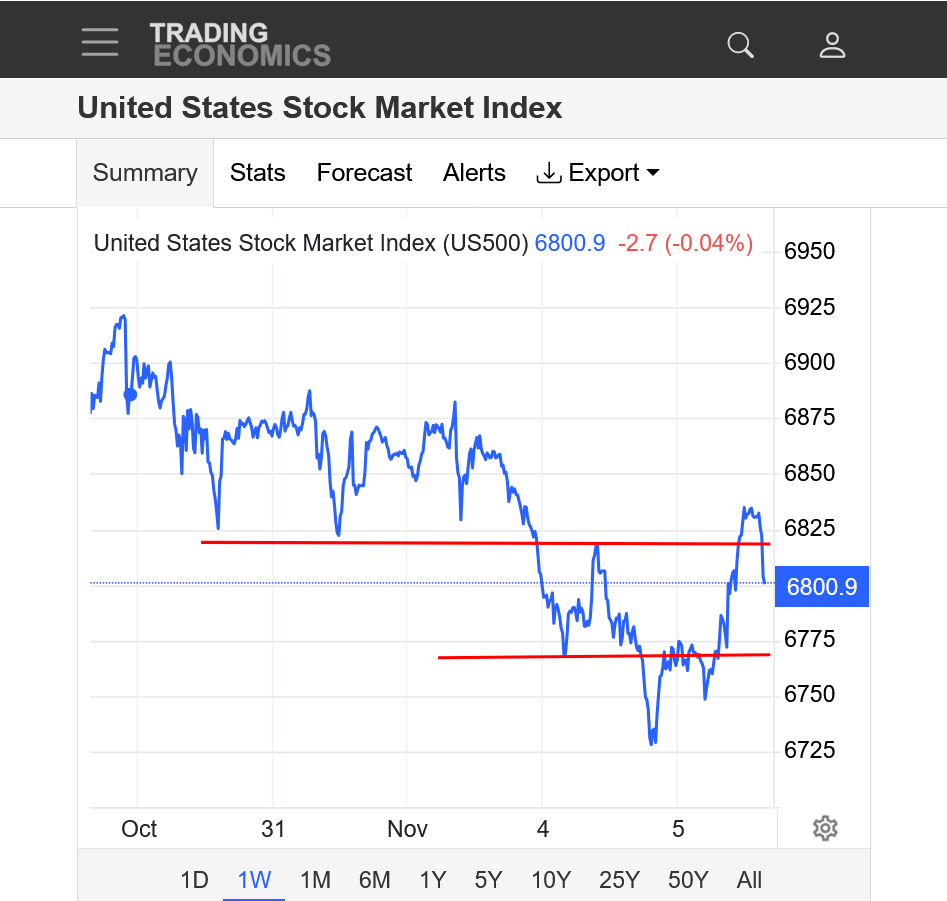

1, 1 week: gap higher. Fridays high lower red line. Sunday nights open upper red line.

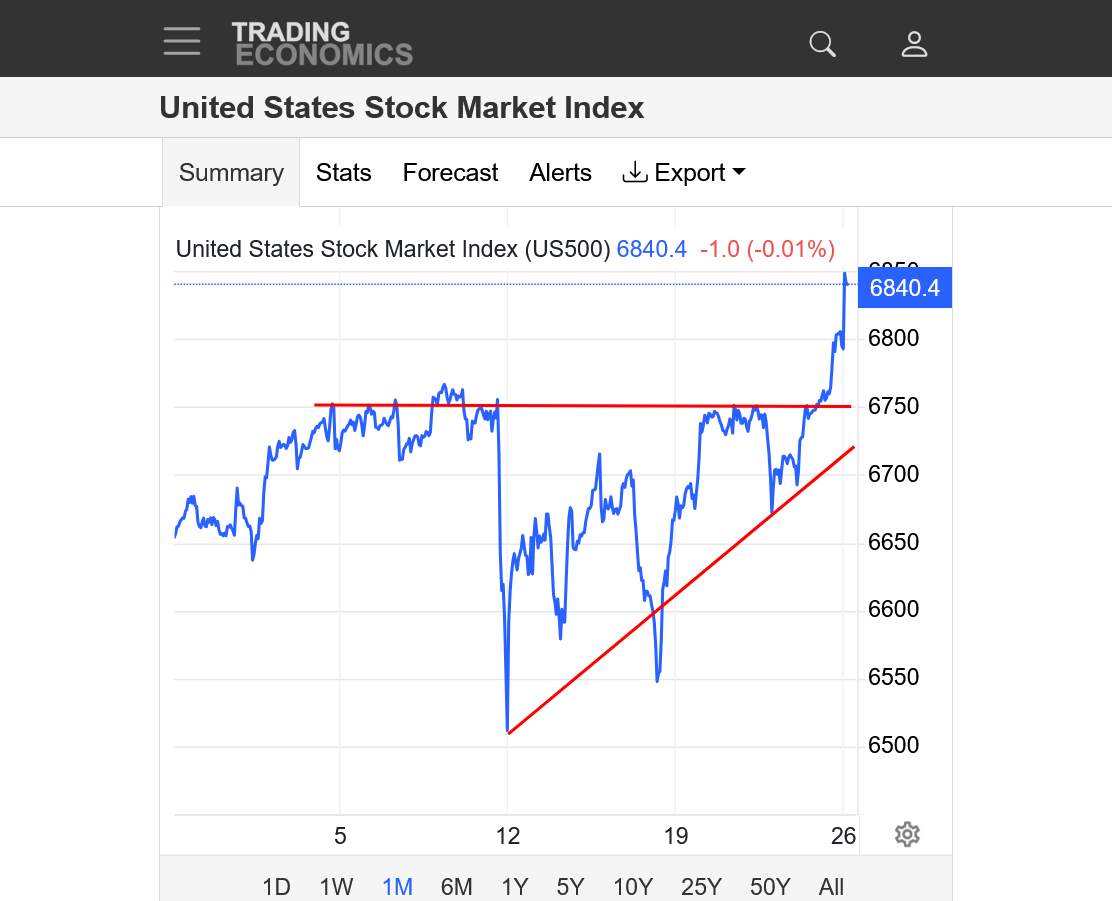

2. 1 month: Bull flag, breaking out to the upside on Friday. New record highs.

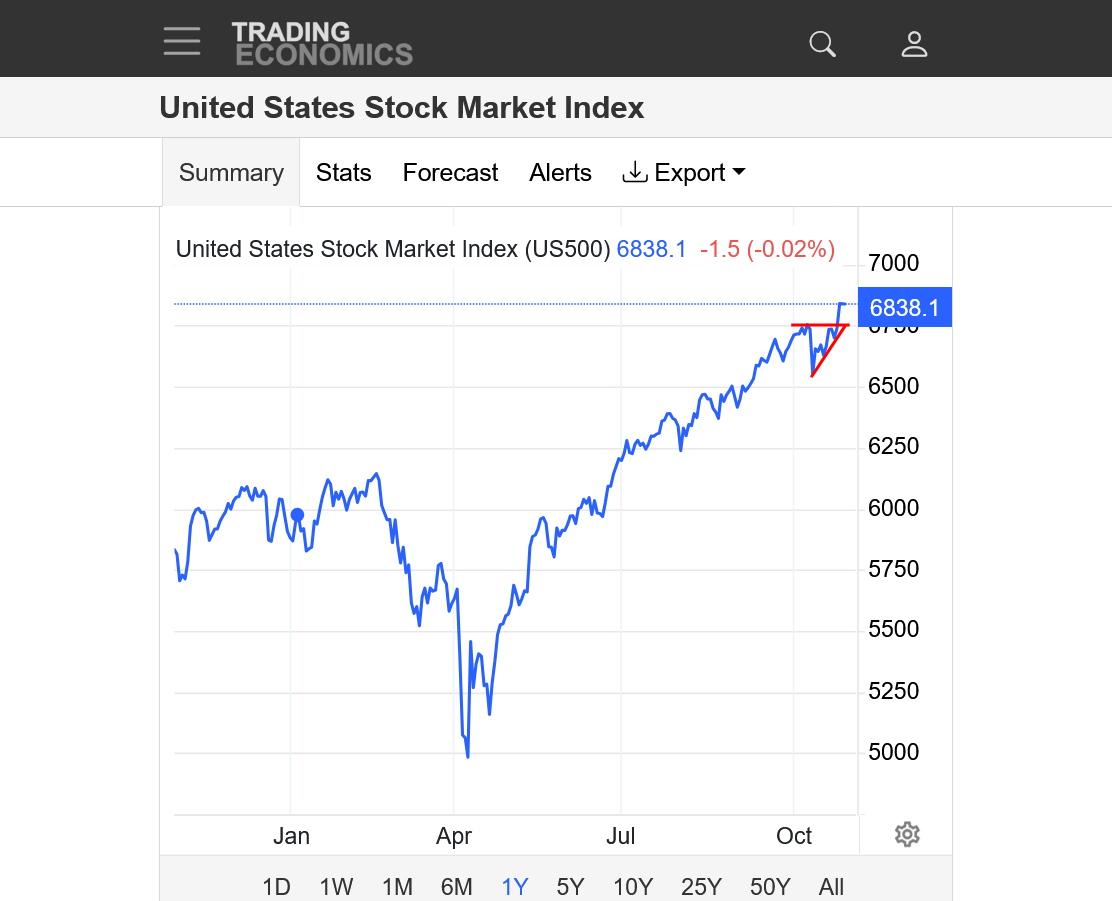

3. 1 year: Bull flag. We can see close to a half dozen bull flag type signatures since early April. All continuation patterns with upside break outs to new highs that resumed the uptrend which has actually been accelerating upward on some time frames.

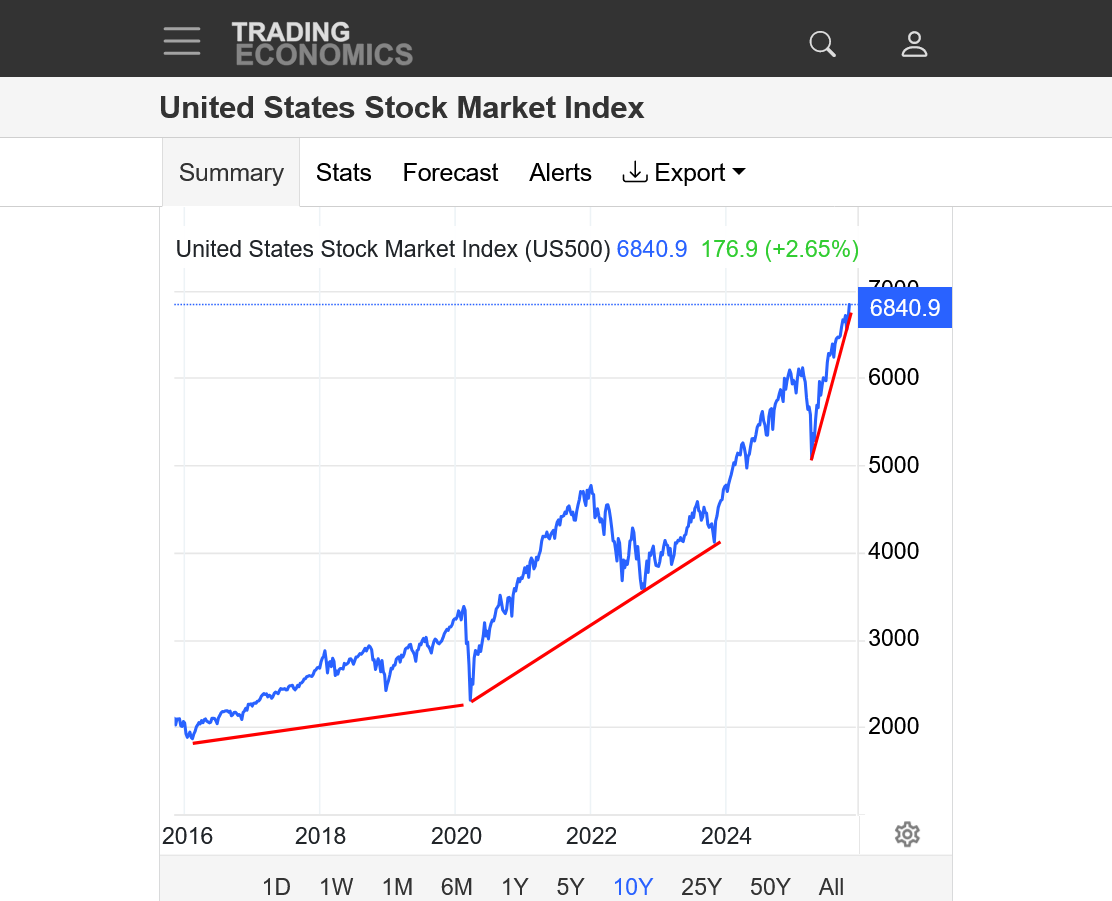

4. 10 years: Parabolic/exponential move higher. Up trend line getting steeper and steeper. This is not sustainable but its impossible to know the exact point when it will come crashing down.

Never mind the government shut down! That's being designed to target POOR people.

By metmike - Oct. 26, 2025, 7:16 p.m.

We are holding the gap higher open from Sunday Night. If we close that gap, it would be a pretty powerful gap and crap buying exhaustion formation at a record high.

I copied the verbiage for the explanation from this source to tell us what's important in this market right now for a reason.

Can you tell what's funny about it?

President Biden is in China right now

By kris - Oct. 28, 2025, 7:43 p.m.

"He's whittling on a piece of wood, when he's done whittling, I'm afraid something is going to happen .......... "

"irrational exuberance"

This market environment beats the dotcom bubble, how long can it last ?

If today's high doesn't hold then maybe tomorrow's [potential] high will, the Fed rate decision could be the catalyst for many weeks to come.

If tomorrow turns out to be another low then the first week of November could be a decisive "tell" !

"stay thirsty my friends"

Thanks, kris!!!

Earlier this year, I would never have guessed the stock market would be doing this in the midst of the current dynamics. However, it is. I believe that this bubble is going to pop, probably soon similar to your thoughts but am just following what the market is saying and not what I think should be happening.

Surging to new highs again today with more irrational exuberance. The Fed will cut interest rates as expected. Will this be a buy the rumor-sell the fact trigger for the start of a correction?

https://tradingeconomics.com/united-states/stock-market

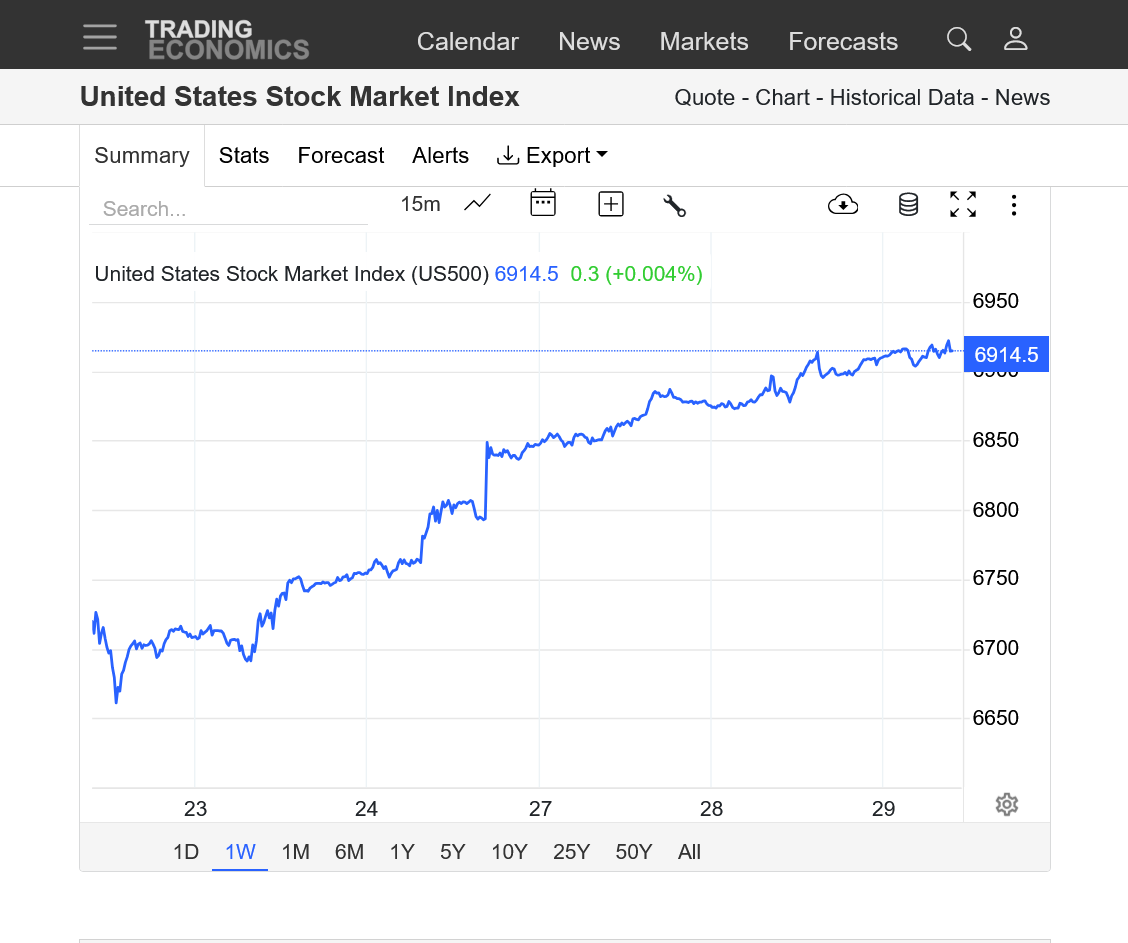

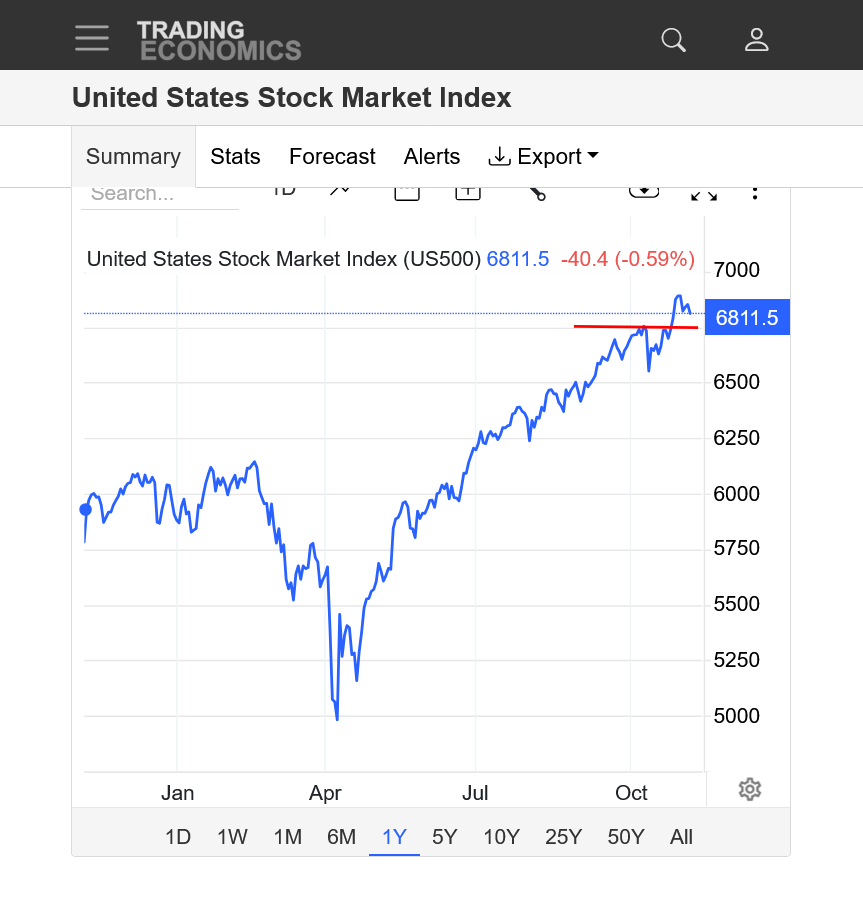

1. 1 week: Pretty much sustained, aggressive buying that is overwhelming the selling orders.

2. 1 month: Huge upside break out last Friday is in the rear view mirror.. That will serve as support on the way down but I suspect, a trigger for any correction, because this market is SO out of whack and unbalanced with incredibly over extended speculative longs that it will cause it to fly thru support like a hot knife thru butter.

On both graphs below, I forgot to mark the gap higher which is the straight up line in the middle of the first chart and towards the right, above the upside breakout of the bull flag/wedge. Filling that gap would be a gap and crap type signature which is a buying exhaustion indicator.

its especially powerful at the top of long lived moves higher and when the exhaustion gap is filled quickly. Several days later is not exactly quickly but it would be one heck of a warning signal to the bulls!

Put another way, a solid close below the previous record high, around 6750 on this index could be the start of a major drop lower.

In almost every other market it would be deadly but the stock market does not follow those rules.

Red line shows when the Fed announced the 1/4 point rate cut. As expected we saw some buy the rumor/sell the fact price action. This puts in a small downside reversal on the daily bar. Future hikes are in doubt so if rate cuts were fuel for the stock market rally, that element has been taken away right now.

Also, the bullish news with regards to China has probably been dialed in.

This would make normal, unmanipulated markets that trade on key fundamentals and true valuations very vulnerable to the downside.

However, the stock market has rejected that as, instead the rich people's Ponzi Scheme trades on a self fulfilling prophesy that controls money flows.

I put the gap higher from Sunday Night in this 1 week chart. Closing below that would potentially be an ominous sign!

https://tradingeconomics.com/united-states/stock-market

The above chart shows the NQ daily as of today's close.

The pitchforks from the August and October lows are at or close to an intersecting juncture.

I'll repeat though: if today's high does not hold we'll have to wait till the first week of November for the next high which could just be a higher high if (again) today's high holds for a few days only ... !

Trade safe everyone !

Thanks very much, kris!

I totally understand why you would be looking for THE top here!

The above chart is the monthly Dow Jones Transports, typically a harbinger of things to come ... stay tuned !

Thanks, kris! I'm guessing that you will be right.

https://tradingeconomics.com/united-states/stock-market

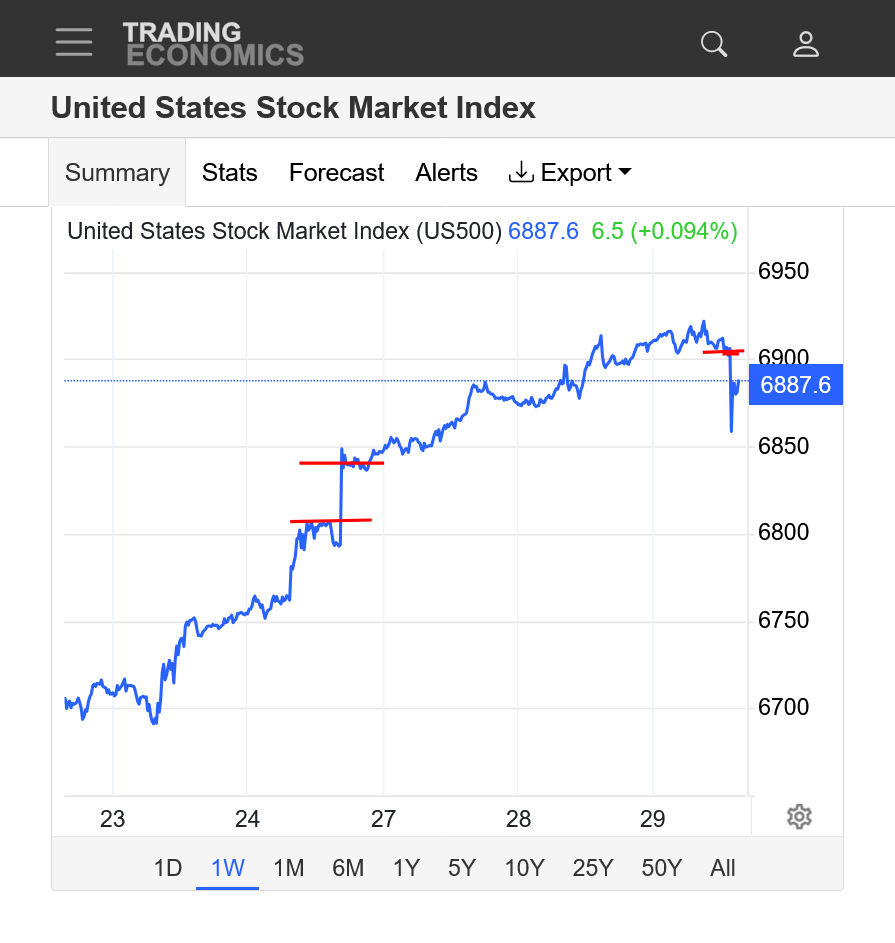

Gap from last weeks close to this weeks open on the right. Previous highs below that.

Filling the gap is a buying exhaustion signal(gap and crap).

Closing below the previous highs adds even more technical/chart bearish fuel to that.

Starting to erode the top of the potential buying exhaustion gap!

This could finally be it, kris!

"Starting to erode the top of the potential buying exhaustion gap!

This could finally be it, kris!"

It could be and we'll know for sure after the first week of November ...

We tested the top of the gap near the end of the session yesterday and uncovered enough speculative buying at that level to bounce back. Despite having so many reasons to go down, the stock market continues to be controlled by bullish speculators.

https://tradingeconomics.com/united-states/stock-market

Oh, Oh! Poised to fill the gap higher that started this week as we end this week, which would confirm it as an exhaustion gap and a market that ran out of new bulls/fresh buying at the higher prices.

This is the 2nd attempt in the last 24 hours to fill it. The recovery after the 1st attempt was pretty feeble.

However, this is a self fulfilling prophesy/rich speculators Ponzi scheme and the market with 9+ lives. Fundamentals and valuations don't apply, neither do interpretations of technicals/charts using classical principles.

https://tradingeconomics.com/united-states/stock-market

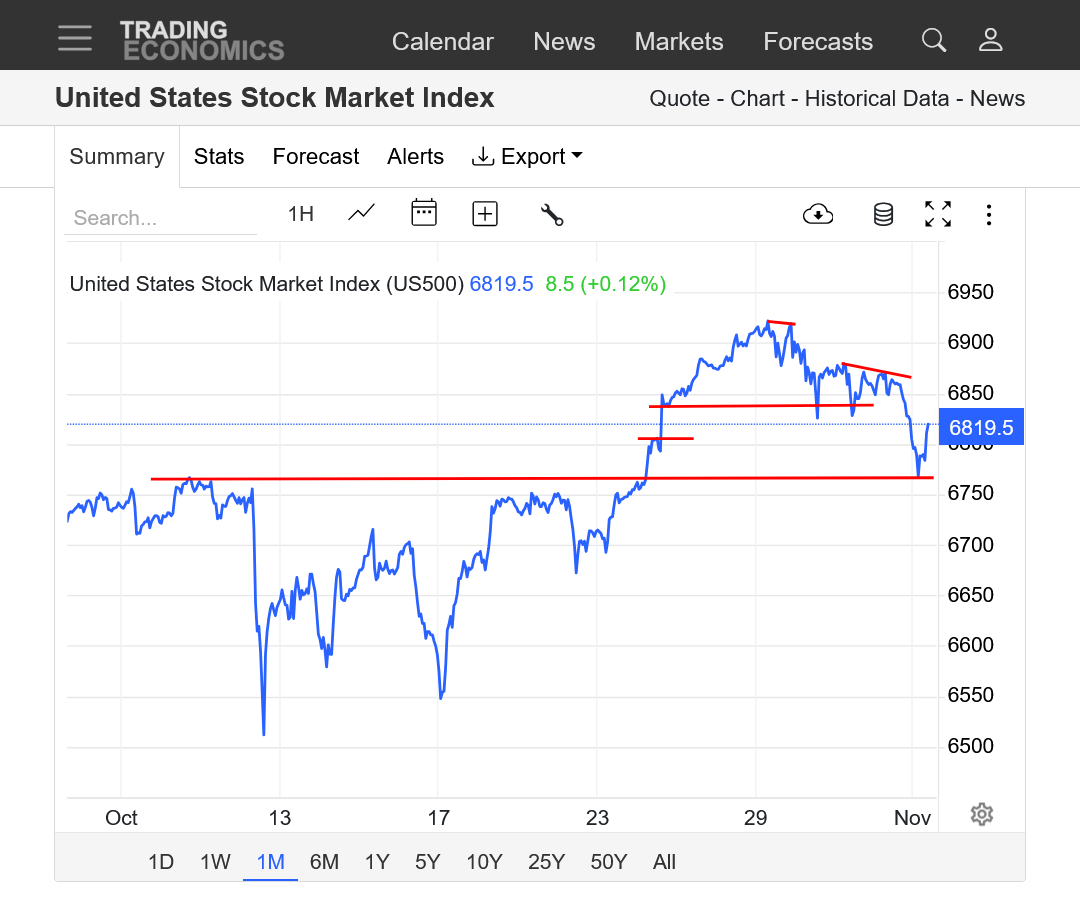

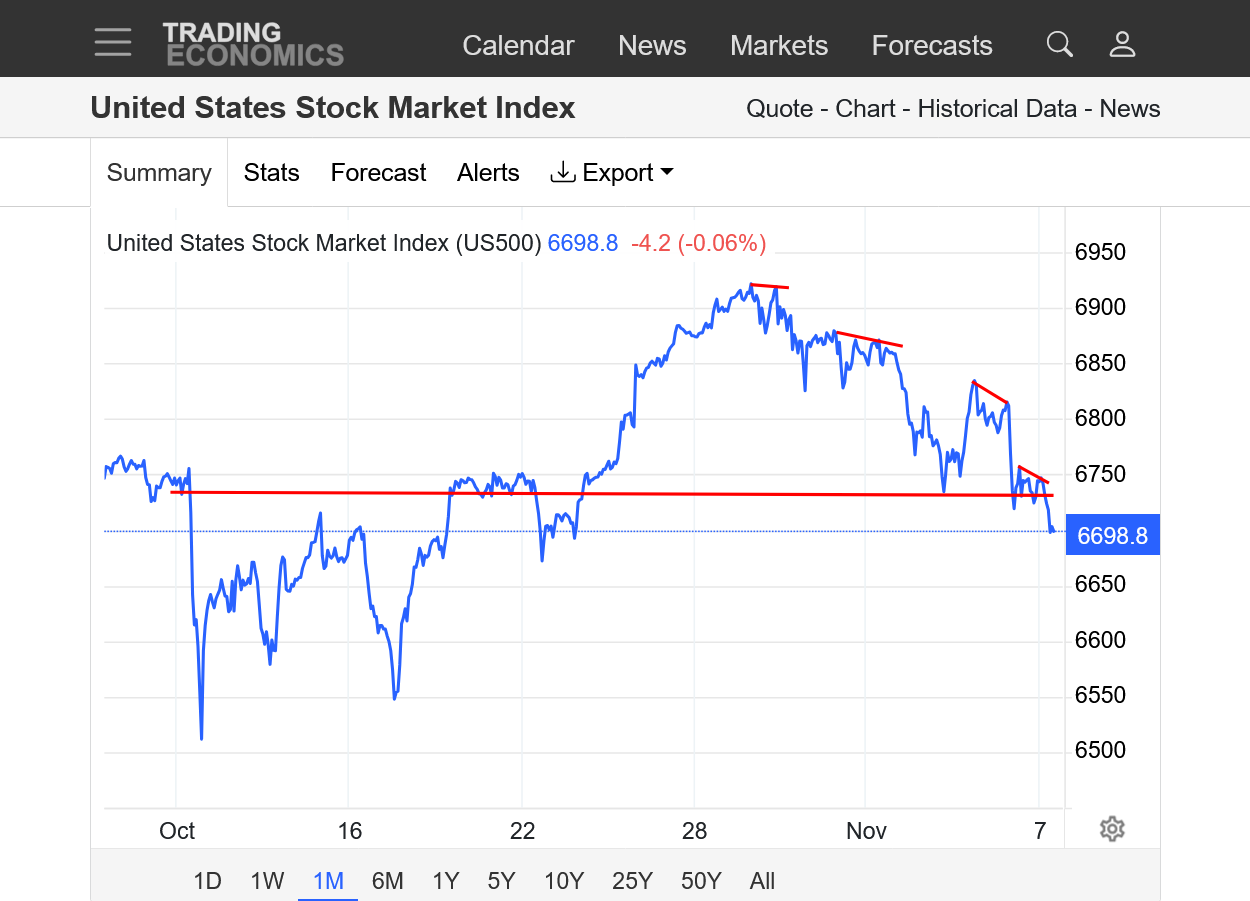

Latest chart with the different formations.

Old highs on the left. Then the gap higher 8 days ago/Sunday Night that's not filled yet.

Then a possible top, followed by a descending wedge (bearing looking) formation that partially filled the gap on the bottom side.

This is the stock market. Classical technical/charting analysis is often trumped by self fulfilling prophesy speculators with big money flows.

We just filled the gap.

Risking higher on the day.

This is out of the Street Smart book, although I am jumping the gun a little bit. It isn't the gap being filled. It's a rejection of the new high breakout from 2 weeks ago. Looking to add 1 lot short under the lows of the session. (confirmation of the rejection)

Thanks extremely much, joj!

I have no confidence in what the stock market might do and believe you to be far superior at that.

The source that I use is just 1 of many and the index also 1 of many and its free, which is why I use it.

The exact placement of gaps, trendlines, tops and so on are a bit different than other sources and are not an absolute thing.

https://tradingeconomics.com/united-states/stock-market

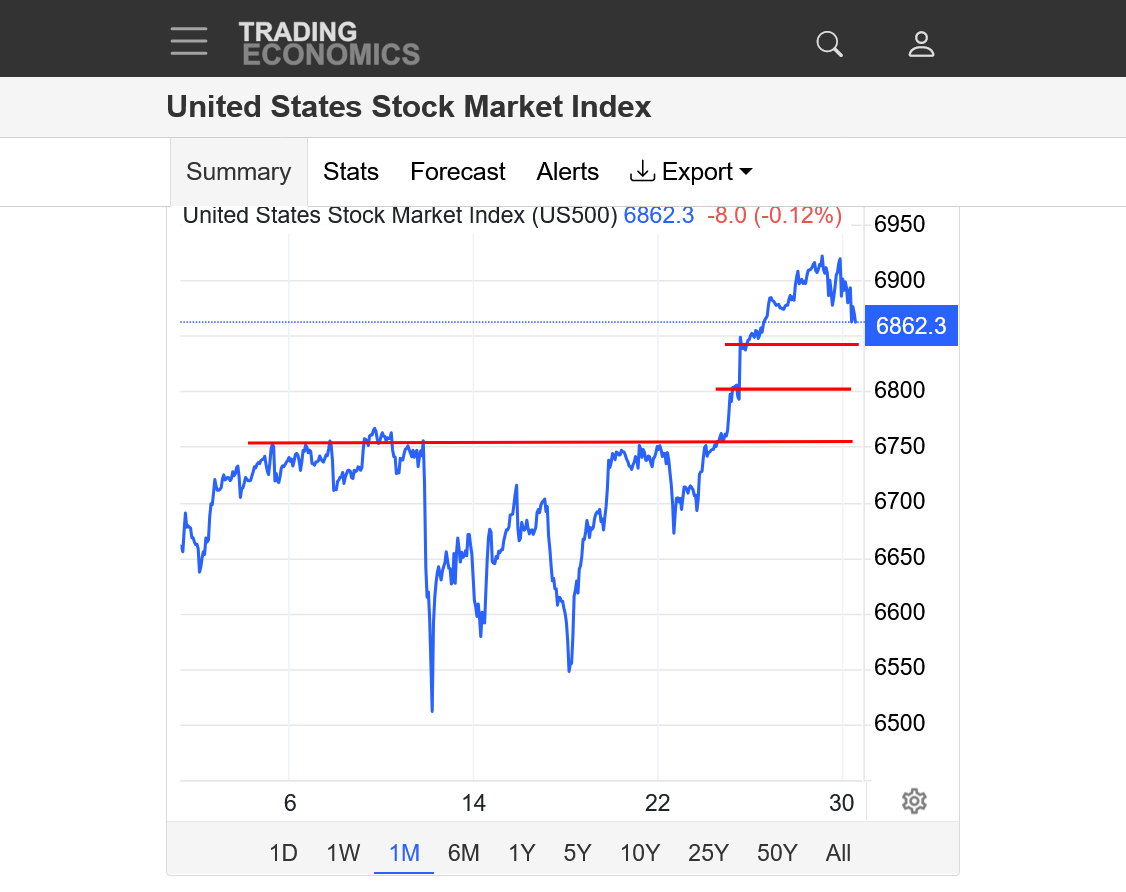

1. 1 month with gap filled. Lower line is the previous high ON THIS TIME FRAME FROM THIS SOURCE. The highs above are also noted, as well as the highs being progressively lower.

2. 1 year: Previous high that appears at a different level for this time frame.

Now that gap filled AND bouncing, a trader might buy short term calls risking a new low on the day. Just saying...

Thanks, tjc!

Another great suggestion and you too are probably more skilled at trading this market than moi.

This is what joj was referring to with his mention of the book "Street Smarts"

By metmike - Oct. 9, 2025, 11:11 a.m.

By metmike - Oct. 9, 2025, 3:13 p.m.

+++++++++++++

Re: Re: Re: Re: Re: Gold Update

By joj - Oct. 10, 2025, 12:11 p.m.

The action from the open was somewhat neutral. (closed where it opened)

Remaining short overnight. Stop is at 6882

Thanks much, joj for sharing your trade with us!

I don't want to jinx you but from my chart perspective, the successive lower highs suggests that every rally is becoming more feeble and failing at lower and lower prices.

We could be completing this latest bear flag type wave/formation and about to break out to the downside.

This market has lost all of its upside momentum that sustained its move up.

Of course this could serve as support that held earlier when we hit this same level.

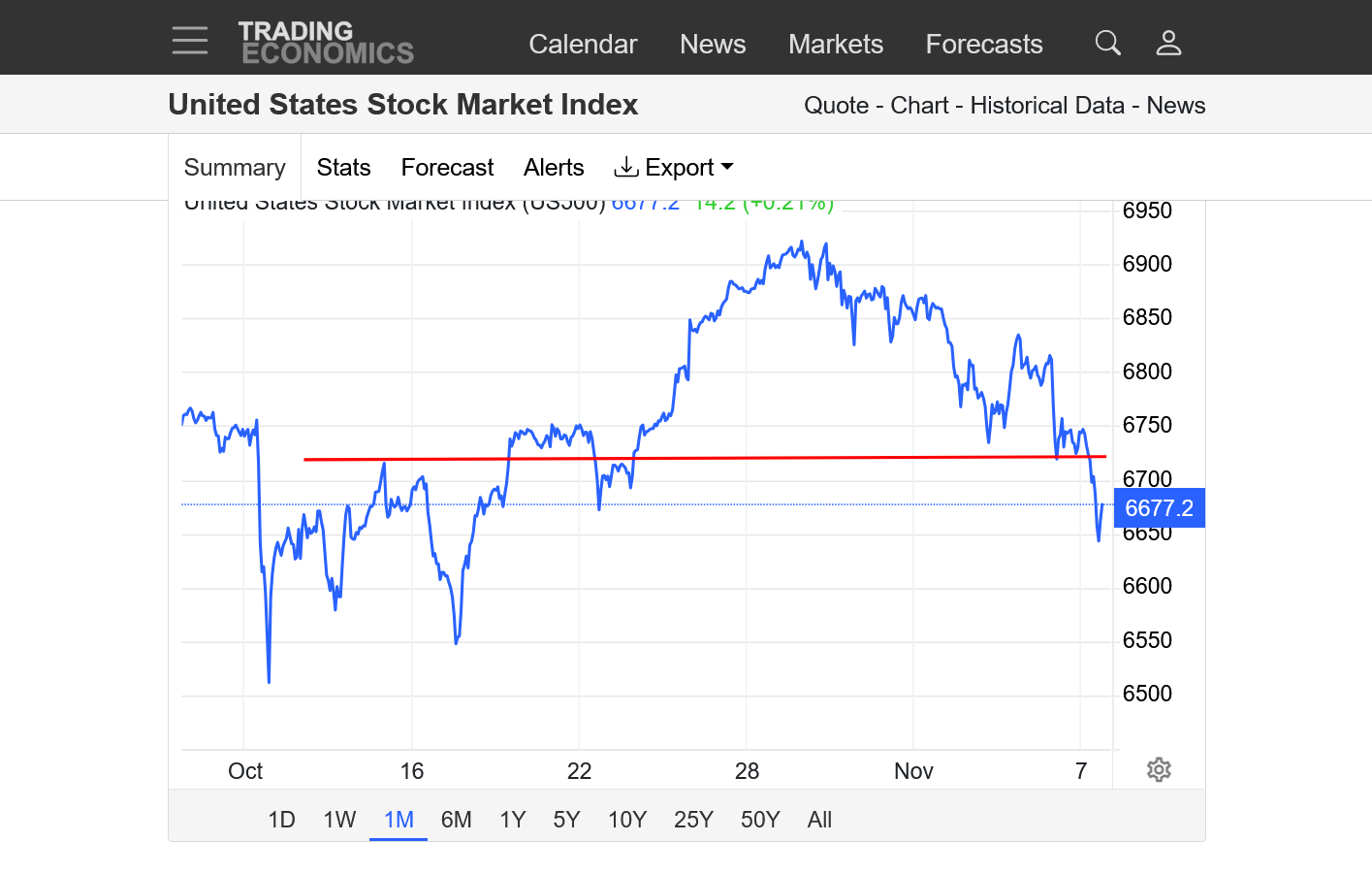

https://tradingeconomics.com/united-states/stock-market

++++++++++++++

joj,

I never traded this market and you clearly know what you are doing but if it was me, I would put in a trailing stop to protect profits, especially since we are living in a time of news that can cause spikes from Trump saying something crazy/unexpected.

There she goes, breaking out to the downside.

9:50 pm: And here she comes back. This is why I would have put in a trailing stop to lock in profits. And why I'm a weather market trader only

https://tradingeconomics.com/united-states/stock-market

The stock market held overnight and I have no ideal where we go from here.

UPDATED 9:15 pm: Bears still have a slight advantage from the lower highs since late last week but the momentum from early morning buying appears to have shifted upwards. Yesterday's highs will be an important test for the bulls.

Again, the lines on this graph only tell us what the market did and was thinking at those points. They are useful as an indicator of what the market MIGHT do because they reflect what Richard Wyckoff referred to as "The Composite Man" (the entire market's combined thinking/actions) but they are THE PAST.

In many situations, THE PAST reveals a ton of things that we can use to predict THE FUTURE. (reactions at support/resistance, for instance. Or lower highs depicted below) but there is always NEW/FRESH information feeding the market that can trump the OLD information which carved out the OLD pattern formations.

https://tradingeconomics.com/united-states/stock-market

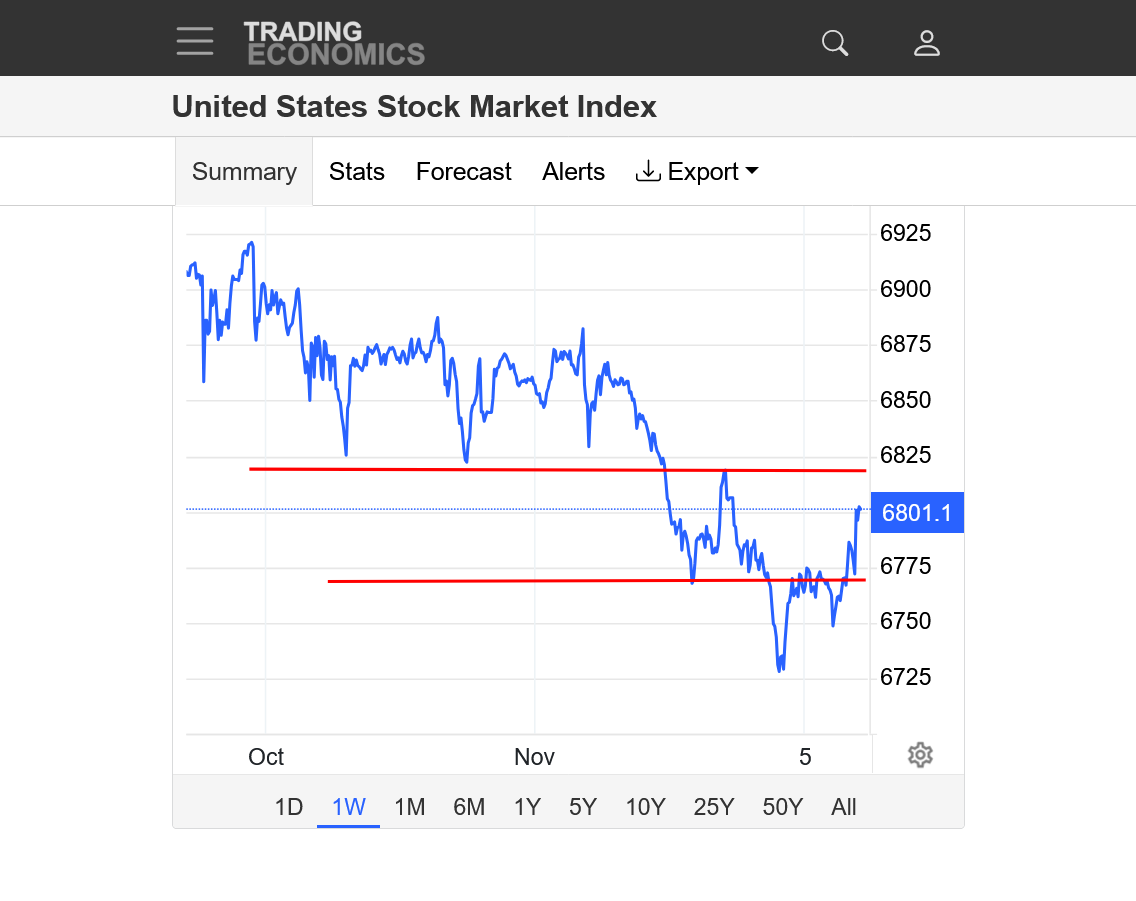

9:33 am. Here's the updated chart on a shorter time scale. With yesterdays trading range between the red lines. Note the spike BELOW that overnight which at the time was a downside break out from that range and new lows for the week.

10: 20am However, trading back up above the break out level(above the lower red line) and back into the previous days range might have been a Street Smarts(Linda Raschke) type, short term buy signal with a sell stop below the overnight lows.

Looking at that chart, the top red line is very significant as yesterdays highs and previous support that held several times on the left side of the price chart. After that support was broken, it became Tuesday's resistance. Broken support=new resistance and broken resistance=new support happens a great deal of the time.

I am a strong advocate of trailing stops. Here, my time frame requires me to keep my stop over yesterday's high. If I trail the stop tighter than that then I am day trading. If I am stopped out, then I am wrong and will take my lumps. If the market doesn't stop me out AND closes lower on the day, tomorrow's stop will be today's high. (A trailing stop on a longer time frame).... And, if this trade plays out favorably, the future trailing stops will be similarly placed.

Based on the current action it seems like I may indeed be in a losing trade. Back in the day when I was a pit trader in the S&Ps traders used to call each other "loser". But it was an affectionate term because we all knew that when managing risk on high leverage, taking your loser was essential for survival. "Hey loser, wanna grab a bite after the close?"

A super successful trader I once chatted with when I was green said to me: "If there are 10 skills required to make it as a trader and you are an expert at 9 of them but the one skill you don't possess is admitting when you're wrong (taking your loser) you will lose ALL your money."

Good trades everyone!

Thanks a ton, joj.

For sure anybody that was a local on the floor knows what they are doing managing a short term trade on MarketForum, so please don't let my advise previously read like it was disrespecting that.

You come up with so many profound statements that relate to trading that I knew that already.

Today was another one which makes it our post of the week. Interestingly, I told a story yesterday about the best trade of my life in 1994. It was losing almost half the money in my account on the Monday open in July on a margined out, long corn/beans trade when the weather turned bearish on Saturday and everybody knew it on Monday's open.

There were 10 minutes to get out before we locked limit down for the rest of they day and opened Tuesday, another 1/2 expanded limit lower.

Had I not exited everything by selling at the market on the open, I would have had to find a real job because Tuesdays open would have put us in a massive hole and there is a 0% chance that I would have ever convinced my wife to let me use our money again for trading when she was petrified the first few years, to the point where she didn't want me to even tell her about trades until they were over or we were way ahead.

And I know what you are saying exactly about stop placement. On weather trades in the 1990s I never used a stop 1 time because I let the weather determine the trade and was extremely selective. Trading only markets very sensitive to the weather. I got out when the weather changed and I had access to weather information BEFORE the market did

Today, people have that info before ME and the weather markets trade with extreme gyrations that make me extremely nervous/emotional with my small account, so I always use very tight stops to prevent any loss if possible. Most of the time it also takes me out before making a nice profit..........which could have improvement if I followed closer to your strategy.

I agree strongly with your buy stop placement being above yesterdays highs as a logical place, though it looks like it will probably get hit.

What I have found, unfortunately and you know this too is that skilled traders and the market KNOW where those logically places protective stops are located and will push to that level to trigger them, then return below/above them to the previous level.

Ouch! That happens to me all the time with my (too tight) stops.

Great story Mike. Thanks for sharing.

Regardless of what happens with this trade, our discussion here between people that actually understand trading principles that includes experience doing it (you actually sharing a good trading idea and how to manage it effectively) is what I would consider an extremely valuable, POSITIVE contribution for others to read and learn from at this trading forum.

This is greatly appreciated!

You might wonder why I rarely share trades(the last one I shared was in June of this year).

1. I don''t trade like I used to

2. I trade entirely on weather information that is coming out with constant updates around XX seconds apart and literally, don't want to waste even X seconds in the process.

3. I could put on a position suddenly and the maps X minutes later will show the change I got long/short over is shaky and cover it or put in a REALLY tight stop.

4. This style of trading is impossible to communicate in real time and just makes me even more nervous.

5. Instead, I review the weather model changes and display to everybody exactly how they caused the (natural gas for instance) to move strongly at that time. It shows everything that people should know about how and why that WEATHER market trades.

6. There is no risk or pressure for me and I serve as an educator, even though I think that its especially wonderful when you, or tjc or kris share your trades, along with the thought processes that go into them which, in the long run can make trading profitable for many people.

7. Other than Larry, nobody else here is going to make money trading weather like I do(and sometimes lose it). Larry retired several years ago because of the crazy algorithms that cause unexpectedly wild gyrations which have also made it almost impossible for me to stay in a trade for more than a few hours. It ain't what it used to be for weather trading(with somebody that doesn't have deep pockets anymore and is usually all in or all out on the SIZE of my trades-vs trading just a few contracts).

By metmike - Nov. 5, 2025, 11:38 a.m. Thanks a ton, joj.

I agree strongly with your buy stop placement being above yesterdays highs as a logical place, though it looks like it will probably get hit.

What I have found, unfortunately and you know this too is that skilled traders and the market KNOW where those logically places protective stops are located and will push to that level to trigger them, then return below/above them to the previous level.

Ouch! That happens to me all the time with my (too tight) stops.

+++++++++++++++++++

3:15pm: It looks like that's what happened today from the graph below.

I've seen it thousands of times, including it happening to me. The closer the stop the more often it occurs. But a trader has to have a loss protection strategy. THEY MUST MAKE THAT TOP PRIORITY.

Where to put the stop is always tricky with no rule that works most of the time, other than:

1. The wider the stop, the bigger the loss when it gets hit.

2. The less frequently it will get hit and the longer the trade will last.

3. Changing the goal posts in the middle of the trade makes sense ONLY IF IT REDUCES RISK! For instance. I might have a trade on where the price is just a few ticks from my stop and it trades there for a really long time and I decide to adjust my stop to give the trade more room to succeed.

4. Very often, I end up losing more money because I suddenly increased my risk to being GREATER than the original risk/reward.

5. What I like to do(in. especially NG but also grains) is put in a profit protecting, trailing stop that lowers the chance of making a big profit but it locks in a minimal profit. Each market and each trader are different and the time frame matters(day trader compared to position-longer term trader) including this trade. I never traded the stock market and have only been following this year. joj and kris have much more experience doing that.

False break outs above resistance or below support that abort and trade back below resistance/above support after hitting all the logically placed stops. This, actually is the Street Smarts trade we were discussing to be put on AFTER the false break out.

https://priceaction.com/price-action-university/strategies/false-break-out/

+++++++++++

I will add that hindsight is always 20-20 which this post is. There are numerous different outcomes that can happen BEFORE a trade is put on and a trader has to make smart risk/reward decisions BEFORE or at the time of putting the trade on AND BE DISCIPLINED to use them consistently. In the long run, this can make money. joj applied this. I've been around this challenging trading game for well over 3 decades and know a legit market trading guy when I read them.

This particular post was made AFTER the market did something today. Everybody is the world's greatest trader when they tell you what already happened and especially when they tell you AFTER it happened that they made big bucks doing it without telling us anything about the set up BEFORE the trade. I'm not trying to give that impression, just discussing what happened and why it happened in this post market analysis to assist people in learning about markets while have great fun and learning at the same time.

+++++++==

One more thing that I hadn't mentioned about personal trading. I never trade 1 or 2 lots. I'm all in or all out when I'm confident and think I have and edge or its not worth it to me.

30 years ago, when I really did have a huge edge and I was much younger I didn't mind the extreme stress of putting on huge positions. Staying up half the night and being exhausted was worth it the vast majority of time. I don't mind hard work, physical or mental.

I'm 70 now and don't have that HUGE edge, along with having Ehlers Danlos and my health is a higher priority. Sleep and avoiding unessesary extreme stress is a great positive contribution to mental and physical health that can't be overestimated. I was an extreme risk taker my entire life which made trading with high stakes positions a natural for me. Not everybody is cut out for this and pulling the trigger on trades is impossible if you can't accept the risk of losing a bunch of money to try to make a bunch of money. My physical condition, age and psyche has evolved to be much more risk and stress avoiding. There are 1,000+ things in our lives that can bring rewards that have very little risk.

Just following, analyzing and sharing market information with like minded people is one of them!

I think the biggest risk of big loss on a short trade like this for the stock market comes if there was/is an announcement that the government shut down was settled. No telling how huge the spike up will be but it will start in seconds and you would definitely want to be one of the first shorts to get out at the best price with a stop helping to achieve/manage that objective.

The greater the size of the position, the higher the risk, which makes me think more about whether I should just be trading smaller size. Either way, nobody HAS to trade and should only do so if you understand the risks and have a good plan. Paper trading is a great way to practice but as anybody that trades size can tell you. There are no emotions attached to paper trading.

When real money is on the line, emotions can skyrocket and cause you to think differently........unless you apply your risk minimizing trading strategy with discipline every time.

I hate to tell people that I never used a stop 1 time during my first year of trading but that was entirely from having a weather data edge, trading exclusively in extremely sensitive weather markets.

Never trading for "the action" or on a hunch or to gamble. Only using well defined set ups that were only triggered in a tiny % of the time and always from big weather forecast pattern changes.

99% of the time............doing nothing.

tjc has followed the markets for decades and looks for similar set ups in weather markets especially near tops and bottoms. He likes options to reduce risk even though, I personally can't use them successfully with my quick turnover time of trades. For that reduced risk when buying options you pay extra. If the price doesn't move much or stays the same, you lose money being long unless the volatility goes insane (but that would be unlikely if the price doesn't move much).

Mike,

I thought about a settlement to the gov't shutdown. Sleeping better with buy stop in place. I moved the stop loss down to 6861 (over yesterday's high).

Regarding grain trading in weather markets, a successful, 5 foot tall Japanese-American gentleman trader in grains would sometimes (not always) "buy wet, sell dry". Which as I understand is similar to buy the rumor, sell the fact.

I was a back office clerk at the time and he would let me pull up a chair at lunch time and pick his brain. He had many other wisdoms to share. One that hit home. He said: "When you're wrong, GET OUT!" He would say it to me so many times. One day I had the gumption to reply, "How do you know when you are wrong?" He thought for a moment and replied, "In your head, you think you're right, but in your heart, you KNOWWW you are wrong." He's touching on the fragility of the human ego. Admitting that you are wrong is like a little death to one's ego.

Another exchange we had once was when I asked him what to do if I am in a trading slump. His reply: "Go home and make love to your wife." (Only, he used a more off color expression that "make love". :-)

Thanks, joj!

More wonderful and profound wisdom!

Being a meteorologist has been the optimal training for weather trading. Not just the WEATHER part, which determines price direction in certain markets(supply side for grains, demand side for natural gas/heating oil).

The most important part of being the best operational meteorologist that you can be involves having great analysis but even MORE important, on every single NEW model run, instead of looking for reasons to bolster the forecast philosophy from previous analysis, what is most important is too look for changes that indicate the older models were and your previous forecasts were wrong.

Whether the models(and your forecast) were wrong by alot and obvious or wrong by a little. The faster you FIX that amount of being wrong before, the sooner and closer you are to being right in the updated forecast.

This is also part of the scientific method(that most scientists don't always use in practice). You can't know you are right until you, first conduct a thorough, sincere attempt to look for legit reasons for why you are wrong. In the absence of being unable to prove yourself wrong, only then can you push forward with confidence on your theory or assessment.

Cognitive bias and human nature cause this to be very difficult for most people, especially in todays world of massive information sources. Most people go to places that tell us what we wish was true. Sharing the same ideologies. Echo chambers. Almost nobody goes to places that disagree with their views on a regular basis to sincerely consider those views as potentially being better than theirs. Just the opposite. Use sites that bolster and reinforce our current views. By definition from our brains, no need to fact check our favorite sites because it ALREADY lines up exactly with what we perceive as our truth.

As a meteorologist, doing this previous forecast intense fact check every model run, conditions a person and helps to carry over to short term commodity trading. I've mentioned the "Composite Man" from Wyckoff which represents everybody at the same time in a particular market. There will always be big traders with the best information sources that get some key information before the rest of the market that are part of that. I was one of them in the 1990s, before the internet with a satellite dish on my roof getting key weather information and interpreting it immediately as a meteorologist. Then buying or selling as many contracts as I was allowed on huge weather model changes before the rest of the market was trading that.

Now, I can see from the market's reactions just before I get the data that people are faster than me.

1. I have to admit that my edge is not what it used to be.

2. I'm not the only one looking for why me and all the other weather traders WERE WRONG before. The latest updated weather models (even though they will be assumed to be wrong tomorrow) are assumed to trump the older ones the instant they are coming out.

Larry knows this better than anyone and it's the most important part of my natural gas updates at this time of year

++++++++++++++++

By WxFollower - Nov. 5, 2025, 2:35 a.m.

Hey MM,

After I saw NG price graph showing a sharp drop from 12:05AM to 12:30AM CDT of 1.8%, I checked out the 0Z EE. Sure enough, the WxBell change maps suggest a sharp drop in HDDs 11/12-19!

How much did 0Z EE HDDs drop 11/12-19?

++++++++++++++++

The reason the NG price dropped when it did is that the "Composite Man" dialed in how much he was wrong when new weather information came out. And it happens in seconds!

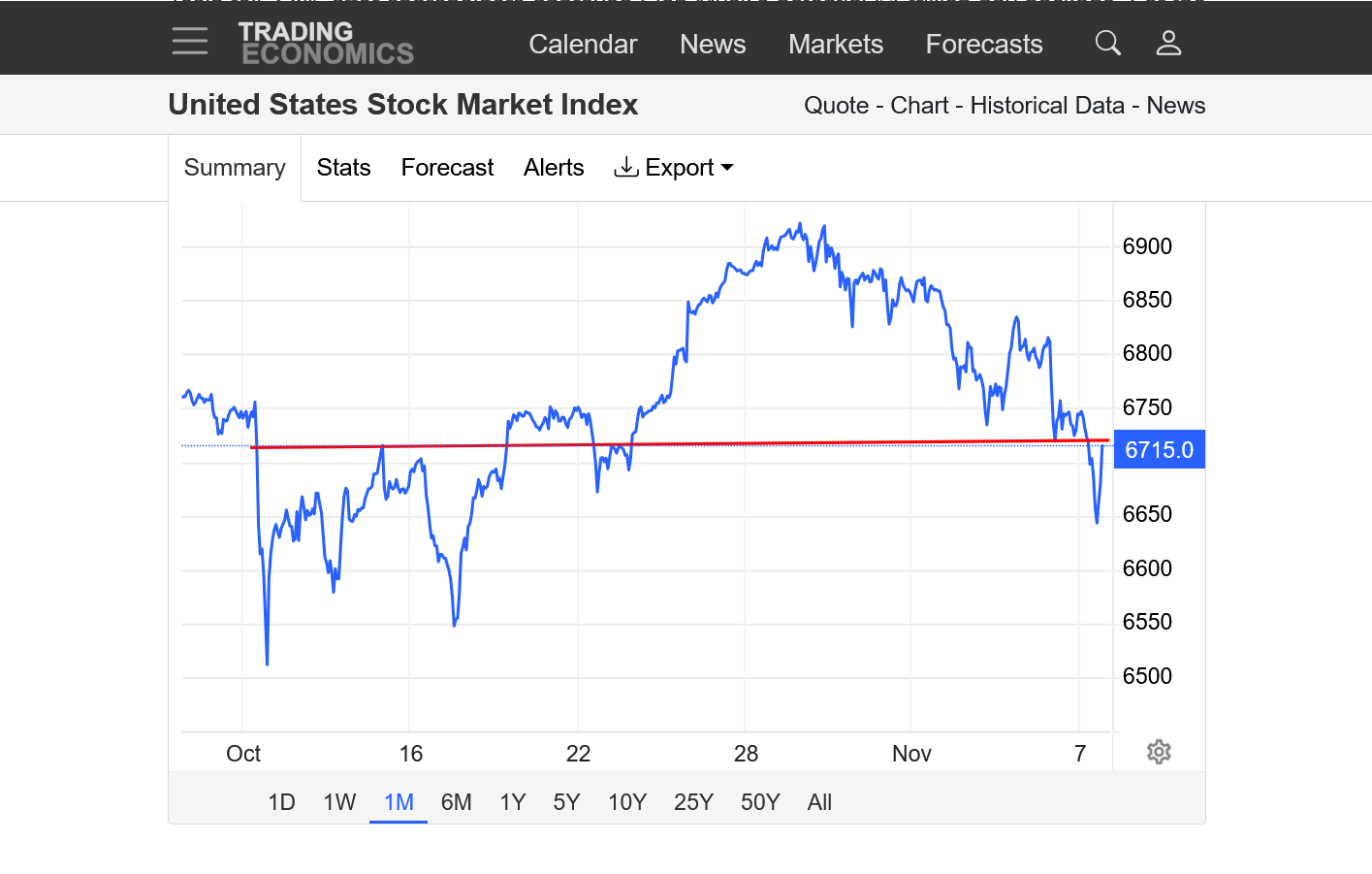

Here's the latest chart for this stock market index. The 2 red lines in the center were Tuesday's price range. The outer 2 red lines/bands were Wednesday's much wider price range.

About to take out yesterday's(overnight) and this week's low??

Yesterday's range is in red.

Will this support hold???

All the lower highs suggest no but this is the stock market.

https://tradingeconomics.com/united-states/stock-market

Moving stop price down to entry 6814. House money

Good on you, joj!

You're a much more patient trader than moi! I would have done that Tuesday Night when we broke below the Tuesday low and been stopped out for a small profit. You're still in it with a chance for a huge gain.

The close looks very bad for the bulls. Honestly, I think we may be finally trading the government shut down and you mentioned earlier, that flight cancellations could be the thing that starts taking a toll on the rich people.

This appears to be exactly right and you are in a position to be rewarded.................unless Trump and his R servants cave and come to the negotiating table, which will spike the stock market much higher in a flash. It's ironic that you will make lots of money, only if what you don't want to happen occurs. (Unresolved government shut down).

Also, it blows my mind that the Rs are so blind to the self inflicted damage they are doing to themselves here and not capitalizing on the perfect opportunity to look good.

If they came to the table and negotiated an ethical settlement that opened the government back up, they would forever be known as the party that opened the government up, while giving less fortunate AMERICANS something they should get as citizens of the richest country in the world. A win-win situation.

Sadly, Trump and MAGA would prefer the current path. However, the stock market matters to a great deal to Trump. He interprets its movements as messages to him about what to do next.

New highs? Stay on the same path, double down on ruinous stuff.

Faltering? Adjust his policies(like he did with China) to something that the rich people will reward him for by reversing back up.

This could limit how much lower he'll let the stock market get, however it would be a big change from his current position.

+++++++++++=

People actually believe all this stuff. However, no question his objective is to make the stock market go up because Donald Trump is the "Rich American Whisperer"

Despite that, it's been amazing to me that the stock market keeps ignoring so many reasons to go lower.

Pretty ominous formation continuing. Lower and lower highs tell us that sellers are stepping it up sooner and sooner with buying drying up on every bounce.

Congrats joj so far.

Don't let Trump know that you are short and you voted for Kamala or he might end the government shutdown to punish you

Seriously, that's what the main risk is to shorts here and its legit because Trump follows the stock market like a hawk and very frequently, will reverse a previous decision when the market is tanking to reverse it(China in October for instance).

Here's the thing with that(and joj knows). If we remember when the market had a huge gap higher on Sunday Night in October after it got clobbered on Friday from Trump's wild threats to China, including higher tariffs.

After the market tanked, over the weekend he completely took away his threat to China and changed it to the complete opposite about working things out.

Shorts that were in the big money going home Friday, holding that position got hit with an immediate loss on the gap higher open Sunday Night.

Again, joj knows this but it illustrates the important point. Stop loss orders only protect you during a trading session. When huge news hits while the market is closed, it will not open at the same price it closed at during the previous trading session.

This exact principle, holding a margined out(long) position over a weekend in a weather market.........when the weather pattern changed completely to bearish on a Saturday(and everybody knew about it when the market reopened) is what cost me more than half of the equity in the account a couple of times.

https://tradingeconomics.com/united-states/stock-market

MM,

You bring up a good point about markets gapping way beyond stops due to markets being closed. I may look into an out of the money call as insurance. On the other hand, if we go through the weekend and talks breakdown, where might the market open? If I was short 2 minis I would probably take one off on the close.

The Supreme Court ruling on tariffs is another wild card. Yesterday conservative justices expressed skepticism towards the arguments offered by Trump's lawyers. Why didn't the market rally on that? Perhaps a ruling against tariffs sets in motion more chaos? (just guessing). How exactly is the government supposed to return all that tariff money? What a mess.

Regardless of the outcome, while you're still in the trade sitting on profits with a break even stop, it feels great. Not just the money but feeling smart because you made the right decisions so far.

Putting on the right trade which exploits your expectation for direction. Stop placement just right (a little too close and you're kicking yourself for getting stopped out too soon which is me the last few years).

And of course, a bit of luck that no Trump caused news came out to spike us higher suddenly. Congrats so far!

I moved stop lower. 6771.00 Basically, we shouldn't be making new highs on the day....

That locks in 43 points profit (minus stop skid)

Wonderful for you, joj!

This graph means 0, except if nothing changes regarding the news over the weekend.

All sorts of news could break related to 2 bad wars, government shut down, tariffs, bombing in the Carribean or something else because of the chaos, uncertainty and impulsiveness/recklessness of the president. . Higher than normal risk this weekend.

Trump tends to be smarter and more disciplined when the stock market is falling to help it to recover. More reckless when its making new highs and giving him authorization(positive reinforcement) to double down on dumb.

1:50 pm CST:

https://tradingeconomics.com/united-states/stock-market

1. month

2. 1 day: Decent late day bounce. Day/short time frame shorts covering before the weekend?

3pm: Very impressive afternoon bounce:

covered on the close. too strong

Nice trade, joj! Fun to follow too.

Thanks Mike.

I obviously left a lot on the table, but hindsight is 20/20.

The 50 day moving average held nicely and the turnaround, according to the talking heads on TV, was based on the Democrats compromise to extend the ACA tax credits for 1 year, and resume negotiations after they agree to open the government. Republicans said the offer was a non starter. I don't know if that was the reason for the turnaround but the action was strong.

I'm interested to see the market action if a deal was agreed upon. If a spike higher happens but fades it would give another entry point from which to short and risk that spike high.

I'm satisfied with the trade because I stayed disciplined. NOT because I made money. I could have easily lost money. It's tempting to evaluate trades based on results. BEWARE !!! You will learn the wrong lesson. For example, if someone puts on a trade that starts to lose money and instead taking the loss at their planned stop loss, they get stubborn and hope for the market to recover. Then suppose they get lucky and turn the loser into a winner. Good trade? NO! Bad trade. Now you are more likely to get stubborn and get blown out on a subsequent trade.

Good trades!

More profound trading advice from a veteran!

One of the worst things that can happen to a beginner is to make a mistake, then make money from luck and assume it was from skill.

Another bad thing that can happen is to get less disciplined when your account size grows because you can "afford" to lose more money.

If you're any good at this and your account grows, you should increase size(# of contracts traded) and with deep pockets you can adjust your risk a bit but only for a rational reason that keeps the original risk/reward and trading strategy the same. We learn things too that might be used to make adjustments to be more successful.

tjc has his own strategies related to using options. The rare times that I traded them was to sell out of the money coffee calls when I was using a service that recommended that trade that Larry used for awhile too "Trade Winds" with Craig Solberg providing advice. I used his thoughts to back up mine but on a few of his trades like selling coffee calls, I did it because I figured it would pay for the service which was something like $100/month but I got a years subscription that would be faxed to me before the internet.

He was really good. When I was trading 100 lot beans and 200 lot corn and even 100 lot NG(when it didn't move much) and he had a recommendation that lined up with mine, I would place the order a couple of ticks above or below his order to make sure that I got filled. I think I screwed him up a few times because the price would never get to his price after I got filled. Maybe I was just more aggressive and he was too conservative.

Lind Waldock assigned 150% margin on anything more than those order sizes(300 corn would be 200 at 100% margin and 100 would be at 150%) and refused to back down when I sent them a written request to change that. I was ticked off because every trade I did pushed to the max and this limited me a bit. The head honcho told me that I scared the shirt off of them with my huge orders and they had to protect themselves. At least they had a special phone number for me to call in orders. They called it "the high rollers hotline" and I would get fills while waiting on the phone instead of getting a call back in 10+ minutes like it was before.

Today's day trading margins at the firm that I use are insanely low!

https://www.ironbeam.com/margins/

Looking back, today's immediate electronic fills are so awesome compared to the 1990s. No way would I trade today with those old rules.

Because of my account size, I was also trading an account for my wifes business and a retirement account for me as well as having accounts, at 1 time at 5 different places to try them out and get their free phone quotes, which, for most accounts was just 15 minutes/day. So I was getting over 2 hours/day of free quotes and right after putting on a trade, would just stay hooked up constantly and keep punching in the same code over and over and over and over until we were way up. Then call less and less frequently the rest of the day.

+++++++++++

If I was still able to trade that way, I would not be posting like this. 20 years ago when I was still trading like that, I would discuss my trades but NOT advertise them ahead of time. This place was hopping with active traders and readers and the last thing I wanted was to give my competition help BEFORE I put on the trade. After it was on.......yes but NEVER before it.

Greenman got my email and in 2002/20023 he would call me on the phone several times a week(he insisted that I was the worlds best weather trader). Local (Mark Kinoff) came to my house and would also call frequently. Greenman started a daily email between the 3 of us to share our thoughts on the markets with each other early in the day. I thought that is was funny that we shared what we were going to do or what the set ups were and nobody every did anything else except what their system told them to do. They weren't meteorologists, so it made sense they wouldn't trade weather. When I use the term "gap and crap" I learned that verbiage from Greenman, one of his favorite trades. Super disciplined and he had some other businesses and was so interested in learning. local was a brilliant chart reader/analyst. For awhile he sold a service with his advice using charts. His handle was from being a floor trader in the bond market. Those 2 guys were the smartest, market savvy guys I ever knew.

Sorry for getting carried away. Those were the good old days in some ways but money and success shouldn't be the main thing. Thats what people that are poor say .

Growth as a human being, integrity and doing the right things to help make others around you to be better people or to make the world a better place.

"Growth as a human being, integrity and doing the right things to help make others around you to be better people or to make the world a better place."

Great insight and advice Mike, see also:

Code of the Old West: "Always do the right thing even when no one is looking !"

The above chart is the NQ daily.

The anticipated high in the first week of November came a day early and we have been in a mild correction since

All my indicators show a downtrend in development

That trend could come to a (temporary) halt after today's strong buying impulse though

The Nasdaq came to life at the 0.707 retracement from the 10/10 low

Until we break that low on a closing basis I would be very careful about shorting heavily

There is a possibility the "final" high won't materialize till December/January and that is speaking of the Nasdaq only,

other indices such as the Russell can/will behave differently

Part of my reasoning is the chart of the DJT to which I have alluded to before and I will post that chart below :

The above chart of the DJT shows a new high and highest close since the late July high

After being rejected at the 0.786 retracement two days ago we closed above it today

The DJT is often the harbinger of things to come economically, the stronger the DJT the stronger the case can be made for future growth

Things can and do change in a hurry but here we are a ways above the 10/10 low so for now the economy is still happily humming along

Trade safe everybody !

Thanks a ton, kris!

We missed your latest updates. Everything that you just stated makes great sense to me!

I just looked up local and he's still in the business!

President,

Core Futures Inc.

https://www.moneyshow.com/expert/cd7c14430fc84ef0ac61d457d3aff1b3/

Mike - Give yourself post of the week for that walk back in time and those morsels of wisdom.

You touched on something which highlights a flaw in me as a trader.

When I was new to trading and didn’t know what I was doing I would look at it chart, form an opinion and risk 25% of my capital. Running my account up from 20K to 100k. But it was just luck and inevitably, I went broke. NOW, with decades of experience, and profitable on balance, my trade size is pathetically small relative to my capital.

i’ve heard it called old man’s disease. I tapped out twice and I don’t want ever to be in that situation again. And so, I err on the conservative side, and what I have is basically a hobby.

I wonder, are you still in touch with Greenman? I loved reading his posts.

Thanks very much, joj!

I have not heard anything from local in well over a decade. He hooked me up with his broker something like 20 years ago who was supposed to give me free price quotes.(he didn't)

He was an agronomist that really did know way more than me about some fundamentals because of that and had a zillion contacts and customers in agriculture which convinced me to listen to him.

This broker with Refco also spent a ton of time trying to convince me that I was wrong on some weather trades right after I opened the account with him and since local swore this guy was the best in the business on grains, I believed him. HE was the one that was wrong and guys like him giving advice to other people is why I made so much money doing the exact opposite based on weather.

I'm sure there are good brokers but it just reinforced my claim that this a the perfect term for that profession in commodities because they make you BROKER from charging commissions and giving flawed advice. My view was that if they were really any good at giving advice, they would use their own advice and make tons of money (like I was) instead of earning a living on commissions and selling their advice.

local was really close with stimpy(from our forum). After MF Global went bankrupt on October 31, 2011 and my 6 figure account vanished(Jon Corzine raided all the segregated trading accounts to make a margin call on a massive, speculative European Bond position that went against him) and it bankrupted MF Global.

https://en.wikipedia.org/wiki/MF_Global

After that happened, stimpy insisted that his brokerage firm had the best services anywhere and that's where I should go. So I borrowed a bunch of money and opened a new account at PFG Best. Then when money was coming back from MFG, I put it into the new PFG Best account. stimpy was right too. Their services and trading platforms really were the best out there.

Unfortunately, their owner had been committing a ponzi scheme type fraud for many years, raiding the customers segregated accounts, living a lavish live style with a private jet and other luxuries and paying for it all with NEW customer money(like mine) that was gushing in because of their awesome services. stimp felt horrible about this but he could never have known. I think he had some sort of fatal disease with only a few years to live.

After PFG went bankrupt in July 2012 (I lost trading account money +borrowed money), we found out that the owner was using a PO Box number for an address for the regulatory organizations and he intercepted all the paperwork there, filling out fake statements every year. There are new laws that were passed to prevent that from happening again. I took a 1 time payout offer from somebody before a part of my funds were returned because we needed the money to pay bills and to open a new very small account. I doubled the money several times but had to take it all out to pay bills so it never grew and remains a small account today with me not trading very often since I no longer have the huge edge of getting weather data before everybody else using a satellite dish on the roof.

https://en.wikipedia.org/wiki/Peregrine_Financial_Group

greenman did make a couple of posts here several years ago and it made my week!

I'll copy the link to those threads which is fun to read.

By metmike - June 17, 2018, 11:38 p.m.

++++++++++++++++++++++

sharp decline in equity futures tonight

11 responses |

Started by greenman - May 5, 2019, 9:29 p.m.

https://www.marketforum.com/forum/topic/29444/

++++++++++

Good lesson on taking big losses to avoid BIGGER losses(-90k on this trade) with a greenman story

Re: Re: Simple(ton) Fundies - OJ's a BUY!

By metmike - Jan. 31, 2020, 11:40 a.m.

++++++++++++++++

Greetings

Started by greenman - Sept. 17, 2020, 8:59 a.m.

greenman here. i want to say hello and express my respect and gratitude to Alex. God bless his soul. I am pleased to see metmike is the moderator. prosperity to all.

https://www.marketforum.com/forum/topic/59210/

+++++++++++++

consider option writing

Started by greenman - Dec. 25, 2020, 9:27 p.m.

https://www.marketforum.com/forum/topic/63320/

+++++++++++

gamestop

Started by greenman - Feb. 1, 2021, 9:21 p.m.

https://www.marketforum.com/forum/topic/65119/

+++++++++++

By metmike - April 6, 2025, 7:26 p.m.

Exactly related to this discussion with joj is something that is extraordinarily important. Every trade has an ENTRY strategy and an EXIT strategy. They should be treated INDEPENDENTLY! This is something that local stressed and especially relates to a position trade.

I violate this alot myself on day trades. For instance, after putting the trade on and going up XX ticks, I put in a stop at XX-Y ticks away to ensure Y profits without considering that MAJOR resistance is at XX+Z ticks away, which might have been my initial stop.

joj, early in his trade above, stuck to this principle with extreme discipline and solid reasoning and it paid off for him(while metmike was suggesting a trailing stop at the first chance when the price broke in his favor). joj had a plan and stuck with it.

The most important part of this principle is the EXIT strategy which is often more important than the entry strategy because the exit strategy is what you did last. Also what you did when the trade was on. When a trade is put on, our emotions can suddenly ramp up and alter the clarity of our thinking. It's ok to change the strategy as you go along based on how the market is acting(if you really are tuned in) but not to INCREASE risk because you are losing. If you are losing, it means that you are WRONG. Admit it and take your lumps. Several of my best trades were huge losses that would have wiped out my account if I didn't admit this and get out. Several of my dumbest exits were small profits because I was right about everything but afraid to risk anything and got out too soon.

That last point about the exit is most profound. If the trade is not working, a trader starts HOPING for it to get back to break even because psychologically and emotionally break even FEELS GOOD compared to having a drawdown. NEVER use hope or wishful thinking.

Related to that also is the size of your position. My mentality has always been one that nobody else should use because of the edge that I especially had before the internet with having weather information BEFORE the market did. I was very selective on trades, using specific set ups that had to be just right, then I pulled the trigger and put on the biggest position that the equity in my account could support. When the equity grew, the size of my positions grew. The stress of this was incredible...........but usually turned to euphoria quickly.

Why this can backfire in the long run is when you eventually have a huge loss, it will come with your biggest position ever, by definition of you increasing the size of the position every time. Manage risk, manage risk, manage risk! Be thrilled to take a small loss to avoid a bigger loss as much as you are thrilled to take a bigger profit instead of a small profit. Those principles are all based on the EXIT strategy, which is what you do when the position is already on but hopefully, what you decided to do BEFORE any emotions impacted your thinking. How the market is trading can impact your adjustments but not cause you to increase risk when the market is telling you that you are wrong.

Again, joj shared with us his live trading thoughts and decisions that demonstrated many of these principles. He almost got stopped out but didn't which suggested some skill on stop placement and this obviously made it more fun to discuss for everybody during and after the trade.

However, we often can learn more from losses than wins. I repeat this all the time to my chess students because losses, mean that they played an opponent that was superior in that game. The opponent did things they were not expecting to beat them. It means that NEXT TIME, they will be prepared and not let that happen again. While the winner, did things that they already knew to win. Futures are MUCH different but I like repeating that one whenever possible!

Learn new things all the time in your life with an open mind, especially about topics and from people that you disagree with whenever possible. Nobody knows everything and everybody knows some unique things that you don't know.

Generously share your unique things with the world and most of all, greatly appreciate how blessed we are to live in this age of human history. Despite the bad things which is what gets the majority of attention(sells and generates ratings) the internet by itself is providing us with trillions of times more information than what we could get a century ago. How we use that.........is entirely up to us.

The choice to use it to make yourself a better person or smarter person or healthier/happier person or to become involved in a positive endeavor is ours.

Great job joj and kris for your ongoing, wise thoughts on this particular market and markets/trading in general.

Hope you find this insightful.

I'm a intraday scalper and look to sell the highs and buy the lows. It took my years to get to this level. Thus the name I post as gedigan.

Years of trial and error. Years of feeling like I'd never make it. But I kept showing up. There were moments I questioned everything. Moments I almost quit. Moments I begged God for a breakthrough. And He gave it to me. Not in the form of success, but in the form of pain that would mold me. Discipline that would refine me. Faith that would sustain me. Trading didn't teach me about money. It taught me about character, patience, trusting God when nothing made sense. I pray I became the man who's worthy of what he asked for.

Higher timeframe draw on liquidity. Hinge into a gap my A+ setup!

Friday's 1 min. chart.

Capturing an easy short in the am session covered when higher timeframe cycle did it's job.

Capturing an easy long after the draw on liquidity was reached. And an example of the overnight gap as I understand it's value.

Best of trades to everyone!!!

Post of the week-gedigan. Thanks!

Started by metmike - Nov. 9, 2025, 3:02 p.m.

On this chart below, at least we had a small gap higher on the open.

https://tradingeconomics.com/united-states/stock-market

I sold 1 Dec mini S&P @ 6783 tonight.

It's a "sell the fact" trade.

Gov deal reached and we gapped higher (but not WAY higher). I gave the market nearly 2 hours and it didn't keep rallying. Stop is at Thursday's high of 6843.

Mike, being a weather trader of grains as you are, did you ever hear the maxim, "Buy wet, sell dry"?

I moved stop down to 6810. I was looking for a pop and drop. Not getting it. I'll tighten up the stop loss.

joj,

That sounds familiar. It's sounds like something local would have said.

To be honest, I didn't pay that much attention to what other people were saying when trading weather, especially in the 1990's because of this Axiom that you know well.

Those who say, don't know and those who know........don't say.

This was especially true with brokers.

In late June 1994, when I had 10 minutes to cover my longs in corn/beans on Monday's open before they went lock limit down and I had only been trading for 2.5 years, I had my money spread out at 4 places to try them all out, get information and maximize free phone quote time.

I was totally convinced we would open lock limit down and my career trading was over that Monday. Starting at 5am Sunday morning when I saw the WETTER(than Saturdays WETTER) forecast model that was DRY on Friday and the reason for me to be long.

I actually started drinking early Sunday because I couldn't take knowing I had just destroyed my new career with one huge mistake. I prepared my wife on Sunday.

I called my Dad and we prayed, not for it NOT to happen but to ACCEPT THAT IT WAS GOING TO HAPPEN FOR SURE and start working on a positive path forward after that and be able to recover from even the worst possible adversity.

I had just left the tv biz so I didn't have to be a weekend dad to our to preschool sons and trading was going to be my new source of income. I was already studying to be a meteorological consultant and get certified by the American Meteorological Society(I already had their seal for broadcasting) but stopped studying when the account grew from 2k to 30k in 2 years. I took 10k out to buy the satellite dish and weather data service. In the first 18 months, I was still at WEHT-TV and going to the tv station, 30 minutes away early in the day (and coming back home) to get the same weather data that they paid for that I used for tv. After I left in 1993, for a short while I had it faxed to me at home but that was inferior until I got the satellite dish.

Anyways, of those 4 brokers........

Every single one of them had opening calls that were just 1/2 the limit down (corns limit was 10c and beans 30c then, I think) and every single one of them told me to stay in and not take the loss because, they said "it will come back".

After hearing the opening calls, I went from despair(and a huge hangover) to "am I going to be the luckiest man in the world and be given a chance to get out????

I had told every single one of them to cover everything, sell at the market on the open against all their advice.

I only lost half our money instead of 150% of our money if I took their advice.

Honest to God that was one of the happiest days of my life!! I actually remember being on cloud 9 the rest of that day when the market was lock limit down after the first 10 minutes and stayed there until the close(then opened 1/2 the expanded limit lower on Tuesday.

Its what I mentioned in an earlier post. Very often, your EXIT strategy is much more important than the Entry.

Incredibly, I mustered the strength to go short either Tuesday or Wednesday with even wetter forecasts and made a big chunk back.

It ended up being a very profitable year after I was, literally just 10 minutes away from losing it forever as my career!

Anyways, that expression kind of sounds familiar and of course I understand the meaning with crystal clarity. At some point, the market will dial in all the adverse or great weather and start trading the NEXT weather pattern. However, when that happens is different each time. That can be tomorrow or it can be in 2 weeks or it can never happen!

Local was extraordinarily descriptive and had his own sayings. One of them related to selling tops in a drought similar to your guys expression.

He would say many times that "once the market kills the crop, no amount of hot and dry can make it go higher."

So true. Everybody that was going to buy on hot/dry on the long way up was already long. No amount of additional hot/dry was going to inspire fresh buying because they already killed the new crop.

Related to that last story.

I was the most popular meteorologist on tv here from 1982-1993. It was a really fun life.

I was grand marshall in parades, judge for different contests, 50 speaking engagements/year, especially to schools that had kids studying weather in their science class.

I got real active at our Catholic Church and taught religious ed there for 15 years. Funny how being on tv qualifies you to do all these things in the minds of people that put you on a pedestal and you're really no better than them and in fact, I knew several that were arrogant and let it get to their heads, thinking that they really were better.

Anyways, it allowed me to make friends with people everywhere that I went.

As a result, i had numerous close friendships with the farm families at our church. I taught some of their kids in my high school religious ed class and was amazed at their work ethic.

The farm kids would get up 2 hours before school to feed the animals(hogs) or do chores and loved it. Best attitudes and work ethic I ever saw in kids.

The ones that were crop farmers would ask me every Sunday at mass what my weather forecast was and after I started trading, they wanted to know where I thought the price of corn and beans was going.

However, the funniest thing was when I told them the story I just repeated about almost losing 150% of our equity in that weekend trade when the forecast turned from hot/dry to less hot and some rain on Saturday to cool and wet on Sunday to cooler and wetter on Monday morning.

They would ask me to retell that story to their friends and repeat it to them over and over. They asked me to speak at their local organization meeting for several years in a row and of course, I had to tell that story again to everybody there.

When I would tell it, I would elaborate even more about my emotions knowing I was going to lose all my money.

I'm sure that they could all relate because THAT WAS THEIR LIFE. Only they owned the actual corn and beans. When prices crash lower, they can't just bail out like I did. They suffer devastating losses after working hard and THEY RISK EVERYTHING, EVERY YEAR because of the weather and because of markets that might crush them for reasons completely out of their control.

I grew up in Detroit, completely oblivious to that world. It wasn't until the drought of 1988 here in this farming community that I found out about the commodities markets.

The front page of the Evansville Courier would have headlines like "Corn and Soybean prices go limit up again because of dry forecasts" I kept thinking, dang I knew that several day ago and told our viewers. There must be a way for me to make money on this.

So I contacted my good stock broker friend from Edward D. Jones and remember his response exactly "It's worse than horse trading!!" "By the time you find out about the news they already knew it and its in the price!" "Don't gamble your money away!"

OK, I trusted him. Then in December 1989, heating oil prices surged to record highs because of extreme cold that I had predicted a week earlier. Hmmmm, maybe my stock broker friend doesn't understand how weather impacts markets.

So in 1991, I got a library card at the 2 local colleges and took out a dozen+ books, all the ones they had about commodities. I contacted the Chicago Board of Trade and had them send me tons of charts and all their information about corn, beans and wheat.

I still had no idea what I was doing when I opened an account in January 1992 at Ira Epstein because thats the only place that let me open an account or less than 5k and we only had 2k in the bank. My wife is NOT a risk taker and didn't understand how this would be possible and my trading stressed her out just thinking about risking our money.

On my first trade I made $800 on heating oil buying on a cold forecast for the Northeast on a bit of luck because, as Larry knows, heating oil is not the best pure weather market. But get this. my full service broker who charged $60/round turn was crooked. I had been picking his brain for 2 weeks before putting that trade on and he knew I was clueless. So when I called him to sell/cover my long he said "I never thought you were serious! I thought you were just practicing and you never told me you that you really wanted to place that order, so it never got placed"

Man, I was devastated. But I had worked hard to make sure I knew how to place that order!!!!

So I contacted the CFTC to tell them what happened. The guy on the phone explained some things I never knew including that all conversations are recorded and my order would be on the audio record at IRA Epstein. He mailed me a complaint form to fill out against the broker

So I called the crooked broker back and laid into him and told him I was filing a complaint. His response? C'mon man, I was just joking around. I know you placed that trade and its in your account.

Anyways, after less than a year my 2K was almost 10K and I had enough money to transfer it and open accounts elsewhere and dump this guy.

His response? I can't believe your leaving!! We make such a good team!!

Right. I placed every order with 0 advice and he collected $60/contract(after trying to rip me off initially). I actually had to threaten him because he kept refusing to close the account. I'm sure that he was probably copying my trades.

I had 1 other broker that kept trying to get me to trade a group account and get paid. At least thats what he said. Not interested. I turned that account from 5K to something like 50K in 2 years and then went to close it to start using a discount broker. He would not do it. I had to keep threatening him with legal action before he finally did it. I would bet that he was copying all my trades and making a killing. Actually, now I remember his offer for me to manage a group account and get paid was to keep me from leaving.

Joj, On your trade. Some people would move their stop UP to give it more room............and lose MORE money. You are acting like somebody that looks for good reasons to cut loss potential.

https://tradingeconomics.com/united-states/stock-market

Gap never got filled. I've been tied up doing chess stuff for our chess clubs today and completely missed the news on the government shut down getting resolved. This would be great news!

I was stopped out at my price giving back half of what I made last week.

My error (aside from being wrong) was looking at the higher opening and thinking I was being patient by waiting 2 hours and thinking that the market not rallying was a sign of weakness, instead of seeing the lack of a sell off as being a sign of strength.

Harrowing story of your flirtation with ruin in the markets. I agree 100% with your statement: "Very often, your EXIT strategy is much more important than the Entry."

Farm kids have strong character. Giving kids work responsibilities builds character and self esteem.

Thanks, joj.

Maybe you trade more often and just decided to share this time. Or maybe your trade last week left you feeling confident that you were tuned to the market and more inclined to exploit that sense of confidence with an additional trade last night?

You would know better than me about yourself as you have outstanding self awareness.

Though it didn’t work out as well this time, there is something to be said about being tuned to the market and capitalizing at those times. It’s exactly what weather trading is about and the only reason I have a chance to make money trading is being a meteorologist. I once did it for a living because I had access to insider weather information before everybody else in the 1990s into the 2000s and used it legally to do weather trades.

I would never have a chance trading the stock market for a living Like some of you guys here. Mikes “secret system” has a knack for showing great trades after they happened here and I give him a hard time every once in awhile but he would destroy me in a day trading contest of the stock market using his indicators.

Related exactly to the buy wet, sell,dry term, is the current trade in natural gas, where cold is bullish and warm is bearish. We could say to buy warm and sell cold but I will be specific right now on the main times that works because it’s only AT MARKET TURNING POINTS FROM A WEATHER PATTERN CHANGE.

If the weather has been bullish and gets even more bullish for instance and you sell, you get run over. It only works when the bullish or bearish news has been exhausted OR YOU ARE ONE OF THE FIRST to see the new pattern while most traders are still trading the old pattern.

Regarding your trade. Your assessment afterwards is solid. You accept it and move on after trying ro see what you might have done wrong, if anything.

To learn something if possible then try to not let it impact your psyche in a negative way, just like a win should not make us over confident and (over) trade more emotionally.

But it does that anyway because we are human. Fighting that and being disciplined is a key to long term success.

You can tell,why I love coaching chess and trading.Everybody posting in this thread shares the same love of ANALYSIS AND BEING BLESSED WITH ANALYTICAL MINDS!

Trading provides a wonderful challenge for us to exploit our analytical minds. Making money is the objective and also the metric to judge our success but it goes beyond that! It's something inside of us that drives how we think. Many human beings thrive on competition and trading provides that opportunity to compete against and in the market with the "Composite Man" as Wyckoff referred to as everybody in the market's thinking and acting combined at one time.

tjc has mentioned this aspect of trading that drives his love for it.