took a good long while but maybe corn users are starting to notice the lower yields. St Louis went to plus 19 for Jan and local Poet here went to plus 22 for Jan

sorry MM should be marketing but you can move it if you like,,,,or not....... I tried but must of missed the connection

There you go mcfarm, thanks for the great post.

Do you remember the last time basis was like this in the midst of harvest?

https://www.agmanager.info/grain-marketing/grain-basis-maps

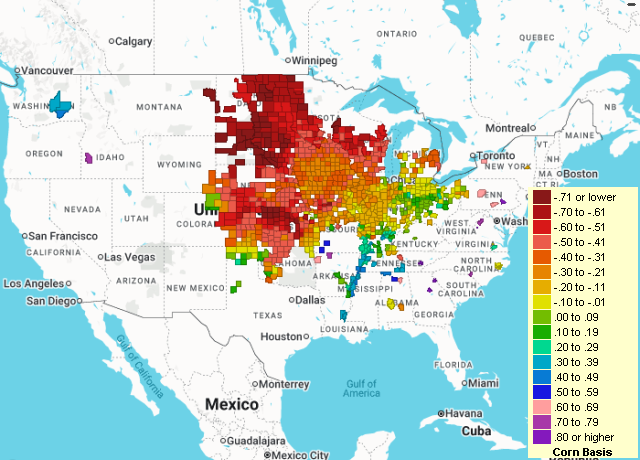

metmike: You will note that the basis is above to waaaay above the average of the last years everywhere for corn. I'm guessing it might even be higher than this in the Eastern belt.

Here are some basis maps for the entire growing regions. These maps are from 1 week ago.

As I suspected earlier, the Eastern Cornbelt is highest with the smallest crop. Also in the south. Maybe part of that is normal but they had a drought too.

https://www.raboag.com/mm/images/Corn-Basis-Map-800xNOctober23.png

I don't know if anybody remembers but Ray Jenkins told us either here or on another forum that basis would improve in a post late last summer

Seems Ray must still have some connections in the trade, or he just knew

Soybean basis is not as strong as corn, in fact very weak in most areas(exception is the ECB, southwestward). Might explain part of corns strength the last few days,. while beans sold off?

MM going by memory alone I would guess the drought of 2012.....wayne, Ray Jenkins is one of the very best on grains. If I had 1/2 the knowledge he has I would be a super marketer

Not sure how updated this map is but it might be pretty current. Very strong basis/bids(cash is actually higher than futures-rare during harvest) in the Eastern Cornbelt where the crop/supply is not there.

https://www.dtnpf.com/agriculture/web/ag/markets/local-grain-bids

Things to note on the graph below:

1. The difference between the 4 year average(spread between the red-futures and black-cash price which is the basis, so futures-cash price =basis).

2. The 4 year average features a HUGE spread/-basis during harvest because of the massive new crop supplies pressuring the cash price lower.

3. Then, as we run lower on supplies, the cash price gradually gets closer to the futures price and the basis shrinks.

4. This year is very unusual. The cash price in green and the futures price in blue are very close to each other........and its occurring during harvest, when they ordinarily are the farthest apart from each other. In the Eastern Belt, the cash price is actually HIGHER than the futures price as seen on the previous page.

This is ordinarily very bullish. The problem is that demand and exports are horrible right now. The US corn crop is not that big but other countries did better and are selling corn cheaper and so globally, our price is not very competitive.

Wayne,

Ray I believe had dealings with the W. G. Branch there in Blenheim I may have even met him in the late 90's in Hensall without even knowing it

Playing the spreads via my 2 measly basis contracts (10,000 bu).

The basis being the spreads, report days were fun, it was like day trading the board but I couldn't lose.

Fun while it lasted.

Wonderful to read you again after all this time ab............thanks much!