Imho we are at a critical inflection point (or very close to it), to wit:

DJI monthly chart : (I'll re-post for clarity below)

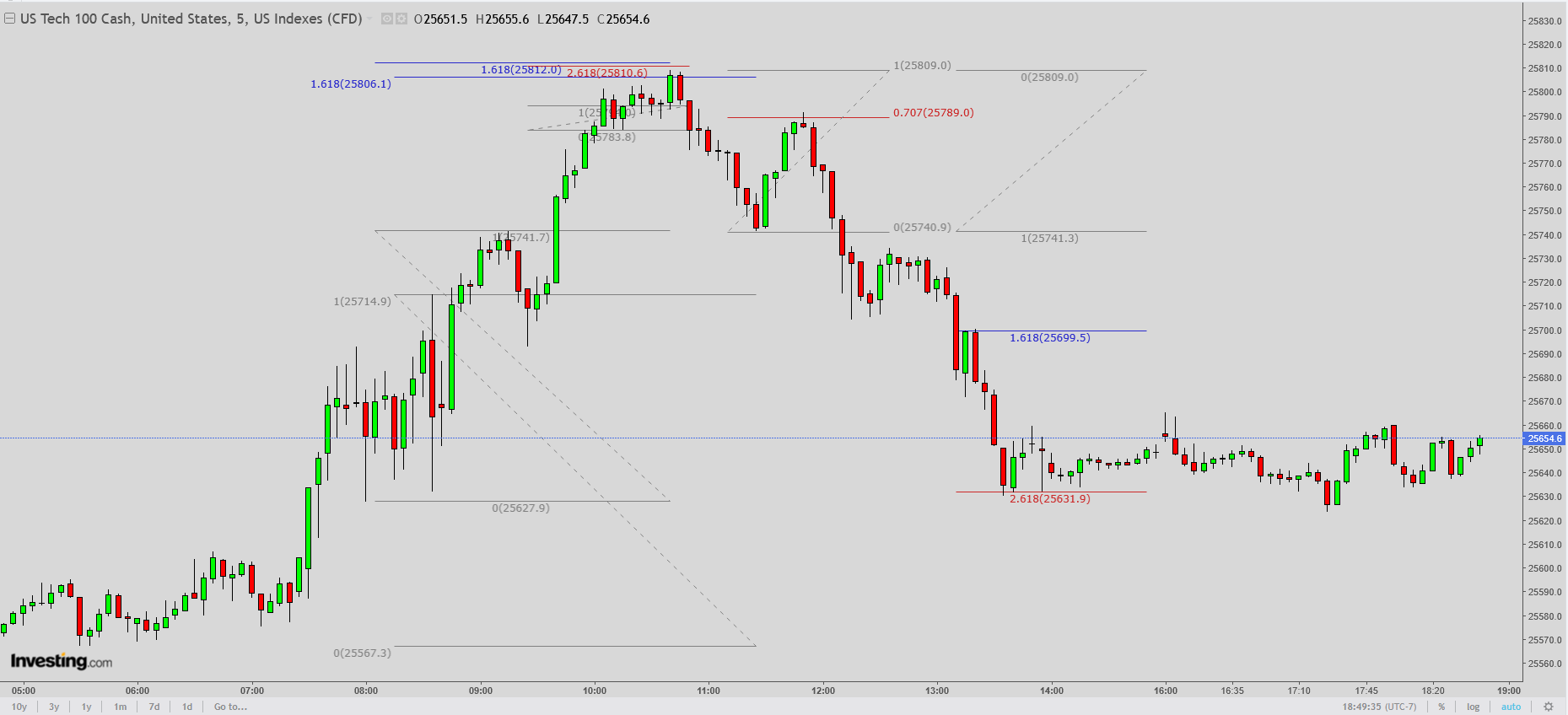

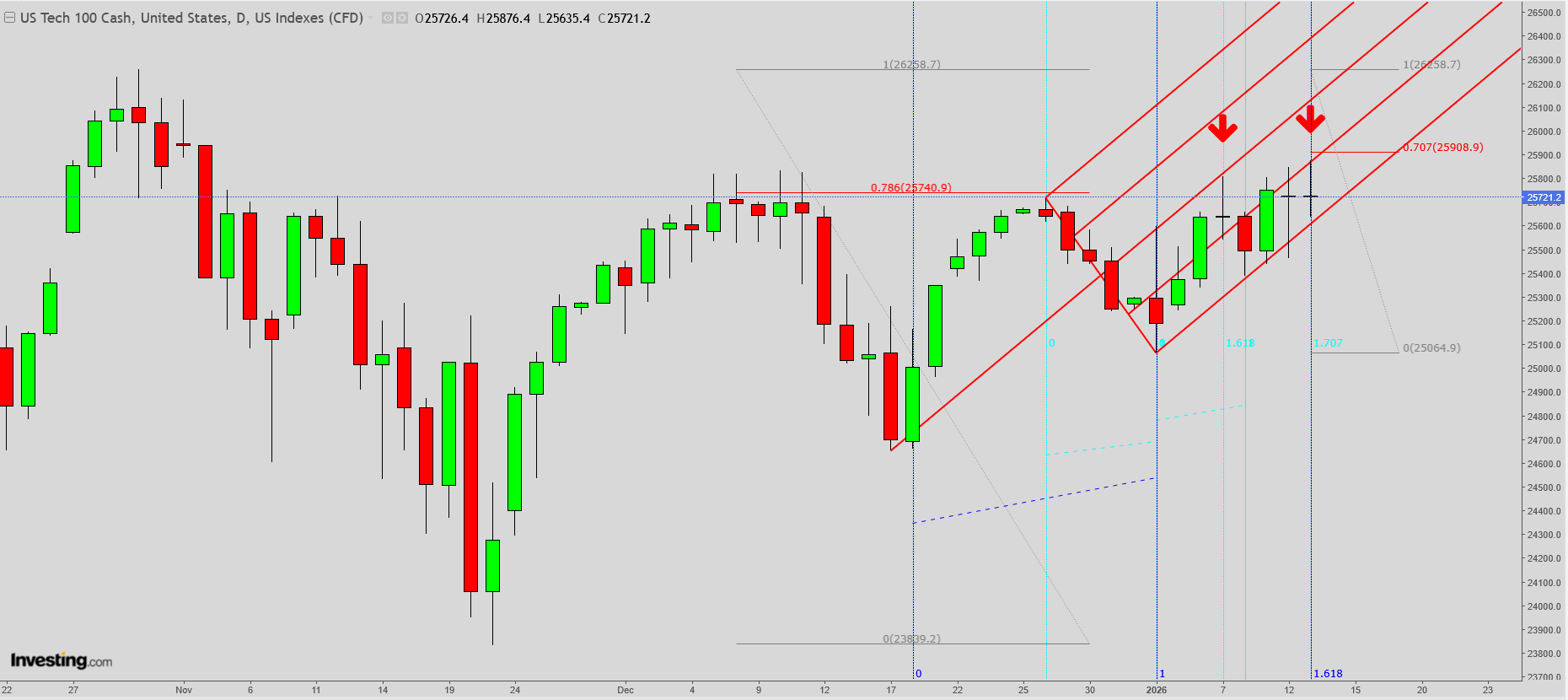

The Nasdaq charts below

Thanks very much, kris and good luck!

We missed you!

Previous thread:

S&P 500 — Long Cycle Structural Outlook

Started by fayq - Dec. 26, 2025, 10:26 p.m.

https://www.marketforum.com/forum/topic/116802/

+++++++++++++++

Thanks for the analysis!

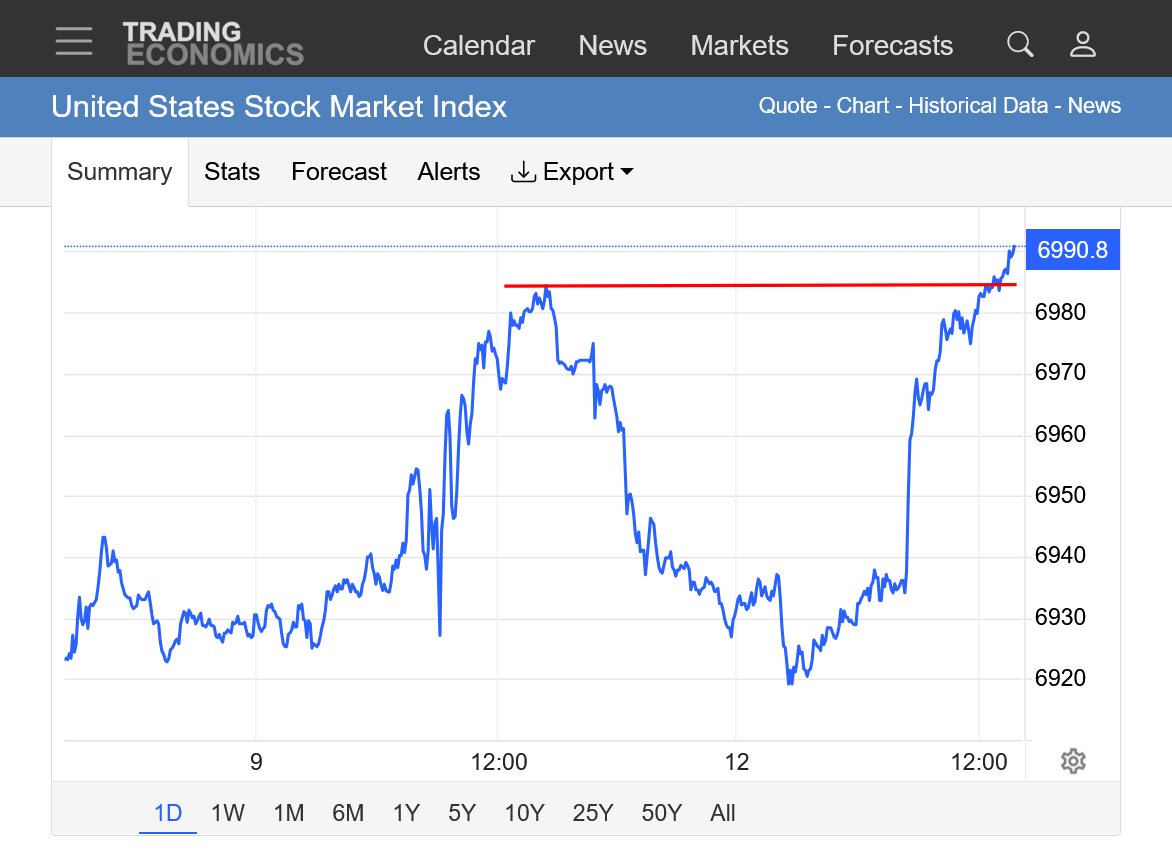

The stock market has been losing steam for some time!

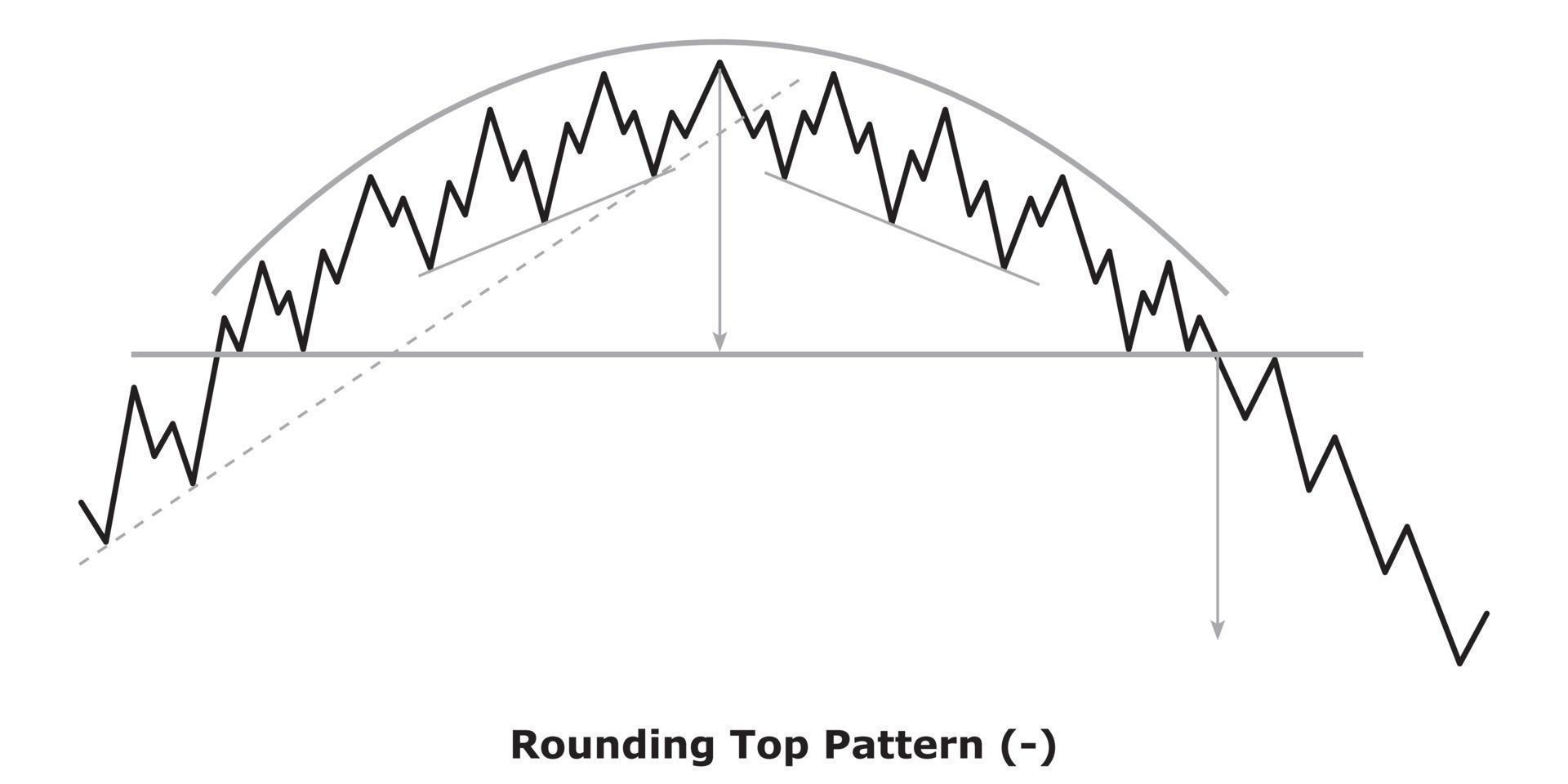

The rounded top formation previously discussed, still remains valid.

https://tradingeconomics.com/united-states/stock-market

++++++++++++++++++++

Re: Re: Re: S&P 500 — Long Cycle Structural Outlook

By metmike - Jan. 2, 2026, 7:32 p.m.

Basically, in a rounding top, the slope up for the uptrend becomes flatter and flatter, with new highs being set by smaller and smaller increments above the previous new highs.

Then, after the top there is a downtrend that starts with a very mild/modest slope.

https://www.ebc.com/forex/rounding-top-pattern-explained-how-to-spot-market-reversals

++++++++++++++

To be honest, with such extremely unbalanced valuations and fundamentals that don't support stock prices this high and the off the charts chaos and damage being caused by Trump, I feel strongly that when we go down, it won't look like the slow progression on the demo graph above.

It's MUCH, MUCH more likely to be a big Spike down. However, I'm only showing the similarity of the current chart formation to that of a rounding top pattern GOING UP.

Major tops in most markets are almost never followed by a chart pattern like that depicted above. When the longs bail or the short pile on based on sell signals, they all try to get thru the door at the same time and the sell orders overwhelm buyers. To find the size of matching, massive buy orders, the market must go pretty dang low, pretty dang fast.

"the off the charts chaos and damage being caused by Trump"

Not sure why you want to continue to bring politics into a discussion and/or analysis on the performance of the markets. I understand you have a deep hatred for the man otherwise you wouldn't continue to bring it up again and again and again.

Where is all this chaos and damage that you refer to anyway ?

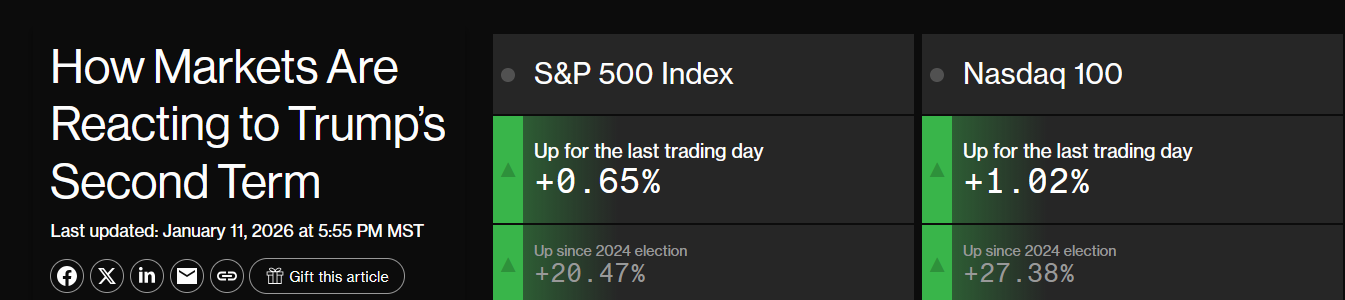

After just about a year in his second term here we are :

https://www.bloomberg.com/graphics/market-reactions-trump-second-term/

+ 20.47 on the S&P and +27.38 on the NQ these past (almost) twelve months

---------------------------------------------------------------------------------------------

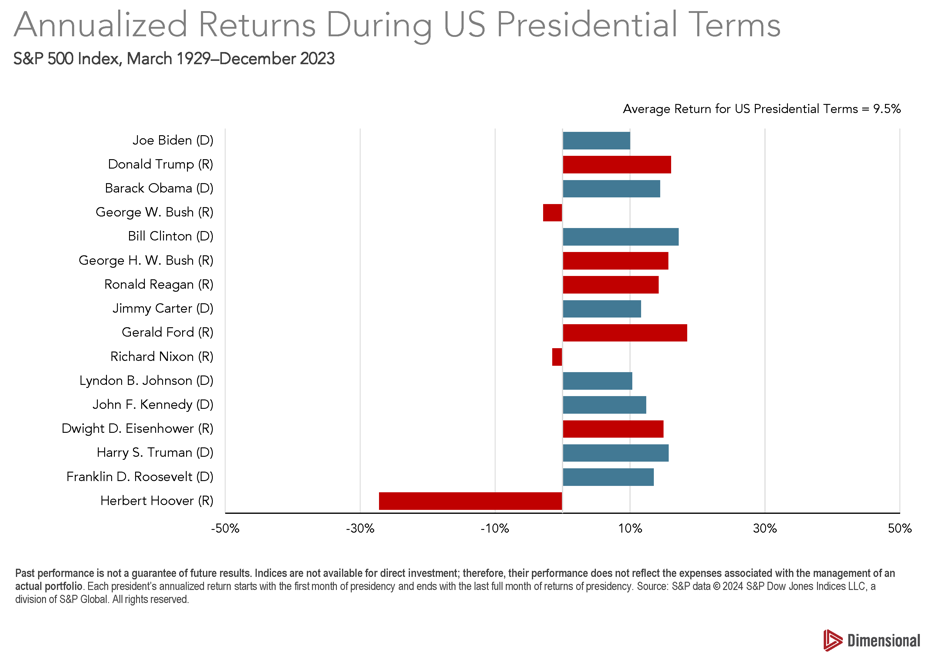

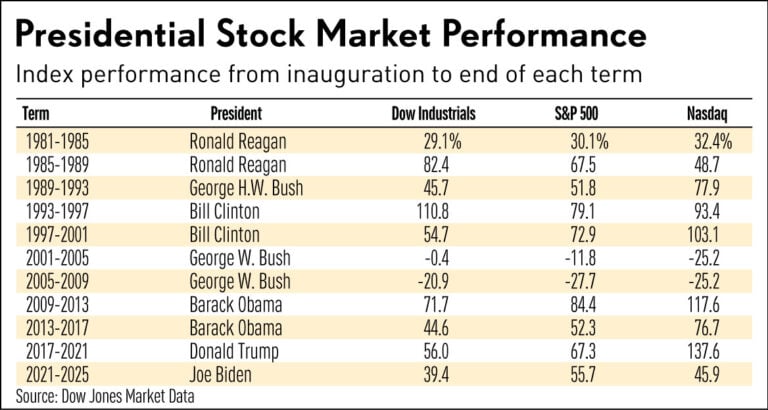

First term results compared long term :

All that being said: will there be another correction? Of course there will be (I am currently short btw).

Corrections are inevitable, financials/metals/ags etcetera; every bull run has been and will be followed by a correction from mild to moderate to severe, has happened/is happening/will happen ..... !!!

All of this talk last year about how the stock market was going to implode, economy was going to tank and a recession was to follow has been proven to be a false alarm so far. That doesn't mean it won't or can't happen but we all should just be able to enjoy what we have going in the USA compared to the rest of the world.

I am grateful every day of the week !

Kris,

I noticed the table of presidential stock market returns shows Clinton and Obama far outpacing the Republican presidents. Interesting...

I have not expected an implosion in the first year of Trump's 2nd term. But I do think policy matters. Trump wants to take over the Fed Reserve bank and push interest rates to a ridiculous 1%. Like a junky who gets a fix, they look pretty good until each fix has diminishing effect. So too the market likes it when Trump puts more vodka in the punch bowl. The party is great but the hangover can be ruinous. But for now, the wind is at our backs regarding interest rates. Andrew Jackson abolished the national bank. The depression came, but not until 3 years later. Trump's wreckage won't be seen until after he's gone. Kind of like the way he ran his businesses. Borrow, borrow, borrow.... declare bankruptcy.... rinse and repeat.

Also, realignment in world trade because of his foolish tariffs takes years to unfold. But it will happen. Even after Trump is gone, the damage in our relationship to our allies and trading partners will likely be lasting. Foreigners won't likely trust a country that elects Trump not once, but twice. 250 years of stability .... oh well....

I wish you the best on your short trade. Thanks for sharing.

"the off the charts chaos and damage being caused by Trump"

Not sure why you want to continue to bring politics into a discussion and/or analysis on the performance of the markets. I understand you have a deep hatred for the man otherwise you wouldn't continue to bring it up again and again and again.

++++++++

Thanks kris.

1. I post authentic, objective facts and belong to neither political party. As a scientist, I try to sincerely apply the scientific method, which includes fact checking myself as much as possible before posting(though I am still wrong sometimes). I voted for Donald Trump twice.

2. If you want to know my political views, visit the NTR forum.

3. You falsely accuse me of having a deep hatred for somebody because you disagree with my analysis.

4. Anybody that doesn't think that Donald Trump is having a massive impact in countless realms is ignoring the facts.

+++++++++++++

I try to minimize the politics on the trading forum as much as possible but when mcfarm brings it up here, I'm more than happy to respond here.

On the NTR forum, I have made it crystal clear that I do not hate Donald Trump dozens of times and the REASONS that I do not hate Donald Trump.

However, I will repeat part of a response to mcfarm on the trading forum made just last month:

Re: Re: Re: Re: Fed's Dual Mandate

By metmike - Dec. 25, 2025, 10:48 a.m.

Just a reminder, I don't hate President Trump. I voted for him in 2016 and 2024. This is just speaking out about the truth, using authentic, empirically based evidence which is INDEPENDENT of my political views.

Hate(and love)

Started by metmike - Oct. 17, 2023, 4:15 p.m.

++++++++++++++

kris,

1. You're accusing me of something that is patently false.

2. You are also making a personal attack against a poster here(in this case, the moderator). mcfarm is the only other one that does this on a regular basis (and interestingly he is another Donald Trump supporter). I tolerate this here because it reflects very negatively on the poster doing it more than anything that I can say.

3. I have no interest in getting into long debates on either forum about things that the other person will never recognize by repeating the same things over and over and over. The things already stated here with crystal clarity in dozens of threads and posts. Especially after they make it personal on the trading forum.

No hard feelings, please continue to generously share your expert opinions on the stock market.

You will note that I am NOT attacking you back (and never have made 1 personal attack against mcfarm), I always encourage him to express his MAGA views so that readers will understand where he is coming from.

I consider mcfarm to be our MAGA spokesperson.

Instead, I'm appreciating your wonderful contributions and encourage you to continue on that path.

I am grateful every day of the week !

kris,

I especially love this message!

We are strongly united on this profound point!

By metmike - Oct. 18, 2023, 1:02 a.m.

++++++++++++++

I will also add, since joj is in this thread, that of my countless posts/threads related to this on the NTR forum, that joj has contributed more than any other poster during my 6+ years as moderator.

With that being the case, I would say that we should cherish our shared views in that realm.

We just can't keep the rich person's Ponzi Scheme down whenever its constantly fed by the law of self fulfilling prophesies.

By metmike - Oct. 3, 2025, 2:01 p.m.

++++++++++++++++++

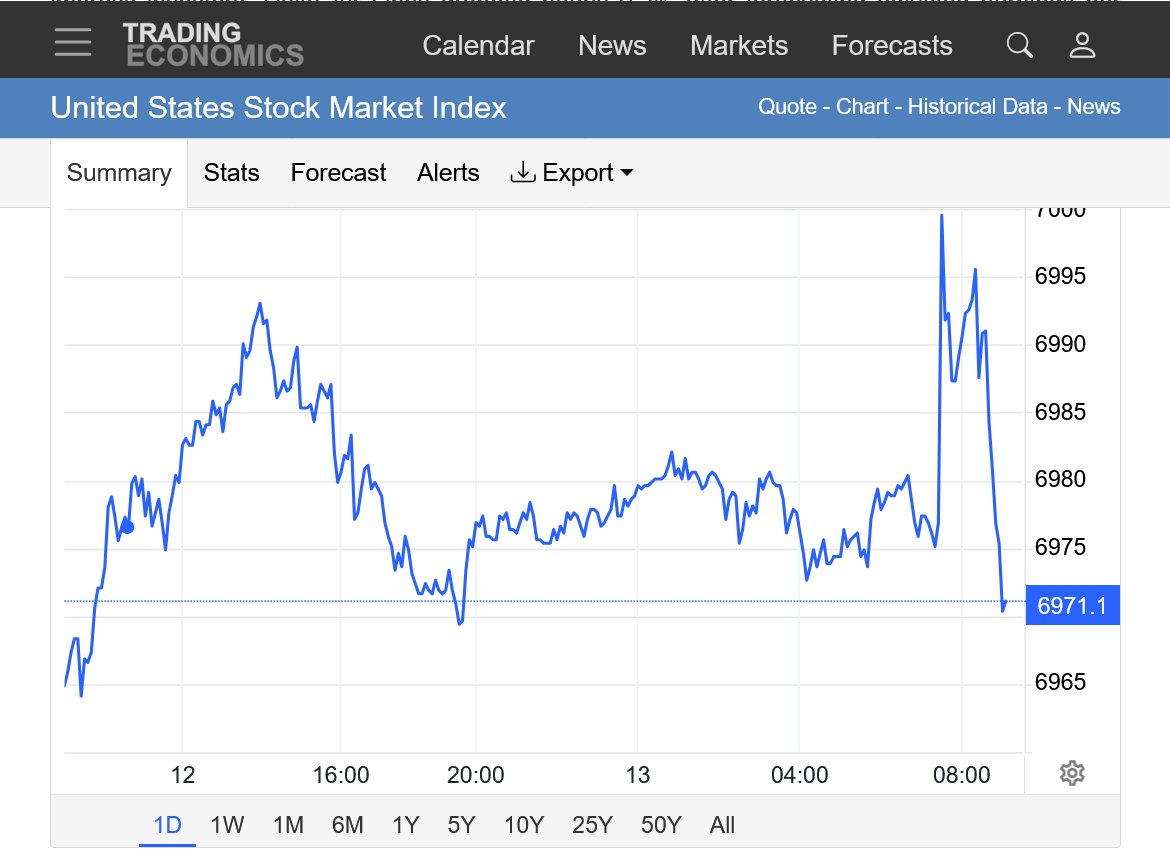

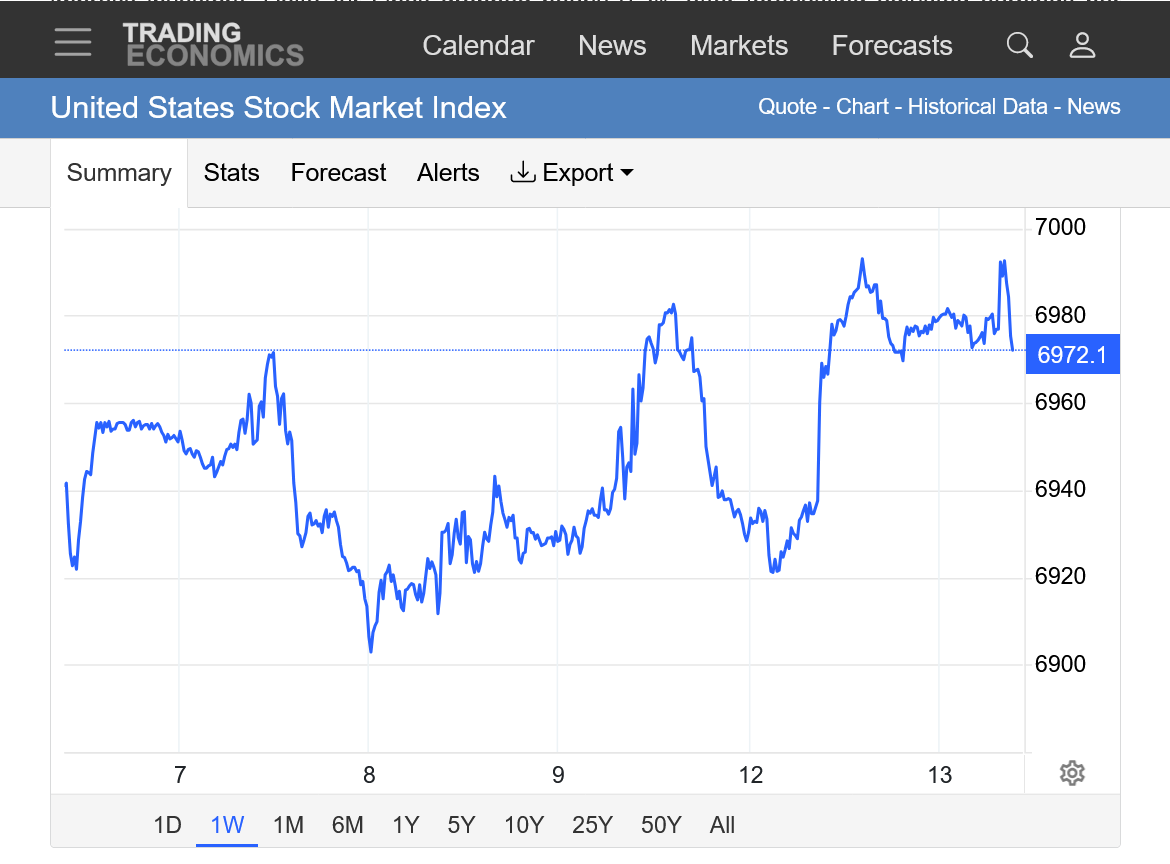

https://tradingeconomics.com/united-states/stock-market

1. 1 month: new highs

2. 1 week: new highs

3. 1 day: Reversed up

Struggling every time we make new highs!

https://tradingeconomics.com/united-states/stock-market

1. 1 day

2. 1 week

3. 1 month

"I noticed the table of presidential stock market returns shows Clinton and Obama far outpacing the Republican presidents. Interesting..."

I'll play:

I noticed Ford outpacing all Dem presidents and Trump outpacing all Dem presidents except Clinton. Interesting ...

"Trump's wreckage won't be seen until after he's gone. Kind of like the way he ran his businesses. Borrow, borrow, borrow.... declare bankruptcy.... rinse and repeat."

That is very deceptive Mike and you should now, 6 filings out of 540+ businesses is a pretty stellar record, those six filings involved the Atlantic City casinos, aside from Trump many other casino operators had to file as well then and there :

https://www.fregolaw.com/fact-check-donald-trump-filed-bankruptcy-six-times/

He is known to be associated with 540+ businesses, with his organization owning most of them.

Donald Trump's businesses have filed for

Chapter 11 bankruptcy a total of six times. These were corporate filings, not personal ones, meaning the companies were able to remain in business and restructure their debts.

The bankruptcies, primarily involving his hotel and casino properties, occurred between 1991 and 2009. The specific businesses included:

While some, including Trump himself, have referred to these as four bankruptcies (counting the 1992 filings as a single event), public records and legal analyses confirm there were six separate Chapter 11 filings. During the restructuring process, investors and bondholders often lost money, while Trump was able to negotiate better terms with banks and maintain some level of ownership

After getting a nibble on the first target (chart above) we are once again at a imho critical junction:

"Trump's wreckage won't be seen until after he's gone. Kind of like the way he ran his businesses. Borrow, borrow, borrow.... declare bankruptcy.... rinse and repeat."

That is very deceptive Mike and you should now, 6 filings out of 540+ businesses is a pretty stellar record, those six filings involved the Atlantic City casinos, aside from Trump many other casino operators had to file as well then and there

++++++++++++++++

Thanks, kris!

Please note that joj was the one that made that comment.

Re: Re: the stock markets, now short ...

By joj - Jan. 11, 2026, 8:44 p.m.

Let's try to go with the new thread since, this one requires several dozen pages of scrolling to get to the last post. Thanks, everyone!

Short 1 Emini S&P

1 response |

Started by joj - Jan. 14, 2026, 3:35 p.m.