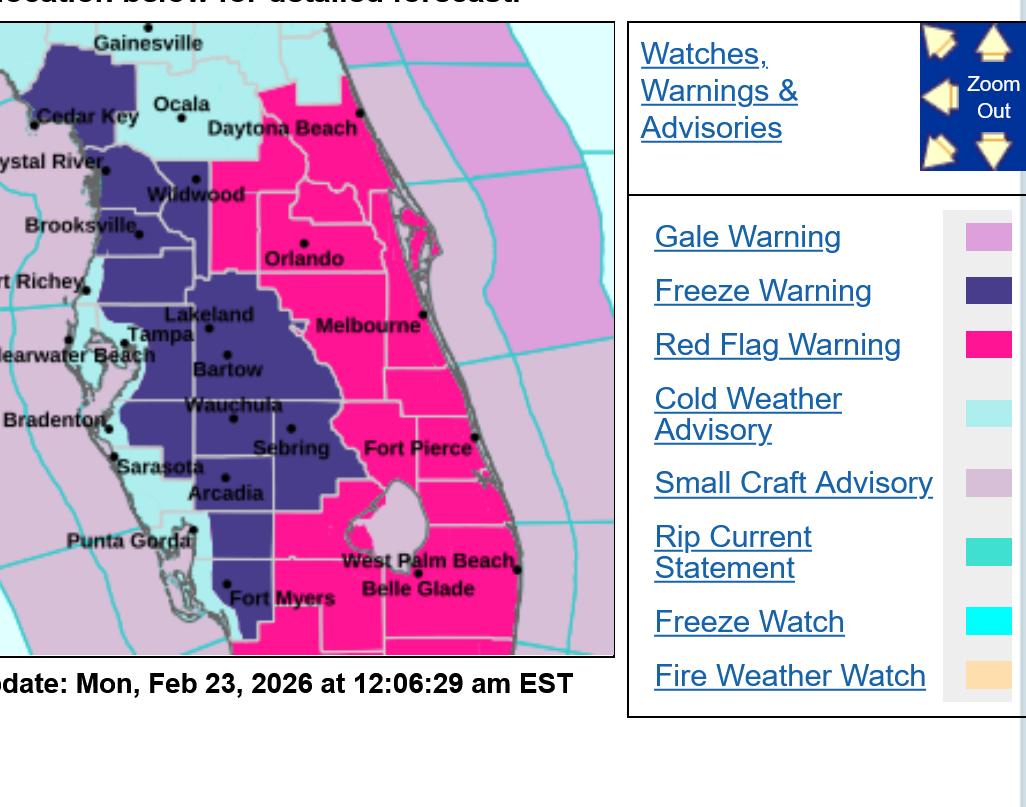

Freeze warnings in Florida, why isn't oj reacting? Maybe to well predicted and already in the market????

I corrected my verbiage in the underlined text below.

Thanks very much, cutworm!

This was an EXCELLENT TOPIC TO BRING UP!

1. The biggest reason is that temperatures will not be cold enough for major freeze damage. It needs to get into at least the mid 20's for major damage. Although there are FREEZE WARNINGS, there are not expecting a HARD FREEZE.

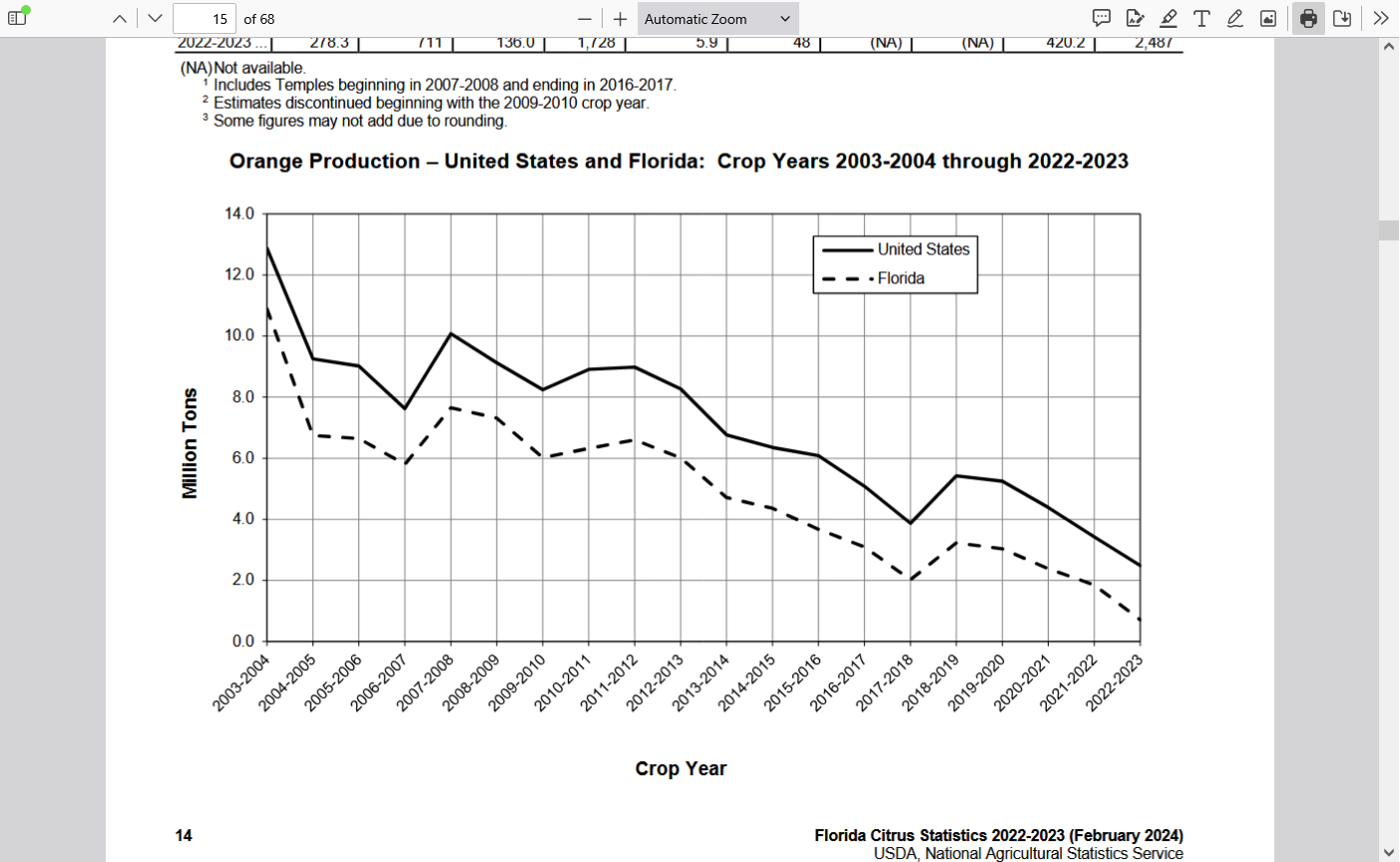

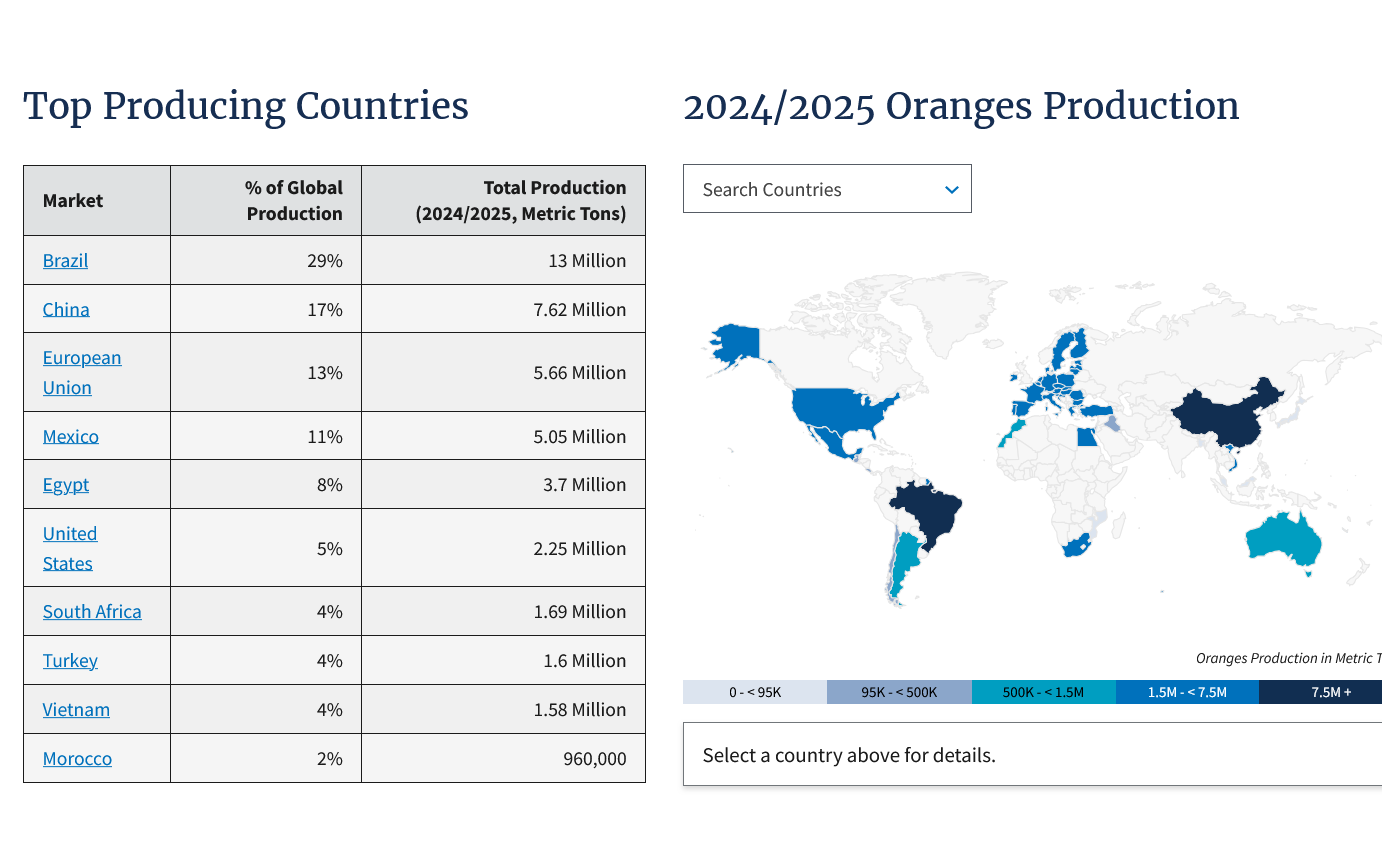

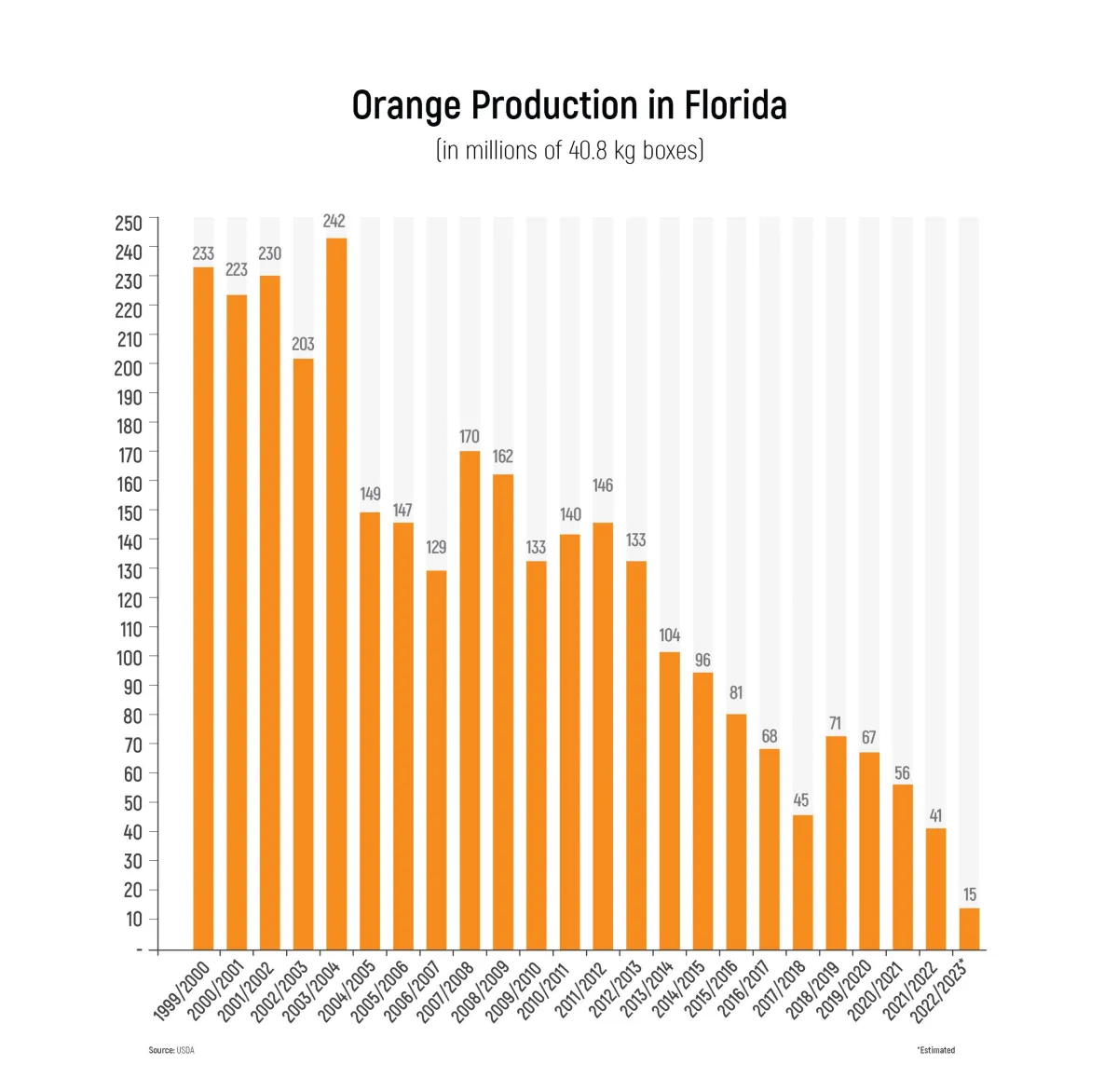

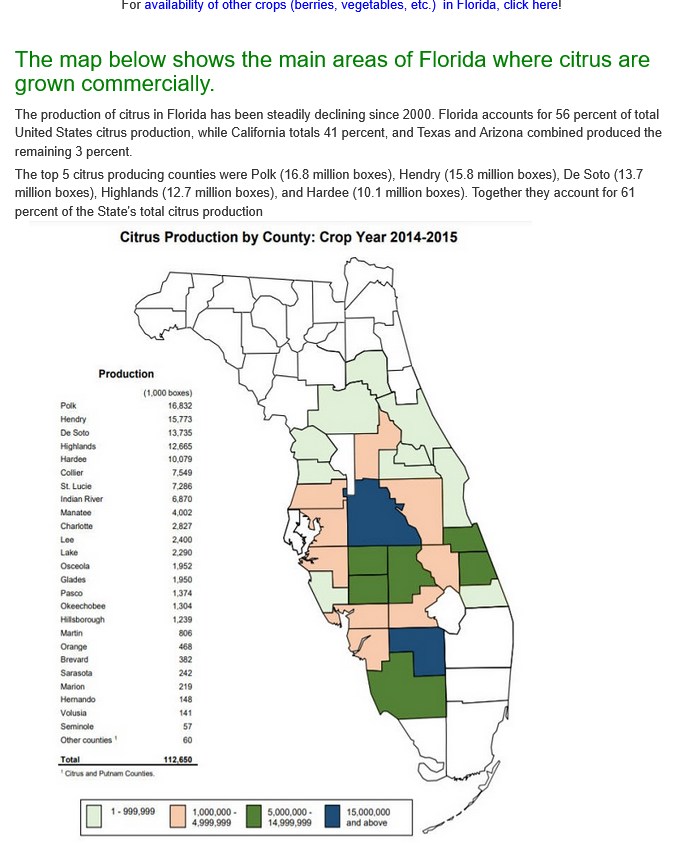

2. Almost as importantly, citrus greening in FL has killed off most of the production.

3. Sao Paolo, Brazil produces the most of any country in the world for oranges now.

https://www.fas.usda.gov/data/production/commodity/0571120

This was a thread about it with more details:

Dangerous time to trade/OJ

20 responses |

Started by metmike - Oct. 3, 2024, 1:19 p.m.

Here's more:

By Karen Braun

Re: Re: Re: Re: USDA October 12, 2023

By metmike - Oct. 12, 2023, 8:43 p.m.

Re: Re: Re: Re: Re: USDA October 12, 2023

By metmike - Oct. 12, 2023, 8:51 p.m.

Great one, cutworm and always fun to watch this video clip again, even though the oj price goes thru several limits in a few minutes!!!

Bonus: The Eddie Murphy Rule

One interesting kicker to the story: Trading commodities on inside information obtained from the government wasn't actually illegal when the movie came out, but it's illegal now. It was banned in the 2010 finance-overhaul law, under a special provision often referred to as the Eddie Murphy Rule.

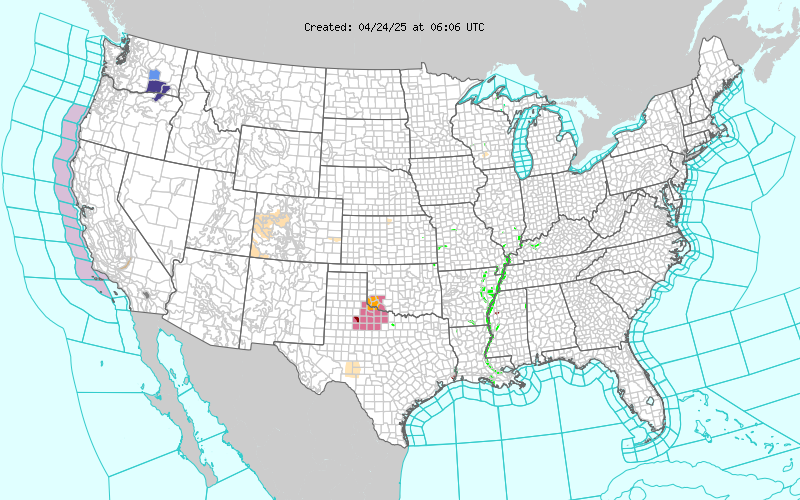

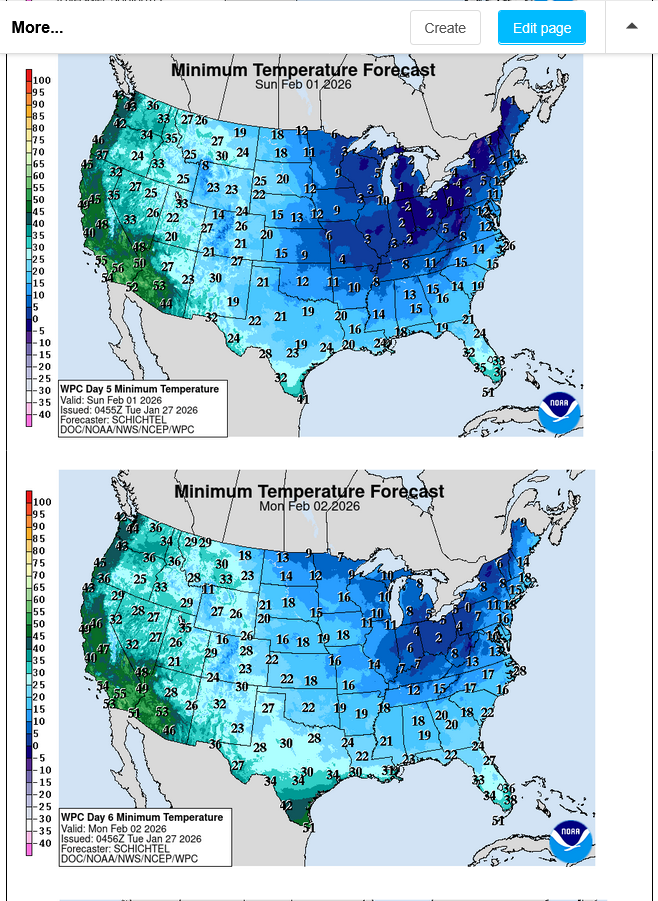

Here's the latest weather that includes forecasts for Florida.

25 years ago, this probably would have inspired a bounce in the OJ, when production was something like 10 times greater.

Current Hazards at the link below.

For your NWS and county, go to the link below.

Then you can hit any spot on the map, including where you live and it will go to that NWS with all the comprehensive local weather information for that/your county.

Here's what the colors on the map above stand for:

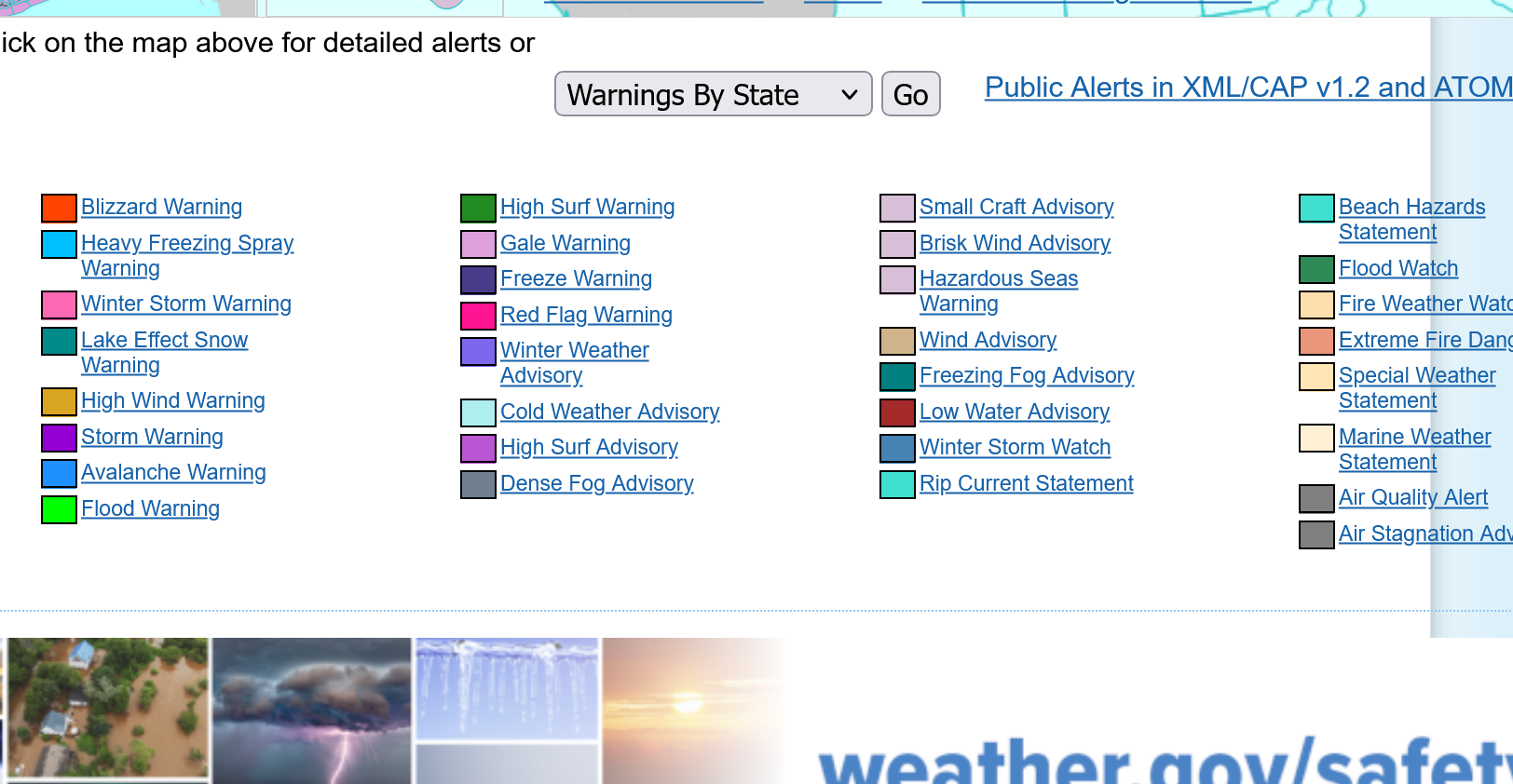

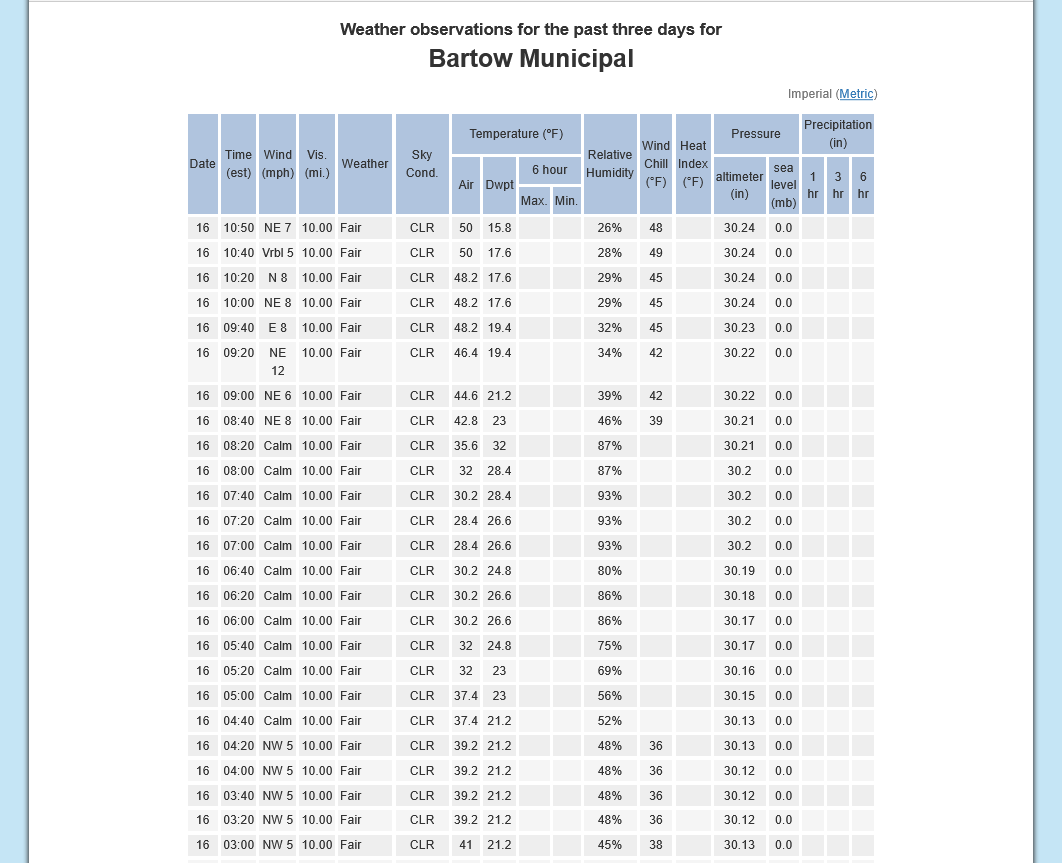

This is from the #1 OJ producing county in Florida:

https://forecast.weather.gov/MapClick.php?x=114&y=163&site=mlb&zmx=&zmy=&map_x=113&map_y=163

Temperatures tonight are not likely to get much below the upper 20's and just above the threshold for damage.

https://www.lsuagcenter.com/profiles/clirette/articles/page1611248225640

If temperatures are predicted to dip below 26-27 degrees for an extended period of times (more than 2 hours), then you should protect the tree.

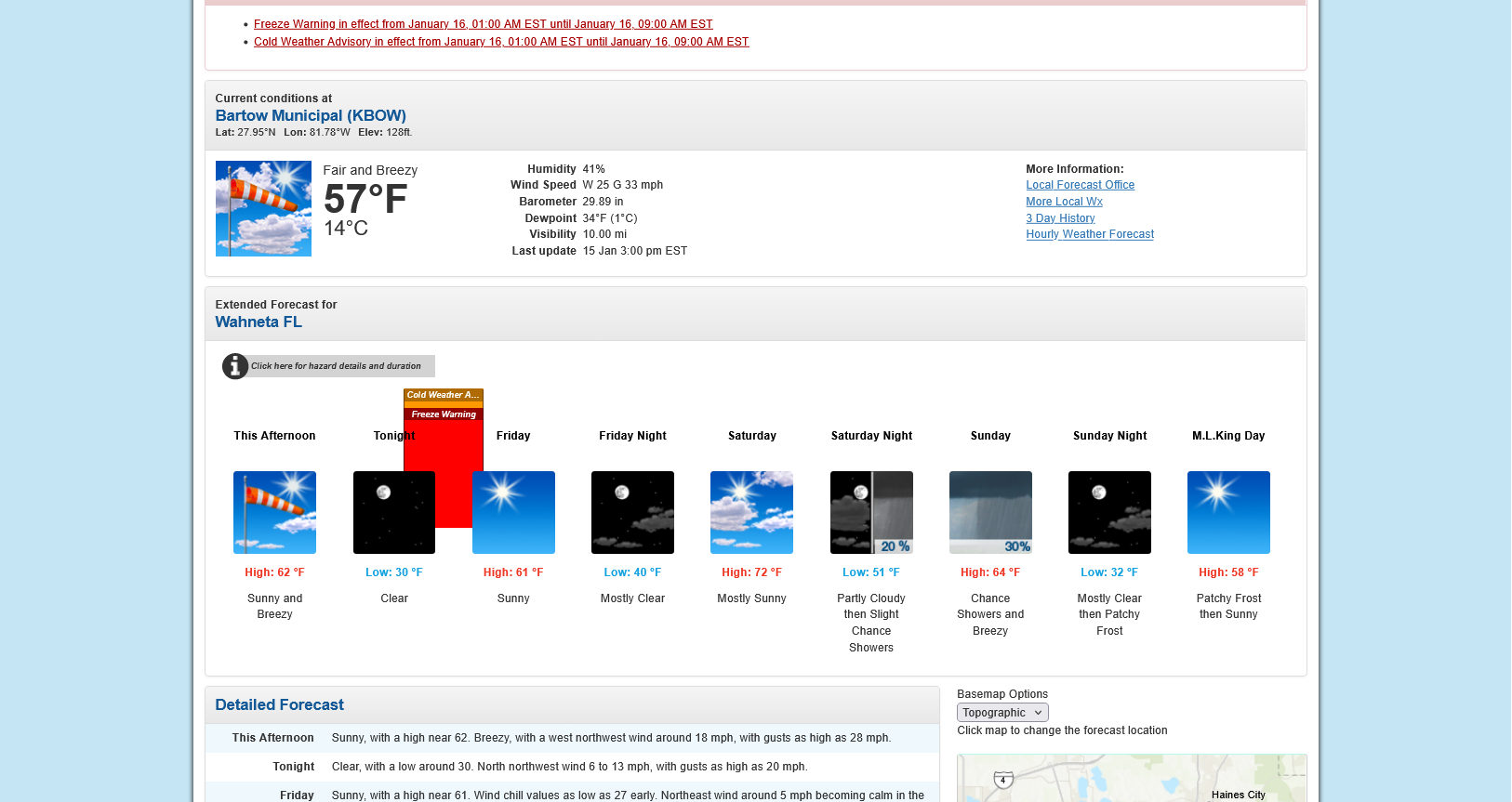

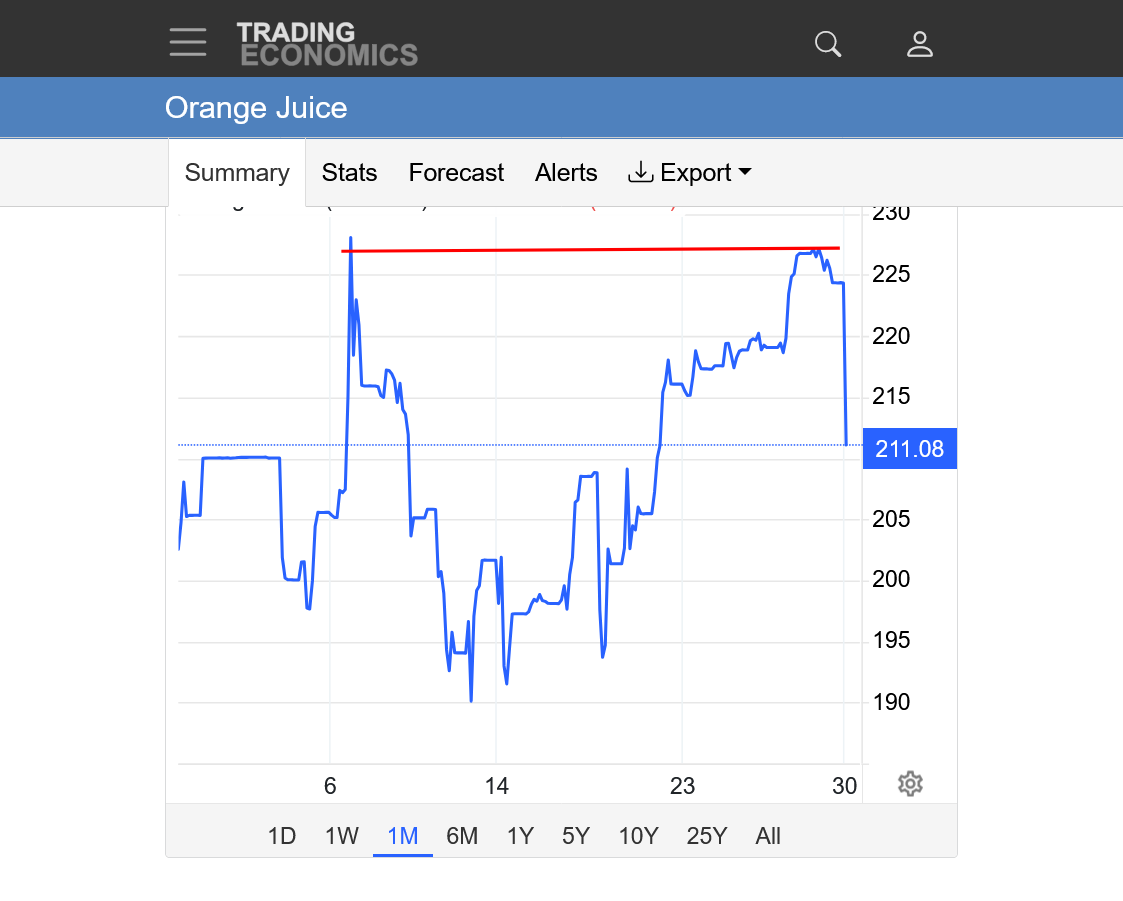

I'm sure there was no freeze damage overnight. The market was not expecting any. One can possibly make a case that we had a bounce from the lows earlier this week from speculators buying ahead of the very light freeze but if that were the case, we would be back down to the lows now after having no damage overnight.

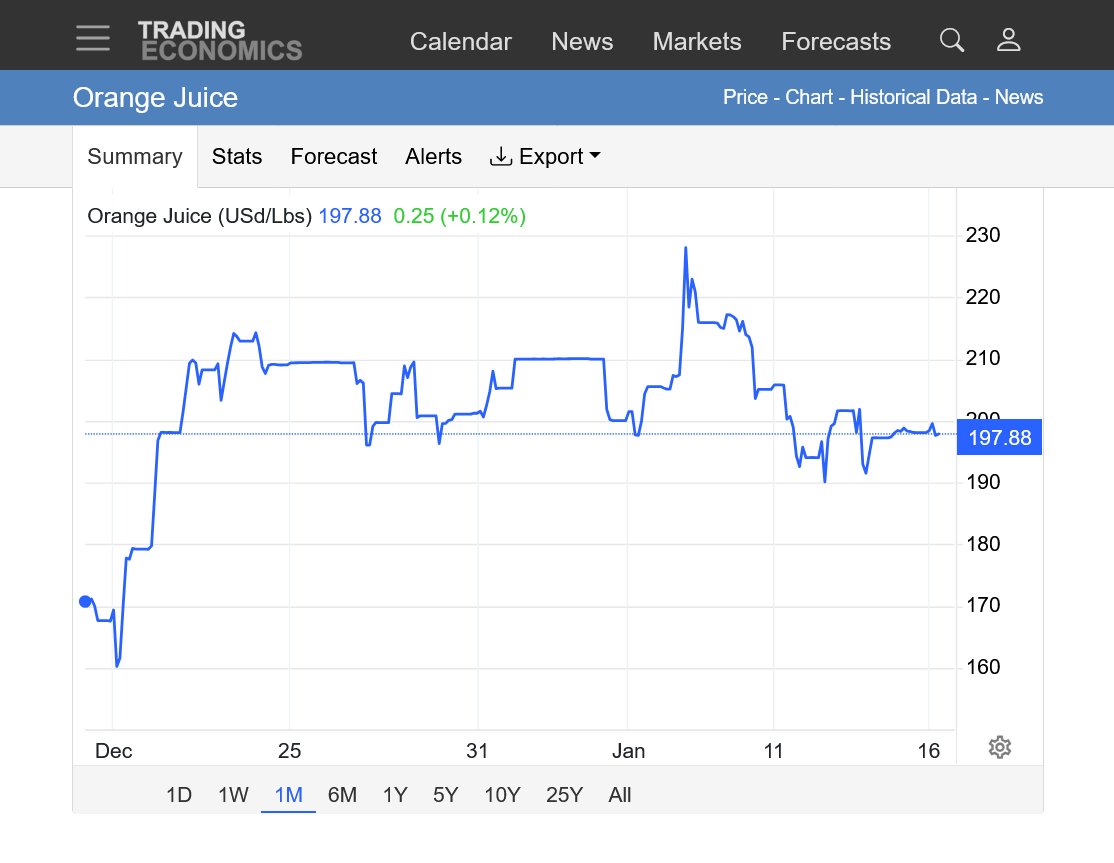

https://tradingeconomics.com/commodity/orange-juice

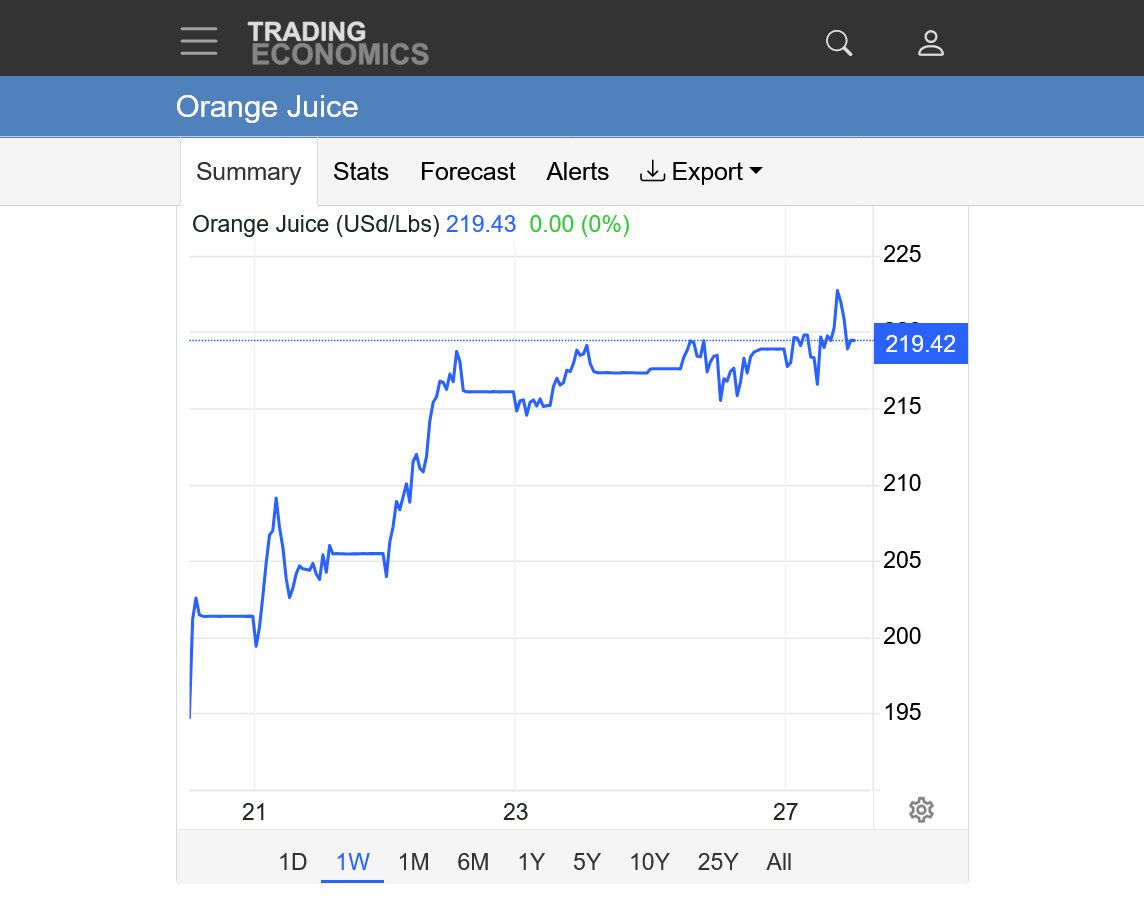

1. 1 week: Still above the lows from earlier this week

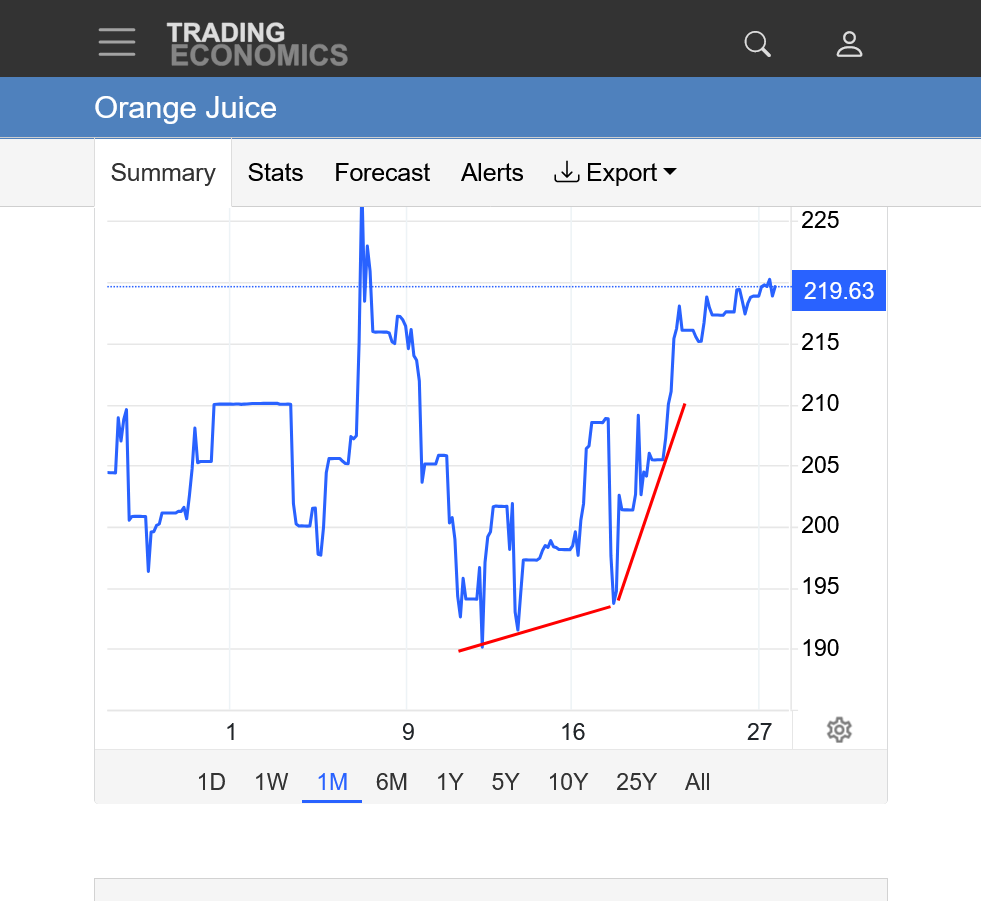

2. 1 month

3. 1 year: Sharp down trend. Bear flag/wedge from April-September, followed by a downside breakout. Price dropping from 500 to 150. Bottom to just below 150 in late November. Is this another bear flag or THE bottom?

4. 10 years. September 2024 peak of 550!!!! Obliterating previous highs by an extremely wide margin!!!! Extreme steep downtrend since then. Back down INSIDE of the previous 10 year range(below previous highs). Are we holding a longer term uptrend or is this another bear flag.

OJ is VERY thinly traded. It's likely the extreme highs over 500 caused price spikes to consumers that were great enough to cut back on demand(the cure for high prices is........HIGH PRICES) Compared to being high enough to generate more production/supply(it takes years for newly planted trees to produce oranges).

The total volume for the front month March contract for just this trading session, just before 10 am CST is 171 contracts with an open interest of 6273!

Most of the high volume commodities average more volume than that EVERY MINUTE during most of the day trading session!

Front month, February natural gas, which I've traded several times this month has almost 70,000 contracts traded in this session(that started at 5pm yesterday). That's over 1,000 times more volume than front month orange juice!!

Open interest is being rapidly liquidated in this front month of natural gas with looming expiration. It's down to 90K while March, the next month is up to 361 K in open interest.

Volume in OJ was much higher 25 years ago. I told the story here about the time I was long 200 contracts of front month OJ over a weekend 2+ decades ago and was WRONG about the freeze and had to get out on Monday morning. It was a big loss of course but there was much more volume back then compared to today and not as bad as you might think. I'll see if I can find that and post it on the next page.

I picked this spot in Florida orange country because, following the weather for years down there during potential freeze season, I remember it always had the COLDEST readings during freeze events.

Last night, the temperature dropped down to 28 degrees F. That did no damage. In fact, temperatures that drop to around 32 and a bit below help to make the oranges a bit sweeter.

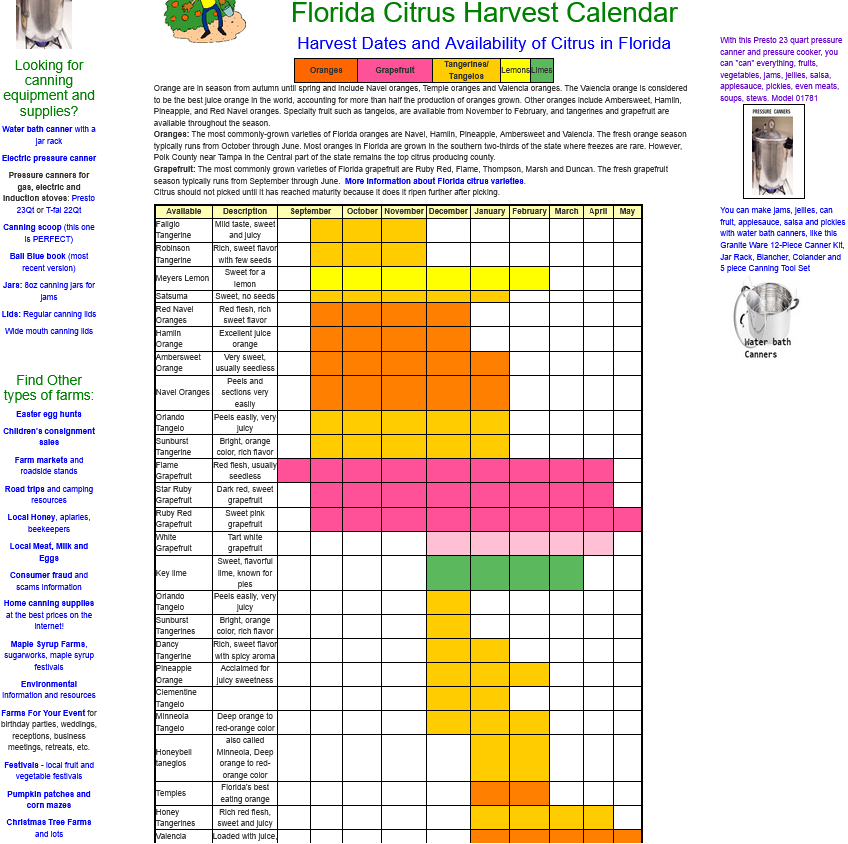

Another item that I just remembered. Much of the orange crop has already been harvested! I'll try to get more on that in a minute. It's been 2 decades since I actively traded OJ but it was excellent for cutworm to start this thread:

https://forecast.weather.gov/MapClick.php?x=114&y=163&site=mlb&zmx=&zmy=&map_x=113&map_y=163

https://www.pickyourown.org/FLcitrus.htm

As you can see above, much of the crop has been harvested already even though the size of the crop is tiny compared to 2+ decades ago as the result of the citrus greening BACTERIA disease destroying the trees. Originally, it was thought to be from a virus.

Re: Re: Simple(ton) Fundies - OJ's a BUY!

By metmike - Jan. 31, 2020, 11:40 a.m.

The total volume so far today for the March OJ contract is 287 contracts traded.

I remember one year almost 20 years ago when I bought 200 contracts of OJ on a Friday before a freeze threat in early January.

The freeze did not do any damage/cold was less on Monday and I had to cover. Volume was thin back then but several times what it is today.

OJ is $150/c for each contract. 200 contacts is $30,000/c

This must have been early 2004 because I was in close touch with Greenman in those days and he was curious how I was going to get out with the total volume in 1 day back then probably around 1,000 contracts.

I just had to bite the bullet and take the loss ASAP to not make it even worse because the entire reason to be long was gone.

Rather than just place a market order to sell everything, like would have been the case for any other market and know that big buy orders below would take care of me, I did price it at a price that I guessed could fill me.........well below the known bids.

Doing a market order on the open that big in oj could have caused it to open 10c lower and be a $300,000 loss.

So obviously my order hit alot bids on the way down to over 3c lower on the open. Luckily, prices had already plunged before that and there were some pretty big bids from entities that considered those low prices as value.

My account was huge back then(not any more) but it took a nearly $90K hit that day because of being wrong about the weather in Florida. However, the question is often not did you make a really bad decision entering a trade but did you make a good decision exiting the position.

If OJ had come back to unch that day, after my order pressured the price lower on the open it would have been devastating. That's all I wanted that day.

"Please don't lget OJ come back now" "Please don't let OJ come back now"

So OJ closed LOWER than the lowest price that I sold(to cover) and I was happy.

OK, not exactly happy but happier than I was when the day started.

++++++++++++++

I see you MetMike, bidding nearly 200 contracts on May OJ~!~

Started by hayman - Feb. 24, 2020, 11:23 a.m.

A hard freeze is forecasted coming to some areas of FL OJ country Sat and Sun nights. However, it doesn’t appear quite cold enough at this time to do appreciable damage to a large portion of the oranges. Even if so, I don’t know how the market would react with such a small crop there now.

Aside: I don’t think I’ve traded it since 2020 though I’ve had some nice trades of it. If I were still actively trading it, I don’t think I’d go long on this.

Other opinions?

Thanks very much, Larry! Great post and point!

For sure, us older guys that used to trade oj in the past remember the impact that extreme cold just like this used to have on the oj market 2+ decades ago.

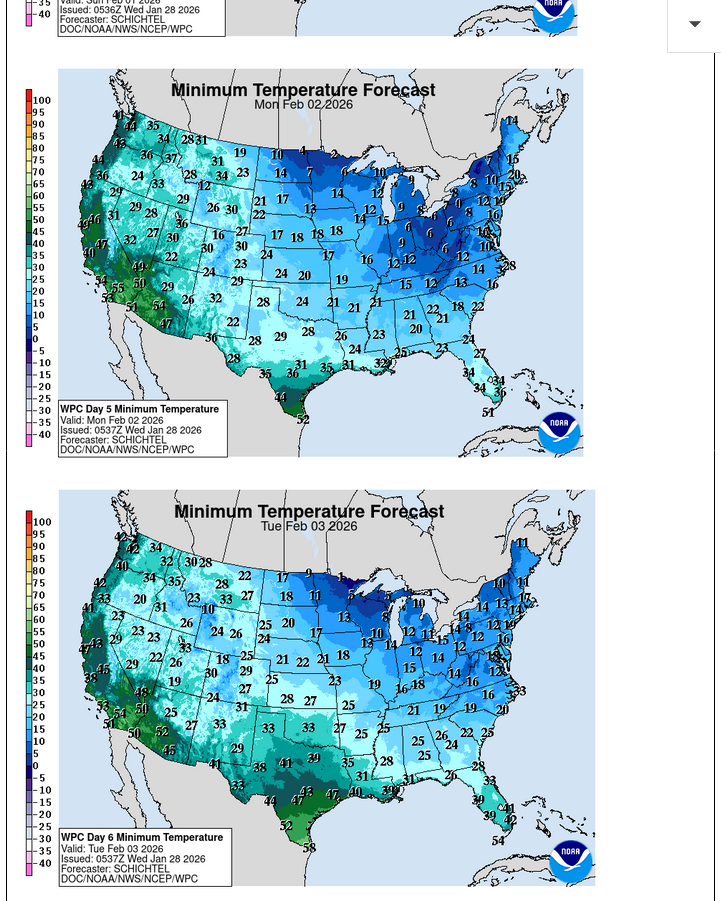

This is the forecast for the cold spot in the OJ groves.

I underlined the forecast for the lows this coming Saturday and Sunday night. Man, that's pretty cold. 2+ decades ago, the OJ market would have been up sharply the past 2 days!!!

However, I picked THE COLDEST SPOT that usually comes in colder than surrounding areas.

https://forecast.weather.gov/MapClick.php?x=114&y=163&site=mlb&zmx=&zmy=&map_x=113&map_y=163

Extended Forecast for

Today

Sunny, with a high near 57. North wind 8 to 11 mph.

Tonight

Clear, with a low around 30. North wind 3 to 6 mph.

Wednesday

Sunny, with a high near 62. Wind chill values as low as 25 early. North wind 6 to 9 mph.

Wednesday Night

Areas of frost after 1am. Otherwise, clear, with a low around 31. Northwest wind around 6 mph.

Thursday

Areas of frost before 9am. Otherwise, sunny, with a high near 65. North wind around 7 mph.

Thursday Night

Partly cloudy, with a low around 39. Light north northeast wind.

Friday

Mostly sunny, with a high near 69. Light and variable wind becoming west southwest 5 to 7 mph in the morning.

Friday Night

A 50 percent chance of showers. Mostly cloudy, with a low around 45. West northwest wind 5 to 10 mph.

Saturday

A 40 percent chance of showers before 1pm. Partly sunny, with a high near 57. Breezy, with a west northwest wind 11 to 18 mph, with gusts as high as 26 mph.

Saturday Night

Mostly clear, with a low around 26. Blustery.

Sunday

Sunny, with a high near 50.

Sunday Night

Clear, with a low around 26.

Monday

Sunny, with a high near 57.

++++++++++++++

This is the forecast for the 2 coldest mornings.

Just a bit above the threshold for freeze damage.

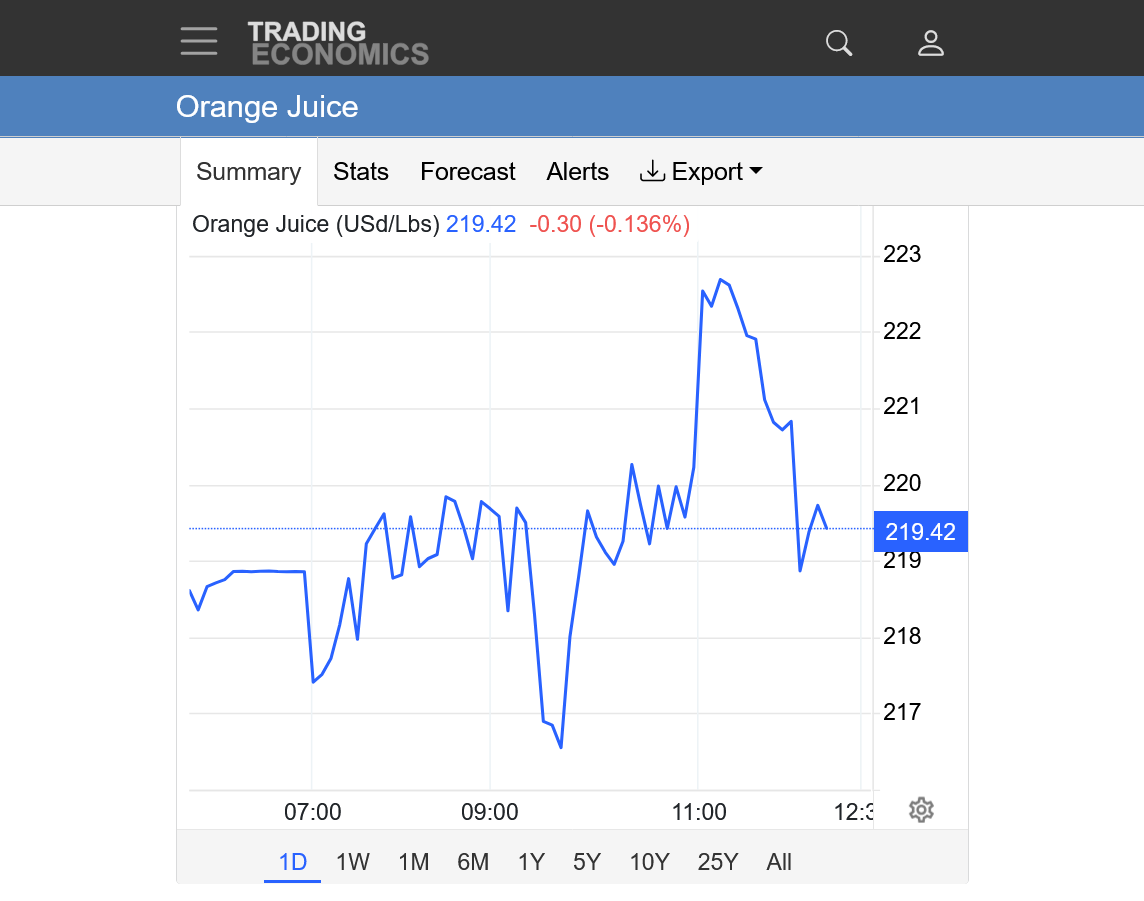

The OJ market has been extremely volatile this morning!!!

It's actually been adding risk premium(going up since December).

More charts on the next page in a minute.

Total volume today for the front month, March is under 800 as we approach the close which is actually high volume for OJ in this age.

Open in interest is just 6,500 contracts.

https://tradingeconomics.com/commodity/orange-juice

Today was an extremely volatile day from lower to higher back to almost unch.

1. 1 day

2. 1 week

3. 1 month

4. 1 year

5. 10 years

The forecast for OJ got a tiny bit colder the past day and helped OJ to bounce, after initially dropping after the open. As a reminder, I copied the forecast from the place that almost always has the coldest low temperatures with cold waves like this.

I will also add that winds below have too much of a westerly component to be optimal for a big freeze. West winds entrain oceanic air in from the Gulf of Mexico that help moisten up the bone dry Arctic air)

For optimal freeze weather, the winds should be straight from the north, so UNmodified Arctic air spills straight south down the entire spine of the FL peninsula.

https://forecast.weather.gov/MapClick.php?x=114&y=163&site=mlb&zmx=&zmy=&map_x=113&map_y=163

Saturday Night

Mostly clear, with a low around 25. Blustery, with a northwest wind 14 to 18 mph, with gusts as high as 28 mph. (this is 1 deg. colder than Tuesday's forecast)

Sunday

Sunny, with a high near 49. West northwest wind around 14 mph, with gusts as high as 21 mph.

Sunday Night

Clear, with a low around 26.

+++++++

++++++++++

We can see that initially, OJ sold off right after the open(red line), then reversed higher, almost immediately. We're up almost 4c right now with 827 contracts traded in the front month, March which is pretty active for OJ in this age.

https://tradingeconomics.com/commodity/orange-juice

I looked around and found some COLDER temperatures farther southeast from this location.

This would likely do some damage to the unharvested portion of the orange crop. This location has more of a northerly component to the wind.

Also, it's pretty impressive that temperatures will drop to 24 degrees on Saturday Night with winds still that high!

https://forecast.weather.gov/MapClick.php?x=245&y=135&site=tbw&zmx=&zmy=&map_x=245&map_y=135

Saturday

A 30 percent chance of showers before 1pm. Mostly sunny, with a high near 60. Windy, with a west northwest wind 5 to 10 mph increasing to 15 to 20 mph in the afternoon. Winds could gust as high as 35 mph.

Saturday Night

Mostly clear, with a low around 24. Windy, with a northwest wind 15 to 20 mph, with gusts as high as 30 mph.

Sunday

Sunny, with a high near 49. West northwest wind 10 to 15 mph, with gusts as high as 25 mph.

Sunday Night

Clear, with a low around 24. Northwest wind around 5 mph.

The temperature for this location went up 1 deg. F on Saturday Night from the previous forecast. I'm going to stick with this specific location to track the cold forecasts because it's in #1 producer, Polk County and typically is a cold spot for the region.

This is the same temp for Sat. Night and +1 deg. F on Sunday Night compared to the previous forecast.

https://forecast.weather.gov/MapClick.php?x=114&y=163&site=mlb&zmx=&zmy=&map_x=113&map_y=163

Saturday Night

Partly cloudy, with a low around 25. Windy, with a northwest wind 18 to 21 mph, with gusts as high as 31 mph.

Sunday

Sunny, with a high near 48. Breezy, with a northwest wind around 16 mph, with gusts as high as 24 mph.

Sunday Night

Clear, with a low around 27. North northwest wind 6 to 9 mph.

The forecast for the 2 coldest nights in the #1 OJ producing county of FL stayed exactly the same overnight.

https://forecast.weather.gov/MapClick.php?x=114&y=163&site=mlb&zmx=&zmy=&map_x=113&map_y=163

Saturday Night

Partly cloudy, with a low around 25. Windy, with a northwest wind 18 to 21 mph, with gusts as high as 31 mph.

Sunday

Sunny, with a high near 48. Breezy, with a northwest wind around 16 mph, with gusts as high as 24 mph.

Sunday Night

Clear, with a low around 27. North northwest wind 6 to 9 mph.

1 deg. F colder for each of the coldest nights. I would guess the market will not find that a big deal.

https://forecast.weather.gov/MapClick.php?x=114&y=163&site=mlb&zmx=&zmy=&map_x=113&map_y=163

Saturday Night

Mostly clear, with a low around 24. Windy, with a northwest wind 18 to 22 mph, with gusts as high as 34 mph.

Sunday

Sunny, with a high near 49. Breezy, with a northwest wind around 15 mph, with gusts as high as 23 mph.

Sunday Night

Clear, with a low around 26. West northwest wind 6 to 8 mph.

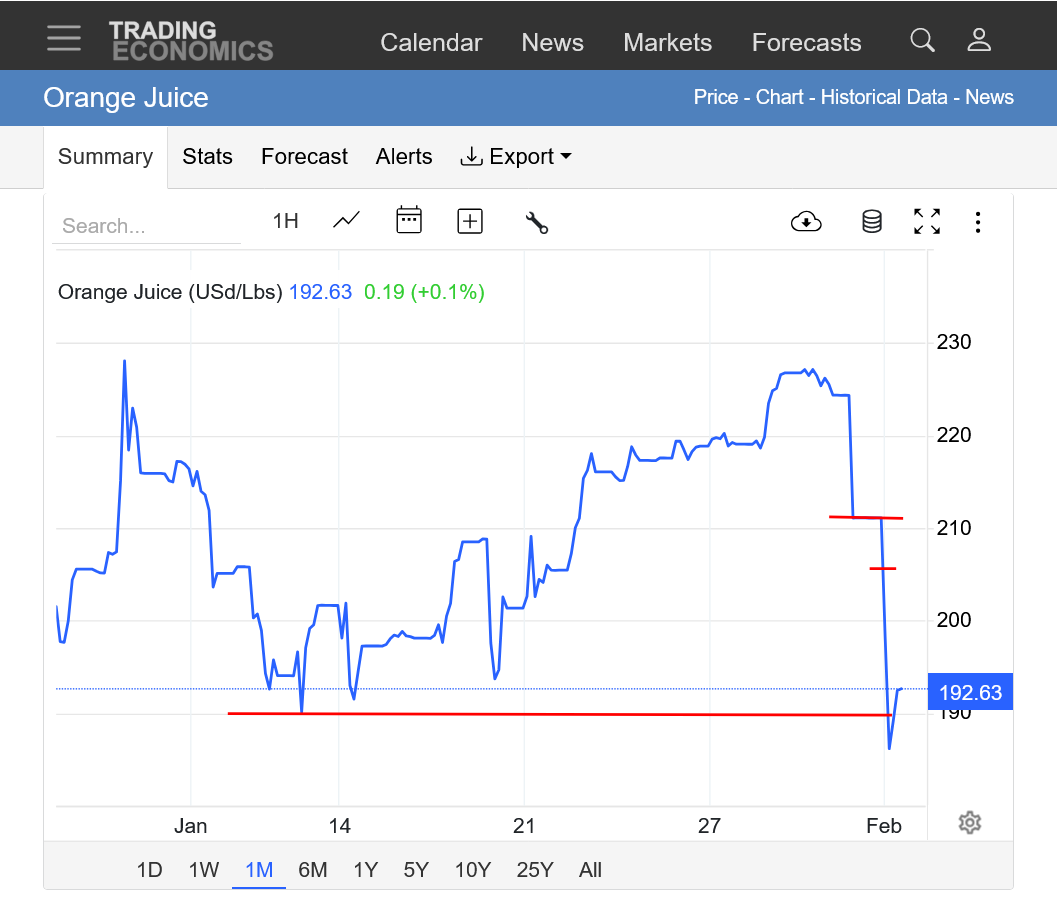

Sure enough, oj bulls didn't find it a big deal and they stopped the buying which dialed in COLD risk premium all week and OJ completely COLLAPSED!!!!!

https://tradingeconomics.com/commodity/orange-juice

1. 1 week. That's not a artifact on the price chart. OJ opened a couple of ticks HIGHER, then collapsed. 6 minutes after the open, we dropped to limit down which is -15c and have been LOCK limit down ever since.

2. 1 month: Double top

3. 1 year: Resistance from previous broken support line

4. 10 years: Bear flag/wedge? Symmetrical triangle longer term with higher lows and lower highs.

I wanted to see how far out the lock limit move extended for futures contracts and am shocked at how low the trading #s are.

For Sept 2026 OJ, for instance, the total volume for today is 8 contracts and the total open interest is 77 contracts.

Energy and grains for Sept often have more volume in a minute than OJ has total open interest and more volume in a week of trading Sept OJ.

I could see some potential for a small spec to make money trading the front month, March as long as they place orders with small size……like 20 contracts or even less and they are taking higher risks than other markets, but other than that, the days for speculators to trade orange juice are long gone!

The same forecast for the coldest spot and #1 OJ producing county in Florida.

https://forecast.weather.gov/MapClick.php?x=114&y=163&site=mlb&zmx=&zmy=&map_x=113&map_y=163

Tonight

Mostly clear, with a low around 24. Wind chill values as low as 13. Windy, with a northwest wind 17 to 23 mph, with gusts as high as 37 mph.

Sunday

Sunny, with a high near 49. Wind chill values as low as 12 early. Breezy, with a west northwest wind around 15 mph, with gusts as high as 23 mph.

Sunday Night

Clear, with a low around 26. North northwest wind 5 to 8 mph.

The lowest temperature that I saw was 24.8 degrees from 6:40am to 8am this morning:

https://forecast.weather.gov/MapClick.php?x=114&y=163&site=mlb&zmx=&zmy=&map_x=113&map_y=163

Considering that March Oj was lock limit down all day Friday, after the first several minutes of trading, one would expect a gap lower open on Monday Morning, which would put in a downside break away gap formation on the price charts.

Tonight's low should be similar but there's an outside(very small) chance of the temperature bottoming out much colder and it having a bullish impact.

Winds would need to go calm for numerous hours and that looks unlikely because the Arctic high is too far to the west right now.

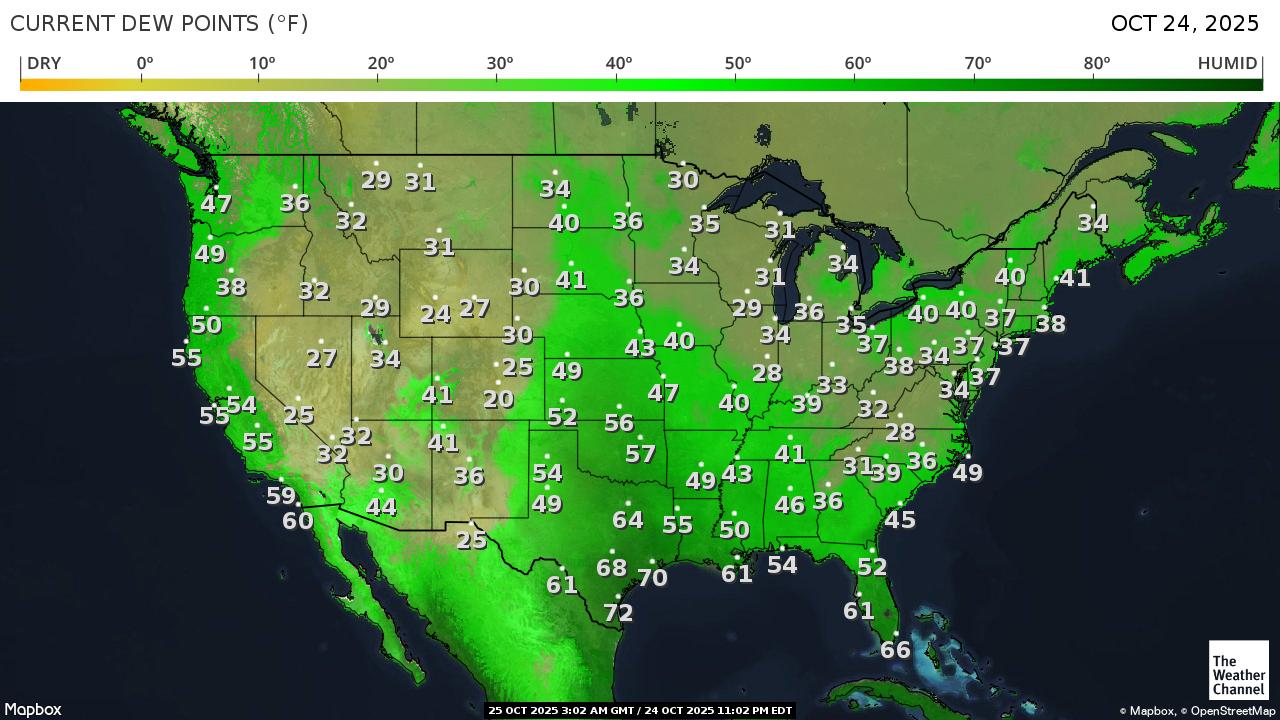

Also, the winds have too much of a west component that brings in modifying Gulf of Mexico air. Ideally, they should be directed straight north to south down the spine of the FL peninsula during the day, then die off to calm at night with that extremely chilly and DRY air mass in place, while clear skies allow for optimal radiating of long wave radiation from the ground out to space.

SOUTHEAST

https://www.spc.noaa.gov/exper/mesoanalysis/new/viewsector.php?sector=18#

There are some extremely low dew points in parts of FL right now though.

https://thermastor.com/dew-point-and-weather-maps/

These are the current Wind chills

https://www.mesonet.org/weather/air-temperature/national-wind-chill-heat-index

As we thought, OJ had a huge gap lower on the open and even traded limit down for awhile with the expanded -25c limits!!!

https://tradingeconomics.com/commodity/orange-juice

1. 1 month: Top red line is the lock limit down price that OJ traded all day Friday, after the first 6 minutes(when it opened close to unchanged)

2nd smaller red line was the gap lower open on Monday/today and the high. This is a downside break away gap. An extremely bearish chart formation, especially after decent move up that goes back to the end of November.

3rd long red line is the low from January.

++++++++++

2. 1 year: Breaking out below the January low or just testing it? Significant low at the end of last November.

3. 10 years: Historical high on September 2, 2024, over $500, then a crash lower as demand dried up from high prices. Is this another bear flag or did we hit the bottom at the end of November 2025? Symmetrical wedge/triangle formation (lower highs and higher lows).

Today is the 3rd day in a row for OJ to drop very sharply: it’s down an amazing 25% from the early Fri high and the lowest since way back on Dec 17th!

Thanks, Larry! March OJ traded 2,202 contracts today which is higher than most days I've observed recently. One can guess that all the really thin volume days on the way up were from lack of sellers to offset the speculative buying on cold weather.

Now, on the way down it appears as if we are uncovering some larger bids. On the other hand, we are having to drop a great deal to do that. Just like the NG volume yesterday for the March contract was the greatest I ever remember because we had the biggest drop ever that was overdone.

Regardless, I have not watched OJ volume extremely close except for maybe 10 days this year and we had a high volume day today compared to the other days and trying to figure out OJ in this age might be fun but its not what it used to be.

https://tradingeconomics.com/commodity/orange-juice

1. 1 year: Lower highs, back below 200 but also a significant low at the end of November 2025.

2. 10 years: Symmetrical wedge with lower highs and lower highs longer term. Also a bear flag which is a continuation of the downtrend pattern.

Another cold snap for Florida Orange country. Not as cold as the last one, despite the freeze warning.

The forecast below is usually the cold spot in the #1 orange producing county.

https://forecast.weather.gov/MapClick.php?x=186&y=147&site=tbw&zmx=&zmy=&map_x=186&map_y=147

Overnight

Mostly clear, with a low around 38. North northwest wind 10 to 13 mph, with gusts as high as 20 mph.

Monday

Sunny, with a high near 57. Wind chill values as low as 31 early. Breezy, with a north northwest wind 14 to 16 mph, with gusts as high as 24 mph.

Monday Night

Clear, with a low around 30. North northwest wind 6 to 10 mph.

Tuesday

Sunny, with a high near 62. Wind chill values as low as 25 early. North northwest wind 3 to 6 mph.

Tuesday Night

Patchy frost after 3am. Otherwise, clear, with a low around 33. Calm wind.

By metmike - Feb. 2, 2021, 5:44 p.m.

Here are some interesting records on freezing temps in FL. Note, these official temps occurred on a thermometer that was probably warmer than outlying area thermometers but outlying temps would need to be well below freezing, U-20's or colder for there to be much damage.

Temperatures ≤ 32°F in Tampa, Florida Actual Dates Each Year

https://www.weather.gov/media/tbw/climate/tpa32orlessdays.pdf

Temperatures ≤ 32°F in Tampa, Florida Number Of Days Each Month

https://www.weather.gov/media/tbw/climate/tpa32orless.pdf

We should note that freezes in central and southern Florida have diminished in the last 35 years.

At Tampa, since 1990, these were the events in February. Just 4 out of the 30, going back the last 130 years.

2009 02/05-32°

1995 02/09-28°

1996 02/05-25° 02/04-31

The coldest one, 25 deg. F in 1996 gave me a huge birthday present. The market had a massive spike higher ahead of the freeze with me long all the way. I covered the day before it hit.

On the day it hit, I remember the talking heads on CNBC telling us how crazy the OJ market was as they showed images of oranges with icicles on them and talked about the major damage.............and OJ was near limit DOWN!

Buy the rumor.............sell the fact!

++++++++++++++

2-22-2026

There were several occasions over 100+ years ago when the temp hit exactly 32 this late.

When we get to late Winter, is just impossible to keep Frigid air masses from moderating too much for a freeze.

March 4, 1943 was the only subfreezing temperature this late or later.

The suns angle right now has been rising in the sky for 2+ months. Warming the ground and melting any snow in the south quickly so Frigid air masses that don't start out as cold at the source region, will moderate even more headed south over bare ground.

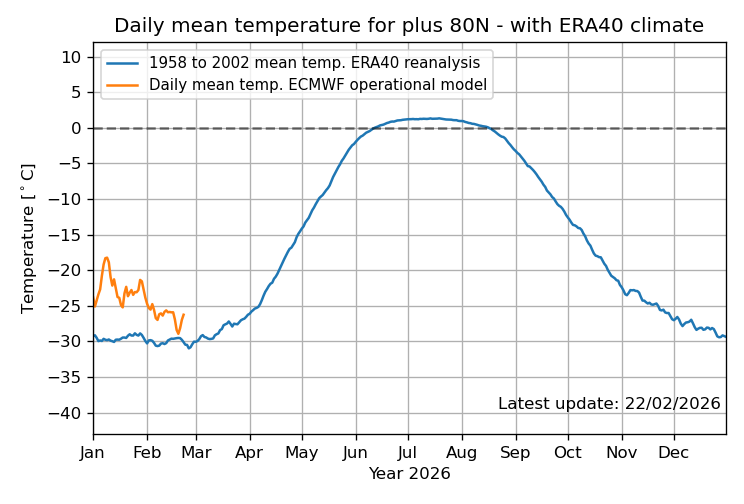

Hey Mike,

The source region for plunging Arctic air masses may not be as cold this late in the winter. However, interestingly enough, the average (climo mean) temperature for 80-90N (blue line) doesn’t reach its coldest til Feb 25th:

Thanks very much, Larry!

I need to adjust my thinking about air masses near the pole at this time of year.

That makes sense because the sun has just risen in must of that area and is still low enough in the sky so that its not generating much heat yet.

This is for 80 deg North belo:

Here is the breakdown of how fast the sun moves north (higher) in February:

1. Noon Sun Angle Change (The "Vertical" Speed)

2. Day-to-Day Change (Daylight Gain)

Summary

In February at 80° N, the sun is gaining height at a rate of approximately 0.4°–0.5° per day at solar noon, with the fastest upward motion happening toward the end of the month.

++++++++++++++++

For sure those frigid air masses, headed south are encountering locations that have had increasing daylight/sunshine for 2 months.

+++++++++++++++

Siberia is between 50 to 80 deg. North.

AI Overview

January is widely recognized as the coldest month in Siberia, with average temperatures plummeting to between

January is widely recognized as the coldest month in Siberia, with average temperatures plummeting to between

and  across the region, and often dropping below

across the region, and often dropping below  in northern and eastern areas. In extreme locations like Yakutsk, the coldest city on Earth, temperatures regularly drop to

in northern and eastern areas. In extreme locations like Yakutsk, the coldest city on Earth, temperatures regularly drop to  or lower in January.

or lower in January.

( ), with lows sometimes reaching

), with lows sometimes reaching

While January is generally the coldest, some areas may experience similar, or slightly lower, extremes in February, but January holds the highest frequency of record lows.

Yakutsk, Russia Weather Conditions | Weather Underground

Sun

Rise

Set

Actual Time

7:46 AM

5:25 PM

Civil Twilight

7:00 AM

6:11 PM

Nautical Twilight

6:08 AM

7:02 PM

Astronomical Twilight

5:17 AM

7:54 PM

Length of Visible Light

11 h 11 m

Length of Day

9 h 39 m

Tomorrow will be 5 minutes 57 seconds longer

Thanks, cutworm.

It's amazing how much daylight those high latitude locations add as we come out of Winter and Yakutsk is BELOW the Arctic Circle(equivalent to CENTRAL Alaska) so it never experiences complete darkness in Winter.

https://en.wikipedia.org/wiki/Yakutsk

Coordinates: ![]() 62°01′48″N 129°43′48″E

62°01′48″N 129°43′48″E

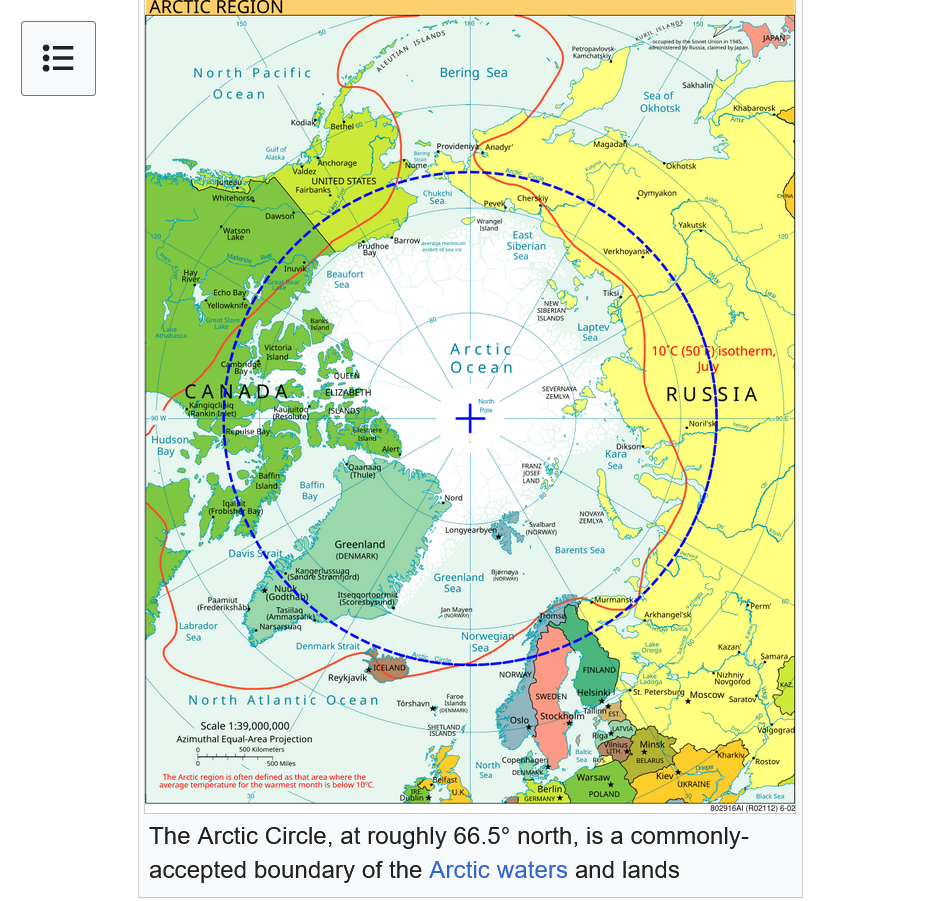

Arctic Circle

https://en.wikipedia.org/wiki/Arctic_Circle

+++++++++++++++++

https://en.wikipedia.org/wiki/List_of_northernmost_settlements

The most northern settlements on Earth are communities close to the North Pole, ranging from about 70° N to about 89° N. The North Pole itself is at 90° N.

There are no permanent civilian settlements north of 79° N, the furthest north (78.55° N) being Ny-Ålesund, a permanent settlement of about 30 (in the winter) to 130 (in the summer) people on the Norwegian archipelago of Svalbard. Just below this settlement at 78.12° N is Svalbard's primary city, Longyearbyen, which has a population of over 2,000.

When occupied for a few weeks some years, the northernmost temporary settlement in the world is Camp Barneo, a Russian tourist attraction located near 88°11'00" N. As of 2022, it had not been occupied since 2018

+++++++++++++++++

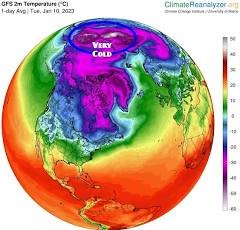

Although Norway and Denmark have numerous cities near the top on that list and they are certainly very cold in the Winter, their temperatures are often moderated by the unfrozen water that is to their, north, west and s/southwest. We can see that on the map copied above from the previous source.

This map below will make it more clear!

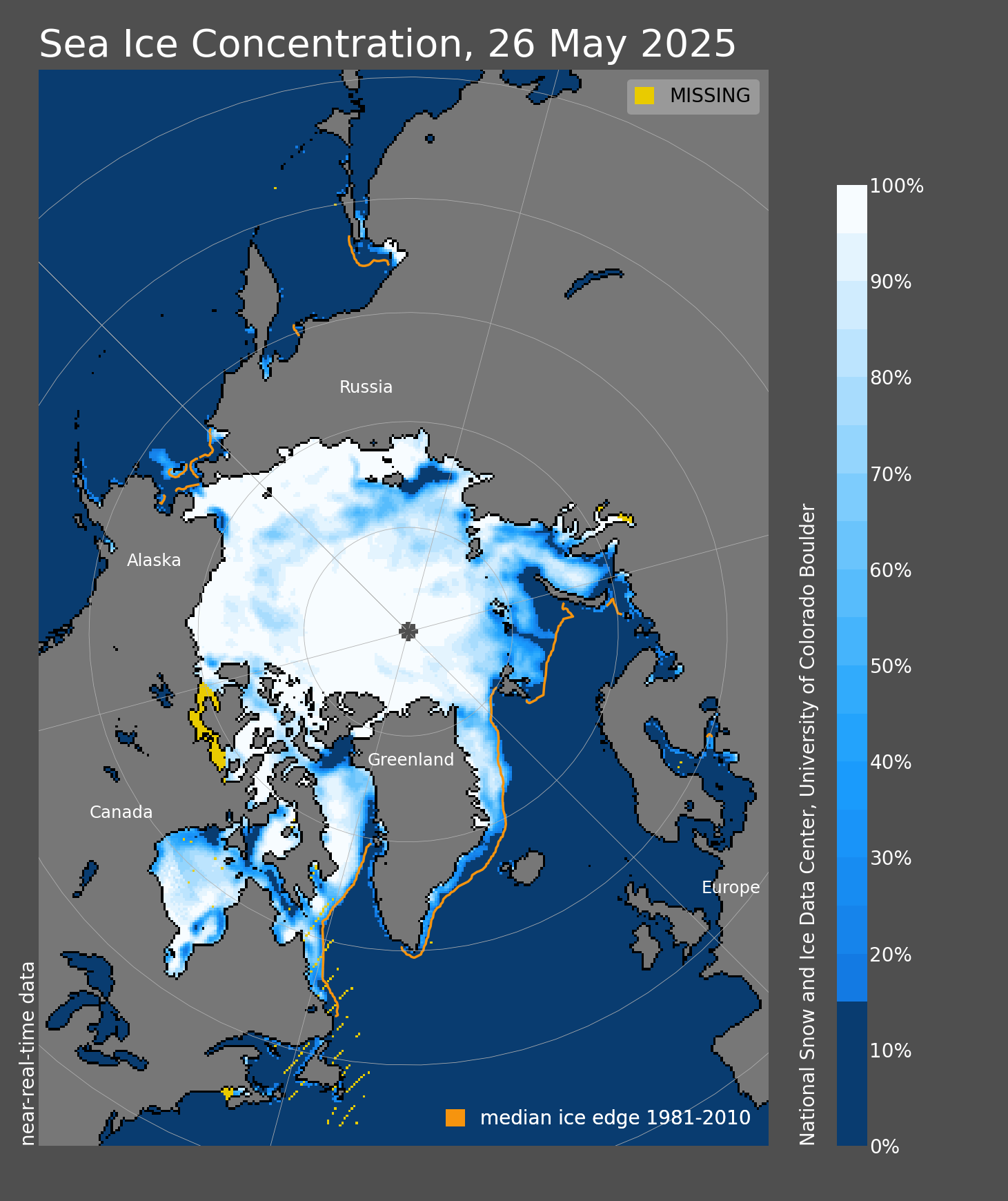

https://nsidc.org/sea-ice-today

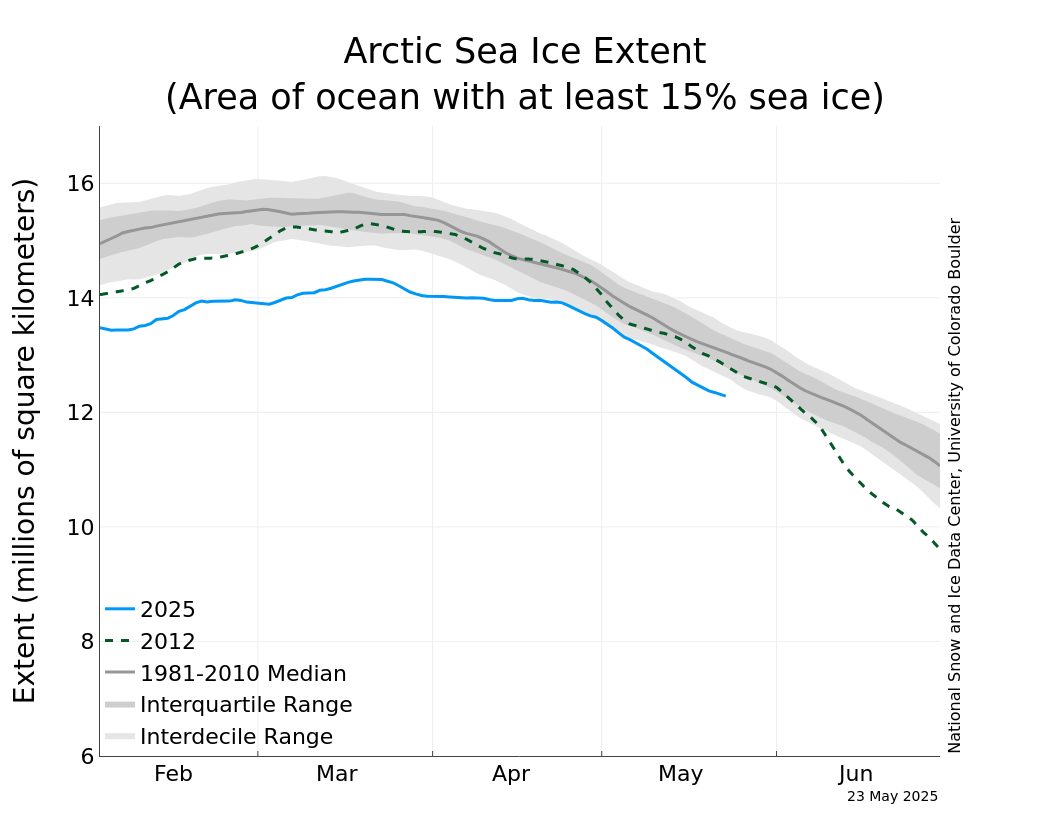

Below, it looks like the peak ice in the Arctic, which won't be coming for another month, will be the LOWEST peak since we've been able to measure that metric. However, there was MUCH LESS Arctic ice during the Holocene Climate OPTIMUM between 8,000 and 5,000 years ago.

https://nsidc.org/data/seaice_index/images/daily_images/N_iqr_timeseries.png

Arctic Ocean Ice: During The Recent Holocene Climate Optimum, It Was Half What It Is Today

Writing in Science, they show that over the last 10,000 years, summer sea ice in the Arctic Ocean has changed dramatically, and for several thousand of those years, there was much less sea ice in the Arctic Ocean than now – probably less than half of current amounts.

++++++++++

https://en.wikipedia.org/wiki/Holocene_climatic_optimum

Temperatures during the HCO were higher than in the present by around 6 °C in Svalbard, near the North Pole.[10]

Of 140 sites across the western Arctic, there is clear evidence for conditions that were warmer than now at 120 sites. At 16 sites for which quantitative estimates have been obtained, local temperatures were on average 1.6±0.8 °C higher during the optimum than now. Northwestern North America reached peak warmth first, from 11,000 to 9,000 years ago, but the Laurentide Ice Sheet still chilled eastern Canada. Northeastern North America experienced peak warming 4,000 years later. Along the Arctic Coastal Plain in Alaska, there are indications of summer temperatures 2–3 °C warmer than now.[11] Research indicates that the Arctic had less sea ice than now.[12] The Greenland Ice Sheet thinned, particularly at its margins.[13] In addition to being warmer, Arctic Alaska also became wetter

++++++++++++++++++

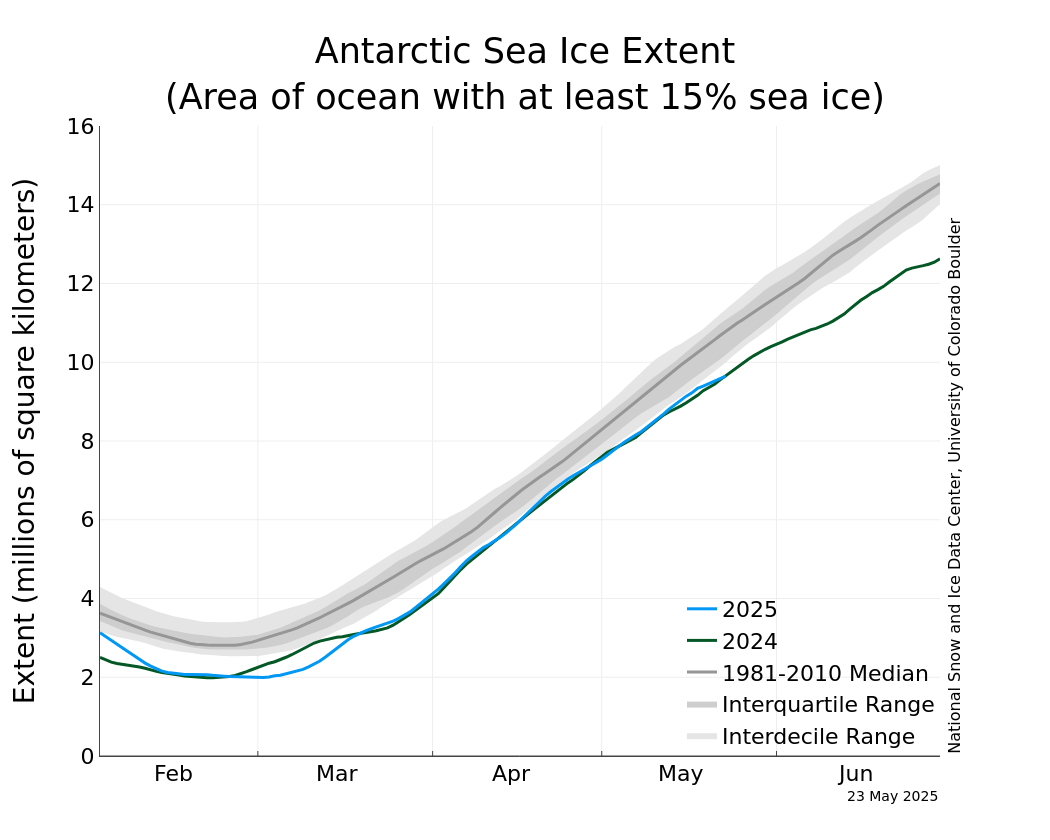

While we're on the topic, here the Antarctic sea ice.

That's not your imagination. The Antarctic sea ice right now (blue line) is back up to the 1981-2010 median, after setting a record low a year ago(green line). This one is more complicated as it depends on the wind direction more than anything.

https://nsidc.org/data/seaice_index/images/daily_images/S_iqr_timeseries.png