Much more to come when back in the office!

In a big way, Larry and I know that we can often look at how natural gas is reacting (or has reacted) to know what the temperature forecast changes were and are.

It makes following the latest weather models as they come out at the same time natural gas is reacting to them tremendous fun and challenging and is also a way to make a lot of money for speculators using this information to position themselves in the natural gas market AHEAD of the price moves based on changes in the weather forecast.

Here are parts of 2 especially detailed, recent posts that describe that impact.

This is the GOLDEN RULE for trading natural gas based on CHANGES in the TEMPERATURE weather forecasts. The market will dial this weather in, sometimes 2 weeks before it hits. When the cold/heat is hitting, the market dialed it into the price much earlier.

There are exceptions but when these changes are powerful and especially when they trend in THE SAME direction, NG always moves in tandem. It may gyrate up and down along the way in an up or down channel but at certain times of year, it always follows the weather forecasts.

WINTER/Cold season/HDD season. This is for the weather FORECAST.

1. When temperatures get colder, natural gas prices go higher.

2. When temperatures get warmer, natural gas prices go lower.

SUMMER/Heat season/CDD season. A complete flip in the impact of cold/warm.

1. When temperatures get colder, natural gas prices go LOWER.

2. When temperatures get warmer/HOTTER, natural gas prices go HIGHER.

++++++++++++++++++++++++++++++++++++++++++++++++=

By metmike - Oct. 10, 2025, 8:07 p.m.

Natural gas price charts.

https://tradingeconomics.com/commodity/natural-gas

2. 1 year:

a. 2 strong uptrend channels from last Winters cold. Major market top in March 2025.

b. Late Spring/early Summer uptrend channel from Spring positive seasonal along with widespread intense heat forecasts for the Summer of 2025.

c. Downtrend channel that accelerated in late August from huge pattern change to widespread near record cool temps(and low electricity use for AC use, generated by burning natural gas)

d. Bottom ahead of positive Fall seasonal and late season heat returning with elevated CDDs.

e. Prices at the very end have plunged again as late season heat has turned from bullish to bearish. Rapidly increasing average HDDs pass up rapidly dropping CDDs on October 4th but every year is different. The VERY warm forecasts this week are now BEARISH weather.

+++++++++++++++++++++++++++++++++

By metmike - Dec. 25, 2025, 10:29 p.m.

Lower open with an immediate $1,000 spike up this evening:

https://tradingeconomics.com/commodity/natural-gas

1. 1 week: Tuesday's biggest gain in 3 years, with a $5,000/contract wide range in the center after models turned sharply colder. On the right is the open tonight.

2. 1 month: Uptrend leading to the blow off top on December 5(after a month long uptrend peaked with the most extreme cold(Polar Vortex) yet forecast that day. Steep move down -$15,000/contract in 7 trading sessions from a pattern change to much warmer, followed by sideways bottoming, then models turned sharply colder early this week.

3. 1 year: False break out above March highs/resistance. Sharp downtrend late in Summer with near record cool temps late August/early September. Bottom in September/October. Sharp move up in November from colder and colder temps. Blow off top December 5 with EXTREME coldest yet, Polar Vortex and peak in bullishness. -$15,000/contract in 7 trading sessions from much warmer weather forecasts. Price recovery this week from weather forecasts turning colder again.

Here are the individual weather threads this past year. WOW! Alot of them.

You will note that many of them focus on Evansville IN weather. I'm chess coach at 5 schools here in Evansville, IN and enjoy sharing comprehensive weather, constantly updated, that relates to our weather, especially at times of extreme, severe and Winter weather with the hundreds of chess families and teachers at those schools.

I was chief meteorologist for WEHT-TV in Evansville from 1982-1993:

1988 - News 25 Weather with Mike Maguire - Evansville, IN

https://www.youtube.com/watch?v=-w7_CLn8QSs

++++++++++++++++

When the weather forecast is the worst, here's a great song to sing

R.E.M. - It's The End Of The World As We Know It (And I Feel Fine) Lyrics

https://www.youtube.com/watch?v=Eh8zeU6XLM8

++++++++++++++

Good tips for bad AND good weather:

The Siberian express:

By metmike - Dec. 21, 2024, 8:46 a.m.

+++++++++++++++++++++++

Winter weather ahead 12-30-24

26 responses |

Started by metmike - Dec. 30, 2024, 10:04 p.m.

https://www.marketforum.com/forum/topic/109248/

+++++++++++++++++++

Evansville Winter Storm 1-4-25+

Started by metmike - Jan. 5, 2025, 12:26 a.m.

https://www.marketforum.com/forum/topic/109322/

+++++++++++++++

Midwest- Tracking the Winter Storm 1-4-25+

Started by metmike - Jan. 4, 2025, 9:21 p.m.

https://www.marketforum.com/forum/topic/109316/

++++++++++++++++

More extreme weather coming up from natural variation with ZERO coming from the fake climate crisis.

Winter Storm in the DEEP South 1-19-25

Started by metmike - Jan. 19, 2025, 9:09 p.m.

https://www.marketforum.com/forum/topic/109603/

+++++++++++++++++++++++++

This will rev up more extremely strong Santa Ana winds again!!

Re: Re: Re: Re: Re: Re: California fires

By metmike - Jan. 19, 2025, 3:17 p.m.

The Spring of 2025 was extraordinarily stormy compared to average!

Windbag Storms! 3-5-25

Started by metmike - March 6, 2025, 1:41 a.m.

https://www.marketforum.com/forum/topic/110314/

+++++++++++++++++++

Severe weather outbreak 3-12-25

https://www.marketforum.com/forum/topic/110407/

+++++++++++++++++++++

Tracking Severe Weather-3-14-25

https://www.marketforum.com/forum/topic/110445/

+++++++++++++++++

3-25-25 Severe weather for 3-30-25

https://www.marketforum.com/forum/topic/110671/

+++++++++++++++++

3-30-25 TORNADO outbreak on 4-2-25

A tornado hit our house on my son's 37th birthday, 4-2-25!

38 responses |

Started by metmike - March 30, 2025, 3:08 p.m.

https://www.marketforum.com/forum/topic/110789/

+++++++++++++++++++++++++++

4-4-25 Continuation of weather threats

26 responses |

Started by metmike - April 4, 2025, 12:50 p.m.

https://www.marketforum.com/forum/topic/110908/

+++++++++++++++++

Severe Storms week of 4-28-25

39 responses |

Started by metmike - April 28, 2025, 5:22 a.m.

https://www.marketforum.com/forum/topic/111519/

++++++++++++++

Severe Weather risk 5-14-25+

33 responses |

Started by metmike - May 14, 2025, 6:13 p.m.

https://www.marketforum.com/forum/topic/111845/

++++++++++++

Severe weather week of 5-18-25

22 responses |

Started by metmike - May 18, 2025, 3:36 p.m.

https://www.marketforum.com/forum/topic/111935/

Summer/Hurricanes/Drought

What La Nina?? April 26, 2025-Summer Outlook

Started by metmike - April 26, 2025, 4:15 p.m.

https://www.marketforum.com/forum/topic/111494/

++++++++++++

Time to worry about 1930s type drought?

Started by tjc - May 15, 2025, 1:12 p.m.

https://www.marketforum.com/forum/topic/111856/

++++++++++++++

2025 Hurricane season

Started by metmike - May 22, 2025, 12:20 p.m.

https://www.marketforum.com/forum/topic/112050/

+++++++++++++++

Eastern Pacific Tropical systems

Started by metmike - May 30, 2025, 4:27 p.m.

https://www.marketforum.com/forum/topic/112231/

++++++++++++

Heavy rains 6-13-25

Started by metmike - June 13, 2025, 8:16 p.m.

https://www.marketforum.com/forum/topic/112531/

++++++++++++++

Severe Weather threat June 17+, 2025

Started by metmike - June 17, 2025, 3:19 p.m.

https://www.marketforum.com/forum/topic/112614/

++++++++++++++++++++++

Heat wave coming, June 17+ 2025

Started by metmike - June 17, 2025, 4:02 p.m.

https://www.marketforum.com/forum/topic/112618/

++++++++++++++++++++++++++++++++++=

odd storm in Dakotas

Started by mcfarm - June 22, 2025, 10:19 a.m.

https://www.marketforum.com/forum/topic/112735/

Post of the week 6-22-25-mcfarm-Wake Low

Started by metmike - June 22, 2025, 11:26 a.m.

https://www.marketforum.com/forum/topic/112742/

++++++++++++++

https://www.weather.gov/bis/SevereWx06202025

++++++++++++++

Texas Floods Biggest weather story in 2025

44 responses |

Started by metmike - July 6, 2025, 5:26 p.m.

https://www.marketforum.com/forum/topic/113021/

++++++++++++

Red Sprites

Started by metmike - July 7, 2025, 12:15 a.m.

https://www.marketforum.com/forum/topic/113037/

++++++++++++++

Severe Storms 7-28-25

Started by metmike - July 28, 2025, 6:25 p.m.

https://www.marketforum.com/forum/topic/113505/

+++++++++++++

2025 NATL Tropical Season

19 responses |

Started by WxFollower - Aug. 3, 2025, 12:08 p.m.

https://www.marketforum.com/forum/topic/113730/

++++++++++++

Hello TS Erin-soon to be a major hurricane

Started by metmike - Aug. 11, 2025, 11:11 a.m.

https://www.marketforum.com/forum/topic/113877/

++++++++++++++++++

mother nature in total control again

Started by mcfarm - Aug. 17, 2025, 10:38 a.m.

https://www.marketforum.com/forum/topic/113995/

+++++++++++++++++

Tropical Storm Ferdinand/Tropics

31 responses |

Started by metmike - Aug. 25, 2025, 5:17 p.m.

https://www.marketforum.com/forum/topic/114178/

++++++++++++++

Flash Drought/Heat/Weather updates

43 responses |

Started by metmike - Sept. 2, 2025, 9:39 a.m.

https://www.marketforum.com/forum/topic/114355/

++++++++++++++

ENSO-weak La Nina coming up-Winter forecast!

Started by metmike - Aug. 27, 2025, 3:54 p.m.

https://www.marketforum.com/forum/topic/114227/

++++++++++++++++++

Hello Gabrielle-the near record long TS drought is over! +Humberto+Imelda+Jerry+Lorenzo

29 responses |

Started by metmike - Sept. 18, 2025, 12:31 a.m.

https://www.marketforum.com/forum/topic/114751/

+++++++++++++++++

We got almost 4 inches of rain here in southwest IN this week!

RAINS THE PAST 7 DAYS:

https://www.wunderground.com/maps/precipitation/weekly

Thru 9-24-25: Best rains in over 2 months for large parts of the southeastern Cornbelt! Yippee!!

+++++++++++++++++++++++

Melissa

33 responses |

Started by WxFollower - Oct. 21, 2025, 11:10 a.m.

https://www.marketforum.com/forum/topic/115367/

+++++++++++++++++

The Beauty of Earth Not exactly weather

35 responses |

Started by metmike - Feb. 25, 2025, 10:20 a.m.

https://www.marketforum.com/forum/topic/110136/

+++++++++++++++++

Climate Crisis 7-25-25

Started by metmike - July 25, 2025, 1:49 p.m.

Fall/Winter

11-15-25 Wonderful, welcome rains in California

Started by metmike - Nov. 15, 2025, 8:35 p.m.

https://www.marketforum.com/forum/topic/115977/

+++++++++++++++++++++++++++++++

11-21-25 Much colder pattern coming up!

16 responses |

Started by metmike - Nov. 21, 2025, 3:17 p.m.

https://www.marketforum.com/forum/topic/116112/

+++++++++++++++++++

Record Winter of 1917/18!

Started by metmike - Dec. 8, 2025, 7:21 p.m.

https://www.marketforum.com/forum/topic/116459/

++++++++++++++++++++++

Huge warm up this week and much more after that!

Started by metmike - Dec. 13, 2025, 9:25 p.m.

Without the NWS, none of us would have the data available to communicate timely, life saving weather information, as well as the data to forecast detailed weather forecasts as well as the data to use to trade weather markets as well as the AUTHENTIC data to use to appreciate the current climate OPTIMUM for most life on this greening planet.

We especially thank our local weather service that operates from Paducah, KY.

This was their compilation of the past year for "some" of our big weather events with a southward bias from their KY location and area of responsibility vs us Hosiers north of the Ohio River.

https://www.weather.gov/pah/2025YearInReview

1. January 5 - Significant winter storm with snow and ice. Over 100K customers without power at its peak.

2.

February 15-16 - Widespread flooding across the state of Kentucky, results in major rises on numerous rivers.

Image: Map showing observed rainfall amounts at Kentucky Mesonet stations for February 15-16.

3. February 18-19 - Snowstorm with widespread 3-8" across our region. Portions of I-57 and I-24 are briefly shutdown

overnight due to accidents.

.

Image: Map showing observed snowfall amounts from this event

4. March 14-15 - Historic severe thunderstorm event produces 14 tornadoes on the night of the 14th into early on the 15th. Six of these tornadoes were EF-3's.

Image: Map showing all the tornado tracks from this event

5. April 2 - Historic tornado outbreak produces 23 tornadoes, breaking the record for a single event in NWS Paducah history.

Image: Map showing all the tornado tracks from this event

6. April 2025 - Significant flash flooding with amounts ranging from 6 to 16" from April 2-6. Moderate to major river flooding follows.

Image: MRMS Rainfall Totals from April 2-6

7. May 16 - Significant severe thunderstorm event which produced 10 tornadoes and very large hail of at least tennis ball to softball size.

Image: Map showing all the tornado tracks from this event

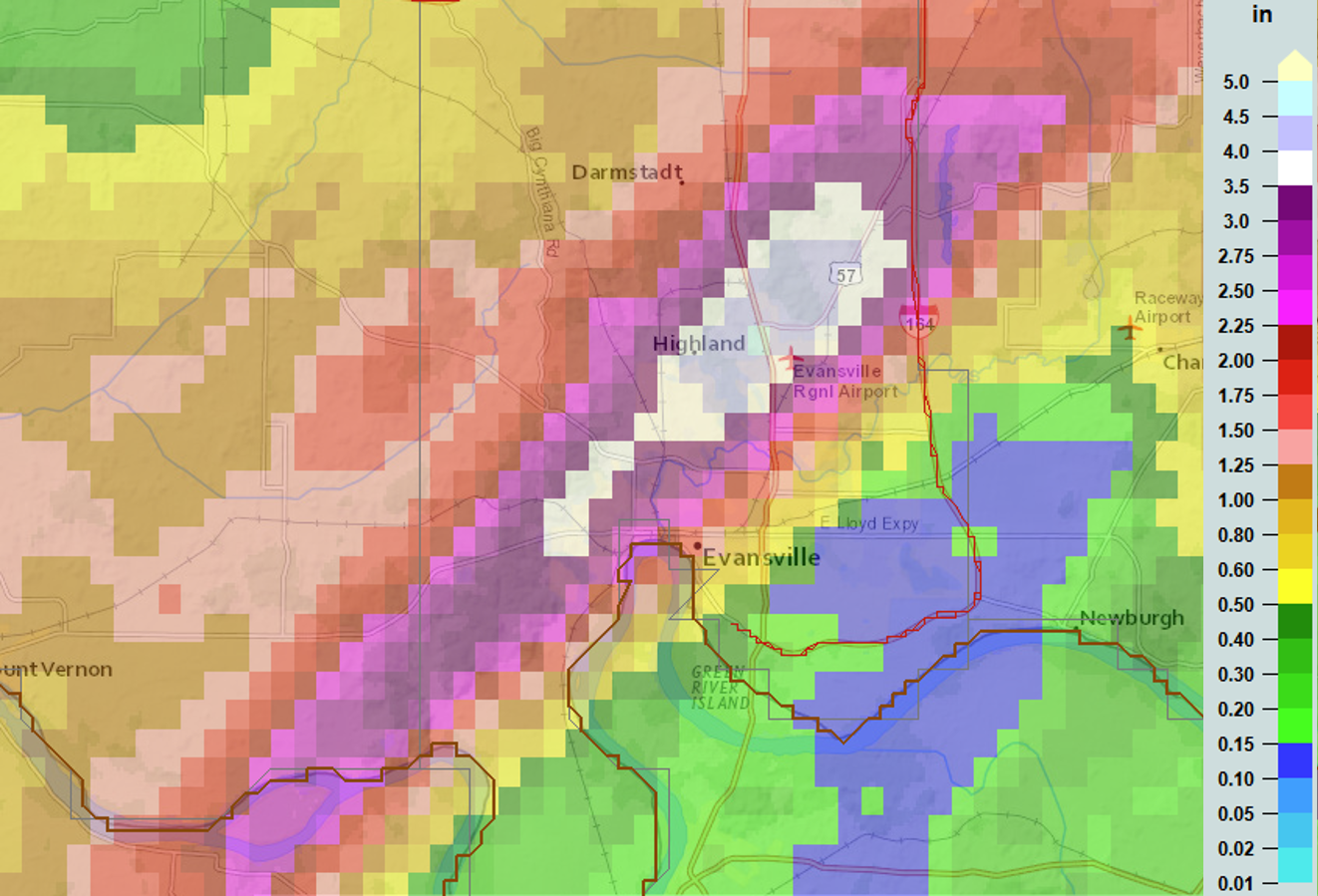

8. June 13 - Major flash flooding strikes the westside of Evansville, IN.

Image: MRMS Rainfall totals from June 13th

9. July 16-30 - One of our longest lasting heat waves on record with heat index readings peaking between 110 and

122 degrees.

Image: Map showing observed peak heat index readings on July 28th (one of the worst days of this prolonged heat wave)

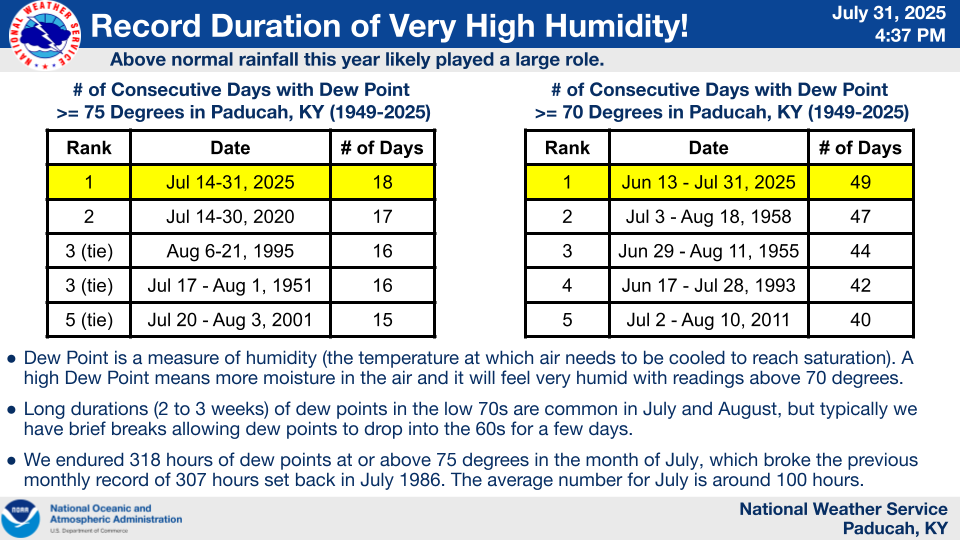

10. Summer 2025 - Record high humidity levels were observed. Keep in mind that Paducah records below only go back 76 years. Evansville, IN records go back to January 1897. That's almost 129 years!

Image: Tables depicting record long durations of high humidity levels were observed in Paducah, KY.

Speaking of Evansville, IN.

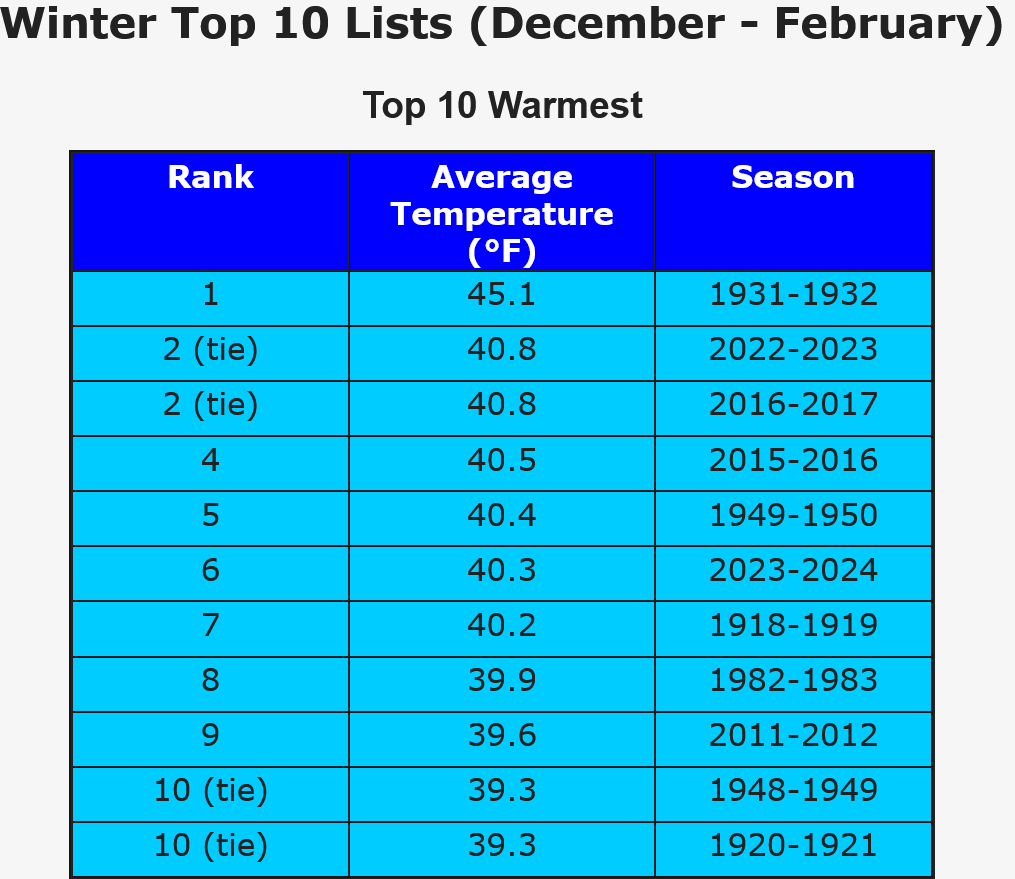

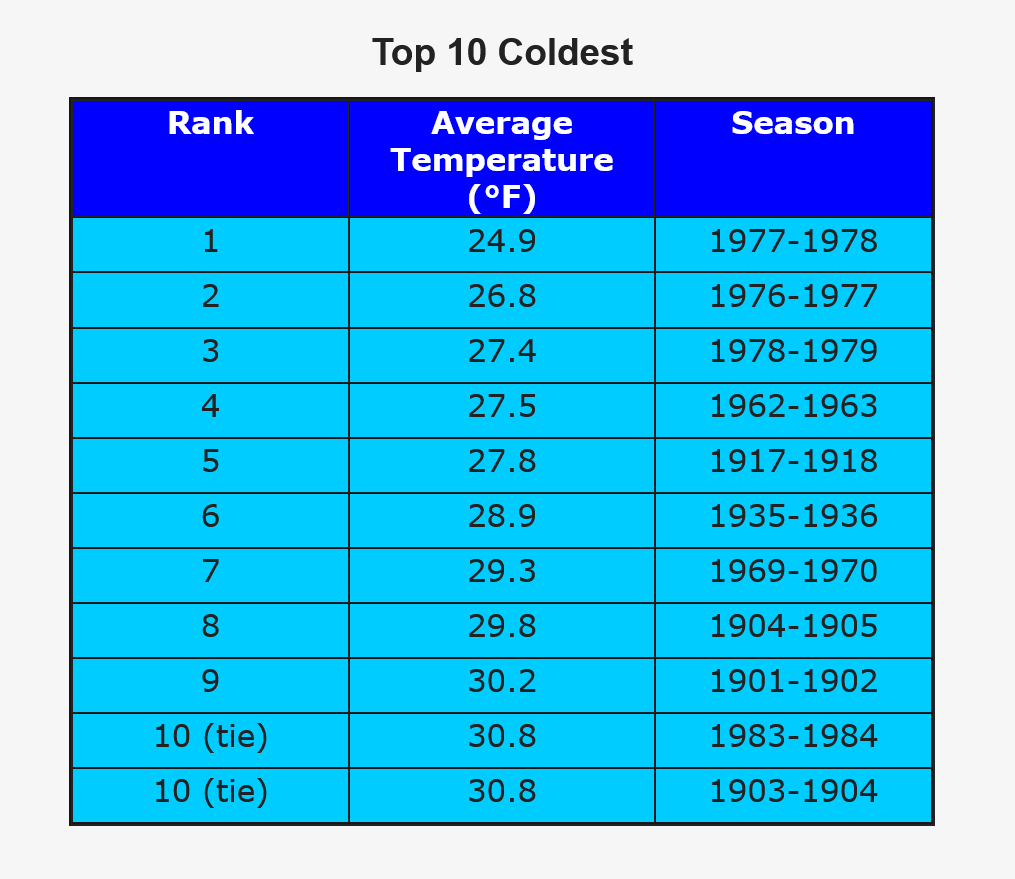

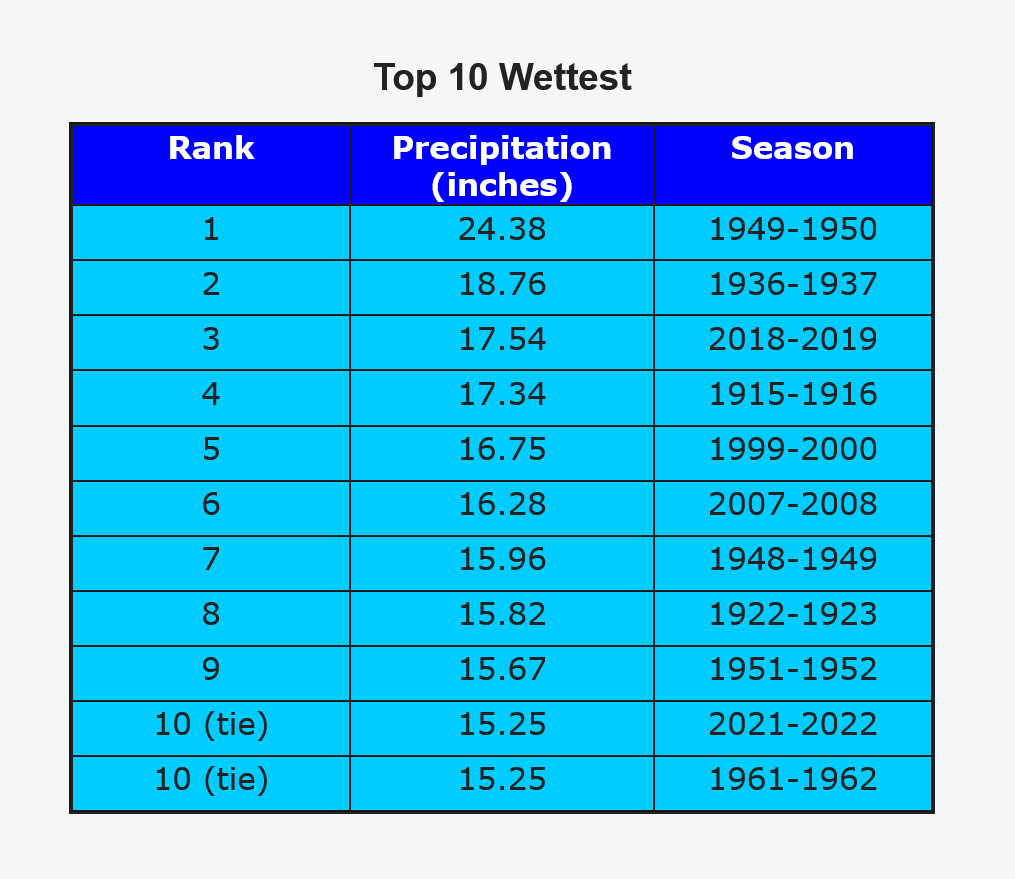

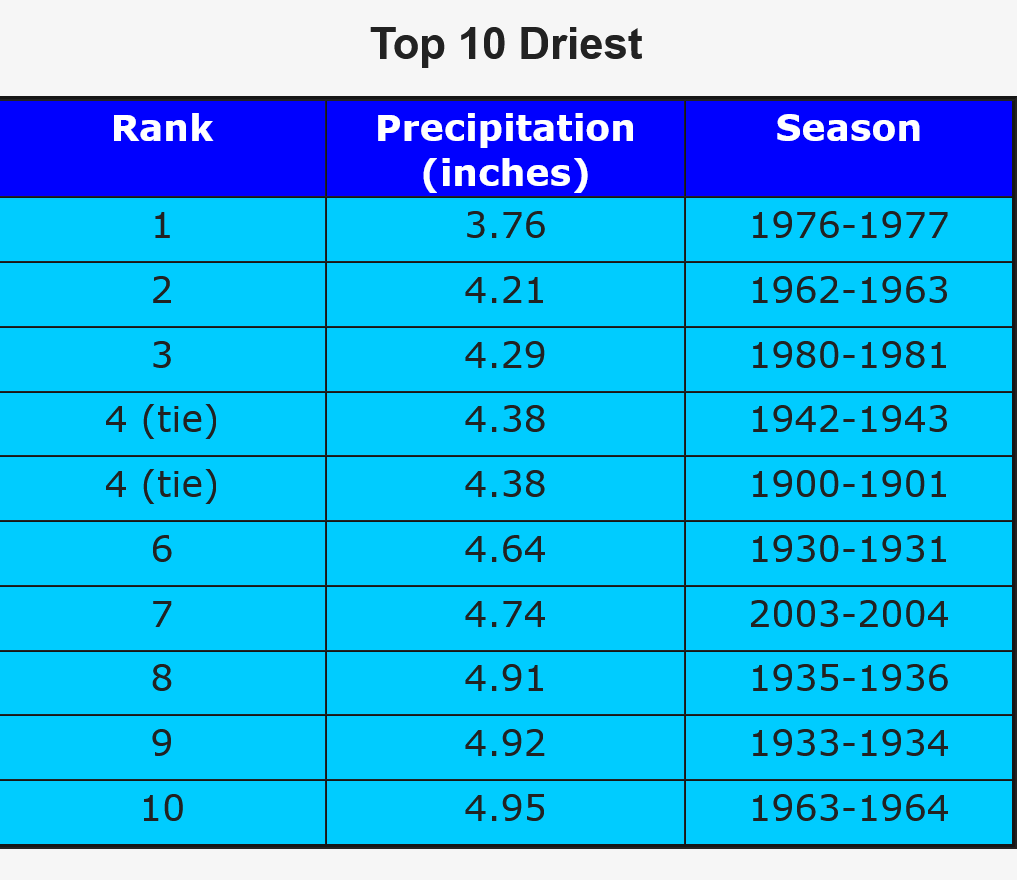

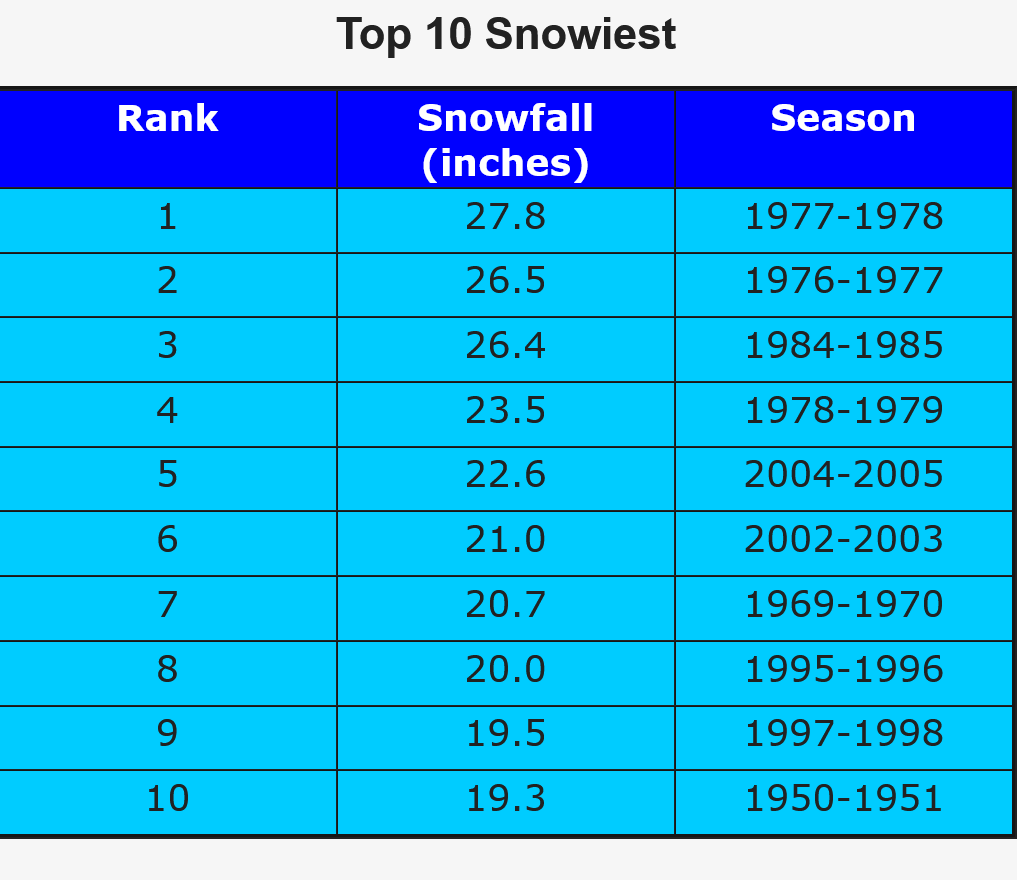

Here are some top 10 Winter weather records. Use this same link to get the top 10 lists for the other 3 seasons too.

I'm not sure who compiled these records but my memory is good enough to know that several of them are WRONG!

Nobody can remember an average temperature for a 90 day period but total snow amounts are a different deal.

I'll make the corrections that I remember at the bottom of the top 10 snow chart.

https://www.weather.gov/pah/EvansvilleSeasonalRecords

*Corrections.

They completely missed the snowiest Winter by far.

Record Winter of 1917/18!

Started by metmike - Dec. 8, 2025, 7:21 p.m.

https://www.marketforum.com/forum/topic/116459/

During the December 1917 - January 1918 winter, Evansville experienced its snowiest period ever recorded, with over

66 to 70 inches of snow falling, including a staggering 41-42 inches in January 1918 alone.

However, I feel like they failed to compile snowfall records BEFORE 1950 on the chart above.

+++++++++++++++++++++

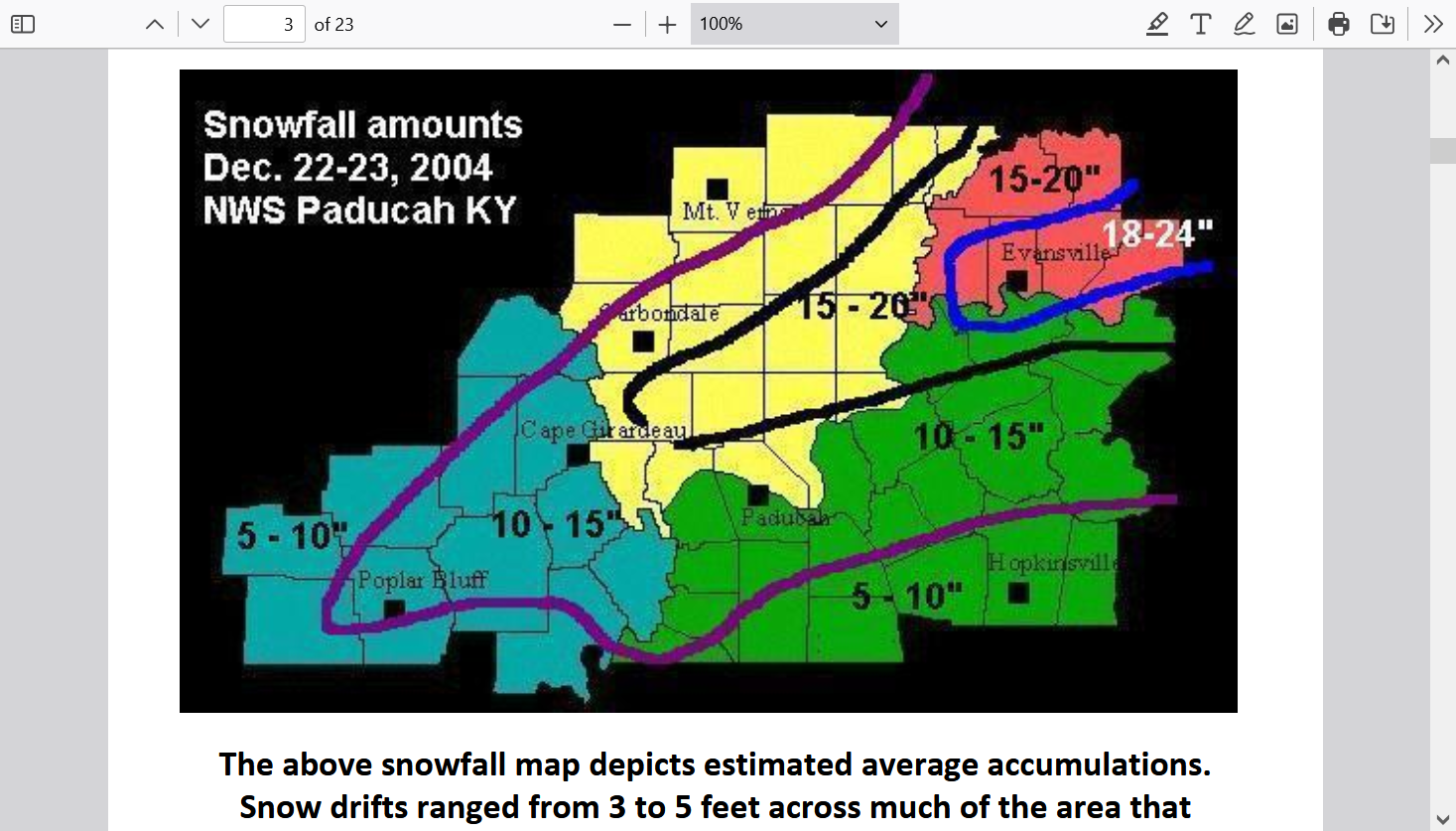

This 1 storm below with 22.3" by itself dumped more snow than every entire SEASON except the top 4 snowiest seasons above. However, I feel like they failed to compile snowfall records BEFORE 1950 on the chart above. Only .3 inches of snow fell that Winter, 2004/2005 other than that for the total of 22.6 inches.

Re: Re: Winter weather ahead 12-30-24

By metmike - Jan. 5, 2025, 9:18 a.m.

Then December 22, 2004 in Evansville during our 2 foot snowstorm. Anybody at least 30 today, that lived here remembers that one!

...Record snowfall up to two feet paralyzed much of the region...

Evansville - 22.3 inches (19.3" on Dec. 22 and 3.0" on Dec. 23). This storm set a new 24-

hour snowfall record, and made this the second snowiest December for Evansville.

Paducah - 14.2 inches. This storm set a new 24-hour snowfall record, and made this the

snowiest December for Paducah.

https://www.weather.gov/media/pah/Top10Events/2004/Dec22_2004Snowstorm.pdf

TORNADOES of 2025 - Return of the EF5