Interesting week, to say the least.

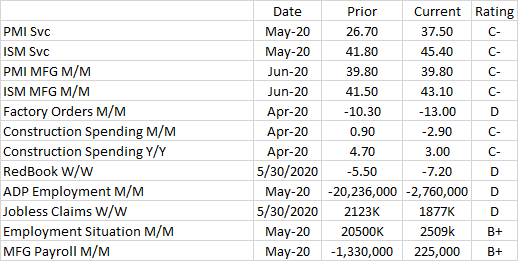

Factory Orders were slammed in April. But it appears the older data will look bad/worse than the current.

April Contruction spending was also down from the previous month, but up from a year ago.

I was disappointed to see a drop in Retail. I expect that trend to reverse sooner than later.

PMI and ISM both showed a better outlook for both MFG and Service. I put more weight on ISM. As a reminder, 50 is considered unchanged, below is contraction and above is expansion.

The real discussion this week is employment. There is often a divergence between ADP and BLS, but this month was HUGE. Also a HUGE surprise in the BLS Employment situation of +2.5 MILLION. I would have bet strongly against a positive report but never in a million years would I have dreamed of +2.5 million. It will be interesting to see what we get next month. Color me skeptical on this. Side note.. Will Wall Street revert to Fed Watch Mode?

Based on the overall ratings, I could go with a C+ this week giving weight to the Employment #'s, but in view of all the data out there, I'll go with a conservative C- as I am a little skeptical. I will downgrade the suck factor to 8.