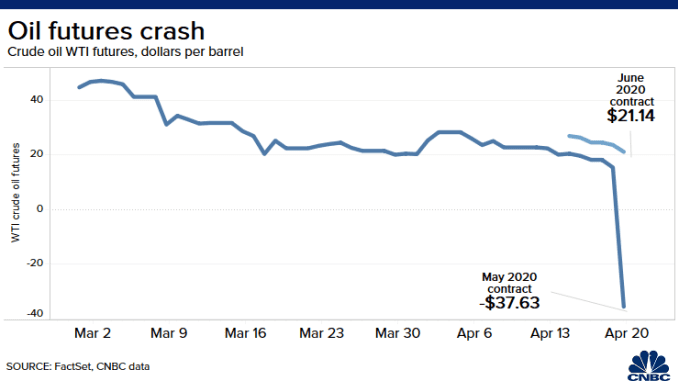

West Texas Intermediate contract for May delivery loses as much as 10% as expiry looms

https://www.ft.com/content/d0a0cfc3-765c-4b55-ada7-11e0d378d406

Last week, OPEC+ agreed to remove 9.7 million bpd of oil from the market, with the cuts beginning next month and remaining in effect until the end of June, after which the group will start to ramp up production gradually.

From 9.7 million bpd in May to June, the cuts will decline to 7.7 million bpd for the period July to December 2020, and then further to 5.8 million bpd until the end of April 2022.

However, demand has continued to fall sharply because of the Covid-19 pandemic. Oil consumption in the United States alone—the world’s largest consumer of oil—has dived by a third, Reuters’ John Kemp wrote in his weekly column. Even though there is talk about reopening the economy, this will most likely happen gradually, as in Europe, and it will be at least a few months until demand begins to recover in any meaningful way.

Meanwhile, oil inventories are on the rise. The federal U.S. government was this week reported to be negotiating leasing space in the Strategic Petroleum Reserve to nine oil companies that have nowhere else to store their unsold and temporarily unsellable crude.

gold to oil ratio today at 93 to 1 ... wow...

of course that is ny crude, brent price is different than ny crude or than wti...

Amazing!

gold - oil ratio

22 responses |

Started by bear - April 15, 2020, 12:26 a.m.

And right now-sunday 9pm est down over 3.50

Yikes

John

You aren't kidding.

The front month got down to $14.47. A part of this is the expiring May contract.

When was the last time we were this low?

RB and HO are around unchanged.

NG opened strong but sold off to unch and is at 1.767 up 0.014.

Corn opened up but is lower from good planting weather.

Beans up a tad, wheat +5c. Will the crop rating for HRW drop a couple % in KS/OK/TX?? because of the freezes on Mon/Tue mornings last week?

WOW! Oil spiked to $10.01 a short while ago.

Expiration is actually tomorrow, which is behind much of the extreme nature of this spike lower.

If I traded crude and this had anything to do with the weather, I would be looking for a spot to buy the June contract.......if the weather was turning less bearish.

This has nothing to do with weather.

Incredible spike lower!

https://www.cnbc.com/2020/04/20/coronavirus-us-oil-prices-collapse-as-storage-runs-out.html

Key Points

Got down to $10.01!

CLK below $9!!!!

Crude below $8!!

CLK below $6!!!!!!!!!!!!!!!!

Spiked down to $4.04!!!!!!!!!!!!!!!!!!!!!!!!

Is this the low finally?

Incredible!

$3.04!

Hi Jim! Glad to see we have another spectator (not speculator).

We spiked just below $3.......$2.99!!

Even lower now.

Must be longs crying uncle under massive water as deep as the Pacific Ocean (-:

Below $2.50

I can't imagine.....but if some Texas drillers are selling crude $2 cash for a barrel of oil, you can't say you couldn't see this coming.

Hit $1.03.

Will we trade below $1??

Make that 1.02 for the low........so far. Watching to see if we can get below $1.

This is like the day last month, that UNL dropped below 38c

90c was the low so far.

Whoops..............we just hit 67c......52c.

Historic day for crude!

CLK hit 19c.

I can't imagine when it last traded that low........OMG it traded 1c!!!

Crude traded to 1 penny!!!! For real, that just happened.

Somebody bought and sold crude for 1 cent.

Pretty soon, they'll be paying us to fill our tanks.

IT WENT NEGATIVE!!

Holy Cow...Holy Cow, Crude is trading negative!!!

The low has been -$1.43

OK, what planet are we on?

CLK has spiked to -$3.70.

This means that somebody can buy a contract of crude, get 1,000 barrels of oil AND get paid $6 for it..........last price

Make that -$7 on the last trade.

There is no place for it to go, so they are paying to get rid of it!

And that contract expires tomorrow correct? So there could be one more day of this bloodletting?

-$35.60!

We often see it the day BEFORE expiration.

Am thinking this is a squeeze. A bunch of traders caught long who are screaming uncle and panic selling or being forced out by massive margin calls with nobody wanting to buy the falling knife.

Crude is down $33 and is negative $14 -$14/barrel for the front month May.

Make that -$26........yeah this is a long squeeze, the opposite of a short squeeze that causes upward spikes from lack of supply.

Long squeezed almost never happen because when you have alot of supply, prices tend to be stable and not volative.

-$37.........

-$40 down $56+ on the day

Historic! We may never see anything like that again.

Looks like -$40.32 is going to be the low, since the main trading session with the huge funds that were trapped long is over.

Yes, we just bounced to $-28.00

Who ever thought that a +$12 bounce in crude.............normally in a bull market takes many days. would happen in a few minutes........and we would still be deeply negative.

Good chance that the lows are in.

The ones getting out when the price was in double digit negative territory were FORCED out with a squeeze. Forced liquidation from margin calls and other factors with expiration tomorrow.

Yes Jim. Traders that were watching this, will remember it forever.

Hopefully from the sidelines.

I really can't imagine normal speculators selling crude when it was negative.

The selling was an exhaustion/panic driven squeeze of the longs that HAD TO GET OUT no matter what.

Surely there were some big, high risk traders willing to buy and sell down here.

How many that deal in cash trades and actually have storage, bought crude today.............got paid $30,000 for 1,000 barrels and got the crude too?

That is like Twilight Zone trading (-:

Before today, I honestly thought it could not go below 0.

It looks like today may be the last trading day for CLK-the May, front month contract, not tomorrow as I suspected, so this makes more sense.

The new front month, June never traded below $20 and has bounced back to $21, down just $4 on the day.

So this was for sure a squeeze with longs, possibly some long lived, having to get the heck out on the last trading day.

An option for some that are in the business is to stay in after expiration, then they are subject to delivery because the contract on paper(futures) can then be exercised and then the seller, can exercise delivery of the product.

So if you are still long those 1,000 barrels of May crude in that 1 contract that you had which just expired and didn't get out, you better have a place for the 1,000 barrels of crude that is coming your way.

If you are not in the business and have no place for it, it will cost you alot of money to pay somebody to take those 1,000 barrels of unwanted crude off of your hands.

https://oilprice.com/Energy/Nuclear-Power/China-Doubles-Rate-Of-Crude-Stockpiling-As-Oil-Falls-Below-0.html

We sometimes (half) joke about #corn or #soybeans going to $0, but this is what it looks like when it really happens. The chart is messy, but today's anomaly is crystal clear. This is front-month U.S. crude #oil futures seasonally back to 1986.

https://www.bbc.com/news/business-52350082

"The price of US oil has turned negative for the first time in history.

That means oil producers are paying buyers to take the commodity off their hands over fears that storage capacity could run out in May.

Demand for oil has all but dried up as lockdowns across the world have kept people inside.

As a result, oil firms have resorted to renting tankers to store the surplus supply and that has forced the price of US oil into negative territory.

The price of a barrel of West Texas Intermediate (WTI), the benchmark for US oil, fell as low as minus $37.63 a barrel."

I wonder how many folks are scrambling to find a tanker, betting on another negative and filling up floating storage and getting paid to do it

Brokers that bought 20 oil and filled tankers are probably crying in their beer tonight, if they waited could have got paid for their rented storage space

It's a cruel world out there, but looking back a person could see storage would run out with no let up in more supply vs demand

That scares me

Who says corn can't go to a dollar/bu

I can store corn , but bet you I can't store it long enough

Wonderful points Wayne. Thanks!

Wayne, you may especially connect to the example below of hedging the price of corn for farmers right now.

I agree with you, with some predicting a 3 billion bushel carryover, if we have another record corn crop this year from a continuation of the climate optimum that has caused the best weather/climate and CO2 levels for growing crops in history, that prices could collapse lower.

I feel that there will still be enough ethanol demand to prevent something as extreme as $2 corn, which would be the current price if not for ethanol demand(every gallon of gas, is blended with at least 10% ethanol. E-15 gas has 15% ethanol).

This has been using up around 40% of our corn crop.

People will still be driving, just not as much.

I responded to John in another thread about this but it also belongs in this thread.

https://www.marketforum.com/forum/topic/50939/

By metmike - April 21, 2020, 12:16 p.m.

Hi John,

Actually, the May contract that went -$40 yesterday does not expire until today but the squeeze happened yesterday..........when the big funds that had been long forever all got forced out as well as other large longs with the panic selling/exhaustion in negative territory.

Massive margin calls and losses, as well as the soon to expire front month having almost no volume left to offset the selling, resulted in prices collapsing lower to find offsetting bids to meet the panic selling.

A month ago, for instance, somebody selling 100 contracts of May crude, could probably get them sold with in 5c of the market price, just like they can with the June contract today. However, in yesterdays thin volume trading, selling 100 contracts of crude at the market may have forced the market down $1.

Recent daily volume for May crude averaged well over 1/2 million contracts, with a few volatile days peaking just above 1 million. Yesterday, even though we had the most extreme day in history by a wide margin(that often causes high volume) featured less than 200 thousand total contracts traded and the lowest volume for May, since it was the front month.

When a contract is expiring..........ALL speculators must get out or risk being forced to take delivery(if long) of the product(or legally make arrangements to do so). In this environment, some that otherwise might stay long to take delivery........WHEN STORAGE SPACE HAS VANISHED, also had to get out, which magnified the selling even more.

So the June contract will be the front month on Wednesday but is getting all the volume now. It looks like the volume today in the June has set a record by a wide margin.

June may trade 2 million contracts today, which for this contract, is almost double the most it ever traded in 1 day and higher in history than any day, I think.

Obviously, being down sharply..........back down below $13, it's massive, massive selling that is pushing us sharply lower but its taking 20 times the volume than what did it to the May contract yesterday to accomplish this because we have 20 times the buy orders below the market to meet the selling, since the June contract has a month left of trading and plenty of traders willing to take both sides.

Some traders selling today may still be long lived longs getting out but some are new traders that think that $20 crude oil, yesterdays price, was too expensive and want to be net short, with an expected drop in price over the next month.

The only traders that would be net short in an expiring contract would mainly be those that actually have crude or the commodity to sell.

A farmer for instance that forward contracts selling December corn in the month of March for instance to hedge his crop, can stay short thru expiration and deliver his crop for the expiration price.

Let's say Dec corn expires at $2.90. A horrible price, lowest in 15 years but he put on a short in March, to hedge his crop when corn was trading at $3.30/bushel.

He captures 40c(2,000/contract) in the futures market(which is the hedge) on expiration and in essence, had locked in $3.30/bushel for his selling price back in March.

Futures markets were originally designed as vehicles for these transactions between producers and end users...........to lock in favorable prices to keep their business's running profitably.

Speculators, however are what makes the market so liquid. The vast majority of volume every day comes from speculators. This pften makes it much easier for large producers and end users to use the futures.

Unfortunately, in bearish times like this, when large speculative funds are piling on the shorts in corn(because they see the bearish fundamentals ahead and are counting on lower prices), they push the price farther south and sooner, which screws a farmer who might want to sell his crop early. If not for the fund selling recently, for instance, the price of corn might be 30c higher than it is.

It would have probably dropped down here..........but taken a couple more months to day it. Large specs just force price moves earlier and to bigger extremes.

June crude is making life of contract lows here below $12 and down $8 on the day.

If not for yesterdays historic drop in the soon to expire May contract, we would all be looking at todays plunge in the june contract with amazement.

OK, we got down to $11 for the June.

There seems to be no way possible that the June contract will go negative today because the dynamics that caused the extreme yesterday were tied to the explanation above.

June Crude got down to $6.50 and closed the day session above $11.........now just below that.

“If we have not recovered from Covid in July so that enough driving has come back and storage is full, then the price of crude oil is going to be zero,” RBN Energy’s Rusty Braziel told CNBC. He called Monday’s trading activity “insane,” and said that in his more than 40 years of trading he had “never seen anything like this.”

West Texas Intermediate crude for May delivery fell Monday more than 100% to settle at negative $37.63 per barrel,

Malek argued the “only way out” for oil markets was for OPEC+ to negotiate a much deeper output cut, suggesting Riyadh should consider production levels as low as 6 million barrels per day.

The next OPEC+ meeting is scheduled to take place on June 10.

By Tsvetana Paraskova - Apr 22, 2020, 11:00 AM CDT

Richard, You almost got it right with all of those cheap $100 August 2019 call options that you bought for $100(.01) each last week.

The only thing that you got wrong was the +/- sign in front of the $100 (-:

We appreciate you sharing and hope you don't mind the kidding. I never could have imagined prices plunging like they did on Monday(would have guessed a 1 in a million chance). The options for that expiring May contract had long since expired so anybody long out of the money May Crude puts which expired worthless last week was kicking themselves.

I"ll have to check but am not sure that June crude calls/puts for big negative values were even trading last week.

gold - oil ratio

22 responses |

Started by bear - April 15, 2020, 12:26 a.m.

https://www.oilandgas360.com/whether-opec-formally-agrees-deeper-oil-cuts-now-look-inevitable/

LONDON – Whether or not OPEC+ oil producers formally agree to extra oil output curbs, rapidly filling storage capacity and plummeting demand due to the coronavirus crisis may force them to cut more.

Source: Reuters

With crude consumption collapsing, the Organization of the Petroleum Exporting Countries, Russia and other producers, a group known as OPEC+, is due to implement a deal to cut supply by a record 9.7 million barrels per day (bpd) from May 1.

But that unprecedented deal to withdraw about 10% of global supply already looks inadequate when demand has plunged by as much as 30% and the world is possibly just weeks away from running out of storage space for the surplus.